Global Digital Language Learning Market Size, Share Analysis Report By Learning Mode (Self-Learning Apps, Tutoring), By End User (Individual Source, Educational Institutions, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153146

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

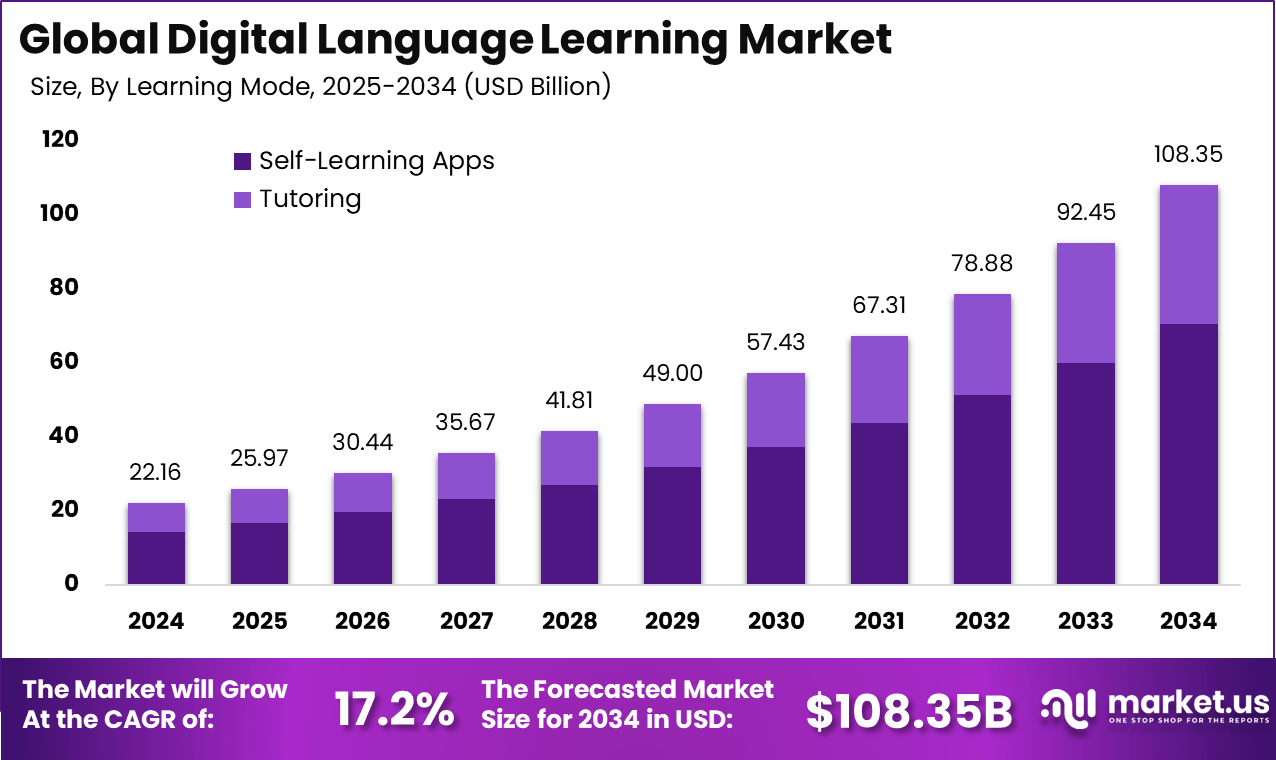

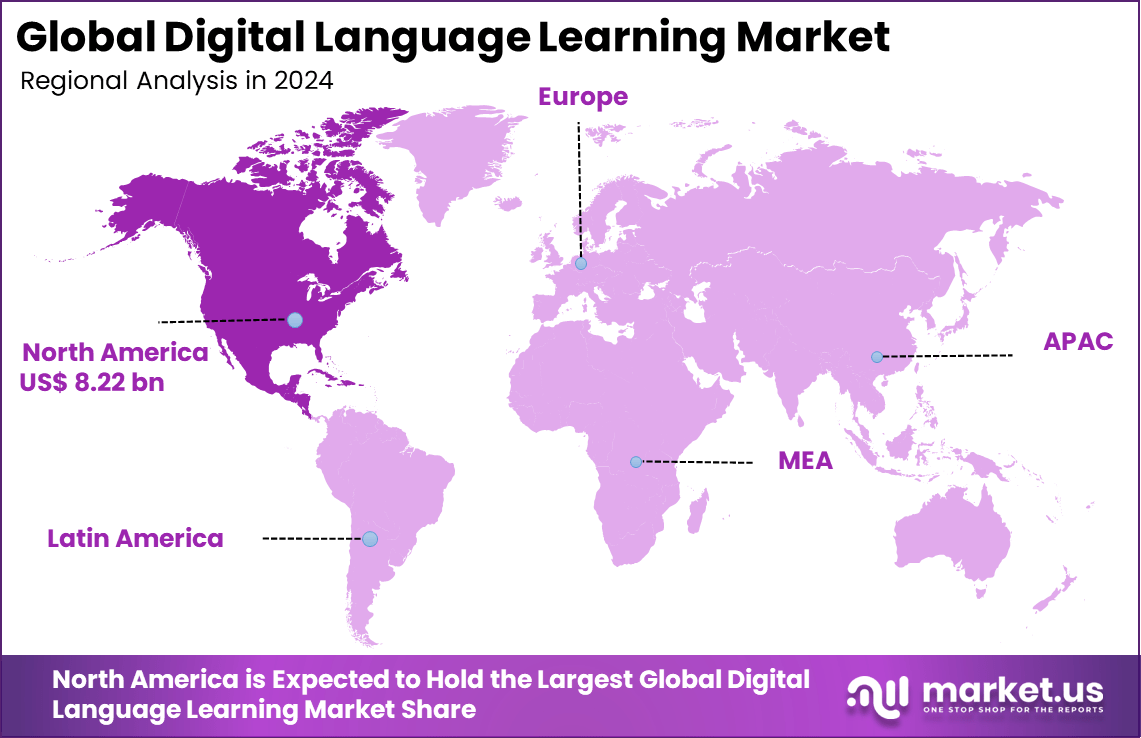

The Global Digital Language Learning Market size is expected to be worth around USD 108.35 billion by 2034, from USD 22.16 billion in 2024, growing at a CAGR of 17.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.1% share, holding USD 8.22 billion in revenue.

The Digital Language Learning Market is characterized by rapid transformation driven by global interconnectivity and technological innovation. Increasing globalization and the expansion of international business operations have elevated demand for multilingual proficiency. This market has been shaped significantly by the shift from traditional classroom settings to digital platforms, accelerated by disruptions in face-to-face instruction.

Demand for digital language learning continues to climb as learners search for convenient, cost-effective alternatives to traditional methods. Surveys show that 65% of digital learners start studying a new language out of personal interest, while another 20% do so with career advancement in mind. The flexibility to study from anywhere and at any time, along with access to custom-tailored courses, has made digital channels extremely appealing

For instance, In October 2024, the Quebec government committed $54 million to develop a digital platform for French language learning. The initiative focuses on interactive online tools to make learning more accessible and engaging. This move highlights Quebec’s dedication to multilingual education, supporting newcomers and international students seeking to improve their French proficiency.

Cutting-edge technologies have pushed digital language learning far beyond standard online courses. Artificial intelligence, machine learning, virtual and augmented reality, and speech recognition now serve as critical features. For example, 78% of users report better retention with personalized learning paths, and platforms that employ AI for content adaptation boast 30% more daily active users.

Scope and Forecast

Report Features Description Market Value (2024) USD 22.16 Bn Forecast Revenue (2034) USD 108.35 Bn CAGR (2025-2034) 17.2% Largest market in 2024 North America [37.1% market share] Key Takeaway

- The Global Digital Language Learning market is projected to grow from USD 22.16 billion in 2024 to approximately USD 108.35 billion by 2034, registering a strong 17.2% CAGR, driven by rising globalization and demand for accessible language education.

- In 2024, North America led the market with over 37.1% share, generating around USD 8.22 billion, supported by high digital adoption and growing interest in multilingual skills.

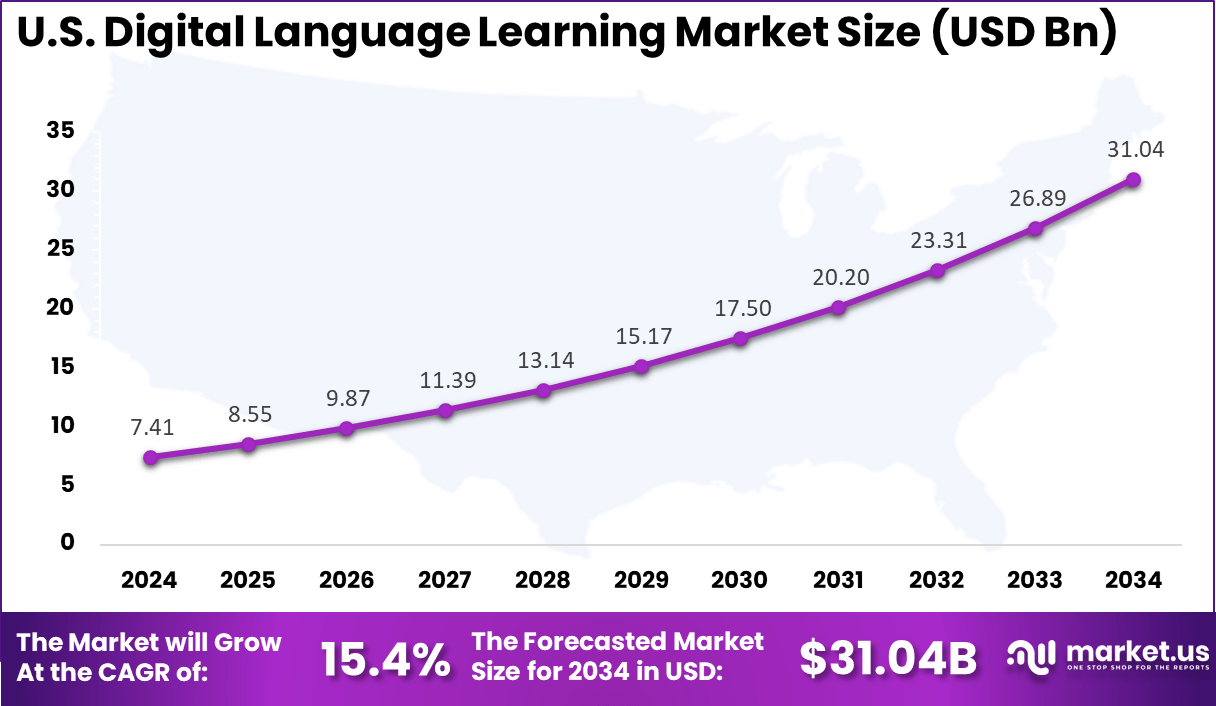

- The United States alone contributed nearly USD 7.41 billion, with a projected 15.4% CAGR, reflecting strong uptake of online and app-based language learning solutions.

- By learning mode, Self-Learning Apps dominated the market with a significant 65.1% share, highlighting user preference for flexible, on-demand learning platforms.

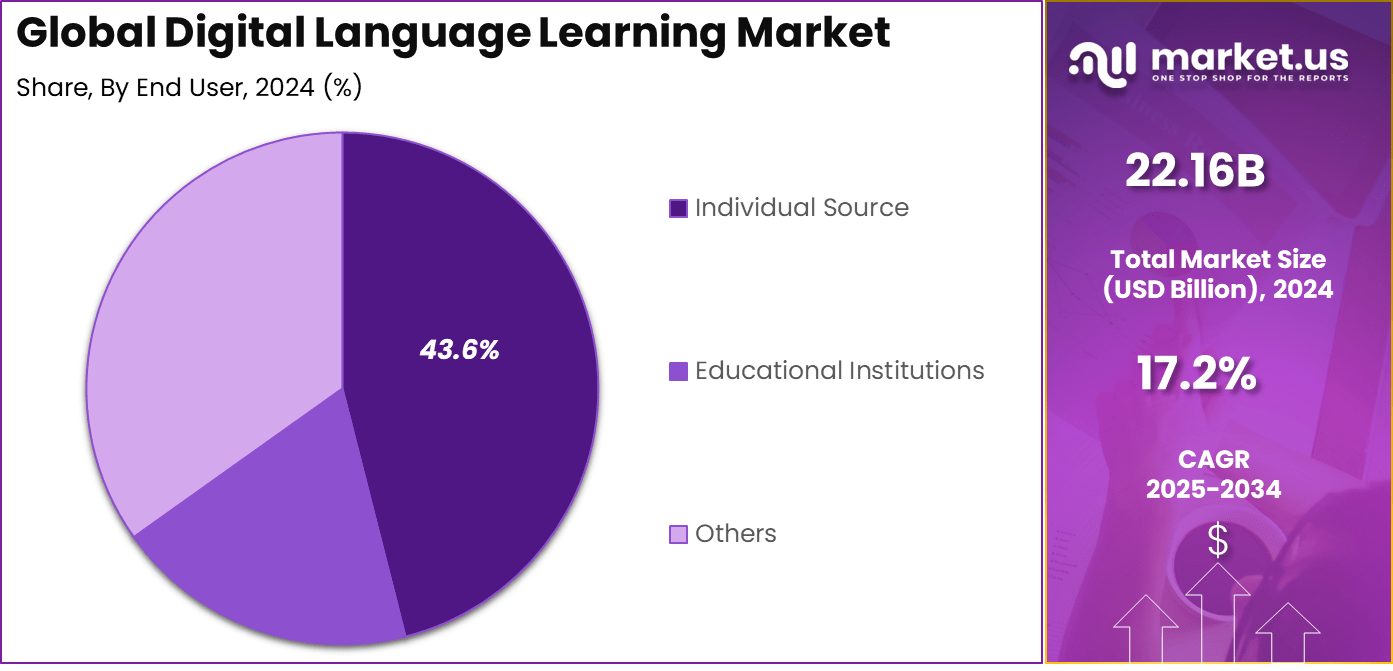

- By end user, the Individual segment accounted for 43.6% share, as more learners seek personal and career advancement through digital language acquisition.

U.S. Market Size

The market for Digital Language Learning within the U.S. is growing tremendously and is currently valued at USD 7.41 billion, the market has a projected CAGR of 15.4%. The market is rapidly expanding due to factors like improved access to high-speed internet, globalization, and diverse work environments. The rise of AI-driven personalized learning and mobile-first platforms is also fueling growth.

Additionally, the demand for remote education and career development is driving individuals and organizations to seek flexible, cost-efficient language learning solutions. These trends, coupled with educational reforms and the increasing need for multilingual skills in the workforce, are reshaping how Americans approach language acquisition in the digital era.

For instance, in June 2025, Babbel, the Berlin-based language learning platform, made significant strides in the U.S. market, further solidifying its presence in the digital language learning space. The company’s expansion reflects the growing demand for language learning solutions in the U.S., driven by globalization, the need for cross-border communication, and increasing professional multilingualism.

In 2024, North America held a dominant market position in the Global Digital Language Learning Market, capturing more than a 37.1% share, holding USD 8.22 billion in revenue. North America’s dominance is driven by increasing globalization, the need for cross-border communication, and a growing emphasis on multilingual skills in the workforce, particularly among multinational companies.

The region’s adoption of advanced technologies like AI-powered personalized learning and widespread use of self-learning apps has further boosted market growth. Additionally, affordable pricing models, investments in ed-tech start-ups, and strong digital infrastructure have supported expansion. The U.S. has led this growth due to high disposable incomes, immigration trends, and a cultural focus on bilingual education.

For instance, In June 2025, ILAC acquired UniApplyNow, a digital platform focused on international student applications. This move strengthened North America’s position in the digital language learning space by combining streamlined application processes with advanced educational services. The acquisition reflects the region’s focus on using technology to enhance global language education access and delivery.

Learning Mode Analysis

In 2024, The Self-Learning Apps segment held a dominant market position, capturing a 65.1% share of the Global Digital Language Learning Market. This dominance is driven by users’ convenience and flexibility, enabling them to learn at their own pace and convenience.

With the growing preference for mobile-first solutions and a broad selection of accessible language courses, these apps have gained widespread popularity. Their affordability, integration of AI for personalized learning, and constant availability make them especially appealing to busy professionals, students, and lifelong learners, further cementing self-learning apps as the preferred choice in the digital language learning market.

For instance, In June 2025, Duolingo launched new AI-driven features in its app, offering personalized lessons, real-time feedback, and gamified experiences. These updates aim to make learning more engaging and effective. The improvements align with rising demand for flexible, self-paced language education and highlight Duolingo’s continued leadership in the global digital language learning market.

End User Analysis

In 2024, the Individual Source segment held a dominant market position, capturing a 43.6% share of the Global Digital Language Learning Market. This dominance is due to the increasing need for flexible and accessible language learning solutions. The widespread use of smartphones, fast internet connections, and the emergence of mobile apps and online resources have made language education more accessible.

The combination of flexible, on-demand learning options, AI-assisted customization, and interactive elements is appealing to learners. Students can use these platforms to customize their learning experiences based on their objectives and timeframes, which drives growth as individuals strive to learn languages for career advancement or academic pursuits.

For instance, in December 2024, a report from Mainichi highlighted the growing popularity of digital language learning among individual users in Japan. The increasing demand for flexible, on-the-go learning solutions has driven a surge in the use of language learning apps and platforms. With a focus on self-paced, accessible learning, individuals are seeking digital tools to improve their language skills for career advancement, travel, and personal enrichment.

Key Market Segments

By Learning Mode

- Self-Learning Apps

- Tutoring

By End User

- Individual Source

- Educational Institutions

- Others

Emerging Trend Analysis

AI-Powered Personalized Learning

One of the most significant trends shaping digital language learning today is the rise of AI-driven personalized education. Artificial intelligence technology enables platforms to tailor lessons uniquely to each learner’s pace, proficiency level, and interests. This personalization offers an adaptive learning path that actively responds to user performance, providing targeted feedback and dynamically adjusting difficulty.

AI-powered language tools simulate real-life conversations and cultural nuances to enhance engagement and help learners focus on areas that need improvement. This trend is revolutionizing traditional language education by making learning more efficient, interactive, and learner-centric, encouraging continuous progress without overwhelming users.

Driver Analysis

Technological Advancements Enabling Engagement

Technological innovation is the key driver propelling the digital language learning market forward. Advances in AI, machine learning, and speech recognition have opened new possibilities for highly engaging and effective language education. These innovations allow for real-time pronunciation feedback, gamified learning experiences, and immersive environments using augmented and virtual reality.

The convenience of cloud-based platforms and mobile accessibility also supports flexible learning anytime and anywhere, resonating with students leading busy lives or in remote locations. This technological foundation fuels the demand for modernized, accessible language learning solutions that meet diverse learner needs.

Restraint Analysis

Fragmented Quality and Infrastructure Gaps

Despite rapid growth, the digital language learning sector faces challenges from uneven software quality and technical limitations. Many available learning applications lack consistent quality control, resulting in ineffective or poorly designed content that can confuse rather than aid learners.

Furthermore, inadequate technical infrastructure – such as unstable internet, limited hardware, and software compatibility issues – restricts smooth adoption, especially in underserved or rural areas. These restraints often slow down the seamless integration of ed-tech in language education, requiring careful management to avoid learner frustration and dropout.

Opportunity Analysis

Immersive Learning through AR and VR

A compelling opportunity in digital language learning lies in immersive learning with AR and VR. These technologies create rich, interactive environments that simulate real-world scenarios for language practice beyond traditional methods. Learners can engage in virtual marketplaces, cultural contexts, or everyday conversations where vocabulary and conversational skills are practiced in meaningful ways.

This immersive approach bridges the gap between theoretical knowledge and practical application, enhancing retention and motivation. As AR and VR become more affordable and accessible, their adoption promises to redefine how digital language skills are acquired and practiced.

Challenge Analysis

Bridging the Digital Skills Gap for Educators

A critical challenge in the digital language learning arena is overcoming the digital skills gap among educators. Many language teachers face difficulties in effectively integrating technology into pedagogy due to limited familiarity or confidence with digital tools. This skill gap complicates the adoption of new tech-based methods and can diminish the potential benefits for students.

Overcoming this barrier requires ongoing professional development, hands-on training, and supportive communities where educators share best practices. Addressing this challenge is essential for ensuring that technological advancements translate into improved learning outcomes rather than merely new tools that are underutilized.

Key Players Analysis

Duolingo, Inc. continues to lead the digital language learning landscape due to its gamified learning approach and wide global reach. The platform’s user-friendly interface and adaptive learning engine have supported strong adoption among casual learners. Babbel GmbH and Rosetta Stone LLC have also maintained a significant market presence by offering structured courses designed for practical use.

Busuu Ltd and Preply Inc. have contributed to growing learner engagement through real-time tutor interaction and AI-supported lesson planning. Busuu’s social learning model, which enables peer feedback, has proven particularly effective. Preply’s tutor marketplace has gained traction due to flexible pricing and personalized teaching.

Meanwhile, Italki HK Limited has built a global community through its pay-per-session model, attracting both learners and freelance language educators looking for scalable income opportunities. Lingoda GmbH, Berlitz Corporation, and Inlingua International Ltd. remain strong players by focusing on immersive experiences and live online instruction.

Top Key Players in the Market

- Duolingo, Inc

- Babbel GmbH

- Busuu Ltd

- Preply Inc.

- Rosetta Stone LLC.

- Berlitz Corporation

- Italki HK Limited.

- Lingoda GmbH.

- Inlingua International Ltd.

- Enux Education Limited

- Others

Recent Developments

- In June 2025, Babbel expanded its language learning ecosystem by acquiring Toucan, a browser extension that helps users learn languages while browsing the web. This acquisition aims to enhance Babbel’s offerings by integrating language learning into users’ daily online activities, making language acquisition more seamless and accessible.

- In April 2025, Lingoda has launched initiatives like “Match Pflege” and “Match Talent” to support international professionals in Germany. These programs offer language courses and integration support to help foreign-trained healthcare workers and other skilled professionals achieve recognition and adapt to the German job market.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Learning Mode (Self-Learning Apps, Tutoring), By End User (Individual Source, Educational Institutions, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Duolingo, Inc., Babbel GmbH, Busuu Ltd, Preply Inc., Rosetta Stone LLC., Berlitz Corporation, italki HK Limited., Lingoda GmbH, inlingua International Ltd., Enux Education Limited, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Language Learning MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Language Learning MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Duolingo, Inc

- Babbel GmbH

- Busuu Ltd

- Preply Inc.

- Rosetta Stone LLC.

- Berlitz Corporation

- Italki HK Limited.

- Lingoda GmbH.

- Inlingua International Ltd.

- Enux Education Limited

- Others