Global Digital Media Subscription Market Size, Share Analysis Report By Content Type (Video, Audio, Text, Images, Interactive Media Content, Others), By Platform (Smartphone, Television, Computer, Tablets, Others), By Application (Marketing & Advertising, Training & E-Learning, Social Media, Streaming, Others), By Payment Frequency (Monthly, Quarterly, Annual, Pay-per-use), By Subscription Model (Tiered Subscriptions, All-Access Subscriptions, Bundle Subscriptions), By Industry Vertical (Entertainment, Retail and E-commerce, Healthcare, Government, BFSI, Telecom, Automotive, Hospitality, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150637

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Impact of AI

- US Market Expansion

- Content Type Analysis

- Platform Analysis

- Application Analysis

- Payment Frequency Analysis

- Subscription Model Analysis

- Industry Vertical Analysis

- Key Market Segments

- Emerging Trends

- Driver

- Restraint

- Opportunity

- Challenge

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

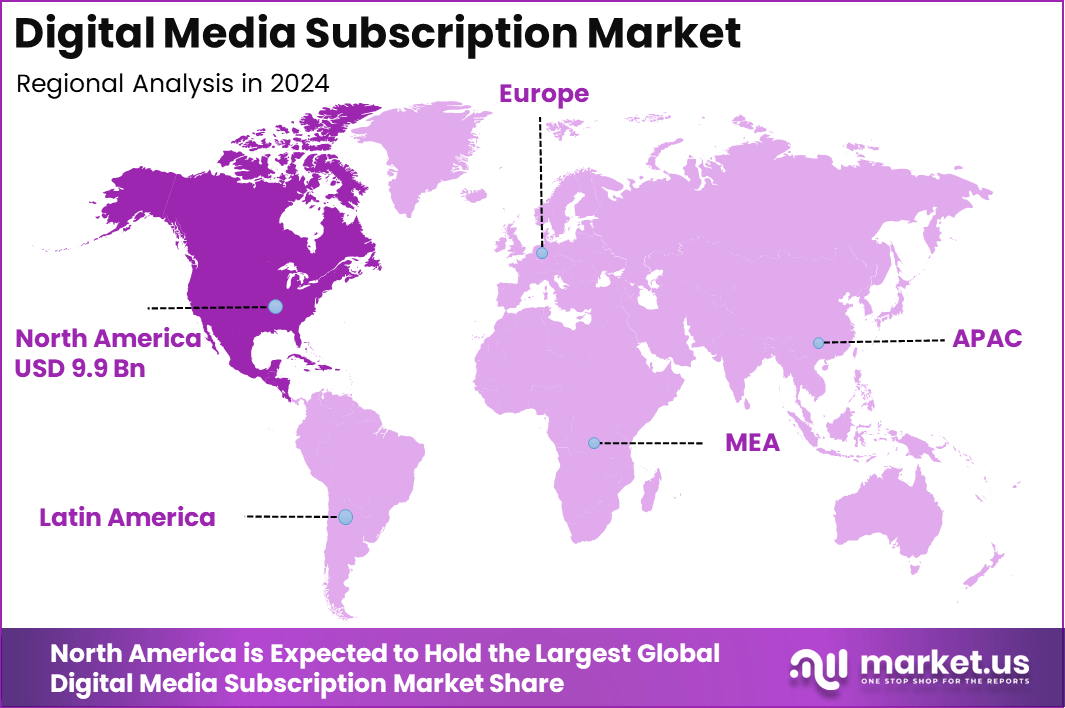

The Global Digital Media Subscription Market size is expected to be worth around USD 323.28 Billion By 2034, from USD 28.27 billion in 2024, growing at a CAGR of 27.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.8% share, holding USD 9.9 Billion revenue.

The global digital media subscription market has been marked by sustained momentum and structural transformation over recent years. Fueled by the proliferation of high-speed broadband and mobile internet, the sector has expanded rapidly, with Video-on-Demand (VoD) Subscription Market is projected to rise from USD 64.98 Billion in 2024 to approximately USD 245.15 Billion by 2034, expanding at a CAGR of 14.2% during the forecast period from 2025 to 2034.

The top driving factors include rising internet penetration, smartphone adoption, and demand for on‑demand virtual media – especially among Gen Z and millennials. Platforms are increasingly embracing ad-supported tiers, as around 81% of users are willing to watch ads in exchange for free content. The shift is further propelled by an appetite for niche and authentic content, especially among younger demographics.

The increasing adoption of technologies such as AI‑driven recommendation engines, cloud-based platforms, and data analytics is optimizing content personalization and delivery. These technologies are enabling more immersive and targeted experiences, strengthening user engagement and retention. Key reasons for adopting these technologies include the aim to better cater to individualized tastes, reduce subscriber churn through algorithmic familiarity and lower operational costs by leveraging scalable cloud infrastructures.

Key Takeaways

- The Global Digital Media Subscription Market reached USD 28.27 Billion in 2024 and is projected to grow significantly to USD 323.28 Billion by 2034, expanding at a remarkable CAGR of 27.4% during the forecast period.

- North America held the leading regional position, capturing over 34.8% of global revenue and generating USD 9.9 Billion in 2024, reflecting high digital consumption and established subscription infrastructures.

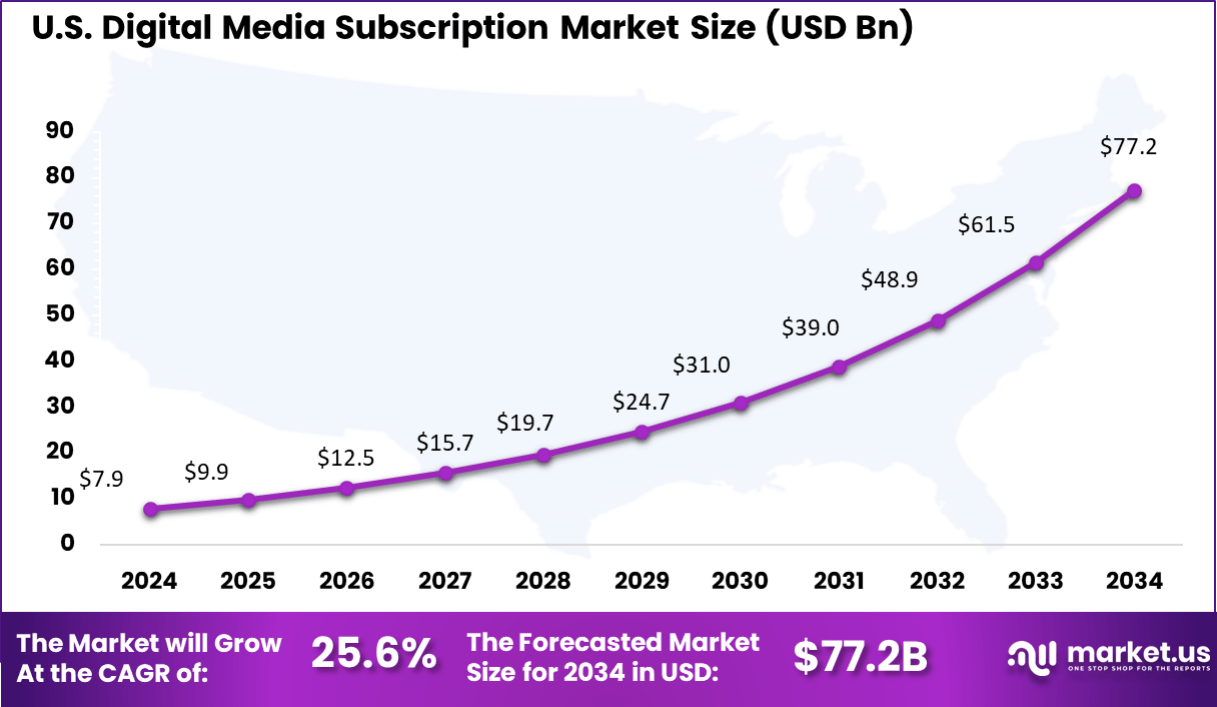

- The U.S. market alone contributed USD 7.9 Billion in 2024, supported by strong digital media penetration and is forecast to grow at a CAGR of 25.6%.

- Video content led the content type category with a 36.2% share, driven by increasing demand for streaming platforms, OTT services, and exclusive content.

- Smartphones dominated as the primary platform, holding 34.2% market share, fueled by mobile-first consumer behavior and seamless app-based media experiences.

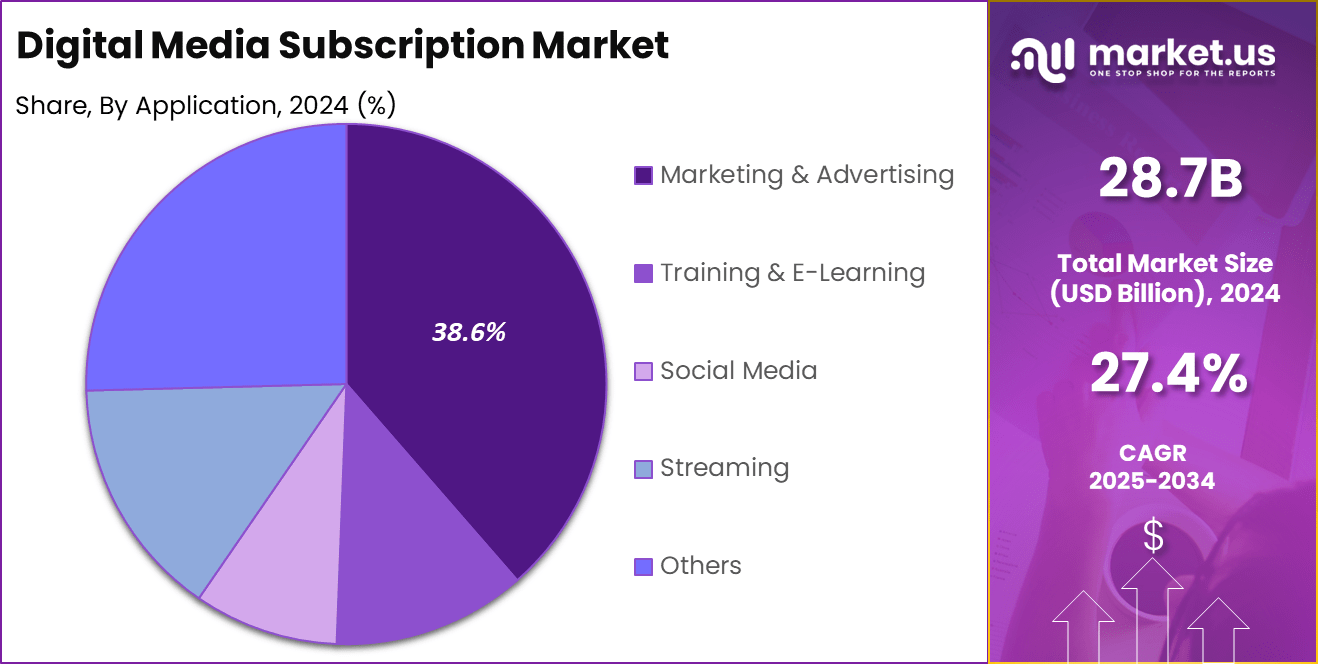

- Marketing & Advertising emerged as the top application, accounting for 38.6%, as digital media is increasingly leveraged for targeted campaigns and branded content.

- The Monthly payment model held 35.6% share, indicating consumer preference for flexible, recurring billing cycles over annual commitments.

- Tiered Subscriptions captured 42.4% of the market by subscription model, supported by user demand for customizable content access and differentiated service levels.

- The Entertainment sector led the industry verticals, holding a 28.5% share, due to its deep integration with streaming, audio platforms, and live digital content offerings.

Impact of AI

The influence of AI on digital media subscriptions has been profound, especially in enhancing user engagement and revenue conversion. AI-driven personalization systems now enable platforms to recommend content based on a reader’s habits and preferences, increasing the likelihood of subscription.

According to Reuters (May 2025), AI technologies helped Google grow its subscription user base to 150 million, showcasing the power of data-driven personalization in attracting and retaining users. Editorial automation is another major impact area. AI is now being used to generate summaries, auto-tag content, and streamline newsroom workflows.

The Wall Street Journal reported in June 2025 that over 87% of newsrooms have adopted AI tools to support production, allowing human writers to focus more on investigative and in-depth reporting. This improves content quality while maintaining efficiency.

However, the rise of generative AI in search engines has negatively impacted media traffic. As AI-generated summaries reduce the need to click through to original articles, many publishers are experiencing sharp drops in site visits. Vanity Fair (May 2025) highlighted that some platforms saw over 50% decline in referral traffic, prompting a shift toward direct subscription models as a more reliable revenue stream.

US Market Expansion

The US Digital Media Subscription Market is experiencing consistent and notable growth, driven by consumers’ rising preference for uninterrupted, on-demand access to content across platforms. In 2024, the market stood at approximately USD 7.9 Billion, and it is projected to expand significantly to reach USD 77.2 Billion by 2034, advancing at a steady CAGR of 25.6% between 2025 and 2034.

By 2029, the market is forecasted to reach around USD 24.7 Billion, underlining the sustained momentum in digital content consumption patterns across the United States. The trajectory of growth is largely supported by technological innovation, improved connectivity, and evolving media consumption behaviors, particularly among younger demographics and mobile-first users.

In 2024, North America held a dominant market position, capturing more than a 34.8% share and generating approximately USD 9.9 Billion in revenue within the Digital Media Subscription Market. This leadership is primarily driven by the region’s high internet penetration, widespread adoption of smart devices, and a deeply entrenched culture of paid digital content consumption.

Platforms offering video streaming, music subscriptions, news media, and gaming content have experienced strong demand, particularly in the United States and Canada, where consumers prioritize convenience, premium content quality, and ad-free user experiences.

Furthermore, the presence of leading global digital media providers – many of which are headquartered in North America – has provided a competitive advantage in content innovation and pricing strategies. Advanced infrastructure supporting 5G, cloud computing, and personalized algorithms has allowed service providers to offer seamless, tailored experiences to users.

Content Type Analysis

In 2024, the Video segment held a dominant market position in the global digital media subscription market, capturing more than 36.2% share. This leadership is driven by the rapid expansion of streaming platforms and the rising consumption of on-demand visual content.

Video owes its edge to the soaring popularity of services such as Netflix, YouTube, Amazon Prime Video, and short‑form platforms like TikTok and Instagram Reels – all of which have transformed consumer habits. Furthermore, the Video segment’s leadership is reinforced by its lucrative integration with advertising and subscription business models.

Premium video-on-demand (PVOD) and ad-supported video-on-demand (AVOD) formats have unlocked new monetization streams, attracting both consumers and advertisers in large volumes. Reports highlight that digital video advertising revenue has grown significantly faster than audio or print advertising – rising over 19% in 2024 compared to only 8.5% for audio.

Summary of Leading Segment – Video

Key Drivers Details Rich Consumer Experience Enhanced quality (4K, low-latency, 5G) enables immersive viewing. Content Ecosystem Strength Expansion of streaming services and social platforms reinforces usage. Advertising & Marketing Focus Video channels attract major ad spend and brand investment. Versatility & Ubiquity Video content spans entertainment, news, education, and social media. Platform Analysis

In 2024, Smartphone segment held a dominant market position, capturing more than a 34.2% share. This prominence is rooted in the immense global penetration of mobile devices, with over 5.61 billion people now owning smartphones – equating to roughly 69% of the world’s population.

The convenience and portability of smartphones enable users to access digital media subscriptions – such as streaming video, music, news, social media, and interactive apps – anytime and anywhere. Technological advancements including 5G, advanced mobile processors, and optimized apps have further enhanced content quality and streaming speed on handheld devices.

Consequently, the smartphone segment has emerged as the preferred digital media gateway for a majority of consumers. The leading status of smartphones is further bolstered by its commanding share of global internet traffic. As of late 2024, approximately 64% of all internet usage occurred on mobile devices, significantly outpacing desktop and tablet traffic.

Summary of Leading Segment – Smartphone

Key Drivers Details Ubiquitous Access Widespread device ownership and 5G connectivity enable anytime, anywhere streaming Optimised User Experience Mobile-friendly UI and AI-driven recommendations improve engagement Cost Efficiency Consolidation of content, communication, and productivity in one device Emerging Market Growth Rapid smartphone adoption in developing regions boosts platform reach Bundled & App-Based Offers Telecom partnerships and mobile subscription models drive usage Application Analysis

In 2024, Marketing & Advertising segment held a dominant market position, capturing more than a 38.6% share. This leadership can be attributed to the accelerating shift of marketing budgets toward digital channels – approximately 77.7% of all media ad spending in the US flows through digital, with digital advertising outpacing traditional by a wide margin.

Summary of Leading Segment – Marketing & Advertising

Key Drivers Details Ad Budget Shift Brands reallocated spend from traditional media to digital platforms Precision Targeting Advanced tools enable audience segmentation and measurable campaign ROI Technology Integration AI and automation improved personalization and ad performance Subscription Value Digital subscriptions provide ongoing access to innovative ad solutions Among these, digital advertising – particularly video, social media, and programmatic ads – has flourished due to its unmatched ability to deliver targeted, measurable campaign performance. Platforms now utilize AI‑driven audience segmentation, leading to higher conversion rates and stronger return on ad spend. As a result, the Marketing & Advertising application remains the primary growth engine within digital media subscriptions.

Payment Frequency Analysis

In 2024, the Monthly segment held a dominant market position in the global digital media subscription market, capturing more than 35.6% share. This leadership is rooted in consumer preference for flexibility and manageable budgeting. The monthly payment model aligns with users’ desire for lower upfront costs and the ability to adjust or cancel services without long-term commitment.

Data indicates that 71% of new digital subscriptions opted for monthly plans, significantly outpacing annual subscriptions, which represented only 14% of new sign-ups. This strong inclination toward monthly billing underscores its strategic appeal to both consumers and providers in 2024. Furthermore, providers benefit from the monthly model due to its ability to attract and retain users through trial offers and adjustable pricing.

The ease of onboarding – combined with opportunities for periodic promotions – allows companies to optimize subscriber acquisition and revenue growth. Notably, the subscription e‑commerce market in 2024 confirmed that the monthly payment frequency held the largest share, reinforcing its dominance across product and service categories.

Summary of Leading Segment – Monthly

Key Drivers Details Lower Upfront Cost Reduces barrier to entry with smaller monthly payments Flexibility & Adaptability Users can cancel or switch plans easily, reducing long-term commitment risk Acquisition & Retention Enables onboarding with trial offers and promotional pricing High Adoption 71% of new subscriptions are monthly, clearly outpacing annual plans E-commerce Confirmation Monthly segment was largest share in subscription markets in 2024 Subscription Model Analysis

In 2024, the Tiered Subscriptions segment held a dominant market position in the global digital media subscription market, capturing more than 42.4% share. This leadership is grounded in its ability to serve diverse consumer segments effectively. By offering basic, standard, and premium tiers, providers can cater to varying budgets and preferences, balancing affordability with enhanced feature options.

This flexible structure has been shown to increase subscriber acquisition and retention – companies using tiered models are 50% more likely to maintain customers than those offering flat-rate plans. Furthermore, tiered models provide natural opportunities for upselling.

As user needs evolve, service providers can encourage upgrades by showcasing additional benefits – such as ad-free experience, higher resolution streaming, or exclusive content – in higher tiers. The sustained success of platforms like Netflix and Spotify, which have leveraged tiered pricing to reach profitability and enhance loyalty, underscores this strategy.

Summary of Leading Segment – Tiered Subscriptions

Key Drivers Details Customer Segmentation Offers varied tiers (basic to premium) that appeal to different user groups Upselling Potential Enables seamless upgrades through added-value incentives (e.g., no ads, HD content) Higher Retention Rates Tiered plans yield 50% better subscriber retention than flat-rate models Premiumization Strategy Adds features and price differentiation that consumers are willing to pay for Industry Vertical Analysis

In 2024, the Entertainment segment held a dominant market position, capturing more than a 28.5 % share of the global digital media subscription market. This leadership is attributed to several converging factors.

First, consumer spending on subscription-based video-on-demand (SVOD) services surged, driven by increasing content production, including original series, movies, and exclusive sports and music events. Deloitte’s 2025 survey indicated that over 53 % of consumers rank SVOD as their most-used paid service, with many households subscribing to multiple platforms – averaging four per household – with rising monthly costs now around US $69.

Second, technology advancements – such as immersive AR/VR experiences, interactive storytelling, and higher internet penetration – have significantly enriched user engagement, enhancing content appeal and encouraging subscriber loyalty. The Entertainment segment continues to benefit from robust monetization strategies.

Streaming platforms have increased investment in exclusive content and leveraged data-driven personalization and targeted advertising to boost both subscription and ad-supported revenue streams. Despite concerns over subscriber fatigue and price sensitivity – 41 % of users reported that SVOD services are not fully worth their cost

Summary of Leading Segment – Entertainment

Key Drivers Details High Consumer Demand Strong viewership for film, TV, live events, and gaming fuels subscription volume. Subscription Dominance Entertainment comprises over 45% of subscription-economy value in 2024. Monetization Innovation Ad-tier, bundling, tiered pricing and sports rights improve revenue performance. Tech & Personalization Platforms utilize tech (4K, AI, low-latency) for immersive and tailored experiences. Strategic Service Launches Major new entrants like ESPN streaming and Fox DTC strengthen market dynamics. Key Market Segments

By Content Type

- Video

- Audio

- Text

- Images

- Interactive Media Content

- Others

By Platform

- Smartphone

- Television

- Computer

- Tablets

- Others

By Application

- Marketing & Advertising

- Training & E-Learning

- Social Media

- Streaming

- Others

By Payment Frequency

- Monthly

- Quarterly

- Annual

- Pay-per-use

By Subscription Model

- Tiered Subscriptions

- All-Access Subscriptions

- Bundle Subscriptions

By Industry Vertical

- Entertainment

- Retail and E-commerce

- Healthcare

- Government

- BFSI

- Telecom

- Automotive

- Hospitality

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Personalized Content Ecosystems

Consumers are increasingly gravitating toward personalized subscription bundles that integrate streaming video, music, podcasts, and news in a single package. Deloitte notes that users now allocate their entertainment time across social video platforms, gaming, music, and streaming – making diverse and personalized content ecosystems the new frontier.

This trend is driven by fatigue from managing multiple subscriptions and the appeal of algorithmically curated content tailored to individual tastes, especially among younger demographics . Platforms adopting AI-based recommendations and aggregated bundles stand to capture heightened consumer loyalty.

Driver

Expansion of 4G/5G and Broadband Infrastructure

Ubiquitous high-speed internet coverage is bolstering digital media subscription uptake. Market.us reports that global Video‑on‑Demand growth is closely linked to widespread broadband and 4G/5G rollout, enabling seamless streaming on mobile and smart devices.

As more households gain access to reliable, fast connectivity, barriers to subscription adoption diminish. This infrastructure trend supports providers in delivering high-quality, buffer-free experiences, making paid subscriptions more compelling.

Restraint

Consumer Subscription Fatigue

Despite growing supply, consumers are exhibiting fatigue from managing multiple subscriptions and rising costs. Deloitte research indicates that about half of surveyed households report no disposable income at month-end, with many describing the burden of high subscription counts

This fatigue limits market expansion. Services must now balance content investment against price sensitivity. Failure to demonstrate clear value or affordability may provoke cancellation, making subscriber retention a complex operational challenge.

Opportunity

Bundled Monetization via Ad-Supported Layers

Introducing hybrid pricing models – combining ad-free and ad-supported tiers within one subscription – offers a promising revenue opportunity. Deloitte has observed that studios and platforms are exploring ad-tech integrations and tiered offerings to balance user experience with advertising income.

This structure enables targeting of both price-sensitive consumers (via lower-cost ad-supported tiers) and premium segments seeking uninterrupted experiences. It reduces friction in conversion funnels and opens dual revenue pathways through subscription fees and ad sales.

Challenge

Intensifying Competition from Social Platforms

Social video giants such as YouTube, TikTok, and Instagram are increasingly competing for entertainment time and advertising dollars. WPP-based research indicates that creator-driven content is expected to surpass traditional media ad revenue in 2025, driven by a 20% growth this year.

This intensifies pressure on subscription services, which must now defend against free, engaging alternatives. They are required to match personalization, interactivity, and community engagement offered by social platforms, often necessitating costly investments in original content and platform innovation.

Key Player Analysis

Apple TV+ reached approximately 45 million paid subscribers by mid‑2025. The company launched new subscription bundles with iPhones later this year, extended app availability to Android via Google Play in February 2025, and introduced a “free first weekend” initiative in January to drive user acquisition.

Disney+ surpassed 126 million subscribers as of May 7, 2025. It rolled out enhanced content bundles across regions and introduced a new flagship ESPN streaming app scheduled for fall 2025, integrating live sports within its subscription ecosystem.

Paramount+ amassed approximately 79 million subscribers by June 2025. The platform has expanded aggressively into international markets, launching branded hubs across Japan and MENA, and struck distribution agreements in the Philippines and Turkey to enhance subscription reach

Top Key Players Covered

- Fuji Media Holdings, Inc.

- Apple, Inc.

- Disney

- AT&T

- Sony Corporation

- Netflix, Inc.

- Paramount

- Charter Communications Inc.

- Thomson Reuters

- Amazon.com, Inc.

- Fox Corporation

- S&P Global

- Kaltura, Inc.

- Others

Recent Developments

- In November 2024, Disney completed a major merger with Reliance in India. This $8.5 billion deal combines Disney Star with Viacom18, creating a streaming giant that controls about 85% of India’s streaming market. The new group will serve over 50 million subscribers and produce 30,000 hours of TV content each year.

- In December 2023, AT&T finalized the sale of its WarnerMedia division to Discovery for $43 billion. AT&T is now focusing on broadband and 5G, moving away from direct involvement in media streaming.

Report Scope

Report Features Description Market Value (2024) USD 28.7 Bn Forecast Revenue (2034) USD 323.28 Bn CAGR (2025-2034) 27.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Content Type (Video, Audio, Text, Images, Interactive Media Content, Others), By Platform (Smartphone, Television, Computer, Tablets, Others), By Application (Marketing & Advertising, Training & E-Learning, Social Media, Streaming, Others), By Payment Frequency (Monthly, Quarterly, Annual, Pay-per-use), By Subscription Model (Tiered Subscriptions, All-Access Subscriptions, Bundle Subscriptions), By Industry Vertical (Entertainment, Retail and E-commerce, Healthcare, Government, BFSI, Telecom, Automotive, Hospitality, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Fuji Media Holdings, Inc., Apple, Inc., Disney, AT&T, Sony Corporation, Netflix, Inc., Paramount, Charter Communications Inc., Thomson Reuters, Amazon.com, Inc., Fox Corporation, S&P Global, Kaltura, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Media Subscription MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Media Subscription MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fuji Media Holdings, Inc.

- Apple, Inc.

- Disney

- AT&T

- Sony Corporation

- Netflix, Inc.

- Paramount

- Charter Communications Inc.

- Thomson Reuters

- Amazon.com, Inc.

- Fox Corporation

- S&P Global

- Kaltura, Inc.

- Others