Global Energy Security Market By Component (Solution, Services), By Technology (Physical Security, Network Security), By Power Plant (Thermal and hydro, Nuclear, Oil and gas, Renewable Energy), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121313

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

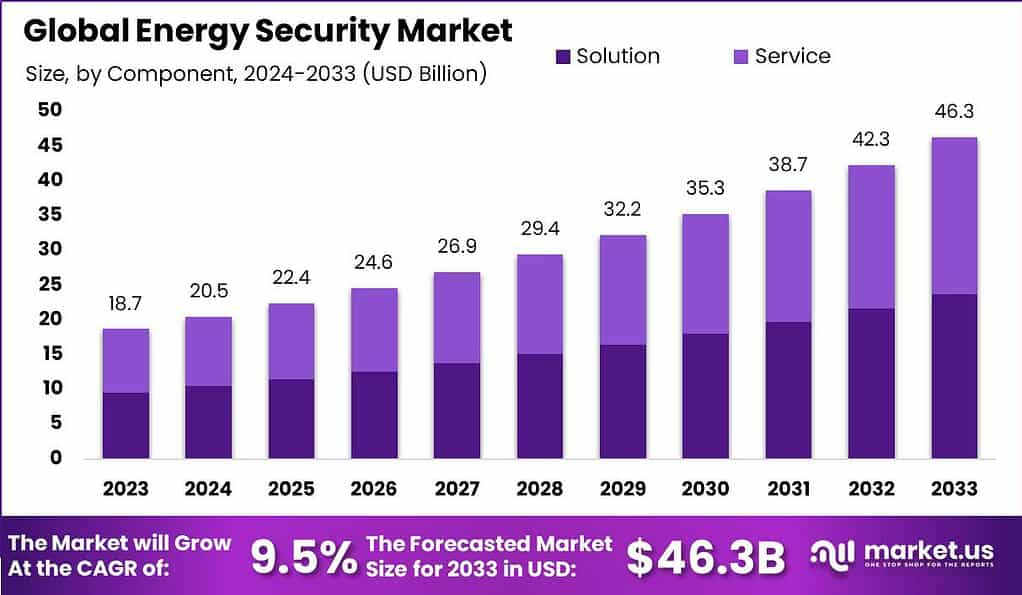

The Global Energy Security Market size is expected to be worth around USD 46.3 Billion By 2033, from USD 18.7 Billion in 2023, growing at a CAGR of 9.5% during the forecast period from 2024 to 2033.

The energy security market refers to the measures and solutions implemented to ensure the reliable supply and protection of energy resources, infrastructure, and systems. Energy security is crucial for the stability and functioning of economies and societies worldwide. It involves safeguarding energy sources, transmission and distribution networks, storage facilities, and critical energy infrastructure from various threats, including physical attacks, natural disasters, cyber-attacks, and geopolitical risks.

The energy security market is experiencing substantial growth driven by an increasing global demand for stable energy supplies amidst fluctuating geopolitical climates and the unpredictability of fossil fuel markets. Factors contributing to the market growth include technological advancements in renewable energy sources, enhanced energy storage solutions, and the escalating need for sustainable energy practices.

Governments and organizations worldwide are prioritizing energy security, investing in infrastructure improvements and renewable installations to mitigate the risk associated with energy supply disruptions. Geopolitical tensions and conflicts in energy-rich regions have also contributed to the growing focus on energy security.

Countries are increasingly seeking to diversify their energy sources and supply routes to mitigate geopolitical risks and reduce dependence on specific regions or suppliers. This has opened up opportunities for new entrants to provide alternative energy solutions, innovative technologies, and resilient infrastructure to enhance energy security.

However, the market faces challenges such as high initial investments required for renewable energy projects, regulatory complexities across different regions, and the technical challenges related to grid integration and energy storage. Despite these hurdles, there are considerable opportunities for new entrants. Innovations in technology, decreasing costs of renewable energy equipment, and increasing support from governments in the form of incentives and policies are opening up new avenues for businesses.

The energy security market includes various stakeholders and solution providers, including energy companies, technology vendors, cybersecurity firms, and government agencies. These entities offer a range of services and solutions, such as risk assessment and management, physical and cyber protection of energy infrastructure, emergency response planning, and advanced monitoring and control systems.

In a recent report from the United Nations Development Program, the global energy demand landscape was found to be shifting. The OECD countries, which are the more developed economies, accounted for around 54% of the world’s energy demand. Meanwhile, transition economies, those undergoing economic changes, made up 14% of the global energy demand. China represented 11%, and the remaining countries in the world constituted 21% of the total energy demand.

Looking ahead, the International Renewable Energy Agency (IRENA) has published a World Energy Transitions Outlook that paints an interesting picture of the future energy mix. According to this outlook, renewable energy sources such as solar, wind, and hydropower are poised to make up a staggering three-quarters of the global energy mix by the year 2050. Additionally, the report suggests that electricity will become the dominant energy carrier, meeting more than 50% of the world’s energy consumption by 2050.

Key Takeaways

- The global energy security market is estimated to reach USD 46.3 billion in the year 2033 with a CAGR of 9.5% during the forecast period and was valued at USD 18.7 billion in the year 2023.

- Based on the component, the solution segment has dominated the market with a share of 51.2% in the year 2023.

- Based on the Technology, the network security segment has dominated the market with a share of 57.6% in the year 2023.

- Based on the Power Plant, the Thermal and hydro segment has dominated the market with a share of 28.1% in the year 2023.

- In 2023, North America held a dominant market position in the energy security market, capturing more than a 40.4% share.

Component Analysis

In 2023, the Solution segment held a dominant market position within the energy security market, capturing more than a 51.2% share. This substantial market share can primarily be attributed to the increasing integration of renewable energy sources into the grid, necessitating advanced solutions for managing grid stability and energy storage.

Additionally, the heightened global awareness and regulatory pressures regarding environmental sustainability have compelled energy providers to invest in robust security solutions that ensure safe and efficient energy production, distribution, and consumption.

The leadership of the Solution segment is further reinforced by technological advancements in energy systems. Solutions such as physical security systems, network security, and cybersecurity measures are critical in protecting infrastructure from both physical and cyber threats, which are increasingly prevalent in the energy sector.

The proliferation of smart grids and IoT devices in energy systems amplifies the need for comprehensive security solutions that can preemptively identify, assess, and mitigate potential threats. Moreover, the ongoing digital transformation in the energy sector, characterized by the adoption of digital twin technologies, predictive maintenance, and blockchain for secure transactions, continues to drive demand for sophisticated security solutions.

These trends collectively contribute to the robust performance of the Solution segment in the energy sector. As technologies evolve and the integration of decentralized energy resources grows, the need for advanced solutions that offer both protection and optimization will likely continue to dominate market preferences. Therefore, the sustained investment in and development of new and effective security solutions are anticipated to support the continued growth and predominance of this segment in the foreseeable future.

Technology Analysis

In 2023, the Network Security segment held a dominant market position in the energy security market, capturing more than a 58% share. This prominence is largely driven by the escalating number of cyber-attacks targeting energy infrastructures, such as power grids and oil and gas pipelines. The growing sophistication of these cyber threats requires equally advanced security measures, leading to increased investments in network security technologies.

These technologies are essential for detecting, preventing, and responding to potential cyber incidents that can disrupt energy supply and distribution, thus ensuring continuous and reliable energy flow. The importance of the Network Security segment is further underscored by the digital transformation of the energy sector. As energy systems become more interconnected and reliant on digital technologies for operations and data exchange, vulnerabilities in network security can have far-reaching consequences.

The adoption of smart grids, IoT devices, and automation in energy production and distribution networks increases the potential entry points for cyber attackers, making robust network security solutions indispensable. This has prompted energy companies to prioritize their cybersecurity measures to protect critical infrastructure and maintain operational integrity.

Given these dynamics, the Network Security segment is poised to maintain its leadership position. Continuous advancements in cybersecurity technologies, such as artificial intelligence and machine learning for real-time threat detection and response, are expected to further enhance the efficacy of network security solutions. This ongoing evolution will likely ensure that network security remains a critical component of energy security strategies, supporting sustained growth in this market segment.

Power Plant Analysis

In 2023, the Thermal and hydro segment held a dominant market position in the energy security market, capturing more than a 28.1% share. This segment’s leadership is largely attributed to the established infrastructure and widespread deployment of thermal and hydroelectric power plants globally.

These traditional energy sources have extensive operational histories and continue to be integral in meeting base-load electricity demands, despite the rise of alternative energy sources. The robustness of thermal and hydroelectric facilities, combined with ongoing technological advancements aimed at improving efficiency and reducing environmental impacts, underpins their substantial market share.

Moreover, the security of these power plants remains a top priority due to their critical role in national energy grids. Threats to these facilities, ranging from natural disasters to cyberattacks, necessitate comprehensive security measures, encompassing both physical and cyber aspects. Investments in enhancing the resilience of thermal and hydroelectric plants are thus significant, propelled by regulatory mandates and the imperative to ensure uninterrupted energy supply.

Considering these factors, the Thermal and hydro segment is expected to maintain a strong position in the energy security market. Continuous improvements in security protocols and technology, coupled with the expansion of smart monitoring systems that leverage data analytics, will likely further solidify the dominance of this segment. As energy security remains pivotal in the broader context of national security and economic stability, the importance of safeguarding thermal and hydro power installations continues to be emphasized in strategic energy planning.

Key Market Segments

By Component

- Solution

- Services

By Technology

- Physical Security

- Network Security

By Power Plant

- Thermal and hydro

- Nuclear

- Oil and gas

- Renewable Energy

Driver

Increasing Demand for Energy

The rising global demand for energy is a significant driver of the energy security market. Rapid urbanization, industrialization, and population growth are key factors contributing to this increased demand. As more countries pursue economic development, the need for a stable and reliable energy supply becomes paramount. This surge in energy consumption necessitates robust security measures to ensure the uninterrupted supply and distribution of energy resources.

Additionally, geopolitical uncertainties and the transition to renewable energy sources add complexity to the global energy landscape, further emphasizing the need for comprehensive energy security solutions. The increasing investment in energy infrastructure and government policies aimed at enhancing energy security also support market growth.

Restraint

Lack of Awareness and Implementation

A major restraint in the energy security market is the lack of awareness and urgency among energy operators regarding the implementation of robust security measures. Despite the growing frequency and sophistication of cyber threats and physical vulnerabilities, some operators may not fully grasp the importance of energy security.

This lack of apprehension can stem from a belief that their facilities are not likely targets or an underestimation of the potential impact of security breaches. This mindset poses a significant risk to the overall security posture of energy infrastructure, as operators may fail to invest in necessary security upgrades and protocols, leading to vulnerabilities that can be exploited by malicious actors.

Opportunity

Technological Advancements and Collaborations

The energy security market presents numerous opportunities, particularly in the realm of technological advancements and collaborations. Innovations in cybersecurity, surveillance systems, and monitoring technologies are crucial for enhancing the security of energy infrastructure. Companies can capitalize on these advancements to develop more effective security solutions.

Additionally, partnerships and collaborations between market players can drive the development of integrated security systems that address various aspects of energy security, from physical threats to cyber-attacks. The expansion of pipeline infrastructure and the adoption of emerging technologies further create opportunities for market growth, as they enable more resilient and adaptive security measures.

Challenge

Evolving Security Threats

One of the most significant challenges facing the energy security market is the evolving nature of security threats. Cyber-attacks, terrorism, and natural disasters pose continuous and dynamic risks to energy infrastructure. The increasing sophistication of cyber threats, in particular, requires constant vigilance and adaptation from security providers. Additionally, the decentralization of energy sources, driven by the shift towards renewable energy, introduces new security challenges.

Ensuring the security of a more distributed and diverse energy supply chain demands innovative and flexible approaches. Addressing these evolving threats requires substantial investment in research and development, as well as ongoing collaboration between governments, industry players, and security experts to stay ahead of potential risks.

Growth Factors

- Growing Cybersecurity Fears: The increase in the number of cyber-attacks that are focused on energy infrastructure has potentially driven the demand for the implementation of cybersecurity solutions. Due to its critical nature, the energy sector is a main target for cybercriminals. This has increased the demand for robust security measures to protect complex data and operational systems.

- Supportive Government Regulations and Compliance: Strict government regulations and compliance requirements are pressuring energy firms to implement advanced security solutions. Different policies including the European Union’s GDPR and other cybersecurity instructions impose the adoption of security frameworks to safeguard critical infrastructure of the energy sector.

- Advancements in Technological: The implementation of progressive technologies including artificial intelligence, machine learning, and IoT in the energy security domain increases the potential of threat recognition and response competencies. Such technologies allow real-time monitoring and predictive analytics and crucially improve the overall security of energy infrastructure.

- Increasing Investment of Government in Energy Infrastructure: Ongoing investments in enhancing the energy infrastructure, especially in developing countries, increase the demand for energy security. The expansion of new and advanced power plants, smart grids, and renewable energy needs security actions to safeguard operative continuousness and flexibility.

- Growing Terrorism and Physical Attacks: The growing terrorist threats and physical attacks on energy infrastructure increase the demand for the implementation of different critical security measures. Different technologies such as surveillance systems, access control, and intrusion detection technologies are significant to protect against such threats and thus ensure the safety of energy infrastructure.

Latest Trends

- Increasing adoption of Advanced Cybersecurity: There is a noteworthy shift towards executing advanced cybersecurity technologies including artificial intelligence (AI) and machine learning (ML) for recognizing and responding to different cyber threats in real-time. Such technologies augment the skill of energy businesses to guard serious infrastructure from developing cyber threats.

- Incorporation of Smart Grid Technologies: The placement of smart grids is becoming necessary to improve the competence and dependability of energy circulation. However, this integration also gives rise to new susceptibilities This increases the need for vigorous security procedures to guard these forward-thinking systems from cyber and physical pressures.

- Improved Emphasis on Physical Safety: In addition to cybersecurity, there is an increasing importance on physical security actions. This comprises the utilization of surveillance cameras, access control systems, and perimeter security to protect energy firms from physical attacks and illegal access.

- Implementation and Development of Renewable Energy Projects: The shift of businesses to renewable energy sources like solar, wind, and hydroelectric power is generating new security issues. The integration of these sources into national grids requires advanced security solutions to protect against cyber and physical threats.

Regional Analysis

In 2023, North America held a dominant market position in the energy security market, capturing more than a 40.4% share. The demand for Energy Security in North America was valued at USD 7.5 billion in 2023 and is anticipated to grow significantly in the forecast period.

This significant market share can be attributed to several factors that uniquely position North America at the forefront of the energy security landscape. Firstly, the region boasts a robust technological infrastructure, which facilitates advanced security solutions to protect critical energy infrastructure from cyber-attacks and physical threats. The proliferation of smart grid technologies and the integration of renewable energy sources also contribute to a more secure and resilient energy system.

Moreover, North America’s stringent regulatory framework, led by initiatives from the U.S. Department of Energy and other governmental bodies, mandates strict compliance and encourages the adoption of best practices in energy security. These regulations are designed to safeguard against potential threats and vulnerabilities, fostering a proactive approach to energy security.

The high level of investment in research and development in the region further bolsters its market position. With a focus on innovation, companies in North America are continually advancing their security technologies, ensuring that the energy sector remains resilient against increasingly sophisticated threats. This environment not only supports technological advancement but also promotes a culture of security awareness, which is critical in maintaining the integrity of energy systems

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the competitive landscape of the energy security market, several key players stand out due to their innovative solutions and strategic market presence. AEGIS Security & Investigations is renowned for its comprehensive security services that cater to critical energy infrastructure, focusing on both physical and cyber threats. Thales and BAE Systems plc are prominent for their advanced technological offerings that include integrated security systems and services designed to protect against a spectrum of vulnerabilities in the energy sector.

Honeywell International Inc. is another major player, known for its robust cybersecurity solutions and smart grid technologies that ensure safe and reliable energy distribution. Similarly, Elbit Systems Ltd. provides sophisticated security technologies tailored to the unique needs of the energy sector, enhancing the resilience of critical infrastructure. Lockheed Martin Corporation leverages its expertise in defense technologies to offer security solutions that address the complex challenges faced by the energy industry.

Top Key Players in the Market

- AEGIS Security & Investigations

- Thales

- BAE Systems plc

- Honeywell International Inc.

- Elbit Systems Ltd.

- Lockheed Martin Corporation

- Siemens AG, hexagon ab

- ABB Ltd.

- Teledyne FLIR LLC

- Other Key Players

Recent Developments

- Lockheed Martin Corporation made strides in advancing its cybersecurity solutions for the energy sector. In January 2024, the company announced new AI-powered threat detection systems specifically designed to protect energy infrastructure from sophisticated cyber-attacks.

- Honeywell International Inc. acquired Carrier’s Global Access Solutions, including LenelS2, Onity, and Supra brands, in December 2023 for $4.95 billion. This acquisition enhances Honeywell’s capabilities in building automation and access control, reinforcing its position in the energy security market.

- Motorola Solutions expanded its portfolio by acquiring IPVideo Corp., the creator of the HALO Smart Sensor, in late 2023. This acquisition integrates advanced threat detection technologies into Motorola’s security offerings, providing comprehensive solutions for physical security.

- ExxonMobil announced a significant move into the energy security sector by acquiring Denbury Inc. for $5 billion in 2023. This acquisition allows ExxonMobil to expand its carbon capture and storage capabilities, crucial for securing energy infrastructure against environmental threats.

- Siemens AG continued its strategic expansion by focusing on smart grid technologies and cybersecurity solutions tailored for the energy sector. In 2023, Siemens launched new digital solutions aimed at enhancing grid security and resilience against cyber threats.

- ABB Ltd. focused on expanding its smart grid and energy management solutions. In November 2023, ABB introduced a new line of products designed to improve grid stability and security, addressing the growing need for resilient energy systems.

Report Scope

Report Features Description Market Value (2023) USD 18.7 Bn Forecast Revenue (2033) USD 46.3 Bn CAGR (2024-2033) 9.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Technology (Physical Security, Network Security), By Power Plant (Thermal and hydro, Nuclear, Oil and gas, Renewable Energy) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape AEGIS Security & Investigations, Thales, BAE Systems plc, Honeywell International Inc., Elbit Systems Ltd., Lockheed Martin Corporation, Siemens AG, hexagon ab, ABB Ltd., Teledyne FLIR LLC, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Energy Security?Energy Security refers to the availability of natural and artificial resources to ensure continuous energy supplies, the ability to withstand sudden disruptions, and the resilience of infrastructure to potential threats.

How big is Energy Security Market?The Global Energy Security Market size is expected to be worth around USD 46.3 Billion By 2033, from USD 18.7 Billion in 2023, growing at a CAGR of 9.5% during the forecast period from 2024 to 2033.

Which regions are leading in the Energy Security Market?North America leads, while the Asia-Pacific region is expected to grow significantly.

What are the key drivers of the Energy Security Market?Key drivers include government regulations, terrorism, cyber threats, and expanding pipeline infrastructure.

What are the major challenges in the Energy Security Market?Challenges are the lack of security implementation by operators and unpredictable cyber threats.

Who are the major players in the Energy Security Market?Major players include AEGIS Security & Investigations, Thales, BAE Systems plc, Honeywell International Inc., Elbit Systems Ltd., Lockheed Martin Corporation, Siemens AG, hexagon ab, ABB Ltd., Teledyne FLIR LLC, Other Key Players.

What are the future opportunities in the Energy Security Market?Opportunities include new energy markets in developing economies and the need for advanced security solutions.

-

-

- AEGIS Security & Investigations

- Thales

- BAE Systems plc

- Honeywell International Inc.

- Elbit Systems Ltd.

- Lockheed Martin Corporation

- Siemens AG, hexagon ab

- ABB Ltd.

- Teledyne FLIR LLC

- Other Key Players