Global Eliquis (Apixaban) Market By Indication (Atrial Fibrillation (AF), Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE), Post-Operative Venous Thromboembolism (VTE) Prophylaxis, Others), By Form (Tablet, Capsule), By Route of Administration (Oral, Nasogastric (NG) Tube), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155030

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

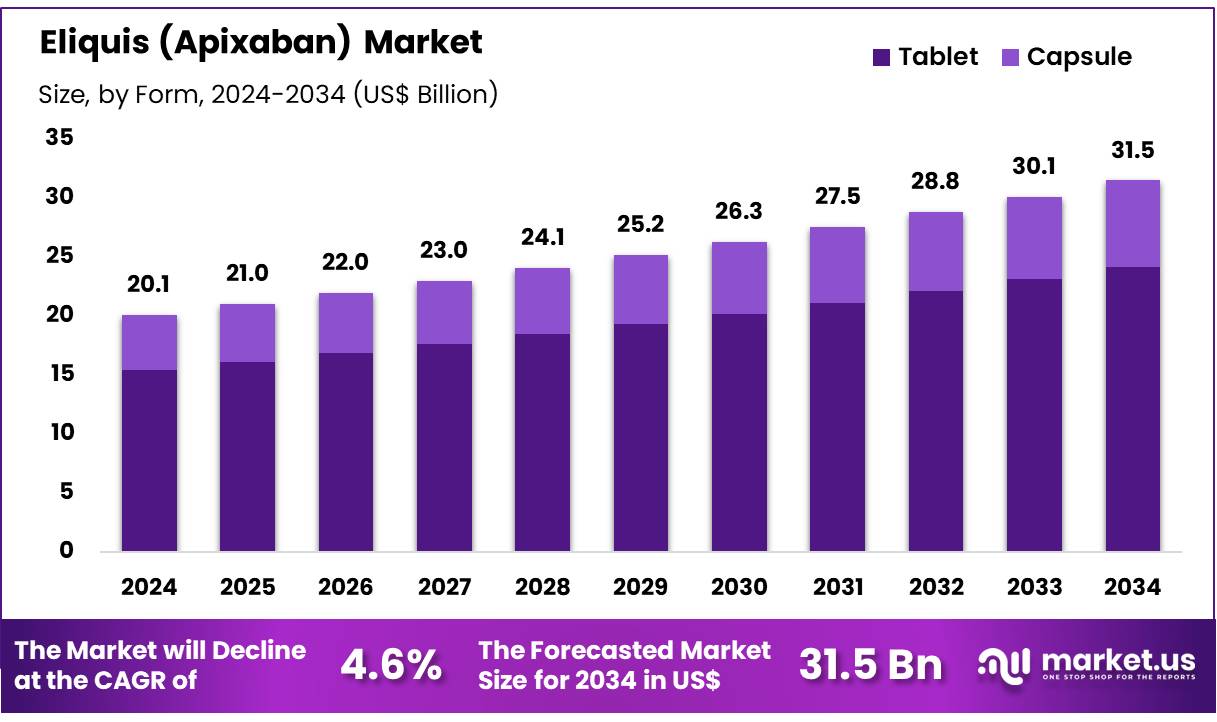

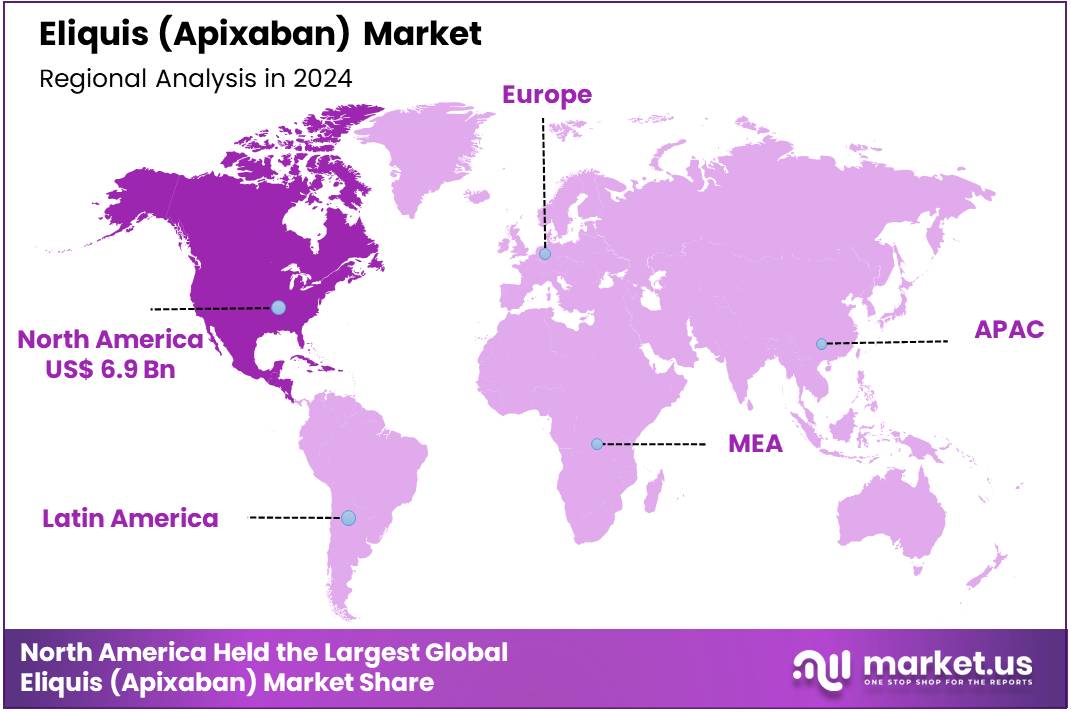

Global Eliquis (Apixaban) Market size is forecasted to be valued at US$ 31.5 Billion by 2034 from US$ 20.1 Billion in 2024, growing at a CAGR of 4.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 34.1% share with a revenue of US$ 6.9 Billion.

Eliquis (apixaban) has emerged as one of the leading anticoagulants in the pharmaceutical market due to its effectiveness in preventing strokes and blood clots. This medication, which is primarily used to treat conditions such as atrial fibrillation and venous thromboembolism, has shown significant growth over the past decade. Its popularity can be attributed to its safety profile, which is more predictable than traditional blood thinners like warfarin. Eliquis does not require regular blood monitoring or dietary restrictions, which makes it an appealing option for both doctors and patients.

Key Initiative:

- In July 2025, the Bristol Myers Squibb-Pfizer partnership launched a new direct-to-patient program through their Eliquis 360 Support platform. This initiative is aimed at helping uninsured, underinsured, and self-paying individuals lower their out-of-pocket expenses for the vital medication. Eliquis is widely used by millions of Americans, and this program seeks to offer a simple, transparent way for patients to obtain it. Beginning September 8, eligible patients in the U.S. with a prescription for Eliquis will be able to purchase it directly through Eliquis 360 Support, at a cost that is over 40% lower than the current list price. Additionally, the program will offer direct shipping to patients in all 50 states and Puerto Rico, ensuring easier access to Eliquis with full clarity on the associated costs.

One of the key factors contributing to the growing use of Eliquis is the increasing prevalence of cardiovascular diseases and conditions that necessitate anticoagulation therapy. For instance, as the global population ages, the rates of atrial fibrillation, which often leads to stroke, are on the rise.

This has created a large patient population in need of effective and convenient treatment options, boosting Eliquis’s market demand. However, Eliquis faces challenges due to patent expirations in the near future. Once the patent protection expires, generic versions of apixaban are expected to enter the market, which could result in price reductions and increased competition.

The Inflation Reduction Act allows Medicare to directly negotiate with pharmaceutical companies, improving access to some of the most expensive single-source brand-name drugs covered under Medicare Part B and Part D. Eliquis is one of 10 drugs included in the first round of negotiations for Medicare Part D in 2024, chosen based on total expenditures under Part D and other criteria specified by the law. Ongoing negotiations with the participating drug companies are set to result in negotiated prices, which will take effect in 2026.

Key Takeaways

- In 2024, the market for Eliquis (Apixaban) generated a revenue of US$ 20.1 Billion, with a declining CAGR of 4.6%, and is expected to reach US$ 31.5 Billion by the year 2034.

- Among the indication segment, Atrial Fibrillation (AF) dominated the market with 58.9% share in 2024.

- Tablets held the largest market share of 76.7% in 2024.

- In 2024, by Route of Administration, Oral segment was the dominant one, capturing a share of 87.1%.

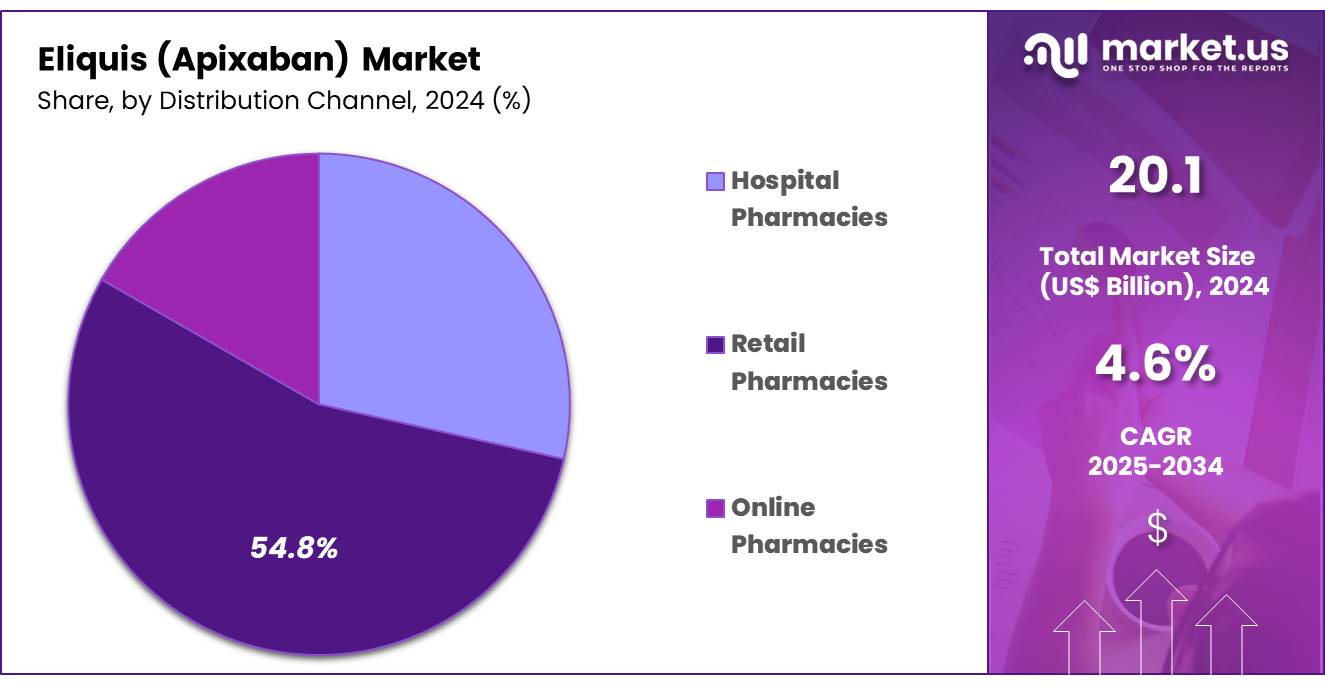

- Based on distribution channel segment, Retail Pharmacies held the largest segment accounting for 54.8% in 2024.

- North America held the maximum share of 34.1% in 2024 in the global market.

Indication Analysis

Atrial Fibrillation (AF) held the largest market share in 2024 with 58.9%. AF is highly common, with a lifetime risk of approximately 1 in 3 to 5 individuals after the age of 45. This prevalence is expected to increase due to an aging population and the growing incidence of risk factors such as hypertension, diabetes, and obesity. This surge in AF cases has heightened the demand for effective anticoagulation therapies like apixaban.

Apixaban Dosing Guidelines to prevent stroke and systemic embolism in nonvalvular AF:

Condition Dose (mg) Normal Renal Function 5 mg PO BID Mild-to-Moderate Renal Impairment No dosage adjustment required Serum Creatinine ≥1.5 mg/dL 2.5 mg BID if age ≥80 years or weight ≤60 kg ESRD on Hemodialysis 5 mg BID; 2.5 mg BID if age ≥80 years or weight ≤60 kg Form Analysis

The tablet form of Eliquis was the dominant dosage form in the anticoagulant market holding 76.7% share in 2024, particularly due to its convenience, effectiveness, and patient adherence benefits. Apixaban tablets are prescribed primarily for conditions like AF, where they serve as a preventive treatment for stroke and systemic embolism.

The oral tablet formulation is favored by both doctors and patients because of its simplicity. Unlike older anticoagulants such as warfarin, which require regular blood tests and dose adjustments, apixaban tablets offer a fixed-dose regimen that eliminates the need for frequent monitoring. This makes it easier for patients to follow their treatment plan, thereby improving overall adherence to therapy.

Dosage Forms and Strengths:

- 2.5 mg: Yellow, biconvex, round, film-coated tablets imprinted with “893” on one side and “2½” on the other.

- 5 mg: Pink, biconvex, oval-shaped, film-coated tablets imprinted with “894” on one side and “5” on the other.

Route of Administration Analysis

Oral administration of apixaban is the most widely used route for anticoagulation therapy, particularly in the treatment and prevention of thromboembolic disorders such as nonvalvular AF, deep vein thrombosis (DVT), and pulmonary embolism (PE). This segment held the largest share of 87.1% in 2024. Oral form of administration has gained prominence due to its ease of use, efficacy, and favorable safety profile.

Another major factor contributing to the preference for the oral form of apixaban is its fewer dietary restrictions and minimal interactions with food and other medications, compared to warfarin. Moreover, the oral form of apixaban offers an advantage over injectable anticoagulants, such as low-molecular-weight heparins, which require injection either at home or in a healthcare setting.

Oral Administration:

- Apixaban tablets are intended for use in adults and pediatric patients weighing 35 kg or more.

- The tablets should be swallowed whole.

- For patients who have difficulty swallowing whole tablets, they can crush the tablets and mix them with water, 5% dextrose in water (D5W), apple juice, or applesauce.

For the oral capsule dosage form used in the treatment and prevention of venous thromboembolism:

- For children weighing between 2.6 kilograms (kg) and less than 4 kg: Initially, administer 0.3 milligrams (mg) twice a day for Days 1 to 7, followed by 0.15 mg twice a day starting from Day 8 onward.

- For children weighing less than 2.6 kg: Use is not recommended.

Distribution Channel Analysis

Retail pharmacies dominated the distribution channel segment with 54.8% share in 2024, particularly for the long-term management of thromboembolic disorders. The widespread availability of retail pharmacies provides significant convenience for patients, allowing easy access to apixaban without the need for hospital visits or complex processes. This accessibility is especially important for patients who require ongoing anticoagulation therapy, as it ensures that they can obtain their medication promptly and adhere to their prescribed regimen.

Beyond just dispensing medications, retail pharmacies also play a critical role in providing patient support. Pharmacists are available to counsel patients on how to take apixaban properly, explain potential side effects, and offer advice on how to manage the drug’s interactions with food or other medications. The broad reach of retail pharmacies, both in urban and rural areas, ensures that apixaban is accessible to a wide range of patients, regardless of where they live.

Key Market Segments

By Indication

- Atrial Fibrillation (AF)

- Deep Vein Thrombosis (DVT)

- Pulmonary Embolism (PE)

- Post-Operative Venous Thromboembolism (VTE) Prophylaxis

- Others

By Form

- Tablet

- Capsule

By Route of Administration

- Oral

- Nasogastric (NG) Tube

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Rising Prevalence of Cardiovascular Diseases

Cardiovascular diseases (CVDs), encompassing conditions such as coronary artery disease, stroke, and heart failure, have become the leading cause of death globally. In 2022, an estimated 19.8 million people died from CVDs, accounting for approximately 32% of all global deaths. Notably, over three-quarters of these deaths occurred in low- and middle-income countries, highlighting the widespread nature of the epidemic. In 2023, cardiovascular disease was responsible for 919,032 deaths in the United States, accounting for approximately one-third of all deaths.

The increasing incidence of risk factors like hypertension, diabetes, and obesity further exacerbates the situation. Hypertension, for instance, affects approximately 33% of the global population, with many individuals remaining undiagnosed and untreated. The aging population also plays a crucial role in the rising prevalence of CVDs. As life expectancy increases, the incidence of age-related cardiovascular conditions, including heart failure, is on the rise. Age is closely linked to the burden of cardiovascular disease, and by 2030, it is projected that nearly one-fifth of the global population will be over the age of 65, leading to a sharp increase in the prevalence of CVD.

Atrial fibrillation is the most prevalent type of cardiac arrhythmia and the leading cardiac cause of stroke. Several risk factors contribute to the development of atrial fibrillation, including advanced age, high blood pressure, heart and lung diseases, congenital heart conditions, and excessive alcohol consumption. The risk of developing AF increases with age, and high blood pressure also more common in older individuals accounts for approximately 1 in 5 cases of AF. Other important risk factors include:

- Older age

- European ancestry

- Obesity

- Heart failure

- Ischemic heart disease

- Diabetes

- Hyperthyroidism

- Moderate to heavy alcohol consumption

- Chronic kidney disease

- Smoking

- Enlargement of the chambers on the left side of the heart

Restraints

Generic Competition

Apixaban, marketed as Eliquis, is a widely prescribed anticoagulant used to prevent and treat blood clots. The introduction of generic versions is poised to impact both pricing and market share dynamics. In the United States, the cost of Eliquis has been a concern, with patients paying significantly higher prices compared to those in countries with earlier generic availability. The entry of generic apixaban is expected to provide a cost-effective alternative, potentially reducing the financial burden on patients and healthcare systems.

Bristol-Myers Squibb anticipates that generic versions of Eliquis will enter the U.S. market starting April 1, 2028. While the patents for Eliquis are still being contested in some European countries, the expiration of patents in major European markets is expected to take place in the latter half of 2026. In 2019, the FDA approved a generic version of Eliquis (apixaban), as the composition patent was set to expire in February 2023. This could have reduced the drug’s cost from $600 to around $12 per month.

However, due to a legal battle, the generic version will not be available until April 2028. Bristol Myers Squibb and Pfizer requested a patent extension, which was approved by the court. This extension, permitted under regulatory guidelines, can extend a product’s patent term by up to five years. Patent extensions are commonly utilized in the pharmaceutical industry, with studies showing that more than 70% of the top 100 best-selling drugs have had their patent protection extended at least once.

The following products (apixaban tablet; oral) with their manufacturers have been approved by the FDA as equivalents to Eliquis:

- ACCORD HLTHCARE

- Approval Date: July 28, 2020

- Strength(s): 2.5mg, 5mg

- IMPAX

- Approval Date: February 14, 2025

- Strength(s): 2.5mg, 5mg

- INDOCO

- Approval Date: September 11, 2020

- Strength(s): 2.5mg, 5mg

Opportunities

Direct-to-Patient Sales Models

The emergence of direct-to-patient (DTP) sales models in the pharmaceutical industry represents a significant shift towards patient-centered care, offering numerous benefits for both patients and manufacturers. By bypassing traditional intermediaries such as wholesalers, pharmacies, and insurers, DTP models facilitate more affordable and accessible medication delivery, particularly for high-cost therapies.

For instance, ahead of the negotiated price for the blood thinner Eliquis taking effect in 2026, Bristol Myers Squibb and Pfizer introduced a direct-to-consumer (DTC) program to help uninsured, underinsured, and self-pay patients reduce their out-of-pocket expenses. Eliquis, the fourth best-selling drug in 2024 with $13.3 billion in sales, is soon expected to undergo changes that could impact its revenue generation.

As part of the first group of drugs to be priced under the Inflation Reduction Act (IRA) negotiations, the Centers for Medicare & Medicaid Services (CMS) secured a 56% discount off the original Medicare cost, capping the price at $231 for a 30-day supply. This move makes Eliquis one of three drugs expected to account for more than half of the savings generated by the program, according to a report from the Brookings Institution.

Pfizer have used the DTC model earlier to boost sales toward the end of Lipitor’s product lifecycle in 2011. More recently, Pfizer launched its PfizerForAll portal in 2024, offering a comprehensive range of services, including telehealth consultations, medication delivery, and diagnostic testing, to simplify access to treatments for conditions such as migraines and COVID-19.

Impact of Macroeconomic / Geopolitical Factors

In recent years, macroeconomic challenges such as inflation, currency fluctuations, and global economic downturns have impacted pharmaceutical companies’ profitability. For instance, inflation can increase the cost of raw materials and manufacturing, leading to higher drug prices. Currency volatility also affects the cost of importing and exporting pharmaceutical products, potentially leading to price adjustments in different markets.

Geopolitical tensions further complicate the landscape. Trade disputes, such as the U.S.-China trade war, have led to tariffs on pharmaceutical ingredients, increasing production costs. These tariffs can disrupt global supply chains, as many pharmaceutical companies rely on raw materials from various countries. For example, the U.S. has imposed tariffs on pharmaceutical imports from China, which could affect the availability and cost of certain medications in the American market.

In addition, with just over two months remaining before the Trump administration’s executive order on “most-favored nation” prescription drug pricing takes effect, and amid ongoing pressure on the pharmaceutical industry to reduce drug prices, Bristol Myers Squibb and Pfizer have launched a voluntary program. This program will provide Eliquis, their popular blood thinner, directly to cash-paying patients for $346 per month, offering a 43% discount off the original price of $606.

Latest Trends

Shifting Trend from Warfarin to DOACs

Over the past decade, there has been a significant shift in the management of AF and other thromboembolic disorders, moving from traditional vitamin K antagonists like warfarin to direct oral anticoagulants (DOACs) such as apixaban, rivaroxaban, dabigatran, and edoxaban. This transition is driven by several factors, including improved safety profiles, ease of use, and enhanced patient outcomes associated with DOACs.

Warfarin, introduced in the 1950s, has been a cornerstone in anticoagulation therapy. However, its use is complicated by the need for regular monitoring of the international normalized ratio (INR), dietary restrictions, and numerous drug interactions. These limitations can lead to suboptimal anticoagulation control, increasing the risk of adverse events such as bleeding or thromboembolic complications.

In contrast, DOACs offer several advantages over warfarin. They have a predictable pharmacokinetic profile, reducing the need for routine monitoring. Additionally, DOACs have fewer drug-drug and drug-food interactions, which simplifies management for both clinicians and patients. These factors contribute to improved patient adherence and potentially better clinical outcomes. For example, a study examining trends in oral anticoagulant use among patients with AF from 2011 to 2020 found that the use of DOACs increased from 4.7% to 47.9%, while warfarin use declined from 52.4% to 17.7%.

Another study reported that DOAC use increased from 2.0% to 30.8%, with a corresponding decrease in warfarin use from 49.3% to 30.8%. These statistics underscore the growing preference for DOACs in clinical practice. Similarly, a recent study published in the American Heart Journal revealed that using DOACs instead of warfarin after transcatheter aortic valve replacement (TAVR) was associated with a lower risk of bleeding that required hospitalization, as well as reduced rates of all-cause mortality and stroke at one year.

The study’s primary outcome was bleeding leading to hospitalization within a year. The results showed that 12% of patients on DOACs experienced bleeding requiring hospitalization, compared to 15% of those on warfarin (p<0.001). DOACs were associated with a significantly reduced risk of hospitalization due to bleeding, with an adjusted hazard ratio of 0.49 (95% CI 0.43-0.56, p<0.001) compared to warfarin.

Regional Analysis

North America is leading the Eliquis (Apixaban) Market

North America, particularly the United States, continues to dominate the apixaban market, driven by high rates of cardiovascular diseases such as atrial fibrillation, deep vein thrombosis, and pulmonary embolism. According to the CDC, venous thromboembolism (VTE), a type of blood clot, affects up to 900,000 people in the United States annually. It is estimated that between 60,000 and 100,000 Americans die from VTE each year, with many others experiencing long-term complications as a result.

The prevalence of these conditions is expected to rise as the population ages, creating sustained demand for effective anticoagulation therapies. In the U.S., the healthcare infrastructure is robust, allowing for the widespread use of innovative treatments like apixaban. The accessibility of the drug is facilitated by a well-established pharmaceutical distribution system and strong insurance coverage, which makes it easier for patients to access and adhere to prescribed regimens.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific (APAC) region is experiencing the fastest-growing market for apixaban, spurred by increasing rates of cardiovascular diseases, particularly atrial fibrillation. In countries like China, India, Japan, and South Korea, the incidence of these diseases is rising due to aging populations, urbanization, and lifestyle changes such as poor diet and lack of exercise.

As a result, the demand for effective anticoagulation therapies is growing rapidly in this region. Though the use of DOAC like apixaban was initially slower in APAC compared to Western markets, there is a clear shift toward adoption as healthcare providers and patients become more aware of the benefits these drugs offer.

Generic versions of Apixaban, such as Apigat (Apixaban) Tablets and Bd-Pixa (Apixaban), are available in India and can be delivered nationwide by Aark Pharmaceuticals. Apixaban is a prescription medication and can be obtained through Aark Pharmaceuticals, based in Delhi, which is an authorized supplier of this product across the country.

In March 2023, Zydus Lifesciences announced that it had received approval from the U.S. FDA ) to market a generic version of Apixaban for the prevention and treatment of blood clots. The approved tablets, available in 2.5 mg and 5 mg strengths, will be produced at Zydus’ formulation manufacturing facility in Moraiya, Ahmedabad, India.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Eliquis, approved in 2012, initially benefited from market exclusivity. Although the U.S. FDA approved the first generic versions of apixaban in December 2019 manufactured by Micro Labs Limited and Mylan Pharmaceuticals Inc. the brand’s market dominance remained intact due to legal action.

Bristol Myers Squibb and Pfizer effectively delayed the commercial launch of these generics through litigation, resulting in a court decision that blocks generic competition until at least April 2028. This extended protection has enabled Eliquis to retain its strong market position and generate significant revenue. However, once generics enter the market post-2028, increased competition is expected to drive down prices and shift market share toward generic alternatives.

Top Key Players

- Bristol-Myers Squibb Company

- Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd.

- Mylan NV

- Pfizer Inc.

- Sanofi

- AstraZeneca

- Novartis AG

- Johnson & Johnson Private Limited

- GSK plc

Recent Developments

- In October 2024, the Barcelona Court of Appeal rejected the challenge to the validity of the patent of Bristol-Myers Squibb and supplementary protection certificate (SPC) for its popular blood-thinning drug, Eliquis®. Previously, generic versions of apixaban, marketed by Sandoz, Normon, and Teva, were withdrawn from the market due to a preliminary injunction issued by the Commercial Court of Madrid in a patent infringement lawsuit filed by Bristol-Myers Squibb. Following the invalidity ruling by the Barcelona Court, these companies began preparing to reintroduce their apixaban generics. In response, Bristol-Myers Squibb filed an action to enforce the SPC, seeking a court order to prevent the generic companies from manufacturing, marketing, or distributing their apixaban generics until the SPC expires, and requested a preliminary injunction.

- In August 2024, Pfizer Inc. announced that the U.S. Department of Health and Human Services had set the “maximum fair price” (MFP) for Eliquis® (apixaban), which was selected in the first round of price negotiations under the Inflation Reduction Act (IRA). The MFP for a 30-day supply of Eliquis, effective January 1, 2026, will be $231.00, the price Medicare will pay for the drug.

- In August 2021, Breckenridge Pharmaceutical, Inc. announced that the U.S. FDA had granted final approval for its Abbreviated New Drug Application (ANDA) for Apixaban Tablets, a generic version of Eliquis®. The product, developed by Towa Pharmaceutical Europe, S.L., is manufactured at its facility in Martorelles, Spain.

Report Scope

Report Features Description Market Value (2024) US$ 20.1 Billion Forecast Revenue (2034) US$ 31.5 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Indication (Atrial Fibrillation (AF), Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE), Post-Operative Venous Thromboembolism (VTE) Prophylaxis, Others), By Form (Tablet, Capsule), By Route of Administration (Oral, Nasogastric (NG) Tube), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bristol-Myers Squibb Company, F. Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd., Mylan NV, Pfizer Inc., Sanofi, AstraZeneca, Novartis AG, Johnson & Johnson Private Limited, GSK plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bristol-Myers Squibb Company

- Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd.

- Mylan NV

- Pfizer Inc.

- Sanofi

- AstraZeneca

- Novartis AG

- Johnson & Johnson Private Limited

- GSK plc