Diabetes Management Apps Market By Type (Type 1 Diabetes and Type 2 Diabetes), By Functionality (Blood Glucose Monitoring Apps, Exercise & Activity Tracking Apps, Medication Management Apps, Weight & Diet Management Apps, and Others), By Platform (Android and iOS), By Subscription Model (Free and Paid), By End-User (Hospitals, Diagnostic Centers, and Home Settings), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152910

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Type Analysis

- Functionality Analysis

- Platform Analysis

- Subscription Model Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

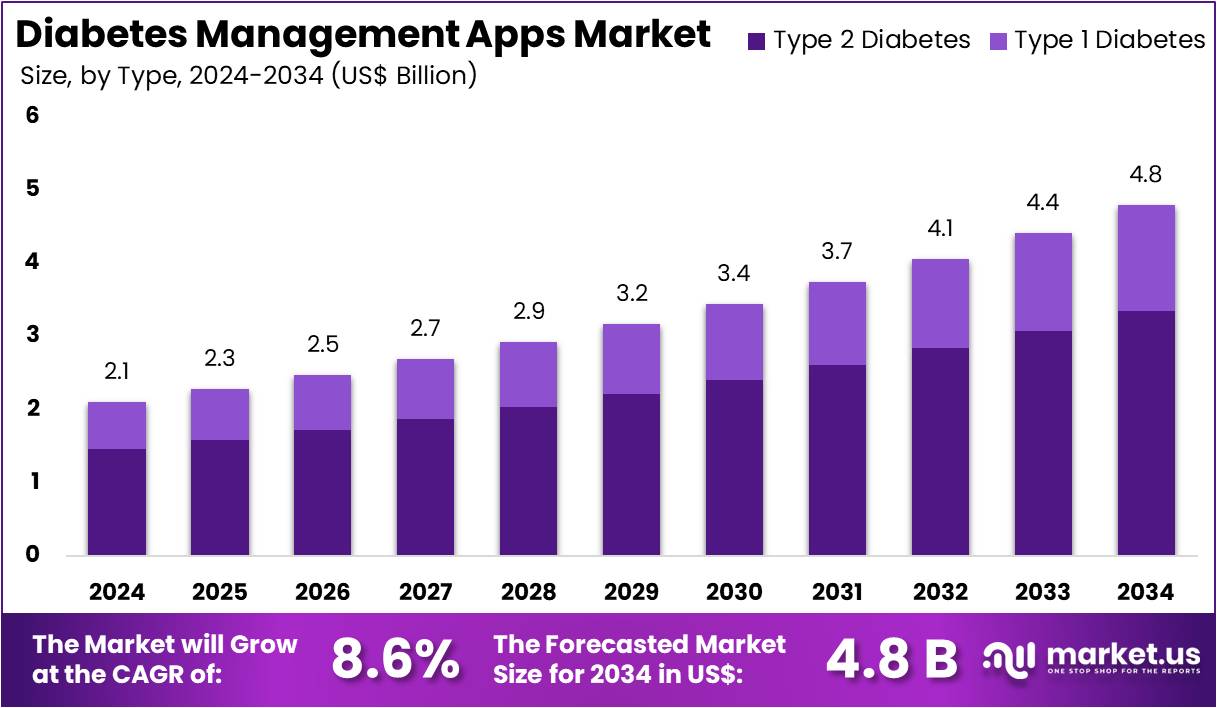

The Diabetes Management Apps Market size is expected to be worth around US$ 4.8 billion by 2034 from US$ 2.1 billion in 2024, growing at a CAGR of 8.6% during the forecast period 2025 to 2034.

Rising global prevalence of diabetes and the growing shift toward digital health solutions are driving the expansion of the diabetes management apps market. Diabetes, a chronic condition affecting millions of people worldwide, requires constant monitoring of blood glucose levels, diet, exercise, and medication. Diabetes management apps provide users with a comprehensive platform to track their health, set reminders for medication, and analyze patterns in their glucose levels to optimize their treatment plans.

The increasing adoption of smartphones and wearable health devices has made these apps more accessible, enabling patients to manage their condition in real-time. According to the International Diabetes Federation (IDF), approximately 32.2 million individuals in the US were living with diabetes in 2024, with projections indicating that this figure will reach 34.7 million by 2030. As the number of diabetes cases continues to rise, so does the demand for effective self-management tools that improve patient outcomes.

Recent trends highlight the integration of artificial intelligence and machine learning into diabetes management apps, allowing for personalized recommendations based on individual health data. These apps are increasingly offering features such as meal planning, exercise tracking, and medication adherence, creating a holistic approach to diabetes care.

Additionally, integration with cloud-based platforms and healthcare systems is enhancing the ability to share data with healthcare providers for more informed decision-making. The growing interest in remote healthcare and telemedicine also presents significant opportunities for further market growth. As healthcare systems continue to embrace digital transformation, diabetes management apps are poised to play a critical role in improving the quality of life for millions of individuals managing diabetes.

Key Takeaways

- In 2024, the market for Diabetes Management Apps generated a revenue of US$ 2.1 billion, with a CAGR of 8.6%, and is expected to reach US$ 4.8 billion by the year 2034.

- The type segment is divided into type 1 diabetes and type 2 diabetes, with type 2 diabetes taking the lead in 2023 with a market share of 69.8%.

- Considering functionality, the market is divided into blood glucose monitoring apps, exercise & activity tracking apps, medication management apps, weight & diet management apps, and others. Among these, blood glucose monitoring apps held a significant share of 40.5%.

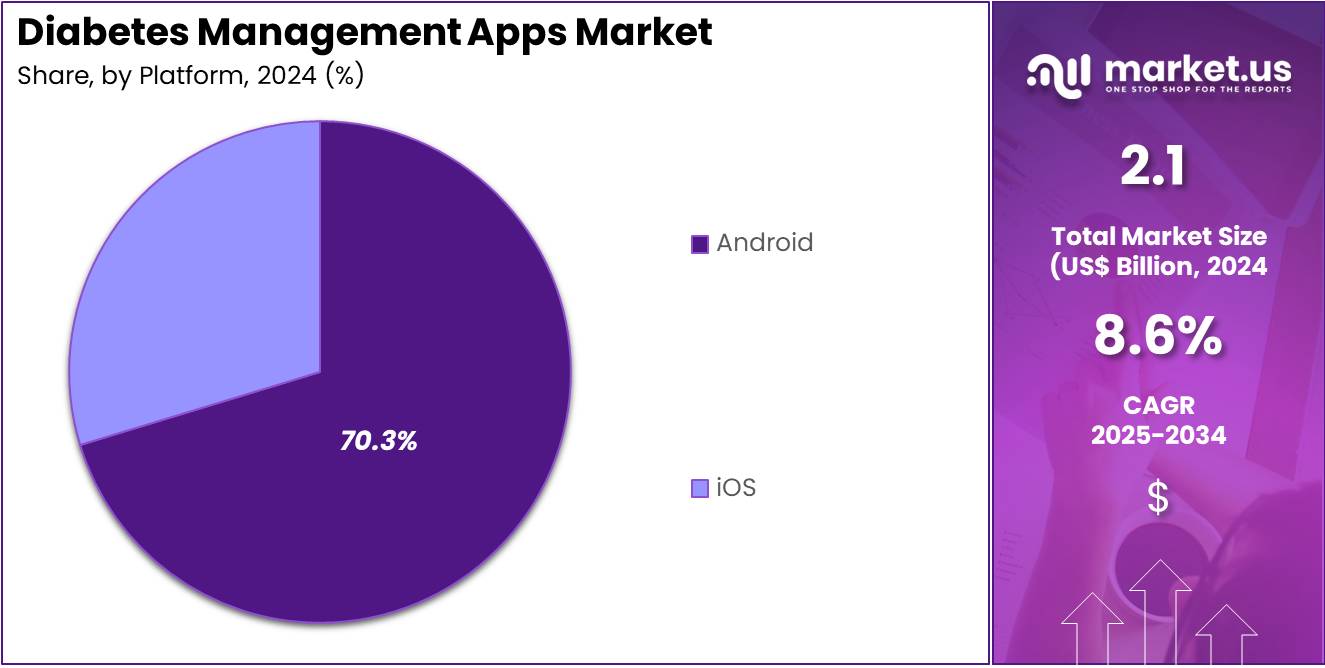

- Furthermore, concerning the platform segment, the market is segregated into android and ios. The android sector stands out as the dominant player, holding the largest revenue share of 70.3% in the Diabetes Management Apps market.

- The subscription model segment is segregated into free and paid, with the paid segment leading the market, holding a revenue share of 58.4%.

- Considering end-user, the market is divided into hospitals, diagnostic centers, and home settings. Among these, hospitals held a significant share of 50.1%.

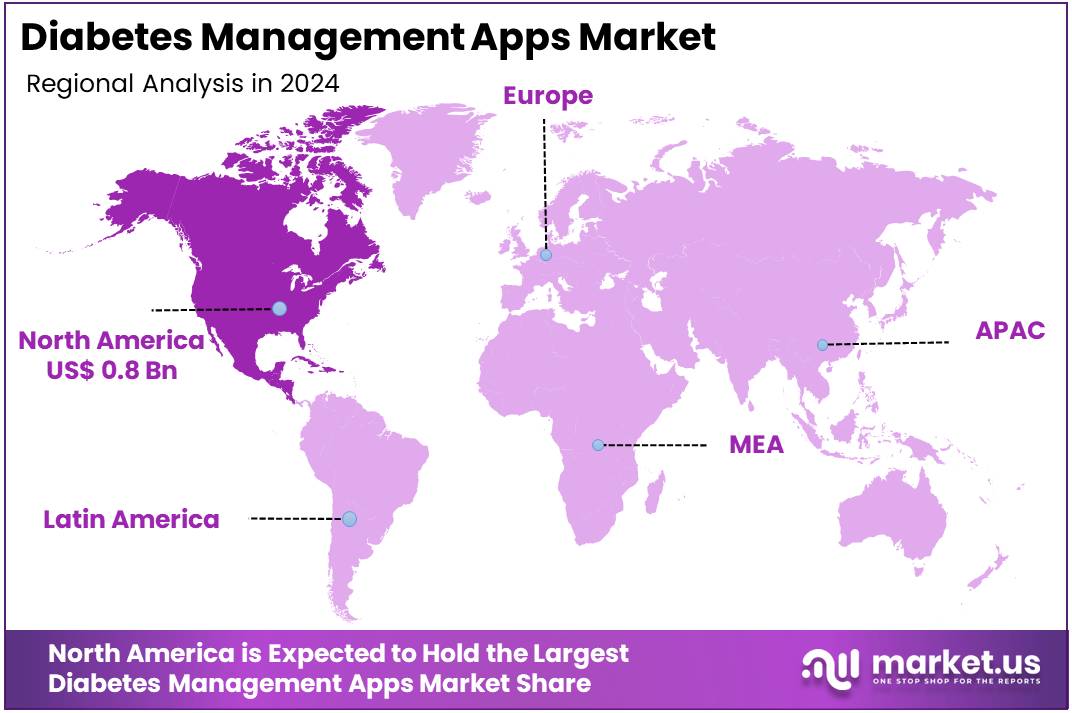

- North America led the market by securing a market share of 38.6% in 2023.

Type Analysis

Type 2 diabetes holds a dominant share of 69.8% in the diabetes management apps market. This segment’s growth is expected to continue as the global prevalence of type 2 diabetes increases due to rising obesity rates, unhealthy diets, and sedentary lifestyles. The increasing awareness of the need for effective management of type 2 diabetes is anticipated to drive demand for mobile health solutions.

Diabetes management apps for type 2 diabetes are projected to offer enhanced functionalities such as real-time blood glucose monitoring, medication reminders, and personalized health tips, which could significantly improve patient adherence to treatment plans.

Furthermore, the growing adoption of telemedicine and remote patient monitoring is likely to fuel the growth of these apps, enabling individuals to manage their condition from home with regular updates to healthcare providers. As more patients and healthcare professionals recognize the benefits of using diabetes management apps, the demand for type 2 diabetes-specific apps is expected to rise, making this segment a key driver in the market.

Functionality Analysis

Blood glucose monitoring apps dominate with 40.5% of the market share. This growth is expected to be driven by the increasing need for precise, real-time tracking of blood sugar levels among diabetes patients. These apps allow individuals with diabetes to monitor their glucose levels continuously and provide alerts for potential highs or lows, which can be critical for avoiding complications. The rising prevalence of diabetes, particularly type 2, and the demand for remote monitoring solutions are anticipated to drive the growth of these apps.

Additionally, advancements in mobile health technology and the integration of glucose meters with smartphones are projected to make these apps even more effective and accessible. Blood glucose monitoring apps are also expected to offer features like data analysis, historical tracking, and integration with wearable devices, which will enhance their value for both patients and healthcare providers. As more individuals embrace mobile health solutions and seek convenient, at-home monitoring tools, the demand for blood glucose monitoring apps is projected to grow significantly.

Platform Analysis

The Android platform holds a dominant share of 70.3% in the diabetes management apps market. This growth is expected to be driven by the widespread use of Android smartphones, particularly in emerging markets where Android devices are often more affordable. The Android operating system’s open-source nature allows for greater flexibility and customization, making it an ideal platform for app developers to create a wide range of diabetes management apps.

Furthermore, the increasing number of Android users, coupled with the availability of a large number of healthcare apps on the Google Play Store, is projected to contribute to the continued dominance of Android in this market. The high penetration of Android smartphones, especially in countries with a growing diabetic population, is anticipated to further boost the adoption of diabetes management apps on this platform. As Android devices continue to dominate global smartphone sales, the demand for Android-based diabetes management apps is expected to remain strong.

Subscription Model Analysis

Paid subscription models dominate with 58.4% of the market share. This growth is expected to be driven by the increasing value placed on premium features offered by paid apps, such as advanced tracking, personalized health recommendations, and integration with healthcare providers. Users of paid diabetes management apps often seek additional functionalities, such as detailed analytics, customizable reports, and enhanced data privacy and security.

As patients and healthcare professionals increasingly rely on these apps to manage chronic conditions like diabetes, the demand for comprehensive, feature-rich paid apps is expected to rise. The willingness of users to pay for these services reflects the growing recognition of the benefits of digital health tools in managing long-term health conditions. Moreover, healthcare systems and insurance providers are anticipated to support paid app models as part of preventive healthcare strategies, providing further opportunities for growth in this segment.

End-User Analysis

Hospitals represent the largest end-user segment in the diabetes management apps market, with 50.1% of the market share. This growth is expected to continue as hospitals increasingly adopt digital health solutions to manage patient care and improve outcomes for individuals with diabetes. Hospitals are particularly focused on the integration of diabetes management apps into their broader patient care systems, allowing for continuous monitoring and more efficient treatment plans.

The ability of these apps to track patient data in real-time, send alerts to healthcare providers, and integrate with electronic health records (EHRs) is anticipated to drive further adoption. Additionally, the growing recognition of the importance of digital tools in managing chronic diseases like diabetes is likely to lead to more hospitals incorporating these apps into their clinical workflows. As healthcare systems continue to invest in digital transformation and patient-centered care, the demand for diabetes management apps in hospitals is expected to remain strong, supporting the ongoing growth of this segment.

Key Market Segments

By Type

- Type 1 Diabetes

- Type 2 Diabetes

By Functionality

- Blood Glucose Monitoring Apps

- Exercise & Activity Tracking Apps

- Medication Management Apps

- Weight & Diet Management Apps

- Others

By Platform

- Android

- iOS

By Subscription Model

- Free

- Paid

By End-User

- Hospitals

- Diagnostic Centers

- Home Settings

Drivers

Rising Prevalence of Diabetes and Need for Continuous Monitoring is Driving the Market

The escalating global prevalence of diabetes, coupled with the critical need for continuous monitoring and proactive management, is a significant driver propelling the diabetes management apps market. Diabetes is a chronic condition that requires constant attention to blood glucose levels, medication adherence, diet, and physical activity.

Traditional management methods often rely on episodic care and infrequent in-person visits, which are insufficient for effective long-term disease control. Apps provide a convenient and accessible platform for real-time tracking, personalized insights, and timely interventions, empowering patients to take an active role in their care. The Centers for Disease Control and Prevention (CDC) continuously reports on the prevalence of diabetes in the US.

According to the CDC’s National Diabetes Statistics Report 2024, in 2021, 38.4 million Americans, or 11.6% of the population, had diabetes. Additionally, an estimated 97.6 million Americans aged 18 and older had prediabetes in 2021, indicating a massive population at risk. This substantial and growing patient base necessitates scalable, user-friendly digital tools to facilitate effective self-management and improve health outcomes, thereby driving significant market expansion for specialized applications.

Restraints

Interoperability Challenges and Data Fragmentation are Restraining the Market

Significant challenges related to the interoperability of diabetes management applications with existing healthcare systems and medical devices pose a considerable restraint on market growth. While many apps collect valuable patient data, a lack of seamless integration with Electronic Health Records (EHRs), continuous glucose monitors (CGMs), and insulin pumps often creates data silos.

Healthcare providers may find it difficult to access comprehensive patient information in real-time, hindering coordinated care and effective decision-making. This fragmentation requires manual data entry by patients or clinicians, increasing the risk of errors and adding to the administrative burden. A November 2024 article discussing health IT interoperability noted that while progress is being made, achieving seamless data exchange remains a major hurdle.

Furthermore, compatibility issues between different devices and platforms can frustrate users and clinicians. The American Diabetes Association (ADA) has emphasized the importance of integrated data for comprehensive diabetes care, highlighting the need for systems that can communicate effectively. The ongoing difficulties in achieving true interoperability limit the widespread adoption of these applications, as the potential benefits are diminished by the inefficiency of fragmented data management.

Opportunities

Integration of AI-Driven Personalized Insights and Behavioral Coaching is Creating Growth Opportunities

The integration of Artificial Intelligence (AI) for delivering highly personalized insights and AI-driven behavioral coaching within diabetes management apps is creating significant growth opportunities in the market. AI algorithms analyze complex data from various sources, including user input, wearable sensors, and clinical records, to predict blood glucose trends, suggest optimal insulin doses, and provide customized dietary and exercise recommendations. This moves the apps beyond simple tracking to active, predictive management tools.

The American Diabetes Association (ADA) has acknowledged the potential of digital health tools in improving patient outcomes. In its 2024 Standards of Care in Diabetes, the ADA emphasizes the role of technology, noting that “digital health solutions can provide individualized guidance and feedback on lifestyle modifications.”

By leveraging AI, apps can offer highly engaging behavioral coaching, such as gamified challenges or personalized goal setting, which has been shown to improve adherence to treatment plans. A key player in the market, Google Health, announced in May 2024 a new AI initiative focused on chronic disease management, highlighting the industry’s shift towards utilizing advanced analytics for personalized care. This focus on intelligent, personalized interventions enhances the apps’ effectiveness in managing a complex condition, driving increased adoption and market expansion.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic shifts, including inflation and government budget allocations for healthcare, influence the diabetes management apps market by affecting consumer access and investment in digital health solutions. Economic stability generally correlates with higher disposable income, enabling individuals to afford smartphones, data plans, and premium app subscriptions.

Conversely, economic downturns can reduce consumer spending on digital health tools, potentially shifting demand toward free versions or delaying adoption. Furthermore, national healthcare spending dynamics play a crucial role. According to the World Bank data on global health expenditure, total healthcare expenditure as a percentage of GDP varies significantly across countries, impacting the resources available for digital health initiatives.

While inflation can increase the operational costs for app developers, particularly for cloud hosting and development talent, the rising cost of diabetes care itself incentivizes healthcare systems to adopt digital tools. These apps offer a cost-effective solution for managing chronic conditions and reducing hospitalizations, fostering continued investment in the market even during periods of economic uncertainty.

Evolving US trade policies, including the implementation of tariffs on technology imports, are shaping the diabetes management apps market by influencing the costs of IT infrastructure and the development of connected medical devices. Diabetes management apps rely on a robust digital infrastructure, including servers, networking equipment, and specialized components for integration with wearables like CGMs. Tariffs on imported hardware can increase the operational costs for developers and cloud service providers, potentially leading to higher prices for digital solutions.

A May 2025 analysis by AAMC noted that while tariffs on medical supplies and devices are a concern, US trade policies also impact the broader IT supply chain, affecting the costs of digital transformation in healthcare. However, these policies also encourage a greater focus on domestic supply chain resilience and data security. The emphasis on securing sensitive health data, driven by regulatory frameworks, strengthens the overall trustworthiness of the digital ecosystem. While tariffs present a financial challenge, the market’s trajectory toward secure, integrated, and domestically resilient digital health platforms remains positive.

Latest Trends

Rise of Prescription Digital Therapeutics and FDA Approvals is a Recent Trend

A prominent recent trend significantly impacting the diabetes management apps market in 2024 and continuing into 2025 is the rise of prescription digital therapeutics (PDTs) and the increasing number of FDA approvals for integrated digital solutions.

Historically, diabetes apps were primarily wellness tools; however, a growing number of platforms are now undergoing rigorous clinical trials and seeking regulatory approval as medical devices. This trend validates the efficacy of these apps in improving clinical outcomes and allows them to be prescribed by healthcare providers and potentially reimbursed by insurers. The US Food and Drug Administration (FDA) has played a crucial role in this shift by establishing clearer pathways for the approval of digital health technologies.

For instance, in 2024, the FDA granted several clearances for software used in conjunction with medical devices. A June 2024 Pharmacy Times report highlighted the FDA clearance of two new over-the-counter Continuous Glucose Monitoring (CGM) systems, Lingo and Libre Rio, for general consumers and certain adults with Type 2 diabetes, accelerating the commercial distribution of integrated digital solutions. This regulatory validation is boosting credibility, expanding access, and driving a shift towards integrated digital platforms that are recognized as legitimate components of diabetes treatment.

Regional Analysis

North America is leading the Diabetes Management Apps Market

North America dominated the market with the highest revenue share of 38.6% owing to the rising prevalence of diabetes and a widespread shift toward personalized, remote patient monitoring solutions. Healthcare providers and patients are increasingly adopting digital tools to facilitate continuous glucose monitoring (CGM), enhance adherence to treatment plans, and improve overall health outcomes.

The Centers for Disease Control and Prevention (CDC) highlights the persistent health challenge, with the American Diabetes Association reporting that in 2021, 38.4 million Americans had diabetes, representing 11.6% of the population. The economic burden of this condition is significant, with the ADA estimating the total cost of diagnosed diabetes in the US at US$ 412.9 billion in 2022. This high cost drives demand for efficient management technologies.

Key market players have demonstrated significant growth in their digital diabetes portfolios. Dexcom, for example, reported full-year 2024 revenue of US$ 4.033 billion, an 11% increase over 2023, supported by strong US revenue growth of 10%, reflecting increased adoption of their CGM systems integrated with management applications.

Similarly, Abbott’s Diabetes Care sales totaled US $6.4 billion in 2024, a notable increase from US $5.3 billion in 2023, largely due to the success of their connected FreeStyle Libre products. The market’s growth reflects a strong response to the need for advanced, user-friendly digital tools that enable proactive disease management and reduce healthcare costs.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is projected to register the fastest CAGR in the digital diabetes management market. The region’s large population, rising smartphone penetration, and high diabetes burden are key drivers. According to the 2023 ICMR-INDIAB study, India alone had 10.1 crore (101 million) diabetes cases. This underscores the urgent need for effective management tools. Governments are actively pushing digital health strategies to improve care, particularly for chronic diseases. This is creating a favorable environment for mobile apps and connected devices for diabetes tracking and lifestyle management.

Key companies are capitalizing on this growing demand. Dexcom reported that its international revenue, including Asia Pacific operations, rose by 27% year-on-year in Q4 2023. The total reached approximately US$ 265 million, showing strong momentum in digital diabetes technology. This trend reflects increased demand for continuous glucose monitors and data-driven platforms. These tools are becoming essential as patients and providers seek real-time monitoring and improved glycemic control. Market expansion is supported by rising adoption in both urban and semi-urban regions.

Abbott’s Established Pharmaceuticals segment also demonstrated robust growth in Asia Pacific. Organic sales in key emerging markets rose by 15.4% in Q1 2024. This supports the broader distribution of medications and possibly digital services. As healthcare infrastructure strengthens, digital literacy also improves. More patients are expected to use mobile platforms to monitor their condition and connect with care providers. The market outlook remains positive as regional governments and healthcare systems embrace digital tools for chronic disease management.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the diabetes management app market employ various strategies to drive growth and enhance user engagement. They focus on integrating advanced technologies such as artificial intelligence and machine learning to offer personalized health interventions and predictive analytics. Companies also expand their service offerings to include chronic disease management, mental health support, and wellness programs, thereby catering to a broader user base.

Strategic partnerships with healthcare providers, insurers, and technology firms enable these companies to enhance their service offerings and expand market reach. Additionally, they invest in user-friendly interfaces and mobile applications to improve accessibility and user experience. Geographical expansion, particularly in emerging markets, further contributes to their growth trajectory.

One key player, Omada Health, is a digital health startup specializing in chronic condition management. Founded in 2011, Omada initially focused on prediabetes but has since expanded into weight and metabolic care, notably benefiting from demand tied to GLP-1 drugs. The company went public in June 2025 with a $1.1 billion valuation. Omada’s approach combines behavioral science with digital tools to deliver personalized care, aiming to improve health outcomes and reduce healthcare costs.

Top Key Players in the Diabetes Management Apps Market

- Tandem Diabetes Care

- Medtronic

- Insulet Corporation

- Glooko, Inc.

- Hoffmann-La Roche Ltd

- Dexcom, Inc

- DarioHealth Corp.

- Abbott

Recent Developments

- In November 2024: Medtronic received FDA clearance for its InPen app, which now includes a feature for detecting missed meal doses. This enhancement is expected to pave the way for the introduction of its Smart MDI system, which will integrate with the Simplera continuous glucose monitor (CGM).

- In January 2024: Abbott and Tandem Diabetes Care, Inc. announced that the t:slim X2 insulin pump with Control-IQ technology is now compatible with Abbott’s FreeStyle Libre 2 Plus sensor. This integration provides users in the US with the benefits of a hybrid closed-loop system, which helps in managing and preventing both high and low blood sugar levels.

Report Scope

Report Features Description Market Value (2024) US$ 2.1 billion Forecast Revenue (2034) US$ 4.8 billion CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Type 1 Diabetes and Type 2 Diabetes), By Functionality (Blood Glucose Monitoring Apps, Exercise & Activity Tracking Apps, Medication Management Apps, Weight & Diet Management Apps, and Others), By Platform (Android and iOS), By Subscription Model (Free and Paid), By End-User (Hospitals, Diagnostic Centers, and Home Settings) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tandem Diabetes Care, Medtronic, Insulet Corporation, Glooko, Inc., F. Hoffmann-La Roche Ltd, Dexcom, Inc, DarioHealth Corp., Abbott Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Diabetes Management Apps MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Diabetes Management Apps MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tandem Diabetes Care

- Medtronic

- Insulet Corporation

- Glooko, Inc.

- Hoffmann-La Roche Ltd

- Dexcom, Inc

- DarioHealth Corp.

- Abbott