Genome Editing Market By Delivery Method (Ex-vivo and In-vivo), By Technology (CRISPR/Cas9, Meganuclease, TALENs/MegaTALs, ZFN, and Others), By Application (Genetic Engineering (Animal Genetic Engineering, Cell Line Engineering, Plant Genetic Engineering, and Others) and Clinical Applications (Diagnostics and Therapy Development)), By End-use (Biotechnology & Pharmaceutical Companies, Academic & Government Research Institutes, and Contract Research Organizations), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 138474

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

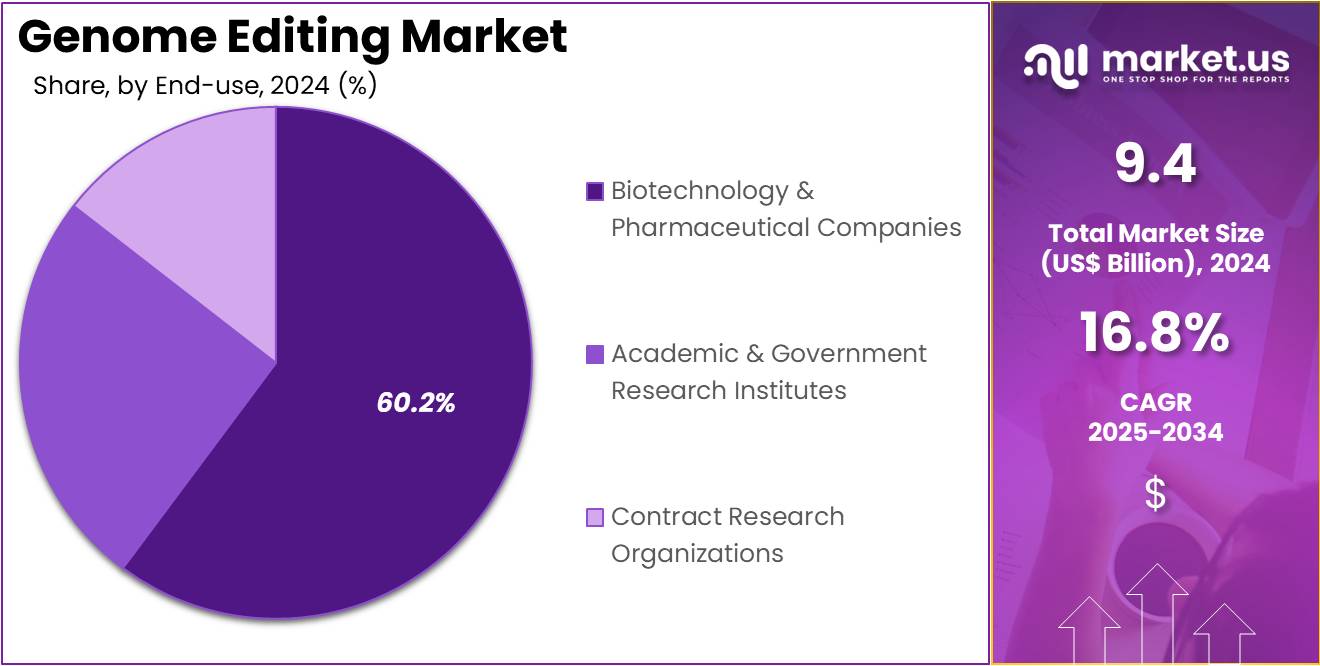

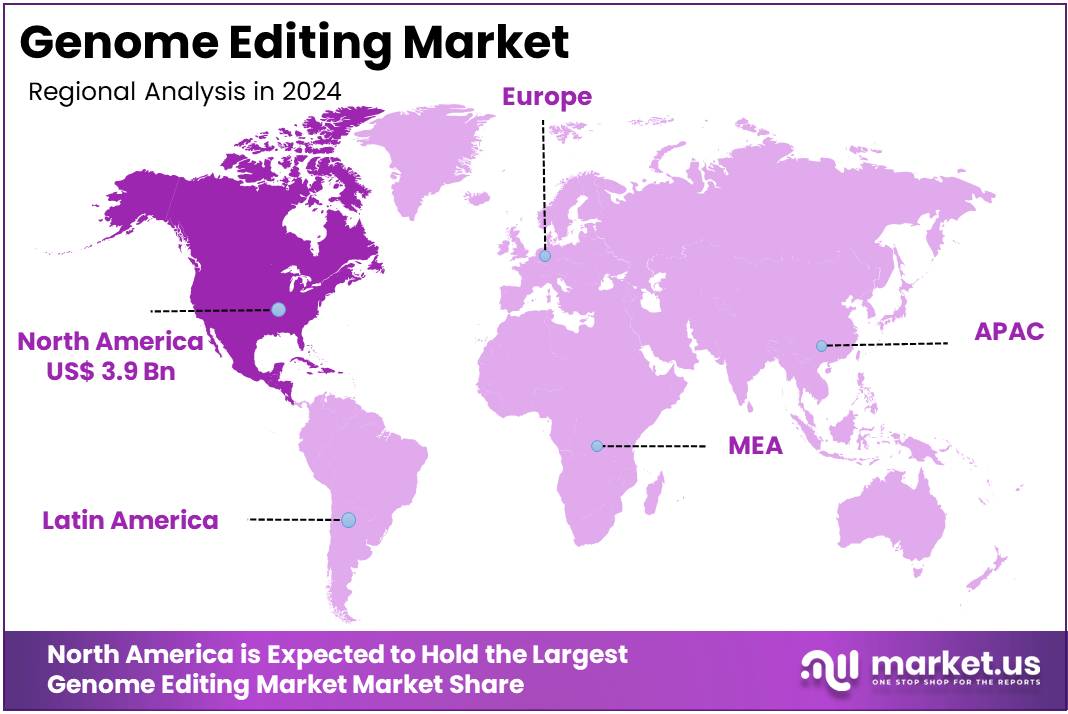

The Global Genome Editing Market Size is expected to be worth around US$ 44.4 Billion by 2034, from US$ 9.4 Billion in 2024, growing at a CAGR of 16.8% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 41.1% share and holds US$ 3.9 Billion market value for the year.

Increasing advancements in genetic research and biotechnology are driving the growth of the genome editing market. Genome editing technologies, such as CRISPR-Cas9, allow scientists to modify specific genes, offering vast potential in areas like gene therapy, agriculture, and disease modeling. These technologies enable researchers to correct genetic mutations that cause diseases, paving the way for personalized medicine and targeted therapies.

The growing demand for precision medicine, where treatments are tailored to an individual’s genetic makeup, further fuels the adoption of genome editing techniques. In May 2023, researchers from the Lewis Katz School of Medicine and the University of Nebraska Medical Center reported using CRISPR to successfully treat HIV infection in animal models, highlighting the increasing potential of genome editing in treating complex diseases.

Additionally, the application of genome editing in agriculture to develop genetically modified crops with improved traits, such as disease resistance and higher yield, presents significant market opportunities. Recent trends also show growing investments in genome editing tools to improve accuracy, efficiency, and ease of use, with companies focusing on developing next-generation technologies.

As regulatory frameworks evolve to support gene editing advancements, the market is expected to expand, with greater integration into clinical settings and a broader range of applications in medical research.

Key Takeaways

- In 2024, the market for genome editing generated a revenue of US$ 9.4 billion, with a CAGR of 16.8%, and is expected to reach US$ 44.4 billion by the year 2034.

- The delivery method segment is divided into ex-vivo and in-vivo, with ex-vivo taking the lead in 2024 with a market share of 63.7%.

- Considering technology, the market is divided into CRISPR/Cas9, meganuclease, TALENs/MegaTALs, ZFN, and others. Among these, CRISPR/Cas9 held a significant share of 55.5%.

- Furthermore, concerning the application segment, the market is segregated into genetic engineering and clinical applications. The genetic engineering sector stands out as the dominant player, holding the largest revenue share of 72.8% in the genome editing market.

- The end-use segment is segregated into biotechnology & pharmaceutical companies, academic & government research institutes, and contract research organizations, with the biotechnology & pharmaceutical companies segment leading the market, holding a revenue share of 60.2%.

- North America led the market by securing a market share of 41.1% in 2024.

Delivery Method Analysis

The ex-vivo segment led in 2024, claiming a market share of 63.7% owing to its increasing use in therapeutic applications, particularly in gene therapies and cellular engineering. Ex-vivo genome editing allows for the precise modification of cells outside the body, which are then reintroduced into the patient. This method is anticipated to see rising demand in the development of personalized treatments, such as in cancer immunotherapy and rare genetic disorders, where cell-specific modifications can significantly improve treatment outcomes.

The ability to control and optimize the editing process in cultured cells before re-integration into the body is projected to reduce risks and improve the precision of treatments. As the focus on cellular therapies increases, the ex-vivo method is likely to continue to grow, especially with advancements in gene editing technologies that enable more efficient and targeted modifications.

Technology Analysis

The genetic engineering held a significant share of 55.5% due to its widespread use and remarkable efficiency in gene editing. As a powerful tool that enables precise DNA modifications, CRISPR/Cas9 is anticipated to become the gold standard for genome editing across various applications, from agriculture to human therapeutics. The ease of design and relatively low cost compared to other genome editing technologies, such as meganuclease, TALENs, and ZFNs, is likely to drive its adoption in both research and clinical settings.

The increasing focus on gene therapies, especially for inherited genetic diseases, is projected to contribute to CRISPR/Cas9’s growth as it provides an efficient, targeted approach to gene correction. Furthermore, ongoing improvements in CRISPR/Cas9’s specificity and delivery mechanisms are expected to enhance its clinical potential, propelling its dominance in the market.

Application Analysis

The CRISPR/Cas9 segment had a tremendous growth rate, with a revenue share of 72.8% owing to the increasing application of genome editing in both basic research and clinical applications. Genetic engineering in research is likely to see more widespread adoption as scientists leverage genome editing tools to better understand gene function, disease mechanisms, and the development of disease models.

In clinical applications, genome editing is expected to revolutionize the treatment of genetic diseases by allowing for the direct correction of mutations within the patient’s DNA. As technologies like CRISPR improve in precision, reliability, and ease of use, their integration into both research and clinical settings is anticipated to drive this segment’s growth. The potential for genome editing to provide curative therapies for genetic disorders, cancer, and other diseases is expected to fuel further investment and development in this area.

End-use Analysis

The biotechnology & pharmaceutical companies segment grew at a substantial rate, generating a revenue portion of 60.2% as these companies increasingly incorporate genome editing technologies into their research and therapeutic development pipelines. The rise in personalized medicine and the growing number of genetic disorders and cancer treatments requiring precise genomic interventions are expected to fuel the demand for genome editing tools in biotechnology and pharmaceutical applications.

These companies are likely to continue investing heavily in genome editing technologies, particularly for developing gene therapies and biologic drugs, which offer the potential to cure previously untreatable diseases. The ability to create customized treatments for patients with specific genetic mutations is expected to drive the market for genome editing technologies. As these companies expand their R&D efforts and clinical trials involving genome editing, this segment is projected to see robust growth, particularly in the fields of oncology, rare diseases, and regenerative medicine.

Key Market Segments

By Delivery Method

- Ex-vivo

- In-vivo

By Technology

- CRISPR/Cas9

- Meganuclease

- TALENs/MegaTALs

- ZFN

- Others

By Application

- Genetic Engineering

- Animal Genetic Engineering

- Cell Line Engineering

- Plant Genetic Engineering

- Others

- Clinical Applications

- Diagnostics

- Therapy Development

By End-use

- Biotechnology & Pharmaceutical Companies

- Academic & Government Research Institutes

- Contract Research Organizations

Drivers

Increasing Popularity Of Gene Editing Is Driving The Genome Editing Market

Growing popularity of gene editing significantly drives the genome editing market by accelerating advancements in medical research and therapeutic development. In February 2024, Ginkgo Bioworks acquired Proof Diagnostics to broaden its portfolio of gene-editing toolkits, further strengthening its capabilities in therapeutic applications.

This strategic acquisition enhances Ginkgo Bioworks’ ability to develop precise and efficient gene-editing solutions, catering to the increasing demand for personalized medicine and targeted therapies. As gene editing technologies like CRISPR-Cas9 become more accessible and cost-effective, researchers and pharmaceutical companies are more inclined to integrate these tools into their workflows, boosting market growth.

Additionally, the rise in genetic disorders and the need for innovative treatments drive the adoption of advanced gene-editing techniques, fostering significant investments in this sector. Educational initiatives and increased awareness about the potential of gene editing also contribute to its growing acceptance and utilization across various industries.

Furthermore, collaborations between biotech firms and academic institutions facilitate the rapid development and commercialization of new gene-editing applications, expanding the market’s scope. The continuous improvement in gene-editing precision and efficiency ensures that these technologies remain at the forefront of scientific innovation, attracting further investment and interest. As regulatory frameworks evolve to accommodate the advancements in gene editing, the market is anticipated to experience sustained growth, positioning gene editing as a pivotal component in the future of biotechnology and healthcare.

Restraints

Growing Ethical Concerns Are Restraining The Genome Editing Market

A significant restraint in the genome editing market is the growing ethical concerns surrounding the manipulation of genetic material, which create barriers to widespread adoption and acceptance. Ethical debates about the potential misuse of gene editing technologies, such as the creation of “designer babies” or unintended genetic consequences, raise public and regulatory apprehensions. High-profile controversies and media coverage amplify fears about the long-term implications of altering human DNA, leading to increased scrutiny from policymakers and ethical boards.

These concerns necessitate stringent regulatory frameworks and oversight, which can slow down the development and deployment of gene-editing solutions. Additionally, the ethical considerations surrounding germline editing, which affects future generations, pose significant challenges for researchers and companies operating in this space. The fear of societal backlash and potential legal restrictions can deter investments and innovation, limiting the market’s growth potential.

Furthermore, the lack of consensus on ethical guidelines across different regions creates a fragmented regulatory landscape, complicating global market expansion efforts. Organizations must invest heavily in ethical compliance and public education to mitigate these concerns, adding to operational costs and delaying project timelines. As a result, these growing ethical concerns act as a substantial barrier to the genome editing market, restricting its ability to fully capitalize on the technological advancements and increasing demand for personalized medical solutions.

Opportunities

Growing Awareness About CRISPR Technology Is Creating Opportunities For The Genome Editing Market

Growing awareness about CRISPR technology creates substantial opportunities for the genome editing market by enhancing public understanding and acceptance of its transformative potential. In March 2024, Carolina Biological Supply collaborated with ChristianaCare Gene Editing Institute to launch the CRISPR in a Box kit, an educational tool designed to teach CRISPR techniques through practical exercises for students in grades 9 to 12 and beyond.

This initiative significantly increases awareness and familiarity with CRISPR technology among the younger generation, fostering interest and expertise in genome editing from an early age. As educational institutions incorporate CRISPR-based curricula, the demand for accessible and user-friendly gene-editing tools grows, driving market expansion.

Additionally, the rise in public interest and media coverage about the breakthroughs and applications of CRISPR technology stimulates further investment and research in this field. The proliferation of online resources, workshops, and hands-on kits like CRISPR in a Box democratizes access to gene editing, making it more appealing to a broader audience, including hobbyists and citizen scientists.

Moreover, increased awareness leads to greater advocacy for supportive policies and funding initiatives, facilitating the development and commercialization of advanced genome-editing solutions. The integration of CRISPR technology into various industries, such as agriculture, medicine, and environmental science, broadens its application scope, further driving the market’s growth. As more individuals and organizations recognize the benefits and possibilities of CRISPR, the genome editing market is anticipated to experience significant growth, supported by a well-informed and enthusiastic user base.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the genome editing market. On the positive side, increased investment in biotechnology, genomics, and healthcare systems drives demand for genome editing technologies in drug development, agriculture, and disease prevention. The growing interest in personalized medicine and targeted therapies further boosts market growth. However, economic slowdowns may lead to budget cuts in research and development, slowing progress in gene editing technologies.

Geopolitical instability, including regulatory changes and trade barriers, can disrupt access to essential raw materials and technologies, raising costs and creating market uncertainties. Additionally, shifting healthcare policies and varying ethical considerations across regions can affect the pace of adoption. Despite these challenges, the ongoing advancements in genome editing technologies, particularly in CRISPR, are expected to continue propelling market growth, offering innovative solutions to a range of sectors.

Trends

Surge in Partnerships and Collaborations Driving the Genome Editing Market

Rising partnerships and collaborations are accelerating growth in the genome editing market. High levels of cooperation between pharmaceutical companies, research institutions, and technology providers are expected to enhance the development of novel gene therapies and precision medicine solutions. These partnerships allow companies to combine expertise, resources, and capabilities, leading to faster innovation.

In January 2024, Danaher Corporation partnered with the Innovative Genomics Institute to develop therapies using CRISPR for treating rare genetic disorders. This collaboration combines Danaher’s technical capabilities with IGI’s research expertise, advancing therapeutic innovation. The increasing trend of strategic alliances is anticipated to continue, creating more opportunities for cutting-edge genome editing applications and expanding the market’s potential.

Regional Analysis

North America is leading the Genome editing Market

North America dominated the market with the highest revenue share of 41.1% owing to significant advancements in gene-editing technologies, increasing investment in genetic therapies, and rising demand for precision medicine. The region’s growing focus on personalized treatments, particularly in the field of genetic disorders, has propelled the adoption of genome editing tools like CRISPR and TALEN.

One key development that highlights this trend is the submission of Biologics License Applications by Vertex Pharmaceuticals and CRISPR Therapeutics to the US FDA in June 2023 for a CRISPR-based ex-vivo gene-editing therapy targeting sickle cell disease. This submission marks a significant milestone in the commercialization of genome editing, reflecting the increasing confidence in its potential to address complex genetic diseases.

Additionally, rising funding from both public and private sectors, along with favorable regulatory environments, has accelerated research and development efforts. The expansion of clinical applications, including cancer immunotherapy and genetic disease treatments, has further driven market growth, positioning North America as a key player in the global genome editing market.

The Asia Pacific Region Is Expected To Experience The Highest CAGR During The Forecast Period

Asia Pacific is expected to grow with the fastest CAGR owing to advancements in biotechnology, increasing investments in life sciences, and rising healthcare demands. Countries like China, Japan, and India are likely to become key contributors to the market as they focus on expanding their research capabilities and adopting cutting-edge technologies in genetics.

In March 2021, researchers at Nanyang Technological University created VaNGuard (Variant Nucleotide Guard), a diagnostic tool designed to detect SARS-CoV-2 strains with mutations in their genetic structure. This breakthrough, which demonstrates the potential of CRISPR-based genome editing in diagnostics, is anticipated to enhance the region’s capabilities in applying genome editing technologies across various medical fields.

As healthcare systems in the region modernize, the demand for precise and efficient diagnostic and therapeutic solutions is projected to increase, driving the adoption of genome editing. Moreover, government support for biotechnology research and the growing number of biotech startups are expected to further accelerate market growth in Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the genome editing market focus on strategies such as advancing CRISPR and other gene-editing technologies to improve precision and efficiency in genetic modifications. Companies form partnerships with biotechnology and pharmaceutical firms to expand applications in therapeutic development and agricultural biotechnology.

Significant investments in research and development enable them to address challenges like off-target effects and regulatory compliance. Expanding into emerging markets with growing demand for genetic therapies supports broader adoption. Many players also work on diversifying their product offerings to cater to research, clinical, and industrial needs.

Editas Medicine, Inc. is a leading company in this market, specializing in CRISPR-based genome editing technologies. The company develops innovative therapies targeting genetic diseases, focusing on both in vivo and ex vivo approaches. Editas leverages strong collaborations with research institutions and pharmaceutical companies to advance its pipeline and maintain its position at the forefront of genetic medicine.

Top Key Players in the Genome editing Market

- Sangamo Therapeutics

- Recombinetics

- Precision BioSciences

- LGC

- Editas Medicine

- CRISPR Therapeutics

- Cellectis

- AstraZeneca

Recent Developments

- February 2024: Precision BioSciences granted Caribou Biosciences a global, non-exclusive license to use its TRAC gene locus insertion technology in human T cells, including upfront fees and royalties.

- November 2023: Cellectis and AstraZeneca collaborated to develop new treatments in oncology and immunology, aiming to enhance therapeutic innovations.

- April 2022: LGC acquired Rapid Genomics to boost its capabilities in next-generation sequencing and high-throughput genotyping for agrigenomics applications.

Report Scope

Report Features Description Market Value (2024) US$ 9.4 Billion Forecast Revenue (2034) US$ 44.4 Billion CAGR (2025-2034) 16.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Delivery Method (Ex-vivo and In-vivo), By Technology (CRISPR/Cas9, Meganuclease, TALENs/MegaTALs, ZFN, and Others), By Application (Genetic Engineering (Animal Genetic Engineering, Cell Line Engineering, Plant Genetic Engineering, and Others) and Clinical Applications (Diagnostics and Therapy Development)), By End-use (Biotechnology & Pharmaceutical Companies, Academic & Government Research Institutes, and Contract Research Organizations) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sangamo Therapeutics, Recombinetics, Precision BioSciences, LGC, Editas Medicine, CRISPR Therapeutics, Cellectis, and AstraZeneca. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sangamo Therapeutics

- Recombinetics

- Precision BioSciences

- LGC

- Editas Medicine

- CRISPR Therapeutics

- Cellectis

- AstraZeneca