Global Tampon Market Size, Share, Growth Analysis By Product (Radially Wound Pledget, Rectangular or Square Pad), By Material (Cotton, Rayon, Blended, Others), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Pharmacy Stores, Online Retail, Hospital Pharmacies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143792

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

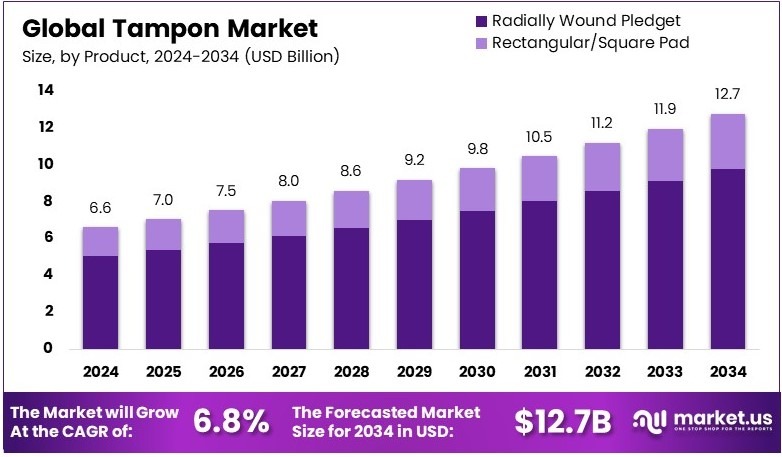

The Global Tampon Market size is expected to be worth around USD 12.7 Billion by 2034, from USD 6.6 Billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

A tampon is a feminine hygiene product designed to absorb menstrual blood internally. Made from compressed layers of soft material, usually cotton or rayon, tampons are inserted into the vagina during menstruation. They offer discretion and comfort, allowing users to remain active with minimal inconvenience.

The tampon market encompasses the production and sale of tampons as a segment of feminine hygiene products. It addresses diverse consumer preferences regarding comfort, absorbency, and material, with a focus on safety and accessibility. Market dynamics include regulatory impacts, demographic trends, and cultural shifts affecting product usage.

The tampon market is currently experiencing significant growth, primarily driven by heightened global awareness of feminine hygiene and an increasing focus on women’s health issues. Legislative efforts in the United States have notably advanced this cause; as of 2023, 26 states have enacted menstrual equity bills aimed at combating period poverty.

These legislative measures are critical as they not only provide menstrual products to incarcerated individuals and students but also work towards reducing or eliminating the sales tax on feminine hygiene products, making them more accessible and affordable.

This trend is not isolated to the United States; worldwide, the demand for tampons is rising due to several influencing factors. Notably, a report from the World Health Organization and UNICEF reveals a substantial challenge: approximately 780 million people lack access to improved water sources, and about 2.5 billion are without improved sanitation.

These conditions pose significant barriers to managing menstrual hygiene effectively, particularly in less developed regions, thereby increasing the reliance on and necessity for hygienic menstrual products like tampons.

The market dynamics are also shaped by the level of market saturation and competitiveness, especially in developed economies where numerous brands vie for a share of consumer attention. Despite the competition, opportunities abound as manufacturers innovate with eco-friendly materials and improved product designs that offer better comfort and protection, aligning with the increasing consumer preference for sustainable and health-conscious products.

Government initiatives play a pivotal role in shaping market prospects. Regulations and investments aimed at promoting menstrual health and ensuring the availability of feminine hygiene products can greatly influence market dynamics. These actions not only support public health but also encourage market entry and expansion by creating a conducive environment for businesses to innovate and grow.

Key Takeaways

- Tampon Market was valued at USD 6.6 Billion in 2024 and is expected to reach USD 12.7 Billion by 2034, with a CAGR of 6.8%.

- In 2024, Radially Wound Pledget led the product segment with 76.4%, owing to its superior absorption and widespread consumer preference.

- In 2024, Cotton dominated the material segment with 35.8%, driven by increasing demand for organic and hypoallergenic menstrual products.

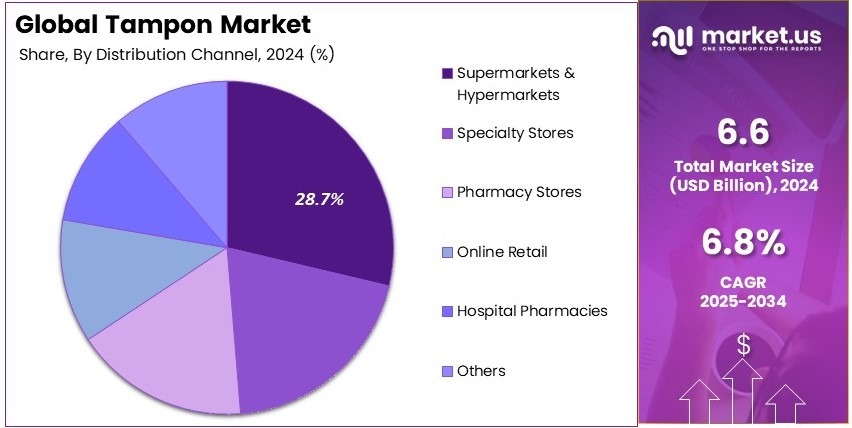

- In 2024, Supermarkets & Hypermarkets held 28.7% of the distribution channel, benefiting from high consumer footfall and product accessibility.

- In 2024, Online Retail experienced significant growth, supported by the rising trend of e-commerce in personal care products.

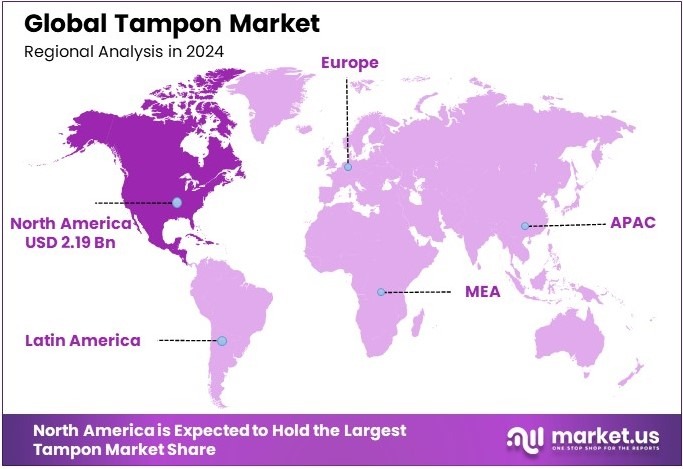

- In 2024, North America dominated the market with 33.2% and a value of USD 2.19 Billion, fueled by strong brand presence and high product awareness.

Product Analysis

Radially Wound Pledget dominates with 76.4% due to its superior absorption and comfort.

In the tampon market, the Product segment is crucial and includes Radially Wound Pledget and Rectangular/Square Pad types. Radially Wound Pledget, the dominant sub-segment, holds a significant 76.4% market share in 2024.

This dominance is attributed to its design, which provides better absorption and comfort, making it highly preferred by consumers for its efficiency in menstrual management. This product type has been embraced for its ability to offer reliable protection, thereby gaining a substantial user base.

Rectangular/Square Pad tampons serve as an alternative to radially wound pledgets, catering to a niche market that prefers a different form factor. Although they hold a smaller market share, these products are pivotal in catering to diverse consumer preferences.

Material Analysis

Cotton dominates with 35.8% due to its natural and hypoallergenic properties.

The Material segment of the tampon market comprises Cotton, Rayon, Blended, and other materials. Cotton leads with a 35.8% market share in 2024, primarily due to its natural and hypoallergenic properties that appeal to health-conscious consumers. Cotton tampons are marketed for their comfort and safety, reducing the risk of irritation and allergies, which endears them to a broad demographic seeking natural menstrual solutions.

Rayon tampons are valued for their absorbency and smoothness, making them a popular choice among users looking for effective moisture management. However, concerns over safety and synthetic materials slightly limit their market share.

Blended materials combine the benefits of cotton and rayon, offering a balance of comfort and absorbency. These are significant for consumers looking for versatile menstrual products.

Distribution Channel Analysis

Supermarkets & Hypermarkets dominate with 28.7% due to their accessibility and variety of options.

The Distribution Channel segment includes Supermarkets & Hypermarkets, Specialty Stores, Pharmacy Stores, Online Retail, Hospital Pharmacies, and other channels. Supermarkets & Hypermarkets are the leading distribution channel with a 28.7% share in 2024, as they offer convenient access to a variety of tampon products under one roof, making it easier for consumers to compare and purchase based on their specific needs.

Specialty Stores provide specialized products and often offer expert guidance, attracting consumers who seek personalized shopping experiences. Although their market share is smaller, their impact on the tampon industry is reinforced by their specialized service.

Pharmacy Stores are essential for consumers prioritizing health and safety, as they often stock tampons that are pharmaceutically approved, catering to a health-conscious market segment.

Online Retail is rapidly growing, providing the convenience of home shopping and often wider product selections than physical stores. Hospital Pharmacies and other channels also play niche roles, supporting specific consumer groups such as healthcare facilities or online shoppers looking for specific brands or types.

Key Market Segments

By Product

- Radially Wound Pledget

- Rectangular/Square Pad

By Material

- Cotton

- Rayon

- Blended

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Pharmacy Stores

- Online Retail

- Hospital Pharmacies

- Others

Driving Factors

Workforce Growth and Urban Lifestyles Drive Market Growth

The global rise in female workforce participation is contributing significantly to the demand for tampons. As more women engage in full-time jobs, especially in urban areas, the need for discreet, comfortable, and portable menstrual hygiene solutions is increasing. Tampons, being compact and easy to use during long work hours, have become a preferred choice for working women.

In addition, increased urbanization is playing a key role. With changing lifestyles and improved hygiene awareness, urban populations are adopting tampons over traditional alternatives. Modern retail formats, including supermarkets and pharmacies, are making tampons more accessible. This wider retail penetration ensures better visibility and consistent availability.

Government initiatives also support market expansion. Many countries are launching menstrual hygiene programs that aim to provide access to safe products and promote menstrual education. For example, school-based awareness campaigns in countries like India and Kenya are slowly improving perceptions and encouraging usage.

Restraining Factors

Social Stigma and Safety Concerns Restrain Market Growth

Cultural taboos surrounding menstruation continue to be a major challenge, especially in developing economies. In many regions, talking openly about periods is discouraged, which leads to hesitation in trying tampons. This limits product awareness and slows adoption, particularly in conservative communities.

Another issue is the increasing popularity of reusable menstrual products like menstrual cups and cloth pads. These options are often seen as eco-friendly and cost-effective, attracting environmentally conscious consumers and reducing the recurring need for tampons.

Safety concerns also affect market growth. Cases of Toxic Shock Syndrome (TSS), although rare, have raised fears among users. Misuse or prolonged use of tampons can pose health risks, making some consumers hesitant to try them.

In rural areas, limited product accessibility further restrains growth. Due to underdeveloped supply chains and low retail presence, many women cannot access tampons regularly. Even if available, affordability and trust issues often prevent purchase. These barriers highlight the need for improved education, safer product innovation, and better distribution to unlock the market’s full potential.

Growth Opportunities

Eco-Friendly Products and Education Provide Opportunities

The introduction of organic and biodegradable tampons is opening new doors for the market. Consumers are becoming more conscious of their environmental impact, and demand is shifting toward chemical-free, compostable options. Brands offering tampons made from organic cotton and sustainable packaging are gaining popularity, especially among younger buyers.

Expanding into emerging markets in the Asia-Pacific region presents a strong opportunity. Countries like Indonesia, Vietnam, and the Philippines have large female populations and rising hygiene awareness. As incomes grow and urban centers expand, these markets show strong potential for tampon adoption.

Subscription-based delivery models are also growing. Many companies now offer monthly tampon deliveries, enhancing convenience for users. This direct-to-consumer model improves brand loyalty and ensures consistent usage.

Moreover, education campaigns are making a real difference. School and community programs that teach girls about menstrual health are helping reduce stigma. As understanding improves, more girls are open to using tampons early on. These combined efforts—innovation, access, and awareness—are building a more inclusive and opportunity-rich market landscape.

Emerging Trends

Sustainability Messaging and Design Innovation Are Latest Trending Factor

Sustainability-focused branding is becoming a key trend in the tampon market. Many brands now highlight their commitment to the environment and social causes. This includes using recyclable packaging, supporting period poverty initiatives, and aligning with gender equality movements. Consumers, especially Gen Z, are responding well to these values.

In addition, applicator-free tampon designs are gaining interest. These tampons reduce plastic waste and appeal to experienced users seeking more eco-conscious options. Their compact size also improves portability, making them convenient for travel and work settings.

Celebrity endorsements are another growing factor. Public figures advocating for menstrual health and equity bring visibility and credibility to tampon brands. Campaigns led by actresses, athletes, or social media influencers help normalize tampon use and start conversations about period care.

Smart packaging innovations are also emerging. Some products now feature QR codes or app integrations that help users track usage and replacement schedules. These digital touches add value and engage tech-savvy consumers. Altogether, these trends reflect a shift toward informed, values-driven, and connected consumers shaping the future of the tampon market.

Regional Analysis

North America Dominates with 33.2% Market Share

North America leads the Tampon Market with a 33.2% share, valued at USD 2.19 billion. This strong market position is bolstered by a combination of high consumer awareness, advanced healthcare standards, and a robust retail infrastructure.

The region’s dominance is driven by progressive health education, widespread awareness about menstrual health, and the availability of a wide range of tampon products tailored to diverse consumer needs. North America also benefits from stringent health and safety regulations that ensure high-quality products.

In the future, North America’s influence on the global tampon market is expected to continue growing. Increased educational efforts and advocacy around women’s health issues will likely lead to greater acceptance and use of tampons. Furthermore, ongoing innovations in product comfort and safety could attract a broader consumer base, solidifying the region’s market leadership.

Regional Mentions:

- Europe: Europe holds a significant portion of the Tampon Market, supported by high consumer health consciousness and stringent product safety regulations. The market is also driven by environmental concerns, leading to increased demand for organic and biodegradable products.

- Asia Pacific: The Asia Pacific region is experiencing fast growth in the Tampon Market due to rising awareness and changing cultural attitudes towards menstrual health. Economic development and increased health education are key drivers in this region.

- Middle East & Africa: The Middle East and Africa are seeing gradual acceptance and use of tampons, driven by urbanization and increased female participation in the workforce. Market growth is modest but promising due to changing perceptions and increasing health awareness.

- Latin America: Latin America’s Tampon Market is growing steadily, fueled by increasing awareness of women’s health and hygiene. The region is seeing a shift in consumer preferences towards more hygienic and convenient menstrual products.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the tampon market, Procter & Gamble, Kimberly-Clark, Johnson & Johnson, and Edgewell Personal Care Company are prominent leaders, significantly shaping industry dynamics with their extensive portfolios and widespread global presence.

Procter & Gamble, through its popular brand Tampax, has been a frontrunner in the tampon market for decades. Known for continuous product innovation, such as the introduction of plastic applicators and compact tampons, P&G remains at the forefront of the industry, appealing to a broad demographic with its commitment to safety and convenience.

Kimberly-Clark competes closely with its U by Kotex brand, which targets younger consumers with vibrant packaging and social media campaigns that focus on breaking stigmas associated with menstrual care. Their products are designed to provide comfort and protection, aiming to empower women through education and community support programs.

Johnson & Johnson, with its o.b. brand, offers a distinctive range of digital-free tampons, emphasizing environmental sustainability and user comfort. Their commitment to producing clinically safe and eco-friendly products helps them maintain a loyal customer base.

Edgewell Personal Care Company, which owns the Playtex brand, is known for its 360-degree protection tampons designed to fit comfortably and adjust to unique body shapes. Their focus on innovation in design and functionality appeals to consumers looking for reliable protection during various activities.

These top companies leverage strong brand reputations, extensive distribution networks, and robust marketing strategies to maintain their positions in the market. By continually investing in research and development, these firms not only enhance their product offerings but also actively participate in educational initiatives to destigmatize menstrual care, thereby expanding their consumer reach and impact on the global market.

Major Companies in the Market

- Procter & Gamble

- Kimberly-Clark

- Johnson & Johnson

- Edgewell Personal Care Company

- Playtex

- Natracare

- Lil-lets

- First Quality Enterprises Inc.

- MOXIE

- Rossmann

- Bodywise Ltd.

- Cora

Recent Developments

- Marlow: In October 2024, Marlow, a Canada-based period care brand, secured $1.9 million in a funding round. The round was led by Love x Money Ventures, with participation from Dream Ventures and other angel investors. This investment is intended to support Marlow’s expansion into the U.S. market and the development of new products.

- Compass Diversified: In January 2024, Compass Diversified (CODI), a publicly traded holding company, acquired a majority stake in The Honey Pot Company, a natural period care brand, for $380 million. At the time of the acquisition, The Honey Pot’s annual sales were estimated at $120 million.

Report Scope

Report Features Description Market Value (2024) USD 6.6 Billion Forecast Revenue (2034) USD 12.7 Billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Radially Wound Pledget, Rectangular/Square Pad), By Material (Cotton, Rayon, Blended, Others), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Pharmacy Stores, Online Retail, Hospital Pharmacies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Procter & Gamble, Kimberly-Clark, Johnson & Johnson, Edgewell Personal Care Company, Playtex, Natracare, Lil-lets, First Quality Enterprises Inc., MOXIE, Rossmann, Bodywise Ltd., Cora Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Procter & Gamble

- Kimberly-Clark

- Johnson & Johnson

- Edgewell Personal Care Company

- Playtex

- Natracare

- Lil-lets

- First Quality Enterprises Inc.

- MOXIE

- Rossmann

- Bodywise Ltd.

- Cora