Global E-Commerce Security Market Size, Share Analysis Report By Security Type (Network Security, Application Security, Endpoint Security, Cloud Security, Payment Security), By Solution (Intrusion Detection Systems (IDS), Encryption, Firewalls, Multi-Factor Authentication (MFA), Anti-Malware Solutions, Others), By Application (Retail, Travel & Tourism, Healthcare, Banking & Financial Services, Government, Others), By End-User (Business-to-Business (B2B), Business-to-Consumer (B2C)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149955

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

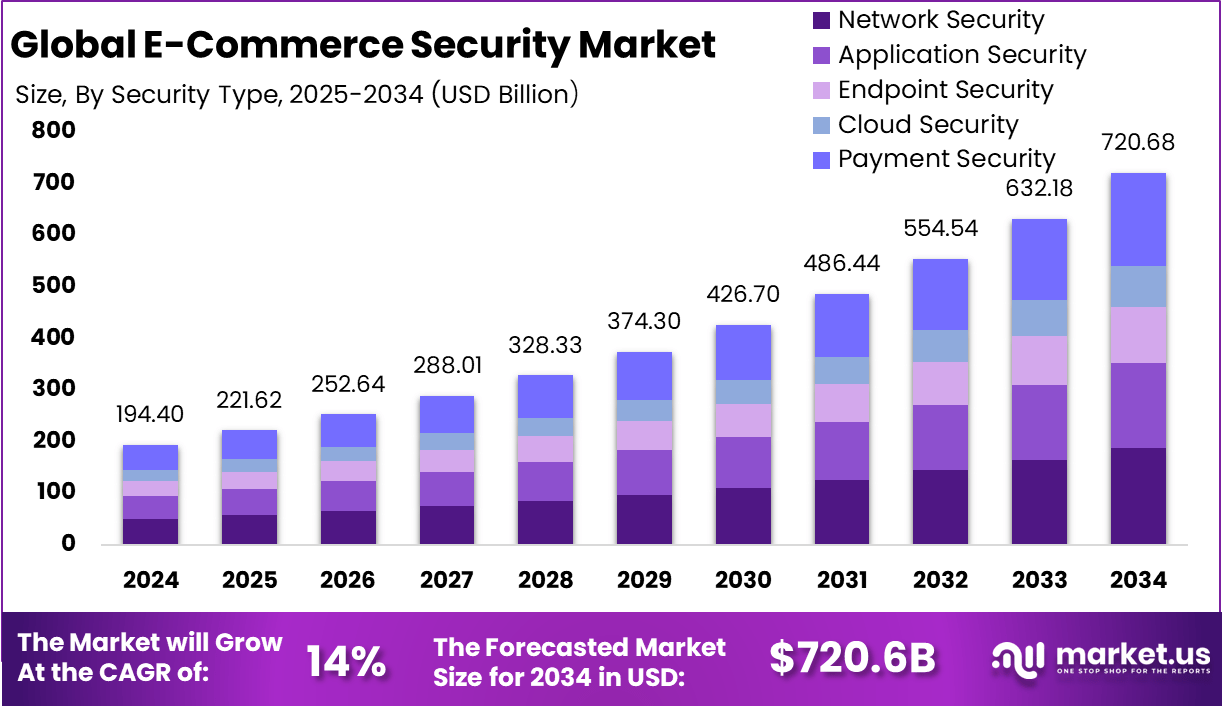

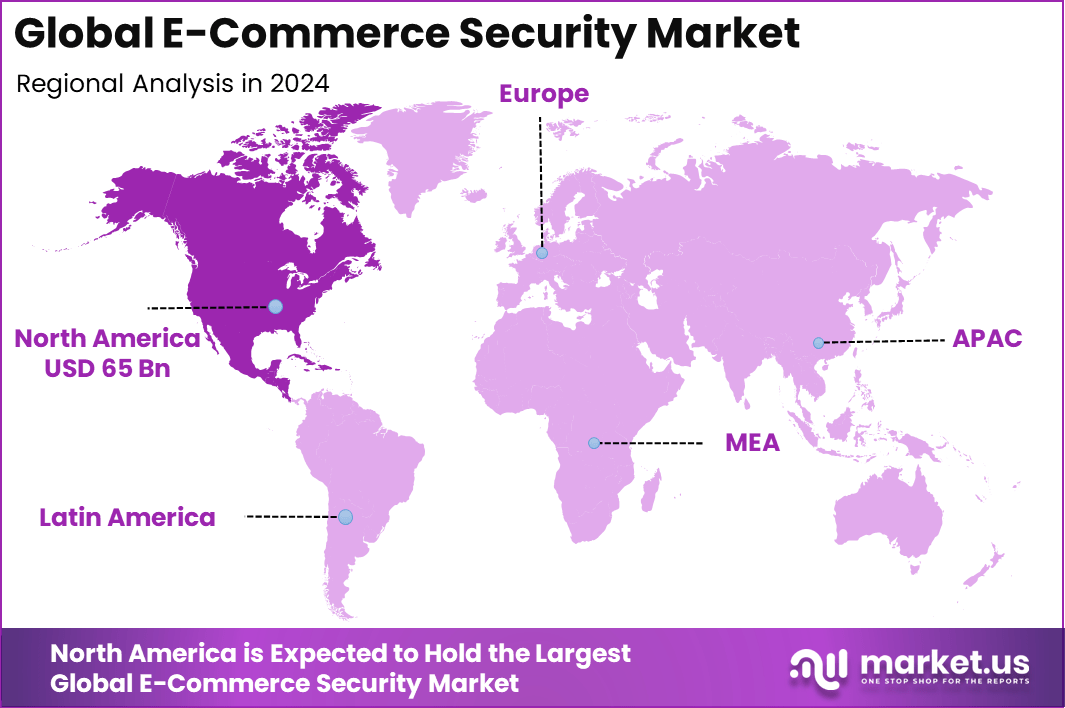

The Global E-Commerce Security Market size is expected to be worth around USD 720.68 Billion By 2034, from USD 194.40 billion in 2024, growing at a CAGR of 14% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 33.5% share, holding USD 65 Billion revenue.

E-commerce security encompasses the strategies and technologies employed to protect online transactions and digital assets from cyber threats. It ensures the confidentiality, integrity, and availability of data exchanged between businesses and consumers. As online shopping becomes increasingly prevalent, robust security measures are essential to maintain customer trust and safeguard sensitive information.

The e-commerce security market has experienced significant growth, driven by the rising incidence of cyberattacks and the expansion of online retail. Several factors contribute to the expansion of the e-commerce security market, the surge in sophisticated cyberattacks, such as phishing, malware, and ransomware, necessitates enhanced security measures. The convenience of online shopping has led to a significant increase in e-commerce activities, requiring robust security protocols to protect transactions.

The demand for e-commerce security solutions is escalating as businesses recognize the importance of protecting customer data and ensuring secure transactions. Industries such as retail, finance, and healthcare are particularly focused on implementing advanced security measures to comply with regulations and maintain customer trust.

For instance, in February 2024, UK retailer Asda partnered with Accertify to enhance its e-commerce security framework. The collaboration focuses on deploying advanced fraud prevention and risk management solutions to protect online transactions and reduce chargebacks. This strategic move highlights the importance retailers place on strengthening e-commerce security to safeguard customer data and ensure seamless shopping experiences.

The adoption of modern security technologies is being primarily driven by the need to build consumer trust and comply with data protection laws. Companies are realizing that poor security not only exposes them to financial loss and legal penalties but also erodes customer confidence and damages brand reputation. Strengthening digital defenses enables companies to provide seamless and secure shopping experiences, which in turn drives customer loyalty and repeat business.

There is a substantial opportunity for investors and innovators in the e-commerce security domain. Areas such as cloud-native security platforms, real-time fraud analytics, and cybersecurity-as-a-service models are witnessing increased funding. With more businesses moving to digital storefronts, especially in emerging markets, demand for affordable, plug-and-play security tools is rising sharply.

Key Takeaways

- In 2024, the Network Security segment led the Global E-Commerce Security Market, securing a 26% share, driven by rising concerns over cyberattacks and data breaches on digital platforms.

- The Encryption segment also held a significant position in 2024, accounting for 20% share, as businesses prioritized secure transaction protocols and user data protection.

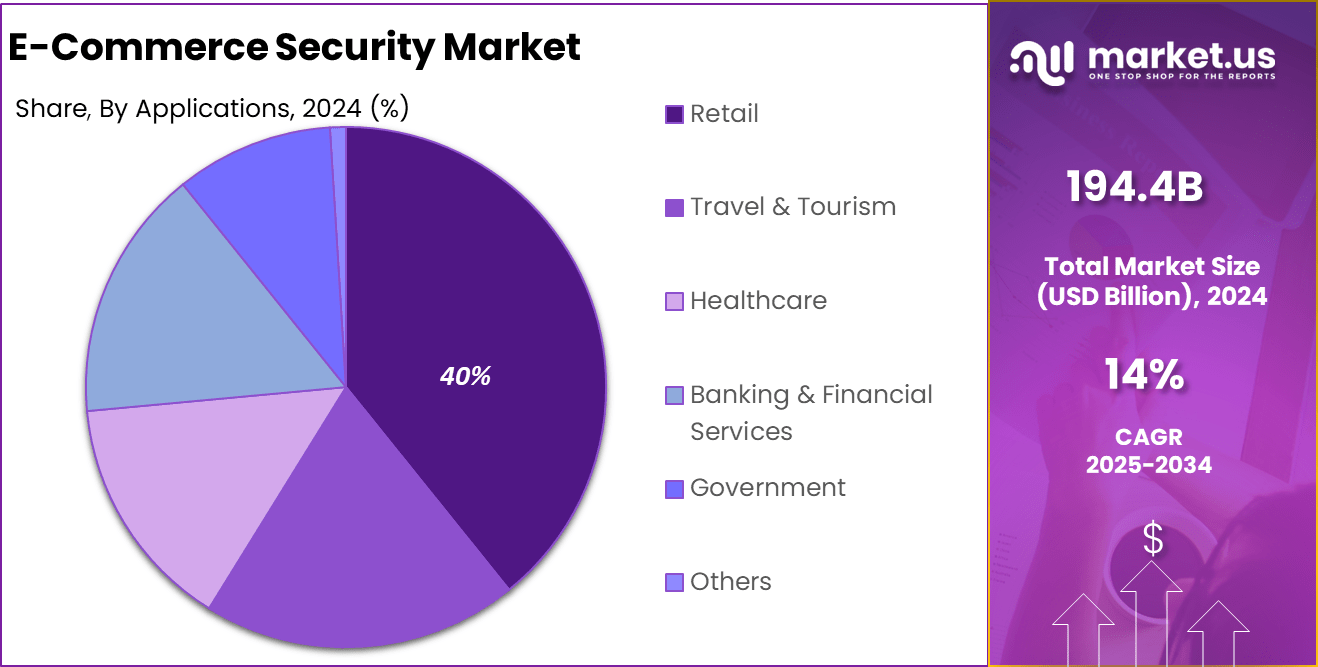

- The Retail sector dominated application usage in the same year, capturing a 40% share, owing to the massive surge in online shopping and customer data processing.

- In terms of transaction model, the B2C segment led the market in 2024, holding a commanding 56% share, backed by the increasing volume of consumer-facing digital platforms.

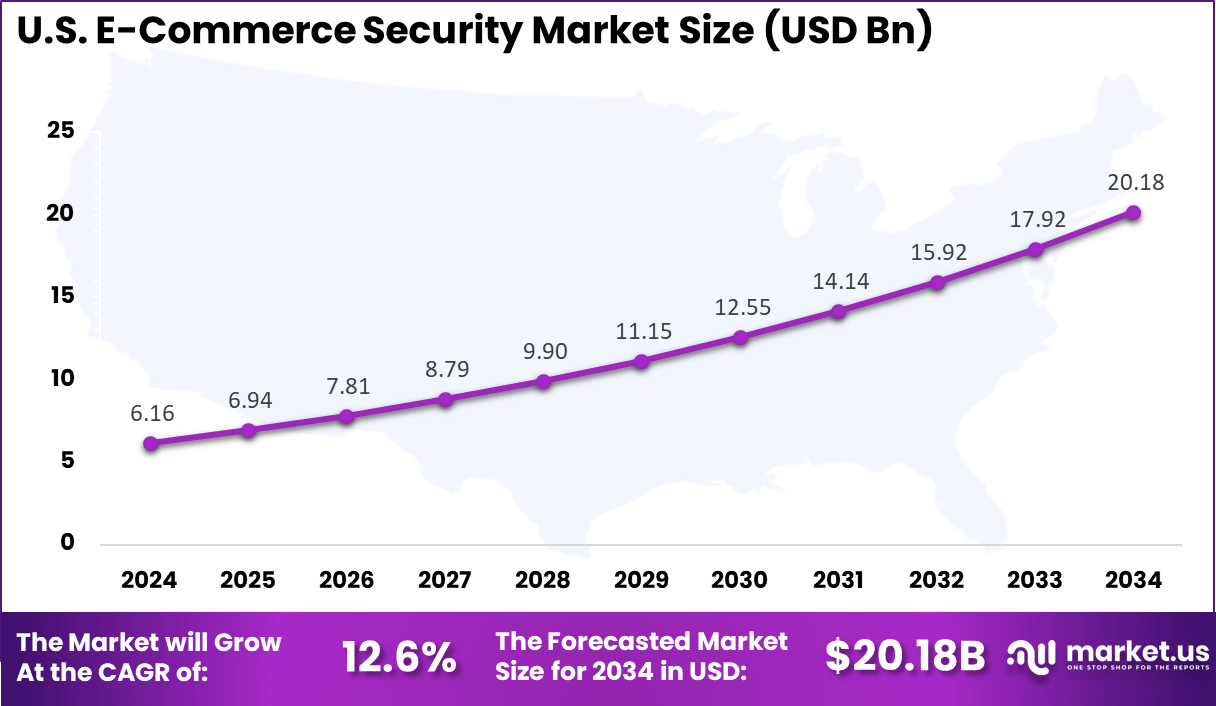

- The U.S. E-Commerce Security Market was valued at around USD 6.16 Billion in 2024 and is expected to expand at a steady CAGR of 12.6%, supported by strong regulatory focus and rising online commerce.

- Regionally, North America maintained its leadership in 2024, capturing over 33.5% share of the global market, fueled by advanced cybersecurity frameworks and high e-commerce penetration.

AI’s Role

AI enhances e-commerce security through real-time fraud detection and prevention mechanisms. Machine learning algorithms analyze user behavior and transaction patterns to identify anomalies indicative of fraudulent activities.

For instance, AI systems can assign risk scores to transactions, flagging those that deviate from established behavioral norms for further scrutiny. This proactive approach enables businesses to intercept fraudulent transactions before they are completed, thereby safeguarding both the merchant and the consumer.

The financial investment in AI-driven fraud detection is substantial, reflecting its critical role in e-commerce security. The AI in fraud detection market is anticipated to reach $108.3 billion by 2033, growing at a compound annual growth rate (CAGR) of 24.5%. This growth underscores the reliance on AI technologies to combat increasingly complex fraud tactics, including the use of deepfakes and synthetic identities to bypass traditional security measures.

Moreover, AI contributes to data protection and privacy by implementing advanced encryption techniques and ensuring compliance with data protection regulations such as GDPR and CCPA. AI systems maintain detailed audit trails of data access and modifications, facilitating transparency and accountability in data handling practices.

In the realm of identity verification, AI-powered biometric authentication methods, including facial and voice recognition, provide robust security measures. These technologies offer dynamic multi-factor authentication, adapting to the assessed risk level of each transaction, thereby enhancing the security framework without compromising user experience.

US Market Expansion

The market for E-Commerce Security within the U.S. is growing tremendously and is currently valued at USD 6.16 billion, the market has a projected CAGR of 12.6%. The market for e-commerce Security within the U.S. is growing tremendously due to the country’s large and rapidly expanding online consumer base coupled with increasing cybercrime targeting digital transactions.

Data privacy, strict regulatory frameworks such as CCPA, and the widespread adoption of mobile commerce further accelerate the demand for sophisticated security solutions. U.S. businesses are prioritizing investments in AI-driven fraud detection, encryption, and multi-factor authentication to protect customer data and ensure seamless, secure shopping experiences.

North America Growth

In 2024, North America held a dominant market position in the Global E-Commerce Security Market, capturing more than a 33.5% share, holding USD 65 billion in revenue. North America held a dominant market position in the Global E-Commerce Security Market due to its advanced technological infrastructure, high internet penetration, and widespread adoption of digital payment systems.

Additionally, the presence of major e-commerce and cybersecurity companies, along with significant R&D activities in AI and machine learning for threat detection, further strengthens North America’s leadership in developing and deploying cutting-edge e-commerce security solutions.

For instance, In February 2025, Protect AI launched a Channel Partner Program aimed at security and AI-focused resellers and distributors across North America. This initiative is designed to accelerate the adoption of AI-driven cybersecurity solutions among e-commerce businesses, enhancing their ability to detect and prevent sophisticated cyber threats.

Security Type Insights

In 2024, The Network Security segment held a dominant market position, capturing a 26% share of the Global E-Commerce Security Market. This dominance is due to the critical need for protecting e-commerce platforms from increasingly sophisticated cyberattacks, such as DDoS attacks, malware, and unauthorized intrusions.

With the growing volume of online transactions and sensitive data transfers, businesses are prioritizing robust network security solutions, including firewalls, intrusion detection systems, and secure gateways to safeguard their infrastructure and ensure uninterrupted service. The ongoing shift to cloud-based platforms and remote access further amplifies the demand for advanced network security, solidifying its leading role in the market.

For Instance, in January 2025, Zero Networks launched its Zero Trust Network Security solutions on the Pax8 Marketplace, empowering Managed Service Providers (MSPs) to offer robust, zero-trust security frameworks to e-commerce businesses. This solution segment enhances encryption and access control measures, reducing the risk of unauthorized network access and data breaches in increasingly complex digital commerce environments.

Solution Insights

In 2024, the Encryption segment held a dominant market position, capturing a 20% share of the Global E-Commerce Security Market. The demand in this sector has been driven mainly by the critical need to protect sensitive customer data, including payment information and personal details, from cyber criminals.

As e-commerce transactions continue to surge globally, businesses are prioritizing encryption technologies to ensure secure data transmission and storage, comply with stringent data privacy regulations, and build consumer trust. Additionally, advancements in encryption methods, including end-to-end and quantum-resistant encryption, have further fueled adoption across the e-commerce ecosystem.

For instance, In August 2024, the National Institute of Standards and Technology (NIST) approved three quantum-resistant encryption standards aimed at future-proofing cybersecurity frameworks against emerging quantum computing threats. This milestone significantly bolsters the encryption segment of e-commerce security by enabling platforms to protect sensitive transaction and customer data against next-generation cyberattacks, ensuring long-term data confidentiality and integrity.

Application Insights

In 2024, The Retail segment held a dominant market position, capturing a 40% share of the Global E-Commerce Security Market. This dominance is driven by the substantial growth of online retail and the increasing volume of digital transactions, which make retail platforms prime targets for cyberattacks such as payment fraud and data breaches.

To protect sensitive customer information and maintain trust, retail businesses are investing heavily in advanced security measures, including AI-driven fraud detection, encryption, and multi-factor authentication, thereby reinforcing their leadership in the e-commerce security landscape.

For Instance, in December 2024, GroupBy partnered with adCAPTCHA to enhance e-commerce security specifically for retail platforms. This collaboration aims to strengthen defenses against automated bot attacks and fraud while revolutionizing search-driven digital shopping experiences. By integrating advanced CAPTCHA technologies, the partnership helps retail e-commerce businesses protect customer data and ensure secure, seamless interactions on their platforms.

End-User Insights

In 2025, The B2C segment held a dominant market position, capturing a 56% share of the Global E-Commerce Security Market. This dominance is attributed to the exponential growth of online retail consumers and the increasing reliance on digital payment methods, which have made B2C platforms prime targets for cyber threats such as identity theft, payment fraud, and account takeovers.

To protect vast consumer bases and maintain brand reputation, businesses in this segment are heavily investing in robust security solutions, including multi-factor authentication, encryption, and AI-powered fraud detection systems.

For Instance, in February 2024, Veo, a UK-based e-commerce software startup, secured $1.78 million in seed funding to develop secure B2C and B2B marketplace solutions. Their focus on integrating robust security features such as encrypted transactions and fraud detection within their platform exemplifies how emerging players are addressing the growing security demands of the expanding B2C e-commerce market.

Key Market Segments

By Security Type

- Network Security

- Application Security

- Endpoint Security

- Cloud Security

- Payment Security

By Solution

- Intrusion Detection Systems (IDS)

- Encryption

- Firewalls

- Multi-Factor Authentication (MFA)

- Anti-Malware Solutions

- Others

By Application

- Retail

- Travel & Tourism

- Healthcare

- Banking & Financial Services

- Government

- Others

By End-User

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

The landscape of e-commerce security is rapidly evolving to counter increasingly sophisticated cyber threats. One notable trend is the deployment of AI-driven fraud detection systems that analyze user behavior and transaction patterns in real-time, enabling the identification and prevention of fraudulent activities before they cause harm.

Additionally, the integration of biometric authentication methods, such as fingerprint and facial recognition, is enhancing security by providing more robust user verification processes. These advancements are crucial in an era where cybercriminals employ advanced tactics like deepfakes and synthetic identities to exploit vulnerabilities in online platforms.

Another significant development is the emphasis on data privacy and compliance with regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). E-commerce businesses are increasingly adopting encryption technologies and secure payment gateways to protect sensitive customer information. The implementation of these measures not only safeguards data but also builds consumer trust, which is essential for the sustained growth of online commerce.

Business Benefits

Investing in advanced e-commerce security measures yields substantial benefits for businesses. Firstly, it significantly reduces the risk of financial losses associated with data breaches and fraud. For instance, the global e-commerce fraud detection and prevention market is projected to reach $69.1 billion by 2025, reflecting the critical importance of security investments in protecting revenue streams.

Secondly, robust security frameworks enhance customer confidence, leading to increased loyalty and repeat business. Consumers are more likely to engage with platforms that demonstrate a commitment to protecting their personal and financial information.

This trust translates into a competitive advantage, as businesses with strong security postures are better positioned to attract and retain customers in a crowded online marketplace . Ultimately, prioritizing e-commerce security is not only a defensive strategy but also a proactive approach to fostering long-term business success.

Driver

Surge in Digital Transactions Necessitates Enhanced Security

The exponential growth of online shopping has significantly increased the volume of digital transactions, thereby elevating the importance of robust e-commerce security measures. With global e-commerce sales projected to reach $6.3 trillion by 2024, businesses are processing more customer data than ever before, making them prime targets for cybercriminals. This surge necessitates the implementation of advanced security protocols to protect sensitive information and maintain consumer trust.

Moreover, the rise in mobile commerce has introduced additional vulnerabilities, as transactions conducted over smartphones and tablets often lack the security features of traditional desktop platforms. This trend underscores the need for comprehensive security strategies that encompass all digital channels, ensuring a secure shopping experience across devices.

Restraint

High Implementation Costs of Advanced Security Systems

While the need for enhanced e-commerce security is evident, the high costs associated with implementing advanced security systems pose a significant barrier for many businesses, particularly small and medium-sized enterprises (SMEs). Expenses related to platform selection, website customization, system integration, and payment gateway setup can range from $50,000 to $150,000, making it a substantial investment.

Additionally, ongoing maintenance costs, including regular security audits, software updates, and staff training, further strain financial resources. These expenses can deter businesses from adopting necessary security measures, leaving them vulnerable to cyber threats and potential financial losses.

Opportunity

Leveraging AI for Proactive Fraud Detection

The integration of Artificial Intelligence (AI) into e-commerce security presents a significant opportunity for businesses to proactively detect and prevent fraudulent activities. AI-driven systems can analyze vast amounts of data in real-time, identifying unusual patterns and behaviors that may indicate fraud, thereby enabling immediate response and mitigation.

Furthermore, AI technologies can adapt to evolving threats, continuously learning from new data to enhance their detection capabilities. This adaptability not only improves security but also enhances customer experience by reducing false positives and ensuring legitimate transactions are processed smoothly.

Challenge

Evolving Sophistication of Cyber Threats

The increasing sophistication of cyber threats poses a significant challenge to e-commerce security. Cybercriminals are employing advanced techniques, such as AI-powered attacks and deepfake technologies, to bypass traditional security measures. These methods can deceive systems and human operators alike, making detection and prevention more complex.

Additionally, the use of social engineering tactics, where attackers manipulate individuals into divulging confidential information, further complicates security efforts. These evolving threats require businesses to adopt more sophisticated and dynamic security solutions, emphasizing the need for continuous innovation and vigilance in e-commerce security strategies.

Key Player Analysis

One of the leading players in the market, In March 2024, Broadcom merged Symantec with Carbon Black to form the Enterprise Security Group, aiming to enhance integrated security solutions across data centers. This strategic consolidation leverages Symantec’s expertise in data and network protection alongside Carbon Black’s strengths in endpoint detection and response, offering a unified approach to enterprise security.

McAfee has focused on expanding its consumer security offerings through AI-driven innovations. In early 2024, the company launched an AI-based threat detection system to enhance real-time protection against cyber threats. By May 2025, McAfee introduced the AI-powered Scam Detector, capable of identifying and flagging scam attempts across various platforms.

IBM has strategically expanded its capabilities in hybrid cloud and AI through significant acquisitions. In February 2025, IBM completed the acquisition of HashiCorp for $6.4 billion, enhancing its infrastructure automation and multi-cloud management offerings. Subsequently, in May 2025, IBM finalized the acquisition of DataStax, aiming to accelerate AI-driven data solutions.

Top Key Players Covered

- Symantec

- McAfee

- IBM Security

- Cisco Systems

- Check Point

- Fortinet

- Palo Alto Networks

- F5 Networks

- Akamai Technologies

- VeriSign

- Entrust

- GlobalSign

- DigiCert

- Others

Recent Developments

- November 2024: McAfee released its 2024 Global Holiday Shopping Scams Study, highlighting growing concerns over AI-powered scams, including deepfakes, impacting holiday shoppers.

- January 2024: Broadcom merged its Carbon Black unit with Symantec, forming an $869 million endpoint security business. This move aimed to enhance Broadcom’s position in the cybersecurity market by combining advanced threat detection capabilities.

Report Scope

Report Features Description Market Value (2024) USD 194.4 Bn Forecast Revenue (2034) USD 720.68 Bn CAGR (2025-2034) 14% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Security Type (Network Security, Application Security, Endpoint Security, Cloud Security, Payment Security), By Solution (Intrusion Detection Systems (IDS), Encryption, Firewalls, Multi-Factor Authentication (MFA), Anti-Malware Solutions, Others), By Application (Retail, Travel & Tourism, Healthcare, Banking & Financial Services, Government, Others), By End-User (Business-to-Business (B2B), Business-to-Consumer (B2C) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Symantec, McAfee, IBM Security, Cisco Systems, Check Point, Fortinet, Palo Alto Networks, F5 Networks, Akamai Technologies, VeriSign, Entrust, GlobalSign, DigiCert, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  E-Commerce Security MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

E-Commerce Security MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Symantec

- McAfee

- IBM Security

- Cisco Systems

- Check Point

- Fortinet

- Palo Alto Networks

- F5 Networks

- Akamai Technologies

- VeriSign

- Entrust

- GlobalSign

- DigiCert

- Others