Global Diamond Jewelry Market Size, Share, Growth Analysis By Product Type (Earrings, Rings, Pendants, Bracelets, Necklaces, Others), By Sales Channel (Jewelry Stores, Departmental Stores, Specialty Stores, Others), By End-User (Women, Men, Unisex), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153442

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

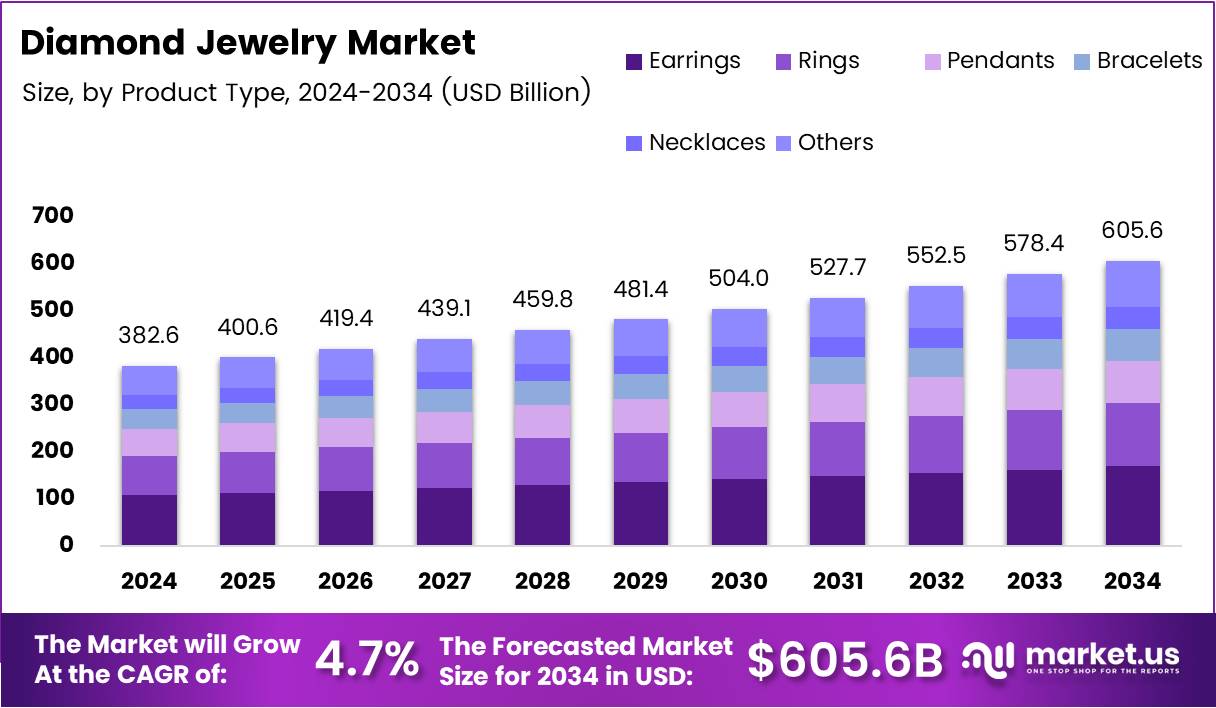

The Global Diamond Jewelry Market size is expected to be worth around USD 605.6 Billion by 2034, from USD 382.6 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

The Diamond Jewelry Market is a segment within the broader luxury goods industry, driven by evolving consumer preferences and high emotional value. Known for symbolizing love, status, and tradition, diamond jewelry continues to attract attention from millennials and Gen Z. The rise in ethical sourcing and lab-grown alternatives has also reshaped this market.

The market has witnessed steady demand for engagement rings and high-end pieces. According to Brides, the average diamond carat weight for an engagement ring in the U.S. is about 1 carat, indicating continued consumer interest in classic, moderate-sized stones. This reflects purchasing patterns rooted in tradition and budget consciousness.

In recent years, lab-grown diamonds have surged in popularity. As reported by revediamonds, they are typically 30-40% cheaper than natural diamonds. This cost advantage appeals especially to younger buyers who prioritize both sustainability and value. As a result, lab-grown options are expanding the market’s customer base.

Meanwhile, luxury diamond jewelry continues to perform well. According to fox10tv, sales of high-end diamond jewelry in the U.S. remain strong in 2025, with overall jewelry sales increasing by 5.2%. This highlights consistent demand despite economic shifts and inflationary pressures.

Government involvement in regulating gemstone sourcing and trade compliance is increasing. Countries are focusing on ethical sourcing, traceability, and import/export duties, which impacts market entry strategies. These regulations aim to ensure transparency, boosting consumer confidence and promoting long-term sustainability in the diamond supply chain.

Investments in mining innovation, blockchain-based tracking, and synthetic diamond production are accelerating. Public and private sectors are collaborating to drive local manufacturing and reduce dependency on foreign supply chains. This move supports job creation and value chain efficiency in key regions such as India, the U.S., and Africa.

Consumer behavior is also shifting toward personalized and custom-designed jewelry. As disposable income rises, especially in emerging markets, customers are willing to invest more in meaningful and unique pieces. This change is opening opportunities for D2C (direct-to-consumer) diamond jewelry brands and online retailers.

The rise of omnichannel retailing has further pushed growth. Brands that blend digital convenience with offline luxury experiences are seeing improved conversions. Augmented reality (AR) and AI are being used to personalize buyer journeys, making the diamond jewelry shopping process more interactive and engaging.

Key Takeaways

- The Global Diamond Jewelry Market is projected to reach USD 605.6 Billion by 2034, growing from USD 382.6 Billion in 2024 at a CAGR of 4.7%.

- In 2024, Earrings led the product segment with a 43.2% market share, driven by their versatility and widespread demand.

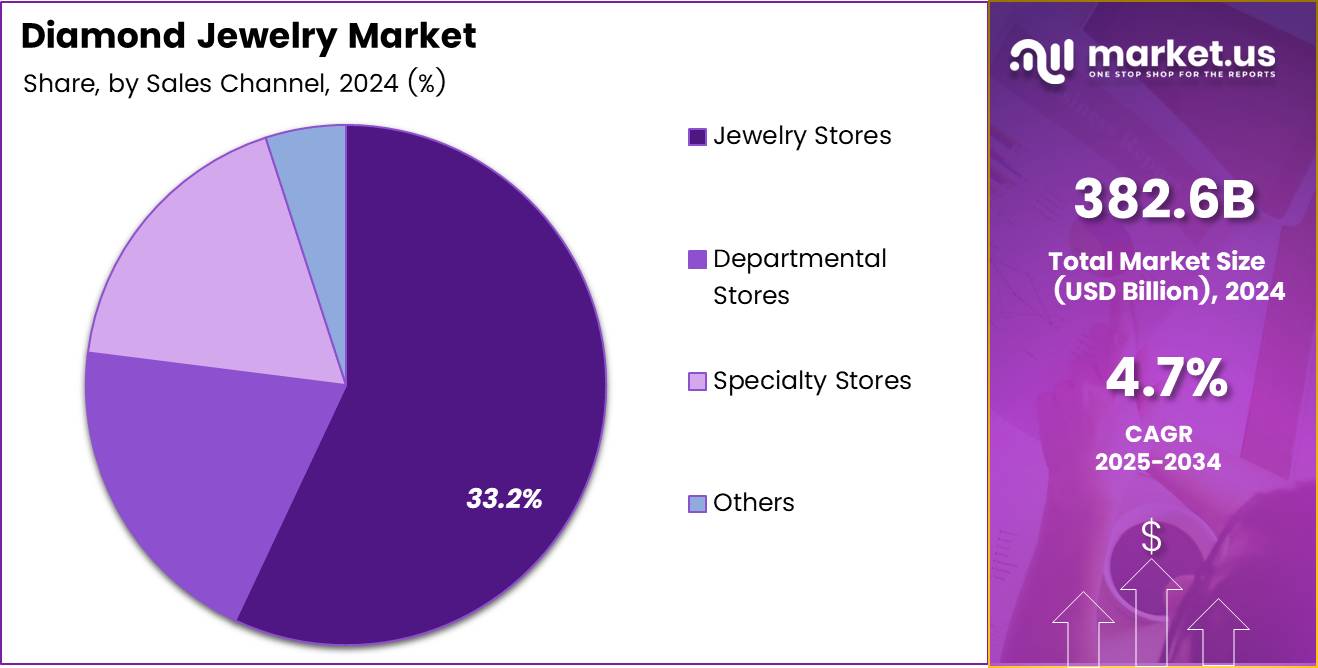

- Jewelry Stores dominated the sales channel in 2024 with a 33.2% share, supported by in-store experiences and customer trust.

- Women were the largest end-user group in 2024, holding a 61.3% share, influenced by cultural norms and self-purchasing trends.

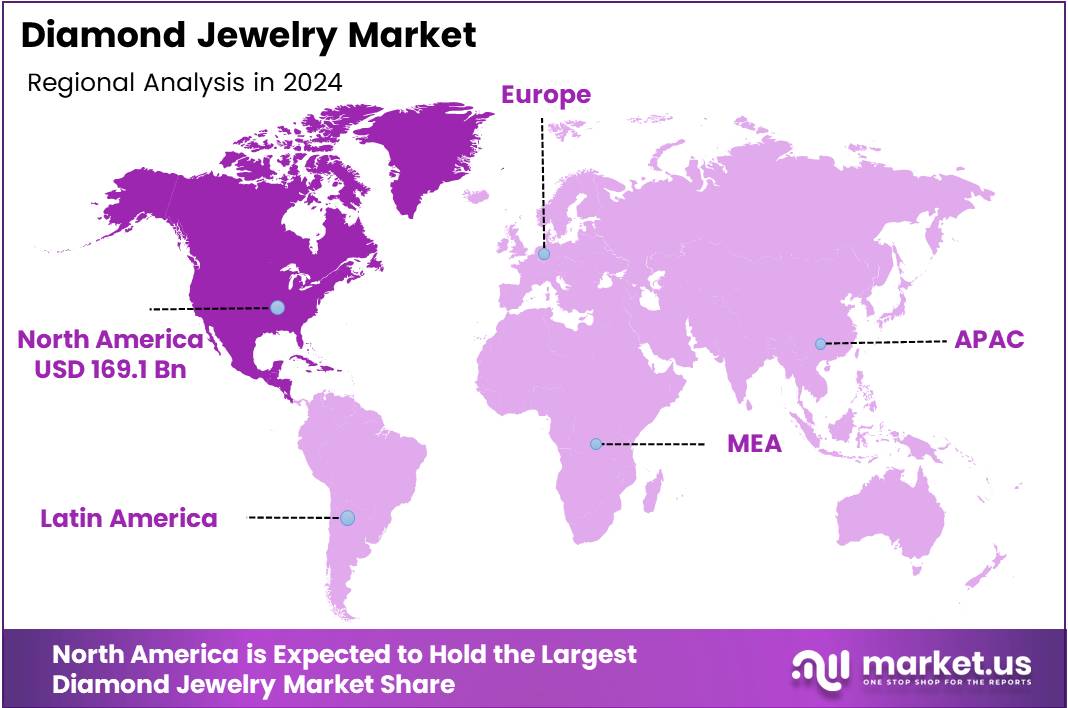

- North America led the regional market with a 44.2% share valued at USD 169.1 Billion, driven by high consumer spending and demand for luxury goods.

Product Type Analysis

Earrings lead with 43.2% share, reflecting their popularity in daily and occasional wear.

In 2024, Earrings held a dominant market position in the By Product Type Analysis segment of the Diamond Jewelry Market, with a 43.2% share. This dominance is largely attributed to their versatility and high demand across age groups and regions, especially for gifting and fashion purposes.

Rings followed closely behind, maintaining significant popularity due to their symbolic value in engagements and weddings. Pendants continued to hold consumer interest as lightweight, everyday options.

Bracelets and Necklaces also showed a steady performance in the market, often marketed as statement pieces. Meanwhile, the ‘Others’ category encompassed a niche segment that includes innovative and custom-made jewelry, which caters to specific buyer preferences and emerging trends.

Sales Channel Analysis

Jewelry Stores top with 33.2% share, proving their trusted role in luxury shopping.

In 2024, Jewelry Stores held a dominant market position in the By Sales Channel Analysis segment of the Diamond Jewelry Market, with a 33.2% share. Their continued success is driven by the in-store experience, trust in authenticity, and personalized customer service.

Departmental Stores also held a notable share, benefiting from their accessibility and product variety. Specialty Stores carved out a loyal customer base with tailored collections and design exclusivity.

The ‘Others’ category includes online platforms and pop-up exhibitions, which are increasingly tapping into digitally savvy consumers. However, traditional jewelry stores remained the cornerstone of consumer trust and brand loyalty in the diamond jewelry sector.

End-User Analysis

Women dominate with 61.3% share, underscoring their influence in diamond jewelry purchases.

In 2024, Women held a dominant market position in the By End-User Analysis segment of the Diamond Jewelry Market, with a 61.3% share. This dominance is reflective of long-standing cultural preferences and rising self-purchasing behavior among women.

Men also comprised a growing segment, especially with increased marketing of minimalist and premium designs tailored to male buyers. Jewelry marketed as Unisex is gaining traction, appealing to contemporary trends and evolving gender norms.

Nonetheless, women continue to shape the bulk of the diamond jewelry market through both personal purchases and as recipients in major gifting categories, maintaining their position as the primary consumer group.

Key Market Segments

By Product Type

- Earrings

- Rings

- Pendants

- Bracelets

- Necklaces

- Others

By Sales Channel

- Jewelry Stores

- Departmental Stores

- Specialty Stores

- Others

By End-User

- Women

- Men

- Unisex

Drivers

Increasing Demand for Customized and Bespoke Diamond Jewelry Drives Market Growth

More customers are now seeking diamond jewelry that feels personal and unique. This trend is pushing the market forward, as brands offer made-to-order or personalized pieces. Consumers want jewelry that reflects their individual style, and this demand has opened new revenue streams for manufacturers and retailers.

Online platforms have made it easier for customers to design and order custom diamond pieces from the comfort of their homes. This has further boosted the popularity of bespoke jewelry. Many luxury brands now include online design tools to help customers visualize their unique creations.

Additionally, the rise in middle-class income, especially in emerging economies, has made diamond jewelry more accessible. Consumers with growing disposable income are now willing to invest in fine jewelry, especially if it’s tailored to their tastes.

Collaborations between diamond jewelry brands and social media influencers are also shaping this market. Influencers promote personalized jewelry lines, drawing in younger buyers who value exclusivity and trendiness. These collaborations often highlight custom-made designs that appeal to niche markets.

Restraints

Fluctuating Raw Diamond Prices Affecting Production Costs

One major restraint in the diamond jewelry market is the unstable cost of raw diamonds. Prices can vary due to changes in mining operations, global supply chain issues, and geopolitical tensions. These fluctuations increase production costs and impact profitability for manufacturers.

Another concern is the ongoing issue of conflict diamonds. Regulatory bodies and consumers alike are demanding transparency about the source of diamonds. Jewelry brands are facing pressure to ensure ethical sourcing, which can raise costs and complicate supply chains.

Lab-grown diamonds are also affecting the market. These alternatives are cheaper and appeal to cost-conscious customers. While natural diamonds still dominate in luxury segments, lab-grown options are taking over price-sensitive markets, posing a threat to traditional sales.

Lastly, many rural and underserved areas lack access to high-end retail outlets. This limited availability hinders market expansion, especially in regions with untapped potential. Without strong distribution networks, brands miss out on valuable customer bases.

Growth Factors

Penetration into Untapped Emerging Markets in Africa and Southeast Asia Drives Growth Opportunities

Emerging markets in Africa and Southeast Asia offer fresh growth opportunities for the diamond jewelry industry. These regions have growing populations, rising middle-class incomes, and a deep cultural connection to jewelry, making them ideal for expansion.

To attract new customers, many brands are adopting digital tools like augmented reality (AR). Virtual try-on experiences allow users to see how a piece looks on them before buying. This enhances online shopping and reduces return rates, making it easier to serve global audiences.

Another major opportunity lies in offering sustainable and ethical diamond jewelry. Consumers—especially younger ones—are showing interest in products that are responsibly sourced and environmentally friendly. Brands that focus on sustainability can build strong reputations and customer loyalty.

Men’s diamond jewelry and gender-neutral collections are also on the rise. As fashion becomes more inclusive, demand for non-traditional designs is growing. Offering a wider variety of styles opens new customer segments, helping brands stand out in a crowded market.

Emerging Trends

Surge in Celebrity-Endorsed Diamond Jewelry Collections Boosts Market Trends

Celebrity influence plays a big role in shaping diamond jewelry trends. When famous personalities wear specific pieces or endorse collections, fans often follow. These endorsements create hype and drive sales, especially among younger buyers.

Vintage and heirloom-inspired designs are gaining popularity as consumers seek timeless elegance. These styles are seen as both fashionable and meaningful, which makes them appealing for gifts and special occasions. The trend is helping to revive classic craftsmanship in modern settings.

Technology is also reshaping the market. Blockchain is being used to ensure the authenticity and traceability of diamonds. This builds consumer trust and supports ethical sourcing efforts, which are increasingly important to informed buyers.

Lastly, pop culture, movies, and TV shows heavily influence what styles are in.” Media exposure can quickly make certain designs trendy, pushing jewelry brands to stay agile and responsive. Monitoring these trends helps businesses stay relevant and capture the attention of trend-conscious consumers.”

Regional Analysis

North America Dominates the Diamond Jewelry Market with a Market Share of 44.2%, Valued at USD 169.1 Billion

North America leads the global diamond jewelry market, accounting for a significant 44.2% market share and valued at USD 169.1 Billion. This dominance is driven by high consumer spending, a strong retail infrastructure, and a cultural preference for luxury goods. Additionally, increasing demand for custom and branded jewelry further propels market growth in this region.

Europe Diamond Jewelry Market Trends

Europe follows as a key region in the diamond jewelry market, benefiting from a strong tradition of fine craftsmanship and luxury branding. Demand remains steady due to a mature consumer base and significant tourist spending in major cities. Sustainability and ethical sourcing are also becoming important drivers of consumer behavior in this region.

Asia Pacific Diamond Jewelry Market Trends

Asia Pacific is witnessing rapid growth in the diamond jewelry sector due to rising disposable income, urbanization, and a growing affinity for luxury products, especially in countries like China and India. Younger consumers are increasingly inclined toward premium and customized jewelry, fueling market expansion across the region.

Middle East and Africa Diamond Jewelry Market Trends

The Middle East and Africa represent a lucrative market, supported by a strong cultural association with gold and diamond ornaments. High-net-worth individuals, particularly in the Gulf countries, drive demand for high-end diamond jewelry. The region also benefits from tax-free zones and large-scale retail hubs.

Latin America Diamond Jewelry Market Trends

In Latin America, the diamond jewelry market is gradually expanding, fueled by economic recovery and an emerging middle class. Brazil and Mexico serve as major contributors to regional growth, with consumers showing increased interest in luxury and designer jewelry products. Market players are focusing on enhancing retail experiences to capture new demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Diamond Jewelry Company Insights

In 2024, the global diamond jewelry market is being shaped by key players leveraging heritage, innovation, and evolving consumer preferences. Tiffany & Co. continues to dominate the luxury segment with its strong brand identity and innovative campaigns, especially targeting younger demographics through sustainability-focused collections and digital engagement. Their legacy in design excellence further bolsters customer loyalty in high-end markets.

Bulgari S.p.A. remains a powerful force in combining Italian craftsmanship with bold, luxurious designs. The brand benefits from its association with high fashion and cinematic glamour, helping it maintain strong sales momentum in both Western and Asian markets. Their retail strategy also emphasizes exclusivity and high personalization.

Cartier, under the Richemont Group, leverages its iconic status and strong heritage to maintain a solid global footprint. Its strategic focus on limited-edition collections and celebrity endorsements keeps the brand aspirational. Cartier’s expansion in Asia, particularly China, has bolstered its performance despite economic fluctuations.

Signet Jewelers, the largest retailer of diamond jewelry in the U.S., focuses on mass-market appeal through brands like Kay and Zales. Its strength lies in omnichannel retailing and value-driven offerings, appealing to a wide range of customers. Signet’s strategic investments in digital transformation and AI-driven customer engagement continue to support its growth.

These players reflect the spectrum of strategies in the diamond jewelry market—from ultra-luxury exclusivity to mass-market accessibility—each playing a crucial role in shaping industry dynamics in 2024.

Top Key Players in the Market

- Tiffany & Co.

- Bulgari S.p.A.

- Cartier

- Signet Jewelers

- De Beers plc

- Pandora Jewellery, LLC

- Chow Tai Fook Jewellery Group Limited

- Swarovski AG

- Petra Diamonds Limited

- Trans Hex Group

Recent Developments

- In Apr 2025, Sasha Primak, a renowned luxury jewelry house from New York, strategically acquired the Ada Diamonds brand. This acquisition enhances its market position and expands its reach in the lab-grown diamond segment.

- In Apr 2024, jewelry company Pascal, founded by serial entrepreneur Adam Hua, has raised nearly $10 million in funding. Since its inception in 2021, the brand has attracted significant investor interest for its innovative designs.

- In Jul 2024, Darry Ring formed a partnership with the Natural Diamond Council to launch a new ring collection. These rings feature natural diamonds, symbolizing true love and emotional authenticity.

Report Scope

Report Features Description Market Value (2024) USD 382.6 Billion Forecast Revenue (2034) USD 605.6 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Earrings, Rings, Pendants, Bracelets, Necklaces, Others), By Sales Channel (Jewelry Stores, Departmental Stores, Specialty Stores, Others), By End-User (Women, Men, Unisex) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Tiffany & Co., Bulgari S.p.A., Cartier, Signet Jewelers, De Beers plc, Pandora Jewellery, LLC, Chow Tai Fook Jewellery Group Limited, Swarovski AG, Petra Diamonds Limited, Trans Hex Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tiffany & Co.

- Bulgari S.p.A.

- Cartier

- Signet Jewelers

- De Beers plc

- Pandora Jewellery, LLC

- Chow Tai Fook Jewellery Group Limited

- Swarovski AG

- Petra Diamonds Limited

- Trans Hex Group