North America Recipe App Market Size, Share Analysis Report By Type (Free Apps, Paid Apps), By Platform (Android, iOS), By Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2024

- Report ID: 142999

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

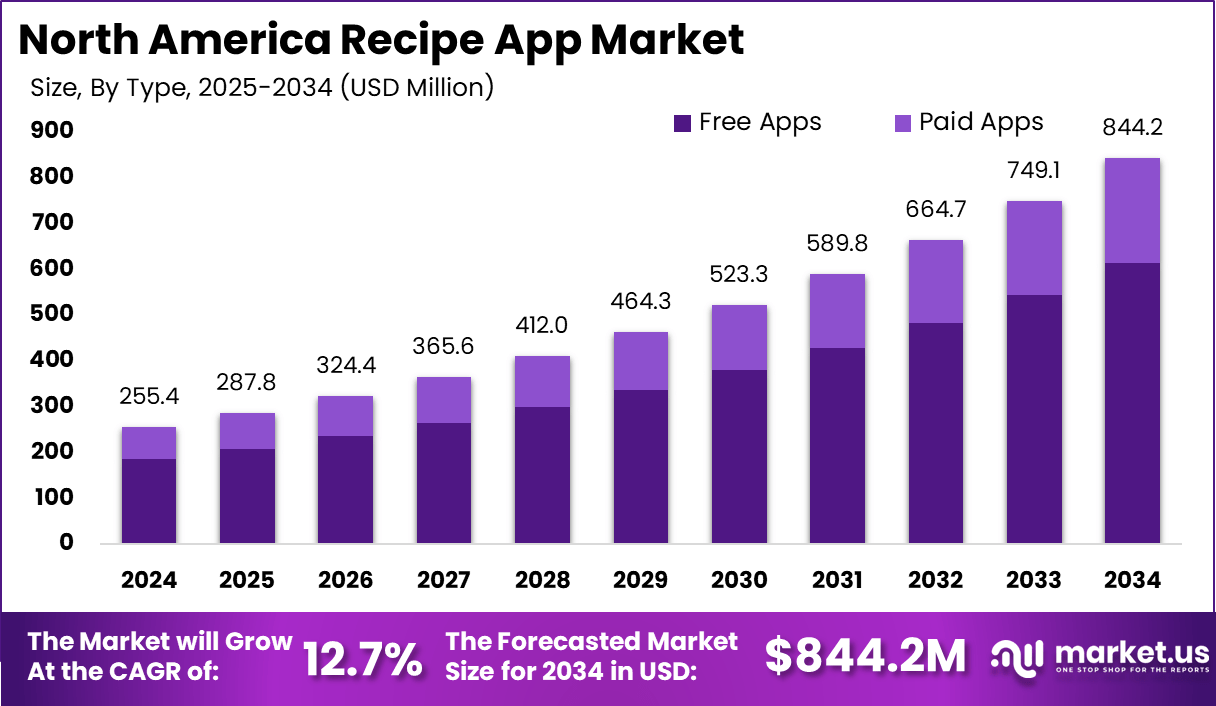

The North America Recipe App Market size is expected to be worth around USD 844.2 Million By 2034, from USD 255.4 billion in 2024, growing at a CAGR of 12.7% during the forecast period from 2025 to 2034. In 2024, U.S. held a dominant market position, capturing more than a 12.5% share, holding USD 239.3 Million revenue.

A recipe app is essentially a digital tool that provides users with a wide array of recipes, cooking instructions, and meal planning capabilities. In North America, these apps are particularly popular due to the high penetration of smartphones and advanced internet infrastructure. Users in this region leverage these apps to enhance their cooking experience, drawing on a rich library of culinary diversity tailored to various dietary preferences and cultural tastes.

The market for recipe apps in North America is experiencing substantial growth, driven by increasing consumer interest in home cooking and digital solutions for meal preparation. This market segment includes a wide range of applications that not only provide recipes but also integrate dietary tracking, social sharing, and personalized culinary recommendations, appealing to a diverse audience interested in culinary arts and healthy living.

The primary drivers for the North America recipe app market include high smartphone penetration, a growing inclination towards digital solutions for meal planning, and the increasing popularity of health-conscious diets. Additionally, the region’s advanced digital infrastructure and the presence of major market players who continuously innovate within this space contribute to the robust growth of this market.

The demand for recipe apps in North America continues to rise as more individuals opt for home-cooked meals and seek convenience in meal preparation. The availability of apps that offer diverse culinary content, grocery list automation, and personalized meal suggestions tailored to dietary preferences caters to a broad consumer base, from casual home cooks to diet-specific users.

According to Market.us, The global recipe app market is projected to expand from USD 667.3 million in 2023 to approximately USD 2,268 million by 2033. This growth represents a Compound Annual Growth Rate (CAGR) of 13.5% over the forecast period from 2024 to 2033. Such a robust growth trajectory highlights the increasing reliance on digital solutions for meal planning and cooking guidance globally.

In 2023, North America held a dominant position in the global recipe app market, accounting for over 35.7% of the total market share. This leadership underscores the region’s strong adoption of mobile technology and a widespread cultural trend towards personalized, health-conscious cooking habits.

Businesses operating within this market benefit from a large, tech-savvy consumer base, the potential for high user engagement through advanced app features, and opportunities for partnerships with food and grocery retailers. The continuous innovation in app functionalities allows businesses to maintain user interest and loyalty.

Key Takeaways

- The North America Recipe App Market is projected to grow from USD 255.4 million in 2024 to USD 844.2 million by 2034.

- The market is expected to expand at a CAGR of 12.7% from 2025 to 2034.

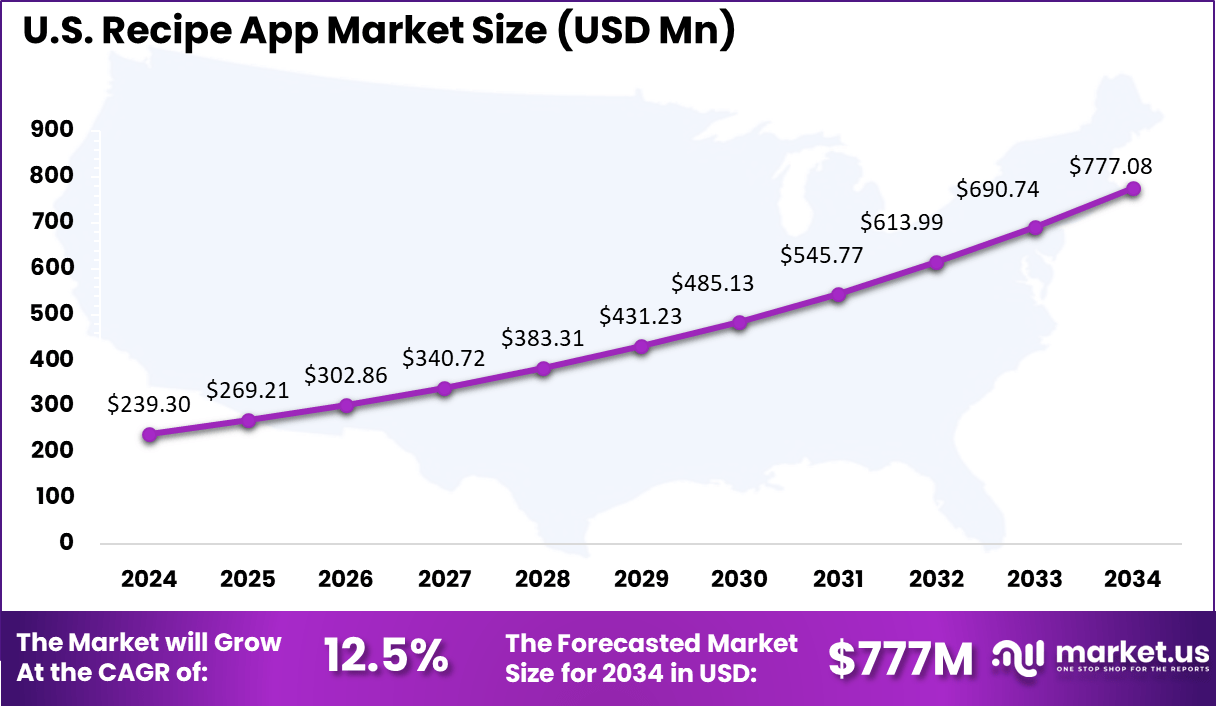

- The U.S. dominated in 2024, holding a 12.5% share and generating USD 239.3 million in revenue.

- The Canada Recipe App Market was valued at USD 16.1 million in 2024 and is projected to reach USD 57.6 million by 2033, growing at a CAGR of 15.2%.

- The Free Apps segment led the market, capturing a 72.7% share.

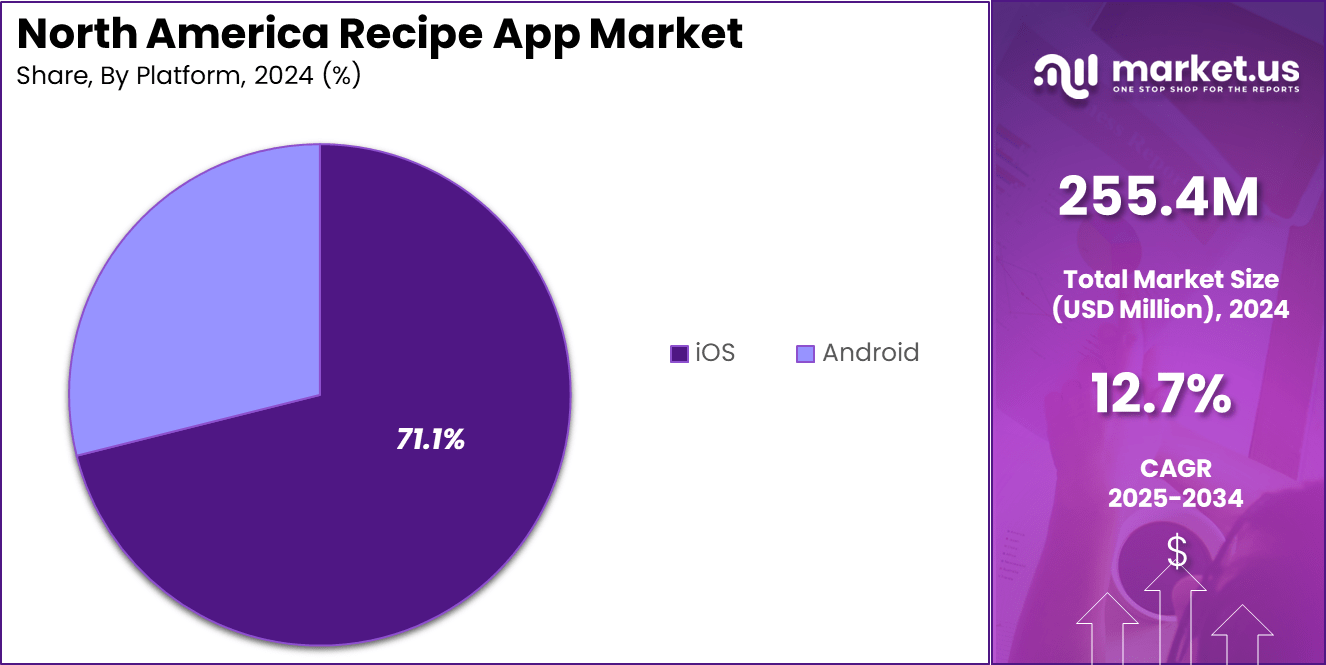

- The Android segment held a dominant position, securing a 71.1% market share.

Analysts’ Viewpoint

The North America recipe app market presents substantial investment opportunities, particularly in areas like AI-driven personalization, integration with smart kitchen devices, and subscription-based models that offer premium, ad-free experiences. Emerging trends such as augmented reality cooking instructions and health-focused features also open new avenues for investment.

Key factors impacting the market include technological advancements in mobile and kitchen technologies, shifts in consumer lifestyle towards healthier eating habits, and the integration of social media within these apps, allowing users to share and discover recipes more interactively.

Technological advancements such as AI and machine learning are increasingly utilized to offer personalized recipe recommendations, improve user interaction, and streamline the cooking process. The integration of AR for interactive cooking tutorials and smart appliance connectivity further enhances the appeal and functionality of these apps.

The regulatory environment for recipe apps primarily concerns data privacy and security, especially regarding user data collected by the apps. Developers must comply with local and international regulations like GDPR in Europe and similar frameworks in North America that govern the handling and protection of personal information.

U.S. Recipe Apps Market

In 2024, the US Recipe App Market was valued at USD 239.3 million. It is projected to increase to USD 269.21 million in 2025, with expectations to reach approximately USD 777.08 million by 2034. This trajectory suggests a robust compound annual growth rate (CAGR) of 12.5% from 2025 to 2034.

The significant expansion in this market can be attributed to several factors, including increasing consumer interest in culinary arts, the growing trend of home cooking, and the widespread use of smartphones and tablets that facilitate easy access to digital recipes.

Additionally, enhancements in app functionalities, such as personalized recipe recommendations and integration with grocery delivery services, are likely to further drive the market’s growth over the forecast period.

Canada Recipe App Market

In 2024, the Canada Recipe App market was valued at USD 16.1 million. It is forecasted to grow significantly, reaching an estimated USD 57.6 million by 2033. This growth represents a compound annual growth rate (CAGR) of 15.2% from 2024 to 2033.

The market’s expansion is propelled by the increasing adoption of mobile devices and the rising interest in cooking and culinary self-education among Canadian consumers. Additionally, the integration of advanced features like meal planning, nutritional tracking, and customizable dietary options in recipe apps enhances user engagement and contributes to the market’s robust growth rate.

North America Recipe App Market Share, By Countrywise, 2019-2024 (%)

Country 2019 2020 2021 2022 2023 2024 US 94.5% 94.3% 94.2% 94.0% 93.8% 93.7% Canada 5.5% 5.7% 5.8% 6.0% 6.2% 6.3% By Type Analysis

In 2024, the Free Apps segment in the North America Recipe App Market held a commanding position, capturing more than a 72.7% share. This dominance is largely attributable to the accessibility and zero-cost entry point these apps offer, which appeals broadly to a wide range of users – from those who are new to cooking to more experienced home chefs looking for variety without financial commitment.

The substantial market share of free recipe apps stems from several key advantages that align well with consumer preferences and technological trends. Primarily, these apps remove the financial barrier for users, which significantly boosts download rates and user engagement.

They typically generate revenue through advertisements and in-app purchases, allowing the basic service to remain free while offering paid options for enhanced features. This model not only facilitates widespread use but also introduces users to cooking apps without immediate costs, making it a popular choice among the majority who are reluctant to commit financially without first evaluating the app’s value.

Furthermore, the technological integration of these apps includes features such as meal planning tools, interactive cooking guides, and extensive libraries of diverse recipes, which enhance user experience and retention. The design of these apps often focuses on ease of use, with user-friendly interfaces that encourage more frequent and prolonged engagement.

Conversely, the Paid Apps segment, while smaller in comparison, caters to a niche market that values exclusive content and advanced functionalities like ad-free browsing, detailed nutritional analytics, and integration with smart kitchen devices. This segment attracts culinary enthusiasts, health-conscious individuals, and professional chefs who seek a more tailored and high-quality experience.

North America Recipe App Market Share, By Type Analysis, 2019-2024 (%)

Type 2019 2020 2021 2022 2023 2024 Free Apps 71.6% 71.8% 72.0% 72.3% 72.5% 72.7% Paid Apps 28.4% 28.2% 28.0% 27.7% 27.5% 27.3% Analysis of the Data:

- Free apps are growing steadily, increasing from 71.6% in 2019 to 72.7% in 2024.

- Paid apps are gradually declining, dropping from 28.4% to 27.3% over the same period.

- This trend reflects the increasing preference for freemium models, where apps are free to download but generate revenue through ads, in-app purchases, and subscriptions.

By Platform Analysis

In 2024, the Android segment held a dominant market position, capturing more than a 71.1% share in the North American recipe app market. This notable market share can be attributed to several factors that favor Android’s widespread adoption and user preference.

Firstly, the open-source nature of Android has fostered a diverse ecosystem of developers creating a wide array of applications, including recipe apps. This openness allows developers to innovate without the constraints often found on more tightly regulated platforms such as iOS.

Consequently, Android users have access to a broader range of recipe apps, which caters to a variety of cooking styles and dietary preferences, enhancing user engagement and retention. Furthermore, Android’s dominance in the North American market is bolstered by its significant price range flexibility, making smartphones accessible to a wider economic demographic.

Affordable Android devices enable a larger number of consumers to access digital services like recipe apps. This accessibility has naturally led to higher download and usage rates of such apps on Android compared to iOS, which typically features higher entry price points.

Lastly, Android’s integration with Google’s extensive suite of services, including Google Search and Google Assistant, facilitates a more integrated user experience. Users can easily search for recipes or use voice commands to follow cooking instructions, making Android platforms particularly appealing for interactive applications like recipe apps.

North American recipe app market Share, By Platform Analysis, 2019-2024 (%)

Platform 2019 2020 2021 2022 2023 2024 Android 70.8% 70.9% 70.9% 71.0% 71.0% 71.1% iOS 29.2% 29.1% 29.1% 29.0% 29.0% 28.9% Analysis of the Data:

- Android maintains a dominant market share, increasing slightly from 70.8% in 2019 to 71.1% in 2024.

- iOS sees a slight decline, moving from 29.2% to 28.9% over the same period.

- This reflects the continued global preference for Android, particularly in emerging markets where affordability plays a key role.

Key Market Segment

By Type

- Free Apps

- Paid Apps

By Platform

- Android

- iOS

Driver

Surge in Home Cooking and Health Consciousness

The North American recipe app market is experiencing robust growth driven primarily by the rising trend of home cooking and health consciousness among consumers. As more individuals opt to prepare meals at home, there’s a growing demand for digital solutions that offer convenient, creative, and healthy cooking options.

Recipe apps cater to this need by providing diverse culinary ideas, nutritional information, and meal planning features, which enhance the overall cooking experience for home chefs. Additionally, the integration of smart kitchen devices with these apps allows for a more streamlined cooking process, further boosting their appeal.

The convenience of having a wide array of recipes at one’s fingertips supports the lifestyle of busy consumers who still wish to eat healthily and save money by cooking at home rather than dining out.

Restraint

High Competition and Market Saturation

One of the primary challenges facing the North American recipe app market is the intense competition and saturation of digital recipe platforms. With a plethora of apps already available, new entrants find it challenging to differentiate their offerings and gain significant user traction.

The dominance of established players who have captured substantial market share with extensive recipe databases and advanced features makes it difficult for newer apps to stand out, potentially stifling innovation and limiting the impact of new entrants.

Opportunity

Personalization and Advanced Technology Integration

There is a considerable opportunity in the North American recipe app market for enhanced personalization and the integration of advanced technologies. Consumers increasingly seek personalized experiences that cater specifically to their dietary preferences, allergies, and cooking habits.

Leveraging artificial intelligence (AI) and machine learning can enable recipe apps to offer tailored recipe suggestions, dietary plans, and shopping lists that adapt to individual user behaviors and preferences over time. Furthermore, the integration of these technologies can enhance user engagement by providing interactive and intuitive app interfaces, thereby improving the overall user experience and satisfaction.

Challenge

Adapting to Rapid Technological Changes

The rapid pace of technological advancements poses a substantial challenge to the recipe app market. Developers must continuously update and refine their apps to incorporate new features and technologies to stay relevant and competitive. This requires ongoing investment in research and development and could strain resources for smaller app developers.

Additionally, staying ahead of technological trends and consumer expectations requires a proactive approach to innovation, which can be particularly demanding in a market as dynamic and fast-paced as that of North America.

Growth Factors

The North America recipe app market is experiencing significant growth, driven primarily by the increasing adoption of smartphones and the widespread availability of high-speed internet.

This growth is augmented by a growing trend towards health and dietary consciousness among consumers, who are increasingly relying on recipe apps to find nutritious meal options and diet-specific recipes, such as vegan, keto, and gluten-free meals.

Another major growth driver is the integration of advanced technologies in these apps, including artificial intelligence (AI) and machine learning (ML), which enhance user engagement by personalizing the cooking experience. These technologies allow apps to recommend recipes based on past user interactions and dietary preferences, making meal planning more accessible and tailored to individual needs.

Emerging Trends

Emerging trends in the recipe app market include the increased use of AI to offer personalized dietary recommendations and the integration of augmented reality (AR) for more interactive and engaging cooking tutorials.

There’s also a notable shift towards multi-functional apps that combine various features such as meal planning, grocery shopping lists, and nutritional tracking into a single platform. This holistic approach caters to the busy lifestyles of modern consumers who prefer comprehensive solutions that streamline their cooking and meal planning processes.

Business Benefits

The business benefits of investing in the North America recipe app market are substantial due to the high engagement levels users exhibit with these platforms. On average, users spend about 25 minutes per day on recipe apps, indicating a strong reliance on these digital tools for meal preparation and cooking inspiration.

For businesses, this translates into numerous opportunities for monetization through subscription models, in-app purchases, and targeted advertising. The extensive user data collected can also be leveraged to improve app offerings and personalize marketing strategies, which enhances user retention and increases revenue potential.

Key Players Analysis

The North America recipe app market is dominated by several key players who contribute significantly to its growth and innovation. Among these, notable companies include BBC Good Food, Tasty, Big Oven, Food Network in the Kitchen, Yummly, Allrecipes Dinner Spinner, Cookpad, Epicurious, and SideChef.

BBC Good Food and Tasty are particularly influential, originating from the United Kingdom and the United States, respectively. They cater to a wide audience with their extensive databases of recipes that appeal to various tastes and dietary requirements. Big Oven and Food Network in the Kitchen are celebrated for their user-friendly interfaces and comprehensive culinary resources that facilitate meal planning and cooking.

Yummly and Allrecipes offer features that go beyond mere recipe sharing; they provide meal recommendations and customization options based on user preferences and past behavior, leveraging AI to enhance user engagement. Similarly, Cookpad combines social networking features with its recipe management tools, allowing users to share and discover recipes globally.

Epicurious is known for its high-quality content that includes expert advice, cooking techniques, and specialty dishes that cater to gourmet cooking enthusiasts. SideChef stands out with its integration of step-by-step cooking instructions, making it easier for beginners and experienced cooks alike to navigate complex recipes.

Top Key Players in the Market

- BBC Good Food

- Oh She Glows

- BigOven

- Yummly

- Allrecipes Dinner Spinner

- Epicurious

- SideChef Inc.

- Kitchen Stories

- SuperCook

- Mealime

- BuzzFeed, Inc. (Tasty)

- Samsung Food

- NYT Cooking

Recent Developments

In recent years, several notable developments have occurred among recipe app companies in North America:

- Samsung Food Launch (September 2024): Samsung introduced “Samsung Food,” a new recipe and meal-planning app designed to integrate with its range of smart kitchen appliances. This launch signifies Samsung’s commitment to enhancing the smart home ecosystem by offering users seamless cooking experiences.

- BuzzFeed’s Tasty App Expansion (June 2024): BuzzFeed expanded its Tasty app by introducing personalized meal plans and grocery delivery integrations. This update aims to provide users with a more tailored cooking experience, aligning with the growing trend of personalized digital services.

- Yummly’s Integration with Whirlpool (March 2024): Yummly, a popular recipe app, announced deeper integration with Whirlpool appliances. This development allows users to send cooking instructions directly from the app to their smart ovens, enhancing convenience and streamlining the cooking process.

- Allrecipes’ AI-Powered Features (August 2024): Allrecipes introduced AI-powered features to its Dinner Spinner app, offering users personalized recipe recommendations based on their cooking habits and preferences. This move reflects the industry’s shift towards leveraging artificial intelligence to enhance user engagement.

- Epicurious’ Partnership with Amazon Fresh (November 2024): Epicurious partnered with Amazon Fresh to enable users to order ingredients directly through the app. This collaboration aims to simplify the meal preparation process by integrating recipe discovery with grocery shopping.

Report Scope

Report Features Description Market Value (2024) USD 255.4 Mn Forecast Revenue (2034) USD 844.2 Mn CAGR (2025-2034) 12.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Free Apps, Paid Apps), By Platform (Android, iOS) Competitive Landscape BBC Good Food, Oh She Glows, BigOven, Yummly, Allrecipes Dinner Spinner, Epicurious, SideChef Inc., Kitchen Stories, SuperCook, Mealime, BuzzFeed Inc. (Tasty), Samsung Food, NYT Cooking Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  North America Recipe App MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

North America Recipe App MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BBC Good Food

- Oh She Glows

- BigOven

- Yummly

- Allrecipes Dinner Spinner

- Epicurious

- SideChef Inc.

- Kitchen Stories

- SuperCook

- Mealime

- BuzzFeed, Inc. (Tasty)

- Samsung Food

- NYT Cooking