Global Digital Signage in Banking & Finance Market Size, Share, Statistics Analysis Report By Type (Digital Notice Board, Digital Standee, Bank Lobby Displays, Kiosks (Interactive Kiosks, Self-service Kiosks, Others), Bank Window Displays, Media Walls, Others), By Component (Hardware (Displays, Media Players, Projectors, Others), Software, Service (Installation Services, Maintenance & Support Services, Consulting Services)), By Technology (LCD, LED, OLED, Projection), By Resolution (8K, 4K, Full High Definition (FHD), High Definition (HD), Lower than HD), By Application (Customer Engagement, Internal Communication, Branding and Marketing, Queue Management, Others), By Location (In-Branch, Out-of-Branch), By Signage Size (Below 32 Inches, 32 to 52 Inches, More than 52 Inches), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 140408

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. Market Size

- Analysts’ Viewpoint

- Type Analysis

- Component Analysis

- Technology Analysis

- Resolution Analysis

- Application Analysis

- Location Analysis

- Signage Size Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

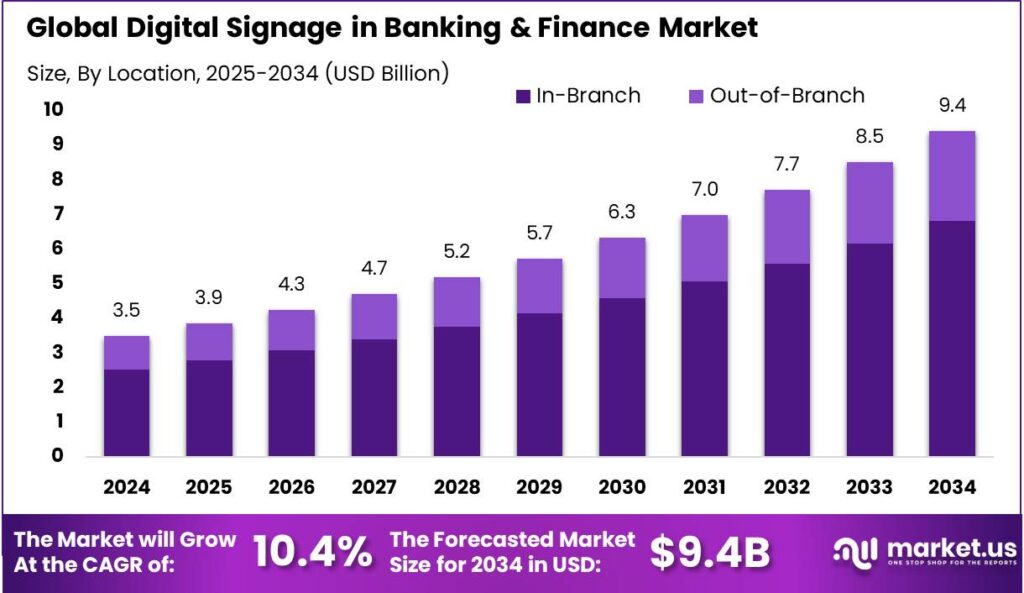

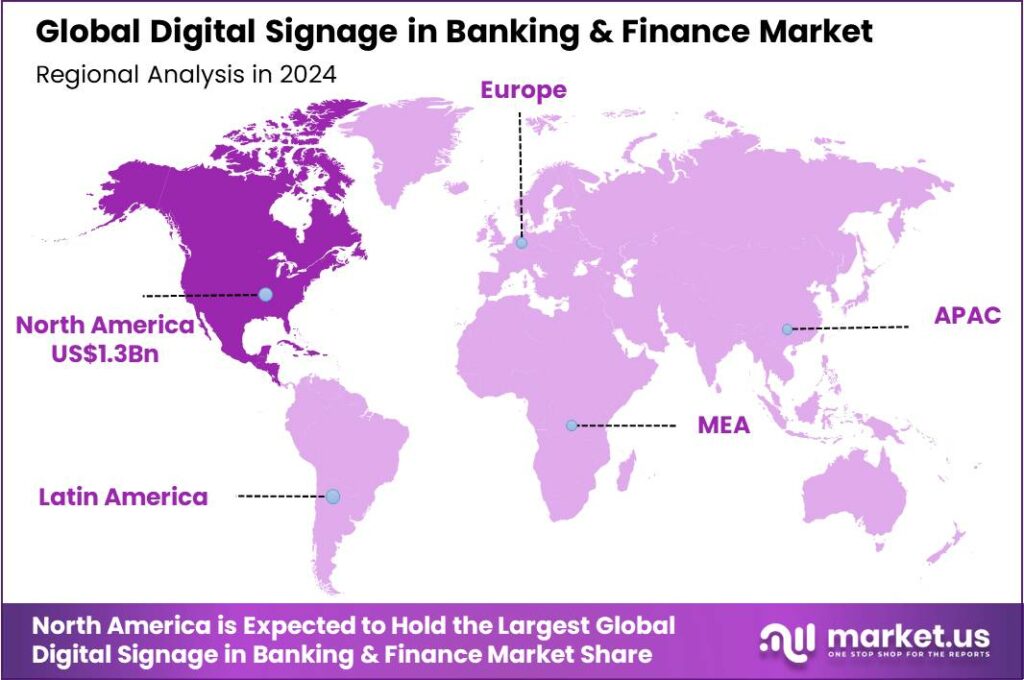

The Digital Signage in Banking & Finance Market size is expected to be worth around USD 9.4 Billion By 2034, from USD 3.5 Billion in 2024, growing at a CAGR of 10.40% during the forecast period from 2025 to 2034. In 2024, North America dominated the digital signage in banking and finance market, with a 37.2% share and revenues of approximately USD 1.3 billion.

Digital signage in the banking and finance sector refers to the use of electronic displays, such as LED screens, interactive kiosks, or video walls, to communicate information and advertisements to customers within financial institutions. These displays are commonly deployed in bank branches, ATMs, and customer service areas to deliver a wide range of content, including promotional materials, product information, news updates, and transactional guidance.

The digital signage market in banking and finance is expanding rapidly due to the increasing demand for efficient communication solutions and improved customer engagement. With the shift toward a more digital world, financial institutions are adopting digital signage as a way to boost customer experience, improve operational efficiency, and enhance brand presence. This market is also being driven by the increased need for personalization and targeted marketing in financial services.

According to Market.us, the digital signage market was valued at USD 28.9 billion in 2024 and is expected to grow significantly, reaching USD 52.7 billion by 2032. This represents a compound annual growth rate (CAGR) of 7.7% between 2023 and 2032, reflecting strong demand across various sectors.

One of the key sectors driving this growth is banking. According to data from Pickcel, 60% of banks are leveraging digital signage as an effective tool to improve customer experience. These banks use digital screens to engage customers while they wait in queues, displaying content that includes 75% bank-related updates and 25% other news. This blend of relevant and diverse content helps keep customers engaged and informed during their wait.

In fact, 9 out of 10 banks agree that digital signage is essential to their customer communication efforts. With the global digital payment market expected to be worth approximately USD 12.56 trillion by 2027, banks and other financial institutions are expected to continue adopting digital signage solutions to enhance customer experience, improve communication, and drive business growth.

Key Takeaways

- The Global Digital Signage in Banking & Finance Market size is expected to be worth around USD 9.4 Billion by 2034, up from USD 3.5 Billion in 2024, growing at a CAGR of 10.40% during the forecast period from 2025 to 2034.

- In 2024, the Digital Notice Board segment held a dominant market position, capturing more than 27.3% of the overall Digital Signage in Banking & Finance market.

- In 2024, the hardware segment held a dominant market position, capturing more than 55.9% share of the digital signage market in banking and finance.

- In 2024, the LED segment held a dominant market position in the digital signage in the banking and finance market, capturing over 46.8% of the total market share.

- In 2024, the 8K resolution segment held a dominant market position in the digital signage for banking and finance sector, capturing more than 36.2% share.

- In 2024, the Customer Engagement segment held a dominant market position in the digital signage for banking and finance sector, capturing more than 30.6% share.

- In 2024, the In-Branch segment held a dominant market position, capturing more than 72.5% share of the Digital Signage in Banking & Finance market.

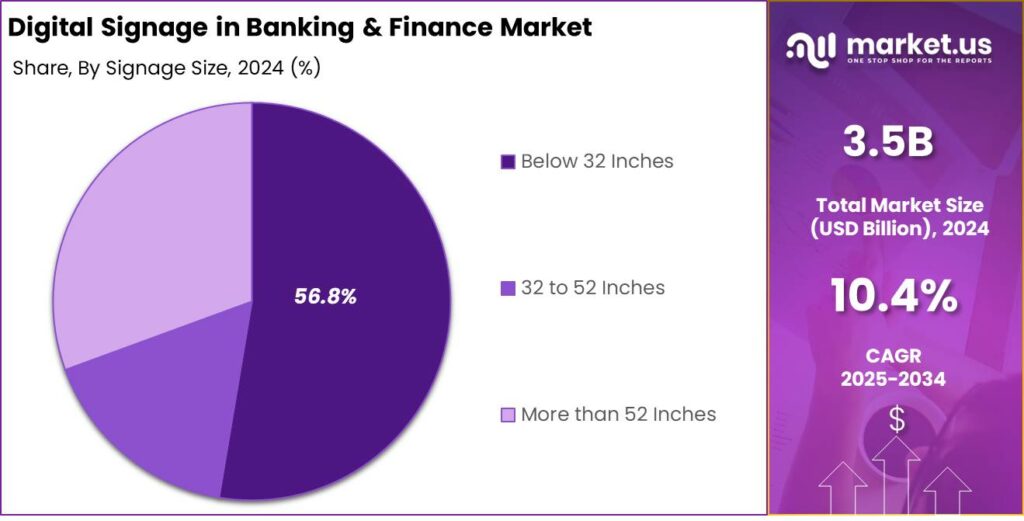

- In 2024, the Below 32 Inches segment held a dominant market position, capturing more than 56.8% share of the Digital Signage in Banking & Finance market.

- In 2024, North America held a dominant market position in the digital signage in banking and finance market, capturing more than 37.2% share with revenues reaching approximately USD 1.3 billion.

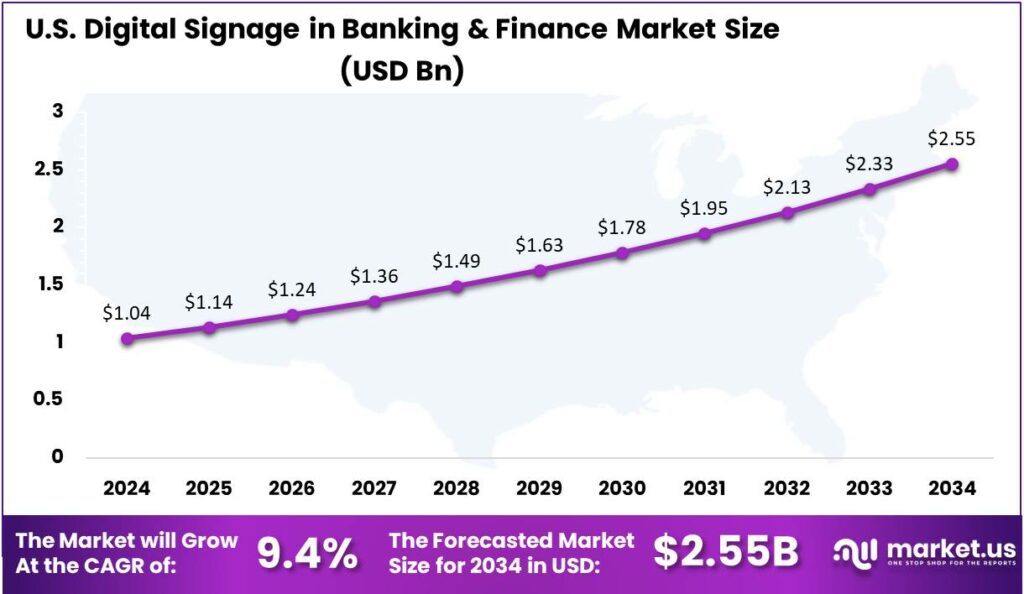

- In 2024, the U.S. market for digital signage in banking and finance was valued at $1.04 billion, experiencing robust growth with a CAGR of 9.4%.

U.S. Market Size

In 2024, the U.S. market for digital signage in banking and finance was valued at $1.04 billion. This sector is experiencing robust growth, with a compound annual growth rate (CAGR) of 9.4%. Digital signage, including LED and LCD displays, is crucial for improving customer engagement and communication in financial institutions.

Digital signage plays a key role in banking and finance by delivering real-time content like financial updates, personalized messages, and promotions. Banks are increasingly adopting this technology to enhance customer experience, streamline operations, and boost service visibility.

The growth in the digital signage market is fueled by advancements in display technology, lower costs, and the increasing need for digitization in banking. As financial institutions prioritize digital transformation, demand for high-quality, interactive signage solutions is set to rise, driving market expansion.

In 2024, North America held a dominant market position in the digital signage in banking and finance market, capturing more than a 37.2% share with revenues reaching approximately USD 1.3 billion. This leadership is largely attributable to the region’s rapid technological advancements and the early adoption of digital solutions within the banking and financial sectors.

North American banks have been pioneers in integrating digital signage solutions to enhance customer experience and streamline information dissemination. This includes the deployment of interactive kiosks, digital posters, and multi-screen displays, which provide real-time financial information and personalized marketing content directly to consumers.

The robust infrastructure for digital technologies and a strong presence of leading digital signage manufacturers have further propelled the market growth in this region. Companies such as Cisco Systems and HP have been at the forefront, driving innovations that cater to the dynamic needs of the financial services industry.

Future growth in the digital signage market will be driven by rising demand for personalized and interactive customer engagement platforms. North American financial institutions are leading innovation in customer service, using digital signage to enhance branch experiences. This trend, backed by technological advancements and strategic investments, will keep North America at the forefront of the global digital signage market in banking and finance.

Analysts’ Viewpoint

The demand for digital signage in the banking and finance sector is expected to grow significantly in the coming years. Customers’ evolving expectations for a modern, tech-driven experience is driving this demand. Banks are increasingly looking for solutions that help them stay competitive in a digital-first world.

Furthermore, digital signage solutions offer flexibility and scalability, enabling institutions to adapt quickly to changing customer needs. Investment opportunities in the digital signage market for banking and finance are significant. As financial institutions continue to digitize, they are actively seeking innovative solutions to enhance their customer-facing technologies.

Companies offering cutting-edge digital signage solutions that integrate AI, machine learning, and data analytics are positioned well for growth. However, there are risks, including high initial costs associated with hardware and installation. Additionally, ensuring a seamless integration with existing banking systems and ongoing maintenance can pose challenges.

Technological advancements are continuously reshaping the digital signage landscape in the banking sector. Interactive displays and AI-driven personalization are leading the charge, enabling institutions to create tailored customer experiences based on real-time data. Moreover, cloud-based systems are improving the flexibility and scalability of digital signage solutions, allowing content to be easily managed and updated across multiple location.

Type Analysis

In 2024, the Digital Notice Board segment held a dominant market position, capturing more than 27.3% of the overall Digital Signage in Banking & Finance market. The continued prominence of this segment can be attributed to its ability to effectively deliver essential information in high-traffic areas within banks.

Digital notice boards offer an efficient way to communicate real-time updates, such as branch hours, financial news, and product promotions, without requiring constant manual intervention. Their simple yet impactful design and versatility make them a preferred choice for banking institutions looking to enhance customer experience.

A key reason digital notice boards lead the market is their cost-effectiveness. Unlike more complex solutions like interactive kiosks or media walls, they are more affordable and easier to implement. Banks value these boards as an efficient, budget-friendly way to keep customers updated with the latest information.

The digital notice board’s scalability and adaptability are key to its dominance. As the banking sector evolves, institutions can easily update or expand their systems to reflect new services, promotions, or regulatory changes, ensuring they remain responsive to customer needs and industry trends.

The ongoing digital transformation in banking is also contributing to the prominence of the digital notice board segment. As financial institutions prioritize efficient communication channels, digital notice boards serve as an effective tool to maintain consistency in messaging across all customer touchpoints.

Component Analysis

In 2024, the hardware segment held a dominant market position, capturing more than a 55.9% share of the digital signage market in banking and finance. This dominance is primarily driven by the essential role of hardware components such as displays, media players, and projectors in facilitating the effective implementation of digital signage solutions.

The demand for high-quality, durable, and versatile displays, including LED and LCD screens, is especially high as financial institutions seek to create impactful visual experiences for their customers. Hardware investments also form the backbone of digital signage infrastructure, which is why they are crucial to the overall success of digital signage deployments in the banking and finance sector.

The popularity of hardware in this space is largely due to the continuous advancements in display technologies. The increasing preference for high-resolution screens, interactive touchscreens, and large-format displays that can convey real-time financial information has made hardware a key focus for many financial institutions.

Another factor propelling the hardware segment is the growing need for reliability and performance. Digital signage hardware in banks and financial institutions needs to operate seamlessly, often for extended hours, to provide continuous service. As such, the emphasis on robust hardware solutions that require minimal maintenance while delivering high-quality output has further bolstered the market share of the hardware segment.

Technology Analysis

In 2024, the LED segment held a dominant market position in the digital signage in the banking and finance market, capturing over 46.8% of the total market share.

LED displays are highly durable, which is a key factor for financial institutions that require cost-effective, long-term solutions. Unlike other display technologies, LED screens offer enhanced performance and lower maintenance costs, making them the preferred choice for banks and financial services providers looking for a balance between quality and operational efficiency.

The growing trend towards digitization in banking is also driving the adoption of LED digital signage. With the increasing need for dynamic and real-time information sharing, such as stock updates, promotional offers, and branch announcements, LED displays are becoming indispensable.

The decreasing cost of LED technology has significantly expanded its reach, making it accessible to smaller banks and credit unions, in addition to large institutions. This democratization of technology strengthens the LED segment’s leadership and supports its continued growth in the coming years.

Resolution Analysis

In 2024, the 8K resolution segment held a dominant market position in the digital signage for banking and finance sector, capturing more than a 36.2% share. This growth is driven by the increasing demand for ultra-high-definition visuals that provide exceptional clarity and detail.

As financial institutions seek to enhance customer experience, 8K resolution has become a key solution for delivering stunning content in environments like branch lobbies, ATM screens, and digital billboards. Its ability to display sharp, vibrant images creates more engaging and immersive experiences, helping banks differentiate themselves in a competitive market.

The key drivers behind the growth of the 8K segment include the continuous advancements in display technology and a shift toward more dynamic and interactive digital signage solutions. Financial institutions are increasingly integrating high-resolution screens to communicate complex data, financial information, and promotional content more effectively.

The rapid adoption of large-format displays in banking environments is boosting the dominance of the 8K segment. With 8K resolution, these large displays maintain high image quality even when stretched across wide formats, preserving sharpness and detail. As banks explore more immersive, interactive technologies, 8K displays help push the boundaries of digital signage.

Application Analysis

In 2024, the Customer Engagement segment held a dominant market position in the digital signage for banking and finance sector, capturing more than a 30.6% share. This dominance is largely attributed to the growing emphasis on delivering personalized, real-time experiences to customers.

As banks move toward a customer-centric model, digital signage has become essential for deeper engagement. Through interactive displays and personalized messaging, it enables banks to connect meaningfully with customers, boosting loyalty and satisfaction.

The shift towards customer engagement through digital signage is also driven by the increasing demand for seamless, omnichannel experiences. Banks are leveraging digital screens not just for promotions but also for interactive features, such as account balance inquiries, financial tips, or customized product recommendations.

Furthermore, advancements in content management systems and interactive technology have empowered financial institutions to enhance their customer engagement strategies. Digital signage solutions now offer real-time content updates, which are particularly valuable in fast-paced environments like banking, where information needs to be timely and accurate.

Location Analysis

In 2024, the In-Branch segment held a dominant market position, capturing more than a 72.5% share of the Digital Signage in Banking & Finance market. This significant share can be attributed to the growing demand for enhancing customer engagement and streamlining the communication process within bank branches.

In-branch digital signage is becoming a key tool for displaying real-time updates, product information, promotions, and customer service instructions, enhancing the in-branch experience. Banks use this technology to boost customer interaction while reducing operational costs by minimizing printed materials and manual communications.

The In-Branch segment’s lead can be further attributed to its ability to personalize content based on specific customer needs. For instance, banks can target specific customer demographics with tailored messaging, improving customer satisfaction and conversion rates.

Digital screens in branches offer the flexibility to instantly update promotions, offers, or branch-specific information, making them more relevant and adaptable than traditional static signage. This dynamic content capability helps meet modern customer expectations and drives further growth in the digital signage segment.

Signage Size Analysis

In 2024, the Below 32 Inches segment held a dominant market position, capturing more than a 56.8% share of the Digital Signage in Banking & Finance market. This dominance can largely be attributed to the versatility and cost-effectiveness of smaller digital displays.

Banks favor smaller screens for applications like queue management, directional signage, and product promotions. Their compact size makes integration into existing spaces easier, and their affordability offers a cost-effective solution, helping banking networks maximize ROI on digital signage investments.

The flexibility of below 32-inch screens has made them popular in high-traffic areas like teller counters, ATMs, and waiting areas. Their compact size allows banks to deliver relevant, personalized content without overwhelming customers, offering product recommendations or promotions based on specific interactions.

The rise in preference for smaller signage is driven by the need for space efficiency in branches. Compact screens fit easily in areas with limited space, like narrow aisles or kiosks, without disrupting customer flow. They are also less intrusive, helping banks maintain a clean, modern aesthetic while delivering key information.

Key Market Segments

By Type

- Digital Notice Board

- Digital Standee

- Bank Lobby Displays

- Kiosks

- Interactive Kiosks

- Self-service Kiosks

- Others

- Bank Window Displays

- Media Walls

- Others

By Component

- Hardware

- Displays

- Media Players

- Projectors

- Others

- Software

- Service

- Installation Services

- Maintenance & Support Services

- Consulting Services

By Technology

- LCD

- LED

- OLED

- Projection

By Resolution

By Application

- Customer Engagement

- Internal Communication

- Branding and Marketing

- Queue Management

- Others

By Location

- In-Branch

- Out-of-Branch

By Signage Size

- Below 32 Inches

- 32 to 52 Inches

- More than 52 Inches

Driver

Increasing Demand for Customer Engagement and Personalization

Digital signage in the banking and finance sector is increasingly driven by the need for enhanced customer engagement and personalization. Banks and financial institutions are focusing on delivering personalized experiences to their customers, which is a key factor in building long-term relationships. Digital signage solutions enable the dynamic display of content tailored to the needs and preferences of individual customers.

The ability to display real-time information, such as interest rates, stock prices, and exchange rates, can significantly improve customer experience, offering a more interactive and relevant service. Moreover, digital signage helps to create a modern, professional ambiance in bank branches, providing a seamless blend of technology and service. This enhances both customer satisfaction and brand image, supporting the digital transformation of the sector.

Restraint

High Initial Investment Costs

A significant restraint to the widespread adoption of digital signage in banking and finance is the high initial investment required for setting up the infrastructure. The costs associated with hardware, software, installation, and ongoing maintenance can be prohibitively high for many smaller financial institutions or banks with limited budgets.

Additionally, the technology requires skilled personnel for both installation and maintenance, which can further increase costs. This can be a significant challenge for banks or financial institutions that operate on tight margins or are hesitant to make large capital expenditures. As a result, some institutions may delay the implementation of digital signage solutions, opting to stick with traditional signage methods, which are less expensive but offer limited functionality and customer interaction.

Opportunity

Enhanced Data Analytics for Decision-Making

One key opportunity presented by digital signage in the banking and finance sector is the integration with advanced data analytics to optimize customer engagement and operational efficiency. With digital signage, banks can capture valuable data on how customers interact with displays, what content captures their attention, and how long they engage with certain messages.

In addition, digital signage solutions can enable banks to gather insights into customer behavior and trends, which can assist in more effective decision-making. For instance, data from digital displays can be used to optimize product offerings, adjust marketing strategies, or improve branch layout to increase customer traffic and sales. This data-driven approach allows banks to stay competitive, improving both customer satisfaction and revenue generation.

Challenge

Integration with Legacy Systems

One of the primary challenges of adopting digital signage in banking and finance is the integration of new technology with legacy systems. Many financial institutions still rely on older infrastructure and software, making the process of incorporating digital signage solutions into their existing networks complex.

This integration challenge can also affect the scalability and flexibility of digital signage solutions. Banks that operate across multiple branches with varying IT setups may struggle to deploy a uniform digital signage strategy, leading to inefficiencies and additional maintenance requirements.

Moreover, the security of sensitive customer data is a primary concern, as banks need to ensure that digital signage platforms are compliant with stringent financial regulations and cybersecurity standards.

Emerging Trends

One of the key trends is the increasing adoption of interactive displays. These screens are being used to create engaging customer experiences, allowing users to access information such as account balances, loan rates, or even perform basic banking services without the need for a teller.

Another trend is the integration of personalized content. With the use of data analytics and customer profiling, banks can display relevant advertisements, offers or financial services tailored to individual customers. This kind of personalization helps banks foster deeper customer relationships while promoting cross-selling opportunities.

The rise of mobile integration is another trend, as banks allow customers to interact with digital signage displays through their smartphones via QR codes or NFC technology. This shift offers convenience while enhancing security, as customers can securely view sensitive account information on their devices rather than through public-facing screens.

Business Benefits

- Enhanced Customer Engagement: Digital signage creates dynamic, interactive displays that attract customer attention. Banks and financial institutions can use these screens to showcase promotions, new products, and customer-facing services in an engaging way.

- Improved Operational Efficiency: Digital signage reduces the reliance on paper signage, which can be costly and time-consuming to update. With digital displays, banks can instantly change information across multiple branches without needing to physically replace posters or flyers.

- Cost Savings in the Long Run: While the initial investment in digital signage might seem significant, the long-term savings are notable. Traditional printing costs, maintenance, and logistics for paper-based materials can add up over time.

- Personalized Customer Experiences: Digital signage allows for the display of tailored content based on customer behavior or demographics. For example, banks can use these screens to offer personalized product recommendations or provide real-time alerts about account activity, enhancing the customer experience and fostering loyalty.

- Enhanced Branding and Consistency: Digital signage ensures that branding and messaging are consistent across all branches, locations, or ATMs. This uniformity helps strengthen the institution’s identity and provides a seamless experience for customers, whether they are at a physical branch or interacting through a digital touchpoint.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

- ADFLOW Networks is a major player in the digital signage industry, particularly in the banking and finance sector. Known for their innovative digital signage solutions, ADFLOW provides easy-to-use software for managing and displaying content across various screens. Their platform allows banks to create custom digital signage networks for branches, offering a seamless way to communicate with customers.

- BrightSign, LLC is a leading provider of digital signage hardware and software solutions. They offer reliable, high-performance media players and software that are scalable for banks and financial institutions looking to enhance their digital signage networks. BrightSign is recognized for its ability to integrate with other technologies and provide a user-friendly interface.

- Cisco Systems, Inc. is a global technology leader, and its digital signage solutions have a significant presence in the banking and finance sector. With a strong focus on network infrastructure, Cisco provides integrated digital signage solutions that leverage their robust communication technologies.

Top Key Players in the Market

- ADFLOW Networks

- BrightSign, LLC

- Cisco Systems, Inc.

- Intel Corporation

- KeyWest Technology, Inc.

- LG Electronics

- Microsoft Corporation

- NEC Display Solutions

- Omnivex Corporation

- Panasonic Corporation

- Samsung

- Scala

- Winmate Inc.

- Allsee Technologies Limited

- The Element Group

- STRATACACHE

- Others

Top Opportunities Awaiting for Players

- Enhanced Customer Engagement: Digital signage is increasingly being used in banks and financial institutions to engage customers in a more interactive and personalized way. Digital displays can be used to show tailored content such as personalized offers, service promotions, or real-time updates about account activities.

- Improved Branch Experience: With the rise of branch transformation initiatives, digital signage provides an opportunity for banks to enhance the in-branch experience. Interactive kiosks and digital displays can guide customers through various services, provide financial advice, or present new offerings, while reducing perceived waiting times.

- Targeted Marketing Campaigns: Digital signage enables banks to run targeted, real-time marketing campaigns customized by location, time, and customer demographics. For example, ads for home loans or credit cards can be displayed in high-traffic branches or at times when customers are most likely to engage.

- Streamlined Communication and Information Sharing: Digital signage in banking improves internal communication and employee training by displaying key announcements, process updates, and training modules. This ensures staff stays informed on policies, reducing miscommunication and enhancing efficiency.

- Real-Time Financial Data & Market Insights: Incorporating real-time financial data like stock updates, exchange rates, and commodity prices into digital signage enhances the customer experience in banks. It provides immediate value by offering timely market insights, especially in branches and waiting areas, helping customers make informed financial decisions while positioning the bank as a trusted source of relevant information.

Recent Developments

- In January 2024, LG showcased its new LG Business Cloud platform at ISE 2024. This platform allows businesses to manage their digital signage solutions remotely and is designed to support various sectors including finance. It aims to improve customer experiences by offering a comprehensive suite of digital signage services.

- In December 2024, Microsoft partnered with First Abu Dhabi Bank to develop AI-powered banking capabilities as part of their cloud strategy. This partnership signifies the growing trend of integrating advanced technology into banking operations, which may include enhanced digital signage solutions.

Report Scope

Report Features Description Market Value (2024) USD 3.5 Bn Forecast Revenue (2034) USD 9.4 Bn CAGR (2025-2034) 10.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Digital Notice Board, Digital Standee, Bank Lobby Displays, Kiosks (Interactive Kiosks, Self-service Kiosks, Others), Bank Window Displays, Media Walls, Others), By Component (Hardware (Displays, Media Players, Projectors, Others), Software, Service, (Installation Services, Maintenance & Support Services, Consulting Services), By Technology (LCD, LED, OLED, Projection), By Resolution (8K, 4K, Full High Definition (FHD), High Definition (HD), Lower than HD), By Application (Customer Engagement, Internal Communication, Branding and Marketing, Queue Management, Others), By Location (In-Branch, Out-of-Branch), By Signage Size (Below 32 Inches, 32 to 52 Inches, More than 52 Inches) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ADFLOW Networks, BrightSign, LLC, Cisco Systems, Inc., Intel Corporation, KeyWest Technology, Inc., LG Electronics, Microsoft Corporation, NEC Display Solutions, Omnivex Corporation, Panasonic Corporation, Samsung, Scala, Winmate Inc., Allsee Technologies Limited, The Element Group, STRATACACHE , Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Signage in Banking & Finance MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Signage in Banking & Finance MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ADFLOW Networks

- BrightSign, LLC

- Cisco Systems, Inc.

- Intel Corporation

- KeyWest Technology, Inc.

- LG Electronics

- Microsoft Corporation

- NEC Display Solutions

- Omnivex Corporation

- Panasonic Corporation

- Samsung

- Scala

- Winmate Inc.

- Allsee Technologies Limited

- The Element Group

- STRATACACHE

- Others