Global Disposable Hygiene Products Market By Distribution Channel (Supermarkets & Hypermarkets, Pharmacy Stores & Drugstores, E-commerce websites, Convenience Stores, Online Stores, Personal care stores), By End-User (Babies, Women, Men, Elderly), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 105049

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Disposable Hygiene Products Market size is expected to be worth around USD 364.2 Billion by 2033, From USD 186.9 Billion by 2023, growing at a CAGR of 6.9% during the forecast period from 2024 to 2033.

Disposable hygiene products encompass a range of items designed for one-time use to maintain cleanliness and personal hygiene. These products include adult diapers, sanitary pads, wet wipes, tissue papers, and incontinence products.

The disposable hygiene products market refers to the comprehensive industry involved in the production, distribution, and sale of these goods, crucial for consumer health and wellness.

Growth factors for this market can be attributed to increasing health awareness, rising disposable incomes, and global population growth, which enhance the demand for personal hygiene products.

The demand for disposable hygiene products is driven by the ongoing need for convenient, effective hygiene solutions, particularly in urban areas and developing regions.

Opportunities within this market are expanding through innovation in biodegradable and eco-friendly products, catering to the rising consumer preference for sustainability.

The Disposable Hygiene Products market is experiencing significant shifts driven by evolving consumer preferences and heightened awareness of environmental issues. The demand for these products is sustained by the essential nature of menstrual hygiene products, which are used by nearly 2 billion people who menstruate monthly. However, the market faces considerable challenges related to environmental impact and social inequities.

According to data from sustainablebrands.com, disposable menstrual products are a notable yet often overlooked contributor to global plastic waste, with over 12 billion such items used annually. This consumption results in around 200,000 tons of plastic waste each year, underscoring the urgent need for sustainable product solutions.

Additionally, unfpa.org highlights that gender inequality, poverty, and other forms of marginalization severely restrict access to menstrual products. These issues become even more pronounced in humanitarian crises, where access to essential hygiene products can be critically limited.

The market is poised for transformation. There is a burgeoning opportunity for innovation in biodegradable and reusable products that address environmental concerns while improving accessibility. Companies venturing into sustainable product alternatives are likely to gain competitive advantages by aligning with consumer trends towards eco-friendliness and social responsibility.

Moreover, there is a clear opportunity for stakeholders to enhance market reach and brand loyalty through initiatives that increase product access during crises, thereby addressing both market demand and social equity.

Key Takeaways

- The Global Disposable Hygiene Products Market size is expected to be worth around USD 364.2 Billion by 2033, From USD 186.9 Billion by 2023, growing at a CAGR of 6.9% during the forecast period from 2024 to 2033.

- In 2023, Baby Care Products held a dominant market position in the By Product Type segment of the Disposable Hygiene Products Market, with a 41.2% share.

- In 2023, Supermarkets & Hypermarkets held a dominant market position in the By Distribution Channel segment of the Disposable Hygiene Products Market, with a 43.4% share.

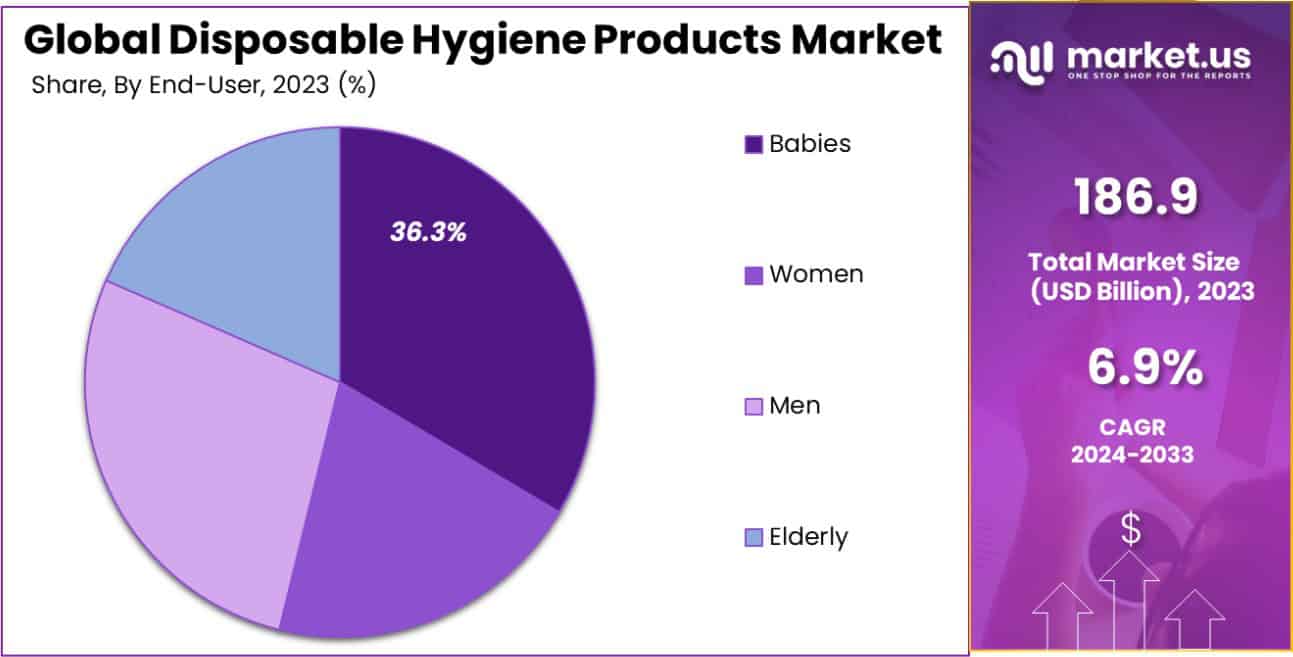

- In 2023, Babies held a dominant market position in the end-user segment of the Disposable Hygiene Products Market, with a 36.3% share.

- Asia Pacific dominated a 39.4% market share in 2023 and held USD 73.6 Billion in revenue from the Disposable Hygiene Products Market.

By Product Type Analysis

In 2023, Baby Care Products held a dominant market position in the By Product Type segment of the Disposable Hygiene Products Market, with a 41.2% share. This category encompasses Diapers, Training Nappies, and Baby Wipes, each essential for daily childcare routines.

The substantial market share is driven by the consistent demand from an increasing global birth rate and a heightened focus on child hygiene and convenience by parents worldwide.

Following closely, Adult Incontinence Products, which include Underpads, Pads and Liners, Protective Underwear, Briefs, and Wipes, captured a significant portion of the market. These products are increasingly in demand due to the aging population in many countries and growing awareness and acceptance of these solutions for managing incontinence.

The Feminine Care segment also plays a crucial role in the Disposable Hygiene Products Market. This segment comprises Menstrual Cups, Sanitary Pads, Tampons, Panty Liners, and Wipes. Despite facing environmental scrutiny, the persistent need for feminine hygiene products, driven by efforts to combat period poverty and increase product accessibility, supports steady market growth.

Innovations such as biodegradable products and subscription services are revitalizing this category, aligning with the shifting consumer preference towards sustainability and convenience.

By Distribution Channel Analysis

In 2023, Supermarkets & Hypermarkets held a dominant market position in the By Distribution Channel segment of the Disposable Hygiene Products Market, with a 43.4% share. These venues are preferred by consumers for their wide range of product availability, competitive pricing, and the convenience of one-stop shopping for diverse household needs, including baby care, feminine care, and adult incontinence products.

Pharmacy Stores & Drugstores also command a substantial market presence, offering specialized products and benefitting from consumer trust in pharmacists for product recommendations and health advice.

E-commerce websites have shown rapid growth, driven by the increasing consumer preference for online shopping, which provides ease of access, home delivery, and often more detailed product information and reviews.

Convenience Stores and Personal Care Stores also contribute to the distribution landscape, catering to immediate and localized consumer needs with faster shopping options and proximity advantages.

Online Stores, distinct from broader e-commerce platforms, focus specifically on health and personal care products, offering subscription services and customer loyalty programs that enhance consumer retention and satisfaction by providing tailored shopping experiences and product customization.

By End-User Analysis

In 2023, Babies held a dominant market position in the By End-User segment of the Disposable Hygiene Products Market, with a 36.3% share. This segment benefits from the continuous demand for baby hygiene products such as diapers, training nappies, and baby wipes, driven by the global birth rate and increasing consumer awareness about baby health and hygiene. Parents’ growing preference for convenient and disposable products that ensure cleanliness and comfort for infants underpins this segment’s strength.

Women are also a significant end-user category, utilizing products such as sanitary pads, tampons, panty liners, and specialized wipes. This segment’s demand is bolstered by a growing focus on feminine hygiene, products along with efforts to address and reduce the stigma associated with menstruation.

Men’s market involvement is expanding, particularly in areas like male incontinence products, which include guards and shields tailored for men. This reflects broader social changes towards greater awareness and acceptance of male-specific hygiene needs.

The Elderly segment, including products like adult diapers and underpads, caters to an aging global population. Increased life expectancy and better healthcare have led to a higher demand for products that assist in managing incontinence and promoting dignity and quality of life for the elderly.

Key Market Segments

By Product Type

- Baby Care Products

- Diapers

- Training Nappies

- Baby Wipes

- Adult Incontinence Products

- Underpads

- Pads and Liners

- Protective Underwear

- Briefs

- Wipes

- Feminine Care

- Menstrual Cups

- Sanitary Pads

- Tampons

- Panty Liners

- Wipes

By Distribution Channel

- Supermarkets & Hypermarkets

- Pharmacy Stores & Drugstores

- E-commerce websites

- Convenience Stores

- Online Stores

- Personal care stores

By End-User

- Babies

- Women

- Men

- Elderly

Drivers

Key Drivers in Disposable Hygiene Market

The Disposable Hygiene Products market is primarily driven by increasing global awareness about personal hygiene and the growing global population, which consistently boosts the demand for these products.

As an analyst, it’s evident that rising incomes across developing nations are making hygiene products more accessible to larger segments of the population, thus expanding the market base. Additionally, innovations in product comfort, effectiveness, and eco-friendliness are attracting consumers who seek quality and sustainability.

The ongoing advancements in product technology, such as ultra-absorbent materials and skin-friendly fabrics, are also pivotal in driving consumer preference and loyalty. These factors collectively facilitate the steady growth of the Disposable Hygiene Products market, making it a robust sector with continued potential for expansion.

Restraint

Challenges in Disposable Hygiene Market

A major restraint in the Disposable Hygiene Products market is the increasing scrutiny over environmental impacts. As an analyst, it’s clear that the high volume of non-biodegradable waste generated by disposable hygiene products, such as diapers and sanitary pads, poses significant challenges.

Environmental concerns are driving stricter regulations and shifting consumer preferences towards more sustainable alternatives. This trend is pressuring manufacturers to invest in eco-friendly technologies, which can be costly and complex to develop.

Additionally, there is a growing awareness and sensitivity around the chemicals and materials used in these products, with consumers increasingly favoring items that are safe and allergen-free. These factors together create a challenging environment for traditional disposable product manufacturers, compelling them to adapt to evolving market expectations and regulatory landscapes.

Opportunities

Growth Opportunities in Hygiene Market

The Disposable Hygiene Products market presents significant opportunities, particularly through the development of eco-friendly and sustainable products. As an analyst, it’s clear that consumer demand for environmentally responsible options is rising sharply.

This trend opens the door for companies to innovate with biodegradable materials and reusable product designs, capturing the attention of environmentally conscious consumers. Furthermore, expanding into emerging markets where awareness and accessibility of hygiene products are increasing can provide substantial growth prospects.

There is also potential in diversifying product offerings to include items specifically designed for aging populations and for consumers with sensitive skin, meeting a broader range of needs. These strategic moves can help companies tap into new customer segments and strengthen their market presence amidst a competitive landscape.

Challenges

Market Challenges in Hygiene Products

Navigating the Disposable Hygiene Products market presents distinct challenges, particularly in balancing cost and sustainability. As an analyst, I observe that the shift towards sustainable products often involves higher production costs due to the use of eco-friendly materials, which can lead to increased retail prices.

This price increase can alienate price-sensitive consumers, especially in emerging markets. Additionally, the industry faces regulatory pressures as governments worldwide impose stricter waste management and product composition standards to mitigate environmental impact.

Another significant challenge is the cultural stigma associated with menstruation and incontinence in many societies, which can hinder market penetration and consumer acceptance.

These factors collectively complicate the market dynamics, posing hurdles for companies aiming to expand their footprint and maintain profitability in a competitive industry landscape.

Growth Factors

Driving Growth in the Hygiene Market

The growth of the Disposable Hygiene Products market is propelled by several key factors. As an analyst, it’s apparent that rising global awareness about personal health and hygiene plays a crucial role. The increasing global population, particularly in emerging economies, leads to higher demand for hygiene products, fueling market expansion.

Economic growth in these regions boosts disposable incomes, allowing more individuals to afford these essential products. Additionally, ongoing product innovations that enhance comfort, absorption, and skin-friendliness cater to evolving consumer expectations and health standards.

There’s also a notable increase in demand driven by aging populations in developed countries, requiring more adult incontinence products. These dynamics are foundational to the market’s robust growth trajectory, demonstrating strong potential for sustained expansion in the coming years.

Emerging Trends

Trends Shaping Hygiene Product Market

Emerging trends in the Disposable Hygiene Products market are significantly influenced by consumer demand for sustainability and innovation. As an analyst, I note the increasing adoption of biodegradable and organic materials in the production of these products as a pivotal trend.

Manufacturers are responding to environmental concerns by creating products that are both user-friendly and eco-friendly. Another trend is the growing popularity of subscription services for hygiene products, offering convenience and ensuring regular delivery to consumers.

There is also a notable shift towards customized products that cater to specific demographic needs, such as products designed for teens or postpartum women, reflecting a deeper understanding of varied consumer needs.

These trends are not only reshaping consumer expectations but also driving competitive strategies in the market, positioning companies that adapt quickly to lead in innovation and customer satisfaction.

Regional Analysis

The Disposable Hygiene Products market demonstrates distinct regional dynamics across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Asia Pacific dominates the market with a substantial 39.4% share, valuing approximately USD 73.6 billion.

This region’s prominence is driven by its large population base, increasing urbanization, and rising disposable incomes, particularly in emerging economies like China and India, which fuel demand for a wide range of hygiene products.

In North America, the market is characterized by high consumer awareness and stringent regulatory standards, leading to the adoption of advanced, sustainable products. Europe similarly shows a strong preference for eco-friendly and high-quality disposable hygiene options, supported by robust regulatory frameworks and high consumer purchasing power.

Conversely, the Middle East & Africa, and Latin America are emerging as potential growth areas. These regions exhibit increasing market penetration due to growing urban populations and improving healthcare infrastructure, though they start from a smaller base.

The demand in these areas is primarily driven by economic development and a growing awareness of personal hygiene practices, presenting significant opportunities for market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Disposable Hygiene Products market for 2023, key players such as The Procter & Gamble Company (P&G), Kimberly-Clark Corporation, and Unicharm Corporation play pivotal roles in shaping industry dynamics. Each company brings distinct strengths and strategies to the table, significantly impacting market trends and consumer preferences.

The Procter & Gamble Company (P&G) continues to lead with its strong brand portfolio, including popular names like Pampers and Always. P&G’s focus on innovation and customer-centric product development allows it to maintain a substantial market share.

The company’s strategic marketing and extensive distribution channels further strengthen its market position, making it a formidable competitor in both developed and emerging markets.

Kimberly-Clark Corporation, known for its Huggies and Kotex brands, excels in creating specialized products that cater to diverse consumer needs across different life stages. Their commitment to sustainability has intensified, with significant investments in developing eco-friendly products and reducing plastic waste. This approach not only aligns with global environmental trends but also appeals to the increasingly eco-conscious consumer base.

Unicharm Corporation stands out in the Asian markets, particularly in Japan, where it holds a leading position. Its success can be attributed to its deep understanding of local consumer behaviors and needs. Unicharm’s strength lies in its innovation in material technology and product design, which ensures comfort and convenience, key factors for consumer loyalty to hygiene products.

Overall, these companies’ robust strategies, focusing on innovation, sustainability, and market-specific adaptations, solidify their standings in the global Disposable Hygiene Products market, driving growth and setting industry standards. Their efforts are crucial in responding to the evolving demands of a diverse global consumer base in 2023.

Top Key Players in the Market

- The Procter & Gamble Company (P&G)

- Kimberly-Clark Corporation

- Unicharm Corporation

- Essity AB

- Hengan International Group Company Limited (China)

- Ontex Group

- Fujian Time and Tianhe Industrial Co. Ltd.

- The Edgewell Personal Care Company

- Dispowear Sterite Company

- Johnson & Johnson

- Ontex Gr

- Kao Corporation

- Other Key Players

Recent Developments

- In September 2023, Zuiko developed a diaper recycling machine called the SFD-600 that turns disposable diaper waste into biomass energy.

- In August 2022, GDM is integrating KODAK PROSPER S-Series and Imprinting Systems for digital printing on Disposable Hygiene products, enhancing their converting and packaging lines with decorative and informational designs.

Report Scope

Report Features Description Market Value (2023) USD 186.9 Billion Forecast Revenue (2033) USD 364.2 Billion CAGR (2024-2033) 6.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Distribution Channel (Supermarkets & Hypermarkets, Pharmacy Stores & Drugstores, E-commerce websites, Convenience Stores, Online Stores, Personal care stores), By End-User (Babies, Women, Men, Elderly) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The Procter & Gamble Company (P&G), Kimberly-Clark Corporation, Unicharm Corporation, Essity AB, Hengan International Group Company Limited (China), Ontex Group, Fujian Time and Tianhe Industrial Co. Ltd., The Edgewell Personal Care Company, Dispowear Sterite Company, Johnson & Johnson, Ontex Gr, Kao Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Disposable Hygiene Products MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Disposable Hygiene Products MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- The Procter & Gamble Company (P&G)

- Kimberly-Clark Corporation

- Unicharm Corporation

- Essity AB

- Hengan International Group Company Limited (China)

- Ontex Group

- Fujian Time and Tianhe Industrial Co. Ltd.

- The Edgewell Personal Care Company

- Dispowear Sterite Company

- Johnson & Johnson

- Ontex Gr

- Kao Corporation

- Other Key Players