Global Electric 3-wheeler Cargo Bikes Market Size, Share, Growth Analysis By Payload Capacity (Light, Medium, Heavy-duty), By Battery (Lithium-ion, Lead-acid, Nickel-metal hydride), By Power Output (1000W to 3000W, Up to 1000W, Above 3000W), By End-Use (Logistics & Delivery, Retail & Wholesale, Construction & Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158330

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

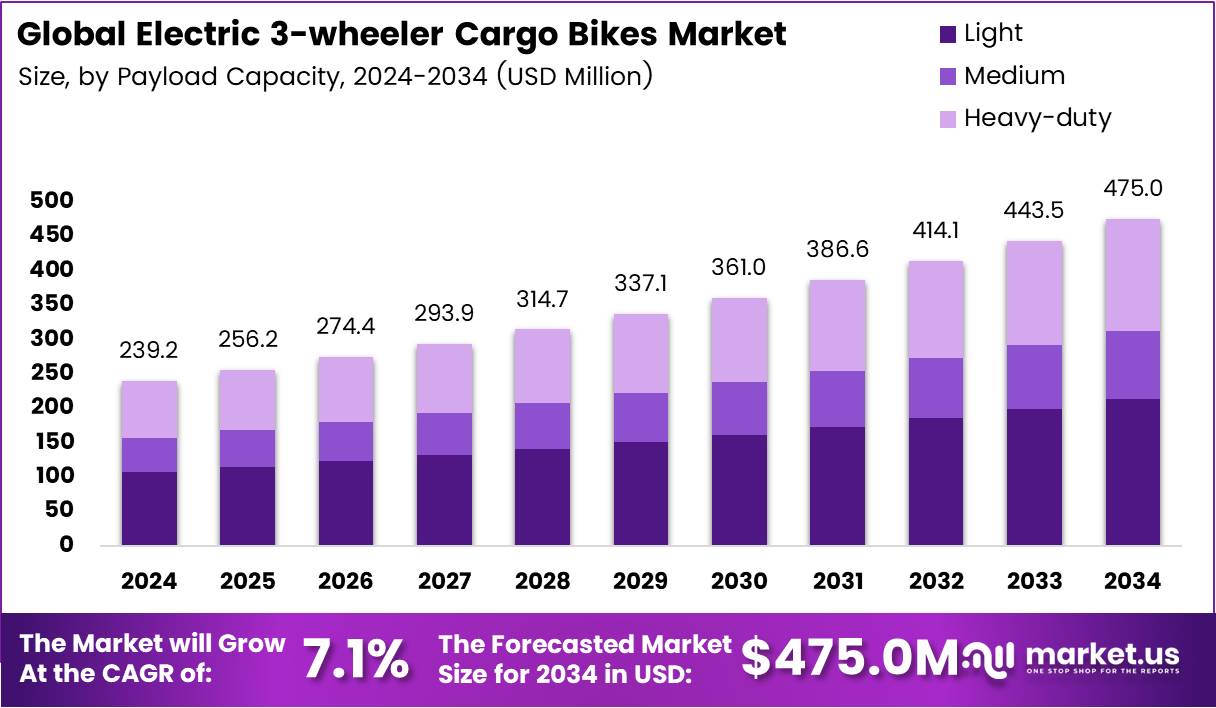

The Global Electric 3-wheeler Cargo Bikes Market size is expected to be worth around USD 475.0 Million by 2034, from USD 239.2 Million in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

The Electric 3-wheeler Cargo Bikes Market is rapidly evolving, driven by a shift towards sustainable transportation solutions. These vehicles, designed for urban cargo delivery, offer a solution to congested cities and rising environmental concerns. Their growing popularity stems from the need for eco-friendly delivery options in crowded urban environments.

The market is seeing increasing adoption, as businesses and consumers seek alternatives to traditional delivery vehicles. With urban areas becoming more congested, the demand for efficient and environmentally friendly solutions is on the rise. The electric 3-wheeler cargo bike meets these needs by offering reduced emissions and lower operational costs.

Government investments and regulations are significantly influencing the growth of this market. Policies promoting clean energy solutions and reducing vehicular emissions are supporting the adoption of electric vehicles. Incentives, subsidies, and grants for electric vehicle manufacturers and consumers are making electric 3-wheelers more affordable and accessible.

Technological advancements are also contributing to market growth. The development of more efficient batteries, improved motor performance, and better cargo handling capabilities are making electric 3-wheelers more competitive. As these technologies improve, the operational range, load capacity, and overall efficiency of these vehicles continue to enhance.

The market is expected to witness substantial growth in the coming years. According to industry reports, sales of Electric 3W Cargo Vehicles increased from 3,312 units in March 2022 to 5,780 units in March 2023, reflecting a clear upward trend in adoption. This growth is further supported by expanding e-commerce demand and last-mile delivery services.

In Europe, the electric 3-wheeler cargo bike market is expected to see significant penetration. By 2025, 35% of urban families in Europe are estimated to own a family bike or electric cargo bicycle for daily use. This growth is driven by the desire for cleaner and more convenient transportation options, especially for short-distance travel and local deliveries.

Key Takeaways

- The Global Electric 3-wheeler Cargo Bikes Market is expected to reach USD 475.0 Million by 2034, growing at a CAGR of 7.1% from 2025 to 2034.

- In 2024, the Light payload capacity segment holds a dominant market position with a 44.8% share.

- In 2024, Lithium-ion batteries lead the market with a 67.1% share in the Electric 3-wheeler Cargo Bikes Market.

- In 2024, 1000W to 3000W power output holds a dominant position with a 55.3% share.

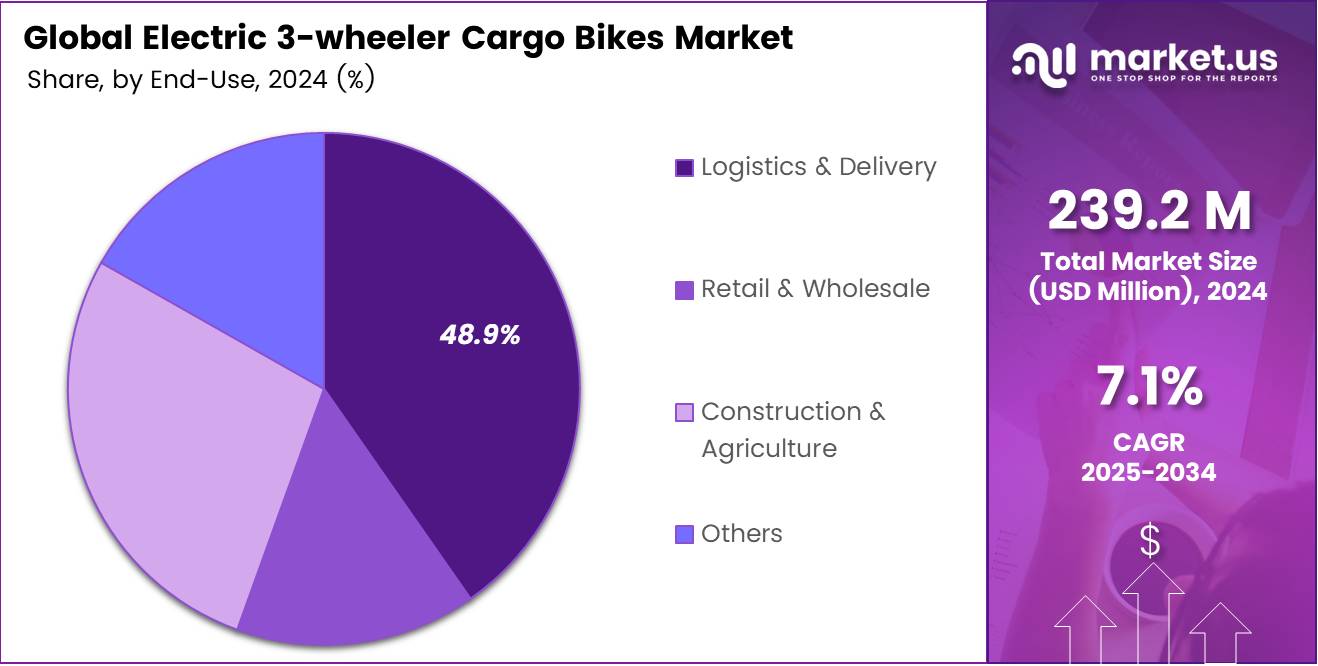

- In 2024, the Logistics & Delivery segment leads with a 48.9% share in the Electric 3-wheeler Cargo Bikes Market.

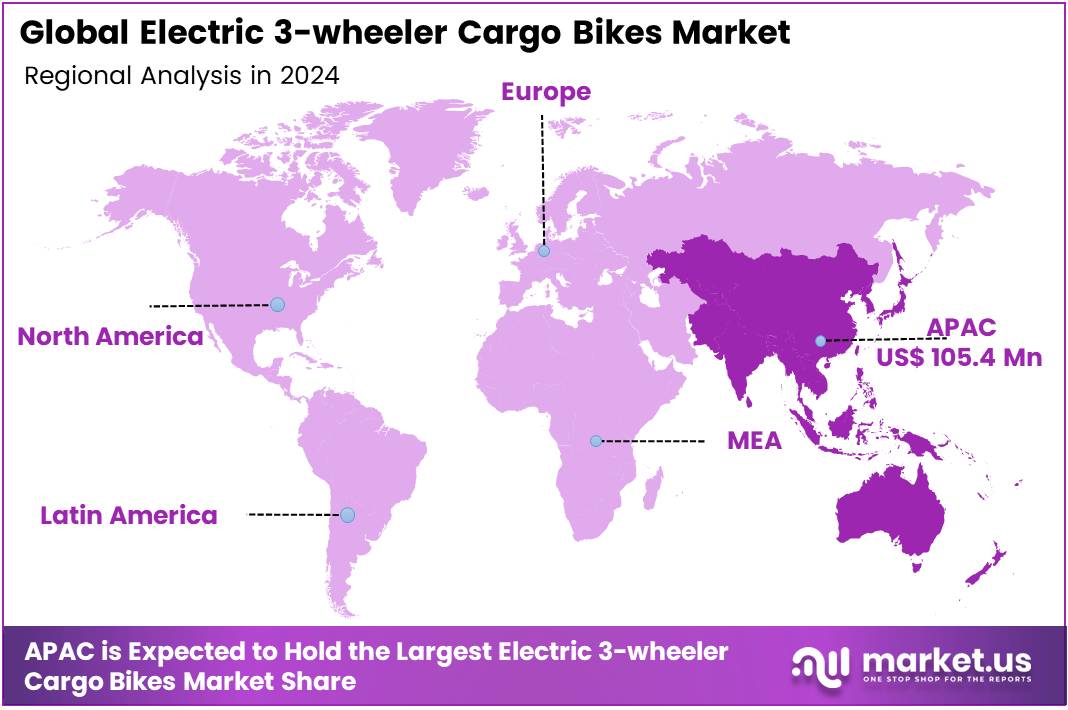

- In 2024, Asia Pacific (APAC) dominates the market with 44.1% share, valued at USD 105.4 Million.

Payload Capacity Analysis

Light segment dominates with 44.8% due to its optimal balance of efficiency and practicality for urban deliveries.

In 2024, Light held a dominant market position in By Payload Capacity Analysis segment of Electric 3-wheeler Cargo Bikes Market, with a 44.8% share. The light payload segment’s leadership reflects the growing demand for agile urban delivery solutions that prioritize maneuverability over heavy-lifting capacity.

Light payload electric cargo bikes have gained significant traction among e-commerce platforms and food delivery services. Their compact design allows for easy navigation through congested city streets while maintaining sufficient cargo space for most delivery requirements. The segment benefits from lower operational costs and reduced charging times compared to heavier variants.

Medium payload capacity vehicles represent a substantial portion of the market, catering to businesses requiring moderate cargo transportation. Heavy-duty segment, while smaller in market share, serves specialized applications in construction and wholesale distribution where maximum payload capacity is essential for operational efficiency.

Battery Analysis

Lithium-ion dominates with 67.1% due to its superior energy density and longer operational lifespan.

In 2024, Lithium-ion held a dominant market position in By Battery Analysis segment of Electric 3-wheeler Cargo Bikes Market, with a 67.1% share. The lithium-ion battery segment’s dominance stems from its exceptional performance characteristics and declining costs over recent years.

Lithium-ion batteries offer significant advantages including faster charging capabilities, lighter weight, and extended cycle life compared to traditional alternatives. These features make them particularly attractive for commercial operators who require reliable daily operation with minimal downtime. The technology’s maturity has also led to improved safety standards and better thermal management systems.

Lead-acid batteries maintain a presence in the market primarily due to their lower initial cost and established recycling infrastructure. However, their shorter lifespan and heavier weight limit their appeal for intensive commercial use. Nickel-metal hydride batteries occupy a niche position, offering moderate performance between lead-acid and lithium-ion technologies but facing pressure from both segments.

Power Output Analysis

1000W to 3000W dominates with 55.3% due to its optimal performance for diverse commercial applications.

In 2024, 1000W to 3000W held a dominant market position in By Power Output Analysis segment of Electric 3-wheeler Cargo Bikes Market, with a 55.3% share. This mid-range power segment perfectly balances performance requirements with energy efficiency for most commercial applications.

The 1000W to 3000W range provides sufficient torque for climbing hills while carrying moderate to heavy loads, making it ideal for urban delivery services and cargo transportation. This power range ensures consistent performance across varying terrain conditions while maintaining reasonable battery consumption rates. Fleet operators particularly favor this segment for its reliability and cost-effectiveness.

The Up to 1000W segment serves lighter applications and cost-conscious buyers who prioritize energy efficiency over raw power. Above 3000W systems cater to specialized heavy-duty applications requiring maximum performance, though their higher energy consumption and cost limit broader market adoption. The mid-range segment’s dominance reflects the practical needs of most commercial users seeking dependable performance.

End-Use Analysis

Logistics & Delivery dominates with 48.9% due to the rapid growth of e-commerce and last-mile delivery demands.

In 2024, Logistics & Delivery held a dominant market position in By End-Use Analysis segment of Electric 3-wheeler Cargo Bikes Market, with a 48.9% share. The logistics and delivery segment’s leadership reflects the explosive growth in e-commerce and the increasing focus on sustainable last-mile delivery solutions.

The rise of online shopping platforms and food delivery services has created unprecedented demand for efficient urban cargo transportation. Electric 3-wheeler cargo bikes offer the perfect solution for navigating congested city centers while meeting environmental regulations. Their ability to access restricted zones and park easily gives them significant advantages over traditional delivery vehicles.

Retail & Wholesale applications represent a substantial market share, with businesses using these vehicles for inventory transportation and customer deliveries. Construction & Agriculture segments utilize electric cargo bikes for transporting tools and materials in areas where larger vehicles cannot access. The Others category includes various niche applications such as municipal services, waste collection, and mobile vending operations.

Key Market Segments

By Payload Capacity

- Light

- Medium

- Heavy-duty

By Battery

- Lithium-ion

- Lead-acid

- Nickel-metal hydride

By Power Output

- 1000W to 3000W

- Up to 1000W

- Above 3000W

By End-Use

- Logistics & Delivery

- Retail & Wholesale

- Construction & Agriculture

- Others

Drivers

Rising Demand for Zero-Emission Urban Delivery Solutions Drives Market Growth

The electric 3-wheeler cargo bikes market is experiencing strong momentum due to increasing demand for clean last-mile delivery options in crowded cities. Urban areas are facing growing pressure to reduce air pollution and carbon emissions, making electric cargo bikes an attractive alternative to traditional delivery vehicles.

Government support is playing a crucial role in market expansion. Many countries are offering financial incentives, tax breaks, and subsidies to encourage businesses to adopt electric cargo vehicles. These policies make it easier for companies to switch from diesel or gasoline-powered delivery trucks to cleaner electric alternatives.

Technology improvements in battery systems are making these vehicles more practical for businesses. New lightweight battery designs allow cargo bikes to carry heavier loads while traveling longer distances on a single charge. This enhanced performance makes them suitable for more delivery applications.

Large logistics companies and online retailers are increasingly adding electric 3-wheelers to their delivery fleets. These businesses recognize the cost savings from lower fuel expenses and reduced maintenance requirements. The vehicles also help companies meet their environmental goals while improving their brand image among eco-conscious customers.

Restraints

Limited Charging Infrastructure Restricts Market Expansion

The growth of electric 3-wheeler cargo bikes faces several significant challenges that limit widespread adoption. The most pressing issue is the lack of adequate charging facilities, especially in developing countries where these vehicles could provide the most benefit for small businesses and delivery services.

Cost remains a major barrier for many potential buyers. Electric cargo bikes require a much higher initial investment compared to traditional pedal-powered or gasoline cargo bikes. This price difference makes it difficult for small businesses and individual operators to justify the purchase, despite long-term operational savings.

Performance concerns also limit market growth. When carrying heavy loads or traveling long distances, electric 3-wheelers may struggle with reduced speed and shorter battery life. This limitation makes them less suitable for certain types of cargo transport, particularly in rural areas or for businesses requiring extended daily operations.

Battery-related expenses create additional financial worries for buyers. The cost of replacing batteries after several years of use can be substantial, and concerns about battery degradation affect the total ownership cost calculations. Many potential customers are uncertain about long-term battery performance and replacement schedules.

Growth Factors

Integration of Solar Technology Creates New Market Opportunities

The electric 3-wheeler cargo bikes market has several promising growth areas that could significantly expand its reach. Solar-powered charging systems represent a major opportunity, allowing vehicles to extend their operating time while reducing dependence on grid electricity. This technology is particularly valuable in areas with limited electrical infrastructure.

Cold-chain logistics presents another significant growth avenue. Electric cargo bikes can be equipped with refrigeration systems to transport fresh food, medicines, and other temperature-sensitive products. This capability opens up new market segments including grocery delivery, pharmaceutical distribution, and restaurant supply chains.

Strategic partnerships with ride-sharing companies and mobility platforms offer expanded utility for these vehicles. By integrating cargo bikes into existing transportation networks, companies can create more efficient multi-modal delivery systems that serve both passenger and freight needs.

Modular cargo compartment designs provide flexibility for different business applications. Interchangeable storage systems allow the same vehicle to handle various types of cargo, from packages to tools to food items. This versatility makes the bikes more attractive to businesses with diverse delivery needs and helps justify the initial investment cost.

Emerging Trends

Smart Technology Integration Shapes Market Evolution

Several technological trends are reshaping the electric 3-wheeler cargo bikes market and improving operational efficiency. Fleet management systems using Internet of Things sensors and telematics allow businesses to track vehicle performance, monitor battery levels, and optimize delivery routes in real-time. This data helps companies reduce costs and improve service quality.

Swappable battery technology is gaining popularity as a solution to reduce vehicle downtime. Instead of waiting hours for batteries to charge, operators can quickly exchange depleted batteries for fully charged ones at designated stations. This system keeps vehicles running throughout the day and maximizes productivity.

Major retail chains are forming partnerships with electric bike manufacturers and startups to develop customized delivery solutions. These collaborations help refine vehicle designs for specific business needs while providing manufacturers with steady demand and valuable feedback for product improvement.

Urban micro-distribution centers are increasingly relying on compact electric cargo bikes for final delivery stages. These smaller facilities, located closer to customers, use electric 3-wheelers to complete the last mile efficiently while reducing traffic congestion and parking challenges in dense city areas.

Regional Analysis

Asia Pacific Dominates the Electric 3-Wheeler Cargo Bikes Market with a Market Share of 44.1%, Valued at USD 105.4 Million

In 2024, Asia Pacific (APAC) held a dominant market position in the Electric 3-Wheeler Cargo Bikes market, capturing 44.1% of the market share, valued at USD 105.4 Million. This growth is driven by the increasing adoption of electric vehicles for last-mile delivery in countries like India and China, where urbanization and environmental concerns are prompting governments and consumers to favor electric alternatives. Additionally, the rise of e-commerce and demand for cost-effective cargo solutions contribute to the market’s expansion.

North America Electric 3-Wheeler Cargo Bikes Market Trends

North America is the second-largest market for Electric 3-Wheeler Cargo Bikes, fueled by the growing demand for eco-friendly delivery solutions. In the U.S., regulations favoring low-emission vehicles, paired with a robust infrastructure for electric vehicle charging, are expected to drive market growth. The region also benefits from advancements in battery technology and the rising popularity of urban cargo delivery solutions, particularly in metropolitan areas.

Europe Electric 3-Wheeler Cargo Bikes Market Trends

Europe follows as a significant market, with governments offering incentives for electric vehicle adoption and stringent emission regulations encouraging the shift towards electric mobility. Urban areas across Western and Northern Europe show an increasing demand for electric cargo bikes, driven by sustainability goals and the need for last-mile delivery solutions. The expanding network of charging stations and supportive policies further boost market development.

Latin America Electric 3-Wheeler Cargo Bikes Market Trends

In Latin America, the market for Electric 3-Wheeler Cargo Bikes is still in its nascent stages but is expected to grow significantly. The region’s increasing focus on sustainability, combined with the affordability and convenience of electric cargo bikes for local businesses, is likely to support market expansion. Countries like Brazil are gradually adopting electric vehicle technologies, including electric cargo bikes, in urban areas.

Middle East and Africa Electric 3-Wheeler Cargo Bikes Market Trends

The Middle East and Africa (MEA) region is projected to see gradual growth in the Electric 3-Wheeler Cargo Bikes market, driven by the need for cost-effective and eco-friendly transport solutions in urban centers. However, market penetration remains slower compared to other regions due to infrastructure and economic challenges. As governments begin to focus more on sustainability, the demand for electric mobility solutions, including electric cargo bikes, is likely to increase in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Electric 3-wheeler Cargo Bikes Company Insights

In 2024, several key players are shaping the global electric 3-wheeler cargo bike market, each contributing unique innovations and facing distinct challenges.

Babboe is a prominent Dutch brand specializing in family-oriented electric cargo bikes. Founded in 2005, Babboe gained popularity for its practical designs catering to urban families. However, in early 2024, the company faced a significant setback when Dutch authorities ordered a recall of approximately 10,000 bikes due to frame safety concerns. This incident has impacted the brand’s reputation and raised questions about its commitment to quality control.

Bunch Bikes, based in Denton, Texas, has established itself as North America’s largest front-load cargo bike brand. Founded in 2016, the company focuses on providing family-friendly electric cargo solutions. Their models are designed to accommodate children and pets, emphasizing safety and ease of use. Bunch Bikes gained national attention through its appearance on a major television show, which helped boost its visibility and customer base.

Butchers & Bicycles, a Danish company founded in 2011, is renowned for its innovative “Built to Tilt” design in electric cargo bikes. The MK1-E model features a tilting mechanism that enhances maneuverability, making it feel more like a traditional bicycle. This design has been particularly appealing to urban families seeking a stylish and functional transportation option.

Cube is a German bicycle manufacturer that has expanded its portfolio to include electric cargo bikes. Known for its engineering excellence, Cube offers models like the Cargo Sport Hybrid, which boasts a powerful motor and a robust frame capable of carrying substantial loads. These bikes are designed for both urban commuting and recreational use, appealing to a broad range of customers.

Each of these companies brings distinct strengths to the electric cargo bike market, from innovative designs and family-friendly features to engineering prowess. However, challenges such as safety concerns and market competition continue to shape the industry’s landscape.

Top Key Players in the Market

- Babboe

- Bunch Bikes

- Butchers & Bicycles

- Cube 50

- Laplandar

- Raleigh UK Ltd.

- Urban Arrow

- Winora Group

- Worksman Cycles

- Xuzhou Beiji Vehicle Co., Ltd.

Recent Developments

- In July 2025, Vok Bikes secured $6 million in funding to expand its e-cargo fleet across Europe, aiming to strengthen its presence in the rapidly growing sustainable transport sector. The investment will help scale operations and meet increasing demand for eco-friendly logistics solutions.

- In June 2024, WeSports acquired the leading bike brand Cargobike to further its expansion in Europe. The acquisition positions WeSports to tap into the growing e-cargo market, enhancing its product portfolio and geographic reach.

- In April 2025, Today acquired Dockr after securing €4 million in funding to accelerate its growth. The acquisition is expected to strengthen its position in the European e-cargo bike market, leveraging Dockr’s established infrastructure and customer base.

Report Scope

Report Features Description Market Value (2024) USD 239.2 Million Forecast Revenue (2034) USD 475.0 Million CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Payload Capacity (Light, Medium, Heavy-duty), By Battery (Lithium-ion, Lead-acid, Nickel-metal hydride), By Power Output (1000W to 3000W, Up to 1000W, Above 3000W), By End-Use (Logistics & Delivery, Retail & Wholesale, Construction & Agriculture, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Babboe, Bunch Bikes, Butchers & Bicycles, Cube 50, Laplandar, Raleigh UK Ltd., Urban Arrow, Winora Group, Worksman Cycles, Xuzhou Beiji Vehicle Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electric 3-wheeler Cargo Bikes MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Electric 3-wheeler Cargo Bikes MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Babboe

- Bunch Bikes

- Butchers & Bicycles

- Cube 50

- Laplandar

- Raleigh UK Ltd.

- Urban Arrow

- Winora Group

- Worksman Cycles

- Xuzhou Beiji Vehicle Co., Ltd.