Global Compact Loader Market Size, Share, Growth Analysis By Product Type (Skid Steer Loaders, Compact Track Loaders, Backhoe Loaders, Wheel Loaders), By Operating Capacity (Less than 1,200 lbs, 1,200–2,000 lbs, 2,000–3,000 lbs, Above 3,000 lbs), By Engine Power (Less than 50 HP, 50–75 HP, Above 75 HP), By Application (Construction, Agriculture, Landscaping, Mining, Forestry, Material Handling), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138116

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

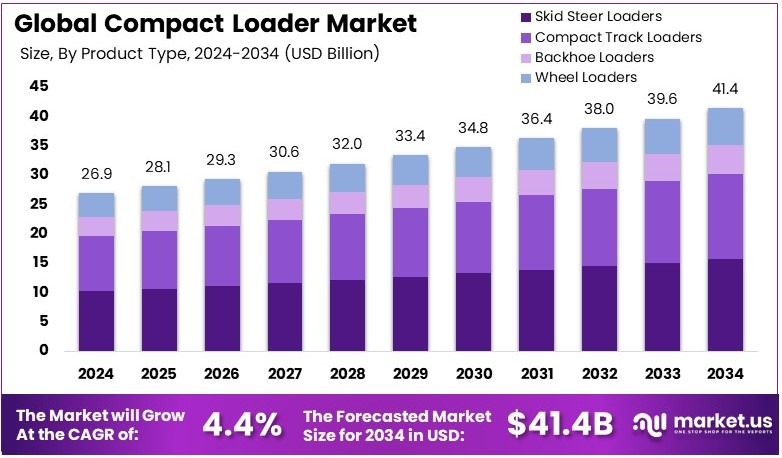

The Global Compact Loader Market size is expected to be worth around USD 41.4 Billion by 2034, from USD 26.9 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

A compact loader is a small, versatile machine used in construction and landscaping. It features a bucket on the front and is designed for tasks in tight spaces. These loaders are ideal for digging, lifting, and moving materials on small sites. They offer agility and efficiency for various job requirements.

The compact loader market involves the design, production, and sale of small loaders. It serves construction companies, landscapers, and farmers. The market includes different models suited for various tasks. It focuses on providing efficient, reliable machines for work in confined spaces and smaller projects.

Compact loaders play a pivotal role in the construction and landscaping sectors, offering unparalleled versatility and efficiency. These machines are highly valued for their ability to operate effectively in confined spaces, making them essential for urban construction sites and small to medium-sized projects.

In Queensland, Australia, the upcoming 2032 Olympic and Paralympic Games are a significant catalyst for infrastructure growth, with over $100 billion allocated to various projects. Notable among these is the $10 billion upgrade to the Bruce Highway and the $18.4 billion Borumba Pumped Hydro project.

These large-scale developments underscore the essential role of compact loaders in major construction efforts, ensuring efficient project execution. Similarly, Southern Europe is witnessing a surge in infrastructure investment, fueled by the €800 billion NextGenerationEU program.

Countries like Greece, Spain, Portugal, and Italy are leveraging these funds to enhance their infrastructure, thus creating substantial opportunities for the compact loader market. The demand in these regions is a testament to the loaders’ versatility and efficiency in handling diverse construction tasks.

In the United States, the landscaping services industry, valued at $153 billion and employing over a million people, extensively uses compact loaders for various landscaping projects. This sector’s growth provides continuous opportunities for the deployment of compact loaders in a range of settings, from residential yards to large public spaces.

Additionally, the U.S. construction industry, with a market size of approximately $1.8 trillion, relies heavily on compact loaders for numerous construction and demolition activities. The broad and localized impact of government investments and regulatory frameworks across these regions not only drives demand for compact loaders but also encourages manufacturers to innovate and adapt to the evolving market needs.

Key Takeaways

- Compact Loader Market was valued at USD 26.9 Billion in 2024, and is expected to reach USD 41.4 Billion by 2034, with a CAGR of 4.4%.

- In 2024, Skid Steer Loaders lead the product type segment with 38%, offering high maneuverability in various construction and agricultural applications.

- In 2024, 1,200–2,000 lbs operating capacity dominates the segment with 40%, suitable for a variety of job site conditions and tasks.

- In 2024, 50–75 HP engine power leads the market with 55%, offering an optimal balance of power and efficiency for small-to-medium tasks.

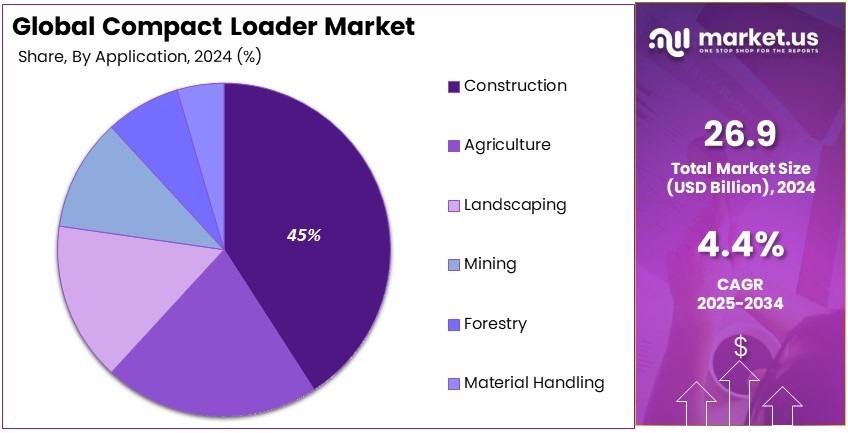

- In 2024, Construction dominates the application segment with 45%, as compact loaders are critical in construction activities for excavation and material handling.

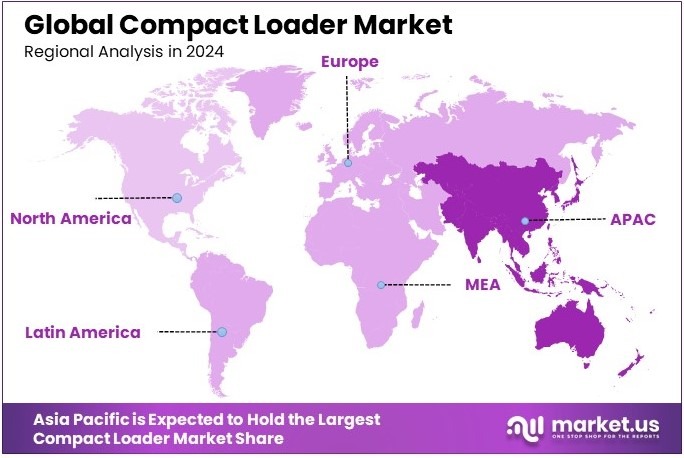

- Asia Pacific’s dominance in the Compact Loader Market is driven by extensive construction activities, agricultural modernization, and increasing infrastructure projects across the region.

Product Type Analysis

Skid Steer Loaders dominate with 38% due to their versatility and ease of operation.

In the Compact Loader Market, Skid Steer Loaders hold the largest market share at 38%, primarily because of their versatility and ease of operation. These compact loaders are favored in construction and landscaping due to their ability to maneuver in tight spaces and their compatibility with various attachments, making them highly adaptable for different tasks.

Other types of compact loaders also contribute significantly to the market. Compact Track Loaders are preferred for their stability and lower ground pressure, which is ideal for soft ground conditions. Backhoe

Loaders combine the functions of a digger and a loader, offering exceptional utility in various scenarios. Wheel Loaders are suitable for tasks that require more power and higher lifting capabilities, commonly used in mining and quarrying.

Operating Capacity Analysis

1,200–2,000 lbs capacity loaders lead with 40% due to their optimal balance of power and maneuverability.

Loaders with an operating capacity between 1,200 and 2,000 lbs dominate the market with a 40% share. This segment offers an optimal balance between power and maneuverability, making these loaders ideal for a wide range of applications, from construction sites to agricultural tasks.

Smaller loaders with less than 1,200 lbs capacity are ideal for indoor work or in environments where space is constrained. Larger loaders, both in the 2,000–3,000 lbs category and those above 3,000 lbs, are preferred for their increased lifting capacity and stability, suitable for heavier industrial applications.

Engine Power Analysis

50–75 HP engines dominate with 55% due to their strong performance in a compact design.

In the engine power segment, loaders equipped with 50 to 75 HP engines hold the largest share at 55%. These engines provide the best compromise between fuel efficiency and power, suitable for the majority of compact loading tasks. Their robust performance in a compact design makes them ideal for both commercial and residential projects.

Loaders with less than 50 HP are typically used for lighter tasks and offer the benefit of lower operating costs. Those with more than 75 HP are necessary for more demanding tasks that require additional power, such as in mining and heavy construction.

Application Analysis

Construction dominates the application segment with 45% due to extensive use in building projects.

The Construction sector is the largest application area for compact loaders, accounting for 45% of the market. Their use in building projects is critical, as they perform a multitude of tasks ranging from site preparation to material handling, proving essential in both small and large scale projects.

Compact loaders are also extensively used in Agriculture for tasks such as feeding livestock and clearing land. Landscaping applications benefit from their ability to handle various ground materials and assist in creating and maintaining aesthetic spaces.

In Mining, these loaders are utilized for material transport and site preparation. Forestry operations use compact loaders for clearing land and managing forest materials efficiently. Lastly, Material Handling applications leverage these loaders’ versatility in warehouses and other storage facilities.

Key Market Segments

By Product Type

- Skid Steer Loaders

- Compact Track Loaders

- Backhoe Loaders

- Wheel Loaders

By Operating Capacity

- Less than 1,200 lbs

- 1,200–2,000 lbs

- 2,000–3,000 lbs

- Above 3,000 lbs

By Engine Power

- Less than 50 HP

- 50–75 HP

- Above 75 HP

By Application

- Construction

- Agriculture

- Landscaping

- Mining

- Forestry

- Material Handling

Driving Factors

Infrastructure Growth and Versatility Drive Market Growth

The compact loader market is driven by increased construction and infrastructure activities globally. Urban projects require equipment that is compact and versatile, making compact loaders an ideal choice for constrained spaces. These machines are also seeing rising adoption in agriculture due to their multi-utility features, such as handling, hauling, and lifting tasks.

In addition, the expanding landscaping and maintenance industry fuels demand for compact loaders. Professionals in this sector prefer these machines for tasks like soil preparation, grading, and debris removal. Their adaptability to different terrains further strengthens their appeal.

Compact loaders offer flexibility with a range of attachments, allowing operators to perform diverse tasks efficiently. For example, a landscaping firm can use a single compact loader for mowing, digging, and moving materials, enhancing productivity and reducing costs.

These factors collectively contribute to the growth of the compact loader market. As construction, agriculture, and landscaping industries expand, the demand for equipment that offers versatility, efficiency, and compactness increases.

Restraining Factors

Limited Scope and Rising Costs Restraints Market Growth

The market faces challenges due to the limited applications of compact loaders in heavy-duty construction projects. Their smaller size and capacity make them less suitable for large-scale operations, restricting their market scope.

Accessing remote and underdeveloped regions is another significant restraint. Poor infrastructure and transportation hurdles make it difficult for manufacturers and suppliers to penetrate these areas.

Rising competition from alternative compact construction equipment, such as skid-steer loaders and mini excavators, further impacts market growth. Customers often weigh these alternatives against compact loaders for cost-effectiveness and functionality.

Fluctuations in raw material prices increase manufacturing costs, putting pressure on both producers and consumers. For instance, steel price volatility can lead to higher production costs, ultimately affecting the final price of compact loaders.

These factors collectively slow market expansion, particularly in regions and sectors where compact loaders face stiff competition or logistical challenges. Overcoming these restraints is essential for the market to achieve sustained growth.

Growth Opportunities

Electric Loaders and Technology Integration Provide Opportunities

The growing adoption of electric and hybrid compact loaders creates significant opportunities in the market. These machines offer energy efficiency, reduced emissions, and lower operating costs, aligning with sustainability goals in the construction and agriculture sectors.

Rental and leasing services for compact construction rental equipment also present growth potential. These services enable small businesses and contractors to access advanced equipment without large capital investments, broadening market reach.

The development of loaders with enhanced telematics and IoT integration is another promising trend. These technologies allow operators to monitor performance, manage fleets, and reduce downtime through predictive maintenance. For example, a construction company can track equipment usage and optimize operations using real-time data from IoT-enabled compact loaders.

Furthermore, the demand for compact loaders in forestry and landscaping applications continues to grow. These machines are ideal for tasks like clearing land, preparing soil, and managing waste in environmentally sensitive areas.

Emerging Trends

Lightweight Designs and Multi-Utility Features Are Latest Trending Factors

The shift toward lightweight and energy-efficient compact loaders is a key trend shaping the market. These loaders reduce fuel consumption and offer better maneuverability, making them attractive for urban and environmentally conscious projects.

The increasing popularity of track loaders over wheeled loaders is another notable trend. Track loaders provide better stability and traction on uneven terrains, making them ideal for construction, agriculture, and landscaping tasks.

The demand for multi-attachment loaders is also growing. These machines support various attachments, enabling operators to switch between tasks like digging, grading, and lifting seamlessly. This versatility enhances their appeal in industries that require diverse applications.

Additionally, compact loaders are being adopted for snow removal and utility applications, especially in regions with harsh winters. For example, municipalities are using compact loaders for clearing snow in narrow streets and sidewalks.

Regional Analysis

Asia Pacific Dominates the Compact Loader Market with Significant Market Share

Asia Pacific’s dominance in the Compact Loader Market is driven by extensive construction activities, agricultural modernization, and increasing infrastructure projects across the region. Rapid urbanization in populous countries like China and India significantly contributes to the high demand for compact loaders.

The region’s growth is supported by strong economic developments and investments in construction and infrastructure sectors. Compact loaders are essential in these areas due to their versatility and ability to operate in varied terrains, which is crucial in the diverse geographical landscapes of Asia Pacific.

The future of the Compact Loader Market in Asia Pacific looks promising with continued urbanization and increased government spending on public infrastructure. As the region focuses more on sustainable and efficient construction practices, the demand for advanced compact loaders is expected to rise, further strengthening its market presence.

Regional Mentions:

- North America: North America remains a key player in the Compact Loader Market, driven by technological advancements and the adoption of new construction practices. The region’s focus on enhancing operational efficiency and emissions reduction continues to influence its market growth.

- Europe: Europe’s Compact Loader Market benefits from stringent environmental regulations and a high focus on fuel efficiency. The market is supported by the construction sector’s push for technologically advanced, eco-friendly equipment.

- Middle East & Africa: The Compact Loader Market in the Middle East & Africa is growing, fueled by infrastructure developments and investments in the oil and gas sector. The region’s strategic initiatives to diversify economies offer new opportunities for market expansion.

- Latin America: Latin America sees steady growth in the Compact Loader Market due to improvements in urban infrastructure and agricultural activities. The region’s economic recovery post-recession aids in the gradual increase in demand for compact loaders.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Compact Loader Market is intensely competitive, with major players like Caterpillar Inc., Deere & Company, Bobcat Company, and Komatsu Ltd. leading the way. These companies have established strong market positions through consistent innovation, robust product offerings, and strategic global networks.

Caterpillar Inc. is renowned for its durable and versatile compact loaders, which are widely used in construction and mining. Caterpillar’s commitment to technological advancement and strong customer service helps it maintain a leading position.

Deere & Company offers a range of highly efficient and reliable compact loaders, popular among customers for their ease of use and technological integration. Deere’s focus on sustainability and innovation further strengthens its market presence.

Bobcat Company specializes in compact loaders and maintains a strong market reputation for the durability and agility of its machines. Bobcat loaders are favored in landscaping and agricultural applications due to their compact size and versatility.

Komatsu Ltd. provides compact loaders that are highly valued for their advanced features and reliability in challenging conditions. Komatsu’s commitment to R&D and its ability to integrate new technologies like automation and data analytics into its products enhances its competitiveness.

These key players dominate the market by leveraging their extensive industry experience, technological leadership, and comprehensive service offerings. They continuously evolve their product lines to meet diverse customer needs across various industries, ensuring their continued market dominance and influence in the global Compact Loader Market. Their ongoing innovation and adaptation to market trends are crucial for maintaining their competitive edge in a rapidly changing industry landscape.

Major Companies in the Market

- Caterpillar Inc.

- Deere & Company

- Bobcat Company

- Komatsu Ltd.

- CNH Industrial N.V. (CASE Construction Equipment)

- JCB Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Volvo Construction Equipment

- Kubota Corporation

- Takeuchi Manufacturing Co., Ltd.

Recent Developments

- Caterpillar: On September 2024, Caterpillar launched eight new next-generation Cat® Skid Steer Loaders (SSL) and Compact Track Loaders (CTL), featuring improved power, performance, and operator comfort. The updated models, including the Cat 250, 260, 270, 275, 285, and their XE variants, offer enhanced lift height, breakout forces, and hydraulic capabilities, with advanced technology integration for greater machine efficiency and operator ease.

- John Deere: On June 2024, John Deere introduced five new P-Tier models of Skid Steer Loaders (SSL) and Compact Track Loaders (CTL), including the 330, 334, 331, 333, and 335 models, featuring enhanced power, technology, and comfort upgrades. Key advancements include a new one-piece cab design, premium seat options, and the integration of SmartGrade™ technology for improved grading capabilities, alongside new attachments such as the CP40G Cold Planer and MK76 Mulching Heads.

- Volvo Construction Equipment: On April 2024, Volvo Construction Equipment launched updated L30 and L35 compact wheel loaders, enhancing functionality and operator experience. These models, designed for a range of applications from construction to agriculture, now feature improved maneuverability, tractive force, and faster work cycles.

Report Scope

Report Features Description Market Value (2024) USD 26.9 Billion Forecast Revenue (2034) USD 41.4 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Skid Steer Loaders, Compact Track Loaders, Backhoe Loaders, Wheel Loaders), By Operating Capacity (Less than 1,200 lbs, 1,200–2,000 lbs, 2,000–3,000 lbs, Above 3,000 lbs), By Engine Power (Less than 50 HP, 50–75 HP, Above 75 HP), By Application (Construction, Agriculture, Landscaping, Mining, Forestry, Material Handling) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Caterpillar Inc., Deere & Company, Bobcat Company, Komatsu Ltd., CNH Industrial N.V. (CASE Construction Equipment), JCB Ltd., Hitachi Construction Machinery Co., Ltd., Volvo Construction Equipment, Kubota Corporation, Takeuchi Manufacturing Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Caterpillar Inc.

- Deere & Company

- Bobcat Company

- Komatsu Ltd.

- CNH Industrial N.V. (CASE Construction Equipment)

- JCB Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Volvo Construction Equipment

- Kubota Corporation

- Takeuchi Manufacturing Co., Ltd.