Edge Computing In Healthcare Market By Product Type (Hardware and Software & Services), By Application (Telehealth & Remote Patient Monitoring, Robotic Surgery, Diagnostics, Ambulances, and Other), By End-user (Hospitals & Clinics, Home Care & Long-term Care Centers, and Ambulatory Care & Other), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155188

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

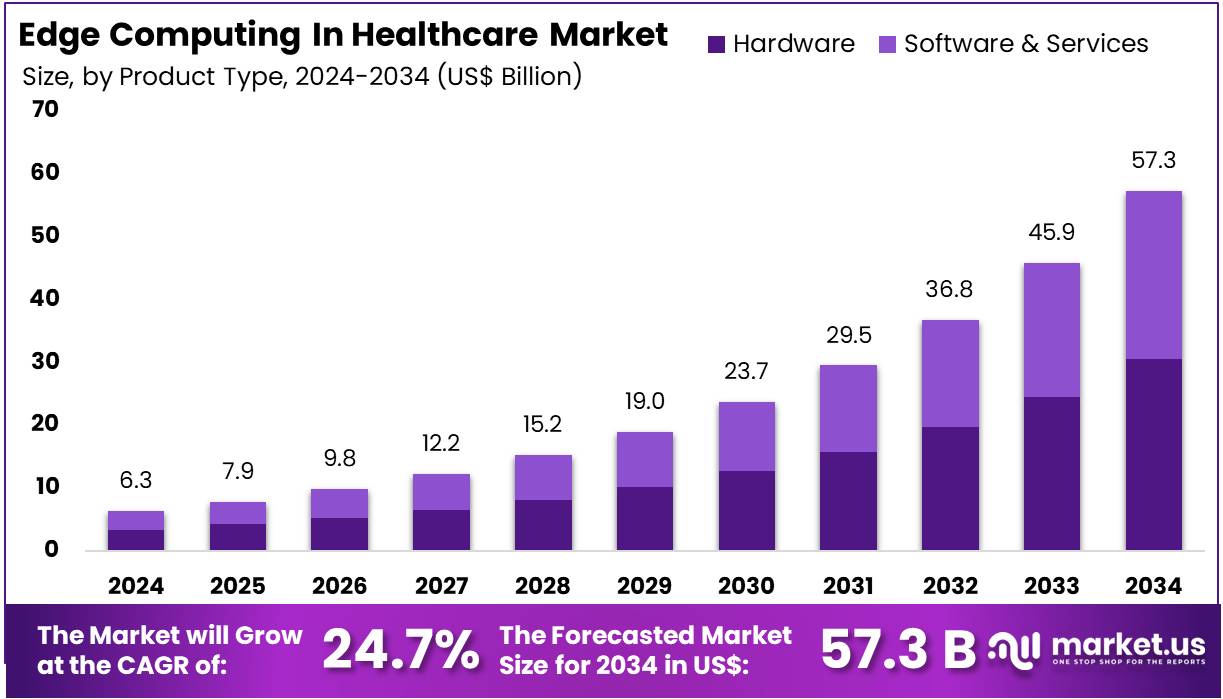

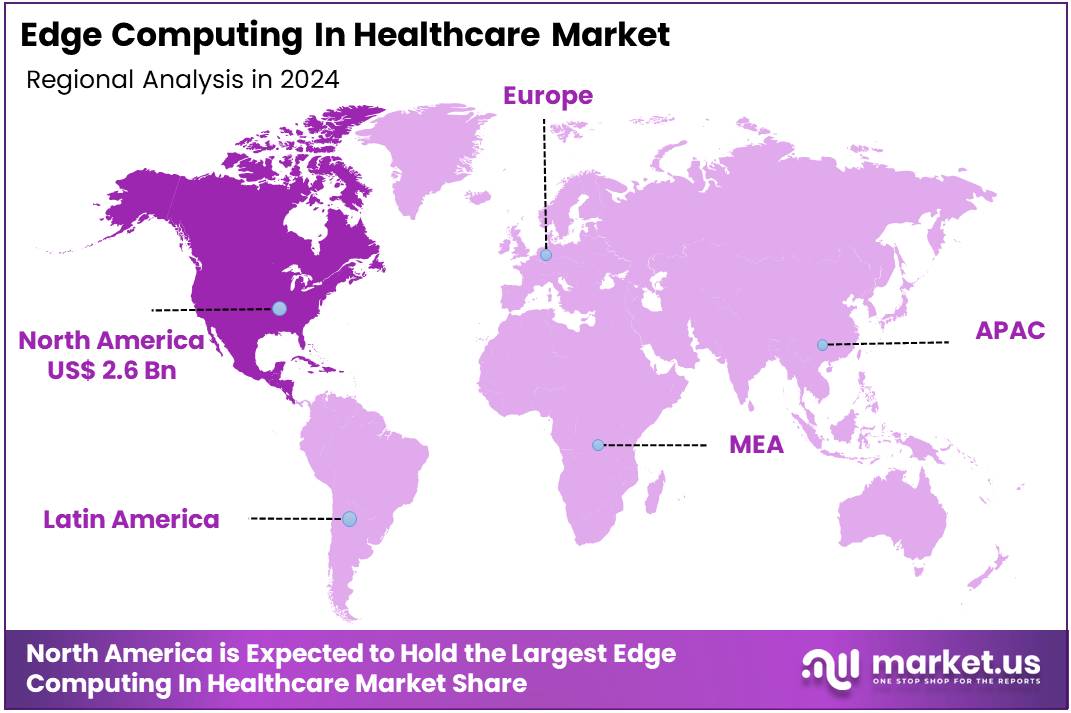

The Edge Computing In Healthcare Market size is expected to be worth around US$ 57.3 billion by 2034 from US$ 6.3 billion in 2024, growing at a CAGR of 24.7% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 41.7% share and holds US$ 2.6 Billion market value for the year.

The market for edge computing in healthcare is in a period of rapid acceleration, driven by a critical need for real-time data processing, evolving reimbursement models, and stringent data privacy regulations. Hospitals are under immense pressure to analyze life-critical data within sub-millisecond windows, a requirement that traditional cloud-only architectures cannot consistently meet. This urgency is compounded by the expansion of “hospital-at-home” programs and tightening data residency rules, which favor on-premises data processing. The hardware refresh cycle has intensified as clinicians increasingly demand deterministic performance for AI-driven applications, such as real-time image analysis.

The deployment of compact servers at the point of care—be it a bedside, an ICU, or an imaging suite—is transforming healthcare delivery. These localized computing nodes are designed to handle the massive streams of data from a new generation of smart medical devices, including continuous glucose monitors, intelligent infusion pumps, and wearable ECG patches. By embedding AI chips at the edge, these devices can flag anomalies locally, ensuring patient safety even during network disruptions. This is a vital capability, especially as healthcare systems increasingly rely on technologies that automate and augment clinical tasks, such as voice-driven charting and ambient listening, which depend on guaranteed performance. The integration of 5G networks, federated learning, and privacy-preserving analytics is creating novel use cases that will anchor the next wave of capital spending in this market.

This strategic shift is also being propelled by significant industry collaborations. For instance, in March 2024, Johnson & Johnson MedTech announced a partnership with NVIDIA to advance AI adoption and real-time analytics in surgical decision-making. This collaboration, leveraging NVIDIA’s IGX and Holoscan edge computing platforms, aims to create an infrastructure that allows for the deployment of powerful AI-powered software applications directly within the operating room. This type of innovation is critical for avoiding the network jitter that could compromise the precision of a robotic arm during a surgical procedure.

The market’s direction is also influenced by broader public health needs and government initiatives. The Centers for Medicare & Medicaid Services (CMS) has demonstrated a commitment to innovative care models, with CMS reports showing that “hospital-at-home” programs can lead to lower mortality rates and a reduction in hospital-acquired infections. This favorable clinical evidence and the associated reimbursement waivers are a powerful incentive for providers to invest in the edge computing infrastructure required to support these programs.

The Centers for Disease Control and Prevention (CDC) has also highlighted the importance of data-driven insights for public health surveillance, a task that can be significantly enhanced by the ability to process and analyze localized data at the edge. Furthermore, the Agency for Healthcare Research and Quality (AHRQ) has consistently focused on improving patient safety and reducing medical errors, a goal that edge computing helps address by providing real-time, deterministic performance for critical clinical applications. Finally, the National Institutes of Health (NIH) continues to fund research into AI-driven medical technologies, and their emphasis on data privacy and security is perfectly aligned with the distributed, on-premises processing capabilities of edge computing.

Key Takeaways

- In 2024, the market for edge computing in healthcare generated a revenue of US$ 6.3 billion, with a CAGR of 24.7%, and is expected to reach US$ 57.3 billion by the year 2034.

- The product type segment is divided into hardware and software & services, with hardware taking the lead in 2023 with a market share of 53.5%.

- Considering application, the market is divided into telehealth & remote patient monitoring, robotic surgery, diagnostics, ambulances, and other. Among these, telehealth & remote patient monitoring held a significant share of 39.4%.

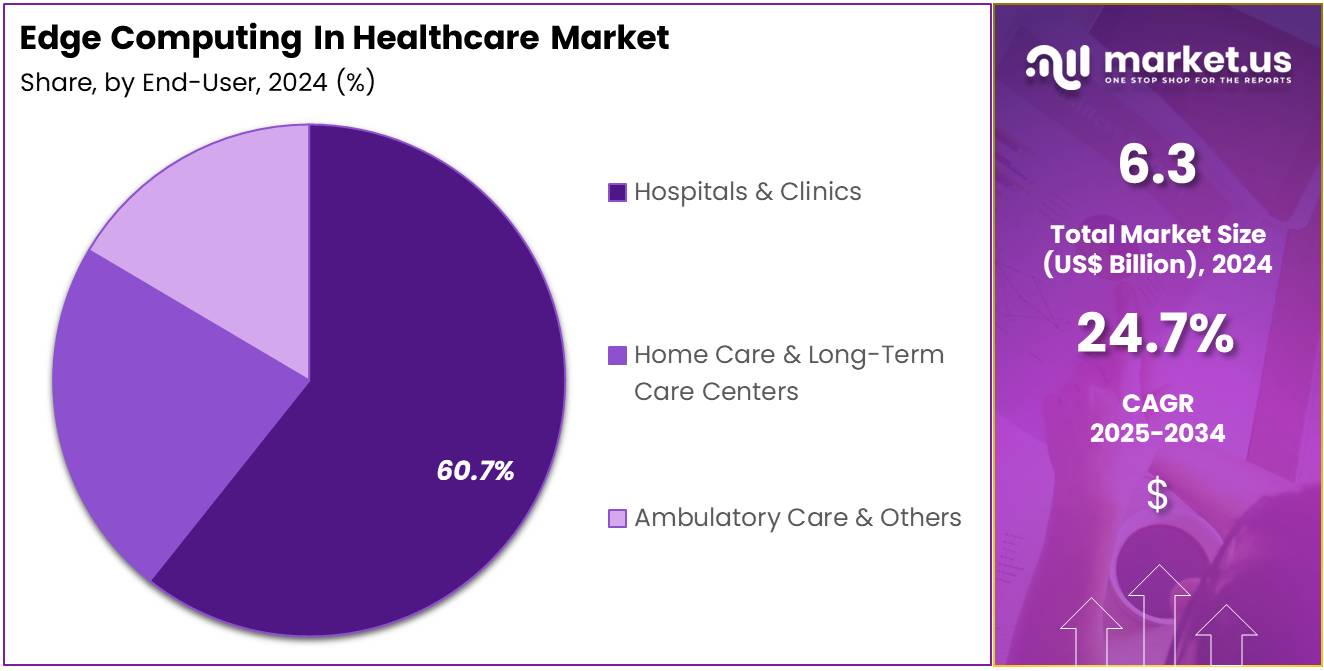

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, home care & long-term care centers, and ambulatory care & other. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 60.7% in the edge computing in healthcare market.

- North America led the market by securing a market share of 41.7% in 2024.

Product Type Analysis

Hardware dominates the product type segment, accounting for 53.5% of the edge computing in healthcare market share. The growth of this segment is expected to continue as healthcare systems increasingly rely on physical devices such as edge servers, sensors, and computing devices for real-time data processing and decision-making. The integration of edge computing in healthcare allows for faster processing of patient data locally, which reduces latency, improves response times, and enhances the overall efficiency of healthcare delivery.

As healthcare facilities demand low-latency computing for applications such as telemedicine, patient monitoring, and diagnostic imaging, hardware is projected to remain a core component of edge computing infrastructure. Additionally, the growing adoption of IoT devices in healthcare, including wearable health trackers and medical equipment, is anticipated to further drive the need for robust hardware solutions. The market for edge computing hardware in healthcare is likely to experience continued growth as more hospitals and clinics embrace real-time, data-driven decision-making capabilities.

Application Analysis

Telehealth & remote patient monitoring accounts for 39.4% of the application segment in the edge computing in healthcare market. This growth is expected to continue as the demand for remote healthcare services surges, driven by factors such as increased access to healthcare, the rise of chronic conditions, and the global push for healthcare modernization. Edge computing enables real-time monitoring of patients’ vital signs and health data outside traditional healthcare settings, enhancing patient engagement and reducing hospital visits.

The adoption of telehealth platforms and remote monitoring systems is expected to accelerate as patients and providers alike seek more convenient, cost-effective, and accessible healthcare options. Additionally, the COVID-19 pandemic has acted as a catalyst, increasing the acceptance of telehealth services across both rural and urban areas. As edge computing further enhances telehealth applications with faster data processing and improved security, this segment is anticipated to see significant growth, especially with the increasing focus on personalized care and preventative health management.

End-User Analysis

Hospitals & clinics represent 60.7% of the end-user segment in the edge computing in healthcare market. This dominance is expected to persist as hospitals and clinics are at the forefront of adopting advanced healthcare technologies. The use of edge computing in these settings enhances operational efficiency, enabling faster decision-making and improving patient outcomes through real-time data analytics. Edge computing solutions are becoming increasingly essential for applications such as electronic health records (EHR), medical imaging, and telemedicine, all of which benefit from low-latency processing.

Hospitals and clinics are expected to invest heavily in edge computing infrastructure to support various initiatives, such as remote monitoring of patients with chronic conditions, smart diagnostics, and precision medicine. Additionally, the growing need to improve healthcare delivery while reducing costs is likely to drive the continued adoption of edge computing technologies in these settings. As healthcare providers strive for higher quality care and more efficient workflows, hospitals and clinics will remain key contributors to the market’s growth.

Key Market Segments

By Product Type

- Hardware

- Software & Services

By Application

- Telehealth & Remote Patient Monitoring

- Robotic Surgery

- Diagnostics

- Ambulances

- Other

By End-user

- Hospitals & Clinics

- Home Care & Long-term Care Centers

- Ambulatory Care & Other

Drivers

The increasing need for real-time data processing and low latency is driving the market

The market for edge computing in healthcare is primarily driven by the critical need for real-time data processing and ultra-low latency. In numerous medical applications, such as remote patient monitoring, surgical robotics, and medical imaging, immediate data analysis is essential for making timely and life-saving decisions. Edge computing processes data locally, near the source of generation, circumventing the delays associated with transmitting large datasets to a centralized cloud. This is particularly vital for applications that require immediate feedback.

For instance, in telesurgery, a 2024 review in the Journal of Robotic Surgery noted that surgical performance can deteriorate exponentially as latency increases, with ideal delays for telesurgery considered to be at or below 200 milliseconds. The American Hospital Association’s 2023 report on health technology highlighted that 74% of US hospitals use telehealth services, a number that has been steadily increasing. As telemedicine and remote monitoring become more prevalent, the demand for edge computing solutions that can ensure the integrity and speed of data transmission becomes paramount. This shift towards real-time, data-intensive healthcare services is a powerful catalyst for the adoption of edge computing to ensure both patient safety and clinical efficacy.

Restraints

Data privacy concerns and the lack of standardized protocols are restraining the market

A significant restraint on the market’s growth is the critical challenge of data privacy and the absence of standardized protocols. Edge computing involves processing sensitive patient health information on devices at the edge of the network, which can be vulnerable to security breaches if not properly secured. The sheer volume of medical IoT devices creates a wider attack surface for cyber threats, and a single breach can have severe consequences for patient trust and institutional liability.

According to a 2024 analysis by the US Department of Health and Human Services (HHS), there was a 20% increase in large-scale healthcare data breaches reported in 2023 compared to 2022. The report found that a significant portion of these breaches involved connected medical devices and other digital health tools.

Furthermore, a lack of interoperability and standardized protocols for these devices complicates integration and security management. The diverse ecosystem of medical IoT devices often uses proprietary communication standards, making it difficult for healthcare providers to implement a cohesive and secure edge computing framework. This combination of heightened security risks and a fragmented regulatory landscape slows the overall adoption rate.

Opportunities

The proliferation of medical IoT and wearable devices is creating growth opportunities

The explosive growth in the number of medical IoT devices and wearable technology presents a major opportunity for the market. Devices such as continuous glucose monitors, smart sensors, and wearable vital signs trackers are generating a massive amount of patient data in real-time. Edge computing is the ideal solution to manage this data overload, as it can process and analyze the information locally, filtering out noise and sending only critical insights to the cloud. The adoption of these technologies has been accelerating.

A 2024 report from the Office of the National Coordinator for Health Information Technology (ONC) highlighted that the use of remote patient monitoring tools has grown substantially, with a projected 30 million US patients using these services by the end of 2024. This growth is further supported by the increasing number of FDA-approved wearable and mobile health devices, which reached over 100 in 2023. These connected devices, both in hospital and home settings, are creating an unprecedented need for a decentralized computing infrastructure, and edge computing is uniquely positioned to meet this demand by enabling efficient, scalable, and secure data processing.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have a profound impact on the operations of manufacturers and suppliers of edge computing solutions within the healthcare sector. Inflationary pressures worldwide have driven up the costs of crucial electronic components, which are essential for the production of edge devices. A 2024 industry analysis of the semiconductor market revealed a recovery, but also highlighted the unpredictability of component pricing. For example, the cost of critical memory components such as DRAM, which are necessary for edge processors, saw price hikes of 10-15% in the first quarter of 2024, affecting the production expenses of medical IoT devices. At the same time, geopolitical tensions continue to disrupt global supply chains.

A report published in 2024 on the semiconductor supply chain noted that trade disputes and political instability have led many companies to rethink their sourcing strategies and reassess production sites. In response, the Semiconductor Industry Association (SIA) reported in May 2024 that the US is planning to more than triple its semiconductor manufacturing capacity by 2032, backed by over $450 billion in investments announced since 2022. This shift toward localizing production aims to mitigate the risks associated with global uncertainties and lays the groundwork for a more stable, robust growth trajectory.

The current landscape of US tariffs is adding further complexity to the supply chain. The introduction of new duties on various imported electronic components and finished goods has raised the landed cost of these vital parts. A 2025 analysis of US tariffs indicated that certain electronic components, including multi-layer printed circuit boards (PCBs), now face duties as high as 55% depending on their country of origin. As edge computing devices essentially function as compact computers, their dependence on these components makes them particularly vulnerable to rising prices.

The medical technology trade association, AdvaMed, criticized these broad tariffs in 2025, calling them an excise tax on medical technology that would “increase overall healthcare costs” and stifle innovation. Although these tariffs introduce friction and added costs at various stages of the global value chain, they also provide a competitive edge to US-based manufacturers, who are not subject to these import duties. This situation is driving a shift toward a more localized supply chain, with companies investing in domestic production to avoid the tariff burden and strengthen their position in the market. The industry is responding by adapting its strategies, finding new suppliers, and optimizing logistics, demonstrating a resilient approach to future growth.

Latest Trends

The integration of AI and machine learning at the edge is a recent trend

A notable trend observed in 2024 and 2025 is the increasing integration of artificial intelligence (AI) and machine learning (ML) capabilities directly into edge devices. Rather than simply collecting data, these smart devices are now capable of performing real-time analysis and making predictive decisions on-site, without needing to connect to a central server. This “AI at the edge” allows for instant diagnostics, predictive maintenance of equipment, and personalized health recommendations.

For example, a 2025 systematic review in a medical journal highlighted the potential of AI models running on edge devices to perform real-time ECG analysis with high accuracy for detecting cardiac arrhythmias. The FDA has been actively approving more AI-enabled medical devices, with a record number of new AI/ML-based medical device authorizations in 2024. This trend is driven by the need for faster, more autonomous, and more reliable healthcare applications. By embedding intelligence directly into devices, the healthcare industry is moving towards a more proactive and decentralized model of care, with the potential to significantly improve patient outcomes.

Regional Analysis

North America is leading the Edge Computing In Healthcare Market

The edge computing in healthcare market in North America, which holds a 41.7% share of the global market, demonstrated significant growth in 2024. This expansion is driven by the region’s advanced technological infrastructure, the increasing proliferation of Internet of Medical Things (IoMT) devices, and a strong regulatory focus on data security and privacy. The high demand for real-time data processing in critical care, remote patient monitoring, and AI-driven diagnostics has made edge computing a crucial enabler. For instance, the number of connected IoT devices in North America reached 13.4 devices per person in 2023, according to some analyses, a far higher density than other major regions, creating a massive amount of data that requires localized processing.

The US government is actively promoting the adoption of these technologies. The FDA has cleared over 950 AI/ML-powered medical devices, many of which rely on edge computing for real-time analysis to provide diagnostic support. This regulatory support, coupled with the high rate of technology adoption among healthcare providers, is a major growth factor. According to a 2024 CDC report on health IT adoption, a growing number of US hospitals are investing in these advanced systems. Furthermore, the push for enhanced data security and compliance with regulations like HIPAA is encouraging the use of edge computing to process sensitive patient information locally, minimizing the risk associated with transmitting data to the cloud.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The edge computing in healthcare market in Asia Pacific is anticipated to grow at the fastest rate during the forecast period. This growth is a result of rapid digitalization in the healthcare sector, government initiatives to improve digital health infrastructure, and a surging population with increasing chronic disease burdens. The region is seeing a boom in the number of IoMT devices, with the World Bank estimating that the number of IoT devices in Asia Pacific surpassed 6 billion in 2024. This proliferation generates a huge volume of data that necessitates localized processing to reduce latency and improve care delivery.

Governments across Asia Pacific are actively supporting the development of a robust digital health ecosystem. China’s government, for example, is making substantial investments, with healthcare IT spending projected to increase significantly. The adoption of telehealth and remote patient monitoring is also on the rise, with many countries establishing new policies to support these services. A 2022 survey by Bain & Company highlighted that telehealth adoption nearly doubled for both consumers and physicians in the region, with consumers expecting this trend to continue through 2024. This is particularly crucial in rural and remote areas where edge computing can enable real-time consultations and diagnostics, bridging the gap in healthcare access and solidifying Asia Pacific as a key growth market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading players in the edge computing for healthcare market are accelerating growth through a combination of technological innovation, strategic alliances, and global expansion. They are focusing on creating advanced edge solutions that enable real-time data processing, which improves decision-making in clinical settings.

Many are also forming partnerships with healthcare providers, technology firms, and research institutions to enhance their products and integrate cutting-edge technologies. Expanding into new regions helps these companies capture new opportunities. In addition, they are prioritizing compliance with regulations and continuously innovating to meet the demand for more accurate, user-friendly solutions that are both scalable and secure. Tailoring their offerings to specific healthcare needs further builds customer loyalty and satisfaction.

IBM is a significant player in the market, providing innovative solutions to improve healthcare delivery. Through its advanced edge computing platform, IBM enables real-time data analysis right at the point of care, which enhances clinical decisions. The company works with healthcare providers and technology partners to integrate artificial intelligence and machine learning into its solutions. With a strong focus on security and compliance, IBM is a market leader, offering reliable and scalable healthcare technologies.

Top Key Players in the Edge Computing In Healthcare Market

- Cisco Systems, Inc

- Dell Technologies, Inc

- Amazon Web Services (AWS)

- Microsoft Corporation

- Intel Corporation

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- Huawei Technologies Co., Ltd

- GE Healthcare Technologies Inc

Recent Developments

- In May 2025, Oracle Health, Cleveland Clinic, and UAE’s G42 unveiled a strategic partnership to develop an AI-driven healthcare platform. This collaboration will leverage Oracle’s Cloud Infrastructure and AI Data Platform to enhance clinical data applications at the point of care while enabling large-scale data analytics to improve patient outcomes across the nation.

- In March 2025, Advantech introduced new Edge AI computing solutions powered by the Snapdragon X Elite platform. These solutions feature AI acceleration up to 45 TOPS and seamless connectivity via 5G and Wi-Fi 7, specifically designed to meet the demands of healthcare applications like computer vision and generative AI.

- In July 2024, Cognizant announced the launch of the Cognizant Neuro Edge, a platform that enables businesses across various sectors to harness the capabilities of artificial intelligence and generative AI at the edge. This solution provides real-time data processing, enhances data privacy, reduces bandwidth usage, and boosts operational resilience, making it an ideal tool for healthcare organizations looking to adopt edge technology for business growth.

Report Features Description Market Value (2024) US$ 6.3 Billion Forecast Revenue (2034) US$ 57.3 Billion CAGR (2025-2034) 24.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hardware and Software & Services), By Application (Telehealth & Remote Patient Monitoring, Robotic Surgery, Diagnostics, Ambulances, and Other), By End-user (Hospitals & Clinics, Home Care & Long-term Care Centers, and Ambulatory Care & Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems, Inc., Dell Technologies, Inc., Amazon Web Services (AWS), Google (Alphabet Inc.), Microsoft Corporation, Intel Corporation, Hewlett Packard Enterprise (HPE), IBM Corporation, Huawei Technologies Co., Ltd., GE Healthcare Technologies Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Edge Computing In Healthcare MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Edge Computing In Healthcare MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems, Inc

- Dell Technologies, Inc

- Amazon Web Services (AWS)

- Microsoft Corporation

- Intel Corporation

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- Huawei Technologies Co., Ltd

- GE Healthcare Technologies Inc