Global Embedded BI in ERP Market Size, Share Analysis Report By Application (Data Visualization, Predictive Analytics, Reporting and Dashboards, Others), By Industry Vertical (Manufacturing, Retail, Healthcare, Financial Services, Government, Others), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 151895

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

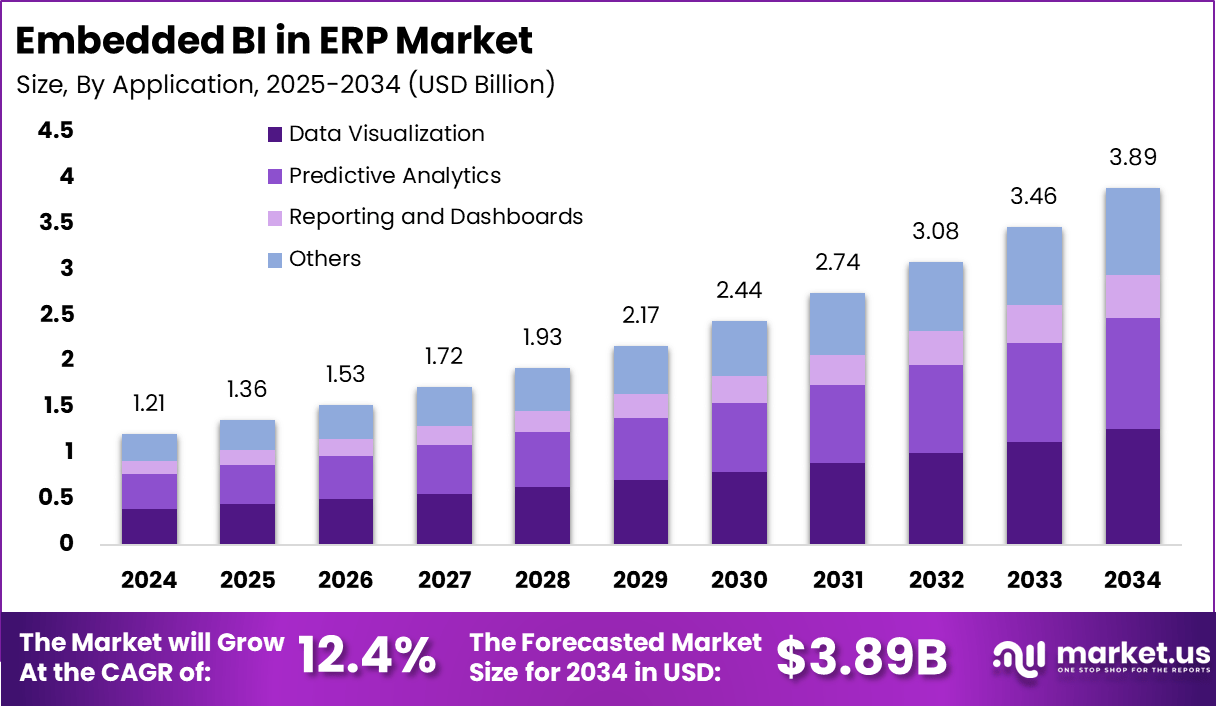

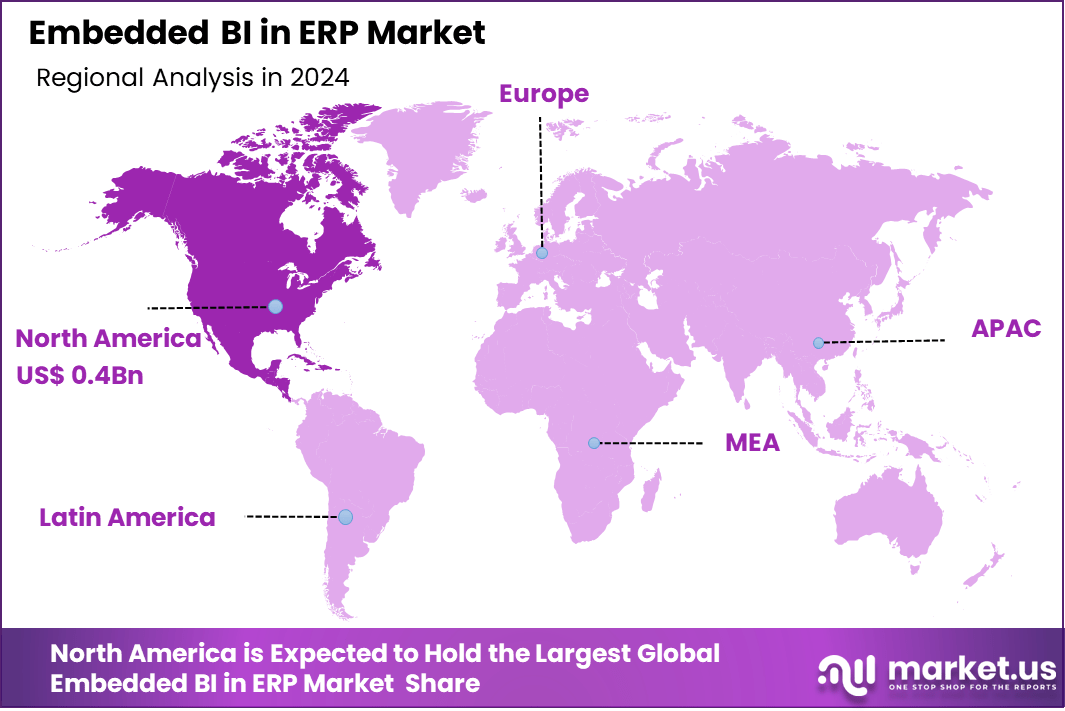

The Global Embedded BI in ERP Market size is expected to be worth around USD 3.89 Billion By 2034, from USD 1.21 billion in 2024, growing at a CAGR of 12.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.7% share, holding USD 0.4 Billion revenue.

Embedded business intelligence (BI) within enterprise resource planning (ERP) systems refers to the seamless integration of analytical tools, dashboards, and reporting capabilities directly into core ERP workflows. By embedding real-time insights straight into modules such as finance, procurement, supply chain, and sales, organizations can streamline operations without toggling between standalone analytics platforms.

Top driving factors fueling adoption include the increasing demand for real‑time analytics and self‑service BI. Many organizations now expect insights to be available instantly, across departments, without reliance on IT support. The shift toward cloud‑based deployments also plays a key role, as these models offer scalability, lower upfront investment, and ease of integration into existing ERP environments.

The increasing adoption of technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT) enhances embedded BI capabilities. These technologies enable predictive analytics, anomaly detection, and more advanced data visualizations, all of which elevate the value derived from ERP‑embedded insights.

Key reasons for adopting embedded BI include improved operational efficiency, enhanced decision‑making agility, and reduced dependency on separate analytic platforms. Organizations also benefit from a more intuitive user experience, as insights are presented within familiar transactional contexts, boosting adoption and usefulness.

As per the latest insights from Market.us, The Global Business Intelligence (BI) Market is set to grow from USD 5.9 Billion in 2023 to around USD 26.5 Billion by 2033, registering a strong CAGR of 16.2%. This growth is driven by rising demand for real-time data insights, simplified analytics, and AI-powered dashboards that support faster decision-making across industries.

Meanwhile, the ERP Software Market is projected to expand from USD 65.2 Billion in 2023 to nearly USD 200.7 Billion by 2033, growing at a CAGR of 11.9%. Businesses are adopting ERP systems to streamline operations, improve transparency, and support digital transformation through flexible, cloud-based solutions.

Investment opportunities emerge in cloud‑native analytics infrastructure, modular embedded BI tools for industry‑specific ERP systems, and AI‑augmented visualizations. These segments cater to both large enterprises demanding custom deployments and SMEs looking for affordable, easy‑to‑integrate BI enhancements.

The business benefits realized from embedded BI include improved operational efficiency, enhanced agility in decision making, increased visibility across business functions, and compliance gains. In sectors like finance or healthcare, embedded analytics help automate reporting, reduce manual intervention, and accelerate response to anomalies.

Key Insight Summary

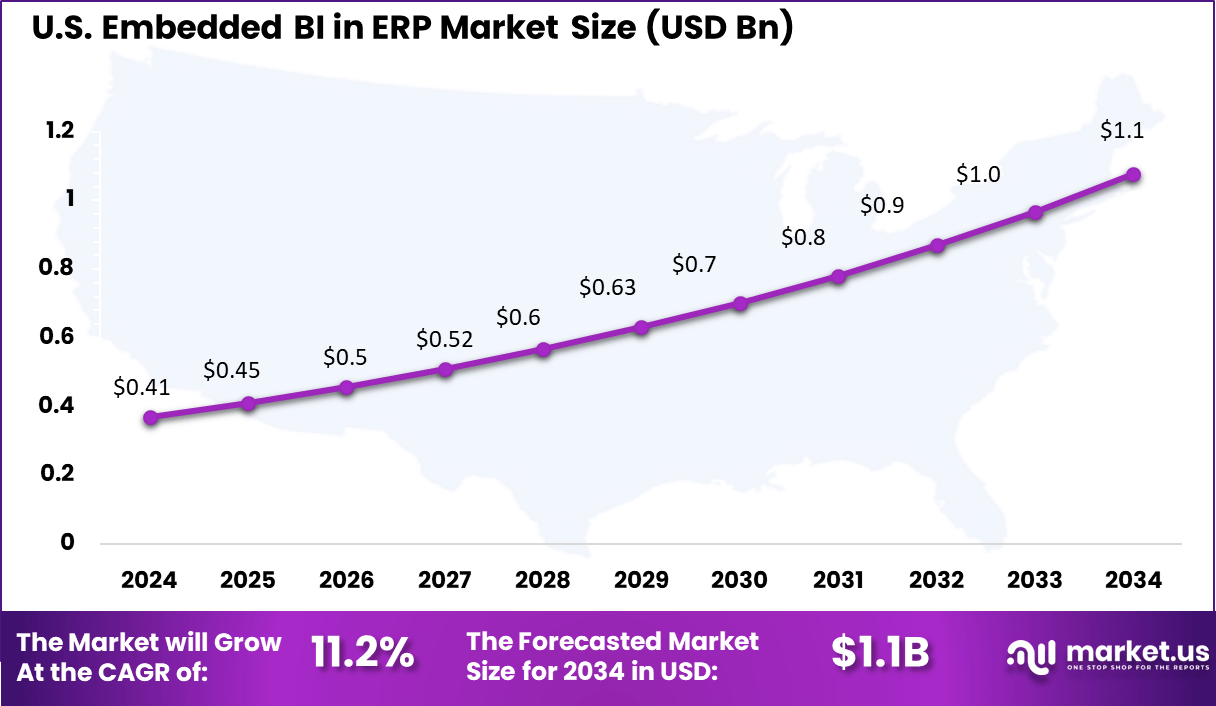

- North America held a leading share of 34.7% in 2024, with the US contributing USD 0.37 billion, supported by high ERP integration across large-scale enterprises.

- The market is growing at a CAGR of 12.4% between 2025 and 2034, driven by the need for faster decision-making through real-time analytics embedded directly into business workflows.

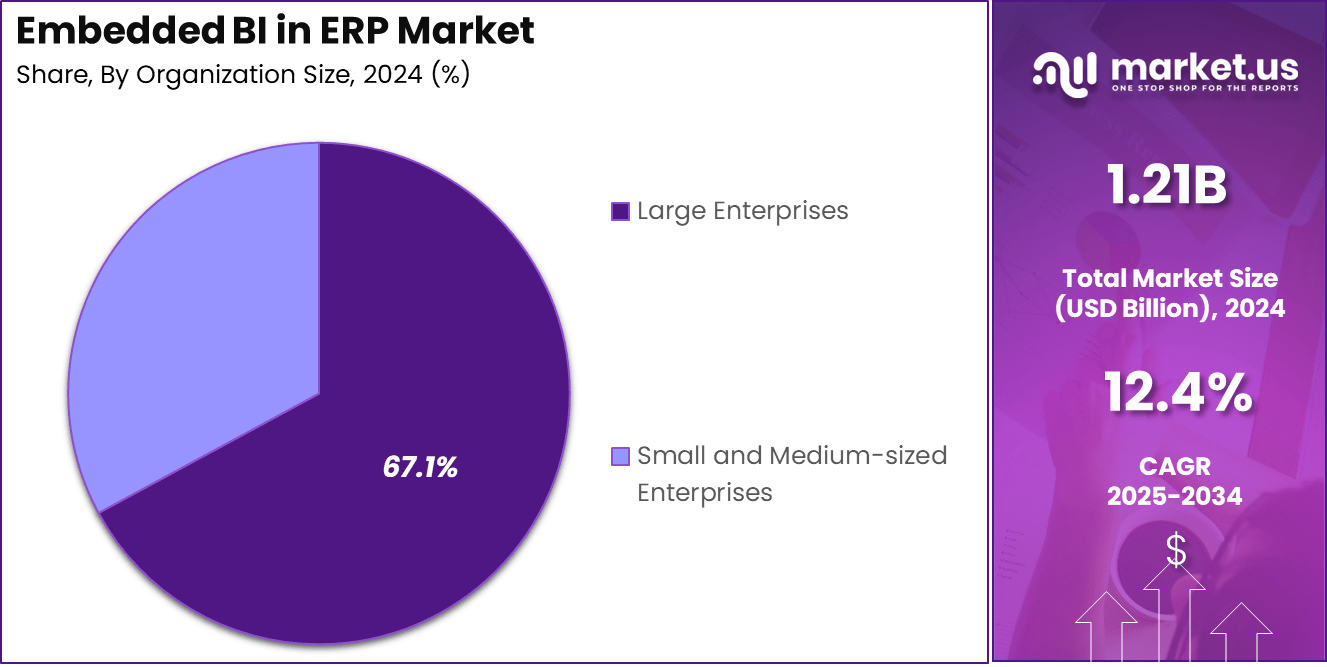

- Large Enterprises dominated the organization size segment with 67.1% share, as these firms rely on deeply integrated systems for performance visibility and efficiency.

- Data Visualization emerged as the top application, capturing 32.4%, due to growing emphasis on user-friendly dashboards and intuitive reporting tools within ERP systems.

- The Manufacturing sector accounted for the highest industry share at 26.8%, driven by the adoption of embedded analytics to monitor production, supply chain, and operations in real time.

US Market Size

The U.S. Embedded BI in ERP Market was valued at USD 0.41 Billion in 2024 and is anticipated to reach approximately USD 1.1 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 11.2% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 34.7% share and generating approximately USD 0.4 billion in revenue within the Embedded BI in ERP Market. This leadership can be attributed to the early and extensive adoption of ERP solutions integrated with real-time analytics across key sectors such as manufacturing, finance, and healthcare.

Enterprises in the U.S. and Canada are prioritizing data-driven decision-making, with embedded BI tools being deployed to enhance visibility across operational workflows. The strong presence of ERP vendors, along with mature IT infrastructure, has accelerated implementation across both large enterprises and mid-sized firms.

Application Analysis

In 2024, Data Visualization segment held a dominant market position, capturing more than a 32.4% share. This prominence can be attributed to its capacity to convert complex data sets into intuitive visual formats – such as charts, dashboards, and maps – that support rapid insight extraction.

The emphasis on real‑time analytics and contextual decision‑making has driven enterprises to embed robust visualization modules within ERP systems, enabling stakeholders across functional layers to access actionable insights directly within their operational workflows.

The growth of the Data Visualization segment has also been fueled by accelerating digital transformation initiatives and the proliferation of cloud-native analytics platforms. As organizations seek to democratize data access, self‑service dashboards have gained traction, allowing non‑technical users to explore trends without dependency on IT teams.

In 2024 alone, over 3.4 million business users leveraged real‑time embedded visual dashboards, highlighting strong adoption momentum. Consequently, the Data Visualization application within Embedded BI for ERP maintains its leading position due to its unique combination of technical sophistication and user‑centric design.

Industry Vertical Analysis

In 2024, the Manufacturing segment held a dominant market position, capturing more than a 26.8% share. This leadership is attributed to the sector’s ingrained reliance on integrated operational systems – enterprise systems in manufacturing have historically received a higher adoption rate, representing approximately 47% of all ERP usage globally.

Manufacturers often demand real‑time insight into production efficiency, inventory levels, quality control, and supply‑chain dynamics, all of which are facilitated by embedded BI capabilities integrated directly within ERP platforms. The close alignment of manufacturing workflows with measurable, sensor‑driven data streams enhances the effectiveness of BI, making it a natural and indispensable choice for this industry.

Furthermore, the Manufacturing segment has benefited from rapid Industry 4.0 adoption. As facilities increasingly deploy IoT sensors, PLCs, and MES systems, the ability to embed dashboards and reports directly into ERP environments has emerged as a strategic enabler of predictive maintenance and quality control.

Organization Size Analysis

In 2024, Large Enterprises segment held a dominant market position, capturing more than a 67.1% share. This commanding lead is explained by the immense scale and complexity of operations that characterize large organizations. These enterprises frequently oversee multiple business units, geographies, and revenue streams, necessitating robust data infrastructure.

Embedded BI within ERP systems facilitates comprehensive reporting, predictive analytics, and real‑time dashboards – all integrated seamlessly across sophisticated operational processes. As a result, analytics capabilities are enhanced across procurement, finance, and supply‑chain operations, aligning with strategic goals and enabling faster, more informed decision‑making.

The superiority of the Large Enterprises segment is further underpinned by high ERP penetration and advanced technology adoption. These organizations often prioritize sizable investments in data architecture, advanced analytics, and cloud‑enabled platforms to support scalability and maintain competitive differentiation.

Key Market Segments

By Application

- Data Visualization

- Predictive Analytics

- Reporting and Dashboards

- Others

By Industry Vertical

- Manufacturing

- Retail

- Healthcare

- Financial Services

- Government

- Others

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

AI‑driven Embedded Analytics

Embedded BI is evolving to incorporate AI, including natural language processing (NLP) and predictive modeling, directly within ERP workflows. This shift enables users to interact through conversational queries and generate predictive insights – such as cash flow forecasting or demand prediction—without leaving the ERP interface. Analytics become more actionable by being contextually triggered within daily ERP operations.

This trend is further accelerated by the increasing adoption of LLMs and generative AI, which are being deployed across BI platforms to enhance insight generation and automate data discovery. This capabilities integration supports real-time, intelligent decision‑making, narrowing the gap between data and action within ERP environments.

Driver

Proliferation of Cloud and SaaS‑native ERP

The migration to multi-tenant, SaaS‑based ERP has facilitated the embedding of analytics modules as part of standard offerings. Cloud ERP eliminates many integration and version‑control challenges, enabling vendors to develop integrated BI capabilities that are continuously updated and available without additional deployment overhead.

This architecture supports scalable BI delivery, where enhancements like dashboards and AI‑powered analytics are seamlessly added to ERP platforms. Improved cloud-native flexibility allows embedded BI to scale across large user bases, promoting broader adoption and smoother upgrades.

Restraint

Data Security and Privacy Risks

Embedding BI within ERP systems introduces significant data governance concerns. Given the centralized nature of ERP databases, any analytics extension must be fortified against unauthorized access, breaches, and compliance violations. Stricter privacy regulations, such as GDPR, complicate embedding analytics without opening new risk vectors.

Developers and system architects must implement robust security controls – such as role‑based permissions, encryption, and secure API endpoints. Absent these safeguards, the benefits of embedded analytics may be overshadowed by potential legal and reputational consequences.

Opportunity

SME Adoption of Low-Code Embedded Analytics

The SME segment presents significant potential for growth in embedded BI. Many lower-cost ERP providers are now offering analytic modules that include drag‑and‑drop dashboards and guided setup processes. This lowers technical barriers and enables smaller organizations to gain immediate business value from embedded insights.

As SMEs increasingly adopt cloud‑based ERP platforms, vendors have an opportunity to offer scalable, pay‑as‑you‑grow analytics. This model aligns with SME preferences for predictable investment and quick returns, encouraging broader adoption within this underserved segment.

Challenge

Integration Complexity and Customization Limitations

Integrating rich analytics into legacy ERP platforms introduces considerable technical complexity. Many ERP systems were not designed for flexible BI extensions; retrofitting analytics often requires extensive customization and data‑architecture rework. This complexity leads to cost overruns, extended timelines, and potential disruptions to ongoing operations.

Beyond technical hurdles, organizational inertia can impede adoption. IT teams may lack experience in modern embedded analytics, and business users may resist changes in workflows. Ensuring successful deployment requires investments in training, change management, and alignment on governance standards.

Key Player Analysis

In the Embedded BI in ERP market, key players such as Tableau Software, Inc., Microsoft Corporation, and Qlik Technologies, Inc. have maintained a strong presence by integrating intuitive dashboards and data discovery tools directly into ERP workflows. Their platforms are known for enabling real-time decision-making and providing user-friendly interfaces.

Sisense Inc., Looker Data Sciences, Inc., and Domo, Inc. are contributing to market innovation by embedding AI-powered analytics into ERP platforms. These players are emphasizing low-code or no-code environments to empower business users with self-service analytics capabilities. By focusing on cloud-native solutions and customizable modules, these companies are targeting mid-sized enterprises and industry-specific ERP systems.

Meanwhile, companies such as Infor Inc., Oracle Corporation, Zoho Corporation, Reveal BI, and ThoughtSpot, Inc. are advancing their embedded analytics offerings through strategic updates and data automation tools. Their focus remains on delivering embedded BI that supports real-time KPIs, financial insights, and predictive analytics within ERP suites. These vendors aim to optimize business process visibility and reduce reporting latency.

Top Key Players Covered

- Tableau Software, Inc.

- Microsoft Corporation

- Qlik Technologies, Inc.

- Sisense Inc.

- Looker Data Sciences, Inc.

- Domo, Inc.

- Infor Inc.

- Oracle Corporation

- Zoho Corporation

- Reveal BI

- ThoughtSpot, Inc.

- Others

Recent Developments

- Salesforce’s Tableau advanced its embedded BI capabilities in April 2025 with the launch of Tableau Next, a platform featuring “agentic analytics” that integrates AI agents, a semantic layer, and open architecture to embed actionable insights directly into ERP workflows. This evolution positions Tableau to simplify data‑to‑action processes and enhance decision‑making efficiency within enterprise systems.

- In March 2024, SAP SE introduced a new embedded analytics suite within its flagship S/4HANA ERP platform. The update integrated enhanced predictive modeling and real-time visualizations directly into core finance, supply‑chain, and procurement modules.

- In May 2024, Epicor acquired Smart Software, a provider of AI-driven inventory planning tools. This acquisition strengthened Epicor’s embedded BI capabilities within its ERP ecosystem, offering advanced analytics for demand forecasting and inventory optimization.

Report Scope

Report Features Description Market Value (2024) USD 1.21 Bn Forecast Revenue (2034) USD 3.89 Bn CAGR (2025-2034) 12.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Application (Data Visualization, Predictive Analytics, Reporting and Dashboards, Others), By Industry Vertical (Manufacturing, Retail, Healthcare, Financial Services, Government, Others), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tableau Software, Inc., Microsoft Corporation, Qlik Technologies, Inc., Sisense Inc., Looker Data Sciences, Inc., Domo, Inc., Infor Inc., Oracle Corporation, Zoho Corporation, Reveal BI, ThoughtSpot, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tableau Software, Inc.

- Microsoft Corporation

- Qlik Technologies, Inc.

- Sisense Inc.

- Looker Data Sciences, Inc.

- Domo, Inc.

- Infor Inc.

- Oracle Corporation

- Zoho Corporation

- Reveal BI

- ThoughtSpot, Inc.

- Others