Global Digital Entertainment Market Size, Share and Analysis Report By Content Type (Video Streaming, Music Streaming, Online Gaming, Digital Reading, Others), By Platform (Smartphones & Tablets, Smart TVs & Connected Devices, Gaming Consoles & PCs, Others), By Revenue Model (Subscription, Advertising-based, Others), By End-User (Individual Consumers, Households, Advertisers & Brands, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173137

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Global Market Statistics

- Drivers Impact Analysis

- Restraint Impact Table

- Investor Type Impact Matrix

- By Content Type

- By Platform

- By Revenue Model

- By End User

- By Region

- Technology Enablement Analysis

- Use Case Adoption by Industry Vertical

- Emerging Trend Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

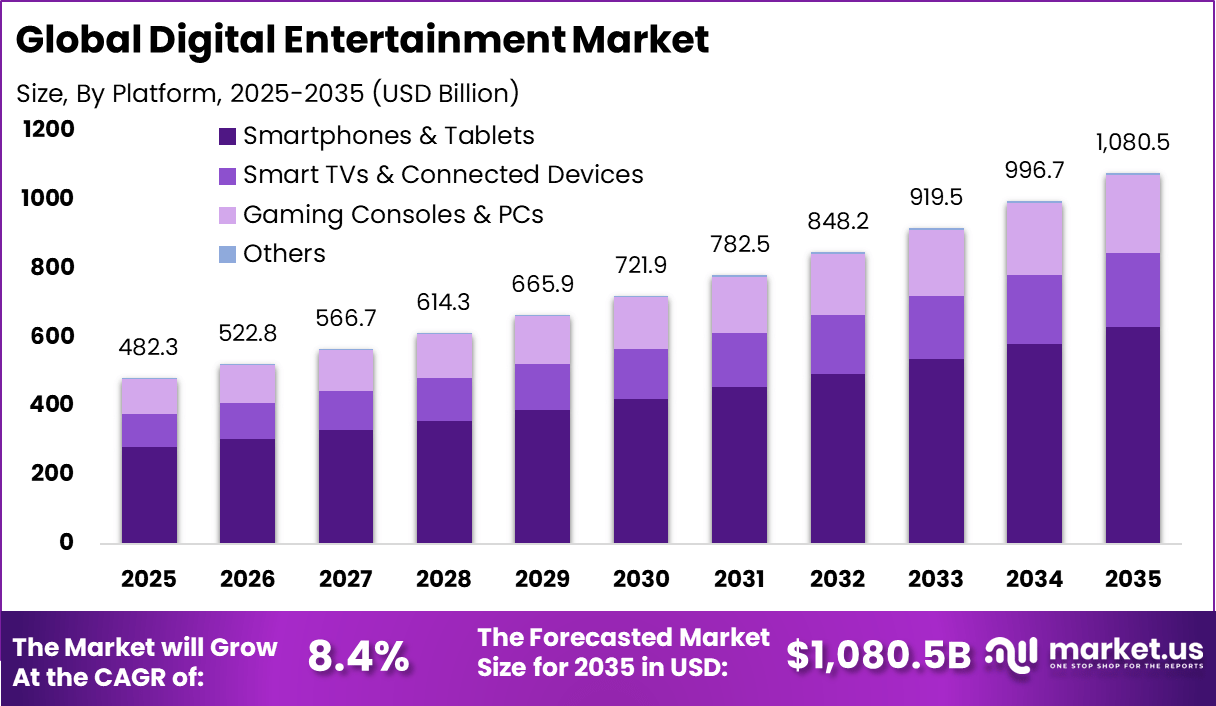

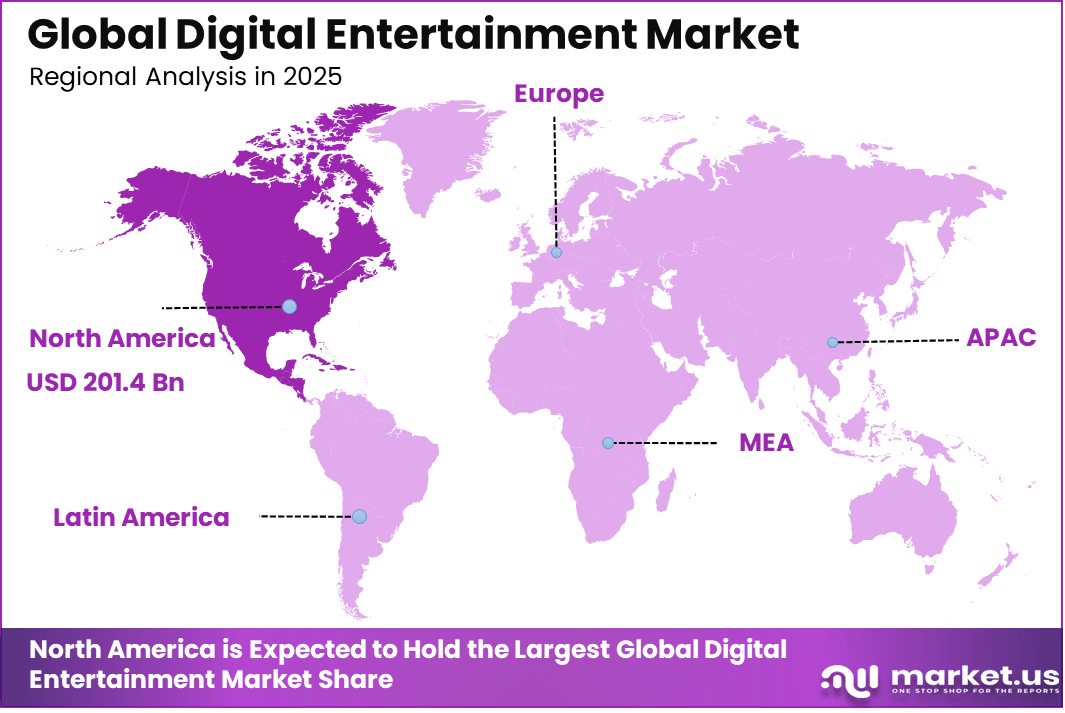

The Global Digital Entertainment Market size is expected to be worth around USD 1,080.5 Billion By 2035, from USD 482.3 billion in 2025, growing at a CAGR of 8.4% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 41.8% share, holding USD 201.4 Billion revenue.

The digital entertainment market refers to platforms, services, and content that deliver media experiences through digital channels. This market includes streaming video, streaming music, online gaming, virtual events, digital publishing, and interactive media. Consumption is enabled by internet connectivity, smart devices, and cloud based delivery systems that support on demand access. Growth has been driven by continuous expansion of content libraries, technological innovation, and evolving consumer preferences for personalized experiences.

The market has expanded as consumer demand shifts toward digital formats over traditional physical media. Audiences increasingly choose streaming and online services that provide convenience, variety, and instant access. Content producers and distributors have embraced direct to consumer models to reach global audiences more effectively. As broadband infrastructure continues to improve, the role of digital entertainment in everyday life has strengthened.

One primary driver of the digital entertainment market is the proliferation of high speed internet and mobile connectivity. Improved network speeds and widespread smartphone penetration have made digital content accessible anytime and anywhere. Consumers are engaging more with high definition video, live streaming, and interactive media. These connectivity improvements have expanded user bases and increased engagement.

Demand for digital entertainment is influenced by changing consumer lifestyles and media consumption habits. Audiences prefer flexible viewing and listening options that fit individual schedules. On demand streaming and user curated playlists have replaced fixed broadcast schedules. These preferences have reinforced market demand for services that provide personalization and convenience.

Top Market Takeaways

- Video streaming leads the market by content type with a 48.6% share, supported by strong demand for OTT platforms, original content, and on-demand viewing.

- Smartphones and tablets dominate platforms with 58.4%, reflecting a clear shift toward mobile-first consumption and anytime access to entertainment.

- Subscription-based models account for 52.7% of revenue, driven by recurring payments, bundled services, and growing acceptance of monthly and annual plans.

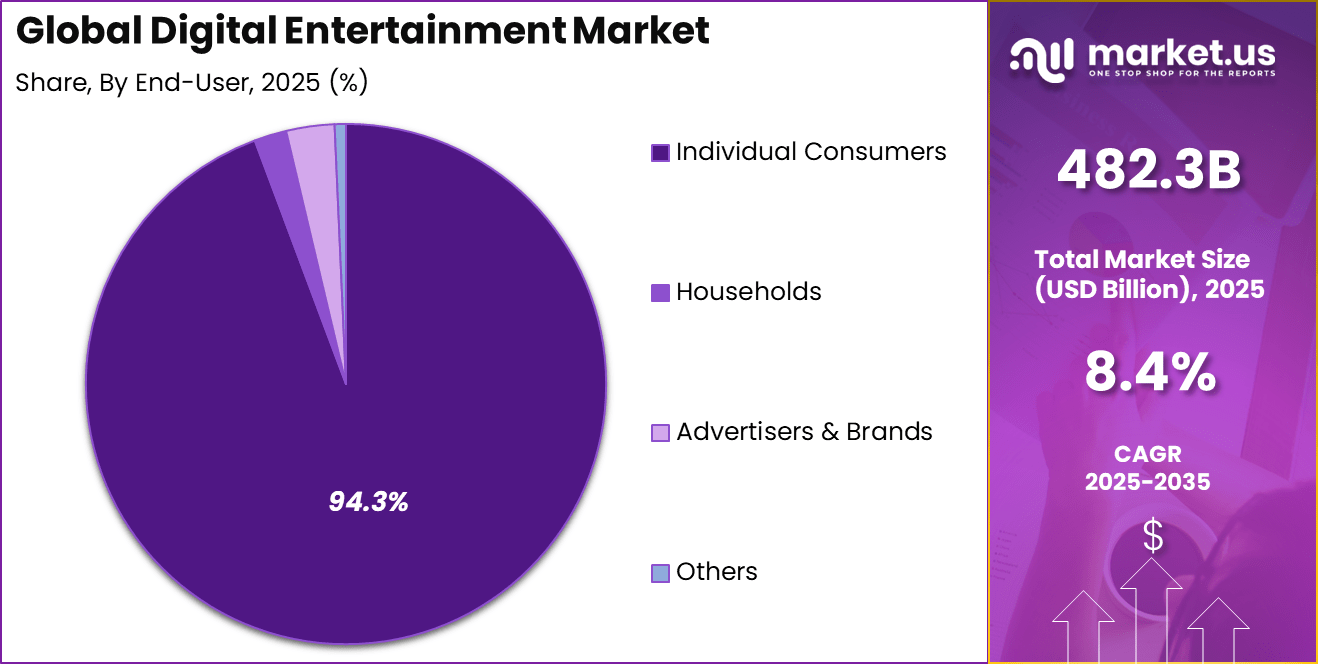

- Individual consumers represent an overwhelming 94.3% of end-user demand, highlighting entertainment as a predominantly consumer-driven digital activity.

- North America holds a leading 41.8% share of the global market, supported by high digital penetration, premium content spending, and advanced streaming ecosystems.

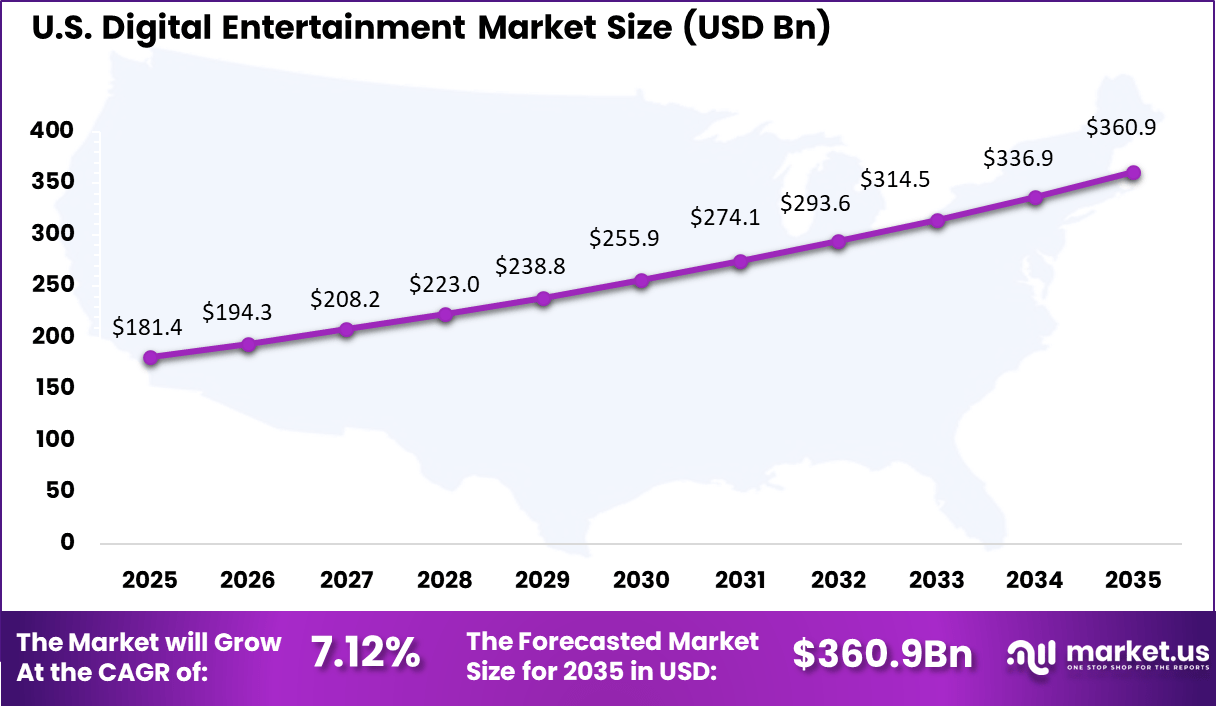

- The U.S. market reached USD 181.4 billion, expanding at a 7.12% CAGR, driven by strong adoption of streaming services, mobile entertainment, and subscription platforms.

Key Global Market Statistics

- Gaming has emerged as the largest global entertainment segment, generating about USD 184 billion annually, nearly twice the combined revenues of film and music. Industry revenues are projected to exceed USD 300 billion by 2028, driven by mobile, live services, and esports.

- Global social media usage has reached approximately 5.66 billion active identities by late 2025, covering nearly 68.7% of the world’s population, highlighting its role as a primary digital engagement channel.

- The average internet user globally now spends around 33 hours and 27 minutes per week consuming digital media, reflecting sustained growth in online content consumption.

- Smartphones accounted for 46% of the total digital media market in 2024, while mobile gaming alone generated USD 92.6 billion, reinforcing mobile devices as the core growth engine.

- Advertising is overtaking direct consumer payments as the dominant revenue source. By 2029, global advertising revenues are expected to exceed consumer spending by USD 300 billion.

- With 39% of consumers canceling at least one subscription in late 2024, platforms such as Netflix and Disney+ have expanded ad-supported tiers, which are growing at an estimated 14% CAGR, helping balance churn and revenue stability.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Streaming platform penetration Expansion of video and music streaming subscriptions ~2.4% North America, Europe Short Term Mobile entertainment growth Increased consumption of content on smartphones ~1.9% Asia Pacific, North America Short to Mid Term Gaming and interactive content Rising engagement with online and cloud gaming ~1.6% Global Mid Term Affordable data access Lower internet costs enabling higher content usage ~1.3% Emerging Markets Short Term Smart TV adoption Growth in connected home entertainment devices ~1.2% Global Mid Term Restraint Impact Table

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact Rising content production cost High spending on original content creation ~2.6% North America Mid Term Price sensitivity Limited willingness to pay higher subscription fees ~2.1% Emerging Markets Short Term Market saturation Slower user growth in mature regions ~1.8% North America, Europe Long Term Licensing complexity Cross border content rights issues ~1.3% Global Mid Term Infrastructure gaps Limited broadband access in rural areas ~1.0% Emerging Markets Long Term Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Individual consumers Very High ~94.3% Entertainment, convenience, personalization Subscription and ad supported usage Media companies High ~3.1% Audience reach and monetization Content heavy investment Advertisers Moderate ~1.6% Targeted digital advertising Performance driven spend Telecom operators Moderate ~0.6% Bundled content offerings Strategic partnerships Educational institutions Low ~0.4% Digital media usage Limited deployment By Content Type

In 2025, Video streaming accounts for 48.6%, making it the largest content type in the digital entertainment market. Consumers increasingly prefer on-demand access to movies, series, and short-form videos. Streaming platforms provide flexibility in viewing time and device choice. High-quality content libraries drive sustained engagement. Ease of access remains a key factor.

The growth of video streaming is driven by changing consumer viewing habits. Users prefer personalized content recommendations. Streaming services reduce dependence on traditional broadcast formats. Continuous content updates keep users engaged. This supports long-term dominance of video streaming.

By Platform

In 2025, Smartphones and tablets represent 58.4%, highlighting the dominance of mobile platforms. Mobile devices allow entertainment access anytime and anywhere. Improved screen quality enhances viewing experience. Touch-based interaction supports user convenience. Portability remains a major advantage.

Adoption of mobile platforms is driven by high device penetration. Users consume entertainment during travel and leisure time. Mobile platforms support multiple content formats. App-based access simplifies usage. This keeps smartphones and tablets as leading platforms.

By Revenue Model

In 2025, Subscription-based revenue accounts for 52.7%, reflecting preference for predictable pricing. Users value unlimited access to content under a single plan. Subscription models support continuous engagement. They provide stable revenue streams for service providers. Pricing transparency improves trust.

Growth in subscription models is driven by content exclusivity. Consumers prefer ad-free experiences. Flexible billing options increase adoption. Subscription plans support long-term user retention. This model continues to expand steadily.

By End User

In 2025, Individual consumers hold 94.3%, making them the primary end-user group. Digital entertainment is largely driven by personal consumption. Users access content for leisure and relaxation. Individual preferences shape platform offerings. High engagement levels sustain demand.

Adoption among individuals is driven by content diversity. Personalized recommendations enhance user satisfaction. Easy access across devices supports frequent usage. Entertainment habits are deeply integrated into daily life. This keeps individual consumers at the center of the market.

By Region

In 2025, North America accounts for 41.8%, supported by advanced digital infrastructure. The region shows high adoption of streaming and digital platforms. Consumers spend significantly on entertainment services. Innovation in content delivery supports growth. The region remains influential.

In 2025, The United States reached USD 181.4 Billion with a CAGR of 7.12%, indicating steady expansion. Growth is driven by strong subscription adoption. Consumers value premium digital content. Investment in content production remains high. Market growth continues at a stable pace.

Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status High speed broadband Foundation for streaming and gaming ~2.7% Mature Mobile networks Enables on the go content access ~2.1% Mature Cloud content delivery Scalable distribution of media ~1.6% Growing AI content recommendation Improves engagement and retention ~1.2% Growing Smart devices Enhances home entertainment experience ~0.8% Mature Use Case Adoption by Industry Vertical

Industry Vertical Primary Use Case Adoption Share (%) Adoption Maturity Individual consumers Video streaming, gaming, music 94.3% Advanced Media and entertainment firms Content distribution ~2.9% Advanced Advertising and marketing Digital video ads ~1.5% Developing Telecom and ISPs Bundled entertainment ~0.8% Developing Education and training Multimedia learning ~0.5% Early Emerging Trend Analysis

The digital entertainment market is evolving with the widespread adoption of immersive content formats that offer richer user experiences across platforms. Consumers are increasingly engaging with high-definition video streaming, interactive games, and virtual events that deliver entertainment in new and dynamic ways. These formats attract broader audiences and extend usage time across devices such as mobile phones, tablets, and connected TVs.

As content creation tools and delivery infrastructure improve, demand for immersive digital entertainment continues to rise. Another emerging trend is the integration of social and community features into entertainment platforms that allow users to interact while consuming content. Viewers now participate in real-time chats during livestreams, co-watch with friends in virtual spaces, and share user-generated content across networks.

Opportunity Analysis

There is strong opportunity in the development of niche content platforms that cater to specific audience segments such as esports, independent films, and short-form video series. By focusing on specialized interests, platforms can attract dedicated user bases and differentiate themselves from mainstream offerings.

Niche services also provide creators with avenues to reach audiences that value unique and tailored content. Expansion of targeted entertainment verticals can drive overall market growth. Another opportunity lies in the integration of interactive advertising and commerce features that allow users to engage directly with products and brands within entertainment environments.

Interactive features such as shoppable video and branded in-game experiences create new revenue models that go beyond traditional ad placements. These immersive monetization methods align with consumer behavior and support diversified platform income streams.

Challenge Analysis

A major challenge for the market is sustaining content quality while scaling production to meet growing global demand. Producing high-quality series, films, games, and interactive experiences requires significant investment in talent, technology, and creative processes.

Balancing cost pressures with audience expectations for premium content is a complex task for entertainment providers. Failure to maintain quality can erode subscriber retention and market competitiveness. Another challenge is navigating regulatory frameworks that differ across regions and cultural contexts.

Content classification, censorship rules, and distribution restrictions vary, requiring platforms to customize offerings for compliance. Managing these differences increases operational complexity and can delay global expansion efforts. Platforms must ensure regulatory adherence while preserving creative freedom and user satisfaction.

Key Market Segments

By Content Type

- Video Streaming

- Music Streaming

- Online Gaming

- Digital Reading

- Others

By Platform

- Smartphones & Tablets

- Smart TVs & Connected Devices

- Gaming Consoles & PCs

- Others

By Revenue Model

- Subscription

- Advertising-based

- Others

By End-User

- Individual Consumers

- Households

- Advertisers & Brands

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Netflix, Inc., Amazon.com, Inc., Alphabet, Inc., and The Walt Disney Company lead the digital entertainment market through large scale streaming platforms, original content investment, and global distribution networks. Their services cover video on demand, live streaming, and subscription based entertainment. These companies focus on content personalization, data driven recommendations, and multi device accessibility. Rising consumer preference for on demand digital content continues to strengthen their leadership.

Meta Platforms, Inc., Tencent Holdings, Ltd., Sony Group Corporation, and Microsoft Corporation strengthen the market by combining social media, gaming, music, and immersive entertainment ecosystems. Their platforms support user generated content, online gaming, and interactive experiences. These players emphasize community engagement, cross platform integration, and digital monetization models. Growing convergence of social interaction and entertainment supports wider adoption.

Apple, Inc., Spotify Technology S.A., ByteDance, Ltd., Nintendo Co., Ltd., and Warner Bros. Discovery, Inc. expand the landscape with music streaming, short form video, mobile gaming, and franchise based content. Their offerings target diverse age groups and consumption habits. These companies focus on platform loyalty and creative partnerships. Increasing screen time and mobile usage continue to drive steady growth in the digital entertainment market.

Top Key Players in the Market

- Netflix, Inc.

- Amazon.com, Inc.

- Alphabet, Inc.

- Meta Platforms, Inc.

- Tencent Holdings, Ltd.

- Sony Group Corporation

- Microsoft Corporation

- Apple, Inc.

- The Walt Disney Company

- Spotify Technology S.A.

- ByteDance, Ltd. (TikTok)

- Nintendo Co., Ltd.

- Electronic Arts, Inc.

- Activision Blizzard, Inc.

- Warner Bros. Discovery, Inc.

- Others

Recent Developments

- Reliance Industries and Disney wrapped up their joint venture by merging JioCinema and Disney+ Hotstar into JioHotstar in February 2025, grabbing about 85% of India’s streaming share and bundling cricket leagues like IPL with global movies. Disney took a 70% stake in a Fubo-Hulu Live TV merger finalized in late 2025, creating a powerhouse with nearly 6 million subscribers for live sports and on-demand content.

Report Scope

Report Features Description Market Value (2025) USD 482.3 Bn Forecast Revenue (2035) USD 1,080.5 Bn CAGR(2026-2035) 8.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Content Type (Video Streaming, Music Streaming, Online Gaming, Digital Reading, Others), By Platform (Smartphones & Tablets, Smart TVs & Connected Devices, Gaming Consoles & PCs, Others), By Revenue Model (Subscription, Advertising-based, Others), By End-User (Individual Consumers, Households, Advertisers & Brands, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Netflix, Inc., Amazon.com, Inc., Alphabet, Inc., Meta Platforms, Inc., Tencent Holdings, Ltd., Sony Group Corporation, Microsoft Corporation, Apple, Inc., The Walt Disney Company, Spotify Technology S.A., ByteDance, Ltd. (TikTok), Nintendo Co., Ltd., Electronic Arts, Inc., Activision Blizzard, Inc., Warner Bros. Discovery, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Entertainment MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Digital Entertainment MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Netflix, Inc.

- Amazon.com, Inc.

- Alphabet, Inc.

- Meta Platforms, Inc.

- Tencent Holdings, Ltd.

- Sony Group Corporation

- Microsoft Corporation

- Apple, Inc.

- The Walt Disney Company

- Spotify Technology S.A.

- ByteDance, Ltd. (TikTok)

- Nintendo Co., Ltd.

- Electronic Arts, Inc.

- Activision Blizzard, Inc.

- Warner Bros. Discovery, Inc.

- Others