Global Digital Currency Market by Type (Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Ripple, Other Types), By Component (Hardware and Software), By Process (Mining and Transactions), By Software, By Hardware, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: April 2024

- Report ID: 54391

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

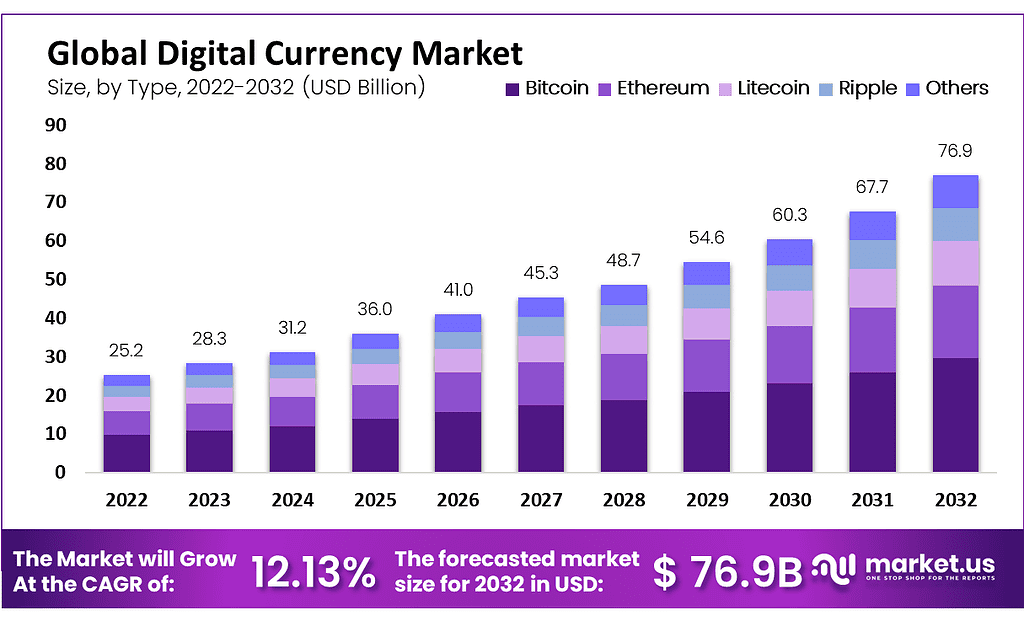

The Global Digital Currency Market size is expected to be worth around USD 76.9 Billion by 2032, from USD 28.3 Billion in 2023, growing at a CAGR of 12.13% during the forecast period from 2023 to 2032.

Digital currency, also known as cryptocurrency, is a form of currency that exists solely in digital or electronic form. It utilizes cryptographic technology to secure transactions and control the creation of new units. Unlike traditional currencies issued by central banks, digital currencies are decentralized and operate on a distributed ledger called a blockchain.

The digital currency market is rapidly expanding, driven by the proliferation of cryptocurrencies like Bitcoin and Ethereum, as well as the development of central bank digital currencies (CBDCs). Key characteristics of this market include its decentralized nature, reliance on blockchain technology for security and transparency, and the volatility of cryptocurrency values.

Market dynamics are influenced by factors such as regulatory developments, technological advancements, and shifts in investor sentiment. Growth projections for the digital currency market are optimistic, reflecting increasing acceptance and integration into mainstream financial systems.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Statistics: By 2032, the global digital currency market is projected to reach USD 76.9 Billion, growing at an expected compound annual growth rate of 12.13% from 2022-2033.

- Type Analysis: Bitcoin dominates the market and generates the greatest revenue.

- By Component: Hardware dominates the digital currency market.

- By Hardware: Application-Specific Integrated Circuit is the leading segment in the digital currency market.

- Software: Exchange software dominates the software sector.

- By Process: Mining has the highest revenue share in the market.

- End User Analysis: The Trading segment dominates in the market.

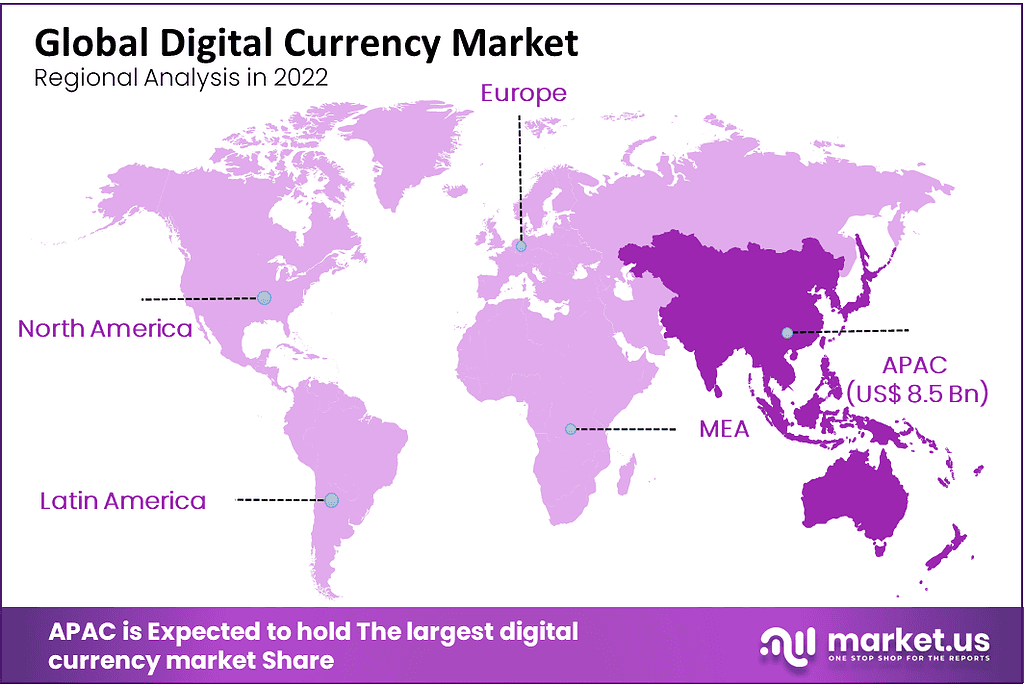

- Regional Analysis: Asia Pacific dominates the market with the highest revenue share.

- Top Key Players: Advanced Micro Devices Inc., Finance, Bit Fury Group Limited, Bit Go Inc, Bit Main Technologies Holding Company Intel Corporation NVIDIA Corporation Ripple Xapo Holdings Limited Xilinx Inc

Driving Factors

Increasing Currency Volumes and investors will be Estimated to Drive the Market Growth

Bitcoin is one of the most popular currencies with the highest adapting rate. The increasing interest of people, supporting regulations, and flexibility help the increasing market growth. Also, increasing bitcoin value and facilities providing bitcoin for transactions help drive the market growth. Financial problems are the main issues in the financial sectors and banking sectors. These financial problems affect the economy by decreasing the value of this currency. Bitcoin and other cryptocurrencies don’t have any financial disaster, and it is used by universal balancing. Cryptocurrency is the best option for financial things in regions with unstable economic l structures, which helps drive global market growth. People in many countries are interested in digital currency, which is estimated to increase the digital currency market growth in the coming years.

Restraining Factors

Decentralized and Unauthorized Changing Platforms will restrict Market Growth.

A Digital currency is a decentralized, unauthorized, and uncontrolled changing platform. There are many complaints regarding misuse of currency, money loss, and illegal activities from currency users. The virtual currency is always changing; sometimes, it shows an incline or decline in currency rate, affecting investors’ money. Treasury Secretary Steven Mnuchin shows their concern about the Facebook currency Libra. The Libra digital currency does not have well security for the investor during the transactions. Many cyber-attack can easily hack the currency rate, which affects the investing currency. The misuse and Security concern of digital currency is the major restricting factor for this market growth.

Growth Opportunities

The Rising Demand for Digital Currency Will Drive the Industry’s Expansion.

The Digital Currency market is also boosted due to growing advanced technologies using software and hardware in several emerging economies regions. The rapidly increasing geriatric population, rising online applications, speedy growth, and individual awareness among individuals are driving the need to enhance the currency market in all nations. Therefore, many market players are investing in the digital currency market due to its easy use, increasing market value, are increasing their investments by driving market growth. Owing to the high number of applications of digital currency in trading, selling, and sifting it helps to raise investment in this digital current, which is expected to offer growth opportunities in the market.

Trending Factors

Increase in Popularity due to its easy use and Flexible Transactions.

The popularity of digital and virtual currency such as Lite coins, Bitcoin, Ethers, and Others helps to drive the market growth in coming years. In developed countries, individuals easily adapt to the transaction methods due to the easy and flexible transaction method offered by digital currency. This digital currency is the exchange medium for the central bank to provide digital currency. Many companies like Facebook, Inc. are focusing on expanding their business by offering the virtual currency that is Libra. Libra is a visual currency. Using this currency, people can easily buy things or transfer money anywhere, such as in malls, grocery shops, and other places. Many companies make a profit by increasing these currency prices.

Type Analysis

Bitcoin Held the Largest Segment in Digital Currency Market

Based on the type segment, this is classified into Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash, and others. The Bitcoin segment is the most dominating segment in the market, generating the largest revenue. The segment is estimated to develop the fastest growth rate during the projected period. Bitcoin is the digital currency generated as a decentralized transaction method. The Emergence of Bitcoin Exchange traded funds is estimated to involve global Bitcoin trades during the forecast period. The Ethereum segment is estimated to grow significantly during the forecast period.

Ethereum is an open software platform that allows users to make decentralized applications. Due to the proliferation of new projects using the Ethereum network, it is related to the Ethereum market expansion. Digital contracts are primarily applied to algorithm-based transactions by using Ethereum. On the blockchain network, digital contracts are applied with written instructions for the transaction process. It is upgraded to Ethereum 2.0, which requires low cost and minimum energy and is expected to support the digital currency market growth during the forecast period.

By Component

Hardware Held the Largest Segment Revenue Shares in the Market

Based on components, the market is segmented into hardware and software. The hardware segment is the most dominating segment in the digital currency market. Due to highly change in the price and reduced power of consumptions of cryptocurrency users is expected to drive the market growth of the hardware segment. Hardware such as, graphics processing units, effective, swift, and stable is required to produce mining devices.

These factors help generate considerable market growth during the forecast period. The software segment is expected to expand at the highest CAGR during the forecast period. The increase in demand for software designed for cryptocurrency exchange and mining as well as the development of software to manage the volume of data generated in cryptocurrency, is estimated to provide segment growth. However, the increasing demand for cryptocurrency across the globe is increasing the demand for crypto software and wallet, which is estimated to increase the growth of this segment.

By Hardware

Application-Specific Integrated Circuit Segment Held the Largest Market Shares in the tin Market

The hardware segment is also divided into the Central Processing Unit, Graphics Processing Unit, Application-Specific Integrated Circuit, and Field Programmable Gate Array. The Application-Specific Integrated Circuit segment is the dominating segment in the digital currency market. The electric circuit is designed especially for mining virtual currencies such as Bitcoin, Ethereum, and Litecion.

Many companies are adapting ASIC minors for mining cryptocurrency with the increasing need for low-energy consumption devices. The ASIC requires less maintenance and efficient energy use, which is anticipated to provide market growth. The Graphics Processing Unit segment is estimated to expand at an average CAGR during the forecast period. This growth is attributable due to increasing demand for GPU as it offers high processing speed and consumes less energy.

By Software

Exchange segment Held the Largest market shares in the Software Segment Market

Based on the software segment, the market is segmented into Mining Software, Exchange Software, Wallet, Payment, and Other Software. The exchange software is the most dominating segment in the software segment. It is necessary for completing cryptocurrency transactions. Hence, it is used to convert cryptocurrency coins to approval of currencies. The increasing development of exchange software to provide seamless cryptocurrency trading is estimated to increase segment growth.

The wallet segment is estimated to expand at a higher CAGR during the forecast period. The growth of this segment is due to the increase in the use of cryptocurrency wallets which offer consumers online tools. Store blockchain assets exchange cryptocurrencies, including Litecoin, Bitcoin, and Ethereum. Many companies offering cryptocurrency wallet services concentrate on creating cryptocurrency using mobile devices. The wallet is prepared to allow customers to send, trade, and receive cryptocurrency by using the Robin Hood application.

By Process

Mining and Transactions are the Main Processes in Digital Currency Market

Based on the process segment, the market is categorized into mining and transactions. The mining segment is dominating the market with the highest revenue shares. The mining process involves blockchain transactions and verified and validated transactions. New coins are introduced into the present supply chain by mining activities. To provide cryptocurrency minors with the best mining experience, many businesses across the globe are concentrating on building and implementing cryptocurrency miner farms. These crypto minors are in an excellent position to drive mining operations as they receive electricity from the public network.

Also, the transaction segment is expected to expand at the fastest CAGR during the forecast period. The need for high use of transaction services by organizations is increasing, resulting in the fast development of technological advancements such as automation and digitization. However, many players are concentrating on preparing the wallet as a service to offer safe digital wallet choices for businesses to effectively use transactions to increase the demand for high-use of this transaction method.

End-User Analysis

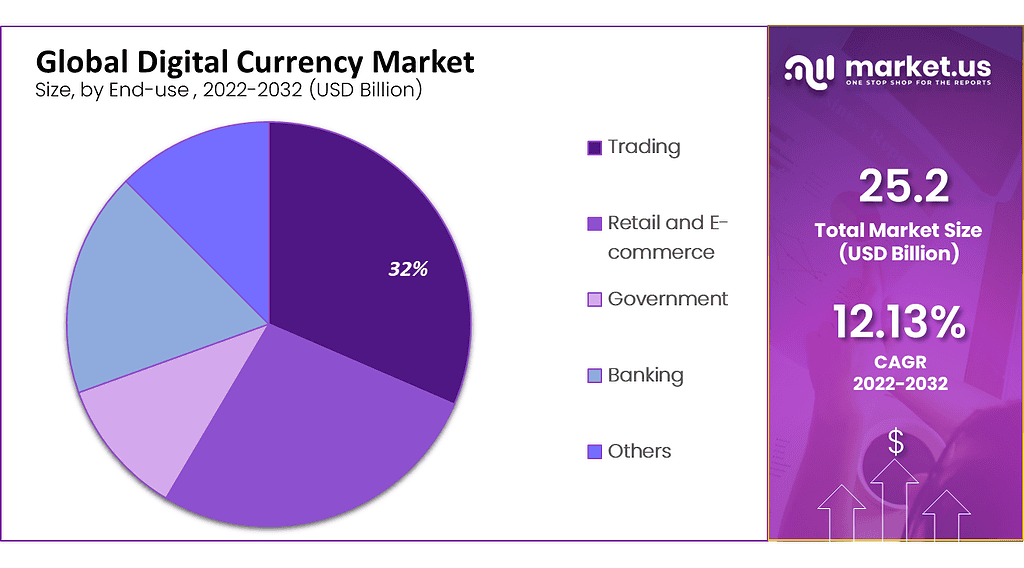

Trading Segment Holds the Dominant Digital Currency Market Shares

Based on end-user, the market is segmented into banking, gaming, E-Commerce, remittance, and trading. The Trading segment is dominant in the market. Trading in cryptocurrency supports the user to buy anything, get a deposit address and examine the currency balances. Several browser technology suppliers are concentrating on forming alliances with blockchain technology. The retail and e-commerce segment is expected to expand with the largest CAGR during the forecast period. The increasing retail land E-commerce industries are adapting currencies as an official payment method. It is one of the major factors that help to drive the market growth. Many cryptocurrency transaction processors are involved in partnerships with E-commerce companies to increase the adoption of digital currency for money transactions.

Note: Actual Numbers Might Vary In The Final Report

Key Market Segments

By Component

- Hardware

- Software

By Hardware

- Central Processing Unit

- Graphics Processing Unit

- Application-Specific Integrated Circuit

- Field Programmable Gate Array

By Software

- Mining Software

- Exchange Software

- Wallet

- Payment

- Other Software’s

By Process

- Mining

- Transaction

By Type

- Bitcoin

- Bitcoin Cash

- Ethereum

- Litecoin

- Ripple

- Other Types

By End-User

- Banking

- Gaming

- Government

- Healthcare

- Trading

- Retail & E-commerce

- Other end-users

Regional Analysis

Asia Pacific Dominates the Global Market During the Forecast Period

Asia Pacific is the most dominating region in the market, with the largest revenue share. The China-based crypto mining hardware manufacturers partner with Northern Data AG to build operational land technological resources. The North American region market is estimated to grow significantly during the forecast period. The increasing acceptance of cryptocurrency and the use of cryptocurrency in NFTs in the region to store the value, is driving the regional market expansion. However, the region is witnessing huge investments in industries for advanced solutions and developing blockchain technology for cryptocurrency systems that have a higher rate and better power of efficiency.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Emerging key players are focused on various strategic policies to develop their respective businesses in foreign markets. Several digital currency market companies are concentrating on expanding their existing operations and R&D facilities. Furthermore, businesses in the digital currency market are developing new products and portfolio expansion strategies through investments, mergers, and acquisitions. In addition, several key players are now focusing on different marketing strategies, such as spreading awareness about natural ingredients, which is boosting the target products’ growth.

Listed below are some of the most prominent Digital currency Market industry players.

- Advanced Micro Devices, Inc.

- Finance

- Bit Fury Group Limited

- Bit Go, Inc.

- Bit Main Technologies Holding Company

- Intel Corporation

- NVIDIA Corporation

- Ripple

- Xapo Holdings Limited

- Xilinx, Inc.

Recent Developments

- In March 2021: Visa Inc. introduced new payment systems to accept digital currency as a payment method. This new service is designed for the digital payment method on Ethereum Blockchain.

- In September 2019: The German restaurant Berger King announced accepting Bitcoin as a payment. This is expected to increase the validation of digital currencies in other e-commerce and retail payments using online platforms.

Report Scope

Report Features Description Market Value (2022) US$ 25.2 Bn Forecast Revenue (2032) US$ 76.9 Bn CAGR (2023-2032) 12.13% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Ripple, Other Types); By Component (Hardware and Software); By Process (Mining and Transactions); By Software; By Hardware; By End-User Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Advanced Micro Devices, Inc.Binance, Bit fury Group Limited, Bit Go, Inc., Bit Main Technologies Holding Company, Intel Corporation, NVIDIA Corporation, Ripple, Xapo Holdings Limited, Xilinx, Inc., Other end-Users Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is digital currency market?The digital currency market is a global marketplace where people can buy, sell, and trade digital currencies. It is a volatile market, and prices can fluctuate wildly. The market is also unregulated, which means there is no central authority to oversee it.

How is digital currency traded?Digital currencies are traded on exchanges, which are online platforms that allow people to buy and sell cryptocurrencies. Exchanges typically charge a fee for each transaction.

There are two main ways to trade digital currencies:

- Spot trading: This is the most common way to trade digital currencies. In spot trading, you buy or sell a cryptocurrency at the current market price.

- Margin trading: This is a more risky way to trade digital currencies. In margin trading, you borrow money from the exchange to buy more cryptocurrency than you could afford with your own money. This can amplify your profits if the price of the cryptocurrency goes up, but it can also magnify your losses if the price goes down.

How does the value of digital currencies fluctuate?The value of digital currencies can fluctuate based on factors such as market demand, adoption rate, technological developments, regulatory changes, macroeconomic trends, and investor sentiment.

Are digital currencies legal?The legality of digital currencies varies by country. Some countries have embraced digital currencies and blockchain technology, while others have imposed restrictions or outright bans.

What are the 4 types of cryptocurrency?There are four main types of cryptocurrency:

- Bitcoin: Bitcoin is the first and most well-known cryptocurrency. It was created in 2009 by an anonymous person or group of people under the pseudonym Satoshi Nakamoto.

- Ethereum: Ethereum is a blockchain platform that allows developers to create decentralized applications. It is the second most popular cryptocurrency after Bitcoin.

- Tether: Tether is a stablecoin, which means that it is pegged to a fiat currency, such as the US dollar. This makes it less volatile than other cryptocurrencies.

- Dogecoin: Dogecoin is a meme coin that was created in 2013 as a joke. However, it has since gained a large following and is now one of the most popular cryptocurrencies.

What is the future of digital currency?The future of digital currency is uncertain. Some people believe that digital currencies will become the dominant form of money in the future, while others believe that they will remain a niche market. Only time will tell what the future holds for digital currencies.

-

-

- Advanced Micro Devices, Inc.

- Finance

- Bit Fury Group Limited

- Bit Go, Inc.

- Bit Main Technologies Holding Company

- Intel Corporation

- NVIDIA Corporation

- Ripple

- Xapo Holdings Limited

- Xilinx, Inc.

- Other