Global Electronic Circuit Board Level Underfill Material Market Report By Material Type (Quartz/Silicone, Alumina Based, Epoxy Based, Urethane Based, Acrylic Based, Other Material Types), By Application (CSP (Chip Scale Package), BGA (Ball Grid Array), Flip Chips), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121377

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

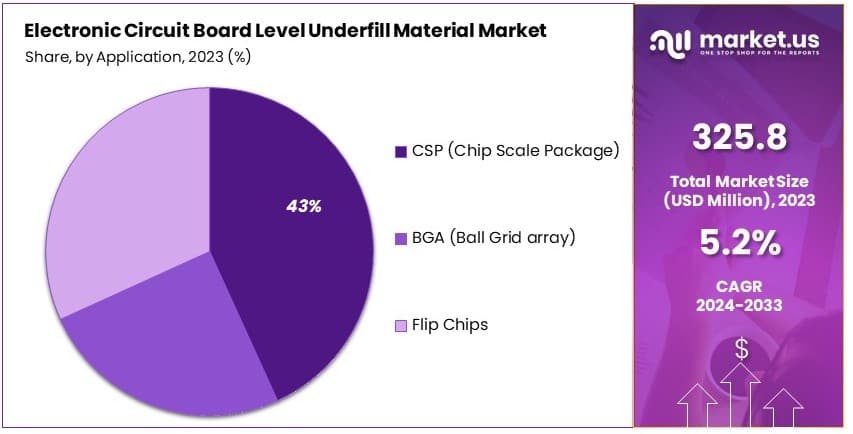

The Global Electronic Circuit Board Level Underfill Material Market size is expected to be worth around USD 540.9 Million by 2033, from USD 325.8 Million in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

The Electronic Circuit Board Level Underfill Material Market is essential for enhancing the performance and reliability of electronic assemblies. Underfill materials are used to fill gaps beneath chips and circuit boards to provide mechanical strength and resistance against thermal stress and vibrations. This market is critical in sectors such as consumer electronics, automotive, and military applications, where device miniaturization and functionality enhancement are paramount.

The rise in smart device adoption and increasing complexity in electronic circuits drive market growth. Advancements in underfill materials that offer superior thermal management and stress absorption capabilities are further catalyzing market expansion, attracting significant investments from leading electronics manufacturers.

The Electronic Circuit Board Level Underfill Material Market is central to the burgeoning electronics sector, leveraging advancements in circuit board technology to enhance device reliability and performance. Underfill materials play a critical role in protecting and reinforcing the connections and components on circuit boards, particularly in sophisticated electronics where thermal cycling and mechanical stress are prevalent.

In 2022, the United States marked its influence in the global electronics arena by exporting $181 billion worth of electrical machinery and electronics. The primary markets for these exports included Mexico, Canada, China, Hong Kong, and Chinese Taipei, highlighting a diverse and strategic distribution network that underscores the country’s pivotal role in the electronics supply chain.

This market’s growth is underpinned by substantial industry infrastructure and workforce. With 13,106 electronics and electrical equipment facilities across the U.S., employing approximately 1.1 million workers and generating annual sales of $1.8 trillion, the sector exhibits robust manufacturing capabilities and financial performance.

Notably, 56% of U.S. electronics manufacturers engage in international distribution, a rate nearly double that of the broader U.S. manufacturing sector, which stands at 29%. This international reach is indicative of the sector’s competitive edge and its crucial position in the global market.

The expansive export activities and substantial domestic production capabilities reflect positively on the underfill material market, suggesting a steady demand driven by the need for high-quality electronic components. As manufacturers continue to prioritize durability and precision in electronic devices, the market for circuit board level underfill materials is expected to witness sustained growth, supported by strong industry fundamentals and strategic global trade practices.

Key Takeaways

- Market Value: Estimated to escalate from USD 325.8 Million in 2023 to USD 540.9 Million by 2033, growing at a CAGR of 5.2%.

- Material Type Analysis: Epoxy-based underfills lead with 38.9%; favored for their superior adhesion and thermal stability essential in protecting high-performance electronic components.

- Application Analysis: CSP (Chip Scale Package) dominates with 43.2%; prevalent in modern electronics due to advantages like reduced size and enhanced performance.

- Dominant Region: North America leads with 40.2% market share; bolstered by technological advancements and stringent environmental regulations.

- High Growth Region: Europe holds a 25% market share; driven by continuous innovations and stringent environmental standards.

- Analyst Viewpoint: The market for electronic underfill materials is seen as competitive and growing, with technological advancements and high demand for reliability in electronics fueling the market’s expansion.

- Growth Opportunities: Development of underfill materials compatible with next-generation electronic assembly techniques could set market leaders apart.

Driving Factors

Increasing Demand for Miniaturization in Electronic Devices Drives Market Growth

The trend towards miniaturization in electronic devices, such as smartphones, tablets, and wearable technology, has significantly fueled the demand for electronic circuit board level underfill materials. These materials provide essential mechanical support and protect solder joints from stress and moisture, which is crucial for the production of compact and reliable electronic components.

For instance, leading companies like Apple and Samsung are continuously innovating to make their devices thinner and more compact. This relentless pursuit of miniaturization necessitates advanced underfill materials that can maintain the integrity and performance of smaller and more densely packed circuits. As electronic devices become increasingly sophisticated and compact, the importance of reliable underfill materials will continue to grow, further boosting market demand.

Adoption of Advanced Packaging Technologies Drives Market Growth

The increasing adoption of advanced packaging technologies, such as flip-chip packaging and ball grid array (BGA) packaging, has significantly driven the demand for underfill materials. These advanced packaging methods require underfill materials to ensure reliable electrical connections and to protect solder joints from thermal and mechanical stress.

Companies like Intel and TSMC are at the forefront of adopting these technologies, leading to increased use of underfill materials. The reliability and performance enhancements provided by underfill materials make them indispensable in advanced packaging, further driving market expansion.

Expansion of Automotive Electronics Drives Market Growth

The automotive industry has seen a substantial increase in the integration of electronic components for applications such as infotainment systems, advanced driver assistance systems (ADAS), and electric vehicles (EVs). These systems require highly reliable and robust circuit boards, which can be achieved through the use of underfill materials.

Major companies like Bosch, Continental, and Denso are significant consumers of underfill materials for automotive electronics. The automotive electronics market is expected to grow at a CAGR of 8.9% from 2021 to 2026, largely driven by the rising demand for EVs and advanced automotive technologies. The use of underfill materials ensures the durability and reliability of automotive electronic systems, contributing to their widespread adoption and, consequently, the growth of the underfill material market.

Restraining Factors

Stringent Environmental Regulations Restrain Market Growth

Stringent environmental regulations significantly hinder the growth of the electronic circuit board level underfill material market. Regulations like the European Union’s Restriction of Hazardous Substances (RoHS) directive restrict the use of hazardous materials in electronic components, including underfill materials.

Compliance with these regulations can be challenging for manufacturers due to the need for additional processes and costs associated with meeting environmental standards. For instance, the RoHS directive impacts the choice of materials and requires manufacturers to invest in eco-friendly alternatives, which can be expensive. These regulatory challenges vary across regions, adding complexity for global manufacturers and potentially slowing market growth.

High Initial Investment and Switching Costs Restrain Market Growth

High initial investment and switching costs are significant barriers to the adoption of underfill materials in electronic assembly processes. Implementing underfill materials requires substantial investment in specialized equipment and infrastructure, which can be prohibitive for smaller manufacturers or those with limited budgets.

Moreover, switching from one underfill material to another involves re-validation and re-qualification processes that are both costly and time-consuming. This financial burden discourages manufacturers from adopting new underfill materials, limiting innovation and slowing market growth. The high costs associated with these transitions can be a critical factor in restraining the market expansion for underfill materials.

Material Type Analysis

Epoxy-based underfills dominate with 38.9% due to their superior properties and versatility.

The electronic circuit board level underfill material market is segmented by material type, including epoxy-based, quartz/silicone, alumina-based, urethane-based, acrylic-based, and other material types. Epoxy-based materials dominate this segment, accounting for 38.9% of the market share. This dominance can be attributed to the superior properties of epoxy-based underfills, such as excellent adhesion, thermal stability, and mechanical strength.

These characteristics make epoxy-based underfills ideal for protecting delicate electronic components from thermal and mechanical stress, thus enhancing their reliability and longevity. The extensive use of epoxy-based underfills in high-performance applications like flip chips and BGA packages further boosts their market share. Additionally, epoxy-based underfills are favored for their compatibility with various electronic assembly processes, making them a versatile choice for manufacturers.

Other material types, such as quartz/silicone, alumina-based, urethane-based, and acrylic-based underfills, also play significant roles in the market. Quartz/silicone underfills are known for their excellent thermal conductivity and flexibility, making them suitable for applications requiring high heat dissipation. Alumina-based underfills offer superior electrical insulation properties, which are essential for high-frequency electronic applications. Urethane-based underfills provide good flexibility and impact resistance, making them ideal for applications that require robust mechanical protection. Acrylic-based underfills are valued for their fast curing times and ease of application, which can enhance production efficiency. Despite the advantages of these materials, their market share remains smaller compared to epoxy-based underfills due to specific application requirements and performance characteristics.

Application Analysis

CSP (Chip Scale Package) dominates with 43.2% due to its widespread adoption in modern electronic devices.

The electronic circuit board level underfill material market is also segmented by application, including CSP (Chip Scale Package), BGA (Ball Grid Array), and flip chips. The CSP (Chip Scale Package) segment is the dominant sub-segment, accounting for 43.2% of the market share. This dominance is driven by the widespread adoption of CSP in modern electronic devices, such as smartphones, tablets, and wearables. CSP technology offers significant advantages, including reduced size, improved electrical performance, and enhanced thermal management, which are crucial for miniaturized and high-performance electronic devices. The increasing demand for compact and efficient electronic products continues to drive the growth of the CSP segment, subsequently boosting the demand for underfill materials in this application.

The BGA (Ball Grid Array) and flip chip segments also contribute significantly to the market. BGA packages are widely used in applications requiring high-density interconnections and reliable thermal performance, such as in computer motherboards, graphics cards, and other high-performance electronic devices. The robustness and reliability of BGA packages make them a popular choice for various electronic applications, thereby driving the demand for underfill materials to protect and enhance the performance of these packages.

Flip chip technology, known for its superior electrical performance and thermal management capabilities, is extensively used in high-end applications such as microprocessors, graphics processors, and advanced communication devices. The need for high-performance underfill materials to ensure the reliability and longevity of flip chips further supports the growth of the underfill material market in this segment.

In summary, while CSP technology leads the market due to its application in compact and efficient electronic devices, BGA and flip chip technologies also play crucial roles in driving the demand for underfill materials. The unique requirements and performance characteristics of each application type contribute to the overall growth and development of the electronic circuit board level underfill material market.

Key Market Segments

By Material Type

- Quartz / Silicone

- Alumina Based

- Epoxy Based

- Urethane Based

- Acrylic Based

- Other Material Types

By Application

- CSP (Chip Scale Package)

- BGA (Ball Grid Array)

- Flip Chips

Growth Opportunities

Emerging Applications in Aerospace and Defense Offer Growth Opportunity

The aerospace and defense industries require highly reliable, durable, and high-performance electronic components that can withstand extreme conditions. Underfill materials are crucial in meeting these stringent requirements. Companies such as Boeing, Lockheed Martin, and Raytheon are increasingly adopting advanced electronic systems in their products, driving the demand for high-quality underfill materials.

This demand presents significant growth opportunities for the underfill material market, as these industries continue to invest in cutting-edge technologies and innovations to enhance their electronic systems’ performance and reliability. The market for aerospace and defense electronics is projected to grow at a CAGR of 6.2% from 2023 to 2033, further boosting the demand for underfill materials.

Development of Flexible and Wearable Electronics Offers Growth Opportunity

The growing trend of flexible and wearable electronics, such as curved displays, smartwatches, and health monitoring devices, has created a demand for underfill materials that can accommodate flexible substrates and withstand repeated bending and flexing.

Companies like Samsung, LG, and Garmin are actively involved in developing these innovative products, driving the need for advanced underfill material formulations that can meet the unique requirements of flexible and wearable electronics. This trend is expected to drive significant growth in the underfill material market, as the global market for flexible and wearable electronics is projected to grow at a high growth rate.

Trending Factors

Integration of Artificial Intelligence (AI) and Machine Learning (ML) Are Trending Factors

The integration of AI and ML technologies in the development and optimization of underfill materials is a significant trend. These technologies can lead to improved material properties, enhanced performance, and more efficient manufacturing processes.

Companies like IBM, Google, and Microsoft are investing heavily in AI and ML, which have the potential to revolutionize the underfill material industry. By utilizing AI and ML, manufacturers can optimize formulations and production methods, resulting in better quality and more cost-effective underfill materials. This trend is expected to drive the market forward, as these advanced technologies continue to be integrated into material science and manufacturing processes.

Emergence of 3D Printing and Additive Manufacturing Are Trending Factors

The emergence of 3D printing and additive manufacturing technologies has opened up new possibilities for the production of customized and complex electronic components. Underfill materials compatible with these technologies enable the creation of unique and innovative electronic products. Companies like Stratasys, 3D Systems, and HP are at the forefront of this trend, driving the demand for underfill materials that can be used in conjunction with 3D printing and additive manufacturing.

This trend is expected to contribute significantly to market growth, as the 3D printing market is projected to grow at a CAGR of 21.2% from 2023 to 2033. The ability to produce complex electronic components with precision and efficiency is a key driver of this trend, further boosting the demand for advanced underfill materials.

Regional Analysis

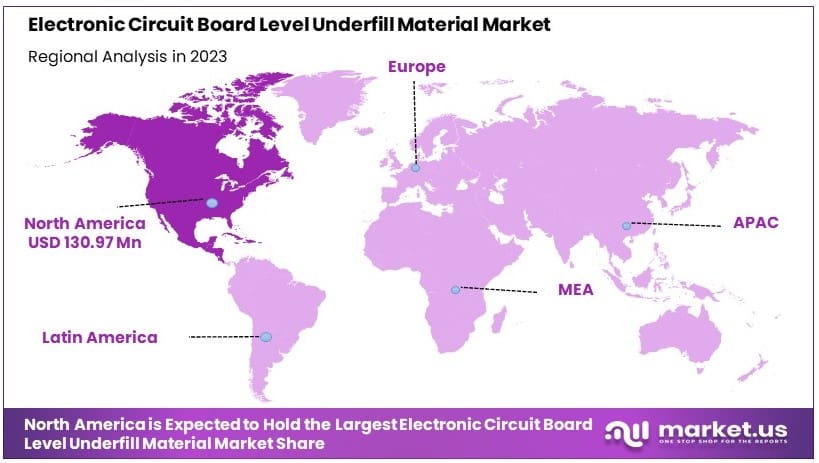

North America Dominates with 40.2% Market Share

North America holds a dominant position in the electronic circuit board level underfill material market, accounting for 40.2% of the market share, with a market value of USD 130.97 million. This dominance is driven by several key factors, including the presence of major electronics manufacturers and advanced technological infrastructure. Companies like Apple, Intel, and Qualcomm lead innovation and demand for high-quality underfill materials. Additionally, North America’s stringent environmental regulations ensure the use of high-performance materials, contributing to market growth.

Several factors drive North America’s high market share. The region’s robust technological infrastructure supports advanced manufacturing processes. Major players in the electronics industry, such as Apple, Intel, and Qualcomm, are headquartered in North America, driving demand for underfill materials. Furthermore, the region’s strong emphasis on innovation and research and development fosters the development of advanced electronic components, which require reliable underfill solutions. Stringent environmental regulations also play a role by enforcing the use of high-quality, environmentally friendly materials.

Regional Market Share and Growth Rate

- Europe: Holds a 25% market share, driven by innovation and stringent environmental standards.

- Asia Pacific: Rapid growth with a 20% market share, fueled by high manufacturing activity and technological advancements.

- Middle East & Africa: Accounts for 10% market share, with growing investments in electronics and infrastructure.

- Latin America: Holds a 5% market share, with potential growth through increased electronic manufacturing activities and investments in new technologies.

Overall, North America’s dominance is underpinned by its technological leadership, strong industry presence, and continuous innovation, positioning it as a key player in the global market for electronic circuit board level underfill materials.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The electronic circuit board level underfill material market is characterized by the strategic positioning and influence of several key players. Henkel AG & Co. KGaA is a market leader, known for its innovation and extensive product portfolio.

Namics Corporation and ASE Group hold strong positions with their advanced technological capabilities and global reach. Hitachi Chemical Co., Ltd. and Panasonic Corporation leverage their extensive R&D facilities to drive market growth. MacDermid Alpha Electronic Solutions and Parker LORD Corporation are pivotal due to their comprehensive solutions and robust distribution networks. H.B. Fuller Company and Dow Inc. significantly impact the market with their diversified offerings and strong financial performance. ELANTAS GmbH and AI Technology, Inc. are notable for their specialized products catering to niche markets.

Indium Corporation and Zymet focus on innovative solutions, enhancing their competitive edge. Key players contribute to market dynamics through strategic alliances, product innovations, and expanding market presence. Collectively, these companies drive innovation, meet diverse industry demands, and maintain competitive market positions, ensuring the steady growth of the underfill material market. The competitive landscape remains dynamic, with continuous advancements and strategic maneuvers shaping the future market trajectory.

Market Key Players

- Henkel AG & Co. KGaA

- Namics Corporation

- ASE Group

- Hitachi Chemical Co., Ltd.

- Panasonic Corporation

- MacDermid Alpha Electronic Solutions

- Parker LORD Corporation

- H.B. Fuller Company

- Dow Inc.

- ELANTAS GmbH

- AI Technology, Inc

- Indium Corporation

- Zymet

- Other Key Players

Recent Developments

- October 2023: Panasonic Industry conducted space exposure experiments on electronic materials on the International Space Station, evaluating their performance in a harsh environment. The results confirmed the high quality and durability of the materials.

- July 2022: DeepMaterial, a leading manufacturer in China, introduced new materials for various applications. The company leverages advanced nanotechnology to develop sustainable products.

Report Scope

Report Features Description Market Value (2023) USD 325.8 Million Forecast Revenue (2033) USD 540.9 Million CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Quartz/Silicone, Alumina Based, Epoxy Based, Urethane Based, Acrylic Based, Other Material Types), By Application (CSP (Chip Scale Package), BGA (Ball Grid Array), Flip Chips) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Henkel AG & Co. KGaA, Namics Corporation, ASE Group, Hitachi Chemical Co., Ltd., Panasonic Corporation, MacDermid Alpha Electronic Solutions, Parker LORD Corporation, H.B. Fuller Company, Dow Inc., ELANTAS GmbH, AI Technology, Inc, Indium Corporation, Zymet, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electronic Circuit Board Level Underfill Material MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Electronic Circuit Board Level Underfill Material MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Henkel AG & Co. KGaA

- Namics Corporation

- ASE Group

- Hitachi Chemical Co., Ltd.

- Panasonic Corporation

- MacDermid Alpha Electronic Solutions

- Parker LORD Corporation

- H.B. Fuller Company

- Dow Inc.

- ELANTAS GmbH

- AI Technology, Inc

- Indium Corporation

- Zymet

- Other Key Players