Electric Brake Booster Market Report By Components (Hydraulic Pump, Accumulator, Master Cylinder), By Type (Vacuum Booster, Hydraulic Booster), By Vehicle Type (Two Wheeler, Passenger Vehicle, Commercial Vehicle), By Propulsion (Battery Electric Vehicle, Plug-In Hybrid Electric Vehicle, Hybrid Electric Vehicle), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 16481

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

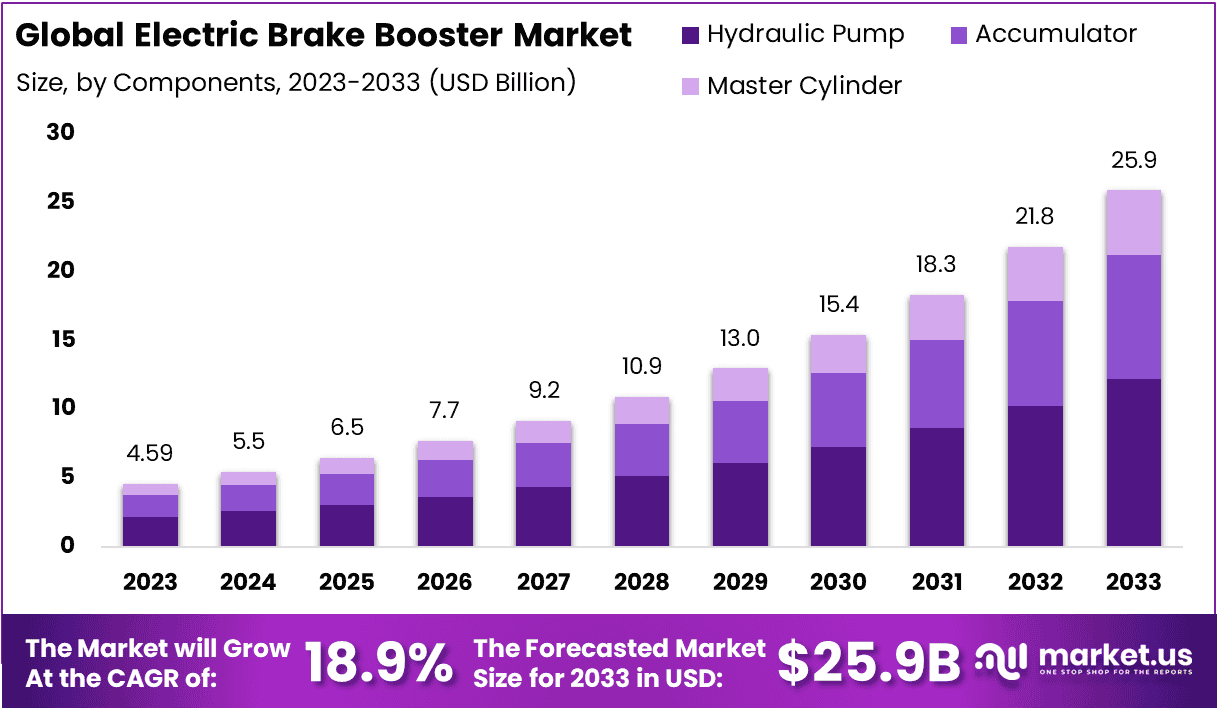

The Global Electric Brake Booster Market size is expected to be worth around USD 25.95 Billion by 2033, from USD 4.59 Billion in 2023, growing at a CAGR of 18.90% during the forecast period from 2024 to 2033.

The Electric Brake Booster Market refers to the industry focused on advanced braking technology used in modern vehicles. This market includes the development, production, and distribution of electric brake boosters, which enhance vehicle control and safety by providing more responsive braking systems. As vehicles increasingly incorporate electronic systems, the demand for electric brake boosters grows, driven by the automotive industry’s shift towards electrification and autonomous driving.

The Electric Brake Booster Market is poised for significant expansion, influenced by the accelerating shift towards electrification in the automotive sector. This market is integral to the next generation of vehicle safety and efficiency, particularly as global automotive manufacturers increasingly prioritize electric and autonomous vehicles.

In 2023, the production outputs of major players in the new energy vehicle sector, such as BYD and Tesla, underscored the growing market shift. BYD’s production exceeded 3 million new energy vehicles, outpacing Tesla for the second year in a row with 1.84 million vehicles produced. This substantial production volume highlights a broader industry trend towards electrification, which is directly beneficial to the electric brake booster market.

Moreover, according to the U.S. Energy Information Administration, the adoption rates of hybrid, plug-in hybrid, and battery-electric vehicles have shown a notable increase. These vehicles accounted for 16% of light-duty vehicle sales in the second quarter of 2023, up from 12.9% in 2022. This growing consumer preference for electrified vehicles enhances the demand for advanced vehicular technologies, including electric brake boosters, which are essential for ensuring the safety and performance of these increasingly complex vehicles.

The rising sales and production of electric and hybrid vehicles are creating fertile ground for the expansion of the Electric Brake Booster Market. The integration of such advanced braking systems is not only a response to consumer and regulatory demands but also a strategic component in maintaining competitive advantage in the rapidly changing automotive landscape.

Key Takeaways

- Market Value: The Global Electric Brake Booster Market is anticipated to reach USD 25.95 billion by 2033, witnessing substantial growth from USD 4.59 billion in 2023, with a notable CAGR of 18.90% during the forecast period from 2024 to 2033.

- Components Analysis: Hydraulic Pump emerges as the dominant segment with 47.3% market share due to its critical role in enhancing vehicle braking performance and reliability.

- Type Analysis: Vacuum Booster leads the segment with a dominant 61.3% market share, driven by its established reliability and integration in both traditional and modern vehicle architectures.

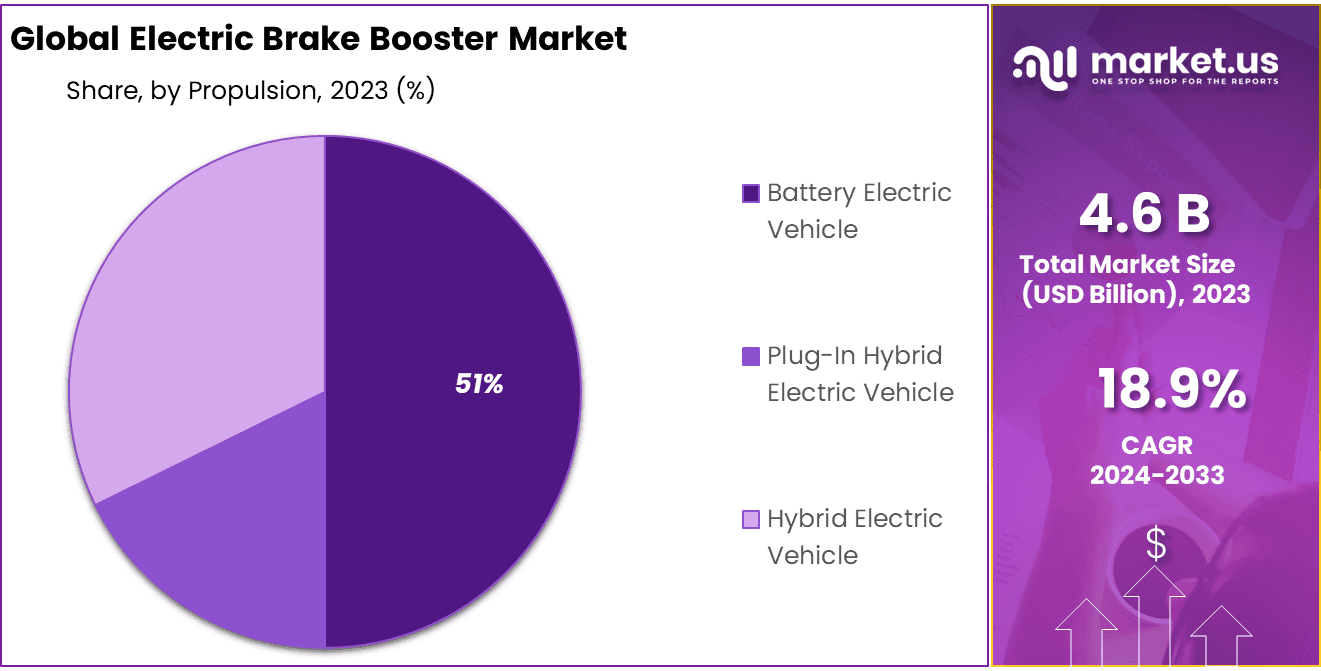

- Propulsion Analysis: Battery Electric Vehicle (BEV) dominates with 50.1% market share, reflecting increasing global adoption of zero-emission vehicles.

- Sales Channel Analysis: Original Equipment Manufacturer (OEM) channel dominates with 63% market share, attributed to manufacturers’ push for integrated advanced safety features.

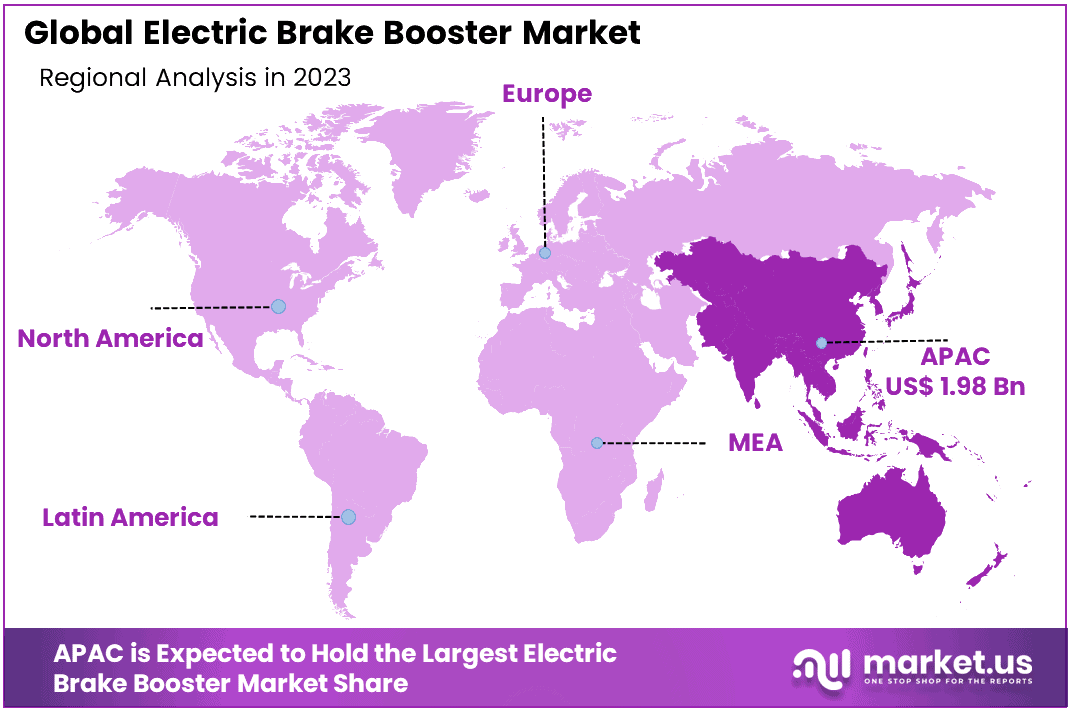

- APAC: Dominates the market with a 43.1% market share, driven by increasing automotive demand and technological advancements.

- North America: Holds a notable market share of approximately 23.5%, fueled by the advanced automotive market, high safety standards, and the presence of leading car manufacturers focusing on incorporating new technologies like electric brake boosters.

- Analyst Viewpoint: Analysts foresee continued growth in the Electric Brake Booster Market, driven by increasing vehicle safety standards, the global shift towards electric vehicles, and the integration of advanced braking technologies by automotive manufacturers.

Driving Factors

Stringent Emission Regulations Drive Market Growth

Governments around the world are tightening emission standards to tackle air pollution and encourage eco-friendly transportation solutions. Electric brake boosters, which help in reducing vehicle emissions by improving fuel efficiency, are becoming increasingly essential.

For example, the implementation of the Euro 6 standards by the European Union has significantly pushed the adoption of electric brake boosters in new vehicles. These devices decrease engine load and, consequently, emissions during braking, making them crucial for automakers to meet regulatory requirements. The synergy between emission regulations and the need for efficient vehicle technologies fosters substantial growth in the electric brake booster market.

Increasing Demand for Fuel-Efficient Vehicles Drives Market Growth

Amidst escalating fuel prices and heightened environmental awareness, the demand for fuel-efficient vehicles is surging. Electric and hybrid vehicles, which require efficient braking systems, are central to this trend.

Electric brake boosters optimize braking performance and reduce engine load, thereby enhancing vehicle efficiency. This trend is reflected in the rising sales of these vehicles, particularly in significant markets such as the United States, China, and Europe. The growing consumer preference for fuel-efficient vehicles, coupled with the need for advanced braking systems, is propelling the electric brake booster market forward.

Advancements in Automotive Technology Drive Market Growth

The automotive industry is witnessing rapid technological evolution, especially in electric and electronic systems such as brake-by-wire and regenerative braking. Electric brake boosters are integral to these technologies, enabling more efficient and smoother braking.

Major companies like Bosch and Continental are heavily investing in the development of innovative electric brake booster solutions to keep pace with these advancements. The continuous evolution of vehicle technology not only drives the demand for electric brake boosters but also integrates them more deeply into the automotive industry’s future.

Increasing Adoption of ADAS Drives Market Growth

The proliferation of Advanced Driver Assistance Systems (ADAS) in vehicles necessitates highly responsive and precise braking systems. Electric brake boosters are key to meeting these requirements, facilitating the implementation of features such as autonomous emergency braking and adaptive cruise control.

For instance, systems like Tesla’s Autopilot heavily rely on electric brake boosters for efficient operation. The increasing inclusion of ADAS features in modern vehicles underscores the growing importance of electric brake boosters, driving their market growth as vehicle safety becomes a paramount concern.

Restraining Factors

Integration Challenges Restrain Market Growth

The process of integrating electric brake boosters into existing vehicle architectures presents significant hurdles, particularly for older models built with traditional hydraulic systems. Automakers face the necessity of substantial investments in redesign and modification of their vehicle platforms to accommodate these advanced systems.

Such changes are not only costly but also time-consuming, potentially slowing the adoption rate of electric brake boosters, especially in the aftermarket sector. This challenge restricts the widespread implementation of electric brake boosters across all vehicle segments, as companies weigh the cost against the benefits of upgrading legacy systems.

Reliability and Maintenance Concerns Restrain Market Growth

Despite the general reliability of electric brake boosters, there are prevailing concerns about their long-term durability and the intricacies of their maintenance compared to traditional systems. Automakers and consumers often exercise caution, preferring to wait until these technologies have established a proven track record through extensive real-world application and testing.

The scarcity of trained technicians and the lack of appropriate service infrastructure, especially in developing markets, further complicate the situation. This reluctance and the logistical challenges impede the broader adoption and acceptance of electric brake boosters in the global market.

Components Analysis

Hydraulic Pump dominates with 47.3% due to its critical role in enhancing vehicle braking performance and reliability.

The ‘By Components’ segment of the Electric Brake Booster Market is crucially driven by the Hydraulic Pump, which constitutes 47.3% of this market segment. The Hydraulic Pump is essential in electric brake booster systems as it supplies the necessary hydraulic pressure to assist the braking mechanism. This component’s dominance is attributed to its fundamental role in ensuring efficient, reliable, and responsive braking, which is increasingly demanded in newer vehicle designs that prioritize safety and performance.

Other significant components in this segment include the Accumulator and the Master Cylinder. The Accumulator stores the hydraulic fluid necessary for the system to function effectively, especially in emergency situations where quick brake application is critical. The Master Cylinder, on the other hand, is responsible for converting the mechanical force exerted by the driver into hydraulic pressure, which activates the braking system. While these components are integral to the system’s overall functionality, they do not match the Hydraulic Pump in terms of market share due to their less direct involvement in the immediate enhancement of braking performance.

The prominence of the Hydraulic Pump in the market is not only due to its direct impact on vehicle safety but also because of its evolving technology which aims to integrate more seamlessly with various vehicle architectures, including those designed for electric and hybrid models. This alignment with broader automotive trends towards electrification and advanced safety systems helps maintain the Hydraulic Pump’s significant share of the market. However, the development of more integrated systems could see future shifts in the relative importance of these components within the market.

Type Analysis

Vacuum Booster dominates with 61.3% due to its established reliability and integration in both traditional and modern vehicle architectures.

In the ‘By Type’ segment of the Electric Brake Booster Market, the Vacuum Booster holds a commanding lead with a market share of 61.3%. This dominance is primarily due to the Vacuum Booster’s long-standing reliability and its adaptability to both traditional and modern vehicle architectures. Vacuum Boosters have been the backbone of brake boosting technology in vehicles for decades, offering proven effectiveness and dependability, which makes them a preferred choice among both automakers and consumers.

The other sub-segment within this category is the Hydraulic Booster, which, while also important, does not share the same level of market penetration as the Vacuum Booster. Hydraulic Boosters are typically used in heavier vehicles and are appreciated for their ability to provide substantial brake force, but they are generally more complex and costly compared to Vacuum Boosters. This complexity and higher cost can make Hydraulic Boosters less attractive for standard passenger vehicles, thus limiting their market share.

Vacuum Boosters continue to evolve with the incorporation of more advanced materials and designs that reduce their overall weight and improve compatibility with new types of vehicle propulsion systems, such as electric and hybrid engines. These innovations help maintain the Vacuum Booster’s dominance in the market by aligning with current trends towards lightweight, efficient, and environmentally friendly automotive components. However, as vehicle technologies advance and the demand for more integrated and efficient systems increases, there may be shifts in the market dynamics between Vacuum and Hydraulic Boosters, potentially altering their respective market shares.

Propulsion Analysis

Battery Electric Vehicle dominates with 50.1% due to increasing global adoption of zero-emission vehicles.

In the propulsion segment of the Electric Brake Booster Market, the Battery Electric Vehicle (BEV) sub-segment stands out, dominating with approximately 50.1% of the market share. This significant portion is driven by the global shift towards sustainable transportation and stricter emissions regulations pushing the automotive industry towards electric vehicles. BEVs, which operate solely on electric power, require sophisticated braking systems like electric brake boosters to handle the unique demands of electric propulsion, such as regenerative braking and high torque management.

Other key sub-segments in the propulsion category include Plug-In Hybrid Electric Vehicles (PHEVs) and Hybrid Electric Vehicles (HEVs). While both are essential to the transition towards electrification, they do not currently match the BEV sub-segment in terms of market dominance. PHEVs and HEVs blend internal combustion engines with electric driving, which requires integrating electric brake boosters to manage the dual systems efficiently. However, the pure electric nature of BEVs demands more from these systems, accentuating the importance of electric brake boosters in these vehicles.

As BEVs continue to gain market share due to environmental policies and consumer preference for zero-emission vehicles, the demand for advanced electric brake systems expected to grow. This trend is further supported by technological advancements in electric vehicle components and battery technologies, making BEVs increasingly accessible and popular among consumers worldwide. The growth trajectory for BEVs directly impacts the expansion of the Electric Brake Booster Market, making this sub-segment a critical area of focus for manufacturers and investors in the automotive sector.

Sales Channel Analysis

OEM dominates with 63% due to manufacturers’ push for integrated advanced safety features.

In the sales channel segment of the Electric Brake Booster Market, the Original Equipment Manufacturer (OEM) channel is predominant, capturing 63% of the market. This dominance is primarily because automotive manufacturers are increasingly integrating advanced safety and performance features, such as electric brake boosters, directly into new vehicles. This integration aligns with global safety regulations and consumer demands for vehicles equipped with the latest technology.

The aftermarket sub-segment, while significant, does not hold as large a share as OEMs. Aftermarket sales involve replacing or upgrading parts on existing vehicles, which can be less appealing to vehicle owners due to the complexities and costs associated with retrofitting older vehicle models with new technologies like electric brake boosters. Moreover, the preference for warranty and quality assurance often leads consumers to opt for original equipment already installed in new cars.

The dominance of the OEM segment is expected to continue as more automakers incorporate electric brake boosters into new vehicle designs to enhance safety ratings and meet regulatory standards. Additionally, the increasing trend towards autonomous and semi-autonomous vehicles, which require highly reliable and responsive braking systems, is likely to boost OEM sales even further. The strategic focus on integrating advanced technologies by vehicle manufacturers not only strengthens the OEM market share but also sets a robust growth trajectory for the Electric Brake Booster Market in the upcoming years.

Key Market Segments

By Components

- Hydraulic Pump

- Accumulator

- Master Cylinder

By Type

- Vacuum Booster

- Hydraulic Booster

By Vehicle Type

- Two Wheeler

- Passenger Vehicle

- Commercial Vehicle

By Propulsion

- Battery Electric Vehicle

- Plug-In Hybrid Electric Vehicle

- Hybrid Electric Vehicle

By Sales Channel

- OEM

- Aftermarket

Growth Opportunities

Expansion in the Commercial Vehicle Segment Offers Growth Opportunity

The commercial vehicle segment presents a notable growth opportunity for the Electric Brake Booster Market. Traditionally focused on passenger vehicles, electric brake boosters are increasingly being adopted in commercial vehicles like trucks, buses, and construction equipment, which demand robust and responsive braking systems.

These vehicles benefit greatly from the enhanced performance and efficiency provided by electric brake boosters, essential for handling heavy loads and rigorous operating conditions. Companies such as Knorr-Bremse and Wabco are pioneering developments in this area, signaling strong market potential. This shift not only meets the needs for improved safety and performance in commercial vehicles but also aligns with global pushes for greater fuel efficiency and lower emissions, thereby expanding the market reach of electric brake boosters.

Aftermarket and Retrofit Opportunities Offer Growth Opportunity

There is significant growth potential in the aftermarket and retrofit sectors of the Electric Brake Booster Market. As vehicle fleets age, retrofitting older vehicles with electric brake boosters becomes an attractive option for enhancing performance and meeting stricter emission standards. This segment is particularly promising in regions with tough environmental regulations or incentives for upgrading older vehicles.

By collaborating with automotive repair shops and service centers, companies can tap into this market by providing retrofit kits and professional installation services. Such partnerships enable vehicle owners to upgrade their braking systems efficiently, improving safety and compliance with environmental norms. This not only broadens the market for electric brake boosters but also supports sustainable automotive practices by extending the viable life of existing vehicles.

Trending Factors

Integration with Regenerative Braking Systems Are Trending Factors

The integration of electric brake boosters with regenerative braking systems marks a significant trending factor in the Electric Brake Booster Market. This synergy is particularly prevalent in electric and hybrid vehicles, where regenerative braking systems capture and convert the kinetic energy during braking into electrical energy to recharge the vehicle’s battery. Such integration enhances the overall energy efficiency and extends the driving range of these vehicles.

Leading automotive companies like Tesla and Toyota are pioneers in this area, consistently implementing advanced regenerative braking systems in their latest models. This trend is driven by the increasing demand for sustainable automotive technologies that not only reduce emissions but also lower energy consumption, positioning electric brake boosters as a key component in the next generation of eco-friendly vehicles.

Development of Brake-by-Wire Technology Are Trending Factors

Brake-by-wire technology represents a significant evolution in automotive braking systems and is quickly becoming a trending factor in the industry. This technology replaces traditional mechanical and hydraulic linkages with electronic controls, allowing for more precise and responsive braking. Electric brake boosters are essential in brake-by-wire systems, providing the necessary control and efficiency.

The adoption of this technology by major automakers, including Nissan and Infiniti, who have incorporated it into some of their high-end models, underscores its growing importance. The benefits of brake-by-wire technology, such as enhanced safety, improved pedal feel, and the facilitation of advanced driver assistance features, contribute to its rising popularity. This trend not only reflects the automotive industry’s shift towards more sophisticated and safer vehicle systems but also highlights the critical role of electric brake boosters in modern automotive design.

Regional Analysis

APAC Dominates with 43.1% Market Share

Asia Pacific (APAC) holds a dominant 43.1% share in the Electric Brake Booster Market due to several key factors. The region’s rapid automotive manufacturing growth, particularly in China, Japan, and South Korea, plays a critical role. These countries are leading in automotive innovation, especially in electric and hybrid vehicles that extensively use electric brake boosters. Furthermore, the strong governmental push towards electrification of transport and stringent emissions regulations in these nations support the adoption of advanced automotive technologies including electric brake boosters.

The market dynamics in APAC are influenced by the region’s robust automotive production and technological advancement infrastructure. The presence of major automotive manufacturers and suppliers who invest significantly in R&D activities contributes to the region’s high market share. Additionally, the increasing consumer demand for safer and more efficient vehicles in populous countries like China and India boosts the adoption of technologies such as electric brake boosters.

APAC’s influence on the global Electric Brake Booster Market is expected to grow even stronger. With ongoing advancements in automotive technologies and increasing vehicle production, coupled with favorable government policies, the region is poised to maintain and possibly increase its market dominance. The continued shift towards electric vehicles will particularly amplify demand for electric brake boosters in this region.

Regional Market Shares:

- Europe: Europe has a 20.4% share of the market, with its strong emphasis on reducing vehicle emissions and the high adoption rate of electric and hybrid vehicles equipped with advanced braking systems.

- Middle East & Africa: This region captures a smaller share of around 4.5%, largely due to its nascent automotive manufacturing capabilities and slower adoption rates of advanced automotive technologies.

- Latin America: Holding around 8.5% of the market, Latin America is gradually progressing in the automotive sector with increasing awareness and adoption of new vehicle safety technologies, including electric brake boosters.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Electric Brake Booster Market is characterized by a diverse range of influential companies, each contributing to the industry’s dynamics through strategic innovation and market presence. Leading the charge are established automotive giants like Aisin Seiki Co. Ltd., Robert Bosch GmbH, and Continental AG, renowned for their extensive research and development capabilities and vast global networks. These companies have been pivotal in driving advancements in electric brake booster technology, largely due to their strong focus on enhancing vehicle safety and performance.

Mid-tier players such as TRW Automotive, Hyundai Mobis, and Mando Corporation also play crucial roles, specializing in the integration of electric brake boosters with other vehicle safety systems, thereby broadening their market reach and technological adoption. Smaller firms like Nissin Kogyo and Hitachi are important for their niche innovations, particularly in compact and efficient design models that cater to specific market segments.

Emerging players like Jilin Dongguang Aowei Brake System Co. Ltd., Zhejiang VIE Science & Technology Co., and Wanxiang Group Corporation are rapidly gaining ground by focusing on cost-effective solutions that appeal to developing markets, thereby increasing the competitive pressure on more established firms.

Overall, the strategic positioning of these key players within the Electric Brake Booster Market significantly influences its growth trajectory. Their ongoing developments and collaborations are crucial in pushing the boundaries of what’s possible in automotive brake systems, ensuring the market’s responsiveness to evolving safety standards and consumer preferences.

Market Key Players

- Aisin Seiki Co. Ltd.

- Robert Bosch GmbH

- TRW Automotive

- Hyundai Mobis

- Continental AG

- Mando Corporation

- Hitachi

- Nissin Kogyo

- Jilin Dongguang Aowei Brake System Co. Ltd.

- Zhejiang VIE Science & Technology Co.

- Wanxiang Group Corporation

- BWI Group

- FTE automotive Group

- APG

- Liuzhou Wuling Automobile Industry Co. Ltd

- Wuhu Bethel

- CARDONE

Recent Developments

- On April 2024, the National Highway Transportation Safety Administration (NHTSA) initiated an investigation into 2023 Cadillac LYRIQ electric vehicles due to reports of brake boost assist loss. This issue, affecting 3,322 units, involves a potential hindrance of ABS performance, with complaints of a hard brake pedal and a “Brake System Failure” message during driving or start-up. General Motors acknowledged the problem, attributing it to the eBoost system’s internal spindle fracturing during ABS events.

- On December 2023, ZF Aftermarket introduced the TRW Electronic Brake Booster (EBB) for electric vehicles (EVs) into the aftermarket. This compact EBB, part of the braking system for EVs without internal combustion engines, eliminates the need for a vacuum pump as a brake booster. Initially compatible with Volkswagen ID.3 and ID.4 EVs, the EBB addresses the challenges of combining recuperation and friction braking in EVs seamlessly. It offers comfort and driver assistance functions and is adaptable across various vehicle classes, including models based on Volkswagen’s Modular Electric Building Kit (MEB).

Report Scope

Report Features Description Market Value (2023) USD 4.59 Billion Forecast Revenue (2033) USD 25.95 Billion CAGR (2024-2033) 18.90% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Components (Hydraulic Pump, Accumulator, Master Cylinder), By Type (Vacuum Booster, Hydraulic Booster), By Vehicle Type (Two Wheeler, Passenger Vehicle, Commercial Vehicle), By Propulsion (Battery Electric Vehicle, Plug-In Hybrid Electric Vehicle, Hybrid Electric Vehicle), By Sales Channel (OEM, Aftermarket) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Aisin Seiki Co. Ltd., Robert Bosch GmbH, TRW Automotive, Hyundai Mobis, Continental AG, Mando Corporation, Hitachi, Nissin Kogyo, Jilin Dongguang Aowei Brake System Co. Ltd., Zhejiang VIE Science & Technology Co., Wanxiang Group Corporation, BWI Group, FTE automotive Group, APG, Liuzhou Wuling Automobile Industry Co. Ltd, Wuhu Bethel, CARDONE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Electric Brake Booster Market Size in the Year 2023?The Global Electric Brake Booster Market was USD 4.59 Billion by 2023, growing at a CAGR of 18.90%.

What is the Estimated Electric Brake Booster Market CAGR During the Forecast Period?The Global Electric Brake Booster Market is expected to grow at a CAGR of 18.90% during the forecast period from 2024 to 2033.

What is the Electric Brake Booster Market Size Estimated During the Forecast Period?The Global Electric Brake Booster Market size is expected to be worth around USD 25.95 Billion during the forecast period from 2024 to 2033.

Electric Brake Booster MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Electric Brake Booster MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Aisin Seiki Co. Ltd.

- Robert Bosch GmbH

- TRW Automotive

- Hyundai Mobis

- Continental AG

- Mando Corporation

- Hitachi

- Nissin Kogyo

- Jilin Dongguang Aowei Brake System Co. Ltd.

- Zhejiang VIE Science & Technology Co.

- Wanxiang Group Corporation

- BWI Group

- FTE automotive Group

- APG

- Liuzhou Wuling Automobile Industry Co. Ltd

- Wuhu Bethel

- CARDONE