Global Drone Service Providers Market Size, Share Analysis Report By Product Type (Fixed Wing, Rotary Blade, Hybrid), By Drone Type (Commercial, Civil, Military), By Application (Filming & Photography, Inspection & Maintenance, Mapping & Surveying, Precision Agriculture, Surveillance & Monitoring, Others), By End Use (Agriculture & Forestry, Delivery & Logistics, Media & Entertainment, Construction & Mining, Oil & Gas, Security & Law Enforcement, Recreational Activity, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150142

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

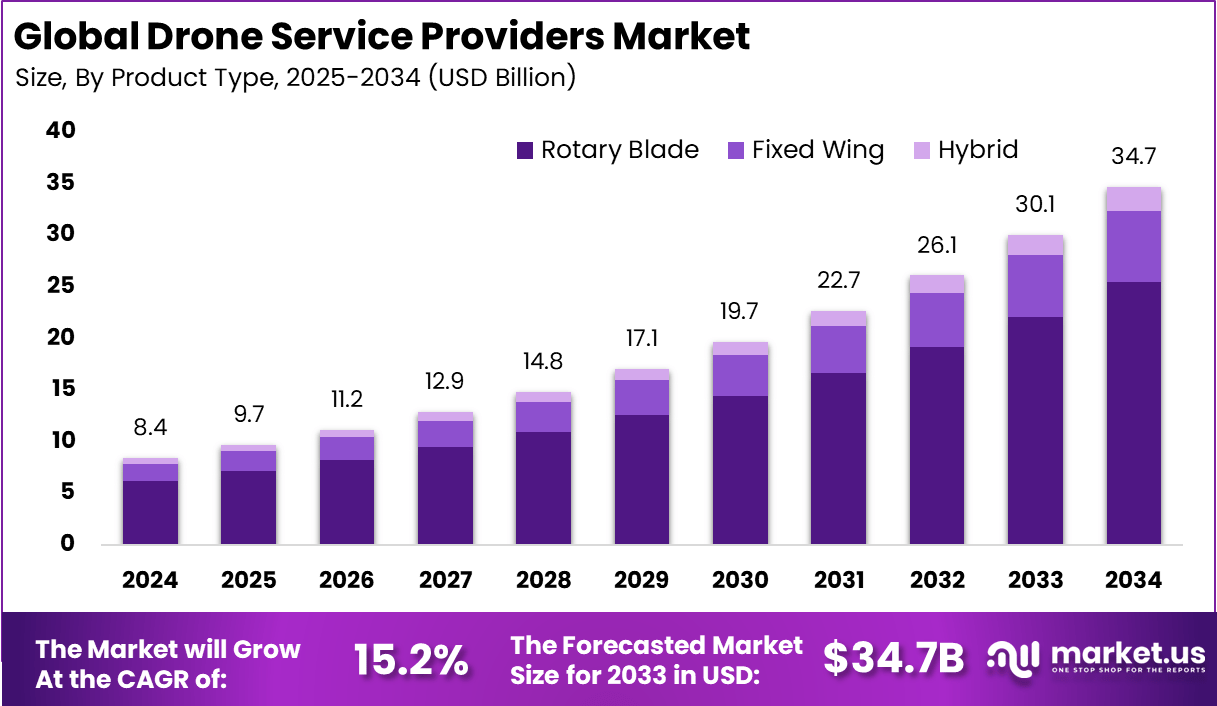

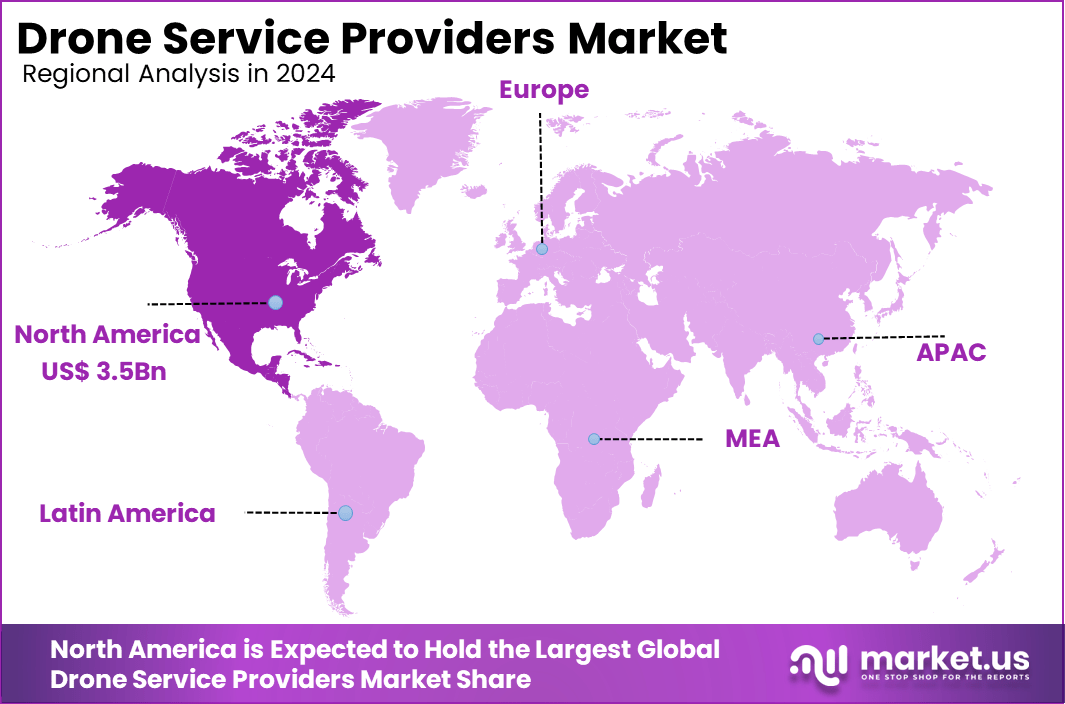

The Global Drone Service Providers Market size is expected to be worth around USD 34.7 Billion By 2034, from USD 8.4 billion in 2024, growing at a CAGR of 15.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.6% share, holding USD 3.5 Billion revenue. The U.S. market for drone services stands at USD 3.22 billion, backed by a healthy 14.3% CAGR.

The drone service providers market has witnessed substantial growth, driven by technological advancements and increasing demand across sectors. Several key factors are propelling the growth of the drone services market. The need for real-time data and high-resolution imagery has led industries to adopt drone technology for tasks like crop monitoring, infrastructure inspection, and emergency response.

Advancements in drone capabilities, including longer flight times, improved sensors, and autonomous operations, have enhanced their utility and reliability. Additionally, supportive regulatory frameworks in regions like North America and Europe have facilitated the integration of drones into commercial operations.

The demand for drone services is particularly strong in sectors that require frequent and detailed monitoring. For instance, the agriculture industry utilizes drones for precision farming, enabling farmers to assess crop health and optimize resource usage. In construction and infrastructure, drones provide accurate site surveys and progress tracking, reducing the need for manual inspections.

According to the findings from Market.us, the Global Drone Market is projected to reach around USD 95.4 Billion by 2034, rising from USD 36.4 Billion in 2024, expanding steadily at a CAGR of 10.1% during the period from 2025 to 2034. This growth is being led by increasing demand across defense, logistics, infrastructure, and agriculture.

In parallel, the Global AI in Drone Technology Market is witnessing a much sharper trajectory. The market is expected to grow from USD 12.5 Billion in 2023 to an impressive USD 206.9 Billion by 2033, registering a remarkable CAGR of 32.4% over the forecast period. This surge is being driven by the rapid integration of AI for real-time analytics, autonomous flight operations, and intelligent image recognition.

Investment opportunities in the drone services market are abundant, given its rapid growth and diverse applications. Investors are focusing on companies that offer specialized drone solutions, such as those catering to agriculture, energy, or logistics. Startups developing innovative drone technologies, including AI-powered analytics and autonomous navigation systems, are attracting significant funding.

Key Takeaways

- The Global Drone Service Providers Market is projected to reach USD 34.7 Billion by 2034, growing at a strong CAGR of 15.2% from 2025.

- In 2024, the market was valued at USD 8.4 Billion, reflecting rapid expansion in drone-based solutions across sectors.

- North America emerged as the leading region, capturing over 42.6% share in 2024, equivalent to USD 3.5 Billion in revenue.

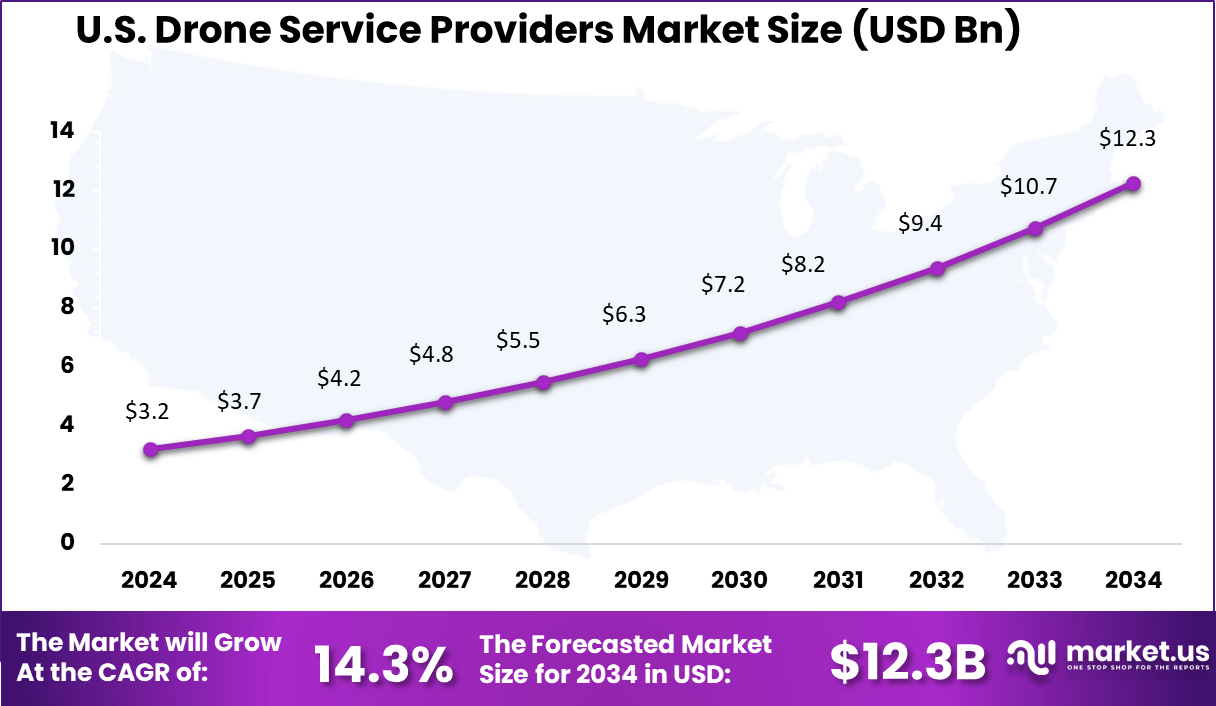

- The U.S. alone accounted for USD 3.22 Billion, supported by a steady 14.3% CAGR, driven by regulatory clarity and enterprise demand.

- Within product segmentation, Rotary Blade drones dominated with a 73.5% share, preferred for their vertical takeoff and maneuverability in confined areas.

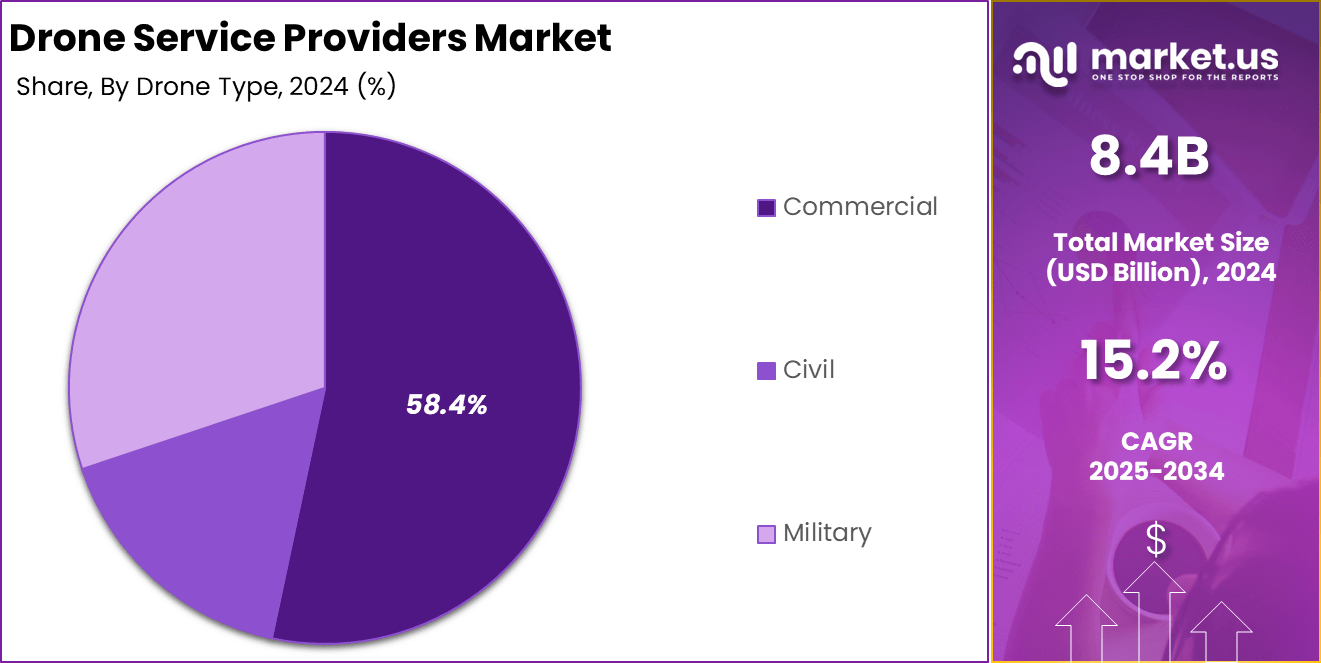

- By drone type, the Commercial drone segment led with 58.4%, highlighting increased adoption in logistics, surveillance, and delivery services.

- In application areas, Inspection & Maintenance accounted for 32.7%, as infrastructure and energy sectors increasingly rely on drones for operational safety.

- From an end-use perspective, Media & Entertainment held 23.2% of the market, driven by rising demand for aerial content in film, sports, and live events.

US Market Size

The US Drone Service Providers Market is valued at approximately USD 3.2 Billion in 2024 and is predicted to increase from USD 6.3 Billion in 2029 to approximately USD 12.3 Billion by 2034, projected at a CAGR of 14.3% from 2025 to 2034.

North America Growth

In 2024, North America held a dominant position in the global drone services market, capturing over 42.6% of the market share and generating approximately USD 3.5 billion in revenue. This leadership is attributed to several key factors. The region’s advanced technological infrastructure, combined with significant investments in research and development, has fostered innovation in drone technologies.

Additionally, supportive regulatory frameworks, particularly in the United States, have facilitated the integration of drones into various commercial applications. The presence of major industry players and a robust startup ecosystem further contribute to North America’s leading position in the market.

Product Type Insights

In 2024, the Rotary Blade segment held a dominant position in the drone service providers market, capturing over 73.5% of the global market share. This leadership is attributed to the segment’s versatility, ease of use, and adaptability across various applications, including aerial photography, agriculture, surveillance, and delivery services.

Rotary blade drones, commonly known as multirotor drones, offer vertical takeoff and landing capabilities, enabling them to operate efficiently in confined spaces and challenging terrains. Their ability to hover and execute agile maneuvers makes them ideal for tasks requiring precision and stability, such as infrastructure inspection, crop monitoring, and emergency response.

Additionally, advancements in drone technology, including improved battery life, autonomous navigation, and integration with artificial intelligence, have enhanced the performance and reliability of rotary blade drones, further solidifying their market dominance.

The segment’s growth is also fueled by the increasing demand for efficient and cost-effective aerial solutions across various industries. In agriculture, for instance, rotary blade drones are utilized for precision farming, enabling farmers to monitor crop health and optimize resource usage. In the logistics sector, these drones facilitate last-mile deliveries, especially in urban areas where traditional delivery methods face challenges.

Drone Type Insights

In 2024, the Commercial segment held a dominant position in the drone service providers market, capturing more than a 58.4% share. This leadership is attributed to the widespread adoption of drones across various industries, including agriculture, construction, logistics, and media. The versatility and efficiency of commercial drones have enabled businesses to enhance operational productivity and reduce costs.

The significant growth in the commercial drone market is further supported by technological advancements and favorable regulatory developments. Innovations such as improved battery life, autonomous navigation, and integration with artificial intelligence have expanded the capabilities of commercial drones, making them more reliable and efficient for complex tasks.

Additionally, regulatory bodies in several countries have implemented policies that facilitate the integration of drones into commercial operations, thereby accelerating market growth. Moreover, the demand for real-time data and high-resolution imagery has propelled the use of drones in sectors like agriculture for crop monitoring, in construction for site surveying, and in logistics for inventory management.

These applications not only improve accuracy and efficiency but also contribute to sustainability by reducing the need for traditional resource-intensive methods. As businesses continue to recognize the value of drone technology, the commercial segment is expected to maintain its leading position in the market.

Application Insights

In 2024, the Inspection & Maintenance segment held a dominant position in the drone service providers market, capturing more than a 32.7% share. This leadership is attributed to the increasing demand for efficient, safe, and cost-effective inspection solutions across various industries, including energy, utilities, infrastructure, and manufacturing.

Traditional inspection methods often involve manual labor, which can be time-consuming, hazardous, and expensive. Drones offer a compelling alternative by enabling rapid data collection, minimizing human exposure to dangerous environments, and reducing operational downtime.

The growth of this segment is further supported by advancements in drone technology, such as high-resolution imaging, thermal sensors, and artificial intelligence for data analysis. These innovations enhance the accuracy and reliability of inspections, allowing for early detection of potential issues and proactive maintenance.

Industries are increasingly recognizing the value of drone-based inspections in maintaining asset integrity and ensuring compliance with safety regulations. As a result, the Inspection & Maintenance segment is expected to continue its upward trajectory, driven by the need for improved operational efficiency and risk mitigation.

End Use Insights

In 2024, the Media & Entertainment segment held a dominant position in the drone service providers market, capturing more than a 23.2% share. This leadership is attributed to the widespread adoption of drones for aerial photography, cinematography, and live event coverage, which has revolutionized content creation by providing dynamic and cost-effective solutions.

The integration of drones into media and entertainment has enabled filmmakers and broadcasters to capture high-quality aerial footage that was previously difficult or expensive to obtain. Advancements in drone technology, such as improved stabilization systems and high-resolution cameras, have further enhanced the quality of content produced.

The demand for engaging visual content across various platforms, including social media, streaming services, and traditional broadcasting, has driven the growth of drone services in this segment. As audiences increasingly seek immersive and visually appealing experiences, the utilization of drones in media production is expected to continue its upward trajectory, solidifying the Media & Entertainment segment’s leading position in the drone service providers market.

Key Market Segments

By Product Type

- Fixed Wing

- Rotary Blade

- Hybrid

By Drone Type

- Commercial

- Civil

- Military

By Application

- Filming & Photography

- Inspection & Maintenance

- Mapping & Surveying

- Precision Agriculture

- Surveillance & Monitoring

- Others

By End Use

- Agriculture & Forestry

- Delivery & Logistics

- Media & Entertainment

- Construction & Mining

- Oil & Gas

- Security & Law Enforcement

- Recreational Activity

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

The drone service industry is experiencing significant advancements, notably with the integration of artificial intelligence (AI) and machine learning. These technologies enhance drones’ capabilities, allowing for real-time data analysis and autonomous decision-making. Such advancements are particularly beneficial in sectors like agriculture, where drones can monitor crop health and optimize resource usage, and in logistics, where they can streamline delivery processes.

Another prominent trend is the expansion of Beyond Visual Line of Sight (BVLOS) operations. BVLOS enables drones to operate over greater distances without direct human oversight, significantly broadening their application scope. This capability is crucial for tasks such as infrastructure inspection, environmental monitoring, and large-scale surveying, where extended range and autonomy are essential.

Business Benefits

Implementing drone services offers substantial business advantages, particularly in enhancing operational efficiency. Drones can perform tasks like inspections, surveys, and deliveries more quickly and safely than traditional methods, reducing the time and labor costs associated with these activities. For instance, in the construction industry, drones provide rapid site assessments, leading to more informed decision-making and project management.

Additionally, drones contribute to improved safety and data accuracy. By taking on hazardous tasks, such as inspecting high structures or accessing hard-to-reach areas, drones minimize the risk to human workers. They also collect high-resolution data, enhancing the quality of information available for analysis. This precision is invaluable in sectors like energy and utilities, where accurate data is critical for maintenance and compliance purposes.

Driver

Rising Demand for Rapid and Contactless Deliveries

The increasing consumer preference for swift and contactless delivery solutions has significantly propelled the growth of drone service providers. Retail giants, such as Walmart, have expanded drone delivery services to numerous U.S. cities, enabling deliveries within 30 minutes for items like groceries and household essentials. This expansion reflects a broader trend where consumers seek faster and more convenient delivery options, especially in urban areas.

Furthermore, the integration of drones into last-mile delivery logistics addresses challenges associated with traffic congestion and reduces carbon emissions. By offering efficient and eco-friendly delivery alternatives, drone services align with sustainability goals and meet the evolving expectations of environmentally conscious consumers. This shift not only enhances customer satisfaction but also opens new avenues for businesses to optimize their supply chain operations.

Restraint

Regulatory and Operational Challenges

Despite the promising prospects, drone service providers face significant regulatory and operational hurdles. Stringent aviation regulations, particularly concerning beyond visual line-of-sight (BVLOS) operations, limit the scalability of drone deliveries. Navigating the complex regulatory landscape requires substantial investments in compliance and safety measures, which can be burdensome for emerging companies.

Operational challenges, such as limited battery life and payload capacity, further constrain the efficiency of drone services. Current drone technologies often struggle with delivering heavier packages over longer distances, especially in adverse weather conditions. These limitations necessitate continuous technological advancements and infrastructure development to ensure reliable and widespread drone delivery services.

Opportunity

Expansion into Healthcare and Emergency Services

The application of drone services in healthcare and emergency response presents a significant growth opportunity. Drones have demonstrated their utility in delivering medical supplies, vaccines, and emergency equipment to remote or inaccessible areas, thereby enhancing the responsiveness of healthcare systems.

The ability of drones to bypass traditional logistical barriers enables timely interventions during emergencies, such as natural disasters or pandemics. By integrating drones into emergency response frameworks, authorities can improve the distribution of essential supplies, conduct rapid assessments, and support rescue operations, ultimately saving lives and resources.

Challenge

Public Perception and Acceptance

Public perception remains a significant challenge for the widespread adoption of drone services. Concerns over privacy, noise pollution, and safety have led to skepticism among communities regarding the integration of drones into daily life. Incidents involving drone malfunctions or unauthorized surveillance have heightened these apprehensions, necessitating proactive measures to build public trust.

To address these concerns, companies must engage in transparent communication, community outreach, and demonstrate the safety and benefits of drone operations. Implementing stringent data protection protocols and adhering to ethical guidelines can further alleviate privacy issues. By fostering a collaborative approach with stakeholders, drone service providers can enhance public acceptance and facilitate smoother integration into society.

Key Player Analysis

Terra Drone Corporation, headquartered in Japan, has significantly expanded its global footprint through strategic acquisitions and partnerships. In 2023, the company acquired a majority stake in Unifly, a leading provider of unmanned traffic management (UTM) systems, enhancing its capabilities in drone airspace management.

PrecisionHawk, once a prominent player in the drone services industry, underwent significant changes in recent years. In March 2023, the company was acquired by European geo-tech firm Field, aiming to combine geospatial data analysis solutions for infrastructure and energy sectors.

Aerodyne Group has focused on expanding its global footprint and technological capabilities. In February 2025, it signed a landmark Memorandum of Understanding with Phoenix-Wings to enhance drone logistics solutions, aiming to address challenges in mainstream logistics and enable efficient delivery networks.

Top Key Players Covered

- Terra Drone Corporation

- PrecisionHawk

- Aerodyne Group

- DroneDeploy

- Cyberhawk Innovations Limited

- Flytrex

- Skyports

- Aerobo

- Measure

- Sky Futures Ltd

- AirMap, Inc.

- Heliguy

- AgEagle Aerial Systems Inc.

- Delair

- Agribotix LLC

- Globhe Drones AB

- Identified Technologies

- Phoenix Drone Services LLC

- Sharper Shape

- Sky Features

- Skylark Drone

Recent Developments

- In February 2025, Aerodyne signed an MoU with Phoenix-Wings to develop efficient drone delivery networks, aiming to address challenges faced by logistics operators . Additionally, the company has expressed intentions to enter the Uzbek market, focusing on agricultural drone services and the production of hybrid drones tailored to local conditions.

- Flytrex achieved a significant milestone in May 2025 by collaborating with Wing to implement the first Unmanned Traffic Management (UTM) enabled drone delivery system in Dallas, Texas. This initiative represents a scalable approach to drone delivery, emphasizing real-time, automated flight coordination .

Report Scope

Report Features Description Market Value (2024) USD 8.4 Bn Forecast Revenue (2034) USD 34.7 Bn CAGR (2025-2034) 15.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Fixed Wing, Rotary Blade, Hybrid), By Drone Type (Commercial, Civil, Military), By Application (Filming & Photography, Inspection & Maintenance, Mapping & Surveying, Precision Agriculture, Surveillance & Monitoring, Others), By End Use (Agriculture & Forestry, Delivery & Logistics, Media & Entertainment, Construction & Mining, Oil & Gas, Security & Law Enforcement, Recreational Activity, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Terra Drone Corporation, PrecisionHawk, Aerodyne Group, DroneDeploy, Cyberhawk Innovations Limited, Flytrex, Skyports, Aerobo, Measure, Sky Futures Ltd, AirMap, Inc., Heliguy, AgEagle Aerial Systems Inc., Delair, Agribotix LLC, Globhe Drones AB, Identified Technologies, Phoenix Drone Services LLC, Sharper Shape, Sky Features, Skylark Drone Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Drone Service Providers MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Drone Service Providers MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Terra Drone Corporation

- PrecisionHawk

- Aerodyne Group

- DroneDeploy

- Cyberhawk Innovations Limited

- Flytrex

- Skyports

- Aerobo

- Measure

- Sky Futures Ltd

- AirMap, Inc.

- Heliguy

- AgEagle Aerial Systems Inc.

- Delair

- Agribotix LLC

- Globhe Drones AB

- Identified Technologies

- Phoenix Drone Services LLC

- Sharper Shape

- Sky Features

- Skylark Drone