Global Semiconductor Process Control Equipment Market Size, Share, Statistics Analysis Report By Equipment Type (Metrology Equipment, Wafer Inspection Equipment, Process Control Equipment, Others), By Wafer Size (300mm Wafers, 200mm Wafers, Others), By End Users (Foundries, Integrated Device Manufacturers (IDMs), Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142757

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- China Market Growth

- Equipment Type Analysis

- Wafer Size Analysis

- End Users Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

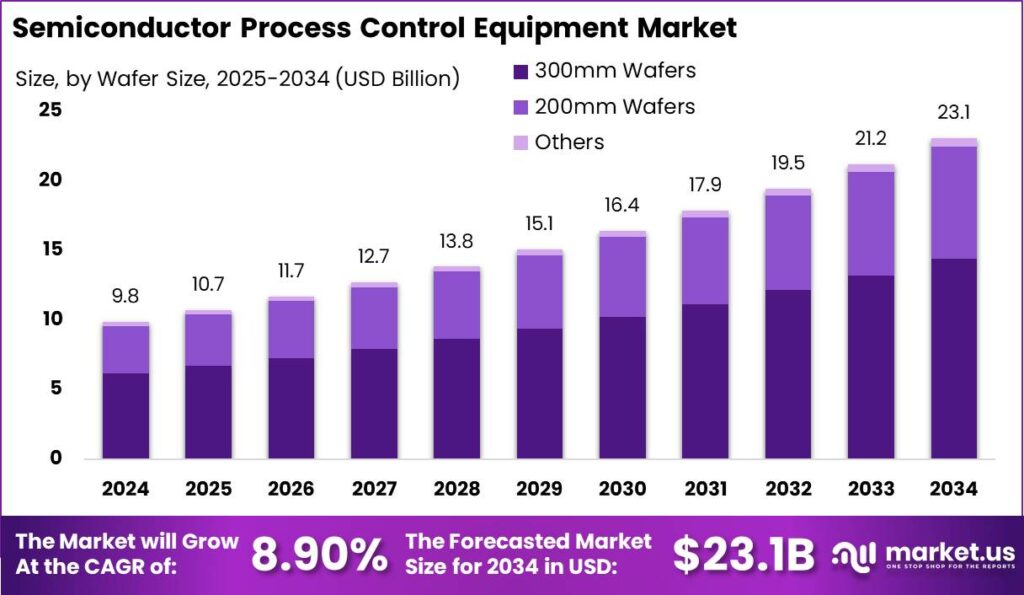

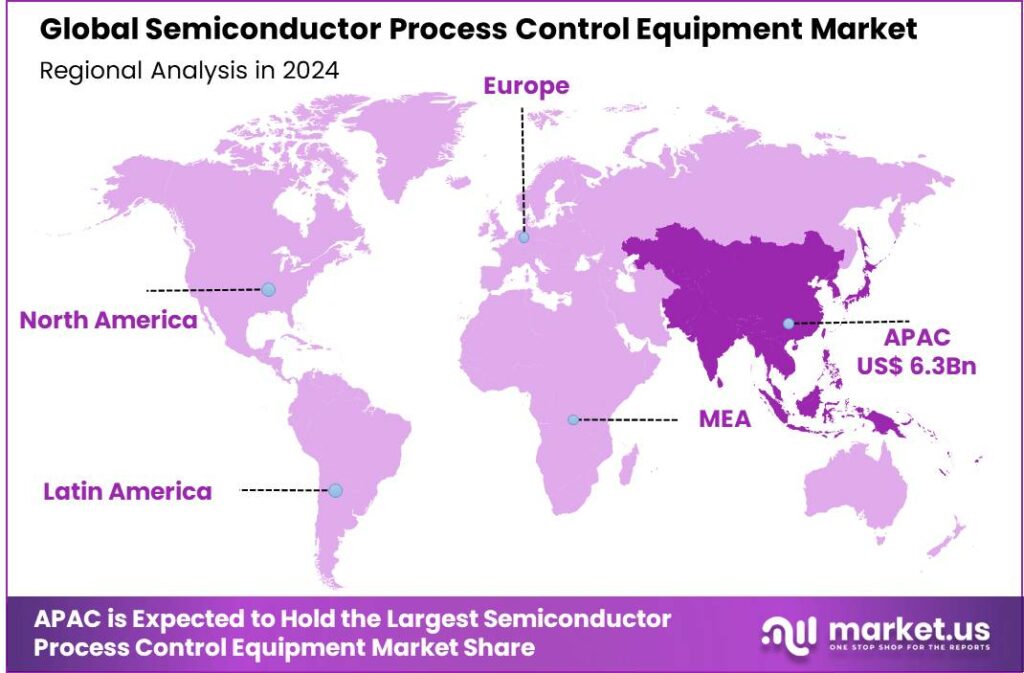

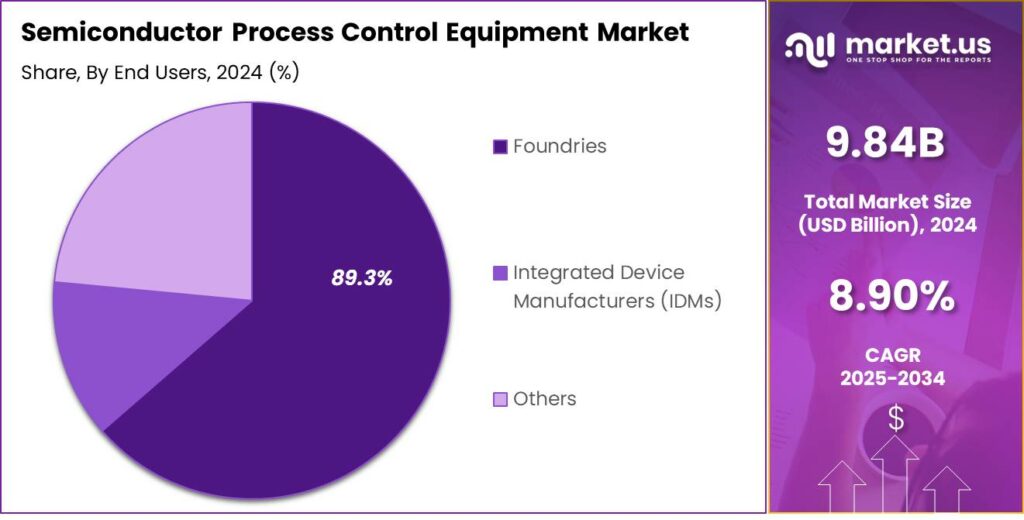

The Semiconductor Process Control Equipment Market size is expected to be worth around USD 23.1 Bn By 2034, from USD 9.84 Bn in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position in the semiconductor process control equipment market, capturing more than a 64.9% share, with revenues amounting to USD 6.3 bn.

Semiconductor Process Control Equipment consists of specialized devices and technologies used to monitor, control, and assure the quality of semiconductor manufacturing processes. Semiconductor process control equipment is essential for detecting defects, managing process variations, and ensuring high yield rates in semiconductor production.

The market includes metrology tools, inspection systems, and process control software, all vital for maintaining precision and efficiency in fabrication plants. The growth of the Semiconductor Process Control Equipment market is driven by the increasing complexity of semiconductor device designs, requiring higher precision in manufacturing.

The primary driving forces behind the growth of the Semiconductor Process Control Equipment market include the escalating need for miniaturized semiconductor devices and the rising complexity of semiconductor device manufacturing processes. Additionally, the integration of semiconductors in diverse industries and the continuous technological innovations in semiconductor fabrication technologies are propelling market growth.

Demand for Semiconductor Process Control Equipment is robust among memory manufacturers, foundries, and Integrated Device Manufacturers (IDMs). These sectors are expanding rapidly due to the soaring demand for advanced and efficient semiconductor devices, further driven by trends like mobile computing, cloud storage, and automotive electronics.

Adopting advanced Semiconductor Process Control Equipment enables manufacturers to enhance their operational efficiency and product quality. These benefits translate to lower manufacturing costs, reduced defect rates, and improved competitiveness in the global market. Businesses can also leverage these technologies to meet stringent international quality and compliance standards, thereby enhancing their market positioning.

Key Takeaways

- The Global Semiconductor Process Control Equipment Market size is expected to be worth around USD 23.1 Billion by 2034, up from USD 9.84 Billion in 2024, growing at a CAGR of 8.90% during the forecast period from 2025 to 2034.

- In 2024, the Metrology Equipment segment held a dominant market position, capturing more than a 48.5% share of the Semiconductor Process Control Equipment market.

- In 2024, the 300mm wafers segment held a dominant market position within the semiconductor process control equipment market, capturing more than a 62.4% share.

- In 2024, the Foundries segment held a dominant market position in the semiconductor process control equipment market, capturing more than an 89.3% share.

- In 2024, Asia-Pacific held a dominant market position in the semiconductor process control equipment market, capturing more than a 64.9% share, with revenues amounting to USD 6.3 billion.

- The U.S. market for semiconductor process control equipment was estimated at USD 2.79 billion in 2024. It is anticipated to grow at a CAGR of 8.12%.

Analysts’ Viewpoint

The Semiconductor Process Control Equipment market presents significant investment opportunities, particularly in regions experiencing rapid technological adoption such as Asia-Pacific, North America, and Europe. Investors are particularly focused on companies engaged in developing innovative process control solutions that cater to the evolving needs of semiconductor manufacturing.

Key factors impacting the market include technological advancements in semiconductor process technology, the global semiconductor demand surge, and stringent quality standards. The market is also influenced by economic fluctuations and global trade policies that affect semiconductor production and distribution.

Technological advancements are pivotal in the Semiconductor Process Control Equipment sector, with developments in areas like AI, machine learning, and advanced imaging technologies. These innovations aid in more precise defect detection and process optimization, leading to greater productivity and efficiency in semiconductor manufacturing processes.

The regulatory landscape for Semiconductor Process Control Equipment is increasingly stringent, focusing on environmental compliance and safety standards. Manufacturers must adhere to various international regulations that govern chemical usage, emissions, and waste management in semiconductor production, which significantly influences market dynamics and operational strategies.

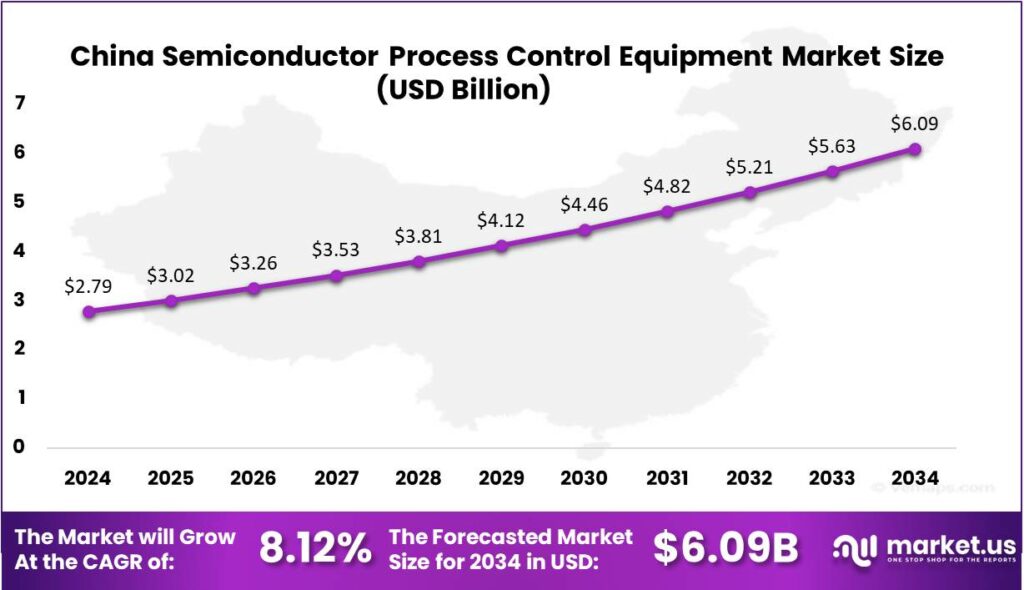

China Market Growth

The China market for semiconductor process control equipment was estimated at $2.79 billion in the year 2024. It is anticipated to grow at a compound annual growth rate (CAGR) of 8.12%.

This growth can be attributed to several factors, including advancements in semiconductor technology and increasing demand for electronics. As devices become more integrated and complex, the need for precise and efficient manufacturing processes becomes crucial. Semiconductor process control equipment ensures the quality and reliability of semiconductor devices by monitoring and controlling key steps in the manufacturing process.

The expansion of industries like automotive, consumer electronics, and telecommunications in the U.S. is driving semiconductor demand, which in turn boosts the market for process control equipment. U.S. government initiatives, such as funding for chip production and research, also support this growth. The increasing adoption of IoT and AI technologies is expected to further elevate the need for high-performance semiconductors, further fueling the market.

In 2024, Asia-Pacific held a dominant market position in the semiconductor process control equipment market, capturing more than a 64.9% share with revenues amounting to USD 6.3 billion. This substantial market share can be primarily attributed to the robust semiconductor manufacturing capabilities established in countries such as South Korea, Taiwan, and China.

Asia-Pacific’s leadership in the semiconductor market is reinforced by government policies that promote technological advancements and self-sufficiency in semiconductor supplies. These include subsidies, tax incentives, and funding for R&D projects. The region’s major semiconductor companies, expanding production to meet the rising global demand for electronics, also play a key role in driving market growth.

Moreover, Asia-Pacific benefits from an integrated supply chain, with easy access to raw materials and skilled labor, lowering production costs and enhancing manufacturing efficiency. The region’s strategic emphasis on semiconductor exports and the growing adoption of advanced technologies like AI, IoT, and 5G in domestic markets further solidify its market dominance.

The regions strong position in the semiconductor process control equipment market underscores its vital role in the global electronics value chain and sets a competitive benchmark for other regions. With ongoing innovations and expansions in the semiconductor sector, Asia-Pacific is poised to maintain its leadership in the market.

Equipment Type Analysis

In 2024, the Metrology Equipment segment held a dominant market position, capturing more than a 48.5% share of the Semiconductor Process Control Equipment market. This segment’s leadership is primarily driven by its critical role in the semiconductor manufacturing process.

The prominence of the Metrology Equipment segment is also bolstered by technological advancements that require rigorous quality control standards. As semiconductors become more integrated into various high-tech applications, from smartphones to autonomous vehicles, the need for precision in manufacturing has never been more critical.

The trend towards smaller node sizes in semiconductor devices, such as moving from 10nm to 7nm and beyond, increases manufacturing complexity and demands more precise metrology solutions. This shift drives sustained demand for metrology equipment, reinforcing its market dominance.

The Metrology Equipment segment thrives due to significant investments by semiconductor manufacturers focused on enhancing yield and efficiency. These investments aim to adopt advanced metrology systems for faster, more accurate data, which accelerates production and reduces waste. This commitment highlights metrology’s critical role in semiconductor manufacturing and strengthens its market position.

Wafer Size Analysis

In 2024, the 300mm wafers segment held a dominant market position within the semiconductor process control equipment market, capturing more than a 62.4% share. This segment leads primarily due to its wide adoption in high-volume manufacturing environments where economies of scale come into play.

Furthermore, the 300mm wafers segment benefits from substantial investments in new technology and infrastructure, tailored specifically to this wafer size. This is because most state-of-the-art semiconductor fabrication plants (fabs) are optimized for 300mm wafers, leveraging advanced process control technologies to enhance yield and efficiency.

Additionally, the demand for 300mm wafers is buoyed by their application in producing high-performance and energy-efficient processors required for modern applications such as smartphones, servers, and cloud computing. As these markets expand, the need for 300mm semiconductor process control equipment correspondingly increases, reinforcing the segment’s market leadership.

The future of the 300mm wafers segment looks promising, driven by technological advancements like extreme ultraviolet (EUV) lithography, which are primarily developed for 300mm wafers. These innovations support the segment’s growth and ensure its continued dominance in semiconductor process control equipment.

End Users Analysis

In 2024, the Foundries segment held a dominant market position in the semiconductor process control equipment market, capturing more than an 89.3% share. This significant dominance is largely due to the pivotal role foundries play in the semiconductor manufacturing process, where they are responsible for the bulk production of chips.

The leadership of the Foundries segment is strengthened through strategic partnerships with major tech companies, driving advanced manufacturing techniques for high-performance computing, mobile devices, and automotive applications. These collaborations boost production capabilities and foster innovation.

The growing demand for smaller, more powerful semiconductor components has pushed foundries to invest in advanced process control equipment. This investment ensures precision and quality in semiconductor products, which are vital for consumer electronics and industrial machinery, driving the sustained growth and market share of the foundry segment.

As technology evolves, foundries are quickly adapting to new market demands by expanding their service offerings to include more complex manufacturing processes. This adaptability has solidified their market position and set a competitive standard within the semiconductor industry, keeping the Foundries segment at the forefront of innovation and excellence.

Key Market Segments

By Equipment Type

- Metrology Equipment

- Wafer Inspection Equipment

- Process Control Equipment

- Others

By Wafer Size

- 300mm Wafers

- 200mm Wafers

- Others

By End Users

- Foundries

- Integrated Device Manufacturers (IDMs)

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Technological Advancements in Semiconductor Manufacturing

Continuous technological advancements in semiconductor manufacturing have significantly driven the demand for sophisticated process control equipment. As the industry progresses towards smaller node sizes and more complex chip architectures, precise control over manufacturing processes becomes imperative to ensure yield and performance.

Advanced process control equipment, such as metrology and inspection systems, are essential in detecting and mitigating defects at microscopic levels, thereby enhancing product reliability. The integration of artificial intelligence (AI) and machine learning (ML) into these systems has further improved their capability to predict and correct process anomalies in real-time, leading to increased efficiency and reduced production costs.

Restraint

High Capital Investment Requirements

The semiconductor process control equipment market is characterized by substantial capital investment requirements, which can act as a significant restraint. Developing and deploying advanced process control systems involve high costs, encompassing research and development, manufacturing, and integration into existing production lines.

For instance, cutting-edge inspection tools and metrology systems require sophisticated technologies that are expensive to develop and maintain. This financial burden can be particularly challenging for small and medium-sized enterprises (SMEs) in the semiconductor industry, limiting their ability to adopt the latest process control equipment. Consequently, the high capital investment required can hinder the widespread adoption of advanced process control technologies, thereby restraining market growth.

Opportunity

Expansion of Semiconductor Applications

The expansion of semiconductor applications into emerging fields presents a significant opportunity for the process control equipment market. The growing adoption of semiconductors in areas such as artificial intelligence, Internet of Things (IoT), autonomous vehicles, and 5G communications has led to increased demand for specialized and high-quality chips.

This diversification necessitates stringent process control measures to meet the specific requirements of these applications, thereby creating a substantial market opportunity for advanced process control equipment. Manufacturers that can provide versatile and adaptable process control solutions stand to benefit from this expanding application landscape.

Challenge

Integration with Existing Manufacturing Processes

Integrating new process control technologies into existing semiconductor manufacturing lines poses a significant challenge. The complexity of semiconductor fabrication processes means that introducing new equipment requires careful calibration and compatibility checks to ensure seamless operation.

Disruptions during integration can lead to production delays and increased costs. Moreover, training personnel to effectively operate new equipment adds to the challenge. Addressing these integration issues is crucial for manufacturers to fully realize the benefits of advanced process control technologies without compromising efficiency or product quality.

Emerging Trends

One notable trend is the adoption of virtual metrology techniques. These methods predict wafer properties using machine parameters and sensor data, eliminating the need for costly physical measurements. Virtual metrology uses statistical methods like classification and regression to improve yield prediction and enable preventive analysis, boosting manufacturing efficiency.

Another emerging trend is the integration of process development execution systems (PDES). PDES guide the development of high-tech manufacturing technologies by integrating personnel, data, information, knowledge, and business processes. PDES reduces time to market, lowers prototyping costs, improves quality, and decreases experimentation, making it valuable in semiconductor manufacturing.

Design for Manufacturability (DFM) focuses on anticipating fabrication challenges and adjusting chip layouts to minimize their impact. By following design rules and addressing manufacturing variability, DFM enhances yield and ensures the reliability of semiconductor devices.

Business Benefits

- Enhanced Product Quality: By maintaining precise control over fabrication processes, these systems ensure consistent production of high-quality semiconductor devices, reducing defects and improving reliability.

- Cost Reduction: Effective process control minimizes material waste and lowers scrap rates, leading to significant cost savings in manufacturing operations.

- Increased Throughput: Automated control systems streamline production workflows, resulting in faster processing times and higher output rates.

- Improved Equipment Utilization: Continuous monitoring and adjustments optimize equipment performance, extending tool life and maximizing return on investment.

- Enhanced Decision-Making: Unified process control systems provide comprehensive data analytics, enabling better detection of issues and informed decision-making, which contributes to overall operational efficiency.

Key Player Analysis

Applied Materials, Inc. is a leading player in the semiconductor process control equipment market. They specialize in providing equipment, services, and software that are crucial in the production of integrated circuits and advanced displays. Applied Materials is known for its innovative technologies in areas like wafer fabrication, deposition, and etching.

Lam Research Corporation is another key player in the semiconductor process control market, focusing primarily on wafer fabrication equipment. Lam Research is known for its expertise in etch and deposition technologies, which are vital for shaping the intricate patterns on semiconductor wafers.

KLA Corporation is a leader in process control and yield management systems for semiconductor manufacturing. The company’s expertise lies in providing advanced metrology, inspection, and data analytics solutions that help semiconductor manufacturers monitor and enhance their production processes. KLA’s products are vital for detecting defects and ensuring the accuracy of semiconductor chips at various stages of manufacturing.

Top Key Players in the Market

- Applied Materials, Inc.

- Lam Research Corporation

- KLA Corporation

- Tokyo Electron Limited (TEL)

- Hitachi High-Technologies Corporation

- Nikon Corporation

- Carl Zeiss

- Lasertec Corporation

- Nova Ltd.

- Other Major Players

Top Opportunities Awaiting for Players

- Integration of Advanced Technologies: The market is seeing a significant push towards integrating advanced technologies such as artificial intelligence (AI), machine learning, and big data analytics within semiconductor process control systems. This integration aids in enhancing precision in process control, which is crucial given the increasing complexity and miniaturization of semiconductor devices.

- Expansion in Emerging Markets: The Asia Pacific region is experiencing robust growth due to the increasing demand for consumer electronics and the presence of major semiconductor manufacturing hubs in countries like China, Taiwan, South Korea, and Japan. This regional market expansion offers substantial opportunities for players in the semiconductor process control equipment industry to establish and expand their operations.

- Advancements in Metrology and Inspection Systems: There is a growing demand for metrology and inspection equipment, driven by the need for high precision during the manufacturing processes to manage the smaller feature sizes of modern semiconductors. This demand is projected to drive the market growth substantially during the forecast period.

- Investments in Semiconductor Fabrication Facilities: Increasing investments in semiconductor fabrication facilities are expected to drive the demand for process control equipment. These facilities require state-of-the-art equipment to maintain high standards of quality and efficiency in semiconductor production.

- Rise in Demand for Electric Vehicles (EVs) and IoT Devices: The market is benefiting from the rising integration of semiconductors in automotive applications, particularly with the growth in production of EVs, and the expanding IoT ecosystem. These sectors require advanced semiconductors that, in turn, depend on sophisticated process control systems to ensure reliability and performance.

Recent Developments

- In March 2024, Lam Research Corporation introduced the Pulsus PLD system, the semiconductor industry’s first pulsed laser deposition tool designed for mass production. This technology enables next-generation MEMS-based microphones and RF filters with enhanced performance for 5G and beyond applications.

- In 2024, IDEX Corporation plans to acquire Mott Corporation, expanding its applied materials science technology capabilities across high-value end markets, including semiconductor wafer fab equipment.

Report Scope

Report Features Description Market Value (2024) USD 9.84 Bn Forecast Revenue (2034) USD 23.1 Bn CAGR (2025-2034) 8.90% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Equipment Type (Metrology Equipment, Wafer Inspection Equipment, Process Control Equipment, Others), By Wafer Size (300mm Wafers, 200mm Wafers, Others), By End Users (Foundries, Integrated Device Manufacturers (IDMs), Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Applied Materials, Inc., Lam Research Corporation, KLA Corporation, Tokyo Electron Limited (TEL), Hitachi High-Technologies Corporation, Nikon Corporation, Carl Zeiss, Lasertec Corporation, Nova Ltd., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Semiconductor Process Control Equipment MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Semiconductor Process Control Equipment MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Applied Materials, Inc.

- Lam Research Corporation

- KLA Corporation

- Tokyo Electron Limited (TEL)

- Hitachi High-Technologies Corporation

- Nikon Corporation

- Carl Zeiss

- Lasertec Corporation

- Nova Ltd.

- Other Major Players