Global Digital Wayfinding Solutions Market Size, Share, Statistics Analysis Report By Component (Hardware (Digital Signage, Kiosks, Beacons and Sensors), Software, Services (Consulting, Maintenance and Support), By Deployment Mode (Cloud-based, On-premise), By End-Use (Hospitals, Airports, Shopping Malls, Corporate Campuses, Universities, Others (Smart Cities, Museums, etc.)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142800

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

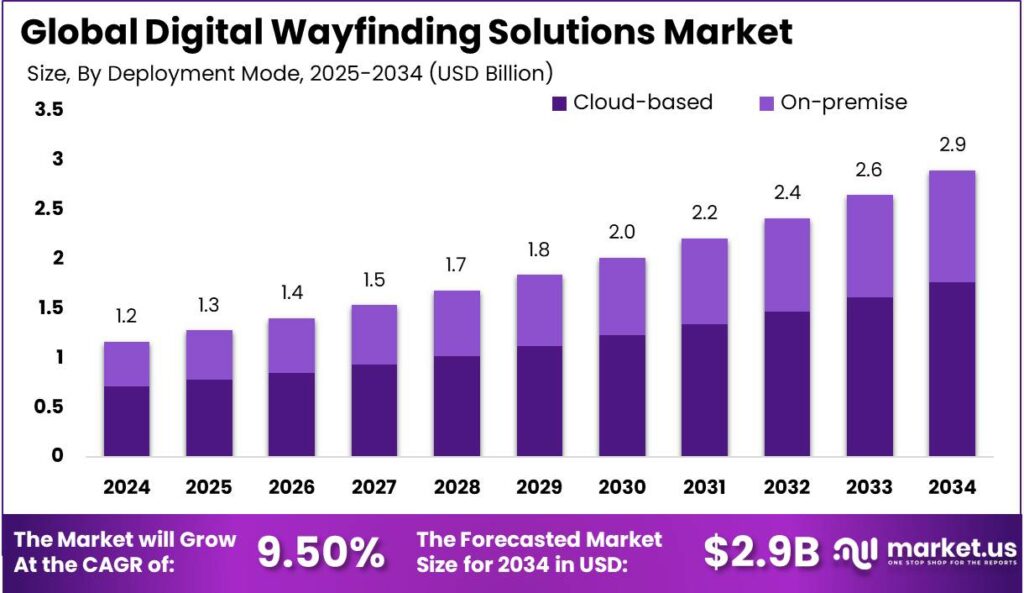

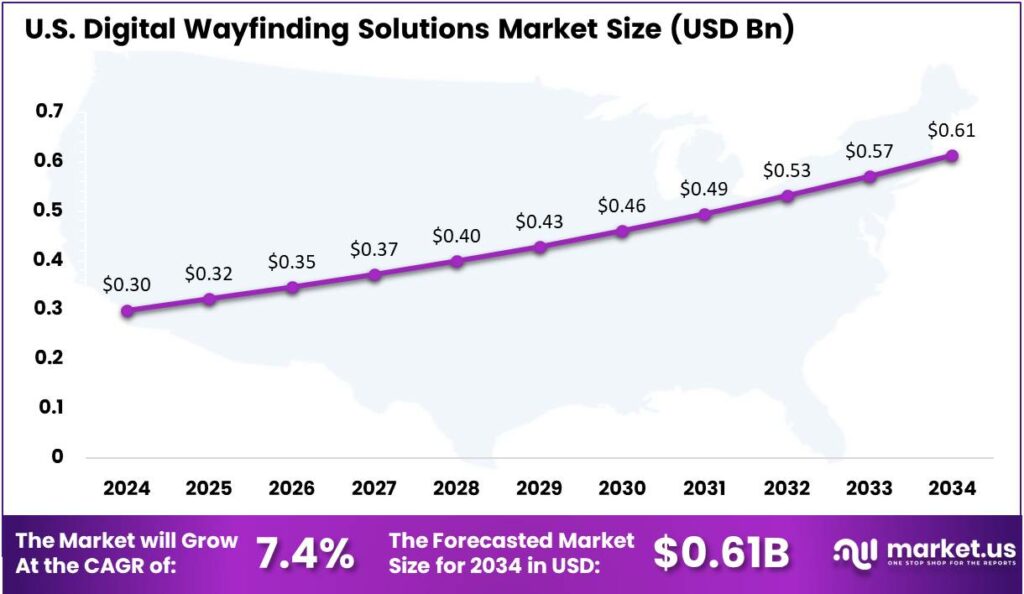

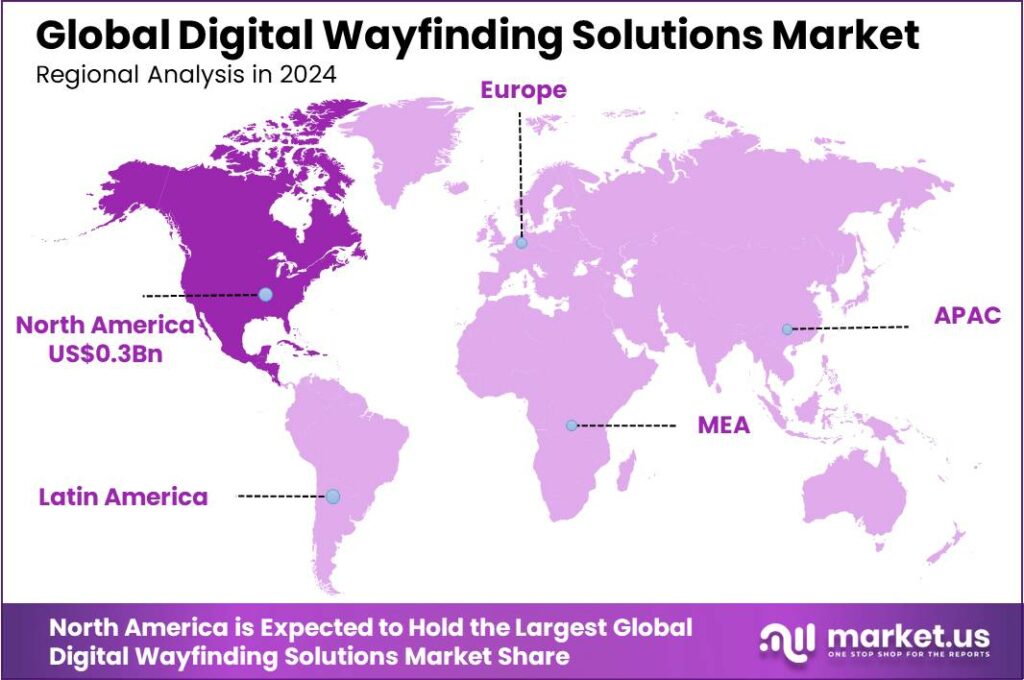

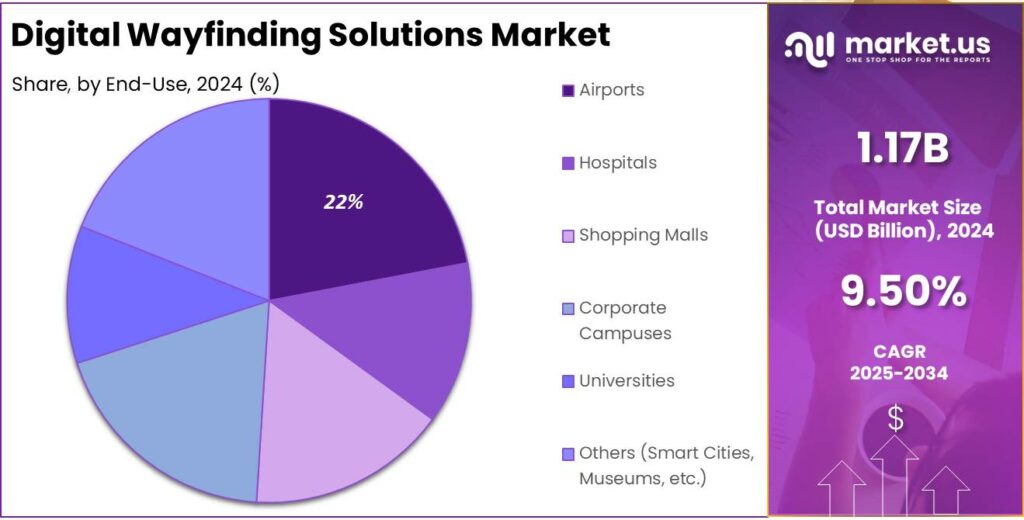

The Global Digital Wayfinding Solutions Market size is expected to be worth around USD 2.9 Billion By 2034, from USD 1.17 Billion in 2024, growing at a CAGR of 9.50% during the forecast period from 2025 to 2034. In 2024, North America dominated the digital wayfinding solutions market with a 34% share, contributing $0.3 billion in revenue. The U.S. market was valued at $0.3 billion, with a projected CAGR of 7.4%.

Digital wayfinding solutions encompass a variety of technologies and platforms designed to guide individuals through physical environments in a seamless and intuitive manner. Digital wayfinding solutions use interactive signage, mobile apps, and web platforms to provide real-time maps and directions in complex spaces like healthcare facilities, campuses, and large venues.

The market for Digital Wayfinding Solutions is on a significant growth trajectory, driven by the demand for enhanced user experiences and operational efficiencies in navigating large and complex facilities. As of recent estimates, the market is expected to grow robustly, characterized by a diverse array of applications across various industries, including healthcare, retail, and transportation

The primary driving force behind the Digital Wayfinding Solutions market is the relentless pursuit of enhanced user experience. Organizations are increasingly prioritizing intuitive navigation systems that offer real-time information and personalized directions. Technological advancements such as augmented reality and indoor positioning systems further amplify market growth.

There is a growing demand for digital wayfinding solutions among both large enterprises and small to medium-sized enterprises (SMEs). Large enterprises often require robust, scalable solutions due to their extensive operations, while SMEs seek cost-effective systems that are easy to implement and maintain.

According to Market.us, The global digital signage market is poised for steady growth, with its value projected to increase from USD 27.1 billion in 2023 to approximately USD 52.7 billion by 2032, registering a CAGR of 7.7% during the forecast period. This expansion is driven by the rising adoption of interactive displays, AI-powered content management, and digital out-of-home (DOOH) advertising.

Adopting digital wayfinding solutions offers businesses several benefits, including improved operational efficiency, enhanced customer satisfaction, and increased foot traffic. These systems enable businesses to streamline visitor management and enhance the overall user experience, thereby supporting brand strengthening and customer retention.

According to LLCBuddy, 60% of businesses without digital signage plan to invest in the technology within the next two years, reflecting a growing demand for dynamic advertising and customer engagement solutions. Additionally, 67% of current users expect digital out-of-home (DOOH) advertising to expand, further driving market growth.

For businesses, digital signage proves to be a powerful tool for sales and brand visibility. 80% of brands using digital signage report a sales increase of up to 33%, along with stronger audience engagement. In public spaces, digital displays reach up to 10% of Americans aged 12 and above, outperforming platforms like Facebook (41%) and the internet (43%).

Moreover, queue management efficiency improves significantly, with perceived wait times reduced by over 35%, enhancing customer experience. With 53% of end users planning to increase digital signage investments, the market is set for continued expansion as businesses recognize its effectiveness in attracting and engaging audiences.

Key Takeaways

- The Global Digital Wayfinding Solutions Market size is projected to reach USD 2.9 Billion by 2034, up from USD 1.17 Billion in 2024, growing at a CAGR of 9.50% from 2025 to 2034.

- In 2024, the Hardware segment dominated the digital wayfinding solutions market, capturing more than 57% share.

- In 2024, the Cloud-based segment held a leading position, accounting for over 61% share in the market.

- The Airports segment was the largest in 2024, holding more than 22% market share.

- North America led the digital wayfinding solutions market in 2024, with a dominant share of over 34%, contributing $0.3 billion in revenue.

- In 2024, the digital wayfinding solutions market in the United States was valued at $0.3 billion, with a projected CAGR of 7.4%.

Analysts’ Viewpoint

The market presents significant investment opportunities, particularly in regions like North America, which dominates due to advanced technological infrastructure and high adoption rates of digital solutions. The continuous innovation within this sector, fueled by the integration of emerging technologies, creates lucrative opportunities for investors looking to capitalize on the digital transformation of physical navigation.

The sector is experiencing rapid advancements, with the integration of AI, augmented reality, and IoT enhancing the functionality and effectiveness of wayfinding solutions. These technologies make navigation systems more interactive and responsive, thus enhancing user engagement and satisfaction.

The regulatory landscape for Digital Wayfinding Solutions generally revolves around data security and user privacy, particularly concerning the tracking and storage of user location data. Companies in the market must navigate these regulations to ensure compliance while delivering effective navigational aids.

U.S. Market Size

In 2024, the market for digital wayfinding solutions in the United States was valued at $0.3 billion. It is projected to expand at a compound annual growth rate (CAGR) of 7.4%.

Digital wayfinding solutions help individuals navigate complex environments like hospitals, campuses, and commercial spaces. These technologies integrate with mobile and digital signage to offer clear, interactive guidance. Market growth is driven by the growing demand for improved consumer and visitor experiences and the increased use of location-based services.

The market expansion is fueled by technological advancements, including AI and IoT integration with wayfinding solutions. These technologies provide real-time data and personalized routes, improving user engagement and operational efficiency. As urbanization increases and public spaces grow more complex, the demand for advanced wayfinding solutions is expected to rise, driving further market growth.

In 2024, North America held a dominant market position in the digital wayfinding solutions sector, capturing more than a 34% share. This region alone accounted for $0.3 billion in revenue.

North America’s leadership in wayfinding solutions is driven by strong technological infrastructure and early adoption of advanced technologies in the U.S. and Canada. The region’s focus on improving user experiences in both public and private spaces greatly boosts demand for sophisticated wayfinding systems.

North America’s dominance in the digital wayfinding market is driven by several factors. The region hosts key industry players who are at the forefront of innovation, particularly in integrating AI and IoT with traditional systems to improve adaptability and user experience.Significant investment in research and development from both private and government sectors is focused on enhancing the accuracy and efficiency of these technologies.

The widespread use of smartphones and mobile internet in North America drives the adoption of app-based wayfinding solutions, especially in urban areas with complex infrastructures. Additionally, smart city initiatives enhance the integration of digital wayfinding into public infrastructure, further expanding the market.

Component Analysis

In 2024, the Hardware segment held a dominant market position in the digital wayfinding solutions market, capturing more than a 57% share. This segment, comprising digital signage, kiosks, beacons, and sensors, leads due to its critical role in the physical deployment of wayfinding solutions.

Beacons and sensors, under the Hardware umbrella, further bolster this segment’s market lead by enabling location-based services within facilities. These technologies are integral for sending push notifications and real-time guidance to users’ mobile devices, enhancing the interactivity and functionality of digital wayfinding systems.

The predominance of the Hardware segment is also underpinned by the tangible investment in physical devices that are required for the implementation of wayfinding solutions. Unlike software or services, hardware demands upfront capital expenditure for physical assets, which contributes significantly to its larger market share.

Ongoing advancements in digital hardware technologies sustain the dominance of the digital wayfinding market. Manufacturers are improving digital signage and kiosks with better displays, increased processing power, and enhanced connectivity. Additionally, advancements in sensor technology ensure more accurate and reliable wayfinding solutions, keeping hardware a key component in the market.

Deployment Mode Analysis

In 2024, the Cloud-based segment held a dominant position in the digital wayfinding solutions market, capturing more than a 61% share. This segment’s leadership is primarily attributed to its flexibility and scalability, which are essential for organizations looking to deploy responsive and adaptable navigation solutions.

Cloud-based digital wayfinding solutions are preferred for their cost-effectiveness, as they eliminate the need for large upfront investments in hardware and infrastructure. This makes them more accessible to smaller organizations and easier to manage within budgets, appealing to a wide range of businesses.

Cloud-based wayfinding solutions benefit from enhanced integration with other cloud services, providing a seamless user experience. This connectivity allows easy interfacing with tools like event management systems and security protocols, boosting the system’s functionality and driving the segment’s popularity.

The shift towards digital transformation across industries drives the growth of cloud-based solutions. As organizations digitize, integrating cloud-based wayfinding systems aligns with broader technological upgrades, ensuring compatibility and future-proofing investments. This trend is set to continue, strengthening the cloud-based segment’s market dominance in digital wayfinding.

End-Use Analysis

In 2024, the Airports segment held a dominant market position in the digital wayfinding solutions sector, capturing more than a 22% share.

This prominence is largely due to the critical need for efficient navigation systems within airports, which are complex environments with high foot traffic and frequent updates to gate information and flight statuses. Effective wayfinding solutions enhance passenger experiences by reducing confusion and stress associated with air travel.

Airports aim to streamline passenger flow and optimize space usage, driving the demand for advanced digital wayfinding systems. These systems, which offer real-time information sharing, are crucial for managing the dynamic airport environment. Additionally, the rise in international travelers and expanding airport infrastructure further accelerates the adoption of sophisticated wayfinding technologies.

The adoption of digital wayfinding in airports is also driven by the need to reduce operational costs. By improving navigation, airports can lower the reliance on staff assistance and cut overheads. Additionally, these tools enhance safety by guiding crowds effectively and helping passengers quickly locate exits and emergency services.

Key Market Segments

By Component

- Hardware

- Digital Signage

- Kiosks

- Beacons and Sensors

- Software

- Services

- Consulting

- Maintenance and Support

By Deployment Mode

- Cloud-based

- On-premise

By End-Use

- Hospitals

- Airports

- Shopping Malls

- Corporate Campuses

- Universities

- Others (Smart Cities, Museums, etc.)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Integration of Advanced Technologies

The integration of advanced technologies has significantly propelled the adoption of digital wayfinding solutions across various sectors. By incorporating features such as interactive kiosks, digital signage, websites, and mobile apps, these solutions have enhanced user experiences and operational efficiencies.

For instance, interactive kiosks and digital signage provide real-time navigation assistance in complex environments like hospitals and airports, reducing visitor confusion and improving satisfaction. Websites and mobile apps extend these functionalities beyond physical locations, allowing users to access navigation information remotely.

Restraint

Data Privacy and Security Concerns

The deployment of digital wayfinding solutions often involves the collection and processing of user data to provide personalized navigation experiences. However, this raises significant data privacy and security concerns. Users may be apprehensive about sharing their location information, fearing misuse or unauthorized access.

Organizations must comply with stringent data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe, necessitating robust security measures and transparent data handling practices. Failure to address these concerns can lead to user distrust and potential legal ramifications, thereby impeding the adoption of digital wayfinding technologies.

Opportunity

Expansion into Emerging Markets

Emerging markets present a significant growth opportunity for digital wayfinding solution providers. Rapid urbanization, infrastructure development, and increasing investments in sectors like retail, healthcare, and transportation in regions such as Asia-Pacific and Latin America are driving the demand for advanced navigation systems.

As these regions modernize their public spaces and commercial establishments, the need for efficient wayfinding solutions becomes paramount. Companies that tailor their offerings to the unique cultural and linguistic needs of these markets, while ensuring cost-effectiveness, stand to gain a competitive advantage and expand their global footprint.

Challenge

Integration with Existing Infrastructure

Integrating digital wayfinding solutions into existing infrastructures poses a significant challenge for organizations. Many establishments operate legacy systems that may not be compatible with modern wayfinding technologies, leading to complexities in system integration.

Ensuring seamless interoperability between new digital interfaces and existing hardware or software requires meticulous planning and technical expertise. Additionally, staff training is essential to manage and maintain these integrated systems effectively. Organizations must allocate resources for comprehensive assessments and potential infrastructure upgrades to facilitate successful implementation, which can be both time-consuming and costly.

Emerging Trends

One prominent trend is the adoption of interactive kiosks and touchscreen displays, which allow users to access real-time directions and information tailored to their specific needs. These systems are prevalent in venues such as malls, airports, and hospitals, enabling visitors to search for locations, amenities, or services through user-friendly interfaces.

Mobile integration represents another significant advancement in digital wayfinding. Facilities are developing mobile applications that offer navigation assistance directly on users’ smartphones. These apps use GPS and Bluetooth for accurate, real-time navigation, making them ideal for complex environments like hospitals or universities.

Augmented Reality (AR) is emerging as a transformative technology in wayfinding. By overlaying digital information onto the physical world, AR enhances navigation by providing immersive, real-time guidance. This innovation is especially useful in environments where traditional signage may be insufficient or overwhelming.

Business Benefits

One primary advantage is the enhancement of the visitor experience. Interactive and intuitive navigation tools reduce confusion and stress, enabling visitors to reach their destinations effortlessly. This positive experience can lead to increased customer satisfaction and loyalty, which are crucial for business success.

Moreover, these systems contribute to environmental sustainability by minimizing the reliance on printed materials. By reducing paper usage, businesses can lower their environmental footprint and align with green initiatives, which can enhance their corporate image.

Digital wayfinding solutions also promote inclusivity. Features such as audio cues for the visually impaired, language options for non-native speakers, and highlighting accessible routes ensure that all visitors can navigate spaces comfortably. This inclusivity can broaden a business’s appeal and comply with accessibility regulations.

Additionally, these systems offer valuable data analytics. By tracking user interactions, businesses can gain insights into visitor behavior, such as popular routes and peak times. This data enables informed decision-making regarding layout optimizations, staffing, and targeted marketing strategies, ultimately driving efficiency and profitability.

Key Player Analysis

Jibestream, now part of Inpixon, stands out with its powerful location-based services and wayfinding technology. The company specializes in creating detailed, interactive, and dynamic maps that integrate seamlessly with building management systems. Jibestream’s strength lies in its ability to provide real-time data updates, making it easy for users to navigate and access vital information.

Signagelive is known for its user-friendly cloud-based platform that enables businesses to easily manage and deploy digital signage solutions, including wayfinding systems. The company’s software allows clients to control content remotely, making it ideal for large or distributed networks. Signagelive’s flexibility and scalability are key advantages, allowing businesses to customize their wayfinding solutions and adapt them to different environments.

Visix Digital Signage provides a robust digital signage solution that includes wayfinding as part of its comprehensive platform. Known for its customizable content options, Visix allows organizations to create interactive and dynamic wayfinding experiences tailored to their specific needs. Visix offers a variety of hardware, including touchscreens and kiosks, and integrates seamlessly with existing building systems.

Top Key Players in the Market

- Jibestream (Inpixon)

- Signagelive

- Visix Digital Signage

- Everbridge

- ConnectedSign

- Poppulo

- Mvix Digital Signage

- Nanonation

- Visix Digital Signage

- TouchSource

- Rise Vision

- YCD Multimedia

- Omnivex Corporation

- Intuiface

- ScreenCloud

- Enplug

- Scala

- Other Key Players

Top Opportunities Awaiting for Players

In the rapidly evolving digital wayfinding solutions market, several significant opportunities are poised to shape the industry’s future and drive growth for market participants.

- Expansion into Smart City Initiatives: The increasing global investment in smart city projects offers substantial opportunities for the integration of digital wayfinding systems. These projects leverage advanced technologies to improve urban living quality and management, thereby expanding the application spectrum for digital wayfinding solutions.

- Advancements in Technology: Continuous technological innovations, including augmented reality, indoor positioning systems, and IoT integration, are creating new possibilities for more sophisticated, accurate, and versatile wayfinding solutions. This not only enhances user experience but also provides companies with competitive advantages in adapting to evolving consumer expectations.

- Healthcare and Tourism Sectors: There’s a growing demand for efficient navigation systems within the healthcare and tourism sectors, where enhancing visitor and patient experiences is crucial. Digital wayfinding systems can significantly contribute to operational efficiency and user satisfaction in these areas, presenting lucrative market opportunities.

- Rise in Mobile and Cloud-Based Solutions: The market is witnessing a surge in demand for mobile and cloud-based wayfinding solutions. These platforms offer flexibility, scalability, and accessibility, catering to the needs of a broad range of enterprises from large corporations to SMEs. This shift is driven by the increased use of smartphones and the need for real-time, on-the-go navigation information.

- Increased Focus on User Experience and Personalization: Businesses are prioritizing the enhancement of user experiences and personalization in their services. Wayfinding solutions that offer intuitive interfaces, real-time updates, and personalized navigation aid significantly in improving customer retention and satisfaction, thereby opening new avenues for market growth.

Recent Developments

- In August 2024, Visix launched advanced workplace wayfinding solutions featuring AI gesture control, virtual tours, and on-screen space booking. These solutions include searchable maps, office directories, and 360° virtual tours, enhancing workspace management and employee engagement.

- In October 2024, TouchSource, a leading provider of digital signage and wayfinding solutions, acquired Oppna Digital to expand its leadership in digital wayfinding. This acquisition strengthens TouchSource’s position in retail, airports, education and government sectors by integrating Oppna’s interactive wayfinding technology and client roster.

Report Scope

Report Features Description Market Value (2024) USD 1.17 Bn Forecast Revenue (2034) USD 2.9 Bn CAGR (2025-2034) 9.50% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware (Digital Signage, Kiosks, Beacons and Sensors), Software, Services (Consulting, Maintenance and Support), By Deployment Mode (Cloud-based, On-premise), By End-Use (Hospitals, Airports, Shopping Malls, Corporate Campuses, Universities, Others (Smart Cities, Museums, etc.)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Jibestream (Inpixon), Signagelive, Visix Digital Signage, Everbridge, ConnectedSign, Poppulo, Mvix Digital Signage, Nanonation, Visix Digital Signage, TouchSource, Rise Vision, YCD Multimedia, Omnivex Corporation, Intuiface, ScreenCloud, Enplug, Scala, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Wayfinding Solutions MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Wayfinding Solutions MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Jibestream (Inpixon)

- Signagelive

- Visix Digital Signage

- Everbridge

- ConnectedSign

- Poppulo

- Mvix Digital Signage

- Nanonation

- Visix Digital Signage

- TouchSource

- Rise Vision

- YCD Multimedia

- Omnivex Corporation

- Intuiface

- ScreenCloud

- Enplug

- Scala

- Other Key Players