Global Diethylene Glycol Monobutyl Ether Market Size, Share, And Business Benefits By Formulation Type (Water-Based, Solvent-Based, Emulsion-Based), By Application (Solvent, Cleaner, Adhesive, Coating, Textile Processing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147955

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

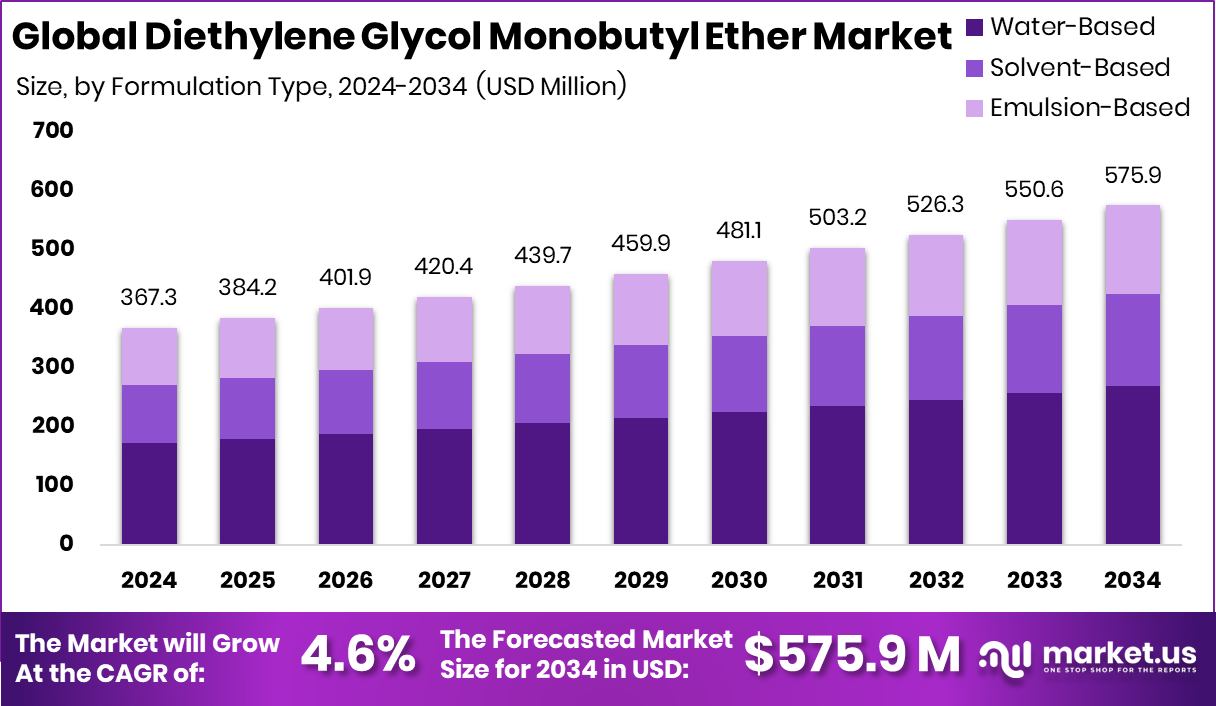

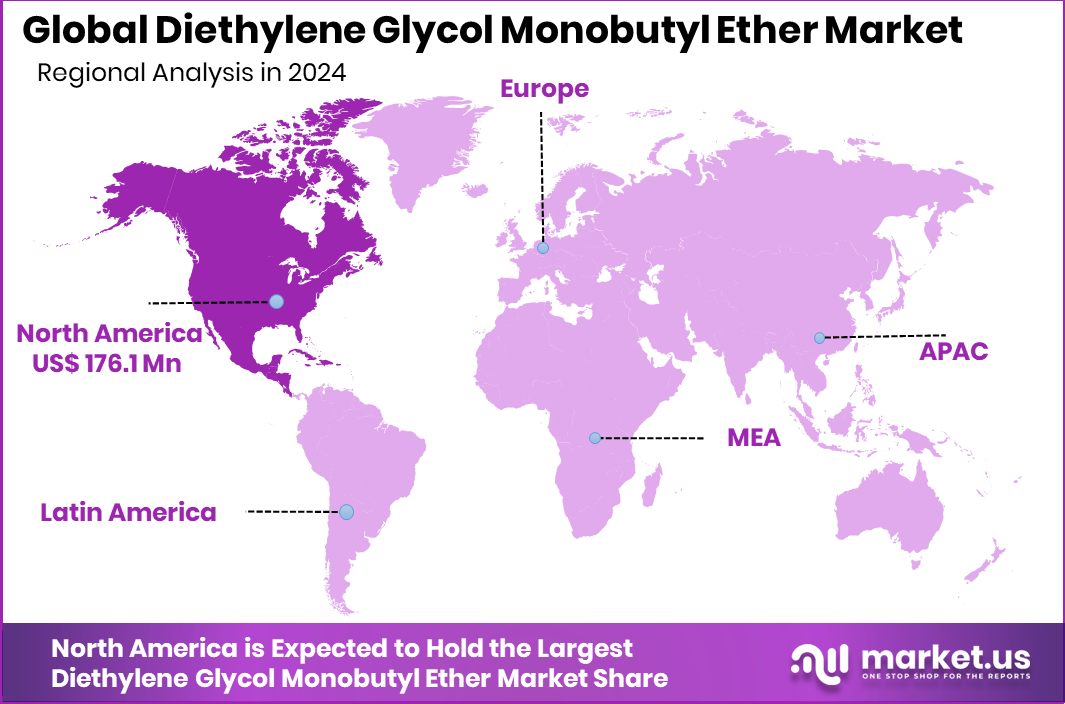

The Global Diethylene Glycol Monobutyl Ether Market is expected to be worth around USD 575.9 million by 2034, up from USD 367.3 million in 2024, and grow at a CAGR of 4.6% from 2025 to 2034. Rising industrial cleaning applications fueled the 47.9% market share in North America.

Diethylene Glycol Monobutyl Ether (DGBE) is a colorless, hygroscopic liquid primarily used as a solvent in industrial and commercial applications. It is known for its excellent solvency, low volatility, and high boiling point, making it ideal for use in coatings, cleaners, and inks. DGBE is commonly utilized in formulations requiring water-miscibility and moderate evaporation rates, aiding in efficient cleaning and surface treatments.

The Diethylene Glycol Monobutyl Ether market is experiencing steady growth, driven by increasing demand in sectors like coatings, paints, and industrial cleaners. The market is characterized by a surge in applications requiring effective solvents with low volatility, particularly in water-based formulations. The expanding construction and automotive industries further fuel the demand for DGBE-based coatings and cleaning agents.

The Diethylene Glycol Monobutyl Ether market is propelled by its expanding usage in the coatings and paint sector, particularly in waterborne formulations. With increasing construction activities and infrastructure projects worldwide, the demand for efficient, low-emission solvents is rising. DGBE’s compatibility with water-based systems and its ability to provide effective solvency while maintaining low toxicity contribute to its growing adoption.

Demand for Diethylene Glycol Monobutyl Ether is rising significantly due to its essential role in industrial and household cleaning products. The chemical’s ability to dissolve greases, oils, and other contaminants effectively makes it a preferred choice in formulations for degreasers, paint removers, and hard surface cleaners.

Key Takeaways

- The Global Diethylene Glycol Monobutyl Ether Market is expected to be worth around USD 575.9 million by 2034, up from USD 367.3 million in 2024, and grow at a CAGR of 4.6% from 2025 to 2034.

- In 2024, water-based formulations dominated the Diethylene Glycol Monobutyl Ether market, capturing 46.8%.

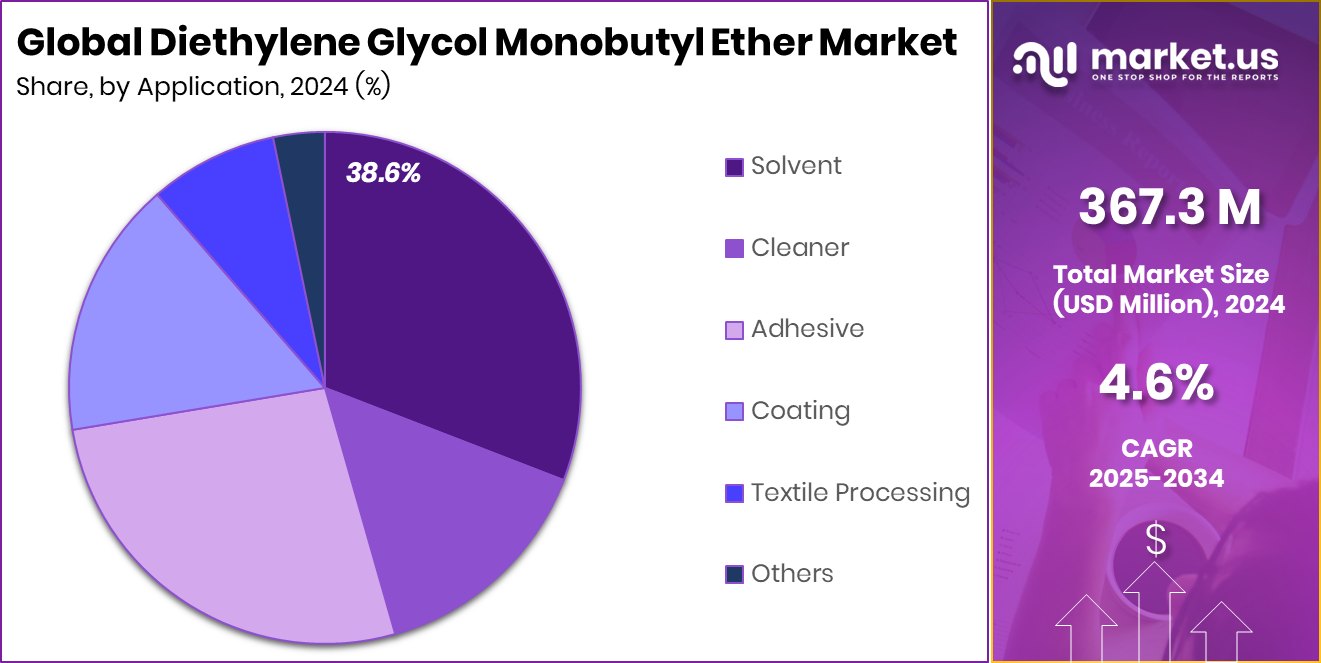

- Solvent applications held a significant market share, accounting for 38.6% in 2024 globally.

- The market in North America generated USD 176.1 million in 2024, showcasing significant demand.

By Formulation Type Analysis

Water-Based formulations dominate the Diethylene Glycol Monobutyl Ether market, capturing 46.8%.

In 2024, Water-Based held a dominant market position in the By Formulation Type segment of the Diethylene Glycol Monobutyl Ether Market, with a 46.8% share. This substantial market share can be attributed to its widespread adoption across various industries due to its low toxicity and environmental benefits. Water-based formulations are extensively utilized in paints, coatings, and cleaning agents, offering enhanced solvency and minimal environmental impact.

Industries prefer water-based Diethylene Glycol Monobutyl Ether as it provides excellent viscosity control and improved stability, leading to higher demand in industrial cleaning and surface coatings. Additionally, the shift towards sustainable and eco-friendly products has further propelled the consumption of water-based formulations.

The segment’s dominance is expected to continue as environmental regulations push for reduced VOC emissions, increasing the demand for safer and less harmful chemical alternatives. Thus, the Water-Based formulation type is anticipated to retain its leading position in the market, driven by regulatory support and growing awareness regarding environmental preservation.

By Application Analysis

The solvent application segment holds a 38.6% share, showcasing robust market demand.

In 2024, Solvent held a dominant market position in the By Application segment of the Diethylene Glycol Monobutyl Ether Market, with a 38.6% share. The solvent segment’s dominance is driven by its extensive use in industrial and commercial cleaning applications, where its superior solvency power effectively removes grease, oil, and other contaminants.

Its application extends across multiple industries, including automotive, textiles, and coatings, where it acts as a crucial component in formulating high-performance cleaning agents and degreasers. The chemical’s ability to dissolve both polar and non-polar substances has made it a preferred solvent in producing water-based and oil-based cleaning solutions.

Additionally, the solvent segment benefits from the increasing demand for Diethylene Glycol Monobutyl Ether as a coupling agent in paints and coatings, enhancing product effectiveness and application properties. As industrial activities continue to expand, the solvent segment is expected to maintain its leading position, bolstered by ongoing demand for efficient and versatile chemical solutions in manufacturing and processing sectors.

Key Market Segments

By Formulation Type

- Water-Based

- Solvent-Based

- Emulsion-Based

By Application

- Solvent

- Cleaner

- Adhesive

- Coating

- Textile Processing

- Others

Driving Factors

Industrial Cleaning Drives Solvent Demand in Key Industries

The growing emphasis on industrial cleaning and maintenance is a significant driving factor for the Diethylene Glycol Monobutyl Ether market. As industries such as automotive, manufacturing, and construction continue to expand, the demand for effective cleaning solvents has surged.

Diethylene Glycol Monobutyl Ether, known for its superior solvency and low volatility, is widely used in industrial cleaners, degreasers, and surface treatment products. Additionally, its compatibility with water-based formulations makes it an ideal choice for environmentally friendly cleaning agents.

With stricter regulatory measures on industrial emissions and workplace hygiene, the adoption of efficient solvents like Diethylene Glycol Monobutyl Ether is expected to rise, reinforcing its market demand across multiple sectors.

Restraining Factors

Environmental Regulations Limit Solvent Usage Across Industries

Stringent environmental regulations pose a significant restraining factor for the Diethylene Glycol Monobutyl Ether market. Government policies aimed at reducing volatile organic compounds (VOCs) and toxic emissions have led to restrictions on the use of chemical solvents in various industries.

Diethylene Glycol Monobutyl Ether, despite its effectiveness as a solvent, faces scrutiny due to its potential environmental and health hazards. Industries are increasingly seeking greener alternatives with lower toxicity and minimal environmental impact, impacting the demand for traditional chemical solvents.

Additionally, regulatory agencies such as the Environmental Protection Agency (EPA) and European Chemicals Agency (ECHA) impose strict guidelines on solvent usage, compelling manufacturers to adopt safer, eco-friendly alternatives, thereby curbing market growth.

Growth Opportunity

Eco-Friendly Formulations Boost Demand in Cleaning Sector

The increasing focus on sustainable and eco-friendly cleaning solutions presents a substantial growth opportunity for the Diethylene Glycol Monobutyl Ether market. As industries transition towards greener formulations, the demand for water-based solvents with lower toxicity levels is on the rise.

Diethylene Glycol Monobutyl Ether, known for its high solvency power and minimal environmental impact, aligns well with the growing preference for sustainable cleaning agents. Its compatibility with water-based formulations makes it an attractive choice for developing biodegradable and less hazardous cleaning products.

With stringent environmental regulations pushing industries to adopt safer chemicals, the market for Diethylene Glycol Monobutyl Ether is poised for significant growth in the industrial cleaning and surface treatment sectors.

Latest Trends

Shift Towards Low VOC Solvents Gains Momentum

A notable trend in the Diethylene Glycol Monobutyl Ether market is the increasing shift towards low-VOC (volatile organic compounds) solvents. As regulatory bodies impose stricter emission guidelines, industries are actively seeking solvents that minimize environmental impact while maintaining performance.

Diethylene Glycol Monobutyl Ether, with its lower VOC content and effective solvency, is gaining traction as a preferred option in paints, coatings, and cleaning formulations.

Manufacturers are focusing on developing advanced solvent formulations that adhere to environmental standards without compromising quality. This trend is further fueled by the growing awareness of sustainable industrial practices, driving demand for eco-friendly and less toxic solvent alternatives across multiple sectors.

Regional Analysis

North America dominated the Diethylene Glycol Monobutyl Ether market, capturing 47.9% share.

In 2024, North America held a dominant position in the Diethylene Glycol Monobutyl Ether market, capturing a significant 47.9% share and generating USD 176.1 million in revenue. The region’s dominance is driven by its extensive industrial and commercial sectors, where Diethylene Glycol Monobutyl Ether is widely used in cleaning agents, solvents, and surface treatments.

Europe follows closely, with growing adoption in paints and coatings, particularly in industrial applications. The Asia Pacific region is witnessing an increasing demand for Diethylene Glycol Monobutyl Ether, fueled by expanding manufacturing sectors and rising construction activities. Meanwhile, the Middle East & Africa and Latin America exhibit moderate growth, driven by industrialization and increasing use of chemical solvents in cleaning and degreasing applications.

However, North America remains the leading market, underpinned by strong industrial demand and widespread application across diverse sectors. The market dynamics across these regions are expected to evolve as regulatory frameworks increasingly emphasize low VOC and environmentally friendly solvent formulations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Kraton Corporation emerged as a notable player in the global Diethylene Glycol Monobutyl Ether market, leveraging its expertise in specialty chemicals to expand its product portfolio. The company focused on sustainable formulations, aligning with rising regulatory pressures to reduce VOC emissions in solvents and cleaning agents. This strategic focus allowed Kraton to strengthen its market position across key industrial sectors, particularly in North America and Europe.

Bharat Petroleum Corporation Limited (BPCL) capitalized on its extensive distribution network and established market presence in Asia Pacific. The company emphasized enhancing production capabilities to cater to the growing demand for Diethylene Glycol Monobutyl Ether in industrial cleaning and degreasing applications. BPCL’s efforts to adopt more eco-friendly chemical formulations resonated well in emerging markets, positioning it as a regional leader.

BASF maintained its dominance by focusing on high-performance solvents that align with environmental standards. The company leveraged its robust R&D capabilities to develop advanced formulations of Diethylene Glycol Monobutyl Ether, targeting industrial and commercial cleaning applications.

BASF’s strategic initiatives to expand its product portfolio in Europe and North America further solidified its market presence, supported by increasing demand for low-toxicity, high-solvency chemical solutions.

Top Key Players in the Market

- Kraton Corporation

- Bharat Petroleum Corporation Limited

- BASF

- LyondellBasell Industries

- Herdillia Chemical Company

- Huntsman Corporation

- SABIC

- King Industries

- Dow Chemical Company

- Eastman Chemical Company

- Ineos

- Shell

- Gujarat State Fertilizers and Chemicals

- ExxonMobil

Recent Developments

- In October 2024, Kraton launched the CirKular+™ Paving Circularity Series, celebrating the fifth anniversary of its CirKular+™ product line. This initiative focuses on maximizing the reuse of reclaimed asphalt, aligning with sustainable practices in the chemical industry.

- In April 2024, Dow announced a $1 billion cost-saving program, which includes workforce reductions and the postponement of major projects, such as the Path2Zero initiative in Alberta, Canada. This project aimed to develop a net-zero emissions ethylene and polyethylene facility.

Report Scope

Report Features Description Market Value (2024) USD 575.9 Million Forecast Revenue (2034) USD 367.3 Million CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Formulation Type (Water-Based, Solvent-Based, Emulsion-Based), By Application (Solvent, Cleaner, Adhesive, Coating, Textile Processing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kraton Corporation, Bharat Petroleum Corporation Limited, BASF, LyondellBasell Industries, Herdillia Chemical Company, Huntsman Corporation, SABIC, King Industries, Dow Chemical Company, Eastman Chemical Company, Ineos, Shell, Gujarat State Fertilizers and Chemicals, ExxonMobil Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Diethylene Glycol Monobutyl Ether MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Diethylene Glycol Monobutyl Ether MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kraton Corporation

- Bharat Petroleum Corporation Limited

- BASF

- LyondellBasell Industries

- Herdillia Chemical Company

- Huntsman Corporation

- SABIC

- King Industries

- Dow Chemical Company

- Eastman Chemical Company

- Ineos

- Shell

- Gujarat State Fertilizers and Chemicals

- ExxonMobil