Global Duodenoscope Market By Product Type (Reusable Duodenoscopes (Flexile and Rigid) and Single-Use Duodenoscopes), By Application (Diagnostics and Therapeutics), By End-User (Hospitals and Outpatient Facilities), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171717

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

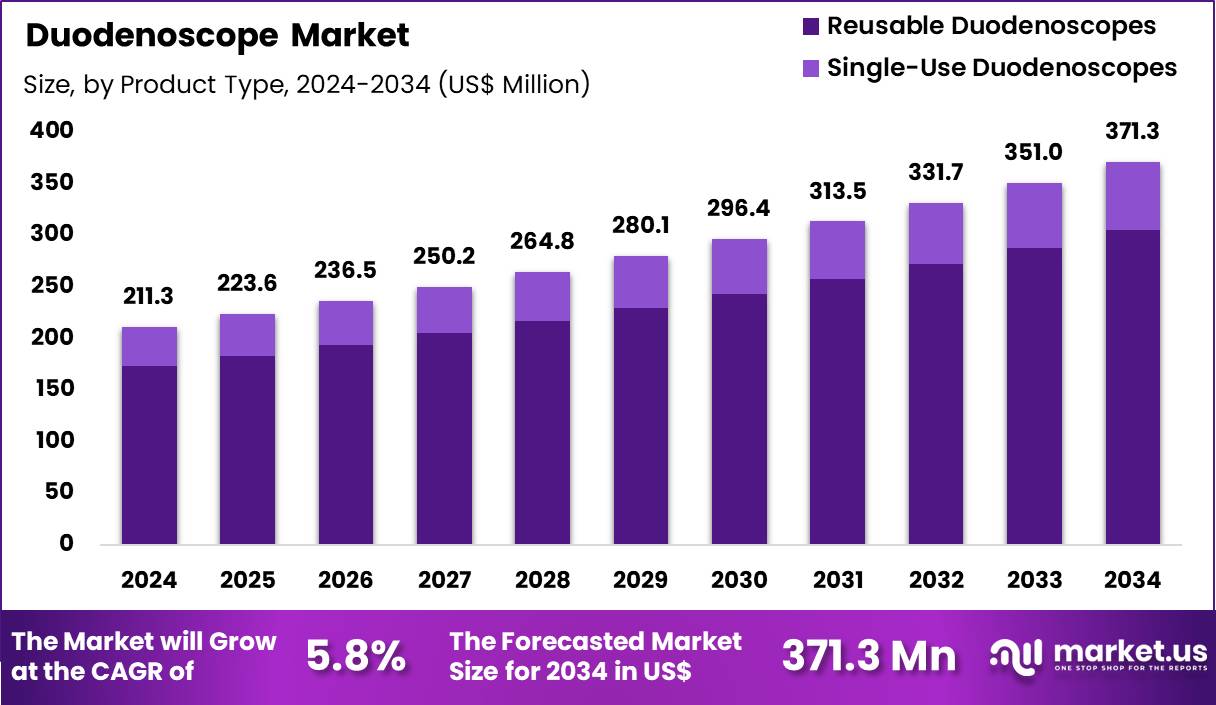

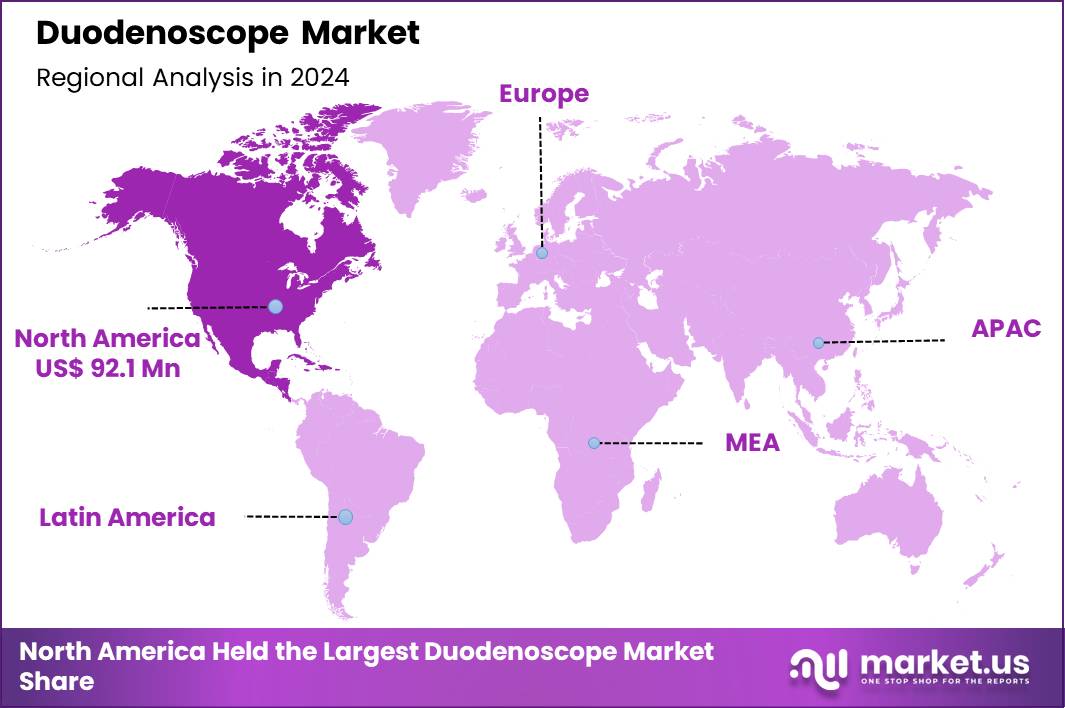

The Global Duodenoscope Market size is expected to be worth around US$ 371.3 Million by 2034 from US$ 211.3 Million in 2024, growing at a CAGR of 5.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.6% share with a revenue of US$ 92.1 Million.

Growing concerns over infection risks from reusable duodenoscopes drive manufacturers to prioritize single-use designs that eliminate cross-contamination in complex endoscopic procedures. Gastroenterologists frequently employ these devices during endoscopic retrograde cholangiopancreatography to cannulate the papilla and access biliary ducts for stone removal. These instruments facilitate sphincterotomy to relieve obstructions caused by gallstones or strictures in pancreaticobiliary pathways.

Clinicians deploy duodenoscopes for stent placement to ensure drainage in cases of malignant biliary obstruction. These tools support tissue sampling through brush cytology or biopsy to diagnose pancreatic neoplasms. In April 2024, Ambu received FDA clearance for its latest duodenoscopy platform, consisting of the Ambu aScope Duodeno 2 used alongside the Ambu aBox 2. The approval supports the use of the system in ERCP procedures and strengthens Ambu’s portfolio in single-use endoscopic solutions, reinforcing its competitive position within the duodenoscopy market.

Manufacturers pursue opportunities to develop hybrid duodenoscopes with disposable distal caps, simplifying reprocessing while maintaining familiarity for high-volume therapeutic interventions. Developers engineer enhanced elevator mechanisms to improve precision in guidewire manipulation during difficult biliary cannulations. These devices expand applications in cholangioscopy-assisted lithotripsy for fragmenting large bile duct stones resistant to standard extraction.

Opportunities arise in integrating narrow-band imaging to better delineate mucosal abnormalities in suspected cholangiocarcinoma evaluations. Companies advance wireless connectivity features to streamline procedural documentation in pancreatic pseudocyst drainage. Firms invest in ergonomic handles that reduce operator fatigue during prolonged sessions involving multiple stent deployments.

Industry leaders introduce fully disposable duodenoscopes that guarantee sterility and bypass traditional high-level disinfection protocols in ERCP workflows. Developers incorporate high-definition optics with wider fields of view to enhance visualization during pancreatic duct stenting. Market participants refine forceps elevator designs for superior control in precut access techniques for challenging anatomy.

Innovators embed fluorescence capabilities to detect subtle lesions in ampullary tumor assessments. Companies prioritize lightweight materials that improve maneuverability in side-viewing navigation for biliary decompression. Ongoing refinements focus on compatible accessory channels that accommodate advanced tools for intraductal radiofrequency ablation in malignant strictures.

Key Takeaways

- In 2024, the market generated a revenue of US$ 211.3 million, with a CAGR of 5.8%, and is expected to reach US$ 371.3 million by the year 2034.

- The product type segment is divided into reusable duodenoscopes and single-use duodenoscopes, with reusable duodenoscopes taking the lead in 2024 with a market share of 82.1%.

- Considering application, the market is divided into diagnostics and therapeutics. Among these, diagnostics held a significant share of 54.2%.

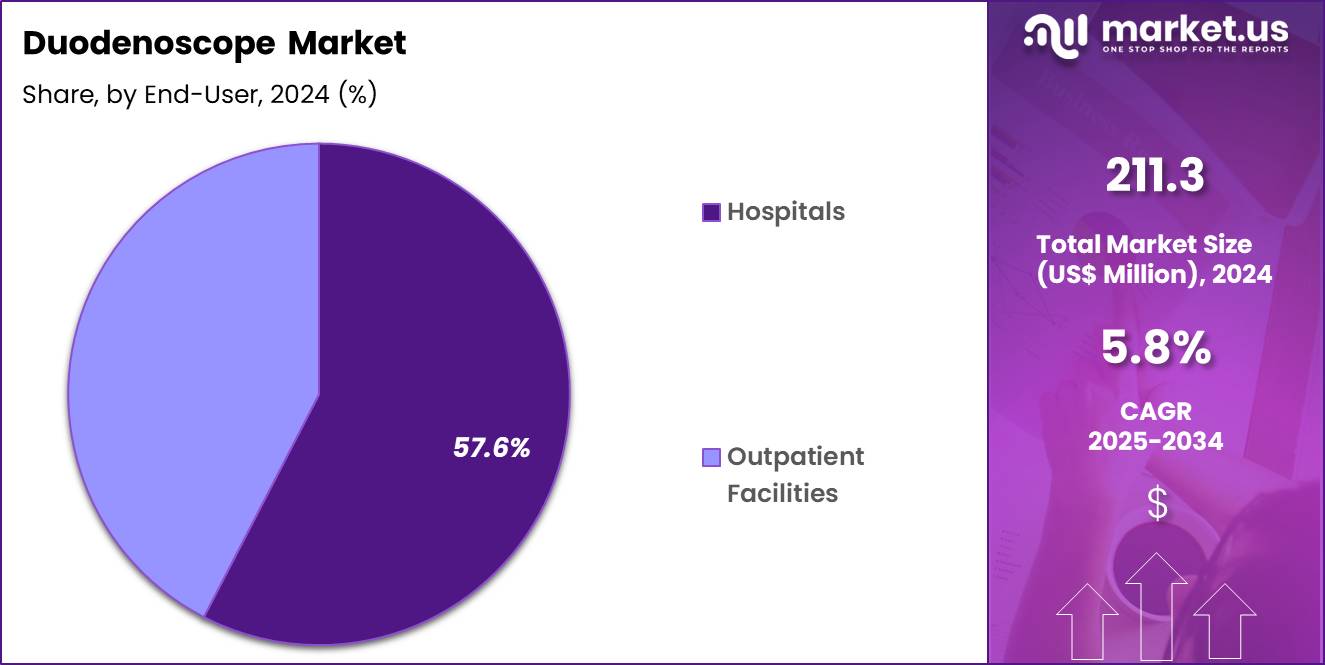

- Furthermore, concerning the end-user segment, the market is segregated into hospitals and outpatient facilities. The hospitals sector stands out as the dominant player, holding the largest revenue share of 57.6% in the market.

- North America led the market by securing a market share of 43.6% in 2024.

Product Type Analysis

Reusable duodenoscopes, holding 82.1%, are expected to dominate because hospitals continue to prioritize cost efficiency and long-term utilization across high procedural volumes. Reusable systems offer lower per-procedure costs when properly maintained, which aligns with budget constraints in endoscopy departments. Hospitals rely on established reprocessing workflows and trained staff to manage cleaning and disinfection, supporting continued confidence in reusable platforms.

Ongoing design improvements focus on enhanced distal-end accessibility and smoother surfaces, which reduce contamination risk and improve usability. High diagnostic demand for biliary and pancreatic disorders sustains consistent procedure volumes, reinforcing reuse economics.

Procurement contracts and service agreements further strengthen adoption of reusable devices. Clinical familiarity among gastroenterologists supports preference continuity. These factors keep reusable duodenoscopes anticipated to remain the dominant product type in this market.

Application Analysis

Diagnostics, holding 54.2%, are projected to dominate because duodenoscopes play a critical role in identifying pancreaticobiliary abnormalities through ERCP procedures. Rising prevalence of gallstones, biliary strictures, and pancreatic diseases increases diagnostic endoscopy demand. Early and accurate diagnosis improves treatment planning, driving higher utilization of diagnostic procedures over purely therapeutic interventions.

Advances in imaging clarity and maneuverability enhance diagnostic yield, encouraging clinician reliance. Healthcare systems emphasize early detection to reduce downstream complications and costs. Growing referrals from primary and specialty care strengthen diagnostic case flow. Training programs continue to focus on diagnostic proficiency, reinforcing procedural volumes. These dynamics keep diagnostics expected to remain the leading application segment.

End-User Analysis

Hospitals, holding 57.6%, are expected to dominate because they manage the majority of complex gastrointestinal cases requiring ERCP and advanced endoscopic evaluation. Hospitals maintain specialized endoscopy suites, infection control protocols, and multidisciplinary support essential for duodenoscope procedures.

Increasing inpatient admissions related to pancreatic and biliary conditions drive sustained hospital-based utilization. Tertiary care centers handle higher-risk patients who require immediate diagnostic assessment under controlled settings. Capital investment capacity allows hospitals to maintain and upgrade reusable duodenoscope fleets.

Integration with surgical and interventional radiology teams strengthens procedural coordination. Regulatory oversight further concentrates use within hospital environments. These factors keep hospitals anticipated to remain the dominant end-user segment in the duodenoscope market.

Key Market Segments

By Product Type

- Reusable Duodenoscopes

- Flexile

- Rigid

- Single-Use Duodenoscopes

By Application

- Diagnostics

- Therapeutics

By End-User

- Hospitals

- Outpatient Facilities

Drivers

Rising prevalence of pancreatic cancer is driving the market

The duodenoscope market is significantly driven by the increasing prevalence of pancreatic cancer, a condition that frequently requires endoscopic retrograde cholangiopancreatography (ERCP) procedures for diagnostic evaluation and therapeutic interventions such as biliary stenting. Duodenoscopes enable access to the pancreatic and biliary ducts for tissue sampling, stone removal, and drainage in obstructive cases.

Advanced imaging and accessory compatibility in modern duodenoscopes support precise management of malignancy-related complications. Oncologists and gastroenterologists increasingly rely on these devices for palliative care in advanced stages. The aging population contributes to higher incidence rates, as risk escalates with age. Screening advancements and improved survival in early detections lead to more procedural needs over time.

Integration of duodenoscopes in multidisciplinary cancer care protocols enhances treatment planning. Research into biomarker-guided therapies further incorporates endoscopic assessments. According to the American Cancer Society’s Cancer Facts & Figures 2025, an estimated 67,440 new cases of pancreatic cancer are projected in the United States for 2025. This figure reflects ongoing trends that sustain demand for specialized endoscopic equipment.

Global epidemiological patterns mirror domestic increases, expanding procedural volumes internationally. Healthcare facilities invest in compatible duodenoscope systems to handle complex oncology referrals. Technological refinements address procedural challenges in tumor environments. Overall, this driver ensures continued relevance of duodenoscopes in comprehensive pancreatic cancer management.

Restraints

Persistent patient safety concerns with reusable models are restraining the market

The duodenoscope market experiences restraints due to ongoing patient safety concerns associated with reusable models, particularly regarding potential transmission of infections despite rigorous reprocessing protocols. Complex device designs with narrow channels and elevator mechanisms pose challenges for complete cleaning and sterilization. Historical associations with multidrug-resistant organism outbreaks have heightened scrutiny from healthcare providers and regulators.

Facilities must implement enhanced reprocessing verification and monitoring to mitigate risks. Adverse event reporting highlights occasional contamination persistence even after adherence to guidelines. Transition delays to newer designs stem from validation requirements and staff training needs. Economic implications include additional costs for surveillance cultures and quality assurance programs.

Regulatory emphasis on human factors testing reveals usability issues impacting safety. Variability in institutional reprocessing efficacy contributes to cautious adoption patterns. In interim postmarket surveillance results referenced in 2022 updates, certain models showed contamination rates requiring ongoing attention.

These concerns compel careful risk-benefit assessments in procurement decisions. Professional societies issue guidance reinforcing strict adherence to manufacturer instructions. Liability considerations influence hospital policies on device utilization. Such factors collectively temper market growth for traditional reusable duodenoscopes.

Opportunities

Regulatory clearances for innovative disposable designs are creating growth opportunities

The duodenoscope market harbors substantial growth opportunities through continued regulatory clearances for innovative designs featuring disposable components or fully single-use configurations, addressing longstanding safety challenges. These advancements eliminate reprocessing variables by incorporating sterile, one-time-use elements that reduce cross-contamination potential.

Manufacturers develop models with equivalent performance to reusable counterparts in visualization and maneuverability. Clearances validate clinical efficacy and safety profiles through rigorous premarket evaluations. Healthcare systems seek these options to streamline workflows and enhance infection prevention strategies. Expanded indications support broader procedural applications in high-risk patient cohorts. Collaborations between device developers and endoscopic experts refine ergonomic features.

Global regulatory alignment facilitates international market access for cleared products. The U.S. Food and Drug Administration cleared models such as the PENTAX Medical Video Duodenoscope ED34-i10T2s in August 2024. Additional clearances in 2024 further demonstrate momentum in this segment. Institutions prioritize these innovations for compliance with evolving safety recommendations.

Training modules accompany introductions to ensure procedural proficiency. Cost-effectiveness analyses in certain volumes favor disposable approaches long-term. These opportunities enable market differentiation and expanded adoption in safety-conscious environments.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics energize the duodenoscope market as expanding healthcare budgets and rising gastrointestinal disorder prevalence worldwide compel gastroenterology centers to integrate advanced endoscopic tools for precise ERCP procedures. Leading manufacturers strategically introduce single-use designs and AI-enhanced imaging, capturing strong demand from aging populations and minimally invasive surgery trends in high-growth economies.

Lingering inflation and global economic slowdowns, however, inflate costs for precision optics and sterilization components, prompting clinics to defer upgrades and constrain procedure volumes amid fiscal pressures. Geopolitical frictions, notably U.S.-China trade disputes and regional conflicts, routinely disrupt supplies of key electronics and stainless steel, generating production delays and sourcing uncertainties for globally dependent producers.

Current U.S. tariffs impose a baseline duty on imported medical devices alongside elevated rates on Chinese-origin endoscopes, amplifying procurement expenses for American distributors and eroding competitive pricing in domestic channels. These tariffs also provoke counter-tariffs from trading partners that curtail U.S. exports of innovative duodenoscopes and impede multinational R&D alliances.

Still, the tariff pressures galvanize substantial commitments to North American manufacturing hubs and diversified sourcing strategies, cultivating fortified infrastructures that promise accelerated innovation and steadfast market progression for the foreseeable future.

Latest Trends

Increasing shift toward single-use duodenoscopes is a recent trend

In 2024 and 2025, the duodenoscope market has demonstrated a clear trend toward increasing shift to single-use models, driven by priorities in infection control and operational simplicity. These devices offer sterile out-of-the-box readiness, bypassing complex reprocessing cycles associated with reusable systems. Gastroenterologists report growing confidence in optical quality and handling characteristics comparable to traditional scopes.

Tertiary centers document rising utilization rates as familiarity increases among procedural staff. Manufacturers expand production to meet emerging demand in both academic and community settings. Professional publications highlight real-world performance data supporting equivalence in ERCP success rates. Environmental impact assessments accompany adoption discussions to balance waste considerations. Hybrid facilities employ selective use for high-risk infections or outbreak scenarios.

Regulatory encouragement reinforces this directional change through safety communications. Studies published in 2025 indicate progressive integration into standard practice at specialized institutions. Supply chain developments ensure availability for routine procedures. Feedback loops from users inform iterative design improvements. Cost modeling evolves with volume-based pricing strategies. This trend reshapes procurement preferences and positions single-use duodenoscopes as a mainstream option moving forward.

Regional Analysis

North America is leading the Duodenoscope Market

In 2024, North America claimed a 43.6% share of the global duodenoscope market, bolstered by heightened procedural demands and rigorous safety innovations in pancreaticobiliary endoscopy. Gastroenterologists embrace single-use and hybrid designs to eliminate reprocessing failures, addressing prior multidrug-resistant outbreaks linked to complex elevator mechanisms.

Regulatory oversight from the Food and Drug Administration enforces human factors validation and post-market surveillance, propelling manufacturers to launch fully disposable platforms with superior maneuverability. Tertiary care facilities incorporate enhanced digital imaging and variable stiffness shafts, facilitating precise cannulation in altered surgical anatomies post-bariatric procedures. Escalating obesity rates exacerbate cholelithiasis complications, necessitating therapeutic ERCP for stone extraction and biliary decompression.

Multidisciplinary tumor boards rely on spyglass cholangioscopy integrations for tissue acquisition in indeterminate strictures. Supply agreements with group purchasing organizations streamline adoption of cost-effective models in ambulatory surgery centers. These advancements prioritize clinical efficacy and infection control, sustaining regional market leadership. The National Institutes of Health indicates that gallstones affect over 6.3 million men and 14.2 million women aged 20 to 74 in the United States.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders envision robust proliferation of pancreaticobiliary endoscopic instruments in Asia Pacific throughout the forecast period, as healthcare systems scale interventional capabilities amid evolving disease patterns. Endoscopy units in Japan and Thailand acquire narrow-band imaging variants, sharpening delineation of neoplastic lesions during diagnostic surveys. Clinicians in high-incidence zones deploy larger channel diameters for efficient debris clearance in recurrent pyogenic cholangitis cases.

Local enterprises produce compatible balloon dilators and stents, optimizing resource allocation in public insurance frameworks. Professional networks conduct hands-on workshops, honing skills in precut techniques for difficult papillary access. Rising affluence supports elective screenings, uncovering asymptomatic choledocholithiasis in metropolitan cohorts.

Regulatory agencies fast-track clearances for ergonomic handles, accommodating diverse operator preferences in prolonged sessions. These efforts empower providers to tackle mounting caseloads, enhancing therapeutic precision across varied etiologies. An epidemiological analysis documents 184,612 pancreatic cancer cases in the Western Pacific Region in 2021, underscoring escalating demands for advanced diagnostic access.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the duodenoscope market drive growth by prioritizing infection-prevention design, including disposable components and enhanced reprocessing features that address hospital safety mandates. Companies expand demand by aligning portfolios with ERCP procedure growth and by offering service models that lower total cost of ownership for endoscopy units.

Product teams invest in imaging clarity, maneuverability, and ergonomic controls to improve procedural efficiency and clinician confidence. Commercial leaders secure long-term adoption through bundled offerings that combine devices, accessories, training, and maintenance contracts.

Market expansion focuses on regulatory-compliant launches across emerging regions with rising gastrointestinal disease burden and improving endoscopy infrastructure. Olympus Corporation exemplifies leadership through its extensive endoscopy portfolio, global manufacturing and service footprint, and sustained innovation in visualization technologies that support high-volume clinical use and long-term customer relationships.

Top Key Players

- Ambu A/S

- Boston Scientific Corporation

- Olympus Corporation

- FUJIFILM Holdings Corporation

- PENTAX Medical

- SonoScape Medical Corp.

- Ottomed Endoscopy

- Richard Wolf GmbH

- Cook Medical

Recent Developments

- In August 2024, PENTAX Medical, part of the HOYA Group, obtained FDA authorization for a newly developed duodenoscope designed with enhanced infection-control features. The device incorporates improved sterilization-focused engineering, supporting safer execution of ERCP procedures and addressing long-standing concerns around endoscope reprocessing in clinical settings.

- In April 2024, Fujifilm presented its Tracmotion Endoscopic Submucosal Dissection device at Endocon 2024 in Delhi. The award-winning system, recognized with a Red Dot distinction, is intended to improve precision and control during complex endoscopic resections, highlighting continued innovation in advanced therapeutic endoscopy tools.

Report Scope

Report Features Description Market Value (2024) US$ 211.3 Million Forecast Revenue (2034) US$ 371.3 Million CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reusable Duodenoscopes (Flexile and Rigid) and Single-Use Duodenoscopes), By Application (Diagnostics and Therapeutics), By End-User (Hospitals and Outpatient Facilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ambu A/S, Boston Scientific Corporation, Olympus Corporation, FUJIFILM Holdings Corporation, PENTAX Medical, SonoScape Medical Corp., Ottomed Endoscopy, Richard Wolf GmbH, Cook Medical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ambu A/S

- Boston Scientific Corporation

- Olympus Corporation

- FUJIFILM Holdings Corporation

- PENTAX Medical

- SonoScape Medical Corp.

- Ottomed Endoscopy

- Richard Wolf GmbH

- Cook Medical