Global Electronic Power Steering Market Size, Share, Growth Analysis By Electric Motor (Brushless Motor, Brush Motor), By Application (Passenger Cars (PC), Commercial Vehicles (CV)), By Type (Column Assist Type (CEPS), Rack Assist Type (REPS), Pinion Assist Type (PEPS)), By Mechanism (Collapsible, Rigid) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155031

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

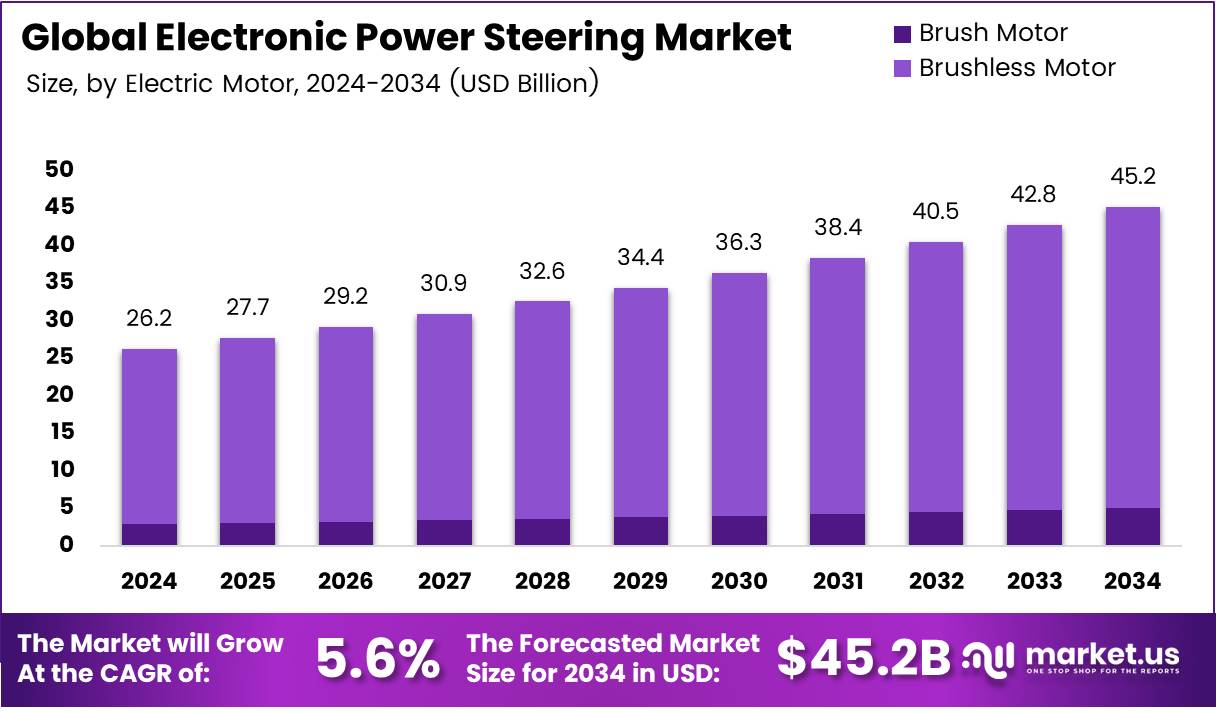

The Global Electronic Power Steering Market size is expected to be worth around USD 45.2 Billion by 2034, from USD 26.2 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The Electronic Power Steering (EPS) market has gained significant traction in recent years due to its ability to enhance fuel efficiency and reduce emissions. EPS systems are designed to adjust steering assistance based on driving conditions, improving vehicle handling and driver comfort. Consequently, the EPS market is forecast to grow at a substantial rate in the coming years.

Growth in the automotive sector is a primary driver for the expansion of the EPS market. As the demand for more fuel-efficient, lighter vehicles increases, EPS becomes a key technology due to its energy-saving benefits over hydraulic systems. Additionally, consumer preference for advanced, intelligent driving systems further accelerates the adoption of EPS, enhancing its market growth.

Moreover, the rise of electric vehicles (EVs) presents significant opportunities for the EPS market. EVs, being more energy-efficient and environmentally friendly, require advanced steering systems like EPS. This creates a large market potential as EV adoption rises globally, further boosting EPS sales. In particular, automakers are prioritizing EPS as a critical feature in their new electric models.

Government regulations aimed at reducing carbon emissions and improving vehicle fuel efficiency also drive the EPS market. Stringent emission norms, such as those enforced in Europe and North America, encourage the adoption of EPS in place of traditional hydraulic systems. Moreover, governmental subsidies and incentives for EVs and fuel-efficient vehicles are further propelling the growth of EPS technology.

In addition, advancements in smart technologies such as autonomous driving and driver assistance systems are playing a significant role in the growth of the EPS market. These technologies require highly precise and responsive steering mechanisms, which EPS systems can provide. As a result, the demand for EPS solutions is expected to rise, especially with increasing interest in autonomous vehicles.

Key Takeaways

- The global Electronic Power Steering market is projected to reach USD 45.2 Billion by 2034, growing at a CAGR of 5.6% from 2025 to 2034.

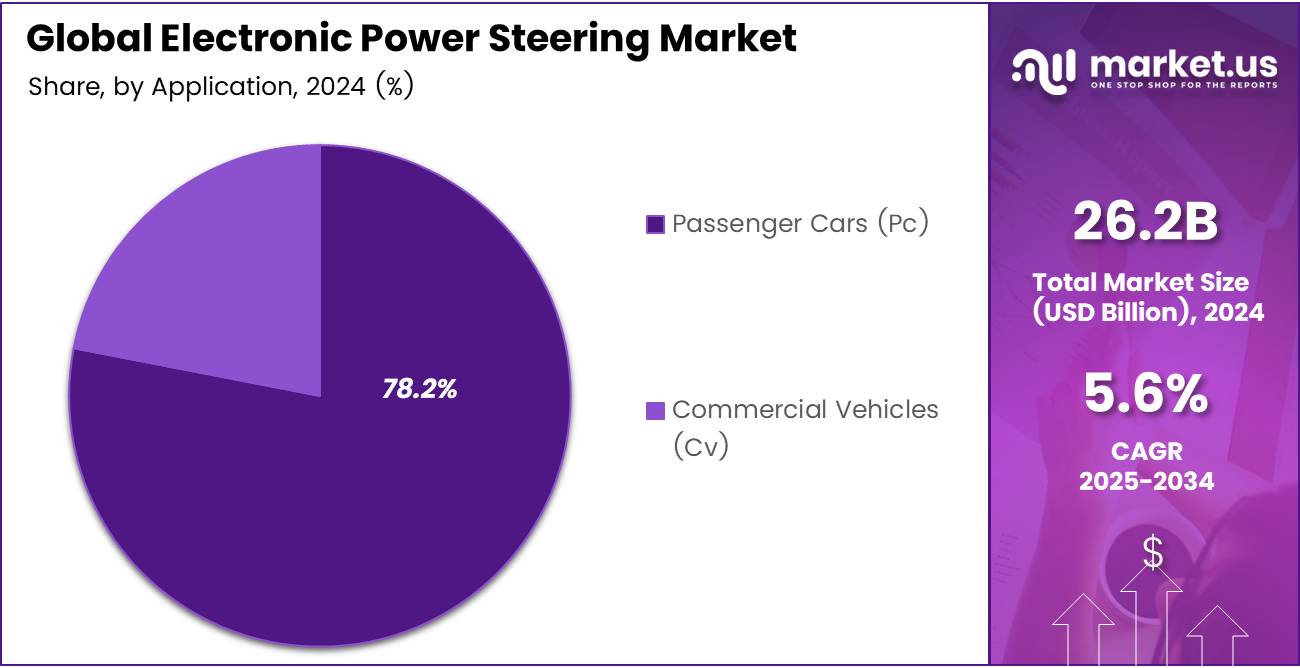

- Passenger Cars dominate the market with 78.2% share in the By Application segment, driven by demand for better comfort, safety, and fuel efficiency.

- The Colum Assist Type (CEPS) leads the By Type segment with 52.7% share, offering precision, compactness, and better fuel efficiency.

- Collapsible systems hold 78.9% of the By Mechanism segment, due to superior safety features and space-saving design.

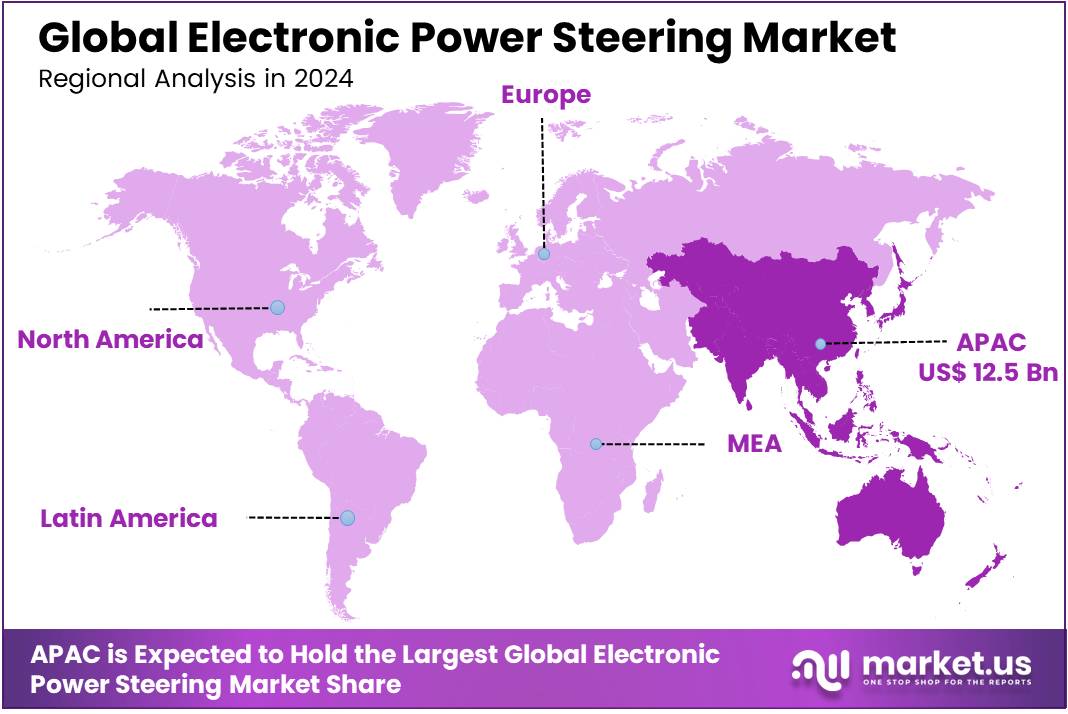

- Asia Pacific is the largest market with 47.8% share, valued at USD 12.5 billion, driven by rapid automotive production and demand for fuel-efficient vehicles.

Application Analysis

Passenger Cars (Pc) leads the market with a 78.2% share, driven by increased adoption in personal transportation.

In 2024, Passenger Cars held a dominant market position in the By Application Analysis segment of the Electronic Power Steering Market, with a substantial 78.2% share. The preference for electric power steering (EPS) systems in passenger vehicles is primarily fueled by the rising demand for enhanced driving comfort, safety, and fuel efficiency. The integration of EPS in passenger cars offers improved maneuverability and better steering response, making it a preferred choice among automotive manufacturers.

The adoption of EPS in commercial vehicles remains lower compared to passenger cars, with commercial vehicles holding a smaller share of the market. However, the segment is gradually expanding as manufacturers seek to improve driver experience and fuel efficiency in larger vehicles.

Commercial vehicles typically require more robust and heavy-duty steering systems, limiting the widespread use of EPS in this segment. Despite this, there is a steady increase in demand for EPS as the commercial vehicle sector focuses on modernizing its technology to meet environmental regulations and improve performance.

Type Analysis

Colum Assist Type (Ceps) holds a dominant 52.7% share, driven by its widespread application in the industry.

In 2024, Colum Assist Type (CEPS) led the By Type Analysis segment of the Electronic Power Steering Market with an impressive 52.7% share. This type of steering system has seen widespread adoption due to its ability to provide a high level of precision, compactness, and ease of integration in vehicles, making it a top choice for automotive manufacturers. The growing demand for fuel-efficient and low-emission vehicles has further fueled the preference for CEPS, as it offers enhanced energy efficiency.

Rack Assist Type (REPS) and Pinion Assist Type (PEPS) hold smaller shares in comparison, with REPS being favored for its ability to deliver strong torque and low energy consumption, while PEPS is appreciated for its compact design and lightweight structure.

However, these systems have a more niche application in the automotive industry, as CEPS continues to dominate the market due to its versatility and performance benefits.

Mechanism Analysis

Collapsible mechanism leads the market with 78.9% share, attributed to its improved safety and compact design.

In 2024, Collapsible systems dominated the By Mechanism Analysis segment of the Electronic Power Steering Market, holding a leading 78.9% market share. This dominance is largely due to the superior safety features and space-saving design offered by collapsible systems.

These mechanisms reduce the risk of injury in the event of a collision, making them a critical component for vehicle safety. Furthermore, the collapsible design allows for better integration into modern vehicle architectures, contributing to its widespread use in the automotive industry.

On the other hand, rigid mechanisms continue to hold a smaller share of the market, as they are less flexible and offer fewer safety benefits compared to collapsible systems. Despite their lower share, rigid mechanisms still see application in certain vehicle types where strength and durability are prioritized over compactness or safety features.

However, as safety regulations become stricter, the demand for collapsible systems is expected to continue rising, further solidifying their dominance in the market.

Key Market Segments

By Electric Motor

- Brushless Motor

- Brush Motor

By Application

- Passenger Cars (PC)

- Commercial Vehicles (CV)

By Type

- Column Assist Type (CEPS)

- Rack Assist Type (REPS)

- Pinion Assist Type (PEPS)

By Mechanism

- Collapsible

- Rigid

Drivers

Increasing Demand for Fuel-Efficient Vehicles Drives Growth in Electronic Power Steering Market

The demand for fuel-efficient vehicles has led to a rise in the adoption of Electronic Power Steering (EPS) systems. EPS technology helps reduce fuel consumption by providing more efficient steering compared to traditional hydraulic systems. As consumers and manufacturers increasingly focus on improving fuel efficiency, the EPS market continues to grow. This trend is especially noticeable in smaller, compact vehicles, where fuel economy is a key selling point.

Moreover, with stricter environmental regulations and higher fuel prices, automakers are looking for solutions to meet government standards while keeping operational costs low. EPS provides an optimal solution by minimizing the energy required for steering, offering better control over the vehicle’s power consumption. As fuel-efficient vehicles become more popular, the demand for EPS systems is expected to keep rising.

Restraints

Complexity in Integration with Existing Vehicle Architecture and Dependence on Raw Material Prices

One of the challenges in the Electronic Power Steering market is the complexity involved in integrating EPS with existing vehicle architectures. Vehicle manufacturers often face difficulties when attempting to fit EPS systems into older or conventional vehicle models. The need for significant redesigns and adjustments to the vehicle’s electrical and mechanical systems can slow down adoption rates and increase costs for automakers.

Additionally, the EPS market faces dependency on raw material prices for key components like electric motors, sensors, and semiconductors. Price volatility of these materials can lead to higher production costs, which may affect the pricing of EPS systems and, ultimately, vehicle prices. This reliance on raw materials presents a significant restraint in the market.

Growth Factors

Growing Popularity of Electric and Autonomous Vehicles Creates New Growth Opportunities for EPS

The rise in popularity of electric and autonomous vehicles presents a huge opportunity for Electronic Power Steering systems. EPS plays a key role in electric vehicles (EVs) by enhancing steering control while reducing energy consumption, which is crucial for EVs’ performance and range. As more consumers switch to EVs, the demand for EPS systems is set to increase.

Furthermore, with autonomous vehicles requiring advanced steering capabilities, EPS systems offer precision and adaptability for self-driving cars. These vehicles need a steering system that can integrate seamlessly with automated driving technologies, positioning EPS as an essential component. As the automotive industry continues to innovate, EPS systems are poised for further growth, especially with the rise of EVs and autonomous driving solutions.

Emerging Trends

Integration of EPS with Advanced Driver-Assistance Systems (ADAS) Drives Market Trends

One of the key trends in the Electronic Power Steering market is the integration of EPS with Advanced Driver-Assistance Systems (ADAS). As ADAS technologies like lane-keeping assist and adaptive cruise control become more prevalent, EPS systems are being designed to work in harmony with these features. This synergy enables vehicles to provide greater driver convenience and safety by automatically adjusting the steering based on real-time driving conditions.

Additionally, the development of variable steering assistance based on driving conditions is another trending factor in the EPS market. This technology allows for different levels of steering response depending on factors like vehicle speed, road conditions, or driving style. These developments enhance vehicle performance and offer a more comfortable driving experience.

The focus on lightweight materials for EPS system components is also gaining momentum, driven by the automotive industry’s push to reduce overall vehicle weight and improve fuel efficiency. Moreover, the growing adoption of wireless and IoT-enabled power steering systems is making EPS more adaptable, enhancing vehicle performance and opening the door to future innovations in automotive steering technology.

Regional Analysis

Asia Pacific Dominates the Electronic Power Steering Market with a Market Share of 47.8%, Valued at USD 12.5 Billion

Asia Pacific holds the leading position in the electronic power steering market, commanding a market share of 47.8%, valued at USD 12.5 billion. This dominance is driven by rapid automotive production, increasing demand for fuel-efficient vehicles, and a growing emphasis on advanced steering systems in emerging economies such as China, Japan, and India. The region’s thriving automotive sector is expected to continue to fuel growth in the coming years.

North America Electronic Power Steering Market Trends

North America ranks as a significant player in the electronic power steering market, driven by robust automotive production and technological advancements. The region is embracing high-performance vehicles with advanced safety features and energy-efficient solutions, contributing to the growing adoption of electronic power steering systems. The U.S., in particular, plays a major role in shaping the market trends.

Europe Electronic Power Steering Market Trends

Europe is a prominent market for electronic power steering, driven by stringent government regulations on emissions and fuel efficiency. The adoption of lightweight and energy-efficient automotive components is accelerating the demand for EPS systems. With major manufacturers focusing on innovation and sustainability, the European market is expected to maintain steady growth in the coming years.

Middle East and Africa Electronic Power Steering Market Trends

The Middle East and Africa (MEA) region is witnessing gradual growth in the electronic power steering market, primarily fueled by increasing vehicle production and infrastructure development. The growing awareness of fuel-efficient technologies and rising demand for luxury vehicles in countries like the UAE and Saudi Arabia are expected to support the market’s expansion.

Latin America Electronic Power Steering Market Trends

Latin America is emerging as a developing market for electronic power steering, with countries like Brazil and Mexico showing steady growth in automotive production. The demand for fuel-efficient vehicles and the adoption of advanced automotive technologies are expected to drive market growth in this region. Although it currently holds a smaller market share, the region presents promising opportunities for EPS manufacturers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Electronic Power Steering Company Insights

In 2024, the global Electronic Power Steering (EPS) market continues to be dominated by key players that drive innovation and growth in this space.

JTEKT Corporation is a major player, leveraging its expertise in steering systems and hydraulic technologies to offer efficient and reliable EPS solutions. The company’s focus on developing lightweight, energy-efficient systems positions it as a strong competitor in the automotive market.

Denso Corporation maintains a significant presence with its advanced EPS technology, focusing on enhancing safety features and improving fuel efficiency. Denso’s strong emphasis on research and development allows it to stay ahead in providing intelligent solutions tailored to evolving automotive needs.

GKN Automotive Limited specializes in high-performance EPS systems and continues to strengthen its position through strategic partnerships with automakers worldwide. Its focus on electric vehicles (EVs) and sustainable mobility solutions enables GKN to cater to the growing demand for next-gen steering systems that complement the shift towards EVs.

Hitachi Astemo, Ltd. stands out for its commitment to advanced electric steering technologies that contribute to smoother driving experiences and enhanced vehicle control. By continuously innovating in response to market demands, Hitachi Astemo is expected to maintain its competitive edge in the EPS sector.

These companies are key drivers of the EPS market, each focusing on technological advancements, efficiency, and the growing shift toward electrification in the automotive industry.

Top Key Players in the Market

- JTEKT Corporation

- Denso Corporation

- GKN Automotive Limited

- Hitachi Astemo, Ltd.

- Hyundai Mobis

- Mitsubishi Electric Corporation

- Nexteer Automotive

- NSK Ltd.

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- thyssenkrupp AG

Recent Developments

- In March 2024, TELO announced it secured funding from Neo to accelerate the development and production of electric trucks, aiming to transform the transportation sector with sustainable solutions. The funding will enhance TELO’s ability to scale up its electric truck build operations.

- In April 2025, Nexteer expanded its product portfolio by introducing high-output column-assist electric power steering, which is designed to deliver improved efficiency and performance for electric vehicles. The new technology strengthens Nexteer’s position in the growing electric vehicle steering market.

- In July 2025, Knorr-Bremse began expanding its German truck plant to produce electric steering systems, with the potential to reduce European CO₂ emissions by up to 5.8 million tonnes over the next decade. The investment is part of Knorr-Bremse’s commitment to sustainable transportation solutions.

- In July 2024, Rane NSK Steering Systems became a wholly-owned subsidiary of Rane Holdings, reinforcing Rane Holdings’ leadership in steering technologies and enhancing its capacity to meet global demand for advanced automotive solutions. The acquisition marks a strategic move to strengthen Rane’s position in the automotive market.

Report Scope

Report Features Description Market Value (2024) USD 26.2 Billion Forecast Revenue (2034) USD 45.2 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Electric Motor (Brushless Motor, Brush Motor), By Application (Passenger Cars (PC), Commercial Vehicles (CV)), By Type (Column Assist Type (CEPS), Rack Assist Type (REPS), Pinion Assist Type (PEPS)), By Mechanism (Collapsible, Rigid) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape JTEKT Corporation, Denso Corporation, GKN Automotive Limited, Hitachi Astemo, Ltd., Hyundai Mobis, Mitsubishi Electric Corporation, Nexteer Automotive, NSK Ltd., Robert Bosch GmbH, ZF Friedrichshafen AG, thyssenkrupp AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electronic Power Steering MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Electronic Power Steering MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-