Global DNA Methylation Market By Product Type (Consumables, Kits & Reagents, Instruments & Software and Enzymes), By Technology (Polymerase Chain Reaction (PCR), Sequencing, Microarray and Others), By Application (Gene Therapy, Diagnostics, Clinical Research and Others), By End-user (Pharmaceutical & Biotechnology Companies, Hospital & Diagnostic Laboratories and Research & Academic Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 176020

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

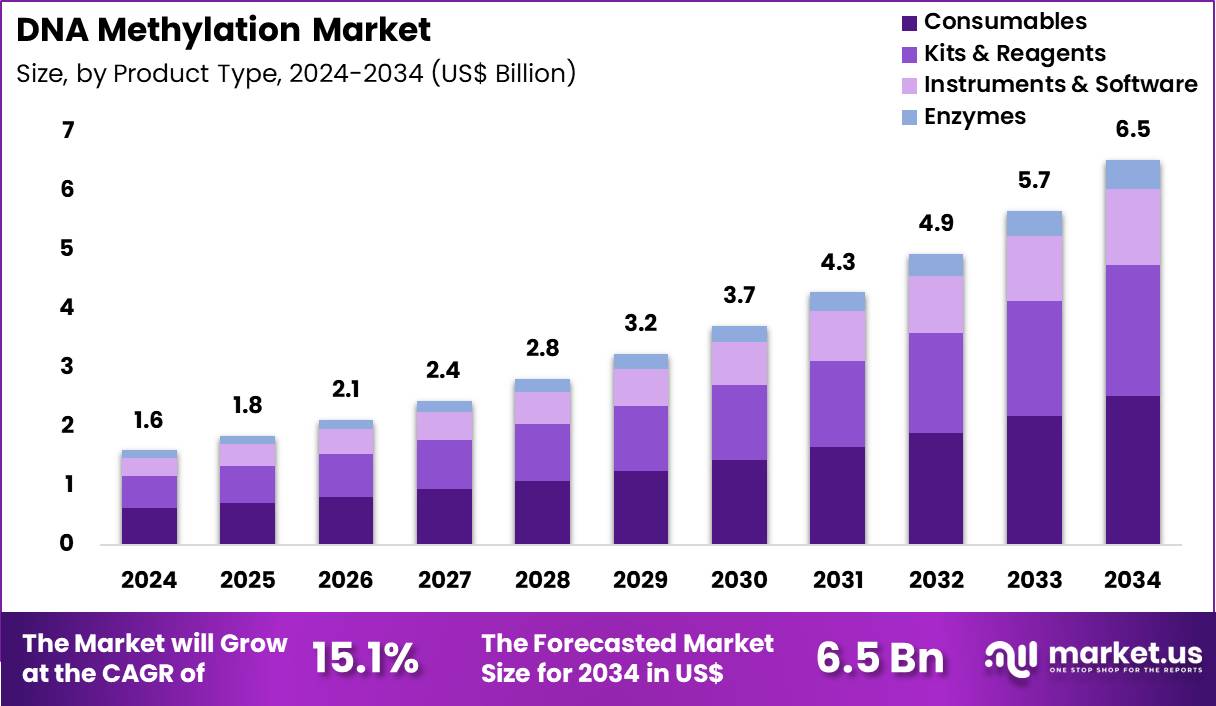

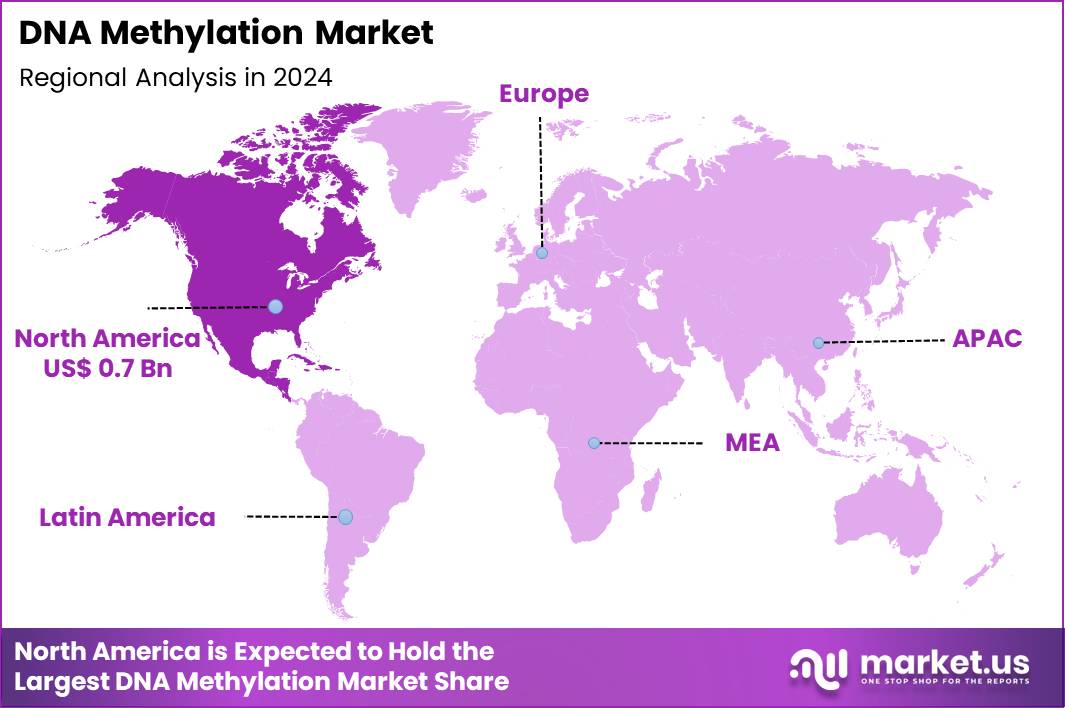

Global DNA Methylation Market size is expected to be worth around US$ 6.5 Billion by 2034 from US$ 1.6 Billion in 2024, growing at a CAGR of 15.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.7% share with a revenue of US$ 0.7 Billion.

Increasing demand for epigenetic insights in precision medicine propels the DNA methylation market as researchers and clinicians harness methylation profiling to uncover disease mechanisms and therapeutic targets. Oncologists apply bisulfite sequencing to detect hypermethylated tumor suppressor genes in colorectal and lung cancers, enabling early diagnosis through circulating tumor DNA analysis with high sensitivity.

These techniques support drug discovery by identifying methylation signatures that predict response to demethylating agents like azacitidine in myelodysplastic syndromes. Laboratories utilize array-based platforms for genome-wide methylation scans in neurodegenerative disorders, revealing altered patterns in Alzheimer’s disease that guide neuroprotective interventions.

Transcriptomics integrates methylation data to study immune cell differentiation, informing immunotherapy strategies in autoimmune conditions. In April 2025, in the United States, EpiCypher introduced CUTANA meCUT&RUN and Multiomic CUT&RUN, a new set of budget-friendly DNA methylation sequencing assays. These solutions support scalable, high-resolution epigenomic analysis, making them suitable for both drug discovery programs and academic research workflows.

Manufacturers pursue opportunities to develop single-molecule long-read sequencing for phased methylation detection, expanding applications in developmental biology to map imprinting disorders and embryonic gene regulation.

Developers advance CRISPR-based epigenetic editors that target specific methylation sites, broadening utility in regenerative medicine for stem cell reprogramming. These innovations facilitate liquid biopsy advancements, where methylation panels achieve over 90% accuracy in multi-cancer early detection as demonstrated in recent clinical studies.

Opportunities emerge in AI-driven classifiers that analyze methylation arrays for prognostic biomarkers in prostate and breast cancers, accelerating companion diagnostic development. Companies invest in portable nanopore devices for field-deployable methylation profiling in infectious disease surveillance, detecting pathogen-host epigenetic interactions. Recent trends emphasize multi-omics integration with methylation data, enhancing pharmacoepigenomics to personalize treatments in hematologic malignancies and solid tumors.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.6 Billion, with a CAGR of 15.1%, and is expected to reach US$ 6.5 Billion by the year 2034.

- The product type segment is divided into consumables, kits & reagents, instruments & software and enzymes, with consumables taking the lead with a market share of 38.6%.

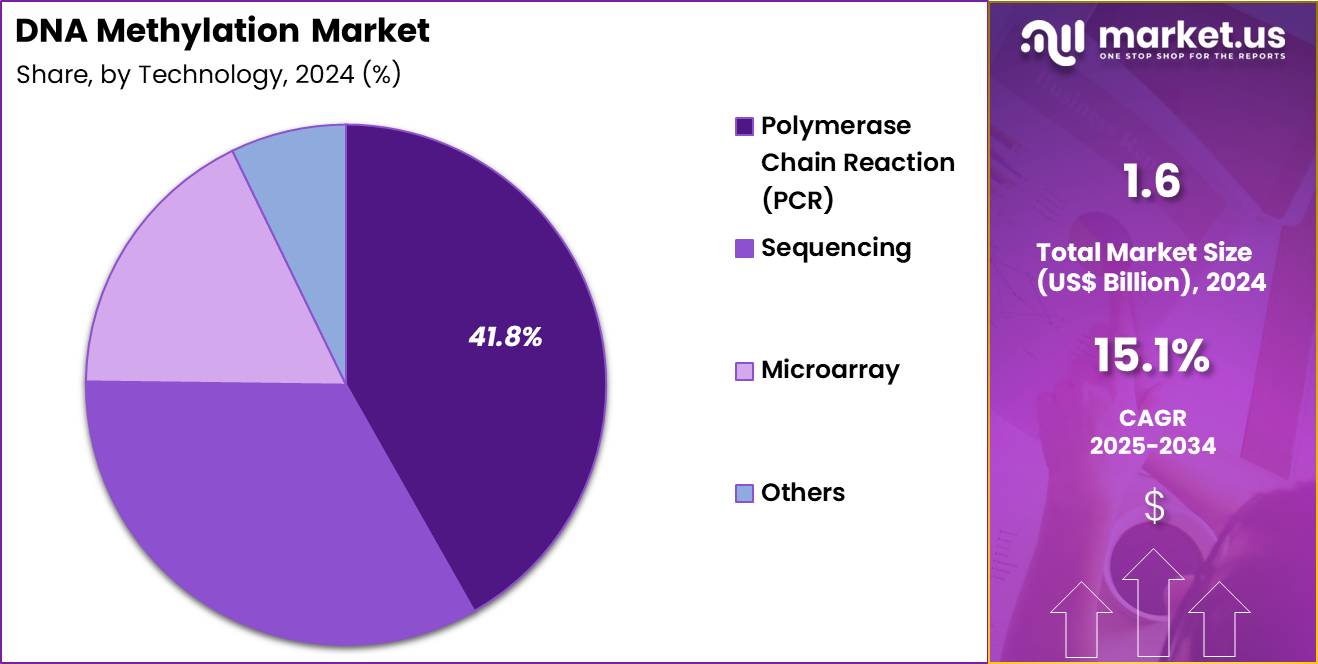

- Considering technology, the market is divided into polymerase chain reaction (PCR), sequencing, microarray and others. Among these, polymerase chain reaction (PCR) held a significant share of 41.8%.

- Furthermore, concerning the application segment, the market is segregated into gene therapy, diagnostics, clinical research and others. The gene therapy sector stands out as the dominant player, holding the largest revenue share of 36.9% in the market.

- The end-user segment is segregated into pharmaceutical & biotechnology companies, hospital & diagnostic laboratories and research & academic institutes, with the pharmaceutical & biotechnology companies segment leading the market, holding a revenue share of 44.7%.

- North America led the market by securing a market share of 42.7%.

Product Type Analysis

Consumables contributed 38.6% of growth within product type and led the DNA methylation market due to their continuous usage across routine testing, assay preparation, and large-scale epigenetic workflows. Laboratories depend on consumables such as reaction buffers, columns, plates, and assay-ready components because every experiment requires fresh inputs. Rising sample volumes in oncology, developmental biology, and rare disease studies increase repeat purchasing frequency.

Research programs prioritize consumables since they scale easily without major capital investment and support high-throughput processing across multiple studies. Growth also accelerates as clinical research adopts standardized methylation protocols that rely on validated consumable sets. Pharmaceutical research teams expand screening activity during target validation, which raises batch consumption rates.

Contract research organizations handle growing outsourced workloads, further increasing turnover. Quality and reproducibility requirements push labs toward premium consumables with consistent performance. The segment is projected to demonstrate sustained dominance as epigenetic testing volumes expand across both clinical and translational research environments.

Technology Analysis

Polymerase chain reaction accounted for 41.8% of growth within technology and dominated the DNA methylation market due to its high sensitivity, fast turnaround time, and compatibility with targeted analysis. PCR-based methylation methods allow precise detection of low-abundance markers, which supports biomarker validation and early-stage research.

Laboratories favor PCR because it integrates smoothly with existing workflows and requires limited retraining. Cost efficiency compared to sequencing strengthens adoption among mid-sized and clinical laboratories. The segment benefits further from expanding cancer screening research and methylation-based diagnostic development.

Digital PCR improvements enhance quantitative accuracy, increasing confidence in longitudinal studies. Pharmaceutical teams rely on PCR to rapidly test epigenetic hypotheses during drug discovery. Multiplexing capabilities reduce per-sample costs while increasing throughput. PCR is anticipated to remain the preferred technology as researchers prioritize speed, reliability, and operational simplicity in methylation analysis.

Application Analysis

Gene therapy generated 36.9% of growth within application and emerged as the leading contributor as developers focus on epigenetic control of long-term gene expression. DNA methylation analysis plays a critical role in understanding transgene regulation, durability, and silencing risks. Researchers use methylation profiling to refine vector design and optimize therapeutic stability.

Increasing investment in rare disease and oncology gene therapy programs strengthens reliance on epigenetic characterization. Regulatory scrutiny further drives demand as developers must demonstrate controlled gene expression over extended periods. Methylation data supports patient stratification and treatment response monitoring.

Academic-industry collaborations accelerate translational research that integrates epigenetics into therapeutic pipelines. Precision medicine strategies rely on epigenetic markers to guide therapy design. The segment is projected to expand as gene therapy pipelines mature and move deeper into clinical development.

End-User Analysis

Pharmaceutical and biotechnology companies contributed 44.7% of growth within end-user and dominated the DNA methylation market due to their heavy investment in epigenetic research and drug development. These organizations integrate methylation analysis early in discovery to identify regulatory targets and validate mechanisms of action. Oncology-focused pipelines rely on epigenetic insights to support targeted therapy design. Internal research teams favor scalable methylation platforms to support multi-project workflows.

Growth strengthens as companies develop companion diagnostics and precision medicine programs that depend on epigenetic biomarkers. Regulatory submissions increasingly require molecular evidence supporting therapeutic rationale. Biotechnology startups focus on niche methylation pathways to differentiate pipelines, increasing specialized assay demand.

Expansion of global R&D hubs raises testing volumes across regions. The segment is expected to remain the primary growth engine due to sustained funding, innovation intensity, and long development cycles in biopharma research.

Key Market Segments

By Product Type

- Consumables

- Kits & Reagents

- Instruments & Software

- Enzymes

By Technology

- Polymerase Chain Reaction (PCR)

- Sequencing

- Microarray

- Others

By Application

- Gene Therapy

- Diagnostics

- Clinical Research

- Others

By End-user

- Pharmaceutical & Biotechnology Companies

- Hospital & Diagnostic Laboratories

- Research & Academic Institutes

Drivers

Increasing prevalence of cancer is driving the market.

The escalating number of cancer diagnoses worldwide has heightened the need for epigenetic tools like DNA methylation analysis in diagnostics and research. Improved screening programs and demographic shifts contribute to this rise, expanding the application of methylation-based biomarkers for early detection.

According to the World Health Organization, there were approximately 20 million new cancer cases globally in 2022. This statistic emphasizes the urgent demand for precise molecular profiling to guide personalized therapies. DNA methylation patterns serve as reliable indicators for tumor classification and prognosis in various malignancies.

Healthcare institutions are increasingly incorporating these analyses into clinical workflows to improve patient outcomes. The link between aberrant methylation and oncogenesis drives investment in related technologies. Leading organizations prioritize methylation studies to address this public health challenge. This driver accelerates product development by key industry participants. Overall, the cancer burden propels sustained market advancement in epigenetic solutions.

Restraints

High technical complexity and standardization issues are restraining the market.

The intricate nature of DNA methylation assays requires specialized expertise, limiting accessibility in standard laboratories. Variations in sample preparation and data interpretation pose challenges to consistent results across studies. Regulatory demands for validation add layers of complexity to product commercialization.

Smaller facilities often lack the infrastructure for advanced sequencing platforms used in methylation profiling. Pre-analytical factors, such as DNA degradation, further complicate reliable biomarker detection. The absence of universal protocols hinders inter-laboratory comparability and adoption. This restraint slows integration into routine clinical practice.

Industry efforts to simplify workflows aim to address these barriers gradually. Despite scientific potential, technical hurdles impede rapid market expansion. Consequently, standardization remains essential for overcoming these limitations.

Opportunities

Advancements in liquid biopsy applications are creating growth opportunities.

The shift toward non-invasive sampling methods opens pathways for DNA methylation analysis in circulating cell-free DNA from blood or urine. Enhanced sensitivity in detecting tumor-specific methylation signatures supports early cancer screening programs. Local biofluids, such as bile or cerebrospinal fluid, offer higher concentrations for specific malignancies. Integrated multi-omics approaches combine methylation with genetic data for comprehensive diagnostics.

Government initiatives for precision medicine bolster funding for liquid biopsy research. Collaborations between diagnostics firms and clinical centers facilitate validation of new panels. This opportunity enables broader access in resource-limited settings.

Key developers are optimizing assays for low-input samples to capitalize on this area. Overall, liquid biopsies align with demands for minimally invasive monitoring. Strategic focus can enhance market reach in oncology and beyond.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions shape the DNA methylation market through funding cycles, trade flows, and research spending priorities, and executives see both pressure points and upside. Inflation and higher interest rates tighten budgets for academic labs and smaller biotech firms, which slows equipment upgrades and delays some epigenetics projects.

At the same time, steady public health spending and sustained oncology and rare disease research keep baseline demand resilient. Current US tariffs on imported lab instruments, reagents, and precision components raise input costs for service providers and kit manufacturers, which compresses margins and pushes selective price increases. Geopolitical tensions also disrupt supply chains for enzymes, sequencing consumables, and specialty chemicals, creating longer lead times and procurement risk.

On the positive side, these constraints encourage domestic sourcing, supplier diversification, and investment in local manufacturing capacity. Companies respond by optimizing workflows, adopting automation, and prioritizing high-value clinical and translational studies. Overall, disciplined cost management, strong innovation pipelines, and growing clinical relevance position the market to absorb shocks and continue expanding with confidence.

Latest Trends

Development of enzymatic methylation sequencing methods is a recent trend in the market.

In 2024, enzymatic methyl-sequencing emerged as a preferred alternative to traditional bisulfite conversion, preserving DNA integrity for cell-free samples. These methods employ enzymes like TET and APOBEC3A to achieve high-resolution profiling with reduced fragmentation. Clinical studies highlighted their utility in hepatocellular carcinoma detection using low-input circulating DNA.

Regulatory progress supported adoption in multi-cancer panels for improved specificity. Industry leaders integrated these techniques into high-throughput workflows for biomarker discovery. The trend addresses limitations in sequence bias and recovery rates from prior approaches. Research in 2024 demonstrated enhanced distinction between 5-methylcytosine and 5-hydroxymethylcytosine.

Partnerships advanced library preparation kits tailored for enzymatic conversion. This evolution enhances efficiency in epigenetic research applications. These innovations position enzymatic sequencing as key for future diagnostic advancements.

Regional Analysis

North America is leading the DNA Methylation Market

North America commands a 42.7% share of the global DNA methylation market, reflecting substantial growth in 2024 driven by intensified research and technological advancements in epigenetics. Key players such as Illumina and Thermo Fisher Scientific have expanded their portfolios with innovative sequencing tools, enabling more precise detection of methylation patterns for applications in oncology and personalized medicine.

The region’s robust healthcare infrastructure, coupled with high investments in biotechnology, has accelerated the adoption of DNA methylation assays in clinical diagnostics and drug development. Government initiatives, particularly through the National Institutes of Health, have bolstered this expansion by funding large-scale projects that integrate methylation analysis into disease studies.

A surge in cancer prevalence has heightened demand for epigenetic biomarkers, as methylation alterations serve as critical indicators for early detection and targeted therapies. Collaborations between academic institutions and industry leaders have further propelled innovation, resulting in new patents and commercial products.

Additionally, favorable regulatory environments, including expedited FDA reviews for methylation-based tests, have facilitated market entry and widespread utilization. According to NIH data, the agency granted over $4.5 billion to epigenetics-related projects in 2024, underscoring the financial commitment fueling this growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Researchers anticipate robust expansion in the Asia Pacific epigenetics sector during the forecast period, as governments actively invest in biotechnology infrastructure to advance precision medicine. Key countries like China and India drive this momentum by launching national programs that prioritize genomic research and foster collaborations with international firms.

Biotech startups in the region attract significant capital, enabling the development of affordable methylation detection kits tailored for local healthcare needs. Academic institutions expand their capabilities through state-sponsored labs, accelerating discoveries in cancer epigenomics and other chronic diseases.

Industry leaders establish regional hubs to tap into growing demand for diagnostic tools, while rising awareness among clinicians boosts adoption rates. Economic growth in emerging markets supports increased healthcare spending, which in turn stimulates innovation in sequencing technologies.

International partnerships enhance knowledge transfer, positioning the area as a hub for epigenetic applications. Biotechnology startups in Asia secure nearly $3.5 billion in investments over the 2022-2024 period, marking a 140% increase driven by government support.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the DNA Methylation market pursue growth through focused product innovation, selective acquisitions, and steady funding of high-precision genomic tools that improve analytical depth and turnaround time. They actively form collaborations with pharmaceutical firms and research institutions to secure long-term demand from drug discovery and clinical research programs.

Companies also strengthen revenue streams by offering integrated ecosystems that combine reagents, instruments, and data analysis software under a single commercial framework. Strategic geographic expansion into emerging research hubs supports volume growth while balancing mature-market saturation.

Thermo Fisher Scientific operates as a diversified life sciences leader with a strong emphasis on scalable epigenetic research solutions and global customer reach. The company reinforces its position through disciplined capital allocation, continuous technology upgrades, and a commercialization strategy aligned with evolving research and diagnostic needs.

Top Key Players

- Illumina Inc.

- Thermo Fisher Scientific

- Agilent Technologies

- QIAGEN

- Roche Diagnostics

- Merck KGaA

- Bio-Rad Laboratories

- New England Biolabs

- Zymo Research

- Pacific Biosciences

Recent Developments

- In April 2025, Agilent presented its advanced multiomic cancer research portfolio in the US, emphasizing NGS-driven DNA and methylation panels alongside automated hematology testing platforms. The showcase also underscored Agilent’s strategic partnerships with Tagomics and Abcam to expand multiomic research capabilities.

- In April 2024, NEB unveiled the Monarch Mag Viral DNA/RNA Extraction Kit, designed to enhance recovery of low-abundance viral genetic material. Using a magnetic bead–based workflow, the kit delivers consistent and efficient extraction of viral DNA and RNA while supporting straightforward automation for high-throughput applications.

Report Scope

Report Features Description Market Value (2024) US$ 1.6 Billion Forecast Revenue (2034) US$ 6.5 Billion CAGR (2025-2034) 15.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Consumables, Kits & Reagents, Instruments & Software and Enzymes), By Technology (Polymerase Chain Reaction (PCR), Sequencing, Microarray and Others), By Application (Gene Therapy, Diagnostics, Clinical Research and Others), By End-user (Pharmaceutical & Biotechnology Companies, Hospital & Diagnostic Laboratories and Research & Academic Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Illumina Inc., Thermo Fisher Scientific, Agilent Technologies, QIAGEN, Roche Diagnostics, Merck KGaA, Bio-Rad Laboratories, New England Biolabs, Zymo Research, Pacific Biosciences Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Illumina Inc.

- Thermo Fisher Scientific

- Agilent Technologies

- QIAGEN

- Roche Diagnostics

- Merck KGaA

- Bio-Rad Laboratories

- New England Biolabs

- Zymo Research

- Pacific Biosciences