Digital Pathology Market By Product Type (Software, Hardware, and Services), By Technology (Whole Slide Imaging, Virtual Microscopy, and Artificial Intelligence), By Application (Disease Diagnosis, Research and Development, and Education), By End-user (Hospitals, Diagnostic Laboratories, and Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 56995

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

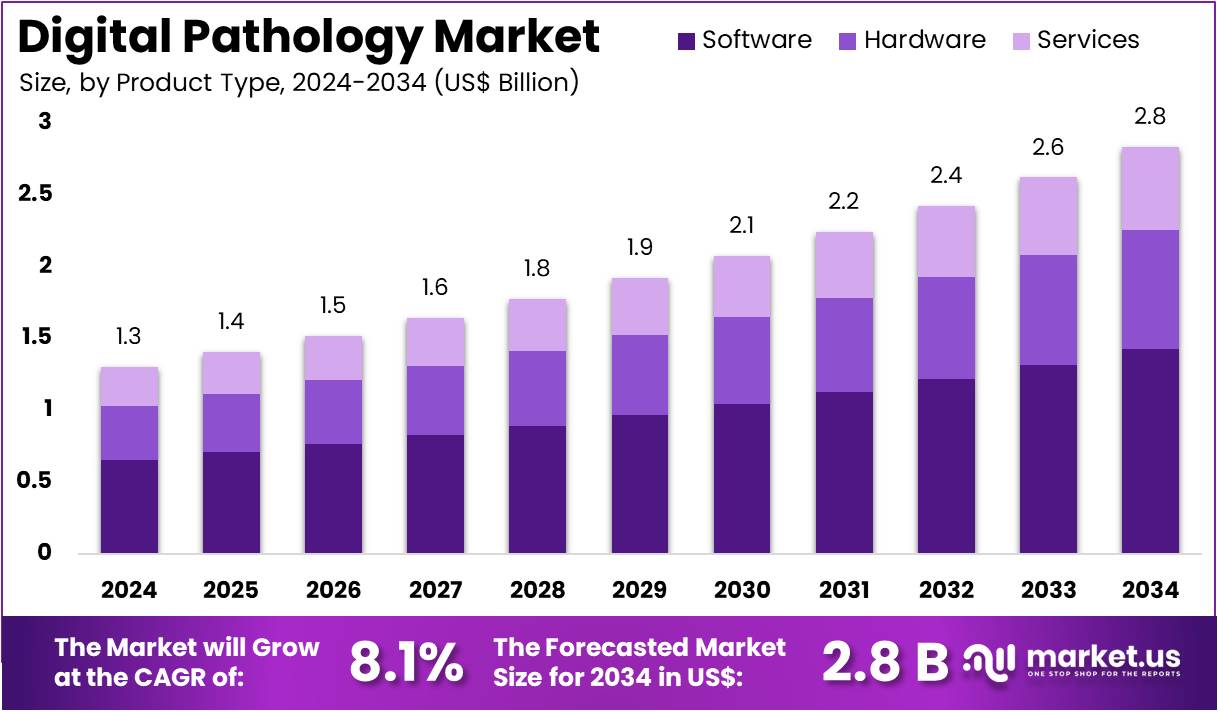

The Digital Pathology Market size is expected to be worth around US$ 2.8 billion by 2034 from US$ 1.3 billion in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034.

Increasing demand for more efficient, accurate, and accessible diagnostic tools is driving the growth of the digital pathology market. Digital pathology uses digital images of tissue samples, allowing pathologists to analyze slides more efficiently and with greater precision compared to traditional methods. This market benefits from advancements in imaging technology, such as high-resolution scanning, which improves the quality and clarity of pathology images, leading to better diagnostic outcomes.

The increasing prevalence of chronic diseases, particularly cancer, and the growing need for precision medicine are significant factors pushing the adoption of digital pathology solutions. These tools enable quicker diagnoses and support telepathology, where medical professionals can share and consult on pathology images remotely. The market also sees a rising demand for artificial intelligence (AI) and machine learning (ML) integration, which helps automate image analysis, identify patterns, and assist in diagnosis, enhancing workflow efficiency.

In October 2023, Pramana and Gestalt launched a unified platform that merges AI with digital pathology, image analysis, and DICOM capabilities. This integrated solution offers a more streamlined and effective approach to diagnostic imaging, exemplifying a trend toward comprehensive platforms that combine multiple technologies for more efficient healthcare delivery.

Digital pathology is also increasingly utilized in research and drug development, where high-throughput screening and data analysis of tissue samples are essential for advancing treatments and understanding disease mechanisms. As healthcare systems adopt more digital solutions and move toward personalized medicine, digital pathology is poised to play an increasingly vital role in improving both clinical and research outcomes. The ongoing innovation and integration of digital tools into pathology workflows present significant opportunities for growth and transformation in the healthcare sector.

Key Takeaways

- In 2024, the market for digital pathology generated a revenue of US$ 1.3 billion, with a CAGR of 8.1%, and is expected to reach US$ 2.8 billion by the year 2034.

- The product type segment is divided into software, hardware, and services, with software taking the lead in 2023 with a market share of 50.3%.

- Considering technology, the market is divided into whole slide imaging, virtual microscopy, and artificial intelligence. Among these, whole slide imaging held a significant share of 55.6%.

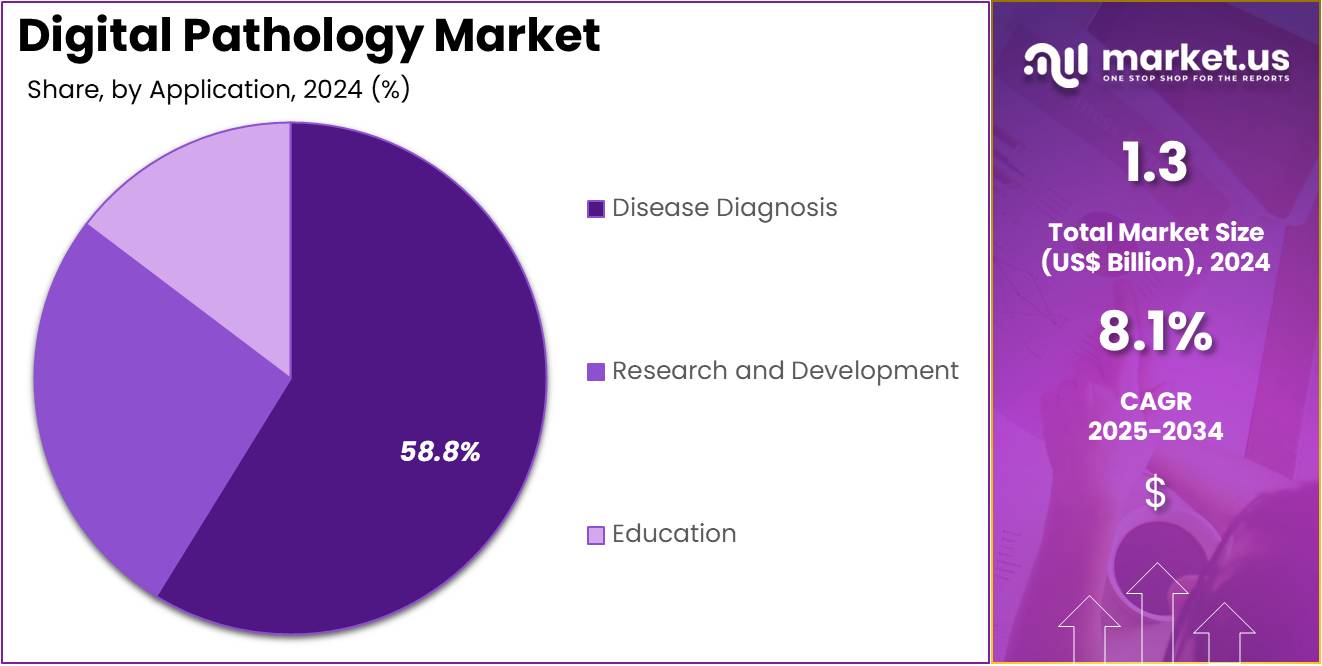

- Furthermore, concerning the application segment, the market is segregated into disease diagnosis, research and development, and education. The disease diagnosis sector stands out as the dominant player, holding the largest revenue share of 58.8% in the digital pathology market.

- The end-user segment is segregated into hospitals, diagnostic laboratories, and research institutes, with the hospitals segment leading the market, holding a revenue share of 44.5%.

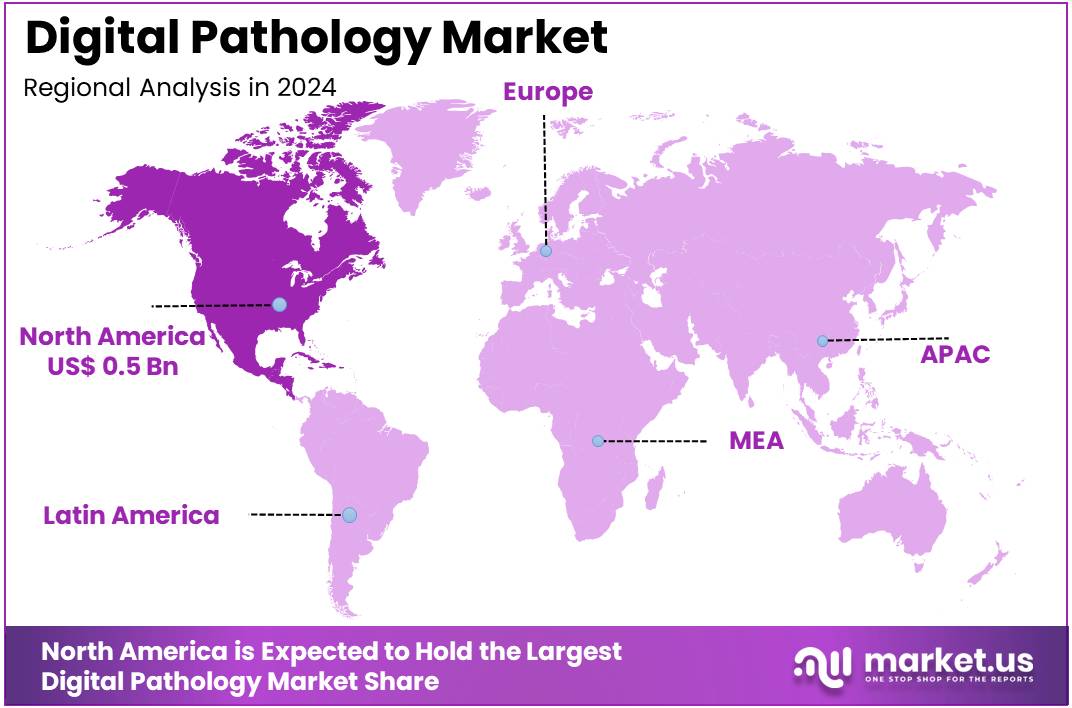

- North America led the market by securing a market share of 40.8% in 2023.

Product Type Analysis

Software holds the largest share of 50.3% in the digital pathology market. This growth is expected to continue as digital pathology software plays a critical role in managing and analyzing large amounts of diagnostic data. As the demand for high-resolution imaging and enhanced diagnostic accuracy grows, healthcare providers are increasingly adopting advanced software solutions to streamline workflows, improve data accessibility, and ensure better collaboration among pathologists.

The integration of software with other healthcare IT systems, such as electronic health records (EHRs), makes it easier for pathologists to access patient data and make more accurate diagnoses. Moreover, software solutions are anticipated to incorporate artificial intelligence and machine learning capabilities, which can assist in analyzing pathology slides, detecting abnormalities, and predicting patient outcomes. The increasing demand for remote diagnostics and telemedicine is projected to further drive the growth of digital pathology software, especially in regions with limited access to specialized healthcare.

Technology Analysis

Whole slide imaging (WSI) technology holds a dominant share of 55.6% in the digital pathology market. This segment’s growth is expected to continue as WSI enables pathologists to scan and store entire tissue slides digitally, offering enhanced image quality and greater efficiency compared to traditional microscopy. The ability to view, analyze, and share high-resolution images in real time is projected to be a key driver for WSI adoption, particularly in remote or underserved areas where pathologists are in short supply.

WSI’s integration with artificial intelligence tools further enhances its value, allowing for automated image analysis, pattern recognition, and quicker diagnosis. The increasing demand for digital workflows in pathology, combined with the growing trend of using telepathology for remote consultations, is expected to accelerate the use of WSI technology. Additionally, the reduction in the need for physical storage and the ability to easily share digital slides among medical professionals worldwide is anticipated to contribute to WSI’s continued dominance in the market.

Application Analysis

Disease diagnosis holds a dominant share of 58.8% in the digital pathology market. This growth is primarily driven by the increasing prevalence of chronic diseases, such as cancer, and the rising demand for more accurate and efficient diagnostic methods. Digital pathology plays a crucial role in enhancing diagnostic accuracy, particularly in the detection of cancerous cells, where early and precise identification can significantly improve patient outcomes.

The integration of digital pathology solutions with AI-based tools is projected to enhance the speed and accuracy of disease diagnosis by automating image analysis and detecting subtle abnormalities that may be missed by the human eye. Furthermore, as healthcare systems focus more on precision medicine, digital pathology is expected to become an essential tool in diagnosing and tailoring treatments to individual patients’ needs. The adoption of digital pathology in routine clinical settings is likely to expand as its benefits in disease diagnosis become more recognized across healthcare systems worldwide.

End-User Analysis

Hospitals represent the largest end-user segment in the digital pathology market, holding 44.5% of the market share. This growth is expected to continue as hospitals increasingly adopt digital pathology solutions to enhance their diagnostic capabilities and improve patient care. Digital pathology offers hospitals the ability to process, store, and analyze pathology data digitally, enabling more efficient workflows and better collaboration among medical professionals.

The integration of digital pathology with hospital information systems, such as EHRs and laboratory information management systems (LIMS), is expected to streamline operations, reduce errors, and accelerate the diagnosis process. As hospitals continue to expand their use of advanced technologies to improve patient outcomes, the demand for digital pathology solutions is projected to rise. Furthermore, the growing trend of telemedicine and remote consultations is likely to drive hospitals to adopt digital pathology systems, allowing pathologists to collaborate with specialists from anywhere in the world.

Key Market Segments

By Product Type

- Software

- Hardware

- Services

By Technology

- Whole Slide Imaging

- Virtual Microscopy

- Artificial Intelligence

By Application

- Disease Diagnosis

- Research and Development

- Education

By End-user

- Hospitals

- Diagnostic Laboratories

- Research Institutes

Drivers

Rising Burden of Cancer and Chronic Diseases is Driving the Market

The increasing global burden of cancer and other chronic diseases, which necessitate precise and timely pathological diagnoses, is a significant driver propelling the digital pathology market. Traditional pathology workflows, relying on physical glass slides, can be cumbersome, time-consuming, and limit remote collaboration, especially as the volume of cases continues to rise.

Digital pathology, through whole-slide imaging (WSI), allows pathologists to view, analyze, and share high-resolution images of tissue samples digitally, improving efficiency and diagnostic accuracy. This is particularly crucial in oncology, where accurate staging and biomarker identification are vital for treatment decisions. The World Health Organization (WHO) and the International Agency for Research on Cancer (IARC) continually highlight the growing incidence of cancer globally.

According to IARC estimates for 2022, there were approximately 20 million new cancer cases and 9.7 million cancer-related deaths worldwide. Furthermore, around 1 in 5 people develop cancer in their lifetime. This immense and escalating caseload places immense pressure on pathology laboratories to adopt more efficient and collaborative diagnostic tools. The ability of digital solutions to streamline workflows, facilitate expert consultations, and enable the application of artificial intelligence for enhanced analysis directly addresses this growing demand, thereby driving market expansion.

Restraints

High Initial Investment and Lack of Interoperability are Restraining the Market

The substantial initial investment required for implementing digital pathology systems, including high-resolution scanners, robust storage infrastructure, and specialized software, poses a considerable restraint on market growth. Pathology laboratories and healthcare institutions often face significant capital expenditure challenges, and the cost of fully digitizing their operations can be prohibitive, particularly for smaller facilities or those in developing regions.

For instance, digital pathology scanners typically range in price from US$100,000 to US$400,000. Beyond hardware, the need for large-scale data storage and advanced computing resources adds to the financial burden. Furthermore, a critical restraint is the lack of seamless interoperability between different vendors’ digital pathology systems and existing hospital information systems (HIS) or laboratory information systems (LIS).

This fragmentation often leads to data silos and complex integration challenges, requiring significant IT resources and custom development. The College of American Pathologists (CAP) continuously works on guidelines for validating whole slide imaging systems, underscoring the complexities involved. These financial and technical hurdles can delay or prevent the adoption of comprehensive digital pathology solutions, thereby limiting the market’s full potential.

Opportunities

Integration of Artificial Intelligence (AI) for Enhanced Diagnostics is Creating Growth Opportunities

The rapid integration of Artificial Intelligence (AI) and machine learning capabilities into digital pathology workflows is creating significant growth opportunities in the market. AI algorithms can assist pathologists by automating repetitive tasks, such as initial screening of slides for abnormalities, quantifying specific markers, and detecting subtle patterns that might be missed by the human eye. This enhances diagnostic accuracy, reduces turnaround times, and alleviates the workload on pathologists, especially amid a global shortage of these specialists.

The US Food and Drug Administration (FDA) has increasingly cleared AI-enabled medical devices, including those for pathology. As of August 2024, the FDA had approved approximately 950 AI or machine learning-enabled medical devices, with a significant portion being in medical imaging. These approvals, including specific tools for cancer detection and grading, validate the clinical utility of AI in pathology and build confidence in its adoption. The ability of AI to provide quantitative analysis and objective insights supports personalized medicine by identifying specific biomarkers and predicting patient responses to therapies, thereby enhancing diagnostic precision and driving substantial market expansion.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic shifts, including inflation and varying national healthcare investment priorities, influence the digital pathology market by impacting the capital budgets of hospitals and the operational costs of technology providers. Inflation can increase the cost of high-resolution scanners, IT infrastructure, and specialized software development for digital pathology systems, thereby affecting affordability for healthcare institutions.

However, the overarching need for improved diagnostic efficiency and cost-containment in healthcare, especially with the rising burden of chronic diseases, often outweighs these inflationary pressures. A report in January 2025 on healthcare finance trends highlighted that while cost increases are still outrunning reimbursement rates for some healthcare providers, the increasing demand for advanced diagnostics compels investment in efficient technologies.

Geopolitical factors, such as regional instability or trade tensions, can also disrupt global supply chains for the precision components used in digital pathology scanners. This can lead to increased costs or delays in procurement. Despite these challenges, the long-term imperative for faster and more accurate diagnoses, coupled with the potential for digital pathology to reduce long-term operational costs and improve patient outcomes, continues to drive strategic investments in the market.

Evolving US trade policies, including the imposition of tariffs on imported technology components, are shaping the digital pathology market by influencing the cost of critical hardware. Digital pathology systems rely on advanced imaging components, high-performance computing hardware, and precision optics, many of which are sourced from international manufacturers.

Tariffs on these imports can increase the overall cost of digital pathology scanners and associated IT infrastructure for healthcare providers in the US. A May 2025 report by AAMC noted that the US had imported over US$75 billion in medical devices and supplies in 2024, highlighting the industry’s reliance on global supply chains and the potential impact of tariffs on prices. This can be a significant financial consideration for hospitals and laboratories planning to digitize their pathology departments.

Conversely, trade policies often come with a heightened domestic focus on cybersecurity and data integrity for medical technologies. This emphasis reinforces the need for secure digital pathology platforms that adhere to stringent US regulatory standards, such as HIPAA, ensuring patient data protection. While tariffs may present an initial cost hurdle, the drive for secure and efficient diagnostic tools ultimately encourages continued innovation and investment in the domestic digital pathology ecosystem.

Latest Trends

Emergence of Cloud-Based Digital Pathology Platforms is a Recent Trend

A notable trend reshaping the digital pathology market in 2024 and into 2025 is the growing shift toward cloud-based platforms. Healthcare providers are steadily moving away from traditional on-premise systems. This transition is driven by benefits such as cost reduction in IT infrastructure, better scalability, and improved system accessibility. Cloud-hosted platforms allow pathology departments to manage and store vast amounts of image data efficiently. These systems also offer operational flexibility, making them increasingly attractive to institutions focused on modernizing their diagnostic workflows.

One major advantage of cloud-based digital pathology is remote access to whole-slide images. This feature supports telepathology, enabling real-time consultation across geographic regions. Experts can review complex or rare cases without needing physical slide transfers. This enhances collaboration between specialists, improving diagnostic accuracy and turnaround times. A May 2025 article emphasized how cloud platforms enhance healthcare data sharing and accessibility, particularly in underserved or rural areas. This capability also contributes to more equitable and timely care.

Moreover, cloud platforms support integration with artificial intelligence tools and large training datasets. This allows laboratories to adopt machine learning without heavy investments in local hardware. AI-powered diagnostics can assist in identifying patterns and anomalies at scale. The flexibility of the cloud also accelerates innovation in pathology, enabling faster deployment of new tools and updates. As a result, cloud adoption in digital pathology aligns with a broader industry trend favoring scalable, collaborative, and data-driven healthcare solutions.

Regional Analysis

North America is leading the Digital Pathology Market

North America dominated the market with the highest revenue share of 40.8% owing to the increasing adoption of whole slide imaging (WSI) for primary diagnosis, the expansion of telepathology services, and the integration of artificial intelligence (AI) for enhanced diagnostic capabilities. The escalating incidence of cancer and other complex diseases across the region has amplified the demand for faster, more accurate, and efficient pathological diagnoses.

This shift towards digital workflows allows for improved collaboration among pathologists, remote consultations, and streamlined laboratory operations, addressing the critical need for efficiency in healthcare systems. While specific FDA clearances for new WSI systems for primary diagnosis in 2022-2024 were not immediately available, the foundational regulatory approvals, such as Philips’ IntelliSite Pathology Solution’s clearance for primary diagnostic use, have paved the way for broader adoption. Major players in the diagnostics sector have shown robust performance, reflecting this market expansion.

For instance, Roche’s Diagnostics Division reported sales growth of 4% to CHF 14.3 billion in 2024, with its base business (excluding COVID-19 related products) growing by 8%, driven by increased demand for immunodiagnostic, pathology, and molecular solutions. Similarly, Danaher, which includes Leica Biosystems, reported that its Diagnostics segment’s non-GAAP core revenue increased 1.0% in 2024, indicating continued investment and growth in advanced diagnostic tools. The increasing burden of cancer in the US, with an estimated 1,958,310 new cancer cases projected in 2023, as per the American Cancer Society, further underscores the imperative for advanced diagnostic technologies like digital pathology.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the region’s large and aging population, the rising prevalence of chronic diseases, particularly cancer, and increasing healthcare expenditure coupled with government initiatives promoting digital health infrastructure. Countries like China, India, Japan, and Australia are actively investing in modernizing their healthcare systems, recognizing the benefits of digital solutions in improving diagnostic accuracy and accessibility.

For example, India is projected to face a significant cancer burden, with an estimated 1.4 million cancer cases in 2023, according to the Indian Council of Medical Research (ICMR), highlighting the immense need for advanced diagnostic tools. Governments across the region are implementing various digital health initiatives; for instance, the Asia Pacific region attracted US$2 billion in digital health funding across 244 deals in 2024, with a focus on medical diagnostics and AI-driven healthcare tools. This investment creates a conducive environment for the adoption of digital pathology solutions.

Leading companies with a strong presence in Asia Pacific are likely to capitalize on this trend. Roche’s Diagnostics Division saw its sales in the International region (which includes Asia Pacific) increase by 17% in 2024, led by growth in China, demonstrating the increasing demand for advanced diagnostic solutions. As healthcare providers in Asia Pacific continue to embrace digital transformation, the market for digital pathology solutions will likely expand significantly, enabling more efficient diagnoses and improved patient outcomes across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the digital pathology market employ various strategies to drive growth and enhance diagnostic capabilities. They focus on integrating artificial intelligence (AI) and machine learning to automate image analysis, improving diagnostic accuracy and efficiency. Companies also prioritize the development of scalable, cloud-based platforms that offer real-time data access and seamless interoperability with existing electronic health record (EHR) systems.

Strategic partnerships with healthcare providers, research institutions, and technology firms enable these companies to expand their market reach and enhance service offerings. Additionally, they invest in user-friendly interfaces and mobile applications to improve accessibility and user experience. Geographical expansion, particularly in emerging markets, further contributes to their growth trajectory.

One key player, Leica Biosystems, is a global leader in laboratory diagnostics and digital pathology solutions. Headquartered in Nussloch, Germany, Leica Biosystems offers a comprehensive range of products, including slide scanners, image analysis software, and tissue microarray systems. The company focuses on enhancing diagnostic workflows through automation and integration, aiming to improve patient outcomes. Leica Biosystems’ commitment to innovation and quality has established it as a prominent player in the digital pathology market.

Top Key Players in the Digital Pathology Market

- Proscia Inc

- Paige AI

- Owkin

- Leica Biosystems

- Indica Labs LLC

- EVIDENT

- Deep Bio Inc.

- Aiosyn

Recent Developments

- In January 2025, Leica Biosystems unveiled updates to its Aperio GT 450 digital pathology scanner, adding new features like 20x/40x magnification, Manual Scan, Extended Focus, Z-Stacking, and Default Calibration, all with DICOM compatibility. The Aperio iQC software now utilizes AI to detect digital and histological errors, enhancing workflow efficiency in digital pathology.

- In November 2023, Owkin extended the reach of its AI diagnostic solution for colorectal cancer by incorporating it with Sectra’s digital pathology platform. This integration of Owkin’s MSIntuit CRC1 aims to streamline MSI screening and improve access to immunotherapy for colorectal cancer patients.

Report Scope

Report Features Description Market Value (2024) US$ 1.3 Billion Forecast Revenue (2034) US$ 2.8 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Software, Hardware, and Services), By Technology (Whole Slide Imaging, Virtual Microscopy, and Artificial Intelligence), By Application (Disease Diagnosis, Research and Development, and Education), By End-user (Hospitals, Diagnostic Laboratories, and Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Proscia Inc, Paige AI, Owkin, Leica Biosystems , Indica Labs, LLC, EVIDENT, Deep Bio Inc., Aiosyn. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Proscia Inc

- Paige AI

- Owkin

- Leica Biosystems

- Indica Labs LLC

- EVIDENT

- Deep Bio Inc.

- Aiosyn