Global Direct-to-Consumer(DTC) Pet Food Market By Type (Meals, Treats, and Supplements), By Pet (Dogs, Cats, and Others), By Health Condition (Nutrition, Digestive Health, Heart Health, Skin Problems, Stress, Allergies, and Others), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 101408

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

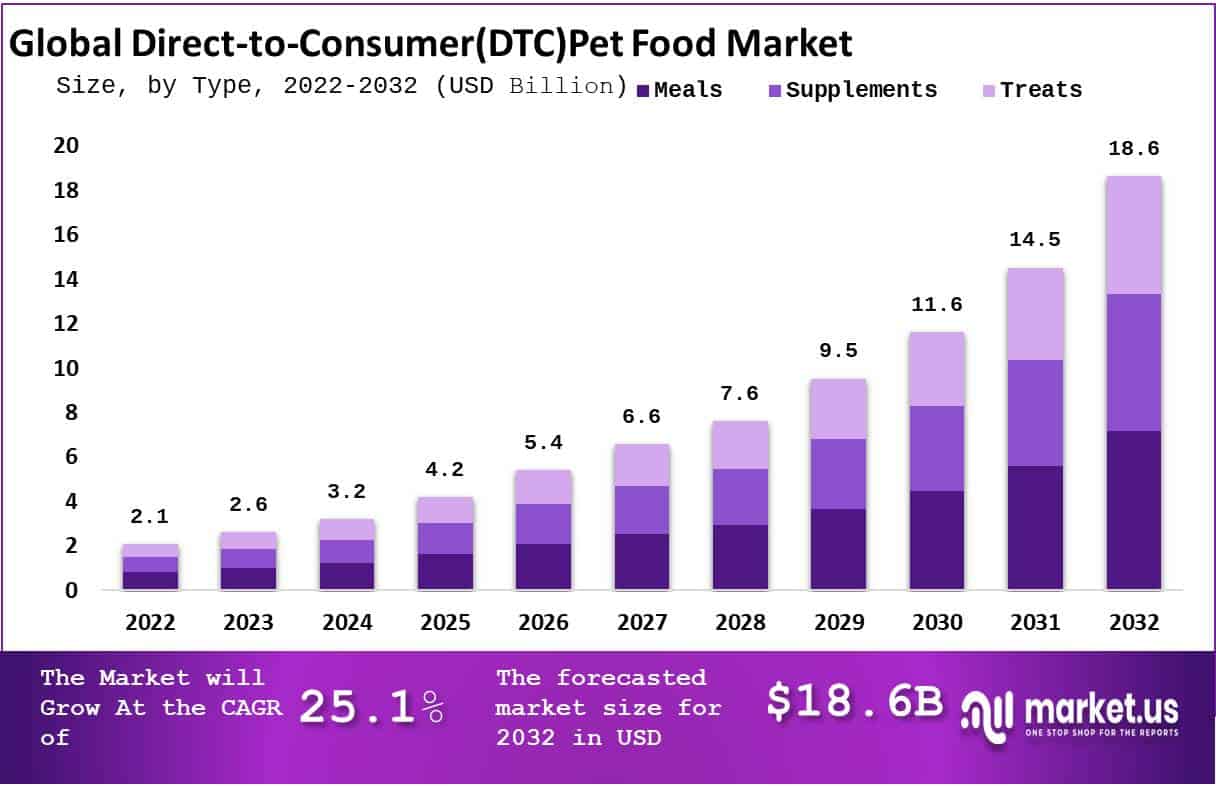

In 2022, the Global Direct-To-Consumer (DTC)pet food market was valued at USD 2.1 billion and is expected to reach USD 18.6 Billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 25.1%.

Direct-to-consumer (DTC) Pet Food refers to a business model where pet food manufacturers sell their products directly to consumers through online channels or in retail stores. direct-to-consumer pet food brands often emphasize the quality of ingredients, transparency in sourcing, and customization options for pet owners.

Additionally, the rising pet ownership and rapid increase in awareness among pet owners towards their health and wellness is projected to be a major factor for market growth.

The DTC pet food section has been increasing rapidly owing to the growing approval of digital channels. The rising use of smartphones has remarkably emphasized online sales.

Key Takeaways

- Market Size and Growth: The DTC Pet Food market was valued at USD 2.1 billion in 2022 and is projected to reach USD 18.6 billion by 2032, with a CAGR of 25.1% between 2023 and 2032.

- DTC Pet Food Definition: DTC Pet Food refers to a business model where pet food manufacturers sell their products directly to consumers through online channels or in retail stores. This approach emphasizes quality, ingredient transparency, and customization for pet owners.

- Driving Factors: The market is driven by an increased awareness of pet health and wellness. Factors include growing demand for premium and natural pet food, rising disposable income, and a higher pet population. Digital channels and internet accessibility have also played a significant role in market growth.

- Restraining Factors: Strict regulations related to pet food products, especially in Western markets, may hinder market growth. Quality issues and product recalls are additional factors limiting the growth of the DTC pet food market.

- By Type Analysis: Market Share (2022): The meal segment accounted for the highest market revenue share of 38.5%.

By Pet Analysis: Market Share (2022): The dog segment dominated the largest market revenue share of 54.6% during the forecast period.

By Health Condition Analysis: Digestive Health Segment Market Share (2022) The digestive health segment registers the highest CAGR during the forecast period, but specific market share data is not provided.

By Distribution Channel Analysis: Online Channel Market Share (2022): The online segment dominated the highest market revenue share in 2022. Specific market share data is not provided. Offline Channel Growth Factors The offline segment is anticipated to grow at a CAGR of 5.3%. The growth is attributed to the increasing availability of supplements like skin and hair products and multivitamins in physical retail stores.

- Key Growth Opportunities: The use of cannabis in pet food is identified as a lucrative opportunity, offering health benefits to pets. Personalized pet food is also a growing trend, particularly in emerging countries.

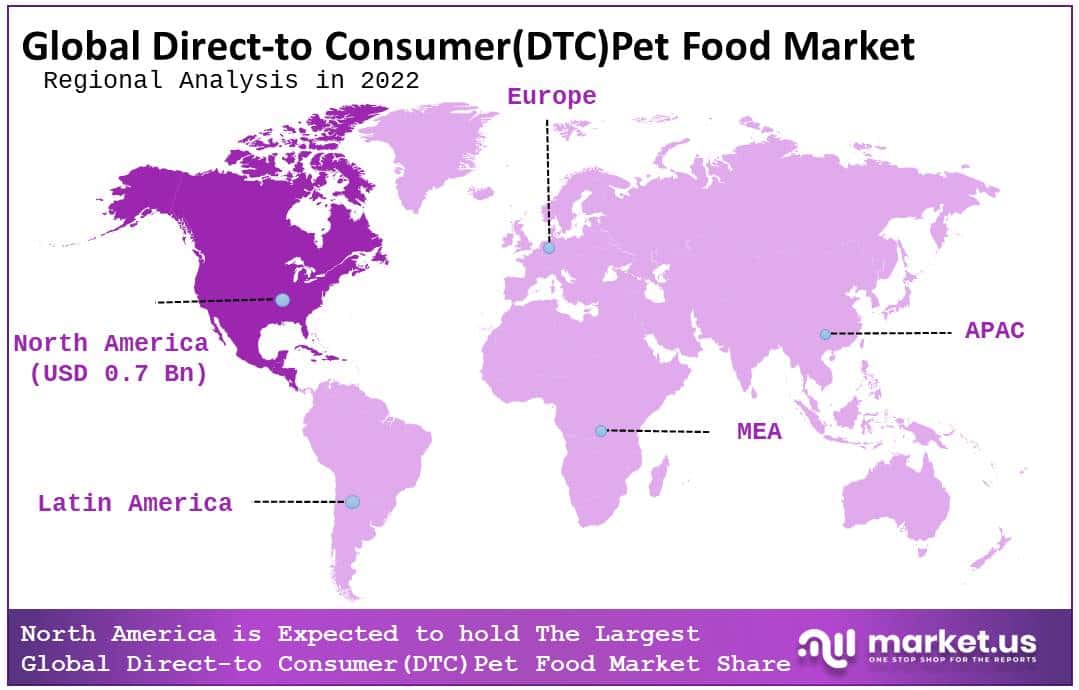

- Regional Analysis: North America and North America accounted for a significant market revenue share of 37.5%. The Asia-Pacific region is expected to register a CAGR of 4.2% during the forecast period.

- Key Players: Major companies in the DTC Pet Food market include Nestle S.A., General Mills, Inc., Mars, Incorporated, and others. These players are focusing on strategies such as collaborations and product innovation.

Driving Factors

Increasing Awareness of Pet Health Drives Market Growth

A wide increase in the requirements for premium and natural brand pet food products combined with the increasing awareness regarding their pet health are the major factors anticipated to propel this market growth. The rise in awareness related to health & wellness, humanization, and growing disposable income drive the market growth.

Additionally, this market is also being driven by the rising pet population and increasing incidences of zoonotic diseases in pets across the world. The increasing popularity of several digital channels combined with the increasing use of the internet and accessibility of high-speed internet facilities are significant factors estimated to propel the market growth.

Restraining Factors

Strict Regulations to Hinder Market Growth

Strict regulations related to pet food products, particularly across the Western market, are likely to hinder the growth of the market. In emerging countries, pet foods are examined and tested stringently at every stage, from the ingredients and sales of products, which is likely to be the main factor hampering the market growth in the upcoming years.

Quality problems in pet food products as well as product recall, are projected to restrict the market growth of the direct-to-consumer (DTC) pet food market.

By Type Analysis

Meals Segment to Witness Significant Growth

The global direct-to-consumer(DTC) pet food market is segmented into meals, treats, and supplements. The meal segment accounted for the highest market revenue share of 38.5% in 2022, Due to the rising focus by individuals on pet health, increased expenditure on quality meals, and the increasing popularity of customized meals, mainly in emerging countries.

Additionally, higher ingredient quality, longer shelf life, and better humanization of pets are some of the factors that propel the approval and demand for meals across the world at a healthy rate of growth. Customized meals support monitoring pet eating patterns, address health conditions and increase demand for customized meals.

The supplements segment dominated throughout the historical period and is estimated to hold the second-largest market share. A supplement is a concentrated ingredient that is added to the diet for therapeutic and nutritional effects.

By Pet Analysis

The Dogs Segment Accounted for the Largest Share of the Global Direct-to-Consumer(DTC) Pet Food Market

Based on the pet, the global direct-to-consumer(DTC) pet food market is divided into dogs, cats, and others. Among these, the dog segment dominated the largest market revenue share of 54.6% during the forecast period. The rising growth rate of the market is attributable to the increasing number of dog approval, rising demand for high-quality dog food, and the humanization of dogs.

According to the American Pet Products Association National Pet Owners Survey, 69.0 million households own a dog in the U.S.

The cats segment is anticipated to witness the fastest growth during the forecast period. Cats provide comfort to their owners, which has led to an increase in demand for cats.

By Health Condition Analysis

The Digestive Health Segment Dominated the Significant Market Revenue Share During the Forecast

Based on the health condition, the global direct-to-consumer(DTC)pet food market is classified into nutrition, digestive health, heart health, dental health, skin problems, stress, joint health, allergies, and others. The digestive health segment registers the highest CAGR during the forecast period. Due to the rising amount of customized nutritional formulations to avoid digestive problems as well as the introduction of probiotics and prebiotics in pet food diets.

The nutrition segment holds the second-largest revenue share during the forecast period, Owing to the rising expansion of premium pet food brands and the increasing awareness of pet owners towards the preferences of health conditions of their pets.

By Distribution Channel Analysis

The Online Segment holds the Highest Market Revenue Share During the Forecast Period

Based on the distribution channel, the global direct-to-consumer(DTC) pet food market is segmented into online channels and offline channels. Among these, the online segment dominated the highest market revenue share in 2022. Attributable to the increasing preference for personalization, accessibility of greater discounts related to offline stores, and customer convenience.

The offline segment is anticipated to grow at a CAGR of 5.3% due to the increasing availability of supplements like skin and hair products and multivitamins in stores.

Key Market Segments

By Type

- Meal

- Treats

- Supplements

By Pet

- Dogs

- Cats

- Other Pets

By Health Condition

- Nutrition

- Digestive Health

- Heart Health

- Dental Health

- Skin Problems

- Stress

- Joint Health

- Allergies

- Other Health Conditions

By Distribution Channel

- Online Channel

- Offline Channel

Growth Opportunity

The usage of Cannabis for Pet Foods Provides Lucrative Opportunities in the Market

One of the major opportunities in the market is the use of cannabis for pet foods. Cannabis has the ability to provide health benefits. It is antioxidant and anti-inflammatory; variations of cannabis–derived products have become more available, and veterinarians have seen increased interest among individuals in using this product for their pets.

The accessibility of several user-friendly websites and apps, along with the increasing dominance of food products, offers significant opportunities in the market.

Latest Trends

Increasing Trend for Personalized Pet Food

The increasing popularity of personalized pet food across many emerging countries, including France, the U.S, and Germany, has been influencing market growth exponentially in the last few years.

Personalization of pet food products has a high potential to grow significantly due to rising customers’ demand for the food they are feeding their pets, and pet owners from emerging countries are also selecting these products, which is likely to drive market growth. The humanization of pets is also a trend in the global direct-to-consumer(DTC) pet food market.

Regional Analysis

North America Dominates the Global Direct-to-Consumer (DTC) Pet Food Market During the Forecast Period

North America accounted for a significant direct-to-consumer(DTC) pet food market revenue share of 37.5%. Due to the rising number id millionaires as pet owners, high accessibility of an extensive range of customized pet products, and increasing focus on the health and diets of pets in this region. The presence of major key market players in the region increases the demand for pet food.

The Asia-Pacific is expected to register CAGR of 4.2% during the forecast period. Owing to the increasing number of individuals who own pets in their houses and rapid urbanization, mostly in various emerging countries such as India, China, and Indonesia. Additionally, rise in efforts by key market companies launching novel production facilities and expanding their market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The key market players are focusing on developing various strategies such as collaborations, partnerships, agreements, and acquisitions & merges. Industry participants are inclined towards investing in R&D to advance processes and create new opportunities in the market.

Various key manufacturers are focused on developing innovative products to offer high-quality food for pets. Some of the prominent key players in the direct-to-consumer(DTC) pet food market include Nestle S.A., General Mills, Inc., Hill’s Pet Nutrition, Inc., The Farmers Dog Inc., Jinx Inc., Diamond Pet Foods, Inc., The J.M. Smucker Company, and other key players.

Top Key Players

- Nestle S.A.

- General Mills, Inc.

- Mars, Incorporated

- Hill’s Pet Nutrition, Inc.

- Diamond Pet Foods, Inc.

- Wellness Pet Company

- The Farmers Dog Inc.

- Jinx Inc.

- The J.M. Smucker Company

- Other Key Players

Recent Development

- October 2022- Wild Earth creates the “First-Ever” cell-based chicken broth for the pet food industry.

- October 2022-BrightPet developed Bravo pet foods to enhance its frozen and freeze-dried portfolio.

Report Scope

Report Features Description Market Value (2022) US$ 2.1 Bn Forecast Revenue (2032) US$ 18.6 Bn CAGR (2023-2032) 25.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type-Meal, Treats, and Supplements; By Pet-Dogs, Cats, and Other Pets; By Health Condition-Nutrition, Digestive Health, Heart Health, Dental Health, Skin Problems, Stress, Joint Health, Allergies, and Other Health Conditions; By Distribution Channel- Online Channel and Offline Channel Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nestle S.A., General Mills, Inc., Mars, Incorporated, Hill’s Pet Nutrition, Inc., Diamond Pet Foods, Inc., Wellness Pet Company, The Farmers Dog Inc., Jinx Inc., The J.M. Smucker Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Why is Direct-to-Consumer(DTC) Pet Food Market gaining popularity?The Direct-to-Consumer(DTC) Pet Food Market continues to grow in popularity because it allows pet-food manufacturers to reach out directly to their consumers, offering them a more personal experience. Direct-to-Consumer(DTC) Pet Food pet brands are able to offer their products more cheaply by cutting out middlemen.

Which types of pet products are available at the Direct-to-Consumer(DTC) Pet Food Market?The Direct-to-Consumer(DTC) Pet Food Market sells a wide variety of pet products including dry, wet, freeze-dried, dehydrated, raw, and treat food.

Do you have any advantages to buying pet foods from the Direct-to-Consumer(DTC) Pet Food Market?Yes, you can get several benefits by buying pet foods from the Direct-to-Consumer(DTC) Pet Food Market. In general, you'll find a larger variety of pet food products available through Direct-to-Consumer(DTC) Pet Food than traditional retail channels. Direct-to-Consumer(DTC) Pet Food petfood brands are also known to prioritize high quality ingredients.

Does Direct-to-Consumer(DTC) Pet Food Market offer discounts or promotions?Yes. Many Direct-to-Consumer(DTC) Pet Food brand pet food companies offer discounts, promotions, or loyalty programs for their customers. You can usually find these offers by visiting their websites or subscribing for their emails.

Direct-to-Consumer(DTC) Pet Food MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Direct-to-Consumer(DTC) Pet Food MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestle S.A.

- General Mills, Inc.

- Mars, Incorporated

- Hill's Pet Nutrition, Inc.

- Diamond Pet Foods, Inc.

- Wellness Pet Company

- The Farmers Dog Inc.

- Jinx Inc.

- The J.M. Smucker Company

- Other Key Players