Global E-scooter Rental Apps Market Size, Share, Statistics Analysis Report By Business Model (Dockless, Docked), By Vehicle Type (Electric Kick Scooters, Electric Mopeds, Electric Bicycles), By End-User (Individual, Business), By Service Type (Pay-as-you-go, Subscription), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143884

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Business Benefits

- Key Government Initiatives

- China E-scooter Rental Apps Market

- Business Model Analysis

- Vehicle Type Analysis

- End-User Analysis

- Service Type Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Key Player Analysis

- Top Opportunities for Players

- Recent Developments

- Report Scope

Report Overview

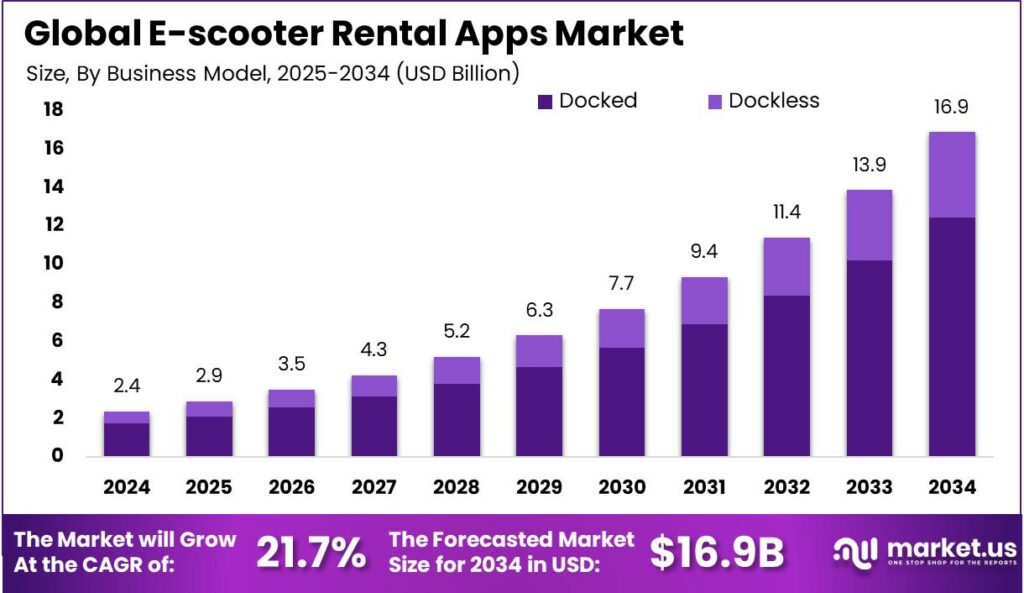

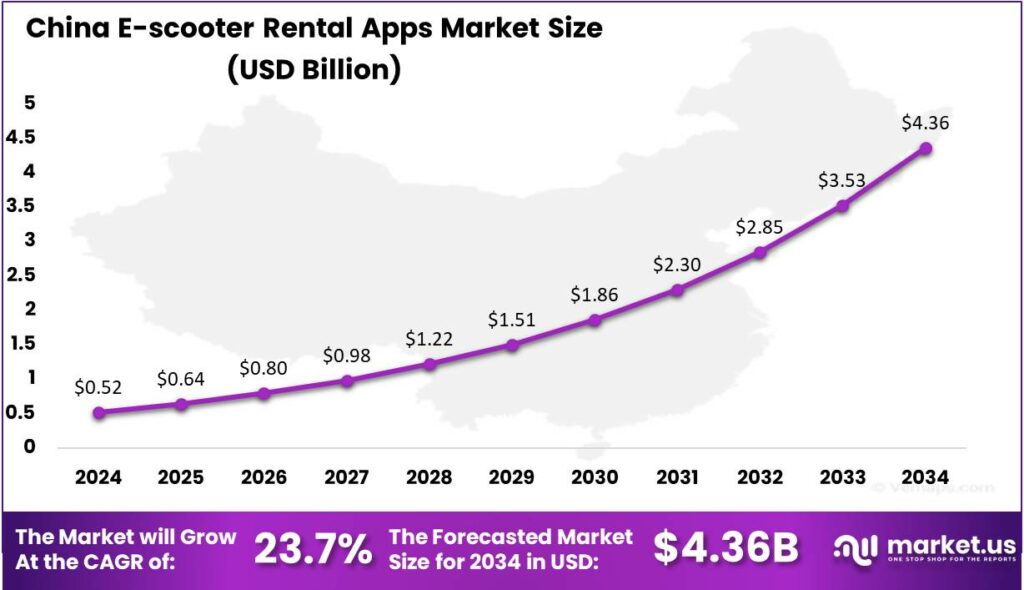

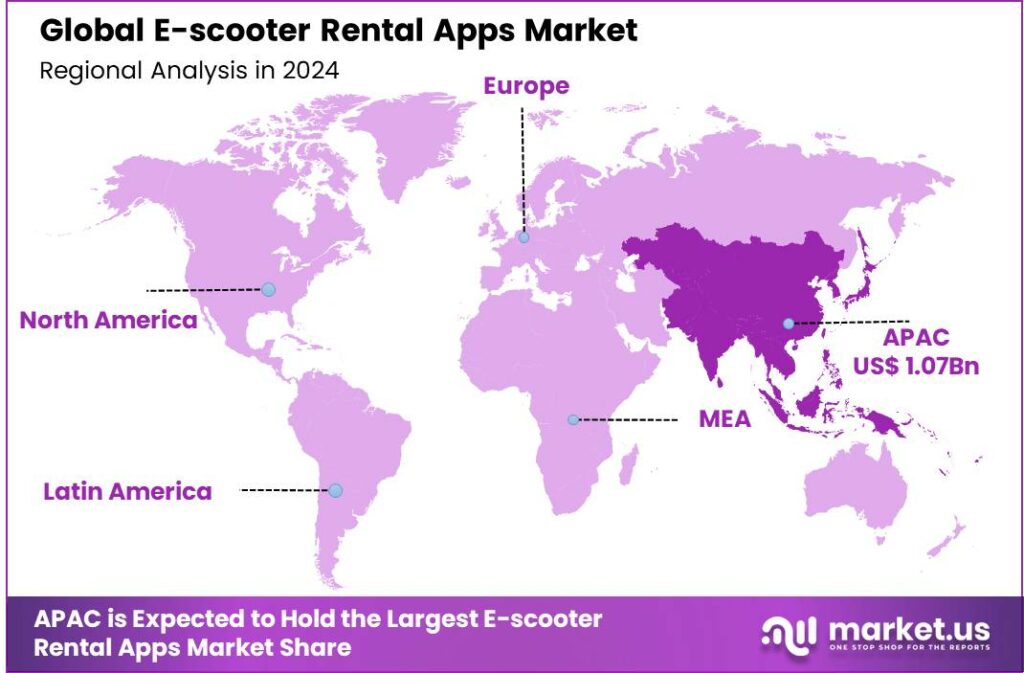

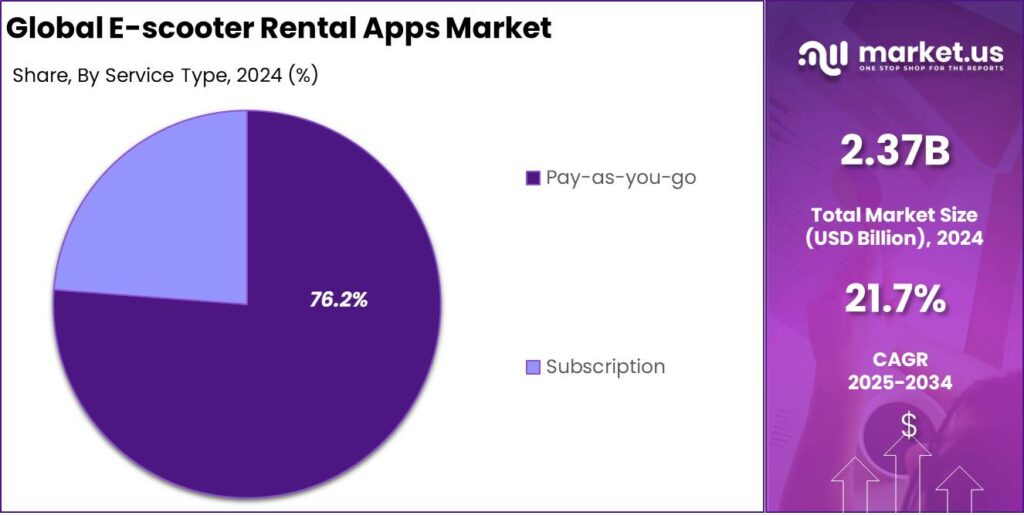

The Global E-scooter Rental Apps Market size is expected to be worth around USD 16.9 Billion By 2034, from USD 2.37 Billion in 2024, growing at a CAGR of 21.70% during the forecast period from 2025 to 2034. In 2024, the Asia-Pacific region led the global e-scooter rental apps market with over 45.5% share, generating USD 1.07 billion in revenue. China’s e-scooter rental market was valued at USD 0.52 billion and is projected to grow at a CAGR of 23.7%.

E-scooter rental apps facilitate the short-term rental of electric scooters, which are accessible in urban and metropolitan areas through a user-friendly mobile application. These apps let users find, unlock, and rent e-scooters, offering an affordable and eco-friendly transport solution. Typically charged by the minute or hour, they address last-mile transportation, complementing public transit and reducing dependence on private vehicles.

The growth of the e-scooter rental apps market is driven by key factors, including increasing urbanization and traffic congestion, which create demand for efficient, scalable transport alternatives. Additionally, rising environmental concerns and the shift towards sustainable urban mobility have led to higher adoption of electric vehicles, including e-scooters.

Additionally, the rising awareness of environmental issues and the adoption of green practices by businesses and individuals further fuel the demand for these services, making e-scooters a preferred option for last-mile connectivity and short urban trips. There is also a growing focus on community and safety, with efforts to educate riders on safe practices and integrate safety features into both apps and scooters.

The Journal of Safety Research highlights that in-app safety features, like tutorials and speed limiters, lead to a 20% decrease in eScooter accidents. By educating users directly through the app, these tools encourage responsible riding and significantly improve safety within the eScooter ecosystem.

According to the NACTO report, e-scooters offer a notable edge over other transportation options, with 35% of trips covering less than one mile and 63% staying under two miles. Their ability to zip through traffic and bypass parking limitations makes them an incredibly efficient choice for short trips.

The market is expanding globally, with companies entering new regions and cities. This expansion is growing beyond the US and Europe, with rapid growth in Asia and Latin America, driven by urban density and demand for fast transportation. Regulatory changes in multiple countries are also fostering the growth of micro-mobility solutions.

Key Takeaways

- The Global E-scooter Rental Apps Market size is projected to reach USD 16.9 Billion by 2034, up from USD 2.37 Billion in 2024, growing at a CAGR of 21.70% during the forecast period from 2025 to 2034.

- In 2024, the docked segment dominated the market, accounting for more than 73.8% of the global e-scooter rental apps market.

- In 2024, the Electric Mopeds segment held the largest share in the market, with more than 58.9% of the total share.

- In 2024, the Individual segment led the market, capturing over 72.4% of the global e-scooter rental apps market share.

- The Pay-as-you-go segment dominated in 2024, holding more than 76.2% of the market share within the e-scooter rental apps market.

- In 2024, Asia-Pacific held the largest share in the global e-scooter rental apps market, capturing more than 45.5%, generating substantial revenue of USD 1.07 billion.

- The market for e-scooter rental apps in China was valued at USD 0.52 billion in 2024 and is expected to expand at a CAGR of 23.7%.

Analysts’ Viewpoint

From an analyst’s viewpoint, the e-scooter rental app market presents robust investment opportunities due to its rapid growth and the continuous evolution of user-friendly technologies. Technological advancements such as improved battery life, GPS tracking, and integration with public transit systems are key factors enhancing the user experience and driving market expansion.

Moreover, the regulatory environment plays a critical role, as supportive government policies and incentives for sustainable transportation systems can significantly accelerate market growth. However, potential investors must also consider challenges such as safety concerns, regulatory compliance, and the competitive landscape, which includes established players like Lime and Bird as well as emerging startups offering innovative solutions.

Business Benefits

E-scooter rental businesses can generate income through various channels, including per-ride fees, subscription models, etc. Operators in the e-scooter rental industry report gross profit margins ranging from 27% to 30% per ride. These figures underscore the financial viability of investing in e-scooter rental services, according to reports from Joyride.

E-scooter apps provide valuable data on rider behavior and traffic patterns. This information aids in strategic decision-making, optimizing fleet distribution, and improving overall service efficiency. The JPLoft report reveals that around 75% of eScooter users favor app-based rentals, citing the convenience and simplicity they offer. This trend underscores the vital role that mobile apps play in shaping the micromobility landscape.

By providing an alternative to car use, e-scooter rentals can reduce traffic congestion and promote healthier lifestyles. According to an App Annie article, eScooter apps boast an impressive 70% user retention rate, indicating a high level of customer satisfaction and loyalty.

Key Government Initiatives

The UK Department for Transport (DfT) has been actively promoting e-scooter trials since 2020, allowing local authorities to implement these trials across 22 regions. As of January 2024, local authorities can request changes to trial operations, such as fleet sizes and coverage, starting in June 2024.

This initiative aims to promote eco-friendly transportation and address public transport capacity challenges. The Indian government has launched initiatives like the National Urban Transport Policy and the National Electric Mobility Mission Plan to promote electric vehicles and improve urban transport infrastructure.

Notably, in July 2023, a partnership between an app-based e-bike rental platform and India Post was established to create docking zones for electric scooters. Additionally, the Pune Municipal Corporation sought approval for a rental e-bike initiative aimed at deploying 1,000 e-bikes as part of public transport solutions

China E-scooter Rental Apps Market

In 2024, the market for e-scooter rental apps in China was valued at USD 0.52 billion. It is projected to expand at a compound annual growth rate (CAGR) of 23.7%. This robust growth can be attributed to several factors, including increasing urbanization, the growing awareness of the environmental benefits of electric scooters, and the supportive policies of the Chinese government promoting eco-friendly transportation options.

Additionally, the convenience and cost-effectiveness of e-scooters for short-distance travel have significantly contributed to their popularity among urban commuters. Looking forward, the market is expected to continue its upward trajectory, driven by technological advancements in e-scooter manufacturing and the integration of smart, connected technologies in rental platforms.

These enhancements aim to improve user experience and expand the accessibility of e-scooters. Moreover, as more cities in China adopt policies to reduce carbon emissions, the demand for electric scooter rentals is anticipated to rise, further fueling market growth.

In 2024, Asia-Pacific held a dominant market position in the e-scooter rental apps market, capturing more than 45.5% of the global market share. This region generated substantial revenue, amounting to USD 1.07 billion.

The proliferation of e-scooter rental apps in Asia-Pacific can be attributed to the region’s rapid urbanization and the growing need for efficient, last-mile transportation solutions in congested cities. Countries like China, South Korea, and Japan have significantly invested in building infrastructure conducive to the operation and growth of e-scooter services, including designated lanes and parking zones.

Technological adoption and innovation are vital to the region’s e-scooter growth. Local companies are using advanced technologies to enhance user experience, improve safety, and streamline payment systems, making e-scooters more appealing to commuters. Increased smartphone penetration and better internet connectivity make rental platforms more accessible, driving higher user engagement.

The economic aspect is crucial, as e-scooters provide a cost-effective alternative to traditional transport, appealing to cost-conscious consumers in Asia-Pacific. This affordability, combined with on-demand convenience, has made e-scooter rentals popular among the region’s young, mobile population, fueling market growth.

Business Model Analysis

In 2024, the docked segment held a dominant market position, capturing more than a 73.8% share of the global e-scooter rental apps market. This segment’s leadership can be primarily attributed to its structured approach to scooter management and parking, which significantly reduces the issues of vandalism and improper parking that are more prevalent.

Furthermore, docked e-scooter systems tend to align better with municipal transportation policies, which often favor transport solutions that minimize clutter and the random scattering of vehicles in public spaces. Municipalities frequently partner with docked e-scooter providers to integrate these services into existing public transport systems, enhancing the overall efficiency of urban transportation networks.

A key factor behind the dominance of the docked model is the integration of advanced technologies into docking stations, such as solar charging panels and security features. These innovations extend scooter lifespan, attract tech-savvy users, and reduce long-term maintenance and operational costs for providers.

The predictability of revenue from fixed docking stations attracts significant investment, as investors favor stable, reliable returns. The docked e-scooter model provides this through fixed locations and managed usage, while the potential for ads and sponsorships at docking stations enhances its financial viability in the rental market.

Vehicle Type Analysis

In 2024, the Electric Mopeds segment held a dominant position in the e-scooter rental apps market, capturing more than a 58.9% share. This segment’s leadership can be attributed to several key factors. Electric mopeds offer a robust blend of convenience and utility, making them particularly appealing for longer commutes and rides across urban environments.

The durability and cost-effectiveness of electric mopeds play a key role in their market prominence. Built for frequent use and longer distances, they offer higher returns on investment for service providers. This results in lower maintenance costs and longer service life, helping rental companies optimize fleet efficiency and profitability.

Regulatory environments in many cities increasingly favor electric mopeds, often classifying them like electric bicycles but with greater transportation capabilities. In areas with strict e-scooter regulations, mopeds are preferred due to their compliance with traffic laws and ability to integrate into the existing traffic system without requiring extra licensing in many regions.

Consumer preference significantly drives the dominance of electric mopeds in the rental market. Their perceived safety and stability, compared to kick scooters, attract a wider demographic, including older users and those less comfortable with balancing. This broad appeal helps maintain high demand, securing mopeds’ leading position in the market.

End-User Analysis

In 2024, the Individual segment held a dominant market position in the e-scooter rental apps market, capturing more than a 72.4% share. This segment’s prominence is largely due to the growing preference among individuals for flexible and eco-friendly modes of transportation, particularly in urban areas where congestion and environmental concerns are major issues.

A key driver behind the success of the Individual segment is the growing demand for cost-effective and convenient transportation. E-scooters provide a practical solution for short commutes, bridging the gap between public transit stops and final destinations. This “last mile” solution reduces reliance on personal vehicles and alleviates public transportation constraints, making daily commutes more efficient.

The rise in smartphone use and better mobile connectivity has made e-scooter rental apps more accessible, improving user experience with features like GPS tracking, easy payments, and real-time availability updates. These advancements make e-scooters a top choice for tech-savvy individuals looking for quick, hassle-free travel.

Environmental awareness is also a key factor in the segment’s growth. As concerns over air pollution and urban congestion rise, more individuals are turning to greener transportation options. E-scooters, being electric, provide a sustainable alternative that supports the goal of reducing greenhouse gas emissions, driving further expansion in the rental market.

Service Type Analysis

In 2024, the Pay-as-you-go segment held a dominant market position within the e-scooter rental apps market, capturing more than a 76.2% share. This model’s popularity can be attributed to its flexibility and cost-effectiveness, which appeal to a broad spectrum of users.

The Pay-as-you-go segment outpaces subscription models due to its low barrier to entry for new users. First-time riders can try e-scooter services without upfront subscriptions, reducing the perceived risk. This model is especially favored by tourists and occasional users, fueling the segment’s growth.

The simplicity of the Pay-as-you-go pricing structure makes it appealing to consumers. Unlike subscription models with complex tiers, Pay-as-you-go is easy to understand, enhancing customer satisfaction and retention. Clear, upfront costs for each ride allow users to control their spending, which is particularly valued by cost-conscious consumers.

The market is also evolving due to technological advancements and changing consumer preferences. While this segment currently leads, innovations and shifts in user behavior may impact future dynamics. Companies in the e-scooter rental market should continually analyze trends and adapt to maintain a competitive edge.

Key Market Segments

By Business Model

- Dockless

- Docked

By Vehicle Type

- Electric Kick Scooters

- Electric Mopeds

- Electric Bicycles

By End-User

- Individual

- Business

By Service Type

- Pay-as-you-go

- Subscription

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Urbanization and Demand for Micro-Mobility

The rapid urbanization of cities worldwide has intensified traffic congestion and increased the need for efficient, flexible transportation solutions. E-scooter rental apps have emerged as a viable response, offering urban dwellers a convenient mode of transport for short-distance travel.

The compact nature of e-scooters allows for easy navigation through congested areas, providing a time-saving alternative to traditional vehicles. Additionally, the integration of user-friendly mobile applications enhances accessibility, enabling users to locate, unlock, and pay for e-scooter services seamlessly.

This convenience aligns with the lifestyle of modern urban residents, particularly among younger demographics who prioritize flexibility and technology-driven solutions. Consequently, the proliferation of e-scooter rental services is closely linked to the ongoing trend of urbanization and the escalating demand for micro-mobility options.

Restraint

Safety Concerns and Regulatory Challenges

Despite their growing popularity, e-scooter rental services face significant hurdles related to safety and regulation. The rise in e-scooter usage has been accompanied by an increase in accidents and injuries, raising concerns among city officials and the public.

In response, various municipalities have implemented stringent regulations to mitigate these risks. For instance, Italy introduced laws requiring e-scooter riders to wear helmets, obtain insurance, and equip their vehicles with number plates.

These measures, while aimed at enhancing safety, have been criticized by e-scooter companies as overly restrictive, potentially deterring users and impacting the viability of their operations. The evolving regulatory landscape poses a challenge for e-scooter rental services, necessitating continuous adaptation to comply with local laws while striving to maintain user engagement and satisfaction.

Opportunity

Integration with Smart City Initiatives

The advancement of smart city initiatives presents a promising opportunity for e-scooter rental services. By integrating with urban infrastructure and leveraging Internet of Things (IoT) technologies, e-scooter companies can enhance operational efficiency and user experience.

For example, equipping e-scooters with sensors enables predictive maintenance, ensuring vehicle reliability and safety. Integration with city transportation networks can facilitate smart parking solutions, reducing clutter and improving urban aesthetics.

Data from e-scooter usage offers insights into traffic patterns, helping city planners optimize transportation systems. Collaboration between e-scooter providers and municipalities can foster sustainable, efficient urban mobility, supporting smart city goals.

Challenge

Achieving Profitability Amidst Competition

The e-scooter rental market is characterized by intense competition and high operational costs, posing challenges to achieving profitability. Companies must invest significantly in fleet acquisition, maintenance, and technological infrastructure.

Additionally, the need for scale to spread these costs and the prevalence of price wars to capture market share can erode profit margins. The bankruptcy filing of prominent player Bird underscores the financial vulnerabilities within the sector.

To navigate these challenges, companies are focusing on improving vehicle durability, optimizing operations, and exploring diversified revenue streams. Achieving a sustainable business model requires balancing competitive pricing with cost management, all while delivering a reliable and appealing service to users.

Emerging Trends

Modern e-scooter apps leverage GPS, NFC, and real-time tracking to enhance user experience by making it easier to locate, book, and pay for scooters. These apps often include features like push notifications for battery status and route reminders, streamlining the user experience for both casual and regular users.

There is a growing preference for eco-friendly transportation options, which e-scooters represent. This trend is not only supported by user demand but also by urban policies aimed at reducing traffic congestion and pollution.

As the market grows, so does the focus on safety and compliance with local regulations. E-scooter rental apps are increasingly incorporating features like geofencing to manage speed limits and designated riding zones, and providing helmets to meet safety regulations

Key Player Analysis

Several companies dominate this growing market, offering users a seamless way to rent scooters through mobile apps.

Bird Rides, Inc. is one of the leading e-scooter rental companies that has revolutionized urban transportation with its easy-to-use app and widespread scooter availability. Founded in 2017, Bird has expanded rapidly and now operates in numerous cities worldwide. The company’s business model focuses on providing quick, affordable, and eco-friendly transportation options.

Neutron Holdings, Inc., commonly known as Lime, is another major player in the e-scooter rental industry. Lime has been a dominant force since its inception in 2017, focusing on providing electric scooters, bikes, and even car-sharing services. The company is known for its broad international reach and integration with public transportation systems in various cities.

Spin, Inc., acquired by Ford in 2018, is a prominent e-scooter rental company that offers electric scooters for urban commuters. Since its acquisition, Spin has leveraged Ford’s resources to expand its scooter-sharing services, focusing on user safety, reliability, and affordability. Spin operates in several cities across the United States, providing an accessible option for short-distance travel.

Top Key Players in the Market

- Bird Rides, Inc.

- Neutron Holdings, Inc.

- Spin, Inc.

- Voi Technology AB

- Tier Mobility GmbH

- Dott BV

- Bolt Technology OÜ

- Scoot Networks, Inc.

- Skip Transportation, Inc.

- Wind Mobility GmbH

- Grin Technologies, Inc.

- Circ Mobility GmbH

- Helbiz, Inc.

- Neuron Mobility Pty Ltd

- Beam Mobility Holdings Pte Ltd

- Revel Transit, Inc.

- Gogoro Inc.

- Others

Top Opportunities for Players

The e-scooter rental app market presents significant growth opportunities, driven by increasing urbanization and focus on sustainable transportation.

- Integration with Public Transportation Systems: E-scooter rental app services provide a crucial solution for last-mile connectivity, seamlessly linking public transportation hubs to final destinations. This integration enhances the utility of public transit systems by offering an efficient, flexible transportation option that complements existing services.

- Adoption of Green Technologies: With rising environmental awareness and the need to reduce urban carbon emissions, e-scooters are gaining traction as a sustainable transport alternative. The market’s growth is partly driven by consumer demand for eco-friendly mobility solutions, encouraging businesses to invest in electric scooters, which use clean energy and help reduce overall greenhouse gas emissions.

- Technological Innovations: The incorporation of advanced technologies such as IoT and AI into e-scooter rental app services enables real-time tracking, predictive maintenance, and enhanced fleet management. These technological enhancements not only improve operational efficiency but also enhance the user experience by ensuring higher availability and reliability of services.

- Expansion into Emerging Markets: There is considerable potential for market expansion in developing regions where urbanization is rapidly increasing. These markets often have less saturated mobility landscapes, offering substantial opportunities for e-scooter companies to establish a strong presence and capitalize on unmet transportation needs.

- Dynamic Pricing Models and Subscription Services: Implementing dynamic pricing strategies allows businesses to adjust prices based on demand and time, optimizing revenue. Additionally, subscription models provide a steady revenue stream and improve customer retention by offering users cost-effective, convenient access to e-scooter services on a regular basis.

Recent Developments

- In January 2024, Tier Mobility and Dott have merged to form Europe’s largest e-scooter operator. To fuel the growth of the newly combined company, their investors are adding an extra 60 million euros ($66 million).

- In October 2024, Greeley has partnered with SPIN for a one-year micromobility pilot, bringing e-scooters and e-bikes to UNC’s campus and downtown. In the soft-launch, about 75 vehicles will be available for short-term rental. Riders can use the SPIN app to find, rent, and pay for rides, along with details on where to ride, park, and report issues.

Report Scope

Report Features Description Market Value (2024) USD 2.37 Bn Forecast Revenue (2034) USD 16.9 Bn CAGR (2025-2034) 21.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Business Model (Dockless, Docked), By Vehicle Type (Electric Kick Scooters, Electric Mopeds, Electric Bicycles), By End-User (Individual, Business), By Service Type (Pay-as-you-go, Subscription) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bird Rides, Inc., Neutron Holdings, Inc., Spin, Inc., Voi Technology AB, Tier Mobility GmbH, Dott BV, Bolt Technology OÜ, Scoot Networks, Inc., Skip Transportation, Inc., Wind Mobility GmbH, Grin Technologies, Inc., Circ Mobility GmbH, Helbiz, Inc., Neuron Mobility Pty Ltd, Beam Mobility Holdings Pte Ltd, Revel Transit, Inc., Gogoro Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  E-scooter Rental Apps MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

E-scooter Rental Apps MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bird Rides, Inc.

- Neutron Holdings, Inc.

- Spin, Inc.

- Voi Technology AB

- Tier Mobility GmbH

- Dott BV

- Bolt Technology OÜ

- Scoot Networks, Inc.

- Skip Transportation, Inc.

- Wind Mobility GmbH

- Grin Technologies, Inc.

- Circ Mobility GmbH

- Helbiz, Inc.

- Neuron Mobility Pty Ltd

- Beam Mobility Holdings Pte Ltd

- Revel Transit, Inc.

- Gogoro Inc.

- Others