Global Engineering Service Outsourcing Market By Services (Designing, Prototyping, System Integration, Testing, Others), By Location (On-shore, Off-shore), By Application (Aerospace, Automotive, Manufacturing, Consumer Electronics, Semiconductors, Healthcare, Telecom, Energy & Utilities, Construction & Infrastructure, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 178355

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Driver Impact Analysis

- Restraints Impact Analysis

- By Services

- By Location

- By Application

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

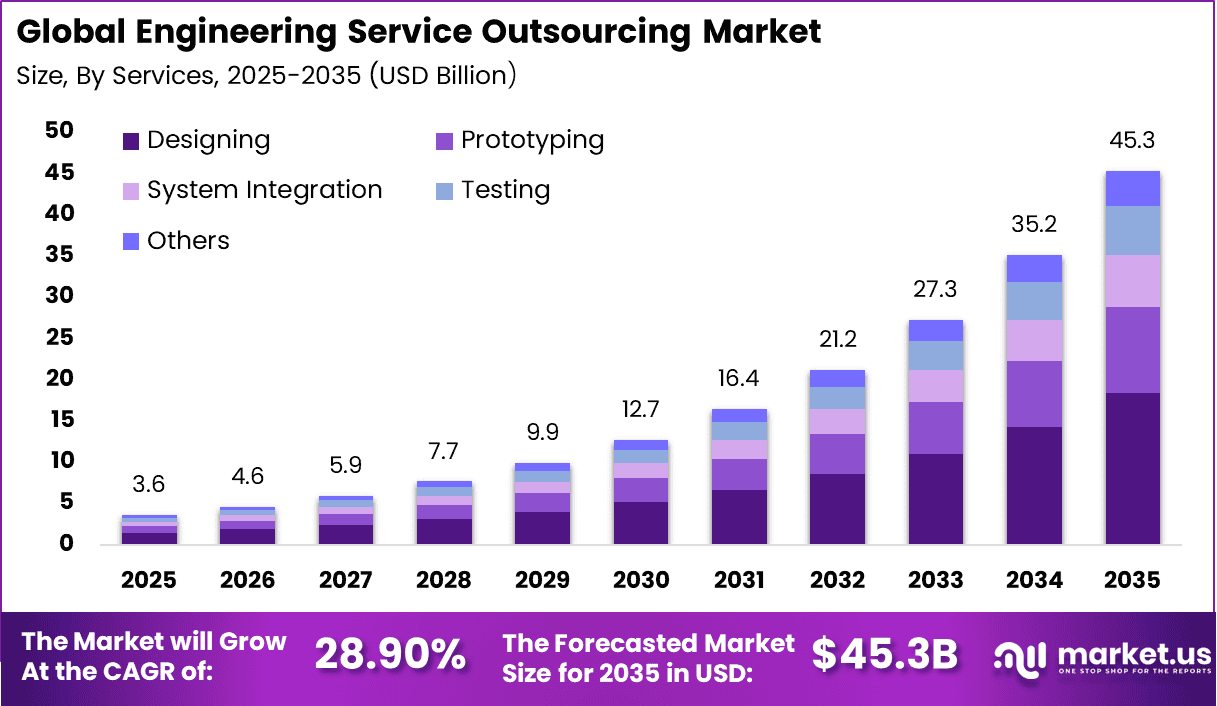

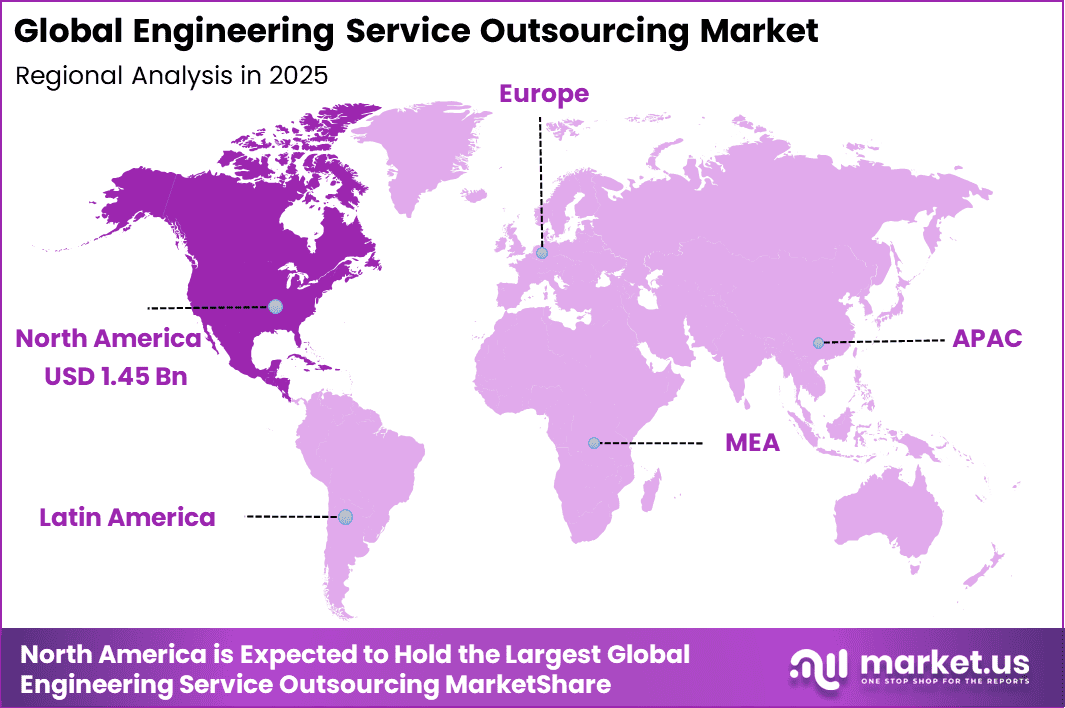

The Global Engineering Service Outsourcing Market generated USD 3.6 billion in 2025 and is predicted to register growth from USD 4.6 billion in 2026 to about USD 45.3 billion by 2035, recording a CAGR of 28.90% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 40.6% share, holding USD 1.45 Billion revenue.

The Engineering Service Outsourcing Market refers to the practice of contracting external specialists and firms to perform engineering functions that support product design, development, testing, and lifecycle management. These services span multiple disciplines including mechanical, electrical, software, industrial, and systems engineering. Outsourcing enables organizations to access skilled expertise, specialized tools, and capacity without maintaining these capabilities internally.

The market has expanded due to the increasing complexity of engineering projects and the need for agile delivery. Industries such as automotive, aerospace, telecommunications, and consumer electronics require advanced engineering capabilities to develop next generation products and systems. Outsourcing partners provide depth of experience across technologies and domains that many enterprises find difficult to build in house.

One major driver of the Engineering Service Outsourcing Market is the need for cost optimization and resource flexibility. Engineering projects often involve fluctuating workloads and specialized tasks that are not required continuously. Outsourcing allows organizations to scale engineering resources up or down based on project demand without the long term overhead associated with full time staff.

Demand for engineering service outsourcing is strongest in sectors undergoing rapid technological change and competitive pressure. Automotive and mobility industries, for example, require significant engineering support for electric vehicles, autonomous driving systems, and connected technologies. Aerospace and defense sectors demand complex systems engineering support with strict compliance and safety standards.

Top Market Takeaways

- By services, designing accounts for 40.5% of the market, encompassing CAD modeling, simulation, prototyping, and digital twin development for complex engineering projects.

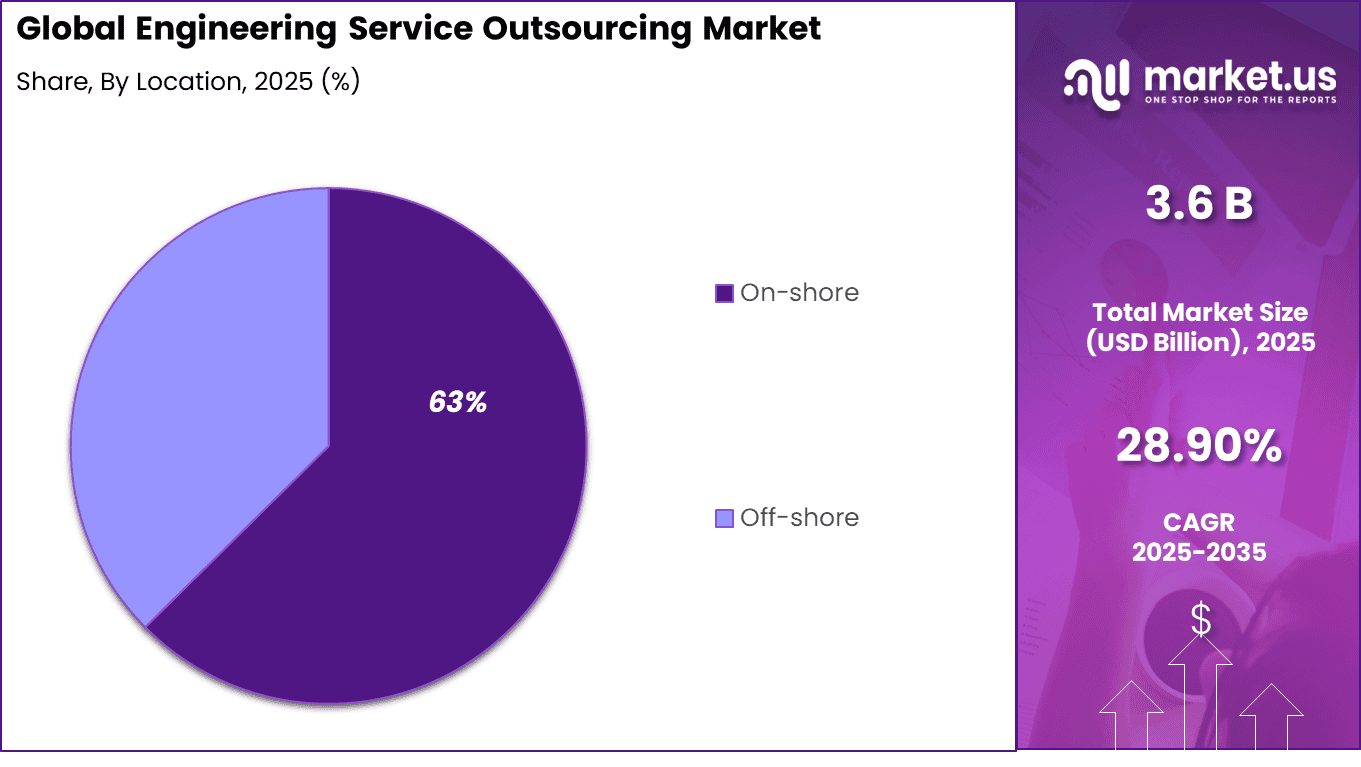

- By location, on-shore represents 62.6%, preferred for seamless collaboration, regulatory compliance, cultural alignment, and rapid iteration in high-precision sectors.

- By application, aerospace holds 30.5% share, outsourcing structural analysis, avionics integration, and certification support to manage rising program complexity and backlogs.

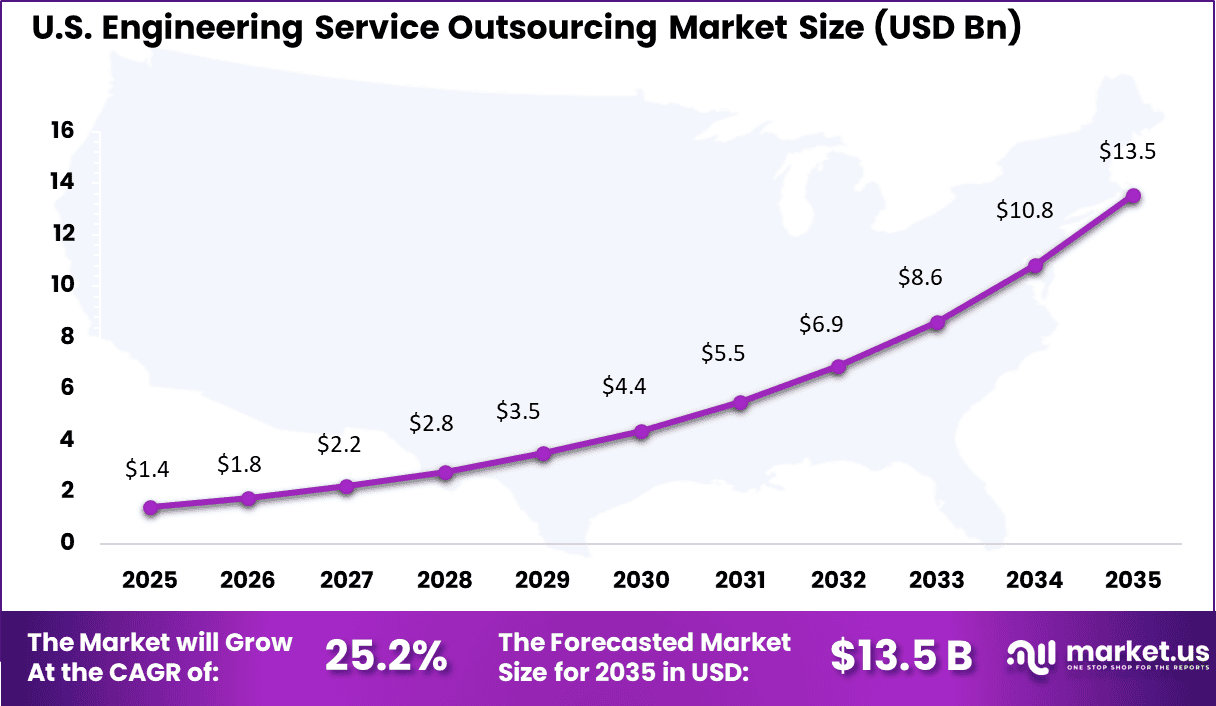

- By region, North America leads with 40.6% of the global market, where the U.S. is valued at USD 1.43 billion with a projected CAGR of 25.2%, driven by OEM demand, defense spending, and advanced manufacturing hubs.

Driver Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Increasing cost optimization initiatives among OEMs and enterprises +7.4% North America, Europe Short to medium term Rapid adoption of digital engineering, AI, and simulation tools +6.6% Global Medium term Growing complexity in product design across automotive, aerospace, and electronics +5.8% North America, Asia Pacific Medium term Expansion of Industry 4.0 and smart manufacturing initiatives +4.9% Europe, Asia Pacific Medium term Talent shortages in advanced engineering domains +4.2% Global Medium to long term Restraints Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Data security and IP protection concerns −4.3% North America, Europe Short to medium term Integration complexity across global project teams −3.8% Global Medium term Dependence on skilled offshore workforce availability −3.2% Asia Pacific Medium term Regulatory and compliance requirements in defense and aerospace −2.7% North America, Europe Medium term Economic volatility impacting R&D budgets −2.3% Global Medium to long term By Services

Designing services account for 40.5% of the engineering service outsourcing market. Organizations increasingly outsource product design, simulation, and prototyping activities to specialized engineering partners. This approach allows companies to access advanced technical expertise without expanding internal teams.

Designing services cover areas such as mechanical modeling, electronic system layout, and product lifecycle optimization. As product complexity increases, demand for outsourced design capabilities continues to grow. Outsourced design services also accelerate time-to-market by leveraging experienced engineering resources.

Service providers use advanced design software and digital simulation tools to improve accuracy and reduce rework. Collaboration models enable continuous feedback between client and service teams. This enhances innovation while maintaining cost efficiency. The need for specialized knowledge and faster development cycles explains the strong share of designing services.

By Location

On-shore outsourcing represents 62.6% of the market share. Many organizations prefer engineering partners located within the same country or region to ensure better communication and regulatory alignment. Proximity facilitates real-time collaboration and easier coordination of complex projects. On-shore models also reduce risks related to intellectual property protection and compliance standards. These operational advantages support strong adoption of domestic outsourcing arrangements.

Industries dealing with sensitive technologies often prioritize on-shore partnerships. Aerospace, defense, and advanced manufacturing projects require strict adherence to national regulations. On-shore outsourcing ensures compliance with safety and quality standards. Shorter travel distances also simplify site visits and project supervision. The emphasis on control and regulatory security explains the leading share of on-shore services.

By Application

Aerospace accounts for 30.5% of the engineering service outsourcing market. The aerospace sector demands high precision engineering, rigorous testing, and advanced design validation. Outsourced engineering firms support aircraft component design, structural analysis, and avionics integration. The increasing complexity of aircraft systems drives demand for specialized engineering expertise.

Aerospace projects require adherence to strict safety and certification standards. External engineering partners often provide simulation, compliance documentation, and testing support. Digital engineering tools improve performance modeling and risk assessment. Collaboration between aerospace manufacturers and engineering service providers enhances innovation efficiency.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Engineering service providers Very High Medium North America, Asia Pacific Strong project-based and recurring contracts Digital engineering and simulation software vendors High Medium Global Platform integration opportunity Private equity firms High Medium North America, Europe Consolidation of mid-sized outsourcing firms Venture capital investors Medium High North America Innovation in AI-enabled design automation Strategic corporate investors High Low to Medium Global Capability expansion through partnerships Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline AI-assisted design and generative engineering tools +7.8% Accelerated product development Global Short to medium term Cloud-based collaboration and simulation platforms +6.5% Distributed engineering support Global Medium term Digital twin and advanced modeling technologies +5.6% Performance optimization North America, Europe Medium term Automation and robotics integration in manufacturing design +4.8% Smart production alignment Asia Pacific, Europe Medium to long term Secure cloud infrastructure and IP protection frameworks +4.1% Data protection and compliance Global Long term Emerging Trends

The Engineering Service Outsourcing market is increasingly shaped by the adoption of digital engineering tools and simulation technologies. Organizations are outsourcing complex design, prototyping, and product development tasks to specialized providers that leverage advanced modeling software and digital twin platforms. This trend enables faster product validation and reduces in house infrastructure requirements.

As product lifecycles shorten, demand for agile and technology enabled engineering partners continues to expand. Another emerging trend is the integration of artificial intelligence and automation within outsourced engineering workflows.

Service providers are utilizing AI driven design optimization and automated testing tools to improve accuracy and efficiency. This capability enhances turnaround time while maintaining quality standards. Digital collaboration platforms are also strengthening coordination between global engineering teams.

Growth Factors

A key growth driver in this market is the need for specialised engineering capacity that may not be readily available within an organisation. Many companies face shortages in specific technical skills or experience areas, and outsourcing provides a practical way to supplement teams when new projects begin or workloads increase.

This helps reduce pressure on existing staff and supports delivery continuity. Another important driver is the desire for operational flexibility in an environment where project scopes and technology requirements can change rapidly.

Outsourcing allows organisations to adjust resource levels without long-term commitments, making it easier to match capacity with demand while maintaining standards of quality and accountability. Together, these factors support broader adoption of engineering service outsourcing as a strategic capability for managing workload variation and accessing targeted expertise.

Key Market Segments

By Services

- Designing

- Prototyping

- System Integration

- Testing

- Others

By Location

- On-shore

- Off-shore

By Application

- Aerospace

- Automotive

- Manufacturing

- Consumer Electronics

- Semiconductors

- Healthcare

- Telecom

- Energy & Utilities

- Construction & Infrastructure

- Others

Regional Analysis

North America holds a 40.6% share of the engineering service outsourcing market, supported by strong demand from automotive, aerospace, industrial equipment, and technology sectors. Companies in the region are outsourcing engineering functions to improve product development speed, optimize design cycles, and reduce fixed operational costs.

The U.S. market is valued at USD 1.43 Bn and is expanding at a CAGR of 25.2%, reflecting accelerated adoption of external engineering partnerships. Growth is influenced by increasing focus on innovation, shorter product life cycles, and pressure to scale technical capabilities without expanding internal teams.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

The Engineering Service Outsourcing Market is led by large global technology and consulting firms with diversified service portfolios. Tata Consultancy Services TCS, Infosys Limited, HCL Technologies Limited, Wipro, Tech Mahindra Limited, Cognizant, Capgemini Engineering, Accenture, and IBM Corporation provide end to end engineering and digital services. These companies serve automotive, aerospace, telecom, and industrial sectors.

L&T Technology Services Limited, Cyient, Alten Group, AKKA Technologies Akkodis, and QuEST Global focus strongly on core engineering design and product development. EPAM Systems Inc., Persistent Systems, Luxoft DXC, Tata Technologies, and KPIT Technologies enhance market competition through embedded systems and mobility engineering expertise. These companies emphasize simulation, testing, and connected product solutions.

GlobalLogic Inc., RLE International, ASAP Holdings, and other emerging players compete through niche engineering services and flexible engagement models. These firms often target specific industry verticals with customized solutions. Cost optimization and offshore engineering centers support competitive pricing strategies. Continuous investments in digital engineering tools improve service quality and speed.

Top Key Players in the Market

- Tata Consultancy Services (TCS)

- Infosys Limited

- HCL Technologies Limited

- Wipro

- Tech Mahindra Limited

- Cognizant

- Capgemini Engineering

- Accenture

- IBM Corporation

- L&T Technology Services Limited.

- Cyient

- Alten Group

- AKKA Technologies (Akkodis)

- QuEST Global

- EPAM Systems, Inc.

- Persistent Systems

- Luxoft (DXC)

- Tata Technologies

- KPIT Technologies

- GlobalLogic Inc.

- RLE International

- ASAP Holdings

- Others

Future Outlook

The future outlook for the Engineering Service Outsourcing Market is positive as companies increasingly seek cost-effective and specialized engineering support. Demand for outsourcing services is expected to grow because these solutions help organizations access skilled talent, accelerate project timelines, and reduce operational costs.

Adoption of digital tools, cloud collaboration platforms, and remote work practices will support efficient service delivery across geographies. Growth can be attributed to rising investments in product innovation, pressure to optimize engineering processes, and the need for flexible workforce models. Overall, the market is expected to expand as firms prioritize strategic partnerships and scalable engineering capabilities.

Recent Developments

- In June 2025, Algoworks Inc. completed its merger with FROM Digital under the ownership of Trivest Partners. The unified company now focuses on AI-driven engineering and human experience services, supporting large enterprises in digital transformation initiatives.

- In May 2025, EY and DXC Technology launched dedicated services to help enterprises migrate from legacy SAP ERP systems to the cloud-based S/4HANA platform ahead of SAP’s 2027 end-of-support deadline. The initiative aligns with SAP’s multi-billion-dollar investment to accelerate cloud adoption and system modernization.

Report Scope

Report Features Description Market Value (2025) USD 3.6 Billion Forecast Revenue (2035) USD 45.3 Billion CAGR(2025-2035) 28.90% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Services (Designing, Prototyping, System Integration, Testing, Others), By Location (On-shore, Off-shore), By Application (Aerospace, Automotive, Manufacturing, Consumer Electronics, Semiconductors, Healthcare, Telecom, Energy & Utilities, Construction & Infrastructure, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tata Consultancy Services (TCS), Infosys Limited, HCL Technologies Limited, Wipro, Tech Mahindra Limited, Cognizant, Capgemini Engineering, Accenture, IBM Corporation, L&T Technology Services Limited., Cyient, Alten Group, AKKA Technologies (Akkodis), QuEST Global, EPAM Systems, Inc., Persistent Systems, Luxoft (DXC), Tata Technologies, KPIT Technologies, GlobalLogic Inc., RLE International, ASAP Holdings, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Engineering Service Outsourcing MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Engineering Service Outsourcing MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Tata Consultancy Services (TCS)

- Infosys Limited

- HCL Technologies Limited

- Wipro

- Tech Mahindra Limited

- Cognizant

- Capgemini Engineering

- Accenture

- IBM Corporation

- L&T Technology Services Limited.

- Cyient

- Alten Group

- AKKA Technologies (Akkodis)

- QuEST Global

- EPAM Systems, Inc.

- Persistent Systems

- Luxoft (DXC)

- Tata Technologies

- KPIT Technologies

- GlobalLogic Inc.

- RLE International

- ASAP Holdings

- Others