Global Edge AI Processor Market By Type (Central Processing Unit (CPU), Graphics Processing Unit (GPU), Application Specific Integrated Circuit (ASIC)), By Device Type (Consumer Devices, Enterprise Devices), By End User (Automotive and Transportation, Healthcare, Consumer Electronics, Retail and Ecommerce, Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: July 2024

- Report ID: 124740

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

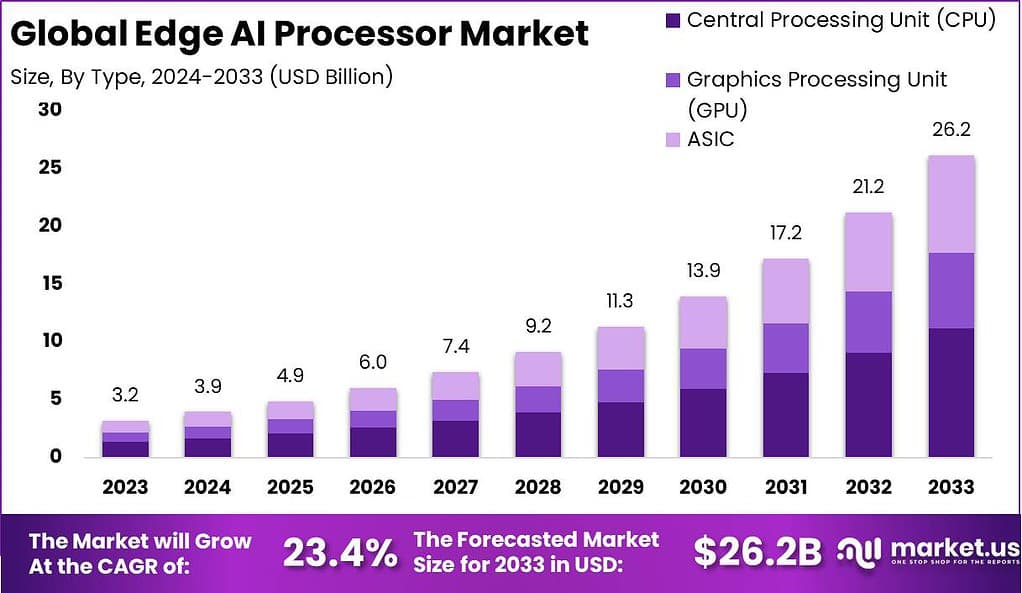

The Global Edge AI Processor Market size is expected to be worth around USD 26.2 Billion By 2033, from USD 3.2 Billion in 2023, growing at a CAGR of 23.4% during the forecast period from 2024 to 2033.

An Edge AI processor is a specialized form of silicon chip designed to perform artificial intelligence tasks directly on edge devices, rather than relying on data centers or the cloud. These processors are integral to handling complex algorithms locally, ensuring quicker decision-making and reducing latency, which is essential for real-time applications such as autonomous driving, industrial automation, and smart city technologies.

The Edge AI processor market is experiencing rapid growth due to the increasing adoption of AI-powered technologies in various industries. Companies are leveraging these processors to enable edge computing, which brings processing power closer to where data is generated, reducing latency and enhancing overall performance. This shift towards edge computing is driven by the need for faster processing speeds, improved efficiency, and enhanced data privacy and security.

Opportunities in this market are large, particularly in developing advanced, power-efficient processors that can operate AI functions with minimal energy consumption. There is also significant potential in sectors such as healthcare, automotive, and manufacturing, where edge AI can provide immediate data processing without the latency associated with cloud computing. As technology evolves, these processors are becoming more capable and accessible, opening new avenues for innovation and application across various industries.

However, the market faces challenges, including the complexity of integrating AI capabilities into small, power-constrained devices. Additionally, there is a continuous need for advancements in semiconductor technology to handle the intensive computational demands of AI applications at the edge, which can be a barrier for rapid deployment.

According to our market.us analysis, the Edge AI market is poised for significant growth, with a projected value of approximately USD 143.6 billion by 2033, up from USD 19.1 billion in 2023, indicating a robust CAGR of 25.9% over the forecast period spanning from 2024 to 2033. This growth is fueled by the increasing demand for edge computing solutions across various industries.

In parallel, the Edge AI Hardware market is anticipated to reach a valuation of USD 43 billion by 2033, compared to USD 8 billion in 2023, showcasing a notable CAGR of 19.2% during the forecast period. This growth trajectory underscores the escalating adoption of hardware components that support edge AI applications.

Moreover, our research indicates that the Edge AI Chips market is set to grow to USD 25.2 billion by 2033, up from USD 2.4 billion in 2023, at a compelling CAGR of 26.5% from 2024 to 2033. This surge is propelled by the increasing demand for specialized processors optimized for edge computing tasks.

Furthermore, industry forecasts suggest that edge intelligence devices are expected to manage a staggering 18.2 zettabytes of data per minute by 2025. This highlights the escalating volume of data being processed at the edge, emphasizing the critical role of edge AI in handling this immense data load efficiently.

Additionally, Edge AI is projected to significantly alleviate cloud traffic, potentially reducing it by up to 99% by 2025. This forecast underscores the pivotal role that edge AI technologies play in enhancing data processing efficiency and reducing network congestion by processing data closer to its source.

Key Takeaways

- The Edge AI Processor Market is projected to achieve a valuation of approximately USD 26.2 Billion by 2033, rising from USD 3.2 Billion in 2023. This represents a robust compound annual growth rate (CAGR) of 23.4% over the forecast period from 2024 to 2033.

- In the segmentation by processor type, the Central Processing Unit (CPU) category maintained a predominant position within the Edge AI Processor market, securing over 42.6% of the market share in 2023.

- Regarding application segments, the Consumer Devices sector emerged as the leading category, capturing more than 64.6% of the market share in 2023. Concurrently, the Consumer Electronics segment also held a significant stake, accounting for over 28.5% of the market share.

- Geographically, North America stood as the foremost region in the Edge AI Processor market, holding more than 38.5% of the global market share, which translated to revenue approximating USD 1.2 billion in 2023.

Type Analysis

In 2023, the Central Processing Unit (CPU) segment held a dominant market position in the Edge AI Processor market, capturing more than a 42.6% share. This leadership can be attributed to several core factors that underline the CPU’s integral role in edge computing environments. CPUs, known for their versatility, are capable of handling a variety of tasks ranging from simple computations to complex processing demands.

This flexibility makes them a preferred choice for many edge applications that require dynamic computing capabilities. Furthermore, CPUs are widely supported by a vast ecosystem of existing software and tools, which facilitates easier integration and deployment in edge devices. This extensive support also allows for quicker updates and adaptability to evolving technologies, which is crucial in fast-paced sectors like edge AI.

Additionally, the maturity of CPU technology ensures reliability and stability – traits highly valued in critical applications such as autonomous vehicles and industrial automation. The lead of the CPU segment is also reinforced by ongoing advancements in semiconductor technology, which enhance their efficiency and processing power without significantly increasing energy consumption.

This improvement is vital in edge computing, where power efficiency translates directly to longer device lifespans and reduced operational costs. Manufacturers are continuously innovating to embed more cores within CPUs, thereby boosting their ability to perform parallel processing – a key requirement for AI applications.

Device Type Analysis

In 2023, the Consumer Devices segment held a dominant market position in the Edge AI Processor market, capturing more than a 64.6% share. This prominence is largely due to the surge in consumer electronics that incorporate AI capabilities, such as smartphones, smart home devices, and wearable technology.

The increasing consumer demand for smarter, more automated, and highly personalized devices has driven manufacturers to integrate advanced edge AI processors that enable local data processing, enhancing device responsiveness and functionality. The proliferation of IoT devices in households, such as smart speakers, security cameras, and automation systems, has further fueled the growth of the Consumer Devices segment.

These devices require robust, real-time processing capabilities to perform tasks locally on the device, minimizing latency and reducing the dependency on cloud-based services. Edge AI processors are crucial in this regard, as they provide the necessary computational power to handle AI tasks effectively at the device level.

Additionally, the push for privacy and data security has made edge processing increasingly relevant. By processing data locally, consumer devices can limit the amount of personal data transmitted to the cloud, reducing exposure to potential data breaches. This aspect is particularly appealing to privacy-conscious consumers and has contributed significantly to the adoption of edge AI technologies in consumer devices.

Overall, the Consumer Devices segment’s leadership in the Edge AI Processor market is sustained by the continuous innovation in consumer technology, coupled with growing consumer expectations for smarter, faster, and more secure devices. As technology continues to advance, the importance of edge AI processors in consumer devices is expected to grow, further solidifying the segment’s market position.

End User Analysis

In 2023, the Consumer Electronics segment held a dominant market position in the Edge AI Processor market, capturing more than a 28.5% share. This leadership stems primarily from the exponential growth in the adoption of smart consumer electronics that integrate advanced AI functionalities. Products such as smartphones, smartwatches, and home assistants have become central to everyday life, driving demand for processors that can handle AI tasks directly on the device.

The need for immediate data processing and real-time decision-making in devices has elevated the role of edge AI processors in consumer electronics. These processors enable devices to perform tasks such as voice recognition, facial recognition, and contextual awareness locally, without relying on cloud computing. This not only enhances user experience by reducing latency but also works to conserve bandwidth and improve the efficiency of devices.

Moreover, the increasing consumer awareness regarding privacy and data security has played a crucial role in the adoption of edge AI processors. By processing data on the device itself, the need to transfer sensitive information to the cloud is minimized, reducing the risk of data breaches and unauthorized access. This feature is particularly appealing in an era where data privacy concerns are escalating.

The sustained growth and dominance of the Consumer Electronics segment in the Edge AI Processor market can be attributed to these factors, alongside continuous innovations and improvements in AI technology that enhance device capabilities and user interactions. As these technologies advance, the integration of edge AI processors in consumer electronics is expected to deepen, further reinforcing the segment’s leading position in the market.

Key Market Segments

By Type

- Central Processing Unit (CPU)

- Graphics Processing Unit (GPU)

- Application Specific Integrated Circuit (ASIC)

By Device Type

- Consumer Devices

- Enterprise Devices

By End User

- Automotive and Transportation

- Healthcare

- Consumer Electronics

- Retail and Ecommerce

- Manufacturing

- Others

Driver

Growing Demand for AI Capabilities at the Edge

The Edge AI Processor market is experiencing significant growth driven by the escalating demand for AI capabilities directly on devices, rather than relying solely on cloud computing. This trend is fueled by the need for faster processing, reduced latency, and improved efficiency in real-time applications such as autonomous vehicles, smart manufacturing, and IoT devices.

Edge AI processors facilitate on-device AI tasks, including data processing and decision-making, enhancing responsiveness and operational efficiency. This shift towards localized, real-time processing is crucial in scenarios where immediate data analysis is vital for decision-making and actions, such as in autonomous driving or emergency response scenarios .

Restraint

Technical and Deployment Challenges

Despite the promising growth, the Edge AI market faces significant restraints, primarily technical challenges related to deployment and management. Building and maintaining edge networks is complex, involving issues such as data security, device management, and seamless integration with existing IT infrastructure.

Additionally, there’s a notable shortage of skilled professionals equipped to handle the intricacies of Edge AI technology. This skills gap can hinder the development and deployment of Edge AI solutions, impacting the market’s overall growth potential.

Opportunity

Integration with 5G and Smart Applications

The rollout of 5G technology presents a substantial opportunity for the Edge AI processor market, offering ultra-low latency and high-speed connectivity that can vastly enhance the performance of edge-based AI applications. This technological advancement enables more sophisticated applications like smart city infrastructure, real-time traffic management, and advanced healthcare monitoring systems.

Moreover, the increasing popularity of smart applications across various sectors, including automotive, healthcare, and manufacturing, provides ample opportunities for Edge AI processors to be integrated into a wide range of devices and systems.

Challenge

Power Consumption and Standardization

A major challenge in the Edge AI market is optimizing power consumption, which is crucial for the functionality and deployment scalability of edge devices. High power consumption can limit the practical deployment of AI applications in environments where power availability is restricted or costly.

Additionally, the lack of standardization across the Edge AI ecosystem can lead to compatibility issues between different devices and technologies, complicating the integration process and hindering widespread adoption.

Growth Factors

The Edge AI Processor market is experiencing significant growth driven by the increasing integration of AI across a wide range of consumer electronics and industrial applications. The proliferation of IoT devices and the advancements in 5G technology are key catalysts boosting the demand for edge AI processors.

These technologies enhance the connectivity and functionality of devices at the edge, pushing for more localized, faster, and efficient processing of data. Additionally, the growing need for real-time, low-latency processing and the rise of smart applications across various sectors such as healthcare, automotive, and manufacturing further fuel the expansion of this market.

Emerging Trends

In the landscape of Edge AI, several emerging trends are shaping the future of the industry. One significant trend is the deepening integration of AI in consumer devices, not just for enhancing performance but also for ensuring greater privacy and security through local data processing. Another notable trend is the use of Edge AI in enabling real-time analytics and decision-making across various industries, which is crucial for applications that require immediate response times, such as in autonomous vehicles or emergency healthcare services.

Furthermore, there is a noticeable shift towards more sustainable and energy-efficient computing solutions at the edge, which aligns with the global push for greener technologies. The development of new architectures and chipsets that can handle more complex computations without significant power consumption is also a key focus area. This is coupled with the continuous evolution of AI capabilities, where edge devices are becoming increasingly autonomous and capable of sophisticated functions like predictive analytics and advanced data analytics.

Regional Analysis

In 2023, North America held a dominant market position in the Edge AI Processor market, capturing more than a 38.5% share with revenue totaling approximately USD 1.2 billion. This leadership is primarily due to the region’s advanced technological infrastructure and the early adoption of AI technologies across various industries.

North America is home to some of the world’s leading tech companies, which not only develop but also rapidly implement edge AI solutions. This ecosystem fosters innovation and drives the integration of edge AI processors in applications such as autonomous vehicles, smart manufacturing, and healthcare.

The presence of a robust network for research and development, supported by significant investments from both public and private sectors, further propels the region’s market dominance. For instance, major U.S. and Canadian universities and tech companies continue to lead groundbreaking research in AI and computing technologies, which directly enhances the capabilities and applications of edge AI processors.

Moreover, the region’s stringent data privacy regulations and increasing concerns over data sovereignty and security are prompting businesses to adopt edge processing solutions. This trend supports local data processing, reducing the need for data transmission and storage in remote cloud servers, thereby enhancing data security and compliance with regulatory standards.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Edge AI Processor market is vibrant and competitive, with key players continuously evolving through strategic innovations, mergers, and acquisitions. These developments are instrumental in driving the market forward, as companies enhance their technological capabilities and expand their market reach.

Qualcomm Technologies Inc. has strengthened its position by acquiring Nuvia, a move that brings valuable expertise in power-efficient, arm-based chips. This acquisition is a strategic enhancement to Qualcomm’s capabilities in the mobile processor sector, where it already holds a significant presence.

NVIDIA Corporation and Advanced Micro Devices Inc. (AMD) are also key competitors in the market, especially in the development of arm-based chips for various consumer devices. NVIDIA’s historical success with arm-based chips and AMD’s launch of new products such as the Versal™ AI Edge XA adaptive SoC highlight their active roles in shaping the market.

Intel Corporation remains a dominant force, particularly with its versatile AI chips that cater to a wide range of edge applications. Intel’s chips are designed to balance performance with low power consumption, making them suitable for diverse edge AI applications.

Top Key Players in the Market

- HiSilicon(Shanghai) Technologies Co Limited

- Google LLC.

- Arm Limited

- Samsung Electronics Co Ltd

- Qualcomm Technologies Inc.

- Mythic

- Advanced Micro Devices Inc.

- Apple Inc.

- NVIDIA Corporation

- Intel Corporation

Recent Developments

- July 2024: Google announced new features in their Edge TPU (Tensor Processing Unit) aimed at enhancing AI workloads on edge devices. These advancements include improved power efficiency and support for more complex machine learning models.

- July 2024: Samsung confirmed the development of the Exynos W1000 processor, utilizing the second-generation 3nm GAA (Gate-All-Around) process. This processor is designed for high-performance edge AI applications, particularly in wearable devices.

- September 2023: HiSilicon launched the Kirin 9000s processor, powering the Huawei Mate 60 Pro smartphone. This processor, manufactured using SMIC’s 7nm (N+2) process, includes homegrown CPU/GPU cores, marking a significant advancement despite US sanctions.

- January 2023: Arm introduced its new Cortex-M85 microcontroller, optimized for edge AI applications. This microcontroller offers enhanced processing capabilities and energy efficiency, catering to various IoT and edge computing needs.

- April 2023: Intel announced the release of its 4th Gen Intel Xeon Scalable processors, which include enhanced AI features for edge computing. These processors are designed to improve real-time analytics and AI inference at the edge.

Report Scope

Report Features Description Market Value (2023) USD 3.2 Bn Forecast Revenue (2033) USD 26.2 Bn CAGR (2024-2033) 23.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Central Processing Unit (CPU), Graphics Processing Unit (GPU), Application Specific Integrated Circuit (ASIC)), By Device Type (Consumer Devices, Enterprise Devices), By End User (Automotive and Transportation, Healthcare, Consumer Electronics, Retail and Ecommerce, Manufacturing, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape HiSilicon(Shanghai) Technologies Co Limited, Google LLC., Arm Limited, Samsung Electronics Co Ltd, Qualcomm Technologies, Inc., Mythic, Advanced Micro Devices, Inc., Apple Inc., NVIDIA Corporation, Intel Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Edge AI Processor Market?The Edge AI Processor Market refers to the sector focused on processors designed to perform artificial intelligence (AI) computations at the edge of the network, closer to the data source, rather than relying on cloud-based data centers.

How big is Edge AI Processor Market?The Global Edge AI Processor Market size is expected to be worth around USD 26.2 Billion By 2033, from USD 3.2 Billion in 2023, growing at a CAGR of 23.4% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Edge AI Processor Market?Key factors include the increasing demand for low-latency processing, the need for real-time decision-making, advancements in AI and machine learning, growth of IoT devices, and the rising adoption of edge computing in various industries such as healthcare, automotive, and consumer electronics.

What are the current trends and advancements in the Edge AI Processor Market?Current trends include the development of more efficient and powerful edge AI chips, integration of AI capabilities in edge devices, advancements in neuromorphic computing, increasing use of AI accelerators, and improvements in energy efficiency and performance of edge AI processors.

What are the major challenges and opportunities in the Edge AI Processor Market?Major challenges include high development costs, power consumption constraints, data privacy and security concerns, and the complexity of AI model deployment at the edge. Opportunities lie in enhancing AI capabilities at the edge, expanding applications in industries like smart cities and autonomous vehicles, reducing latency, and improving edge AI processor efficiency.

Who are the leading players in the Edge AI Processor Market?Leading players include HiSilicon(Shanghai) Technologies Co Limited, Google LLC., Arm Limited, Samsung Electronics Co Ltd, Qualcomm Technologies, Inc., Mythic, Advanced Micro Devices, Inc., Apple Inc., NVIDIA Corporation, Intel Corporation

-

-

- HiSilicon(Shanghai) Technologies Co Limited

- Google LLC.

- Arm Limited

- Samsung Electronics Co Ltd

- Qualcomm Technologies Inc.

- Mythic

- Advanced Micro Devices Inc.

- Apple Inc.

- NVIDIA Corporation

- Intel Corporation