Global End-of-line Packaging Market Size, Share, Growth Analysis By Technology Type (Automatic, Semi-Automatic, Manual), By Machine Type (Standalone Machines, Integrated Systems), By End-User Industry, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135654

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- End-of-line Packaging Market Core Findings

- End-of-line Packaging Business Environment Analysis

- Technology Type Analysis

- Machine Type Analysis

- End-User Industry Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Latest Trends

- Regional Analysis of End-of-line Packaging Market

- Competitive Landscape of End-of-line Packaging Market

- Recent Developments in End-of-line Packaging Market

- Report Scope

Report Overview

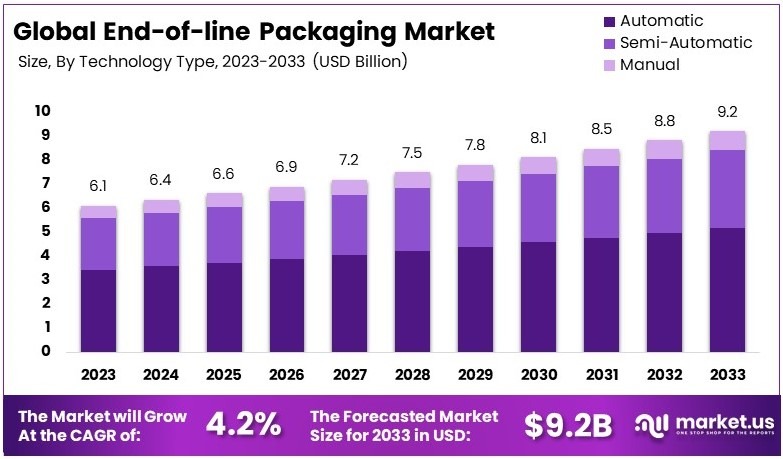

The Global End-of-line Packaging Market size is expected to be worth around USD 9.2 Billion by 2033, from USD 6.1 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2024 to 2033.

End-of-line packaging refers to the final stage in the packaging process where products are prepared for shipping and distribution. It involves packaging machines and systems that automate tasks such as sealing, labeling, and palletizing. This type of packaging ensures products are securely and efficiently packaged for delivery.

The End-of-line Packaging Market includes all activities and technologies related to the final packaging stages before products reach consumers. It covers machinery, automation systems, and packaging solutions used in various industries like food and beverages, pharmaceuticals, and electronics.

End-of-line packaging is rapidly evolving, largely due to the increased integration of automation technologies. In 2021, the installation of industrial robots in various industries saw a remarkable 31% increase from the previous year, elevating the global operational robot count to approximately 3.5 million units.

Furthermore, the end-of-line packaging market is becoming more competitive and technologically advanced. By 2023, the robot density in manufacturing sectors globally reached 113 units per 10,000 employees, highlighting a significant uptick in automation adoption.

According to the International Federation of Robotics, the U.S. significantly contributed to this trend with the installation of 44,303 industrial robots in 2023, marking a 12% increase over 2022. This demonstrates a strong market shift towards more automated, efficient and smart packaging systems.

Additionally, sustainability is becoming a crucial factor in the industry. As per the Consumer Brands Association, 20 of the largest fast-moving consumer goods (FMCG) manufacturers have pledged to transition to 100% recycled packaging by 2030. This commitment reflects a broader industry trend towards environmentally friendly packaging solutions, which is increasingly important to consumers.

Moreover, the economic scale of the packaging machinery industry is substantial, with a total turnover of €9.2 billion in 2023, and exports contributing €7.2 billion. Italy, in particular, saw a significant 10.5% increase in its foreign turnover, reaching €7.2 billion.

These figures not only reflect the robust health of the packaging industry but also highlight its critical role in global trade and manufacturing. The combined impact of technological advancements and a shift towards sustainable practices is setting new standards in the packaging market, making it a key area of growth and innovation.

End-of-line Packaging Market Core Findings

- End-of-line Packaging Market was valued at USD 6.1 Billion in 2023, expected to reach USD 9.2 Billion by 2033, with a CAGR of 4.2%.

- In 2023, Automatic technology dominates, comprising 56.3% of the market, reflecting the shift towards automation to increase efficiency.

- In 2023, Stand-alone machines lead with 63.7%, popular for their flexibility and scalability in various industries.

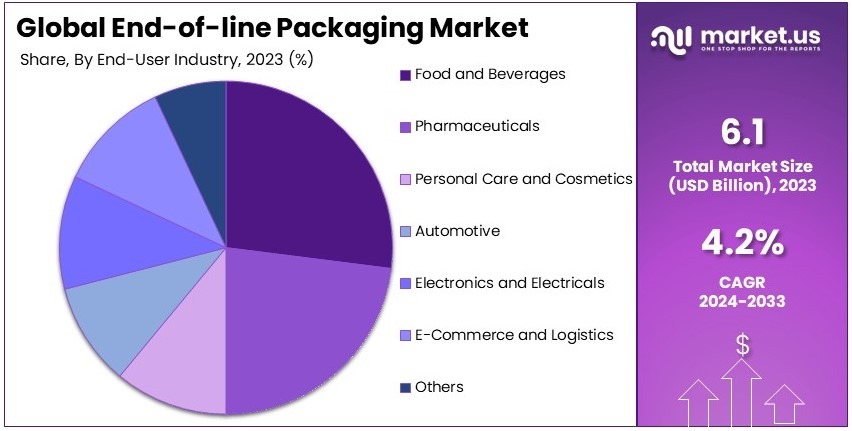

- In 2023, the Food & Beverages industry leads the end-use segments, due to increasing automation in food production and packaging.

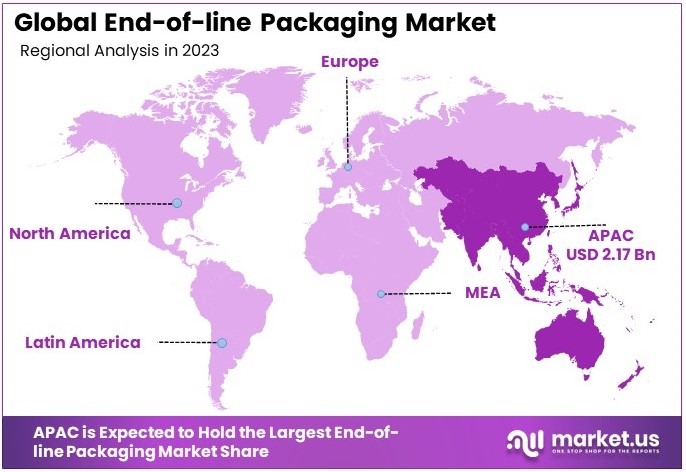

- In 2023, Asia Pacific is the dominant region with 35.6% market share, fueled by rapid industrial growth and expanding manufacturing sectors.

End-of-line Packaging Business Environment Analysis

The end-of-line packaging market is nearing saturation in several developed regions; however, innovation continues to open new opportunities. According to Automation World, approximately 44.9% of manufacturers have now integrated industrial robotic systems into their end-of-line processes, marking a significant adoption rate that underscores the current technological push.

The target demographic for end-of-line packaging is broad, encompassing manufacturers who prioritize efficiency and precision in their operations. The recent acquisition of Berry Global Group by Amcor PLC for approximately $8.4 billion, as announced on November 15, 2024, highlights the industry’s focus on consolidating capabilities to better serve these demanding market segments.

Product differentiation in this sector is increasingly driven by the integration of advanced technologies such as robotics and AI, which enhance both the speed and quality of packaging. This shift is not only responding to consumer demands but is also reshaping the competitive landscape, providing clear advantages to early adopters.

Value chain analysis reveals that end-of-line packaging is critical in minimizing operational downtimes and optimizing supply chains. With the projected combined revenues to reach $37 billion post-Amcor and Berry merger, the emphasis on streamlined packaging solutions is more pronounced, reflecting a highly coordinated industry effort to enhance overall value delivery.

Investment opportunities are abundant, particularly in areas involving automation and sustainable practices. Companies are continually looking for innovative solutions that can offer both cost reductions and improved environmental impacts, aligning with global sustainability trends.

Export and import dynamics are also crucial, as the market adjusts to global trade flows and regulatory changes. The end-of-line packaging market plays a pivotal role in ensuring that products are market-ready and compliant with international standards, which is essential for maintaining smooth global distribution channels.

Technology Type Analysis

Automatic technology dominates the End-of-line Packaging Market with 56.3% due to its efficiency and ability to reduce labor costs.

In the End-of-line Packaging Market, Automatic technology has emerged as the dominant sub-segment, commanding a significant market share of 56.3%. This dominance can be attributed to its high efficiency and the substantial reduction in labor costs it offers.

Automatic systems streamline the end-of-line packaging process, allowing for faster production rates and fewer errors, which is critical in high-volume manufacturing environments.

Semi-Automatic technologies also play a crucial role by offering a balance between manual labor and automation. These systems are particularly valuable in mid-size operations where full automation may not be cost-effective.

Manual systems, while less prevalent, are indispensable in specialized packaging operations where precision and customization are required. They remain relevant in industries where the intricacies of the product necessitate a hands-on approach.

Machine Type Analysis

Standalone machines lead the segment with 63.7% due to their versatility and ease of integration into existing lines.

Standalone machines have secured a leading position in the End-of-line Packaging Market with a market share of 63.7%. These machines are favored for their versatility and ease of integration into various production lines without the need for extensive modifications.

Standalone units are particularly appealing to small and medium enterprises that require flexibility in their packaging processes to adapt to different products or packaging designs.

Integrated systems, although they account for a smaller portion of the market, are critical in large-scale operations where high throughput and seamless coordination of the packaging line are necessary. These systems offer enhanced synchronization between different packaging stages, resulting in higher productivity and reduced downtime.

End-User Industry Analysis

The Food and Beverages industry is the predominant user of End-of-line Packaging solutions.

The Food and Beverages sector stands out as the dominant end-user in the End-of-line Packaging Market. This industry relies heavily on effective end-of-line packaging solutions to ensure product safety, maintain freshness, and meet stringent regulatory standards. The growth of this segment is propelled by increasing consumer demand for packaged foods and beverages driven by changes in lifestyle and consumption habits.

The Pharmaceuticals industry also makes significant use of these packaging solutions to maintain the integrity and sterility of its products. Personal Care and Cosmetics benefit from advanced end-of-line packaging that can provide aesthetically appealing and durable packaging, which is crucial in a market where brand presentation is key.

Other sectors such as Automotive, Electronics and Electricals, and E-Commerce and Logistics utilize end-of-line packaging to enhance the efficiency of their distribution systems and protect products during transit. The Chemicals and Petrochemicals industry, along with Industrial Goods, require robust packaging solutions that can handle potentially hazardous materials safely and comply with global safety standards.

Key Market Segments

By Technology Type

- Automatic

- Semi-Automatic

- Manual

By Machine Type

- Standalone Machines

- Integrated Systems

By End-User Industry

- Food and Beverages

- Pharmaceuticals

- Personal Care and Cosmetics

- Automotive

- Electronics and Electricals

- E-Commerce and Logistics

- Chemicals and Petrochemicals

- Industrial Goods

Driving Factors

Automation and Consumer Demand Drives Market Growth

The End-of-line Packaging Market is significantly propelled by increasing automation in manufacturing and the rising demand for consumer goods. The integration of automated systems in end-of-line packaging processes allows for higher efficiency, accuracy, and speed, which are crucial in meeting the growing production demands.

This automation is particularly vital in industries like food and beverages and consumer electronics, where the market pressure for rapid production cycles is high.

Moreover, the growth of e-commerce has fueled the need for robust packaging solutions that ensure product safety during transit, thereby driving the demand for advanced end-of-line packaging solutions. These factors collectively enhance production capacities and market responsiveness, making automation and consumer demand pivotal in driving market growth.

Restraining Factors

Cost and Flexibility Restraints Market Growth

The expansion of the End-of-line Packaging Market faces significant hurdles due to high installation and maintenance costs of advanced machinery. These financial burdens can deter small to medium-sized enterprises from adopting the latest technologies, limiting market growth.

Additionally, the limited flexibility of existing packaging machinery to adapt to new packaging styles or materials poses a challenge, as it prevents quick shifts in production lines to accommodate market trends or regulatory changes.

The market is also constrained by the shortage of skilled labor necessary to operate and maintain sophisticated end-of-line packaging systems, further compounded by stringent regulations that require compliance with safety and environmental standards. These factors collectively form substantial barriers, restraining the market’s growth potential.

Growth Opportunities

Technological Innovations Provide Opportunities

Emerging opportunities in the End-of-line Packaging Market are predominantly driven by technological innovations, including the integration of IoT and smart technologies. These advancements offer significant benefits such as enhanced monitoring and automation capabilities, leading to improved efficiency and reduced downtime.

Expansion into emerging markets also presents a substantial growth opportunity as these regions exhibit increased demand for packaged goods due to urbanization and rising income levels. Additionally, the growing food and beverage industry requires innovative packaging solutions that extend shelf life and maintain product integrity, further expanding the market’s potential.

The adoption of sustainable practices in packaging operations aligns with global environmental goals, offering opportunities to innovate and capture new market segments prioritizing eco-friendly solutions.

Latest Trends

The end-of-line packaging market is currently experiencing several dynamic shifts, reflecting broader changes in technology, consumer behavior, and regulatory environments. Here are some of the latest trends influencing this sector:

- Automation and Robotics: There is a significant increase in the adoption of automation and robotics in end-of-line packaging. This trend is driven by the need for greater efficiency, faster production rates, and reduced labor costs.

- Sustainability Initiatives: Environmental concerns are shaping the market as companies seek to reduce the environmental impact of their packaging processes. This includes the use of recyclable and biodegradable materials, as well as systems that minimize waste.

- Flexible Packaging Solutions: As product variety increases, there is a growing demand for flexible packaging solutions that can accommodate different product types and sizes. This flexibility is crucial for companies looking to quickly adapt to market changes without significant additional investment in new packaging machinery.

- Smart Packaging Technologies: Smart packaging, which includes the integration of QR codes, RFID tags, and other tracking technologies, is becoming more prevalent. These technologies help in enhancing the traceability of products, improving inventory management, and offering a platform for engaging consumers with additional product information and authenticity assurance.

These trends indicate a market that is becoming increasingly sophisticated, with a strong emphasis on efficiency, customization, and sustainability. As these trends continue to evolve, the end-of-line packaging market is expected to see significant growth and transformation, offering substantial opportunities for industry participants.

Regional Analysis of End-of-line Packaging Market

Asia Pacific Dominates with 35.6% Market Share

Asia Pacific leads the End-of-line Packaging Market with a 35.6% share, amounting to USD 2.17 billion. This dominance is propelled by rapid industrial growth, expanding manufacturing sectors, and increasing automation in packaging processes across the region.

The region’s strong performance is influenced by its large manufacturing base and high demand for automated packaging solutions. Additionally, economic growth in countries like China and India boosts the market. The development of e-commerce also plays a significant role in increasing demand for efficient packaging systems.

Asia Pacific’s influence in the End-of-line Packaging Market is expected to grow, driven by continuous advancements in automation and a rising focus on sustainable packaging. The expansion of manufacturing capabilities and increasing investments in technology are likely to further enhance the region’s market presence.

Regional Mentions:

- North America: North America remains a key player in the End-of-line Packaging Market, with strong technological advancements and a focus on customization and integration of smart technologies. The region’s developed retail and e-commerce sectors significantly contribute to its market size.

- Europe: Europe is advancing in the End-of-line Packaging Market through innovation and stringent sustainability mandates. The region is focused on enhancing recycling processes and reducing packaging waste, which supports its robust market position.

- Middle East & Africa: The Middle East and Africa are developing markets in the End-of-line Packaging sector, driven by improvements in industrial infrastructure and increased foreign investments. These factors are beginning to stimulate local production capacities.

- Latin America: Latin America is progressing in the End-of-line Packaging Market with a focus on modernizing its packaging machinery and expanding its manufacturing sectors. The region benefits from increased urbanization and industrial activities that spur demand for efficient packaging solutions.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape of End-of-line Packaging Market

The End-of-Line Packaging Market is dominated by four major players: Krones AG, IMA Group, Robert Bosch GmbH, and ProMach Inc. These companies significantly influence market dynamics through their innovative solutions, global reach, and comprehensive product lines.

Krones AG excels with its high-tech machinery that caters to the packaging needs of the beverage, food, and pharmaceutical industries. The company is renowned for its efficiency and reliability, offering systems that integrate seamlessly into existing production lines, enhancing operational throughput and reducing downtime.

IMA Group is a key player known for its versatile and advanced end-of-line packaging solutions. Specializing in the healthcare and food sectors, IMA’s equipment is designed for precision and adaptability, allowing for customization according to client requirements. This flexibility makes IMA a preferred partner in various industries seeking innovative packaging technologies.

Robert Bosch GmbH offers a robust lineup of packaging technology, especially noted for its sustainable and flexible packaging systems. Bosch’s commitment to innovation is evident in its development of intelligent, networked packaging solutions that support Industry 4.0 initiatives, aiming to improve productivity and environmental sustainability.

ProMach Inc. is distinguished by its comprehensive range of product offerings, spanning multiple packaging categories including labeling, capping, and handling. ProMach’s strength lies in its integrated solutions that cover every aspect of the packaging line, which simplifies procurement and maintenance for clients, thereby enhancing overall customer satisfaction.

These top companies shape the competitive landscape of the End-of-Line Packaging Market through their continuous innovation, customer-focused solutions, and strategic global operations. Their efforts not only meet current market demands but also address evolving challenges in packaging, setting the stage for future advancements in the industry.

Major Companies in the Market

- Krones AG

- IMA Group

- Robert Bosch GmbH

- ProMach Inc.

- Schneider Packaging Equipment Co., Inc.

- A-B-C Packaging Machine Corporation

- Marchesini Group S.p.A.

- Coesia Group

- Sidel Group

- Brenton Engineering

- Fuji Machinery Co., Ltd.

- KHS GmbH

Recent Developments in End-of-line Packaging Market

- Pacteon Group: In June 2024, Pacteon Group announced the acquisition of Descon Integrated Conveyor Solutions, a key player in integrated conveyor systems for the food and beverage industry. This strategic acquisition aims to broaden Pacteon’s market reach and enhance its offerings in end-of-line packaging equipment.

- Standard-Knapp: In 2024, Standard-Knapp merged with EoL Packaging Experts, forming a globally active leader in end-of-line packaging machines and systems. This merger strengthens their position in the food and beverage sector across America and Europe.

- ProMach: In October 2024, ProMach acquired HMC Products, enhancing its portfolio in packaging machinery by adding expertise in horizontal form fill seal machine manufacturing and support.

Report Scope

Report Features Description Market Value (2023) USD 6.1 Billion Forecast Revenue (2033) USD 9.2 Billion CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology Type (Automatic, Semi-Automatic, Manual), By Machine Type (Standalone Machines, Integrated Systems), By End-User Industry (Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Automotive, Electronics and Electricals, E-Commerce and Logistics, Chemicals and Petrochemicals, Industrial Goods) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Krones AG, IMA Group, Robert Bosch GmbH, ProMach Inc., Schneider Packaging Equipment Co., Inc., A-B-C Packaging Machine Corporation, Marchesini Group S.p.A., Coesia Group, Sidel Group, Brenton Engineering, Fuji Machinery Co., Ltd., KHS GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  End-of-line Packaging MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

End-of-line Packaging MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Krones AG

- IMA Group

- Robert Bosch GmbH

- ProMach Inc.

- Schneider Packaging Equipment Co., Inc.

- A-B-C Packaging Machine Corporation

- Marchesini Group S.p.A.

- Coesia Group

- Sidel Group

- Brenton Engineering

- Fuji Machinery Co., Ltd.

- KHS GmbH