Global Digital Marketing Outsourcing Market Size, Share Analysis Report By Type (Digital Marketing, Social Media Management, Design and Content Services, Others), By Industry Vertical (IT & Telecommunications, Retail & e-commerce, Healthcare, Media & entertainment, Sports & events, BFSI, Real Estate, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151681

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

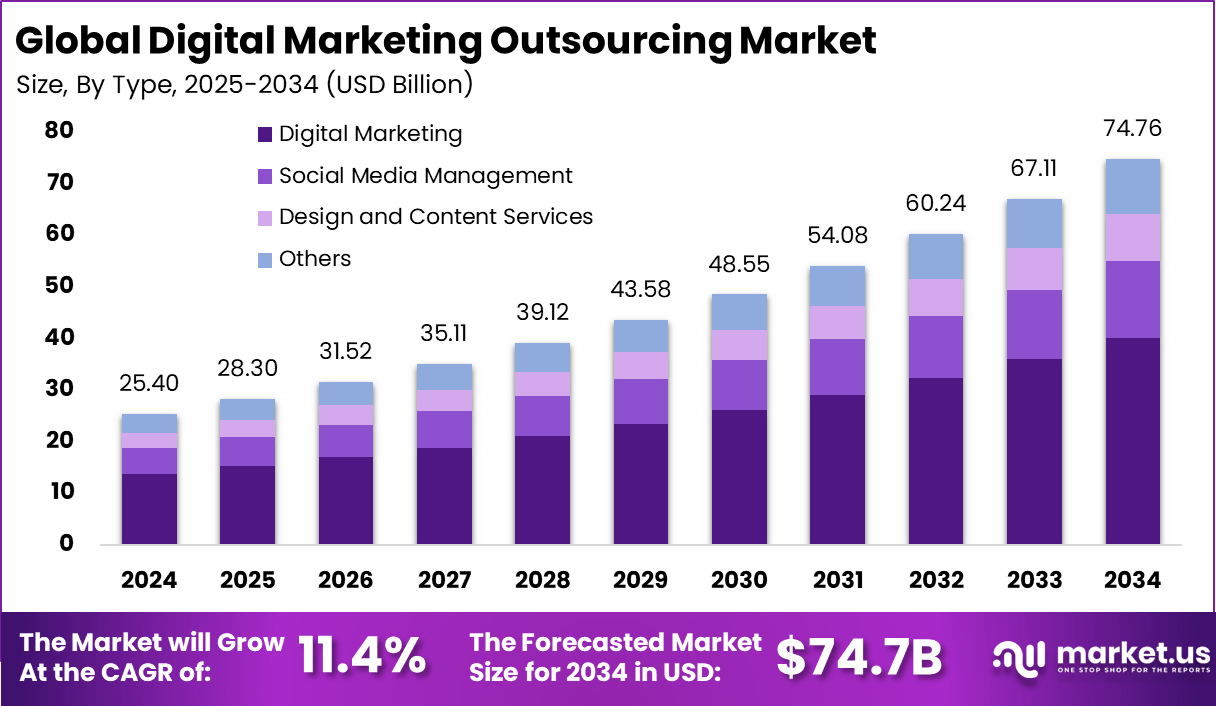

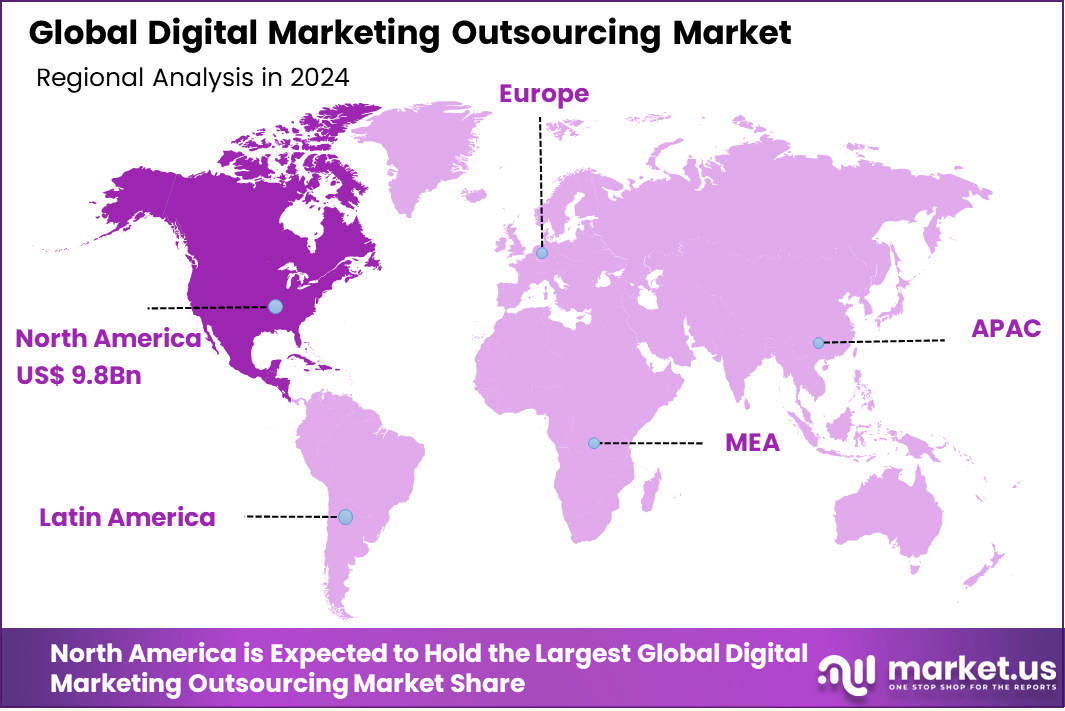

The Global Digital Marketing Outsourcing Market size is expected to be worth around USD 74.76 Billion By 2034, from USD 25.4 billion in 2024, growing at a CAGR of 11.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.6% share, holding USD 9.8 Billion revenue.

The digital marketing outsourcing market is expanding as organizations seek to enhance performance and innovation by leveraging specialized external expertise. Outsourcing digital marketing activities – such as search engine optimization, social media management, content creation, paid media strategy, and performance analytics – is enabling businesses to access advanced skills and technologies without the burden of in-house investment.

As per the latest insights from ExplodingTopics, 92% of G2000 companies use IT outsourcing to cut costs and focus on core areas. In the Philippines, outsourcing contributes 9% to the national GDP, showing its deep economic impact. Around 37% of small businesses outsource at least one function to gain flexibility and expertise. In China, the sector grows rapidly with over 1 million new outsourcing employees joining each year, reinforcing its role as a global service hub.

The top driving factors shaping this market include the need for advanced automation and data-driven strategies. Businesses are increasingly leveraging AI‑powered analytics, predictive tools, and omnichannel capabilities through outsourcing partners. Moreover, the mounting complexity of multi-tool marketing stacks has propelled organizations to seek specialized support in managing campaigns and customer data platforms.

Increasing adoption of technologies such as AI, machine learning, marketing automation platforms, cloud‑based CRM, and predictive analytics has been evident. These tools are being embraced to enhance targeting precision, performance tracking, and campaign personalization. The main reasons for adopting these technologies include improved return on marketing investments, better customer insights, faster campaign optimization, and reduced errors – all delivered through the expertise of outsourcing firms.

Key Insight Summary

- The Global Digital Marketing Outsourcing Market is projected to grow from USD 25.4 billion in 2024 to approximately USD 74.76 billion by 2034, registering a CAGR of 11.4% during the forecast period.

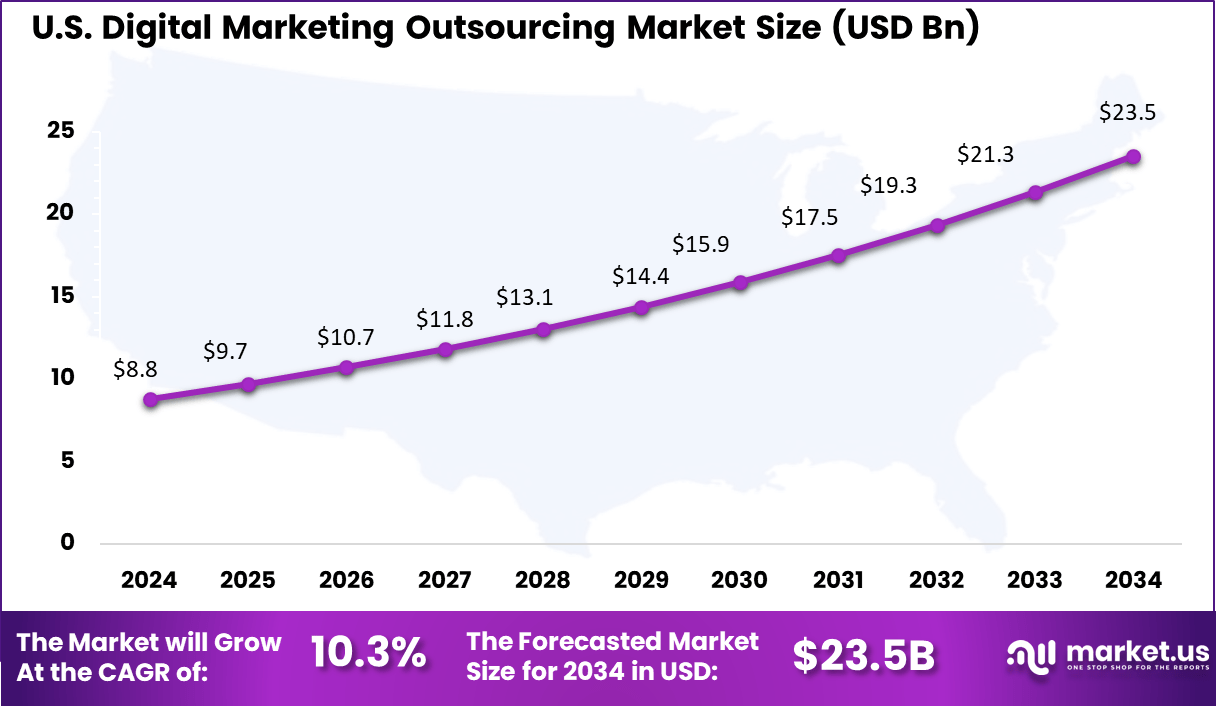

- The U.S. market is expected to reach USD 8.82 billion by 2034, growing steadily at a CAGR of 10.3%, reflecting consistent demand for outsourced digital expertise.

- In 2024, North America led the global landscape with a commanding 38.6% market share, translating to about USD 9.8 billion in revenue.

- Based on service type, Digital Marketing services accounted for the largest portion, contributing 53.7% of the overall market in 2024, indicating its core role in outsourced functions.

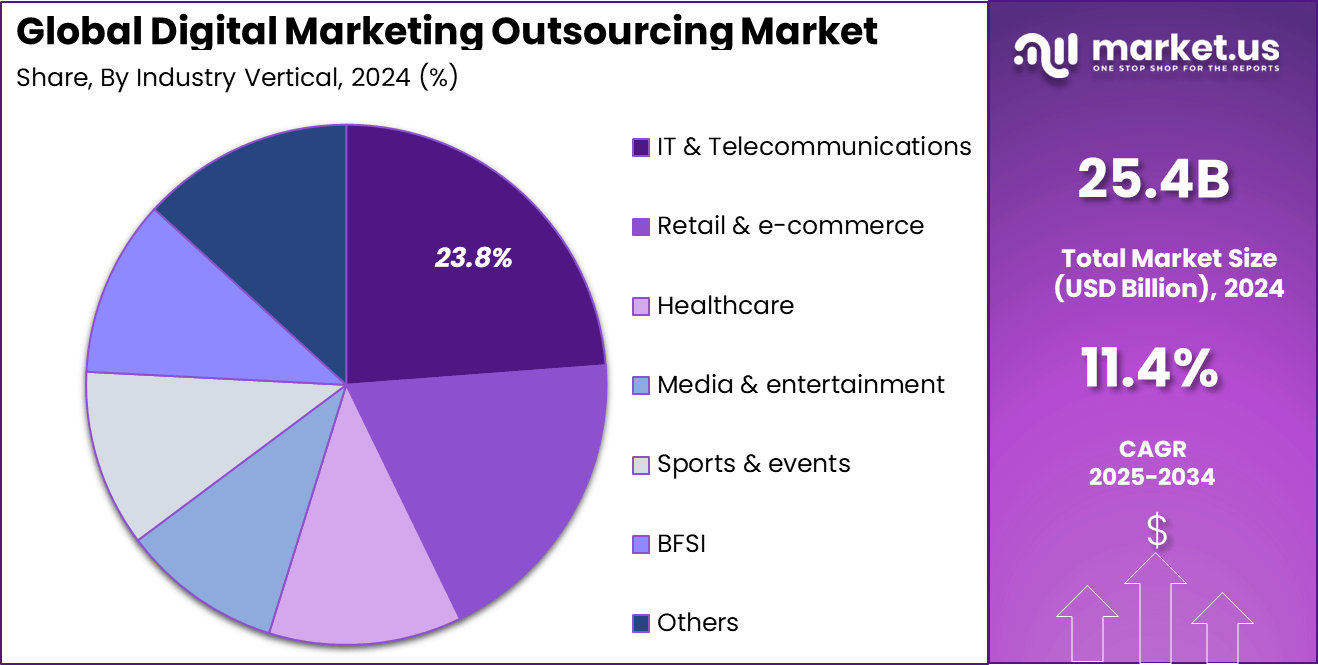

- Among industry verticals, the IT & Telecommunications sector held a significant 23.8% share, showcasing its reliance on third-party digital solutions to stay competitive and agile.

Role of AI

The role of AI in the Digital Marketing Outsourcing market has been progressively transformative, evolving from a supplemental tool to a core strategic component. AI enables outsourcing providers to process vast volumes of data, automate complex tasks, and enhance personalization using modeling techniques and machine learning.

These advances facilitate refined customer targeting, automated content production, predictive segmentation, and dynamic campaign optimization. AI-powered predictive analytics has emerged as a fundamental capability within outsourced marketing services. Algorithms identify customer intent, forecast campaign performance, and guide budget allocation.

Studies indicate that such algorithmic forecasting has improved conversion outcomes and allowed more nimble adjustments than manual approaches. Natural Language Processing (NLP) has revolutionized content generation and conversational engagement. Outsourcing agencies now deploy AI-driven tools to craft personalized blogs, social media posts, ad copy, and email sequences.

Analysts’ Viewpoint

Regarding investment opportunities, the market offers substantial potential in specialized service verticals – especially in industries with rigorous regulatory demands such as healthcare, BFSI, and telecom. These sectors require nuanced marketing strategies and compliant operations, fostering demand for niche specialists. Additional growth opportunities lie in expanding regional hubs across Asia‑Pacific and supporting omnichannel ecosystems.

The business benefits attained through digital marketing outsourcing are multifold: cost savings from scalable labor use, enhanced access to specialist skills, accelerated deployment of advanced technologies, and retention of strategic focus. These advantages collectively support improved campaign results, brand consistency, and operational efficiency.

The regulatory environment poses both challenges and necessary guardrails. Sensitive data management and data‑privacy regulations – such as HIPAA in healthcare – require outsourcing partners to maintain strict compliance protocols, secure data handling, and robust consent processes . Additionally, evolving global privacy norms are shaping vendor selection and service delivery structures.

Key impacting factors include growing cybersecurity and data‑privacy concerns, potential integration friction with internal systems, and dependency risk on third‑party providers . In some cases, high setup costs and fragmented internal- vendor coordination reduce scalability and process consistency.

US Market Size

The U.S. Digital Marketing Outsourcing Market was valued at USD 8.8 Billion in 2024 and is anticipated to reach approximately USD 23.5 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 10.3% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 38.6% share, holding USD 9.8 billion in revenue. This leadership can be attributed to the region’s early adoption of advanced digital technologies, widespread availability of skilled digital marketing talent, and strong presence of data-driven industries such as e-commerce, finance, and healthcare.

Organizations across the United States and Canada have been at the forefront of outsourcing digital marketing services to enhance operational flexibility, reduce fixed costs, and stay competitive in a rapidly evolving consumer environment.

Furthermore, North American firms have shown a strong inclination toward outsourcing specialized functions like search engine optimization (SEO), paid media, and analytics to expert third-party providers, enabling sharper focus on customer acquisition and engagement.

By Type Analysis

In 2024, Digital Marketing segment held a dominant market position, capturing more than 53.7% share. This commanding lead arises from the segment’s critical role in enabling brands to navigate the increasingly complex digital consumer journey.

Digital channels – from SEO to PPC to programmatic ads – form the backbone of customer acquisition and engagement, prompting companies to outsource these functions to secure best-in-class expertise and agile execution. Agencies with digital marketing specialization deliver data-driven insights, real-time performance tracking, and optimization – capabilities often unavailable in-house.

The Digital Marketing segment’s leadership is also driven by continuous advances in technology and automation. Outsourcing providers offer access to sophisticated platforms that integrate AI‑based analytics, predictive modeling, and personalized content delivery. This allows clients to deploy campaigns with greater speed and precision, avoid costly in-house tool investments, and apply scalability during peak periods.

By Industry Vertical Analysis

In 2024, IT & Telecommunications segment held a dominant market position, capturing more than 23.8% share. This leadership is rooted in the industry’s rapid digital transformation and growing dependency on robust marketing technologies.

Organizations within IT and telecom manage vast customer databases, multifaceted product lines, and global outreach strategies. Such complexity has driven them to outsource marketing tasks – ranging from customer data analytics to campaign automation – so as to secure scalable solutions without diluting focus on core infrastructure management.

The segment’s prominence is further supported by its demand for real-time customer engagement and personalized communication. Telecom operators and IT firms require tailored outreach across digital channels to manage customer lifecycle, service launches, and churn mitigation.

Outsourcing partners, equipped with industry-specific tools and predictive analytics platforms, facilitate targeted campaigns while ensuring seamless integration with internal CRM systems. This alignment of specialized knowledge and technical setup has made outsourcing an essential competitive tool for firms in this vertical.

Key Market Segments

By Type

- Digital Marketing

- Social Media Management

- Design and Content Services

- Others

By Industry Vertical

- IT & Telecommunications

- Retail & e-commerce

- Healthcare

- Media & entertainment

- Sports & events

- BFSI

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

On‑Demand Outsourcing

The rise of on‑demand outsourcing is reshaping the market, enabling businesses to engage specialized marketing services when needed – such as campaign bursts or events – rather than committing to long-term contracts. This shift delivers agility and precise cost control, as companies only incur expenses when actively using services. The trend supports a more modular, outcome-based outsourcing model that aligns well with rapid market changes and project-based needs.

Driver

Rapid Adoption of Automation and AI

A principal driver is the swift integration of automation and AI-powered marketing tools. Outsourcing providers are leveraging intelligent systems for predictive analytics, real-time campaign optimization, and personalized content delivery. These technologies enable faster decision-making, higher ROI, and improved targeting precision – benefits that internal teams often lack the resources or expertise to replicate.

Restraint

Data Privacy and Security Concerns

However, data privacy and security remain critical restraints. As firms share sensitive customer information with external partners, they face increasing regulatory scrutiny – such as GDPR and CCPA requirements. Ensuring compliance and maintaining stringent security protocols adds both complexity and cost to outsourcing arrangements.

Opportunity

Niche Specialization for SMEs

An evolving opportunity exists in niche digital marketing services for SMEs, particularly among e-commerce brands. Many smaller companies lack in-house digital expertise but can benefit from tailored, cost-effective outsourcing solutions that offer advanced tools without heavy capital investment. The expansion of specialized platforms catering specifically to SMEs’ needs presents a growing segment ripe for growth.

Challenge

Quality Consistency Across Platforms

Finally, a significant challenge is maintaining consistent quality across diverse digital platforms. Managing campaign performance on channels like search, social media, email, and programmatic ads requires broad expertise. Poor coordination can fragment brand messaging, reduce campaign effectiveness, and erode trust in outsourced partners – making integrated service delivery crucial.

Key Player Analysis

In the Digital Marketing Outsourcing space, Accenture remains a dominant force. The company has focused on integrating AI, data, and creative services through strategic acquisitions like Work & Co and Yumemi. Cognizant has enhanced its AI-based marketing delivery through partnerships with Microsoft and acquisitions such as Belcan.

Capgemini is exploring expansion by targeting data-driven outsourcing firms. These firms invest in digital customer experience and cross-platform marketing to meet rising demand from global clients seeking cost-efficient, performance-driven marketing services.

Infosys, HCL Technologies, and IBM Corporation continue to strengthen their foothold by embedding AI, automation, and analytics into outsourced marketing models. Their digital offerings help clients personalize campaigns, enhance targeting, and manage multi-channel interactions.

TCS has invested in platform-led delivery, making its solutions more agile for global marketing teams. These companies cater to industries such as retail, banking, and telecom, focusing on measurable outcomes and ROI-driven campaigns in outsourcing engagements.

Wipro, Invensis Technologies, and BCM Marketing Industrial S.L. serve niche segments with tailored solutions in content management, SEO, and media buying. Wipro is expanding its creative tech capabilities to compete with larger peers. Invensis Technologies offers value-driven outsourcing for mid-sized firms. BCM leverages regional expertise to manage local-language campaigns across Europe.

Top Key Players Covered

- Accenture

- BCM Marketing Industrial S.L.

- Cognizant

- Capgemini

- HCL Technologies

- Infosys

- IBM Corporation

- Invensis Technologies Pvt Ltd

- Tata Consultancy Services (TCS)

- Wipro

- Others

Recent Developments

- Apr 2024: Cognizant Formed strategic alliance with Microsoft to embed generative AI and Copilot technologies across digital engagement and marketing platforms.

- Feb 2024: Accenture Completed acquisition of Jixie, a marketing‑tech business focused on personalised ad monetisation in Southeast Asia. Integration into Accenture Song expanded capabilities in data‑driven customer engagement in Indonesia.

Report Scope

Report Features Description Market Value (2024) USD 25.4 Bn Forecast Revenue (2034) USD 74.76 Bn CAGR (2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Digital Marketing, Social Media Management, Design and Content Services, Others), By Industry Vertical (IT & Telecommunications, Retail & e-commerce, Healthcare, Media & entertainment, Sports & events, BFSI, Real Estate, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture, BCM Marketing Industrial S.L., Cognizant, Capgemini, HCL Technologies, Infosys, IBM Corporation, Invensis Technologies Pvt Ltd, Tata Consultancy Services (TCS), Wipro, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Marketing Outsourcing MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Marketing Outsourcing MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture

- BCM Marketing Industrial S.L.

- Cognizant

- Capgemini

- HCL Technologies

- Infosys

- IBM Corporation

- Invensis Technologies Pvt Ltd

- Tata Consultancy Services (TCS)

- Wipro

- Others