Global Empty Capsules Market By Product (Gelatin, Non-Gelatin Capsules) By Capsule Size (Size "000" Empty Capsules, Size "00" Empty Capsules, Size "0" Empty Capsules, Size "1" Empty Capsules, Size "2" Empty Capsules, Size "3" Empty Capsules, Size "4" Empty Capsules, Size "5" Empty Capsules) By End-user (Pharmaceutical Industy, Nutraceutical and Cosmetics Industries, Clinical Research Organizations) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 130343

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

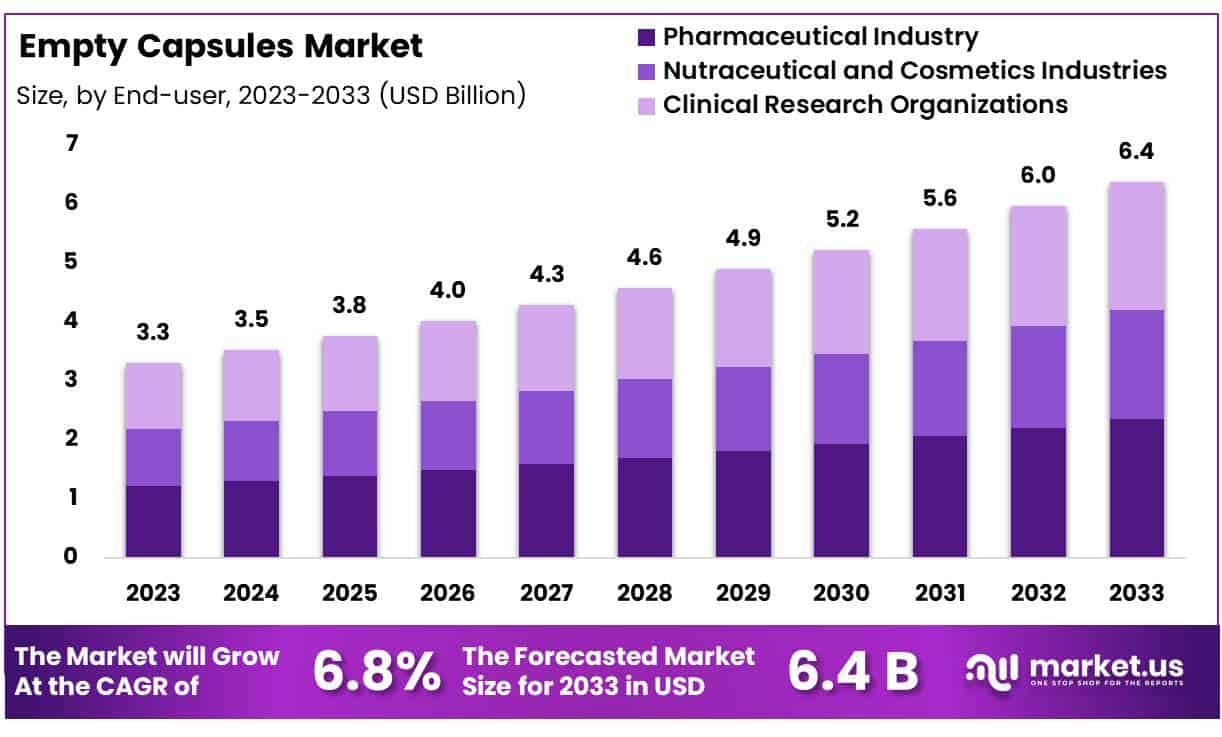

Global Empty Capsules Market size is expected to be worth around USD 6.4 Billion by 2033 from USD 3.5 Billion in 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

Empty capsules are specialized shells designed to encapsulate medicinal agents and inert substances for pharmaceutical and nutraceutical use. They are crafted from various materials including gelatin, Hydroxypropyl Methylcellulose (HPMC), starch, or pullulan—a unique film-forming material. The adoption of capsule formulations by pharmaceutical manufacturers is on the rise, driven by the protective qualities of enteric capsules that shield drugs from the acidic environment of the stomach, enhancing drug stability and efficacy. This has been demonstrated in studies such as a March 2024 research from Nutrients, which highlighted the efficiency of enteric-coated tablets in delivering sodium bicarbonate effectively to the intestine.

The market for empty capsules is also expanding into the cosmeceutical and food industries, further propelled by the aging population’s increasing demand for nutraceuticals. This trend is particularly strong in North America, where the growth of the geriatric population is significant. For instance, the Population Reference Bureau projects that the number of Americans aged 65 and older will nearly double by 2060.

Concurrently, dietary supplements are increasingly popular, with a significant portion of the American population incorporating them into their health routines, as noted in the 2019 CRN Consumer Survey on Dietary Supplements. This broad usage underscores the extensive potential and diverse applications of empty capsules in today’s market.

Key Takeaways

- Market Size: Global Empty Capsules Market size is expected to be worth around USD 6.4 Billion by 2033 from USD 3.5 Billion in 2023.

- Market Growth: The market growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

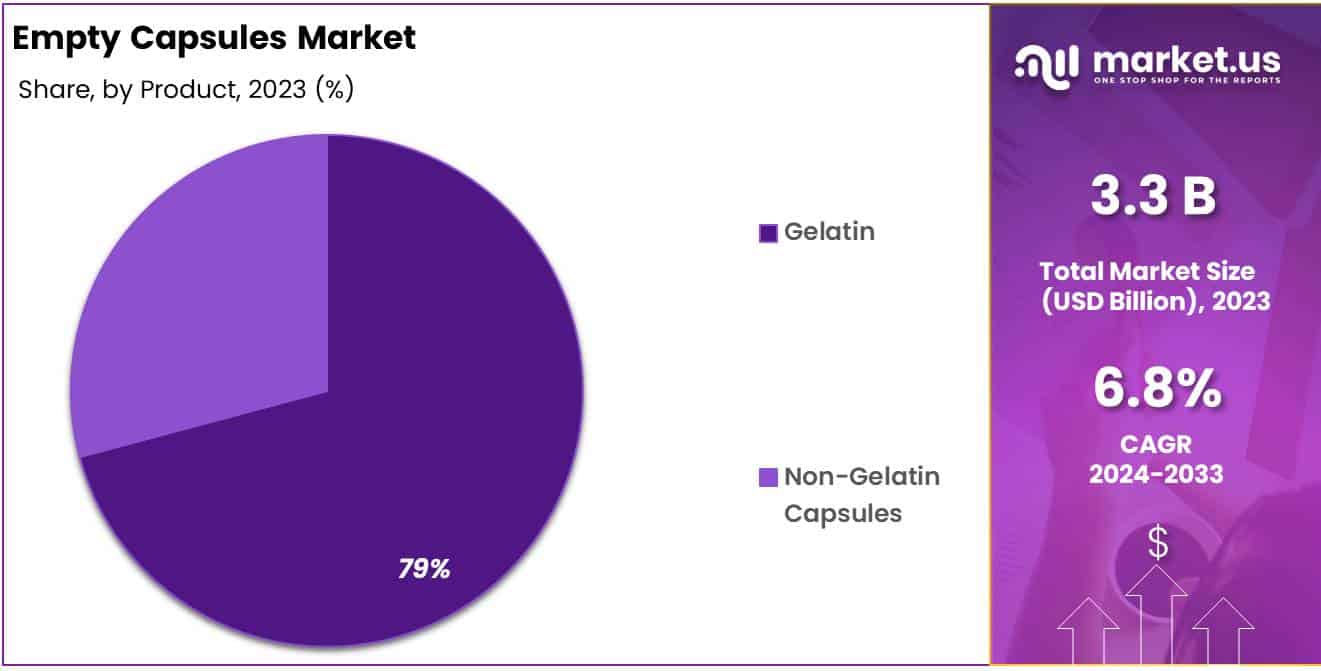

- Product Analysis: In 2023, the market for empty capsules was notably dominated by non-gelatin capsules, which accounted for a remarkable 79% market share.

- Capsule Analysis: In 2023, the market for empty capsules exhibited a pronounced preference for “Size 0” capsules, which captured a 23% market share.

- End-Use Analysis: In 2023, the empty capsules market was significantly shaped by its diverse end-user base, with the pharmaceutical industry leading at a 37% market share.

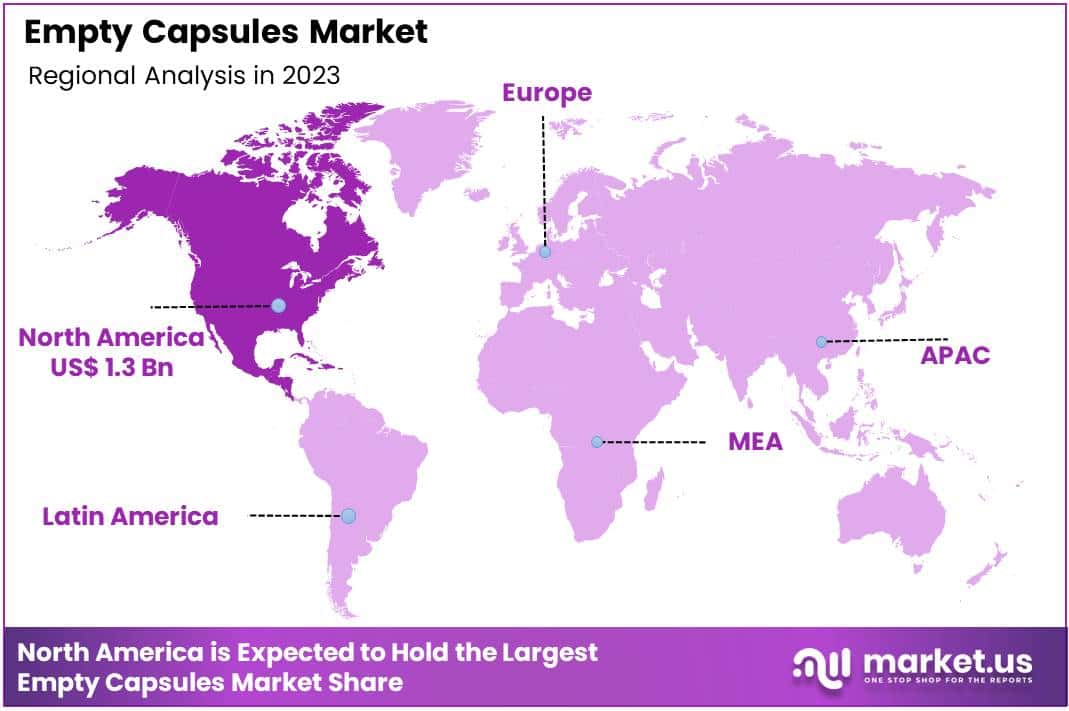

- Regional Analysis: In 2023, the North American region dominated the empty capsules market, holding a substantial 40% market share.

- Market Dynamics: Key players in the market are distinguished by their strong R&D capabilities, global distribution networks, and strategic initiatives such as mergers and acquisitions to sustain growth and expand market reach.

- Regulatory Influence: Strict regulatory environments, particularly in regions like North America and Europe, shape market operations and ensure product quality and safety, posing both challenges and opportunities for market participants.

Product Analysis

In 2023, the market for empty capsules was notably dominated by non-gelatin capsules, which accounted for a remarkable 79% market share. This overwhelming preference underscores a significant consumer shift towards alternatives that align with vegan and vegetarian lifestyles, avoiding animal-derived ingredients like gelatin. Non-gelatin capsules are predominantly made from hydroxypropyl methylcellulose (HPMC), catering effectively to consumers with specific dietary restrictions or allergies associated with gelatin.

Meanwhile, gelatin capsules, once the standard due to their cost-effectiveness and functional versatility, have observed a decline in market preference. This trend is influenced by heightened consumer consciousness regarding animal welfare and a growing inclination towards clean-label health products. The shift is reflective of a broader movement within the pharmaceutical and nutraceutical industries towards plant-based products, prompting manufacturers to innovate and expand their non-gelatin offerings.

These market dynamics highlight a pivotal transition in consumer demands and industry responses, emphasizing the increasing importance of ethical and health-conscious production practices in the empty capsules market. This analysis points to a continued growth trajectory for non-gelatin capsules driven by evolving consumer preferences and market demands.

Capsule Analysis

In 2023, the market for empty capsules exhibited a pronounced preference for “Size 0” capsules, which captured a 23% market share, illustrating their robust demand across pharmaceutical and nutraceutical sectors. This preference underscores the industry’s recognition of “Size 0” as an ideal middle ground for encapsulating a sufficient quantity of substances while maintaining user-friendly dimensions.

The market also showcases a diverse range of capsule sizes tailored to specific applications and consumer needs. Larger capsules like “Size 000” are preferred for their capacity to accommodate higher doses, making them suitable for nutritional supplements that require large ingredient volumes. Conversely, “Size 00” is extensively utilized within the dietary supplement industry due to its practical size for daily consumption.

Smaller capsules, ranging from “Size 1” to “Size 5”, serve niche markets where lower dosages or targeted delivery mechanisms are required. Each size offers unique benefits, reflecting the strategic alignment of product offerings with market demand and consumer preferences.

End-user Analysis

In 2023, the empty capsules market was significantly shaped by its diverse end-user base, with the pharmaceutical industry leading at a 37% market share. This major share is indicative of the pharmaceutical sector’s substantial reliance on capsules for drug delivery, underpinning the industry’s ongoing need for innovative and effective delivery mechanisms.

Further contributions to the market come from the nutraceutical and cosmetics industries. The nutraceutical sector’s growth is driven by increasing consumer interest in dietary supplements and wellness products, where capsules play a crucial role due to their precise dosage delivery and extended shelf life. Similarly, in the cosmetics industry, capsules are utilized to encapsulate active ingredients, ensuring their stability and enhancing the efficacy of skincare and beauty products.

Clinical Research Organizations (CROs) also form a vital part of the market landscape. They predominantly use capsules for administering drugs in clinical trials, facilitating the controlled study of new therapeutic substances.

Key Market Segments

By Product

- Gelatin

- Non-Gelatin Capsules

By Capsule Size

- Size “000” Empty Capsules

- Size “00” Empty Capsules

- Size “0” Empty Capsules

- Size “1” Empty Capsules

- Size “2” Empty Capsules

- Size “3” Empty Capsules

- Size “4” Empty Capsules

- Size “5” Empty Capsules

By End-user

- Pharmaceutical Industy

- Nutraceutical and Cosmetics Industries

- Clinical Research Organizations

Market Driver

Growing Health Consciousness

The expanding pharmaceutical and nutraceutical sectors are key drivers of the empty capsules market. This growth is catalyzed by an increased global focus on health and wellness, alongside a surge in chronic diseases and an aging population, which collectively heighten the demand for medication and dietary supplements delivered in capsule form.

This driver is robustly supported by the rising consumer preference for preventive healthcare measures and precision medication, underscoring the essential role of capsules in effective dosage delivery.

Market Trend

Vegan Capsules on the Rise

A pivotal trend in the empty capsules market is the increasing consumer shift towards non-gelatin capsules. This shift is largely driven by the rising number of vegetarians and vegans and the growing scrutiny over the use of animal-derived products such as gelatin in capsules.

Non-gelatin capsules, primarily composed of hydroxypropyl methylcellulose (HPMC), are favored for their ethical sourcing and stability under various environmental conditions. This evolution is prompting manufacturers to innovate within this space, catering to a demographic that values ethical and dietary compliance in pharmaceuticals.

Market Restraint

Stringent Regulations

Regulatory and quality standards represent a significant restraint in the empty capsules market. The adherence to stringent safety, efficacy, and quality regulations can be a formidable barrier, particularly for new market entrants and smaller firms lacking the resources to easily comply.

This challenge is acute in rigorously regulated regions like the U.S. and Europe, where compliance costs can be prohibitive and the regulatory approval process is extensive, demanding substantial investments in both time and capital.

Market Opportunity

Targeting Emerging Markets

The empty capsules market holds considerable opportunity in emerging markets, where rapid economic growth, rising healthcare expenditure, and infrastructural improvements are ongoing. These regions, characterized by an expanding middle class with an increasing capacity for health expenditure, present fertile ground for market expansion.

Manufacturers can leverage these conditions by establishing operations within these markets or forming local partnerships, thus tapping into a new customer base while navigating less stringent regulatory landscapes. This strategic move not only increases market share but also diversifies the geographical footprint of capsule manufacturers.

Regional Analysis

In 2023, the North American region dominated the empty capsules market, holding a substantial 40% market share. This significant dominance is largely attributed to the region’s advanced healthcare infrastructure, high healthcare spending, and the strong presence of leading pharmaceutical and nutraceutical companies.

The market’s growth in North America is also propelled by the increasing consumer demand for dietary supplements and the widespread acceptance of preventive healthcare measures. Additionally, the region’s stringent regulatory standards ensure high-quality and safe capsule products, further solidifying its leadership position in the global empty capsules market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Empty Capsules Market, key industry participants are characterized by their advanced manufacturing technologies and broad product ranges. These entities have established extensive global distribution channels that enhance their market reach and customer base. They are at the forefront of innovation, focusing on developing new capsule types that cater to evolving consumer preferences towards vegetarian and allergen-free products. Strategic investments in research and development allow them to address complex health and medication delivery challenges effectively.

These market leaders also engage in strategic mergers, acquisitions, and collaborations, which help them expand their geographical footprint and enter new markets. Their adherence to high regulatory standards across various regions ensures they maintain a competitive edge by offering high-quality, safe products. Sustainability is a core component of their operational strategies, reflecting a commitment to environmentally friendly manufacturing processes and ethical sourcing. These strategies collectively bolster their market dominance and responsiveness to the shifting landscape of consumer health preferences and regulatory environments.

Market Key Players

- ACG Worldwide

- Capsugel

- Qualicaps Inc.

- Bright Pharma Caps Inc.

- Sunil Healthcare Ltd.

- CapsCanada Corporation

- Roxlor LLC

- Snail Pharma Industry Co. Ltd.

- Suheung Co. Ltd.

- Medi-Caps Ltd.

Recent Developments

- ACG Worldwide: In March 2023, VANTAGE NUTRITION, an ACG company, expanded its footprint by acquiring ComboCap, Inc. (US) and BioCap (South Africa), aiming to enhance its technology and market reach, particularly in North America.

- Capsugel: As part of Lonza Group, Capsugel continues to play a leading role in the empty capsules market, leveraging advanced manufacturing processes and innovation to maintain market dominance.

- Qualicaps Inc.: A subsidiary of Mitsubishi Chemical Holdings, Qualicaps is noted for its significant role and innovations within the empty capsules sector, with no specific recent acquisitions or merges reported during this period.

- Bright Pharma Caps Inc.: This company remains active in the market, focusing on the production and development of gelatin and non-gelatin capsules, though no specific recent developments were highlighted in the latest reports.

- Sunil Healthcare Ltd.: While specific recent developments were not detailed, Sunil Healthcare continues to be recognized for its significant presence in the market and its range of capsule products

Report Scope

Report Features Description Market Value (2023) USD 3.5 Billion Forecast Revenue (2033) USD 6.4 Billion CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Gelatin, Non-Gelatin Capsules) By Capsule Size (Size “000” Empty Capsules, Size “00” Empty Capsules, Size “0” Empty Capsules, Size “1” Empty Capsules, Size “2” Empty Capsules, Size “3” Empty Capsules, Size “4” Empty Capsules, Size “5” Empty Capsules) By End-user (Pharmaceutical Industy, Nutraceutical and Cosmetics Industries, Clinical Research Organizations) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape ACG Worldwide, Capsugel, Qualicaps Inc., Bright Pharma Caps Inc., Sunil Healthcare Ltd., CapsCanada Corporation, Roxlor LLC, Snail Pharma Industry Co. Ltd., Suheung Co. Ltd., Medi-Caps Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ACG Worldwide

- Capsugel

- Qualicaps Inc.

- Bright Pharma Caps Inc.

- Sunil Healthcare Ltd.

- CapsCanada Corporation

- Roxlor LLC

- Snail Pharma Industry Co. Ltd.

- Suheung Co. Ltd.

- Medi-Caps Ltd.