Global Maritime Drones Market Size, Share, Statistics Analysis Report By Type (Unmanned Aerial Vehicles (UAVs), Unmanned Surface Vehicles (USVs), Unmanned Underwater Vehicles (UUVs)), By Propulsion (Battery-Powered, Hybrid-Powered, Fuel-Powered), By Application (Surveillance & Monitoring, Search and Rescue, Inspection & Maintenance, Environmental Monitoring, Tactical Operations, Others), By End Users (Naval Forces, Ports & Terminals, Shipping Companies, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145244

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Government Led Investments

- U.S. Maritime Drones Market

- Type Analysis

- Propulsion Analysis

- Application Analysis

- End Users Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities For Players

- Recent Developments

- Report Scope

Report Overview

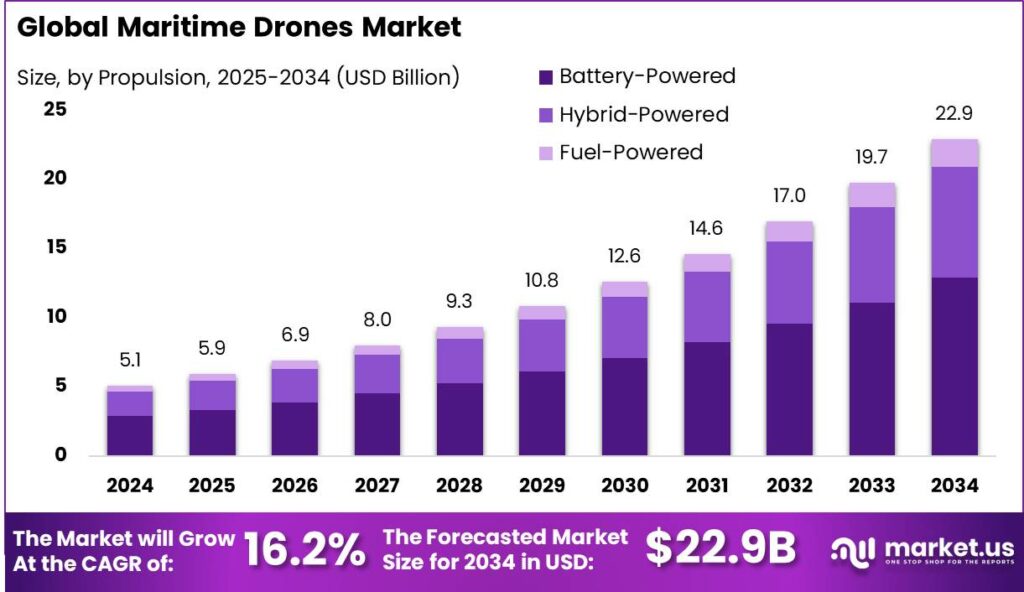

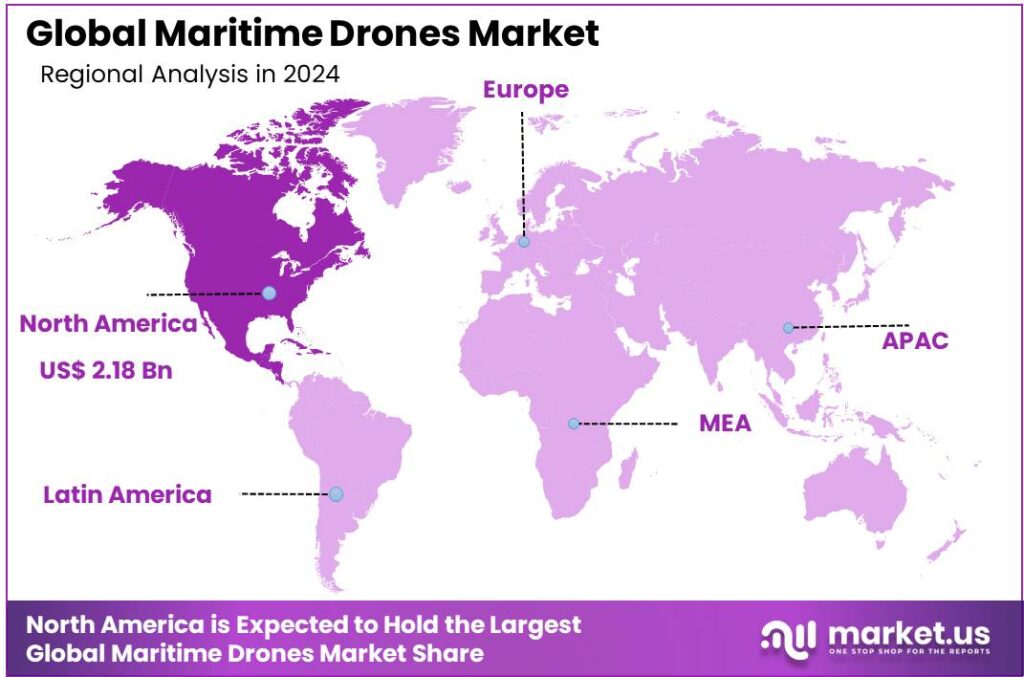

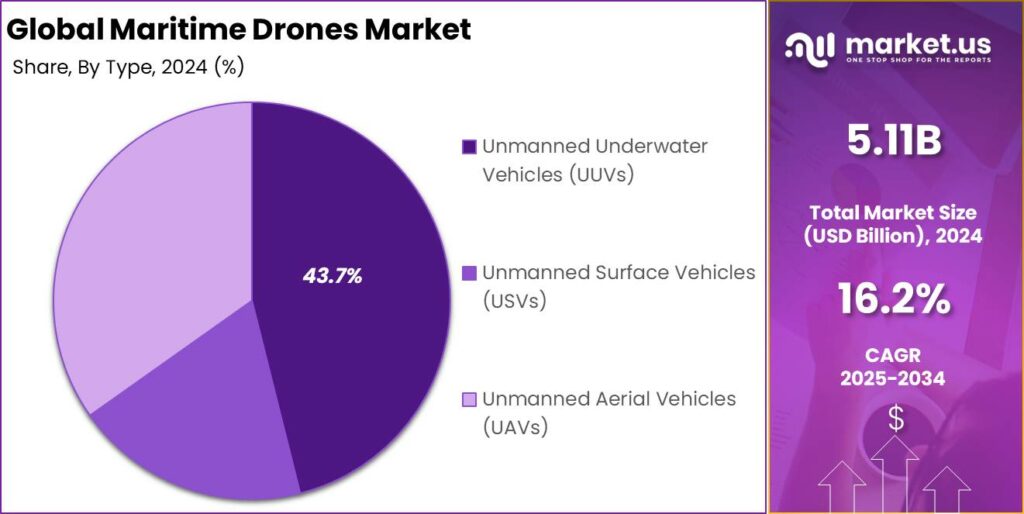

The Global Maritime Drones Market size is expected to be worth around USD 22.9 Billion By 2034, from USD 5.11 Billion in 2024, growing at a CAGR of 16.20% during the forecast period from 2025 to 2034. North America was the dominant region in the global maritime drones market in 2024, with a share exceeding 42.8%, which corresponds to a revenue of approximately USD 2.18 billion.

Maritime drones, also known as unmanned maritime systems, are robotic vehicles used for operations in marine environments. These drones include unmanned surface vehicles (USVs), unmanned underwater vehicles (UUVs), and autonomous underwater vehicles (AUVs), and are used for oceanographic research, environmental monitoring, maritime security, and resource exploration.

The maritime drones market is witnessing significant growth, fueled by the increasing demand for ocean data and advancements in drone technology. This market incorporates both military and commercial sectors, with a growing emphasis on sustainable maritime operations and enhanced security measures at sea.

The market is expanding due to rising geopolitical tensions and piracy threats, driving the need for efficient surveillance. Drones offer a cost-effective solution for continuous monitoring. Technological advancements in endurance, autonomy, and data collection are enabling more sophisticated applications in challenging marine environments.

Current trends in the maritime drone market include the development of autonomous operations, integration of artificial intelligence for improved data processing and decision-making, and the use of hybrid drone designs that offer versatility in operation modes. There is also a growing emphasis on cybersecurity measures to protect the data collected by maritime drones from potential threats.

Technologies enhancing the maritime drone market include advanced sensor packages, AI-powered analytics, and improved communication systems. These technologies enable drones to perform complex surveillance tasks with greater accuracy and less human intervention. The key reasons for adopting these technologies are to enhance the effectiveness of maritime operations, reduce costs, and minimize risks to human life during maritime security operations,

Accoridng to Market.us, The predictive maintenance market in the maritime sector is projected to grow from USD 433 million in 2024 to around USD 3,058 million by 2034, with a CAGR of 21.6% from 2025 to 2034. Additionally, the global maritime security market is anticipated to expand from USD 25.8 billion in 2023 to approximately USD 50.8 billion by 2033, growing at a CAGR of 7% from 2024 to 2033.

The growing scope of maritime drone applications creates numerous market opportunities. Innovations in drone technology are advancing oceanography, underwater infrastructure inspection, and automated shipping. Additionally, AI and machine learning developments are enhancing drone autonomy, making them essential tools for the maritime industry.

Key Takeaways

- The Global Maritime Drones Market size is projected to reach USD 22.9 Billion by 2034, up from USD 5.11 Billion in 2024, reflecting a CAGR of 16.20% during the forecast period from 2025 to 2034.

- In 2024, the Unmanned Underwater Vehicles (UUVs) segment led the maritime drones market, accounting for more than 43.7% of the total market share.

- In 2024, the Battery-Powered segment dominated the market, holding over 56.3% of the share.

- The Surveillance & Monitoring segment had a strong market position in 2024, capturing more than 26.4% of the market share.

- In 2024, the Ports & Terminals segment held the largest share in the market, accounting for over 32.1%.

- North America was the dominant region in the global maritime drones market in 2024, with a share exceeding 42.8%, which corresponds to a revenue of approximately USD 2.18 billion.

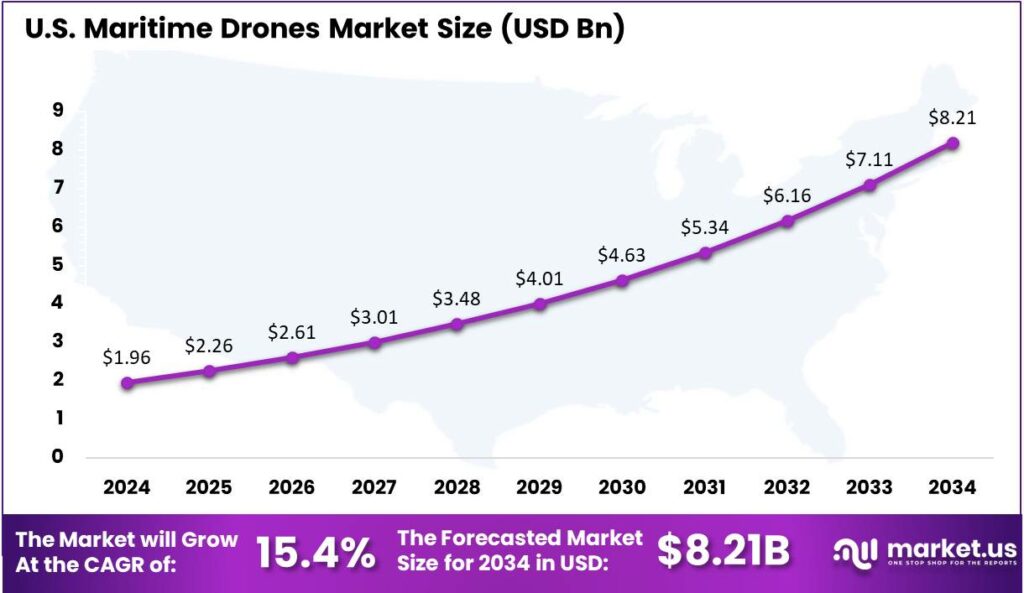

- The United States maritime drones market in 2024 was valued at USD 1.96 billion, with projections indicating a CAGR of 15.4% for the upcoming years.

Government Led Investments

- Japan’s SeaGuardian Drone Expansion: Japan announced plans to acquire 23 MQ-9B SeaGuardian drones by 2028, with the first deliveries expected in 2025. Each drone costs approximately $77 million, with an additional $164 million allocated for infrastructure. These aircraft will bolster 24-hour surveillance over the Sea of Japan and the Pacific, targeting illegal fishing and territorial disputes.

- India’s Swarm Drone Development: India advanced its autonomous underwater swarm drone projects for mine detection and reconnaissance. The ALFA-S air-launched swarms, deployable from aircraft, provide scalable surveillance over vast maritime zones. The AI-integrated drones analyze data in real time to detect smuggling, piracy, and unauthorized vessels. The initiative aims to cut naval patrol costs by 30-40% and enhance coastal security through collaboration with systems like the Coastal Surveillance Network.

- Maharashtra’s Fisheries Surveillance Project : In 2025, Maharashtra launched an 8-year drone surveillance project to monitor its coastline and fisheries, deploying 9 drones across 7 coastal districts. The project aims to enforce the Maharashtra Marine Fishing Regulation (Amendment) Act, 2021, prevent illegal fishing, and protect traditional fishing communities while enhancing maritime security. The 8+2 year lease covers drone monitoring and data systems, providing the department with real-time information on unauthorized fishing boats and evidence for enforcement.

U.S. Maritime Drones Market

In 2024, the market for maritime drones in the United States was estimated to be valued at $1.96 billion. It is projected to grow at a compound annual growth rate (CAGR) of 15.4% over the ensuing years. The U.S. maritime drone market is growing due to increased investments in maritime security and surveillance by both government and private sectors.

Drones are widely used for monitoring waters, search and rescue, and environmental monitoring. Technological advancements in endurance, range, and data processing have further enhanced their utility in maritime applications.

The market’s growth is driven by innovations like AI for autonomous operations and advanced imaging for improved data collection. Companies are also developing eco-friendly drones, aligning with sustainability trends. These advancements enhance drone efficiency and expand their applications to underwater surveying, oil spill monitoring, and climate research.

The U.S. maritime drone market is set for continued growth, fueled by the increasing adoption of drones for improved maritime domain awareness and cost-effective surveillance. The evolving regulatory landscape supporting the safe integration of unmanned systems into airspace and marine environments is expected to further drive market expansion.

In 2024, North America held a dominant market position in the global maritime drones market, capturing more than a 42.8% share. This translates to a revenue of approximately USD 2.18 billion. The region’s leading position is due to factors that support the widespread deployment and development of maritime drone technologies.

North America, especially the U.S., is home to leading tech firms and defense contractors driving innovations in drone technology, including automation, endurance, and data analytics. Significant investments in R&D from both public and private sectors have established the region as a global hub for maritime drone innovation.

The region’s market dominance is also bolstered by substantial government and defense expenditures in maritime security. The U.S. government, for instance, has launched several initiatives to enhance maritime surveillance and security, which include the use of unmanned systems to patrol maritime borders and engage in intelligence, surveillance, and reconnaissance (ISR) missions.

North America benefits from a well-established regulatory framework that supports the integration of drones into commercial and defense sectors. The regulatory environment, along with strategic partnerships between government agencies and private companies, accelerates advancements in drone technology. These collaborations focus on refining operational capabilities and improving effectiveness in complex maritime operations.

Type Analysis

In 2024, the Unmanned Underwater Vehicles (UUVs) segment held a dominant position in the maritime drones market, capturing more than a 43.7% share. This significant market share can be attributed to the extensive application of UUVs in critical sectors such as defense, environmental monitoring, and hydrography.

The UUV segment holds a leading position due to its crucial role in military and security operations, including mine countermeasures, surveillance, and reconnaissance. Their autonomous operation without risking human lives adds to their strategic value, driving significant government investments and ensuring continued growth and innovation.

UUVs are also key in environmental research, monitoring underwater ecosystems, pollution levels, and supporting climate change studies. The growing urgency to address environmental issues and understand global warming’s impact on marine life has led to increased funding, further driving their market dominance.

Advancements in UUV technology, including improved battery life, better data collection tools, and enhanced navigation systems, have expanded their applications. These upgrades increase efficiency, reduce costs, and enable UUVs to perform complex tasks autonomously, making them more attractive in the maritime drones market.

Propulsion Analysis

In 2024, the Battery-Powered segment held a dominant market position in the maritime drones market, capturing more than a 56.3% share. This segment’s leadership can be attributed to several key factors that align with the current demands and environmental standards of the industry.

Battery-powered maritime drones offer environmental benefits by operating without emitting greenhouse gases, making them ideal for sensitive marine environments. With growing focus on environmental conservation, these eco-friendly drones are becoming the preferred choice for organizations aiming to reduce their carbon footprint.

Advancements in battery technology have significantly boosted drone efficiency and capabilities. Improved battery life and energy density enable longer missions with less recharging, making battery-powered drones highly effective for maritime operations like surveillance, research, and data collection, covering larger areas without refueling.

Battery-powered drones, with lower operational and maintenance costs, have gained dominance in the market. Unlike fuel-powered drones, which require regular fuel replenishment, battery-powered drones offer a more cost-effective long-term solution, making them appealing to both governmental and non-governmental organizations involved in maritime monitoring and research.

Application Analysis

In 2024, the Surveillance & Monitoring segment held a dominant market position in the maritime drones market, capturing more than a 26.4% share. This leading position is driven by multiple factors that underscore the importance of application in maritime operations.

Advances in drone technology have significantly enhanced the capabilities of maritime drones in surveillance and monitoring tasks. Modern drones, equipped with high-resolution cameras, thermal imaging, and advanced sensors, provide real-time data over vast sea areas, enabling precise monitoring and swift responses to irregular activities, making them essential for maritime surveillance.

The growing regulatory support for the use of unmanned systems in national waters has also played a crucial role in the expansion of the Surveillance & Monitoring segment. Governments are framing policies that facilitate the deployment of maritime drones for national security and surveillance purposes, which in turn boosts market growth in this segment.

Maritime drones are increasingly being integrated into the national defense strategies of various countries. Maritime drones are crucial for border surveillance and protecting offshore assets like oil rigs, undersea cables, and port facilities. Their strategic role in national defense strengthens the Surveillance & Monitoring segment, ensuring its dominance in the market.

End Users Analysis

In 2024, the Ports & Terminals segment held a dominant position in the maritime drones market, capturing more than a 32.1% share. This leadership can be attributed to several pivotal factors.

Ports and terminals, key to global trade, require high efficiency and security. Maritime drones provide significant advantages in surveillance, inspection, and operational monitoring, improving security against unauthorized activities and boosting logistical efficiency.

The segment has witnessed substantial adoption of advanced technologies, including maritime drones, to manage expansive areas and monitor diverse activities such as cargo handling and vessel traffic. This trend is driven by the need to reduce operational costs and improve the throughput of shipping operations.

Ports and terminals are using drone technology to better comply with stringent maritime and environmental regulations. Drones offer a versatile solution for environmental monitoring and adherence to international standards. Their deployment enhances service delivery and operational capabilities, with ROI driven by reduced labor costs and improved risk management, justifying their widespread adoption.

Key Market Segments

By Type

- Unmanned Aerial Vehicles (UAVs)

- Unmanned Surface Vehicles (USVs)

- Unmanned Underwater Vehicles (UUVs)

By Propulsion

- Battery-Powered

- Hybrid-Powered

- Fuel-Powered

By Application

- Surveillance & Monitoring

- Search and Rescue

- Inspection & Maintenance

- Environmental Monitoring

- Tactical Operations

- Others

By End Users

- Naval Forces

- Ports & Terminals

- Shipping Companies

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increased Demand for Maritime Surveillance and Security

The escalating concerns over maritime security have significantly propelled the adoption of maritime drones. Unmanned Surface Vehicles (USVs) and Unmanned Underwater Vehicles (UUVs) are increasingly utilized for surveillance, reconnaissance, and patrolling of coastal and territorial waters.

These drones offer real-time data collection, extensive area coverage, and cost-effectiveness compared to traditional manned vessels. The U.S. Navy is quickly deploying new UUVs alongside submarines to refine technology. Vice Admiral Robert Gaucher noted testing with Virginia-class submarines and Remus UUV 600 in environments like Norwegian fjords.

This approach enables rapid design improvements through user feedback. The Navy has set up an underwater testing range in Keyport, Washington, to support these efforts. UUVs offer significant potential for extending mission ranges and reaching difficult areas, while being cost-effective and versatile with customizable payloads, energy sources, and propulsion systems.

Restraint

Regulatory Challenges and Compliance Issues

Despite promising prospects, the maritime drone market faces significant regulatory challenges. Strict regulations and compliance requirements for drone operations in maritime environments can hinder growth. Varying laws across countries regarding airspace and maritime zones create a complex regulatory landscape.

Other regulatory bodies frequently update their guidelines, creating uncertainty for companies investing in drone technology. Ensuring safe and legal operations in maritime areas requires coordination among multiple authorities, which can be complex and time-consuming.

Privacy concerns over drone surveillance raise ethical and legal questions that must be addressed. Ensuring compliance with existing regulations and creating clear guidelines for maritime drone operations will be key to overcoming these challenges and supporting market growth.

Opportunity

Technological Advancements in Autonomous Systems

The maritime drone market offers substantial opportunities for innovation and growth, driven by emerging applications and technological advancements. Improvements in drone technology, such as longer flight endurance, enhanced sensors, and autonomous capabilities, are accelerating market expansion.

Governments, coast guards, and maritime agencies are increasingly deploying drones for border surveillance, maritime patrols, and maritime domain awareness, driving the adoption of maritime drones worldwide.

As sustainability and environmental conservation gain focus, demand for drones in marine pollution monitoring, marine mammal research, and ecosystem mapping is growing. Drones’ ability to access remote and hazardous areas makes them ideal for conducting surveys and assessments in challenging marine environments.

Challenge

High Initial Investment and Maintenance Costs

One of the primary challenges hindering the growth of the maritime drone market is the high initial investment and maintenance costs associated with these technologies. The development and deployment of marine drones require substantial investment in technology and infrastructure, posing a barrier for smaller companies and startups. Additionally, maintaining these drones demands specialized skills and facilities, increasing operational costs.

Drones are rapidly deployed alongside submarines to gather feedback and refine technology iteratively. While this enables quick design improvements, it requires significant investment in testing facilities and equipment, such as the Navy’s underwater range in Keyport, Washington. Balancing the benefits of advanced maritime drones with their costs remains a major challenge for industry stakeholders.

Emerging Trends

- Adoption of Unmanned Surface Vessels (USVs): Navies worldwide are integrating USVs into their fleets to enhance surveillance, reconnaissance, and combat capabilities. For instance, the U.S. Navy is developing autonomous warships capable of executing diverse missions with reduced costs and risks.

- Development of Drone Swarm Technologies: The concept of deploying coordinated groups of drones, known as swarms, is gaining traction. Sweden is accelerating the development of AI-powered drone swarms for surveillance and attack missions, aiming to bolster NATO’s defenses.

- Integration of Advanced Navigation Systems: Ensuring reliable navigation for autonomous maritime drones, especially in GPS-denied environments. The U.S. Navy is exploring technologies that enable uncrewed platforms to operate effectively without satellite navigation.

- Emergence of Drone Carriers: Naval forces are developing vessels specifically designed to deploy and recover drones. Turkey’s TCG Anadolu, for example, has been adapted to operate Bayraktar TB3 UAVs, marking a significant shift in naval aviation.

- Focus on Counter-Drone Measures: As drone usage increases, so does the need for effective countermeasures. Technologies such as quantum radars are being developed to detect and neutralize unauthorized drones, enhancing maritime security.

Business Benefits

- Enhanced Safety: Drones can perform hazardous tasks such as inspections and surveillance in challenging conditions without risking human lives. For example, they can operate in storms or rough seas, reducing the need for personnel to be exposed to dangerous environments.

- Cost Efficiency: Utilizing drones for inspections and deliveries can lead to significant cost savings by minimizing the need for expensive manned operations and reducing downtime. This efficiency is particularly beneficial in offshore industries where traditional methods are costly and time-consuming.

- Improved Data Collection: Equipped with advanced sensors, drones can capture high-resolution images and videos, providing precise data for analysis. This capability allows for early detection of structural issues, enhancing maintenance and operation plans.

- Operational Efficiency: Drones can swiftly navigate through congested port areas and tight spaces, facilitating quicker inspections and deliveries. Their adaptability enhances the agility of maritime operations, leading to improved overall efficiency.

- Environmental Monitoring: Drones assist in environmental reconnaissance by monitoring marine ecosystems and detecting pollution. This application supports compliance with environmental regulations and promotes sustainable maritime practices.

Key Player Analysis

Key market players are focusing on advancing drone capabilities to meet various maritime needs, with technology driving their strategies.

Textron Inc. is a major player in the maritime drone market, known for its innovative unmanned systems. The company has developed a range of drones that cater to various maritime applications, from military defense to environmental monitoring. Textron’s maritime drones are highly regarded for their reliability and advanced features, such as long endurance and real-time data transmission.

General Atomics Aeronautical Systems is another key player in the maritime drone industry. The company has earned a reputation for producing cutting-edge unmanned aerial systems (UAS) that are capable of operating in complex maritime environments. Their Predator B and MQ-9 drones are particularly popular for maritime surveillance and reconnaissance tasks.

AeroVironment, Inc. is a leading innovator in the unmanned systems industry, with a strong focus on maritime drones. The company’s maritime drones are widely used in defense and security operations, providing critical support for naval forces. AeroVironment’s products, such as the Puma 3 and Wasp AE drones, are known for their portability, high performance, and versatility in various maritime applications.

Top Key Players in the Market

- Textron Inc.

- General Atomics Aeronautical Systems

- AeroVironment, Inc.

- Lockheed Martin Corporation

- Boeing

- Elbit Systems Ltd.

- Northrop Grumman Corporation

- Thales Group

- Saab Group

- Airbus

- Other Major Players

Top Opportunities For Players

- Expansion into Commercial Applications: Beyond traditional defense and security roles, maritime drones are increasingly being utilized in commercial sectors such as environmental monitoring, hydrographic surveys, and commercial shipping. This diversification opens new revenue streams and broadens the market base.

- Technological Advancements: Continuous improvements in drone technology, such as enhanced sensor capabilities, AI-powered analytics, and autonomous operations, are propelling the market forward. These advancements improve operational efficiency and open up new applications in maritime surveillance and reconnaissance.

- Regulatory Developments: As regulatory frameworks around drone operations evolve, there are significant opportunities for market growth. Clearer regulations can facilitate safer and more efficient drone operations, reducing barriers to entry and accelerating adoption across various maritime environments.

- Hybrid and Autonomous Systems: The development of hybrid drones that combine the endurance and range of fixed-wing drones with the maneuverability of rotary drones offers versatile solutions for complex maritime tasks. Moreover, the trend towards fully autonomous drones enhances capabilities for extensive and remote operations without human intervention on-site.

- Collaboration and Integration: There is a growing trend towards collaborative operations and integration of drones with other maritime surveillance systems, including satellites and manned aircraft. This integration enhances the overall effectiveness of maritime security systems, offering comprehensive coverage and improved response strategies.

Recent Developments

- In October 2024, Airbus unveiled the VSR700 naval helicopter drone at Euronaval 2024, featuring advanced anti-submarine warfare capabilities, designed to fulfill the demanding requirements of global navies.

- In November 2024, AeroVironment announced plans to acquire BlueHalo, a company recognized for its drone swarm and counter-drone technologies, in an all-stock transaction valued at approximately $4.1 billion.

Report Scope

Report Features Description Market Value (2024) USD 5.11 Bn Forecast Revenue (2034) USD 22.9 Bn CAGR (2025-2034) 16.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Unmanned Aerial Vehicles (UAVs), Unmanned Surface Vehicles (USVs), Unmanned Underwater Vehicles (UUVs)), By Propulsion (Battery-Powered, Hybrid-Powered, Fuel-Powered), By Application (Surveillance & Monitoring, Search and Rescue, Inspection & Maintenance, Environmental Monitoring, Tactical Operations, Others), By End Users (Naval Forces, Ports & Terminals, Shipping Companies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Textron Inc., General Atomics Aeronautical Systems, AeroVironment, Inc., Lockheed Martin Corporation, Boeing, Elbit Systems Ltd., Northrop Grumman Corporation, Thales Group, Saab Group, Airbus, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Textron Inc.

- General Atomics Aeronautical Systems

- AeroVironment, Inc.

- Lockheed Martin Corporation

- Boeing

- Elbit Systems Ltd.

- Northrop Grumman Corporation

- Thales Group

- Saab Group

- Airbus

- Other Major Players