Global Digital Twins in Manufacturing Market Size, Share Analysis Report By Solution (Component, Process, System), By Deployment (Cloud, On-premise), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Application (Product Design and Development, Process Optimization, Quality Management, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151216

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

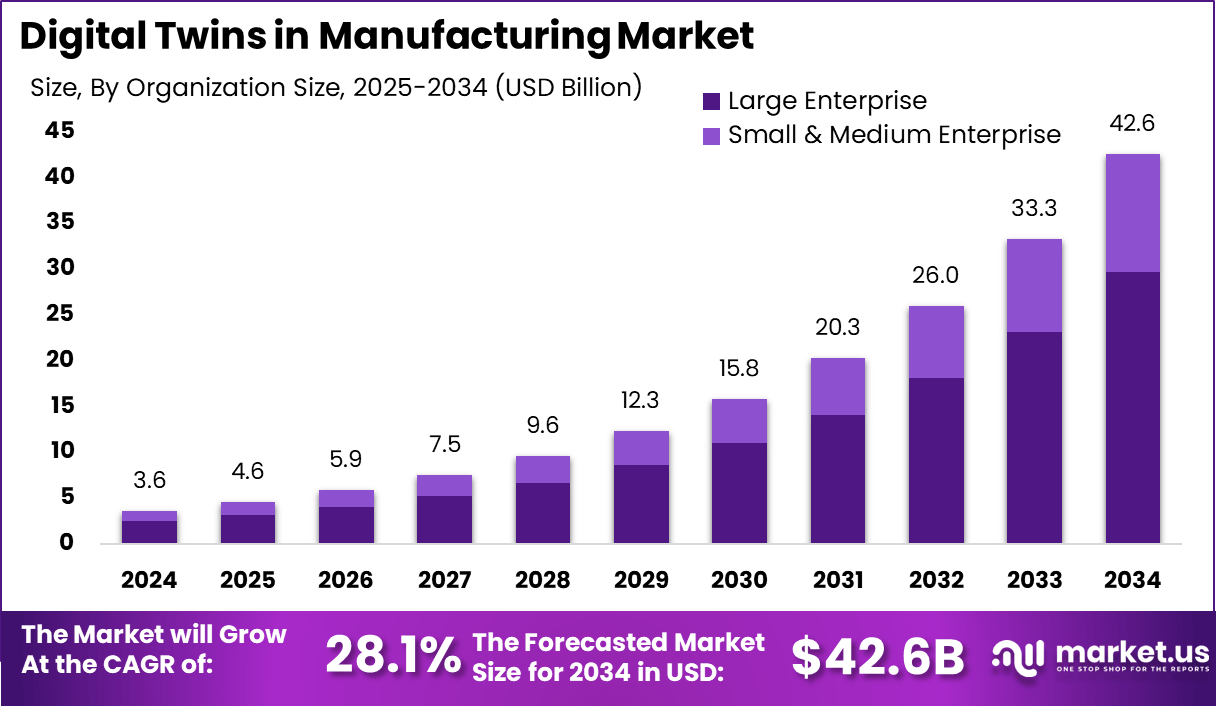

The Global Digital Twins in Manufacturing Market size is expected to be worth around USD 42.6 Billion By 2034, from USD 3.6 billion in 2024, growing at a CAGR of 28.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 33.7% share, holding USD 1.2 Billion revenue.

The digital twin concept within manufacturing refers to powerful, virtual replicas of physical assets, production processes, or complete factories. These mirrored models are built using real-time data captured from sensors and IIoT devices, enabling dynamic simulation, monitoring, and optimization. In manufacturing contexts, digital twins have evolved beyond static models to become living tools that mirror live operations, providing deeper process insight

Key driving factors for this market include the rapid proliferation of industrial IoT devices generating real-time data, increasing deployment of 3D printing technologies, and a strong shift toward sustainable, data-informed production. Advances in cloud computing, wireless connectivity, and 5G are enabling richer and faster twin simulations.

The rising adoption of technologies such as AI and machine learning further enhances the value of digital twins. Simulations become predictive, scenario-driven, and performance-optimized. Blockchain is also emerging as a means to ensure data integrity in twin systems, enhancing trust in complex, multi-stakeholder environments. These converging technologies enable deeper insights and clearer decision-making.

As reported by Market.us, The Global Digital Twins-as-a-Service (DTaS) Market is experiencing significant momentum, projected to grow from USD 16.8 bn in 2023 to nearly USD 397.1 bn by 2033, reflecting an impressive CAGR of 37.2% during the forecast period. This robust growth is being driven by the rising adoption of cloud platforms, real-time monitoring needs, and increasing integration of IoT and AI in industrial environments.

Organizations invest in digital twins primarily to reduce operational costs, improve product quality, and accelerate time-to-market. Virtual commissioning of production lines, training in risk-free environments, and fewer physical prototypes all contribute to business agility. Metrics such as a reduction of nearly 25 % in quality incidents, and a 3-5 % lift in sales due to quicker feature rollouts, underscore the tangible ROI of these systems

Key Takeaways

- The Global Digital Twins in Manufacturing Market is expected to surge from USD 3.6 billion in 2024 to approximately USD 42.6 billion by 2034, registering an impressive CAGR of 28.1% during the forecast period.

- In 2024, North America led the global market, accounting for over 33.7% of the share, with regional revenue reaching USD 1.2 billion.

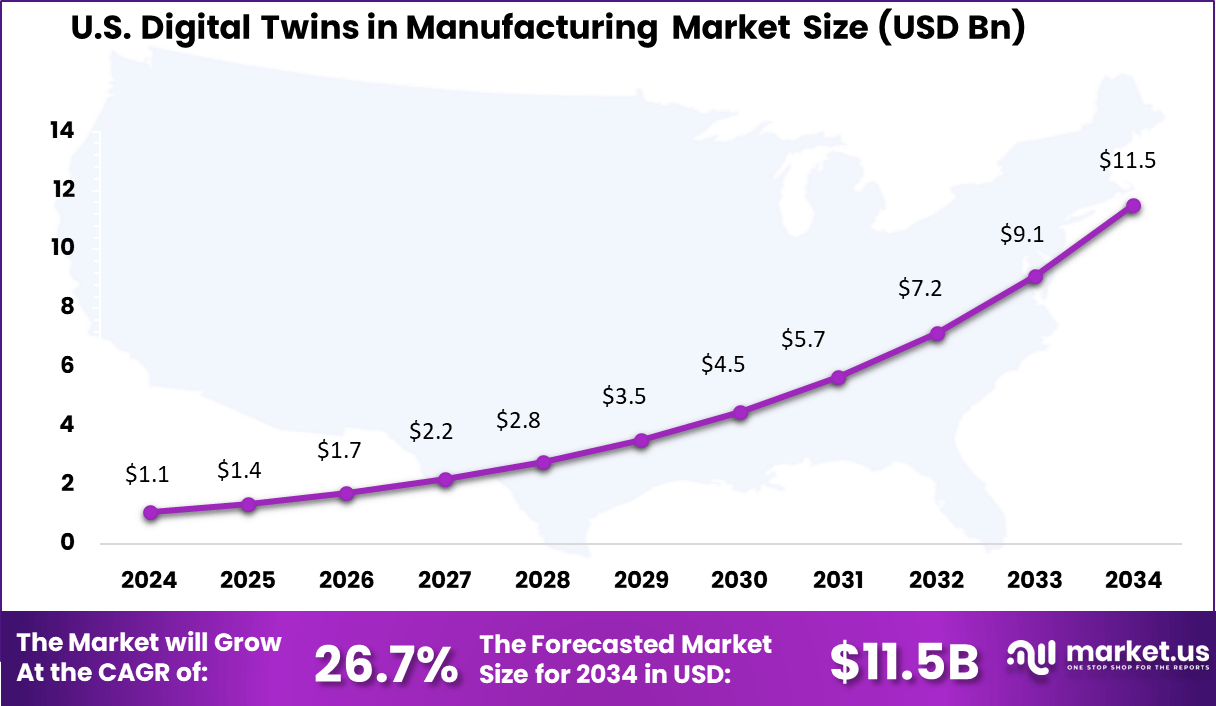

- The United States alone contributed USD 1.08 billion and is projected to expand at a robust CAGR of 26.7%, reflecting strong digital transformation in industrial operations.

- By solution, the System segment captured a dominant 42.3% share due to its comprehensive integration of hardware, software, and network capabilities across smart factories.

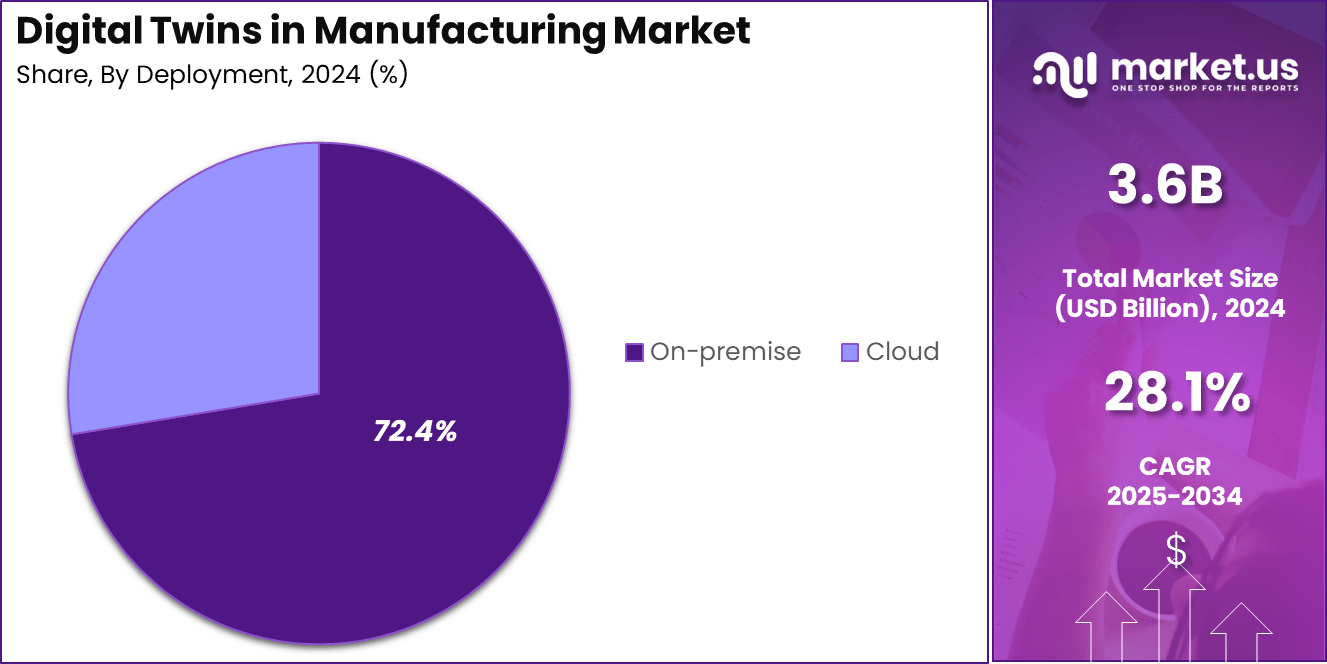

- In terms of deployment, the On-premise model led with 72.4% share, driven by the demand for data privacy, real-time performance, and legacy system integration in manufacturing environments.

- By enterprise size, Large Enterprises maintained dominance with 69.7% market share, supported by greater investment capacity and the need for end-to-end production visibility.

- For applications, Product Design and Development was the leading use case, accounting for 41.5% share, as manufacturers increasingly relied on simulation-driven design to shorten time-to-market and reduce prototyping costs.

Analysts’ Viewpoint

Investment opportunities are concentrated in cloud-native twin platforms, easy-to-deploy managed services for SMEs, and next-gen analytics dashboards. Vendors who offer turnkey twin deployments with strong integration into MES, ERP, and PLM systems are gaining attention. Geographic expansion, especially in regions with rising manufacturing digital transformation, is likewise opening investment windows, particularly in emerging markets.

Enterprises gain numerous benefits from adopting digital twins. These include improved asset availability through predictive maintenance, fewer production disruptions, enhanced process transparency, and stronger stakeholder confidence. Additionally, virtual training reduces human risk while accelerating workforce readiness, directly impacting productivity and safety.

The regulatory environment is increasingly supportive. In regions with tight sustainability and safety regulations, digital twins are being deployed to model emissions, product compliance, and lifecycle impacts. Manufacturing standards now often reference virtual testing for certification, prompting broader adoption.

US Market Expansion

The US Digital Twins in Manufacturing Market is valued at USD 1.1 Billion in 2024 and is predicted to increase from USD 3.5 Billion in 2029 to approximately USD 11.5 Billion by 2034, projected at a CAGR of 26.7% from 2025 to 2034.

In 2024, the United States held a dominant position in the digital twins in manufacturing market, driven by early technological adoption, robust industrial automation infrastructure, and a well-established presence of digital transformation strategies across sectors.

The leadership of the U.S. can be attributed to its advanced manufacturing ecosystem, where key industries – including aerospace, automotive, electronics, and heavy machinery – have widely embraced digital twin technologies to improve operational efficiency, predictive maintenance, and real-time simulation.

In 2024, North America held a dominant market position, capturing more than a 33.7% share, holding USD 1.2 billion revenue in the digital twins in manufacturing market. This leadership has been primarily driven by the United States, which has established itself as an early adopter of advanced industrial technologies such as IoT-enabled systems, edge computing, and AI-powered digital replicas.

The region’s mature manufacturing base, spanning industries like aerospace, automotive, electronics, and heavy engineering, has been instrumental in accelerating the deployment of digital twin solutions to optimize asset performance, reduce downtime, and simulate real-time operational changes before implementation.

By Solution Analysis

In 2024, System segment held a dominant market position, capturing more than a 42.3% share in the digital twins in manufacturing market. The dominance of this segment is largely attributed to its comprehensive integration capabilities across entire production lines and industrial assets.

System-level digital twins provide a real-time digital representation of entire machinery systems, enabling manufacturers to monitor interactions between machines, identify potential failures, and optimize full-system performance before physical deployment. These capabilities are especially critical in sectors like automotive, aerospace, and energy, where large-scale, interconnected systems require high precision and uptime.

The growing preference for end-to-end visibility across manufacturing operations has further pushed the adoption of system-based digital twins. Unlike component or process twins that focus on smaller elements, system twins allow plant managers and engineers to simulate various scenarios across the full production environment.

This supports faster decision-making, improved predictive maintenance, and more effective resource utilization. As manufacturing facilities continue to digitize and demand scalable, centralized monitoring platforms, the system segment is expected to maintain its lead through deeper AI integration and increasing connectivity across smart factory ecosystems.

By Deployment Analysis

In 2024, On-premise segment held a dominant market position, capturing more than a 72.4% share in the digital twins in manufacturing market. This leadership is strongly influenced by the high demand for data security, operational control, and real-time processing capabilities among manufacturers.

On-premise deployments allow organizations to manage their digital twin infrastructure within their own secured IT environments, ensuring sensitive production data and proprietary simulation models are fully protected. This is especially critical in industries such as defense, automotive, and pharmaceuticals, where data privacy and regulatory compliance are of paramount importance.

Moreover, on-premise solutions offer lower latency and higher customization, making them better suited for complex and resource-intensive manufacturing environments. These systems are often integrated directly with in-house industrial control systems, enabling seamless real-time synchronization between physical and digital assets.

While cloud-based adoption is steadily rising due to its scalability and cost efficiency, manufacturers with mission-critical operations continue to prefer on-premise setups to maintain system uptime, reduce external dependencies, and exercise tighter control over performance optimization.

By Enterprise Size Analysis

In 2024, Large Enterprises segment held a dominant market position, capturing more than a 69.7% share in the digital twins in manufacturing market. The segment’s leadership is driven by the significant financial and technological resources that large enterprises possess, enabling them to invest in complex digital twin ecosystems.

These organizations often manage expansive manufacturing operations involving multiple production lines, high-value machinery, and global supply chains – making real-time simulation, asset tracking, and predictive maintenance through digital twins a strategic necessity. Their ability to integrate digital twins with AI, IoT, and ERP systems allows for enhanced decision-making, reduced downtime, and more efficient operations at scale.

Large enterprises are also more likely to prioritize long-term digital transformation roadmaps. As a result, they lead in deploying end-to-end system-level twins for continuous monitoring, process optimization, and sustainability reporting. Furthermore, many of these companies operate in highly regulated industries, where traceability, compliance, and operational transparency are mandatory.

Digital twins provide a critical layer of visibility and control that aligns with both internal performance goals and external compliance requirements. Given their early adoption and capability to pilot and scale advanced solutions across multiple facilities, large enterprises are expected to maintain their leadership throughout the forecast period.

By Application Analysis

In 2024, Product Design and Development segment held a dominant market position, capturing more than a 45.5% share in the digital twins in manufacturing market. This segment leads primarily because digital twin technology enables engineers and designers to create, test, and refine product models in a virtual environment before they are physically produced.

The ability to simulate real-world conditions, stress levels, and performance parameters at the design stage significantly reduces the risk of costly design flaws and accelerates time-to-market. For industries like automotive, aerospace, and electronics – where precision, innovation, and product differentiation are critical- this virtual prototyping capability is now considered a foundational tool in the development cycle.

The rising complexity of modern products and growing demand for customization have further pushed manufacturers to adopt digital twins for design validation and iterative improvements. Digital twins facilitate continuous feedback from the physical asset to its virtual model, allowing manufacturers to optimize product features post-launch based on real-time usage data.

This approach supports sustainable product innovation while minimizing development costs and improving customer satisfaction. As companies increasingly prioritize simulation-led design strategies to stay competitive, the Product Design and Development segment is expected to remain the most influential application area in the near future.

Key Market Segments

By Solution

- Component

- Process

- System

By Deployment

- Cloud

- On-premise

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Application

- Product Design and Development

- Process Optimization

- Quality Management

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Shift Toward Cloud-Based Twin Platforms

The manufacturing sector is witnessing a strong shift toward cloud-based digital twin platforms. These platforms allow manufacturers to remotely simulate, monitor, and optimize physical assets using real-time data. By moving to cloud infrastructure, manufacturers can reduce the burden of on-premises IT resources and scale their digital twin models more efficiently.

This shift also encourages more collaboration across departments and geographic locations, making design validation and performance monitoring more seamless. The growing preference for subscription-based models is further driving the adoption of cloud-enabled twin systems.

Driver

Growing Demand for Predictive Maintenance

One of the strongest drivers behind the adoption of digital twins in manufacturing is the increasing need for predictive maintenance. With sensors and real-time data feeding into digital replicas of machinery, manufacturers can detect abnormal patterns and predict failures before they happen.

This reduces unexpected downtime, extends equipment life, and enhances productivity. As factories become more automated and data-driven, the value of digital twins in maintaining continuous operations and improving asset reliability is becoming more evident.

Restraint

High Initial Investment and Complexity

Despite the advantages, implementing digital twins in manufacturing often requires a significant upfront investment. Costs related to sensors, data integration, 3D modeling, and skilled workforce make it challenging, especially for small and mid-sized manufacturers.

Additionally, the complexity involved in setting up accurate virtual models of physical assets – along with the need for high data accuracy – can delay full-scale deployment. This financial and technical burden can limit adoption rates in some regions or sectors.

Opportunity

Integration with Smart Manufacturing Initiatives

Digital twins present a significant opportunity when aligned with smart manufacturing initiatives. These virtual models play a central role in optimizing production planning, enhancing energy efficiency, and supporting the design of automated workflows.

As governments and enterprises invest in Industry 4.0 infrastructure, digital twins are expected to become foundational tools in next-generation factories. Their ability to simulate entire production lines and test process changes before implementation makes them essential for continuous improvement strategies.

Challenge

Data Security and Interoperability

A major challenge facing digital twin adoption is related to cybersecurity and interoperability. Since digital twins rely on real-time data from machines, networks, and cloud systems, any vulnerabilities in data transmission or storage could pose operational risks.

Manufacturers also face issues in making different systems and platforms communicate with each other, especially when dealing with legacy equipment. Without common data standards and strong security frameworks, the full potential of digital twin ecosystems may remain underutilized.

Key Player Analysis

In early 2025, Siemens unveiled new AI‑driven digital twin features at CES and Hannover Messe. These innovations deliver high‑fidelity, photorealistic simulations of aircraft production lines and factory floors via its NX Immersive Designer and cloud‑based manufacturing tools. This places Siemens at the forefront of realistic, scalable factory simulation.

GE Vernova has continued to enhance its APM (Asset Performance Management) suite, combining machine learning and digital twin data at its 2025 APM conference in Houston. They also invested heavily in manufacturing capacity in U.S. plants, integrating advanced monitoring and twin‑based analytics into new hydrogen and turbine facilities.

At GTC 2025, NVIDIA expanded Omniverse Blueprints to support AI factory simulations in OpenUSD and released tools for physical‑AI digital twins. They also partnered with Deutsche Telekom to build Europe’s first industrial AI cloud to accelerate factory digital twins.

Top Key Players Covered

- Siemens Industry Software Inc.

- GE Vernova Inc.

- Microsoft Corporation

- NVIDIA Corporation

- IBM Corporation

- PTC Inc.

- Dassault Systèmes SE

- Bentley Systems, Incorporated

- Oracle Corporation

- Bosch Business Innovations GmbH

- Rockwell Automation, Inc.

- Hexagon AB

- Ansys, Inc.

- SAP SE

- Matterport, Inc.

- Others

Recent Developments

- October 2024: Siemens acquired Altair Engineering for approximately $10 billion. This transaction is intended to integrate Altair’s simulation and AI-based engineering tools into Siemens’ Xcelerator platform, strengthening its end-to-end digital twin and simulation capabilities in manufacturing and industrial design.

- March 2024: A leading technology vendor launched an AI-powered digital twin solution for real-time predictive maintenance on manufacturing lines.

- Feb 2024: GE Vernova spun off from GE and announced GridOS Data Fabric, a new digital twin and orchestration tool for electrical grid planning.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Bn Forecast Revenue (2034) USD 42.6 Bn CAGR (2025-2034) 28.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Component, Process, System), By Deployment (Cloud, On-premise), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Application (Product Design and Development, Process Optimization, Quality Management, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Industry Software Inc., GE Vernova Inc., Microsoft Corporation, NVIDIA Corporation, IBM Corporation, PTC Inc., Dassault Systèmes SE, Bentley Systems, Incorporated, Oracle Corporation, Bosch Business Innovations GmbH, Rockwell Automation, Inc., Hexagon AB, Ansys, Inc., SAP SE, Matterport, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Twins in Manufacturing MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Twins in Manufacturing MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Industry Software Inc.

- GE Vernova Inc.

- Microsoft Corporation

- NVIDIA Corporation

- IBM Corporation

- PTC Inc.

- Dassault Systèmes SE

- Bentley Systems, Incorporated

- Oracle Corporation

- Bosch Business Innovations GmbH

- Rockwell Automation, Inc.

- Hexagon AB

- Ansys, Inc.

- SAP SE

- Matterport, Inc.

- Others