Global Digital Twin Market By Type (Product Digital Twin, Process Digital Twin, and System Digital Twin), By Technology (IoT and IIoT, Blockchain, Big Data Analytics, Artificial Intelligence and Machine Learning, Augmented Reality, Virtual Reality, Mixed Reality, and 5G), By End-Use Industry (Aerospace and Defense, Automotive & Transportation, Healthcare, Energy & Utilities, Oil and Gas, Agriculture, Other End-Use Industries), By Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Aug. 2024

- Report ID: 102617

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

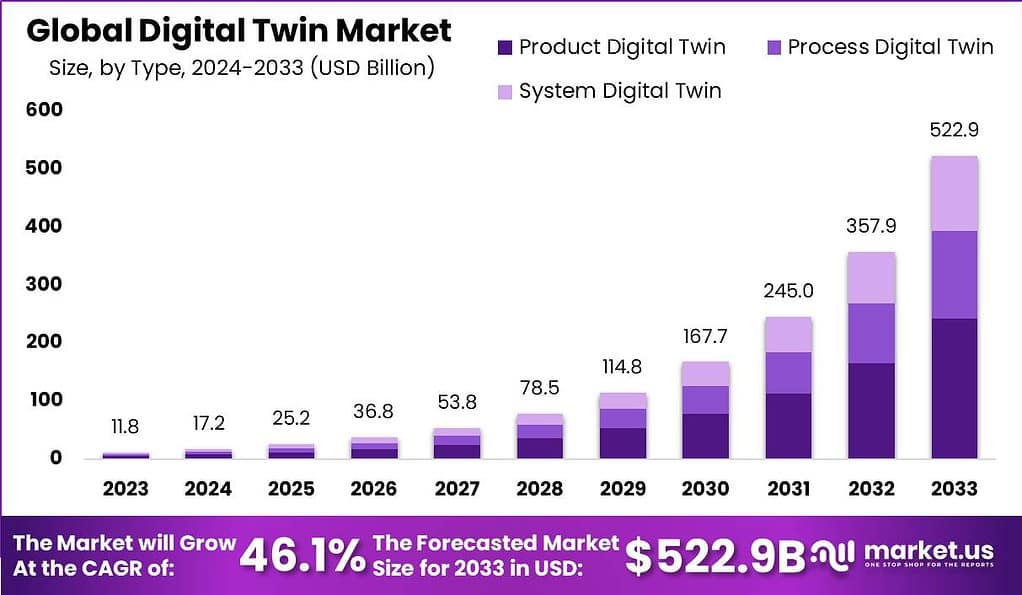

The Global Digital Twin Market size is expected to be worth around USD 522.9 Billion by 2033, from USD 11.8 Billion in 2023, growing at a CAGR of 46.1% during the forecast period from 2024 to 2033.

A digital twin is a virtual representation of a physical object, process, or system. This technology integrates internet of things (IoT) data, artificial intelligence (AI), machine learning, and software analytics to create living digital simulation models that update and change as their physical counterparts change. By mirroring the real world, digital twins enable companies to analyze data and monitor systems to prevent issues before they occur, decrease downtime, develop new opportunities, and even plan for the future by using simulations.

The digital twin market is experiencing significant growth, driven by the increasing adoption of IoT and the need for efficient operational performance across various industries like manufacturing, automotive, and healthcare. This market encompasses various applications, including product design and development, predictive maintenance, and the optimization of manufacturing processes. Companies use digital twins not only to optimize operations but also to test and validate equipment performance before actual deployment.

The integration of digital twins with AI, machine learning, and advanced analytics is enabling more accurate simulations and predictions. For example, virtual sensors are being used to monitor conditions that are difficult or expensive to measure directly, enhancing operational efficiency in complex environments.

Despite the benefits, the adoption of digital twins faces challenges such as high implementation costs, data privacy concerns, and interoperability issues. These challenges are particularly significant for small and medium-sized enterprises (SMEs) that may struggle with the complexity and cost of integrating digital twin technologies into their existing systems.

The opportunities presented by digital twins are vast and transformative across various industries. By utilizing real-time data to create accurate simulations, businesses can optimize operations, reduce maintenance costs, and prevent equipment failures. This technology enables proactive problem-solving and decision-making, leading to improved efficiency and reduced operational costs. Additionally, digital twins allow for safer testing and simulation of products in a virtual space before actual implementation, reducing the risk and costs associated with physical prototypes.

According to survey, 75% of firms utilizing IoT are either already benefiting from digital twins or plan to deploy them within the next year. A significant example of this trend is Unilever, which has developed an AI-powered digital twin for over 300 factories, leading to potential annual savings of $2.8 million and productivity gains ranging from 1-3%.

Furthermore, 80% of engineers acknowledge the added value of VR when paired with digital twins. Capgemini research reveals that 57% of firms view digital twins as essential for enhancing sustainability, a role that is expected to grow as stakeholders increasingly demand accountability on ESG metrics.

A market analysis by EY, various industries are effectively leveraging digital twin technology to achieve significant operational improvements. For instance, a global aviation company has adopted component digital twins, achieving an impressive 99.9% accuracy in predicting anomalies within jet engine parts.

This application not only enhances the reliability of the engines but also substantially reduces maintenance downtime. Similarly, a manufacturing firm has implemented process digital twins to fine-tune its production parameters, successfully cutting the rate of defective products by a substantial 75%. This adjustment significantly boosts product quality and operational efficiency.

In the energy sector, an oil company has introduced process digital twins to streamline its drilling operations. This strategic deployment has led to remarkable cost savings, reportedly reaching up to US$1 million per day. These examples underscore the transformative impact of digital twin technology across diverse industries, enhancing predictive maintenance, optimizing manufacturing processes, and refining resource management to deliver substantial financial and operational benefits.

Key Takeaways

- The global digital twin market is anticipated to witness remarkable growth, with a forecasted worth of USD 522.9 billion by 2033, showcasing a robust Compound Annual Growth Rate (CAGR) of 46.1% from 2024 to 2033.

- Type Analysis: The market is segmented into Product Digital Twin, Process Digital Twin, and System Digital Twin, with the Product Digital Twin segment dominating due to its critical role in product development and optimization, obtaining a greater revenue share of 46.3% in 2023.

- Technology Analysis: Technologies such as IoT and IIoT hold the largest revenue share, facilitating the creation and operation of digital twins by providing essential infrastructure, with the IoT and IIoT segment holding a revenue share of 28.9% in 2023.

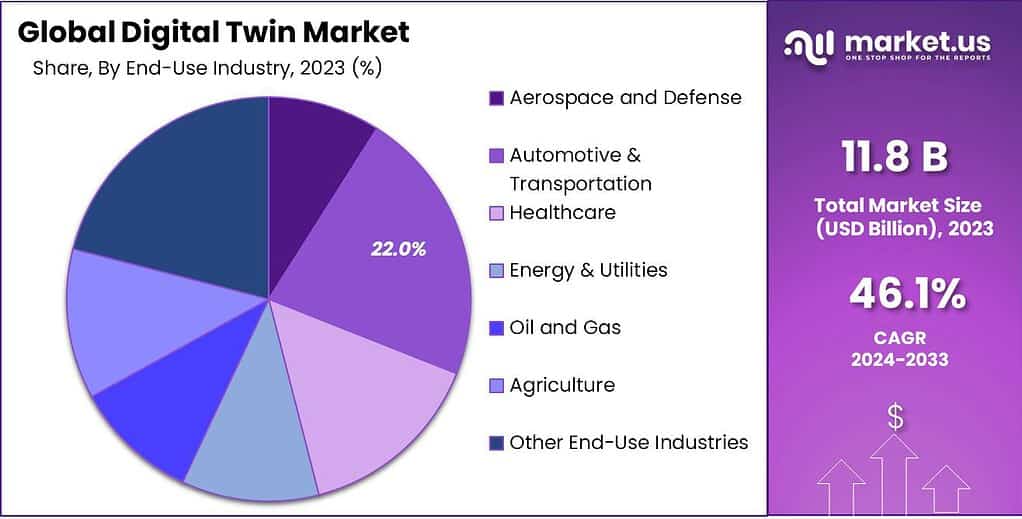

- End-User Analysis: Industries like Automotive & Transportation lead in digital twin adoption, leveraging the technology for innovation, efficiency, and safety improvements, securing a larger revenue share of 22.0% in 2023.

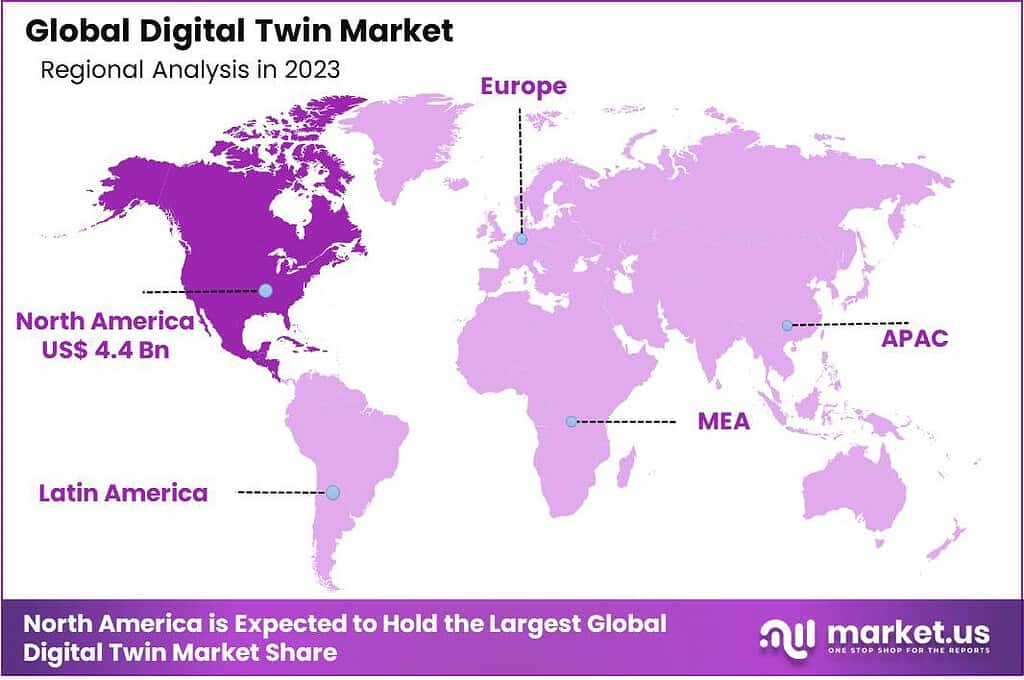

- North America dominates the global digital twin market, fueled by its robust technological infrastructure, presence of industry leaders, and proactive stance towards digital transformation, holding a greater revenue share of 37.1% in 2023.

Type Analysis

In 2023, the Product Digital Twin segment held a dominant market position, capturing more than a 46.3% share. This segment is leading due to its critical role in enabling manufacturers to create accurate, virtual replicas of physical products. These replicas allow for extensive testing, monitoring, and optimization before actual production, significantly reducing costs and time associated with product development.

The ability to simulate different conditions and scenarios ensures that products are designed with high precision, ultimately enhancing quality and performance. Additionally, the integration of IoT and AI technologies with product digital twins facilitates real-time data analysis, providing valuable insights for continuous product improvement.

Furthermore, the Product Digital Twin segment is gaining traction due to the increasing adoption of Industry 4.0 practices across various sectors. Industries such as automotive, aerospace, and consumer electronics are leveraging digital twins to innovate and stay competitive.

The capability to predict and prevent potential issues through advanced simulations leads to improved reliability and customer satisfaction. As companies strive to enhance their product lifecycle management, the demand for product digital twins is expected to grow, reinforcing the segment’s leadership in the market.

Moreover, the rise of customized and complex product designs necessitates advanced digital tools for efficient management. Product digital twins offer a robust solution for handling the intricacies of modern manufacturing processes.

They enable seamless collaboration across different departments and stakeholders, fostering a more integrated and streamlined workflow. This holistic approach to product development and management underscores why the Product Digital Twin segment continues to lead the market, providing unparalleled value in terms of innovation, efficiency, and quality assurance.

Technology Analysis

In 2023, the IoT and IIoT (Internet of Things and Industrial Internet of Things) segment held a dominant market position, capturing more than a 28.9% share of the Digital Twin technology market. This segment’s prominence is largely due to its critical role in connecting physical devices with their digital counterparts, thereby laying the foundation for the creation and operational success of digital twins across various industries.

By providing real-time data from sensors and devices, IoT and IIoT technologies enable companies to monitor, analyze, and optimize the performance and health of their assets continuously. The integration of IoT and IIoT with digital twins transforms traditional business models by offering profound insights into product performance, system operations, and process efficiency.

For instance, in manufacturing, IoT-enabled digital twins can predict equipment failure and facilitate preventive maintenance, significantly reducing downtime and operational costs. Similarly, in sectors like energy and utilities, IoT-driven digital twins enhance grid management and energy distribution, leading to increased sustainability and efficiency.

Moreover, the scalability of IoT and IIoT solutions allows for their application in complex systems ranging from single manufacturing units to entire smart cities, making them indispensable for large-scale operations that seek to leverage digital twin technology. This widespread applicability is bolstered by continuous advancements in IoT technology, including better security measures and enhanced connectivity options, which further solidify the IoT and IIoT segment’s leadership in the digital twin market.

End-User Analysis

In 2023, the Automotive & Transportation segment held a dominant market position in the Digital Twin industry, capturing more than a 22% share. This significant market share can be attributed to the automotive industry’s rapid adoption of advanced technologies for enhancing vehicle design, production, and maintenance.

Digital twins have become a pivotal element in this sector, providing engineers and designers with sophisticated tools to simulate vehicle behaviors under various conditions without the need for physical prototypes. Digital twin technology in the Automotive & Transportation sector allows for a more integrated approach to vehicle lifecycle management.

It helps manufacturers monitor real-time data from vehicles on the road, which is crucial for predictive maintenance, optimizing fuel efficiency, and improving overall vehicle performance. This technology also supports the development of autonomous vehicles by enabling the simulation of sensor data and testing autonomous driving algorithms in virtual environments before they are deployed on real roads.

Furthermore, the push towards more sustainable and smarter transportation solutions has fueled the growth of digital twins in this segment. Automotive companies are using digital twins to design electric vehicles and their components, such as batteries, more effectively. By analyzing data collected from various sources, manufacturers can predict battery life spans, optimize charging cycles, and enhance the overall performance of electric vehicles.

Key Market Segments

Based on Type

- Product Digital Twin

- Process Digital Twin

- System Digital Twin

Based on Technology

- IoT and IIoT

- Blockchain

- Artificial Intelligence and Machine Learning

- Augmented Reality, Virtual Reality, and Mixed Reality

- Big Data Analytics

- 5G

Based on End-User

- Aerospace and Defense

- Automotive & Transportation

- Healthcare

- Energy & Utilities

- Oil and Gas

- Agriculture

- Other End-Users

Driving Factor

Demand for Enhanced Operational Efficiency and Predictive Maintenance

The drive towards enhanced operational efficiency and the need for predictive maintenance are significant factors fueling the growth of the Global Digital Twin Market. In today’s competitive world, organizations across various industries are under constant pressure to reduce costs, improve productivity, and maintain operational quality. Digital twins address these challenges by enabling companies to create virtual replicas of physical systems or processes for real-time monitoring, simulation, and analysis.By predicting equipment failures before they occur and optimizing maintenance schedules, digital twins can significantly reduce downtime and maintenance costs. This predictive maintenance capability is particularly valuable in asset intensive sectors such as manufacturing, energy, and transportation, where equipment failure can result in significant operational disruptions and financial losses. As organizations continue to recognize the value of digital twins in achieving operational excellence, the demand for these technologies is set to rise, driving market growth.

Restraining Factor

High Implementation Costs

One of the significant hurdle to the widespread adoption of digital twin technology is the high cost of implementation. Developing a digital twin requires substantial investment in advanced hardware, software, and skilled personnel to integrate and manage the system. For many organizations, especially small and medium-sized enterprises (SMEs), the initial setup and ongoing operational expenses can be prohibitively expensive.This includes the costs associated with data collection sensors, secure cloud storage, high-performance computing resources, and the development of customized software solutions. Furthermore, the need for continuous updates and maintenance to ensure the digital twin remains accurate over time adds to the total cost of ownership. These financial barriers can deter companies from investing in digital twin technology, limiting its market growth potential. Addressing these cost concerns through more affordable and scalable solutions could help mitigate this restraint, making digital twins more accessible to a broader range of businesses.

Growth Opportunity

Advancements in Artificial Intelligence and Machine Learning

The advancements in Artificial Intelligence (AI) and Machine Learning (ML) present a significant opportunity for the Global Digital Twin Market, propelling its capabilities. AI and ML enhance digital twins by helping them with predictive analytics, intelligent automation, and enhanced decision-making capabilities. This collaboration allows for the creation of more accurate, dynamic, and self-optimizing digital replicas of physical assets and systems.In industries such as manufacturing, energy, and healthcare, AI-enhanced digital twins can predict equipment failures before they happen, optimize energy consumption, and personalize medical treatments based on predictive health models. Moreover, the integration of AI and ML enables the processing of vast datasets generated by digital twins, extracting actionable insights more efficiently and identifying patterns. This leads to improved operational efficiency, reduced costs, and the acceleration of innovation.

As AI and ML technologies continue to evolve, their integration with digital twins opens new avenues for application, driving the market forward by enabling smarter, more connected, and autonomous systems. This factor represents a transformative opportunity for businesses to leverage the full potential of digital twin technology.

Latest Trends

Rise of Digital Twins in Healthcare

The healthcare industry is witnessing a transformative trend with the adoption of digital twin technology for personalized medicine and advanced patient care. Digital twins of human organs or entire physiological systems are being developed to simulate individual health conditions and predict responses to various treatments. This innovative approach enables healthcare professionals to tailor therapies and interventions to the specific needs of patients, improving outcomes and reducing the risk of adverse reactions.

The trend towards personalized medicine, supported by digital twins, is driven by advancements in genomics, data analytics, and computational biology. As the healthcare sector continues to seek more effective and patient-centered treatment modalities, the role of digital twins is becoming increasingly significant. This trend not only highlights the potential for digital twins to revolutionize medical research and patient care but also indicates a growing market segment.

Geopolitical and Recession Impact Analysis

Geopolitical Impact Analysis

Geopolitical tensions and trade disputes can have profound implications on the Global Digital Twin Market. Such tensions can disrupt global supply chains, affecting the availability of hardware and software components essential for digital twin implementations. For instance, restrictions on technology transfers and tariffs can increase costs and delay projects.

Furthermore, data sovereignty issues may arise, with countries imposing regulations on data storage and transfer, complicating the deployment of digital twins across different jurisdictions. However, these challenges also encourage innovation as companies seek resistant supply chains and data management strategies, potentially accelerating the adoption of local digital twin solutions.

Recession Impact Analysis

Economic downturns or recessions have both positive as well as negative impact on the Global Digital Twin Market. On one hand, budget constraints and cost-cutting measures during recessions can lead to reduced spending on new technologies, including digital twins, especially in sectors most affected by economic downturns. Companies might prioritize short-term financial stability over long-term investments in innovation, slowing down market growth.

On the other hand, the drive for efficiency and cost optimization during such periods can fuel the adoption of digital twins. Organizations can adopt digital twins for their potential to enhance operational efficiency, reduce costs through predictive maintenance, and support decision-making with accurate simulations.

Regional Analysis

North America dominated the Global Digital Twin Market with a greater revenue share of 37.1% in 2023. The North America holds a dominant position in the market, largely due to its robust technological infrastructure, strong presence of leading industry players, and significant investments in research and development.

The demand for Digital Twin in North America was valued at US$ 4.4 billion in 2023 and is anticipated to grow significantly in the forecast period. This region, particularly the United States, is home to technology giants and innovative startups that are at the forefront of digital twin technology. These companies drive market growth through continuous innovation, extensive partnerships, and the adoption of digital twins across a wide range of industries including manufacturing, aerospace, healthcare, and automotive.

Furthermore, North America’s advanced IoT and cloud computing infrastructure provides the necessary support for the deployment and scaling of digital twin solutions. The region’s proactive stance on embracing Industry 4.0 technologies along with digital transformation of industries contributes to its leading market position.

Key Regions and Countries Covered in this Report:

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The competitive landscape of the Global Digital Twin Market is marked by intense competition and innovation, with key players such as Siemens AG, General Electric Co., IBM Corporation, and Dassault Systèmes SE leading the market. These industry giants are complemented by a vibrant ecosystem of startups and niche providers, who introduce cutting-edge solutions tailored to specific industry needs.

The market is characterized by a strong focus on technological advancement, with companies investing heavily in research and development to enhance the capabilities of their digital twin offerings. Strategic partnerships and collaborations are common, as firms seek to expand their technological capabilities and market reach. Additionally, the push towards standardization and interoperability of digital twin technologies is a notable trend, aiming to facilitate seamless integration across different platforms and industries.

This competitive environment is driven by the demand for increased efficiency, optimization, and innovation across sectors such as manufacturing, automotive, healthcare, and energy. As the market continues to evolve, the competition is expected to intensify, with players striving to offer differentiated and value-added solutions to capture market share.

Top Key Players in the Digital Twin Market

- General Electric Co.

- Microsoft Corporation

- Hitachi, Ltd.

- Dassault Systèmes SE

- Autodesk, Inc.

- SAP SE

- Siemens AG

- Ansys, Inc.

- PTC Inc.

- IBM Corporation

- ABB Ltd.

- Hexagon AB

- AVEVA Group plc

- Other Key Players

Recent Developments

- In January 2024, Valeo, a company specializing in automotive technology, joined forces with Applied Intuition, a supplier of vehicle software. Their collaboration aims to introduce a digital twin platform specifically designed for advanced driver-assistance systems (ADAS) sensor simulation. This innovative solution enables original equipment manufacturers (OEMs) to accelerate the development of reliable and safe ADAS features, allowing them to bring these advanced capabilities to the market more quickly.

- In February 2024: Dassault Systèmes SE partnered with BMW Group for developing the company’s future engineering platform with the help of Dassault Systèmes’ 3DEXPERIENCE platform.

- In June 2023: Hexagon AB collaborated with NVIDIA Corporation for transforming industrial digital twin solutions. With the help of this collaboration, Hexagon AB’s Nexus manufacturing and HxDR reality capture platform will be connected with the NVIDIA Omniverse plaform.

Report Scope

Report Features Description Market Value (2023) USD 11.8 Bn Forecast Revenue (2033) USD 522.9 Bn CAGR (2024-2033) 46.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Product Digital Twin, Process Digital Twin, and System Digital Twin), By Technology (IoT and IIoT, Blockchain, Big Data Analytics, Artificial Intelligence and Machine Learning, Augmented Reality, Virtual Reality, and Mixed Reality, and 5G), By End-Use Industry (Aerospace and Defense, Automotive & Transportation, Healthcare, Energy & Utilities, Oil and Gas, Agriculture, Other End-Use Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape General Electric Co., Microsoft Corporation, Hitachi Ltd., Dassault Systèmes SE, Autodesk Inc., SAP SE, Siemens AG, Ansys Inc., PTC Inc., IBM Corporation, ABB Ltd., Hexagon AB, AVEVA Group plc, Other Key Players, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Digital Twin?A digital twin is a virtual representation of a physical object or system. It uses real-time data and simulations to mimic the behavior and characteristics of its physical counterpart.

How big is Digital Twin Market?The Global Digital Twin Market size is expected to be worth around USD 522.9 Billion by 2033, from USD 11.8 Billion in 2023, growing at a CAGR of 46.1% during the forecast period from 2024 to 2033.

Which region accounted for the highest share in the digital twin market?North America dominated the Global Digital Twin Market with a greater revenue share of 37.1% in 2023.

What are the challenges of implementing Digital Twins?Challenges include data security and privacy concerns, interoperability issues, and the complexity of creating accurate virtual models.

Who are the leading players active in digital twin market?key players engaged in the digital twin market include General Electric Co., Microsoft Corporation, Hitachi Ltd., Dassault Systèmes SE, Autodesk Inc., SAP SE, Siemens AG, Ansys Inc., PTC Inc., IBM Corporation, ABB Ltd., Hexagon AB, AVEVA Group plc, Other Key Players,

Which end-use segment accounted for the largest digital twin market share?The Automotive & Transportation dominated the market by securing a larger revenue share of 22.0% in 2023.

-

-

- General Electric

- Microsoft Corporation

- Hitachi Ltd

- Dassault Systems SE

- Autodesk Inc.

- SAP SE

- Siemens AG

- ANSYS Inc

- PTC Inc

- IBM Corporation

- ABB Ltd.

- Hexagon AB

- Other Key Players