Global Digital Twin Simulation Market Size, Share Analysis Report By Solution (Component, Process, System), By Deployment (Cloud, On-premise), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Application (Product Design & Development, Predictive Maintenance, Business Optimization, Others), By End User (Manufacturing, Agriculture, Automotive & Transport, Energy & Utilities, Healthcare & Life Sciences, Residential & Commercial, Retail & Consumer Goods, Aerospace, Telecommunication, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145379

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- US Digital Twin Simulation Market

- Solution Analysis

- Deployment Analysis

- Enterprise Size Analysis

- Application Analysis

- End User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

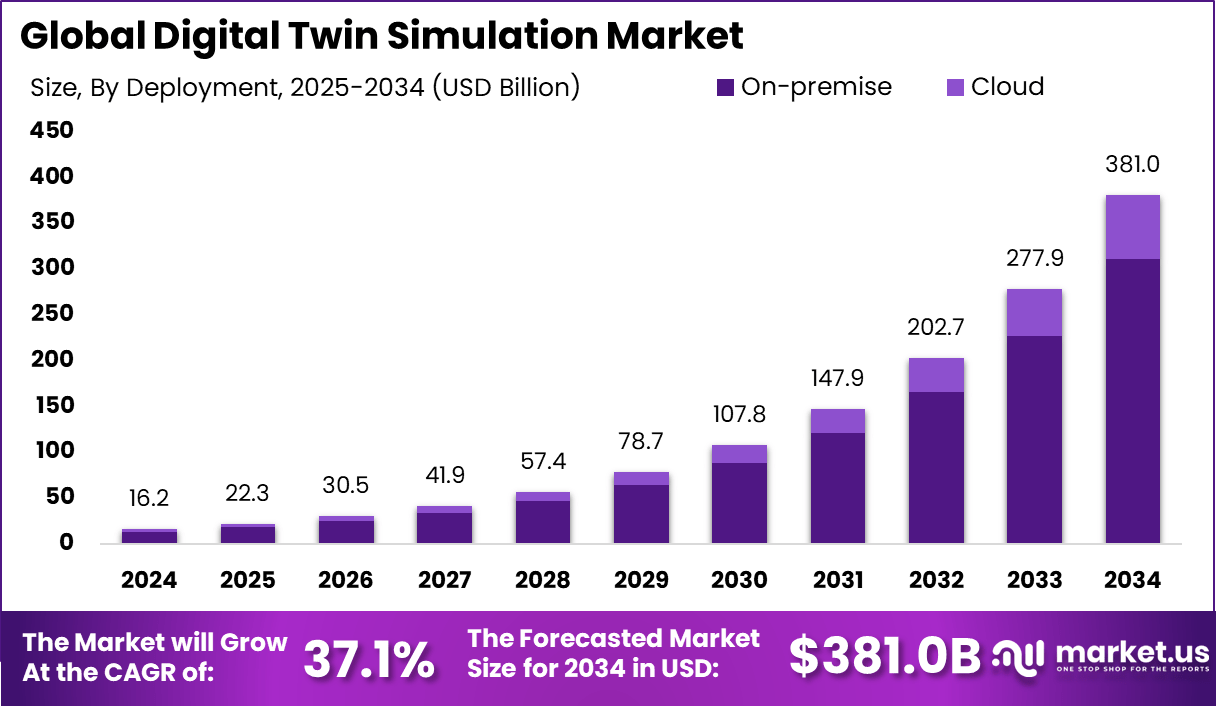

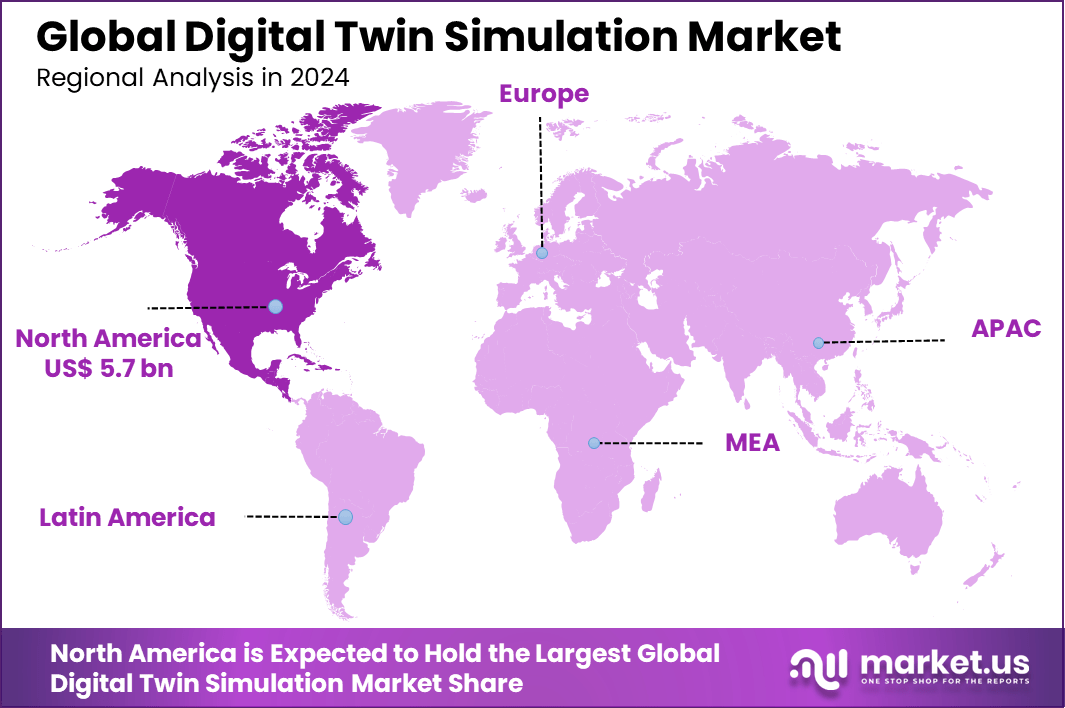

The Global Digital Twin Simulation Market size is expected to be worth around USD 381 Billion By 2034, from USD 16.2 billion in 2024, growing at a CAGR of 37.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.7% share, holding USD 5.7 Billion revenue.

Digital Twin Simulation involves the creation of a virtual model that represents a physical object or system. This model is continuously updated with data from its real-world counterpart, allowing it to simulate real-time conditions and predict future behaviors or outcomes. The core elements of a digital twin include a digital model, the physical twin it represents, and the data that connects the two.

The digital twin simulation market is experiencing robust growth, driven by the increased adoption across multiple sectors such as manufacturing, healthcare, and urban planning. The primary drivers of the digital twin market include the need for improved R&D, greater operational efficiency, and enhanced product lifecycle management.

Companies are investing in digital twins to refine product designs and optimize manufacturing processes before production, significantly reducing costs and improving time-to-market. Demand for digital twins is propelled by their ability to provide detailed insights into product performance and operational efficiency.

Industries such as aerospace, automotive, and energy are increasingly adopting digital twins to predict maintenance needs and optimize operations, thereby reducing downtime and extending asset life. There is a notable trend towards integrating digital twins with IoT and AI technologies to enhance their predictive capabilities and real-time data analysis.

This integration supports more complex simulations and better decision-making, further driving the adoption of digital twins in sectors like healthcare for personalized treatments and in urban planning for sustainable development.

As reported by Market.us, the Global Digital Twin Market is projected to experience robust growth over the coming decade. The market size, which stood at USD 11.8 billion in 2023, is expected to reach approximately USD 522.9 billion by 2033. This growth reflects an exceptional compound annual growth rate (CAGR) of 46.1% from 2024 to 2033.

In parallel, the Global AI-powered Simulation & Digital Twins Market is also demonstrating strong momentum. Valued at USD 3.7 billion in 2024, it is anticipated to grow to around USD 81.3 billion by 2034, advancing at a CAGR of 36.20% during the forecast period 2025–2034.

Organizations are adopting digital twin technologies primarily to gain a competitive advantage through enhanced analytical capabilities and operational insights. The ability to test scenarios virtually before applying them in the real world reduces risks and costs associated with physical trials.

Key Takeaways

- By Solution: The system segment accounted for 42.8% of the market share, indicating its dominant role in the deployment of digital twin simulations.

- By Deployment: On-premise deployment held a significant majority with 81.7%, reflecting a strong preference for internal infrastructure among enterprises.

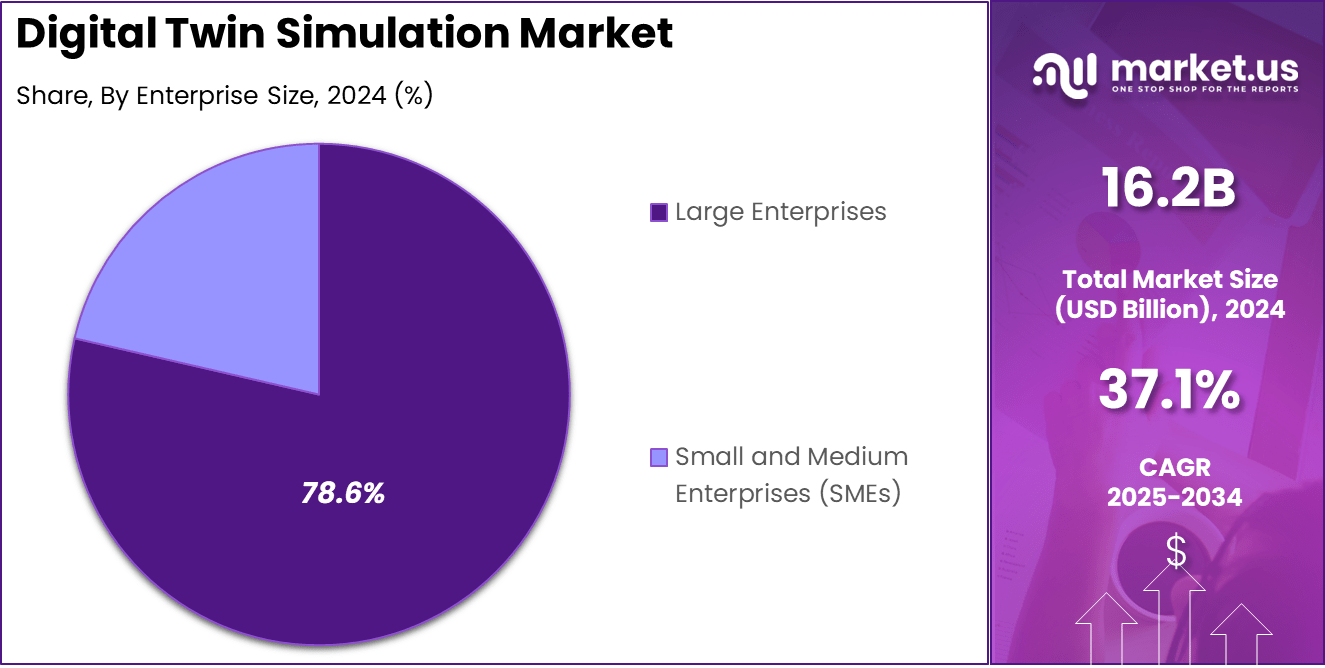

- By Enterprise Size: Large enterprises constituted 78.6% of the market, highlighting their substantial investment capacity and early adoption rate.

- By Application: Predictive maintenance led the application segment with a 38.7% share, underscoring its critical value in operational efficiency.

- By End User: The automotive and transportation sector held a 23.2% share, positioning it as the leading industry user of digital twin simulation technology.

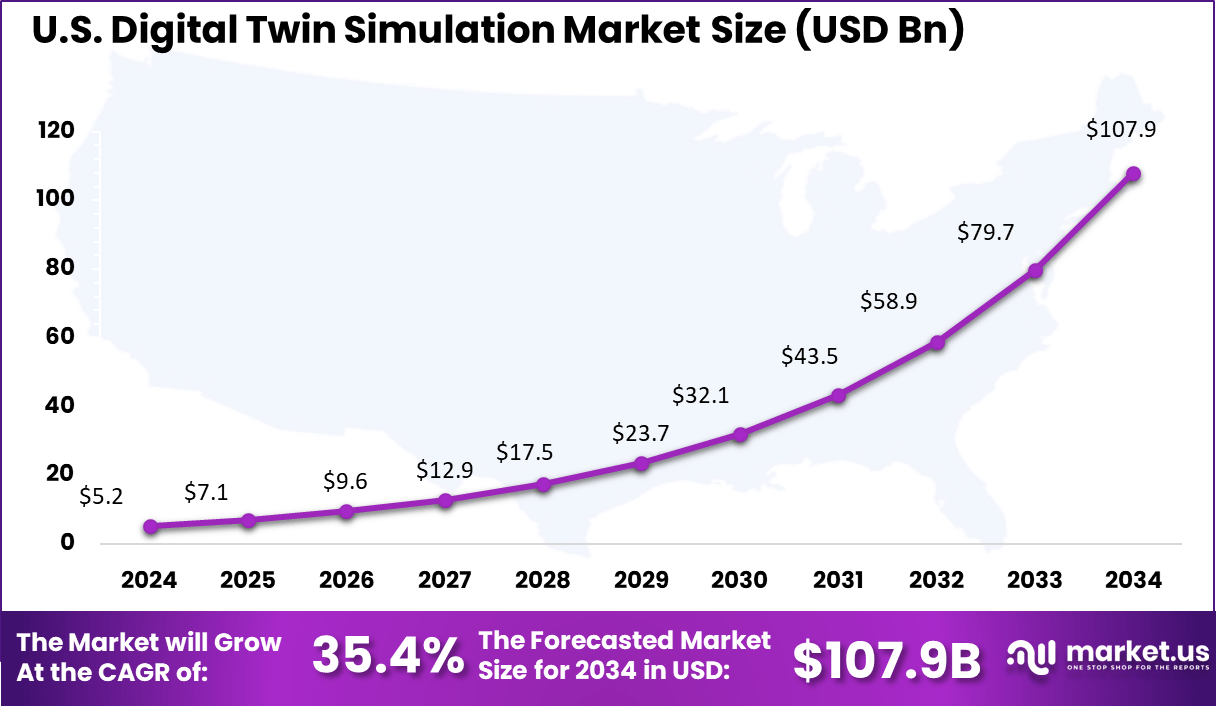

- By Region: North America accounted for 35.7% of the market, with the United States contributing USD 5.21 billion.

- Growth Outlook: The market in the United States is projected to grow at a robust CAGR of 35.4%, driven by technological advancements and increased digital adoption.

Analysts’ Viewpoint

Digital twins offer substantial investment opportunities, particularly in sectors that rely heavily on operational efficiency and equipment reliability, such as manufacturing, healthcare, and automotive industries. The business benefits are extensive, ranging from enhanced operational efficiency to improved product quality and reduced environmental impact.

Advancements in digital twin technology continue to evolve, focusing on better integration with existing systems, enhanced data analysis capabilities, and more sophisticated predictive analytics. These advancements are making digital twins more accessible and valuable across a wider range of industries and applications.

The regulatory environment for digital twin technology is still developing, with significant attention on data security and privacy concerns. As the technology involves extensive data collection and analysis, ensuring the security and privacy of this data is paramount for its wider adoption.

The top impacting factors include technological innovation, industry adoption rates, and regulatory policies. The cost of implementing and maintaining digital twin technologies can also significantly affect their adoption, particularly in cost-sensitive industries.

US Digital Twin Simulation Market

The US Digital Twin Simulation Market is valued at approximately USD 5.2 Billion in 2024 and is predicted to increase from USD 7.1 Billion in 2025 to approximately USD 107.9 Billion by 2034, projected at a CAGR of 35.4% from 2025 to 2034.

In 2024, North America held a dominant market position in the digital twin simulation market, capturing more than a 35.7% share with revenues amounting to USD 5.7 billion. This significant market share can be attributed to several key factors. Firstly, the region boasts a robust technological infrastructure, which facilitates the development and adoption of advanced digital twin technologies.

Additionally, the presence of leading technology firms who are pioneers in digital twin applications contributes to the market’s growth in this region. Moreover, the integration of digital twins with Internet of Things (IoT) devices, which is more prevalent in North America than in other regions, enhances the operational efficiency of industries such as manufacturing, automotive, and aerospace.

These industries are notably quick to adopt innovative technologies that promise improved data analytics and real-time monitoring capabilities. Government initiatives and funding in North America also play a crucial role in advancing digital twin technology.

Such policies support research and development activities, encouraging startups and established companies to innovate in this field. Furthermore, the increasing investment in smart cities and infrastructure projects in the U.S. and Canada is expected to drive demand for digital twin solutions to optimize project outcomes and maintenance.

Solution Analysis

In 2024, the System segment of the Digital Twin Simulation Market held a dominant position, capturing more than 42.8% of the market share. This significant market presence is attributed to the comprehensive nature of system solutions in digital twin technology, which encompasses the creation, deployment, and operation of digital twins at scale.

System solutions offer platforms and frameworks that are integral for managing digital twins across various industries, enhancing their functionality through seamless integration with existing IT systems and leveraging advanced predictive capabilities.

The leadership of the System segment is further reinforced by its ability to provide end-to-end solutions that are crucial for the successful implementation of digital twins. These solutions enable organizations to not only visualize but also operate their digital twin environments efficiently, ensuring real-time data utilization and interoperability across different platforms and devices.

The integration of AI and analytics within these system solutions enhances their capability to perform complex simulations and analyses, making them invaluable tools for industries looking to optimize operations and reduce downtime.

Moreover, the growing emphasis on digital transformation across sectors such as manufacturing, healthcare, and urban planning has propelled the adoption of system solutions. These platforms facilitate a more holistic approach to managing lifecycle processes and assets digitally, from initial design through to maintenance and decommissioning phases.

Deployment Analysis

In 2024, the On-premise segment of the Digital Twin Simulation Market secured a commanding market share, accounting for more than 81.7%. This dominant position can primarily be attributed to the enhanced security and control that on-premise solutions offer organizations.

These solutions are particularly favored by large enterprises that handle sensitive or critical business information and require strict compliance with governmental regulations. By maintaining digital twins on-premises, these organizations can ensure complete ownership and control over their data and infrastructure, which is crucial for protecting against data breaches and other cyber threats.

Furthermore, the preference for on-premise deployments is driven by their capability to offer real-time data processing and immediate responsiveness with minimal latency. This is essential in industries where decisions need to be quick and based on the latest available data, such as manufacturing and utilities, where efficiency and safety are paramount.

On-premise solutions also allow for better customization and integration with existing IT infrastructure, which is often necessary for complex industrial environments. Despite the growth in cloud-based solutions, which are celebrated for their flexibility and cost efficiency, the on-premise segment continues to thrive due to its unrivaled security and control features.

Enterprise Size Analysis

In 2024, the Large Enterprises segment of the Digital Twin Simulation Market maintained a dominant market position, securing more than a 78.6% share. This substantial market presence is largely due to the extensive resources that large enterprises can allocate towards adopting and integrating advanced technologies like digital twins.

These organizations often have complex, global operations requiring sophisticated management and optimization tools. Digital twins provide a robust solution by enabling detailed simulations and scenario testing without risking actual operations, thereby enhancing asset management and operational efficiency.

Large enterprises leverage digital twin technology not only for operational optimization but also as a strategic tool for innovation in product development, testing, and design validation. This allows for the creation of high-quality products by simulating and adjusting designs before they reach the production stage, significantly reducing costs and time to market.

Additionally, the scalability of digital twin technology meets the expansive needs of large enterprises, fitting into their large-scale IT ecosystems and providing integration capabilities with existing corporate systems. This integration is crucial for achieving real-time visibility and data-driven decision-making across various departments and sectors within the enterprise.

Application Analysis

In 2024, the Predictive Maintenance segment of the Digital Twin Simulation Market held a dominant market position, capturing more than a 38.7% share. This prominence can be attributed to its critical role in optimizing the performance and extending the lifespan of equipment across various industries.

Predictive maintenance utilizes digital twins to forecast potential issues before they occur, allowing businesses to perform maintenance proactively. This approach significantly reduces downtime and operational costs, which is a compelling benefit for industries that rely heavily on machinery and equipment.

The effectiveness of predictive maintenance is enhanced by integrating real-time data analytics and machine learning, which enables more accurate predictions and insights. This integration helps companies not only prevent costly failures but also optimize their maintenance schedules based on actual equipment condition rather than on predetermined schedules.

As industries continue to focus on efficiency and cost reduction, the adoption of predictive maintenance facilitated by digital twins is expected to grow, maintaining its substantial market share. Moreover, sectors such as manufacturing, energy, and transportation are increasingly implementing digital twins within their predictive maintenance strategies.

End User Analysis

In 2024, the Automotive & Transport segment of the Digital Twin Simulation Market held a commanding market share, capturing over 23.2%. This segment’s leadership is primarily due to its crucial role in enhancing vehicle design, production, and operational efficiency through digital twin technologies.

Automotive manufacturers leverage these virtual models to simulate and analyze vehicle performance under various conditions, thereby optimizing the design and testing processes before physical production begins. Digital twins in the automotive sector facilitate significant advancements in vehicle safety, efficiency, and lifecycle management.

By integrating with real-time data from IoT devices, digital twins enable continuous monitoring and predictive maintenance, which helps manufacturers reduce downtime and maintenance costs. Additionally, as the push towards electric vehicles and autonomous driving technologies grows, digital twins are instrumental in accelerating R&D and ensuring these innovations meet safety and performance standards before hitting the market.

Furthermore, the adoption of digital twins in transportation extends beyond manufacturing to include fleet management and logistics. Here, they improve routing efficiency, fuel consumption, and overall fleet operations by providing insights derived from the simulation of real-world scenarios..

Key Market Segments

By Solution

- Component

- Process

- System

By Deployment

- Cloud

- On-premise

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Application

- Product Design & Development

- Predictive Maintenance

- Business Optimization

- Others

By End User

- Manufacturing

- Agriculture

- Automotive & Transport

- Energy & Utilities

- Healthcare & Life Sciences

- Residential & Commercial

- Retail & Consumer Goods

- Aerospace

- Telecommunication

- Others

Driver

Increasing Adoption of AI and IoT Technologies

The accelerated growth of the Digital Twin Simulation market can be attributed significantly to the increasing adoption of Artificial Intelligence (AI) and Internet of Things (IoT) technologies. These technologies enhance the capabilities of digital twins, enabling more precise simulations and predictions that are essential for decision-making across various industries.

AI enhances the analytical capabilities of digital twins, allowing for more accurate scenario forecasting and operational optimization, while IoT provides the necessary data infrastructure to capture real-time data from physical assets. This synergy not only improves operational efficiency but also reduces maintenance costs and prolongs the lifespan of equipment.

Restraint

High Implementation Costs and Complexity

Despite the advantages, the adoption of digital twin technologies faces significant challenges, primarily due to high implementation costs and complexity. Establishing a digital twin requires substantial investment in compatible hardware and software, as well as expertise to integrate and manage the system.

This complexity can be a significant barrier, particularly for small and medium-sized enterprises (SMEs) that may lack the financial and technical resources to invest in such advanced technologies. Furthermore, the integration of digital twins into existing systems poses additional challenges, potentially increasing operational disruptions during the transition period.

Opportunity

Expansion into Healthcare and Manufacturing

The healthcare and manufacturing sectors present considerable opportunities for the application of digital twin technologies. In healthcare, digital twins can simulate medical treatments and predict patient responses to various therapies, thus enhancing personalized medicine and improving treatment outcomes.

In manufacturing, digital twins optimize production processes, reduce downtime, and enhance product quality by allowing for the real-time monitoring and predictive maintenance of manufacturing systems. The ability to conduct virtual trials and adjustments before actual implementation reduces both the risk and cost associated with physical prototyping and testing.

Challenge

Data Privacy and Security Concerns

Data privacy and security are paramount concerns in the deployment of digital twins, as these systems rely heavily on the continuous flow of operational data. The potential for data breaches or unauthorized access poses significant risks, especially when sensitive or proprietary information is involved. Ensuring robust security measures are in place is crucial but can be complex and costly.

Moreover, the legal and regulatory landscape surrounding data privacy is continually evolving, which requires organizations to remain agile and compliant with new regulations, adding another layer of complexity to the deployment of digital twins.

Growth Factors

The growth of the Digital Twin Simulation market is predominantly driven by the integration of advanced technologies like AI and IoT, which significantly enhance simulation capabilities. This technology allows organizations to create highly accurate replicas of physical assets, systems, or processes, enabling them to predict outcomes and optimize operations without the risks associated with physical trials.

As industries increasingly focus on efficiency, the ability to conduct preemptive maintenance and operations optimization through digital twins is proving indispensable. This is particularly evident in sectors like manufacturing, where digital twins are used to minimize downtime and streamline production processes

Emerging Trends

One notable trend is the use of digital twins in achieving sustainability goals. Organizations utilize digital twin technology to optimize resource use and reduce environmental impacts, which is becoming a critical factor in corporate strategies.

Additionally, digital twins are being employed as virtual sensors in environments where traditional sensors are impractical or too costly. This application is expanding the scope of digital twin usage beyond traditional sectors to include more complex and asset-intensive industries like oil and gas and large-scale manufacturing.

The proliferation of cloud-based digital twin solutions is also a significant trend. These solutions offer greater flexibility and cost-effectiveness, encouraging even small and medium-sized enterprises to adopt digital twin technology. This shift is facilitated by the lower barriers to entry and scalability provided by cloud platforms, which align well with the digital transformation goals of various industries.

Business Benefits

Digital twins provide numerous business benefits, including enhanced operational efficiency, reduced maintenance costs, and improved product and service quality. They allow companies to test scenarios in a virtual environment before implementing changes in the real world, significantly reducing the risk and cost associated with physical prototyping and testing.

In sectors like aerospace and defense, digital twins are critical for the simulation and testing of complex systems under various scenarios, ensuring products meet the stringent safety and reliability standards required.

Moreover, the data-driven insights offered by digital twins help businesses in making informed decisions, optimizing processes, and predicting future outcomes. This capability is crucial for maintaining competitive advantage in rapidly changing markets. The technology’s ability to integrate seamlessly with existing IT infrastructure makes it a valuable tool for companies looking to enhance their digital strategies.

Key Player Analysis

The digital twin simulation market is being shaped by several key players, each bringing unique expertise and technologies. These companies are not only driving innovation but also helping industries adopt smarter, data-driven systems. Among the most influential names are Siemens AG, General Electric, IBM Corporation, Microsoft Corporation, and PTC Inc.

These companies are known for offering advanced simulation software, real-time analytics, and integration with Internet of Things (IoT) platforms. Their solutions are helping manufacturers, healthcare providers, energy companies, and city planners create virtual models that mirror physical systems.

Siemens AG, for example, has been leading with its Siemens Xcelerator portfolio, which supports digital twin capabilities across industries. General Electric is widely recognized for using digital twins in industrial and energy applications, helping reduce downtime and improve efficiency. IBM combines AI with its cloud-based digital twin services to support real-time decision-making.

Meanwhile, Microsoft leverages its Azure platform to provide scalable digital twin environments, especially for smart buildings and infrastructure. Lastly, PTC Inc. focuses on combining IoT and augmented reality with digital twins, offering a more immersive and interactive approach for users.

Top Key Players in the Market

- Hexagon AB

- IBM Corporation

- Microsoft Corporation

- PTC Inc.

- Robert Bosch GmbH

- Rockwell Automation

- SAP SE

- Siemens AG

- ABB Group

- Amazon Web Services, Inc.

- ANSYS, Inc.

- Autodesk Inc.

- AVEVA Group plc

- Bentley Systems Inc.

- Dassault Systemes

- General Electric

- Others

Recent Developments

- Rockwell Automation: In March 2025, Rockwell Automation showcased its Emulate3D Factory Test at NVIDIA GTC 2025. This integration of NVIDIA Omniverse technologies and OpenUSD aims to bring next-generation digital twins to the industrial sector, facilitating improved visualization and simulation capabilities for manufacturing environments.

- Siemens AG: At CES 2025, Siemens unveiled innovations in industrial AI and digital twin technology. The company introduced the Siemens Industrial Copilot for Operations, enabling AI tasks to run closer to the shop floor. Additionally, Siemens announced collaborations with NVIDIA to enhance visualization and simulation capabilities, allowing for the creation of immersive, photorealistic digital twins.

Report Scope

Report Features Description Market Value (2024) USD 16.2 Bn Forecast Revenue (2034) USD 381.0 Bn CAGR (2025-2034) 37.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Component, Process, System), By Deployment (Cloud, On-premise), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Application (Product Design & Development, Predictive Maintenance, Business Optimization, Others), By End User (Manufacturing, Agriculture, Automotive & Transport, Energy & Utilities, Healthcare & Life Sciences, Residential & Commercial, Retail & Consumer Goods, Aerospace, Telecommunication, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hexagon AB, IBM Corporation, Microsoft Corporation, PTC Inc., Robert Bosch GmbH, Rockwell Automation, SAP SE, Siemens AG, ABB Group, Amazon Web Services, Inc., ANSYS, Inc., Autodesk Inc., AVEVA Group plc, Bentley Systems Inc., Dassault Systemes, General Electric, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Twin Simulation MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Twin Simulation MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Hexagon AB

- IBM Corporation

- Microsoft Corporation

- PTC Inc.

- Robert Bosch GmbH

- Rockwell Automation

- SAP SE

- Siemens AG

- ABB Group

- Amazon Web Services, Inc.

- ANSYS, Inc.

- Autodesk Inc.

- AVEVA Group plc

- Bentley Systems Inc.

- Dassault Systemes

- General Electric

- Others