Global Bipolar Forceps Market by Type (Smart Bipolar Forceps, Common Bipolar Forceps and Others), By End-Use (Surge Protection, Fuse-based Protection and Other End-Uses), By Application (Household, Commercial and Industrial) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 20903

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

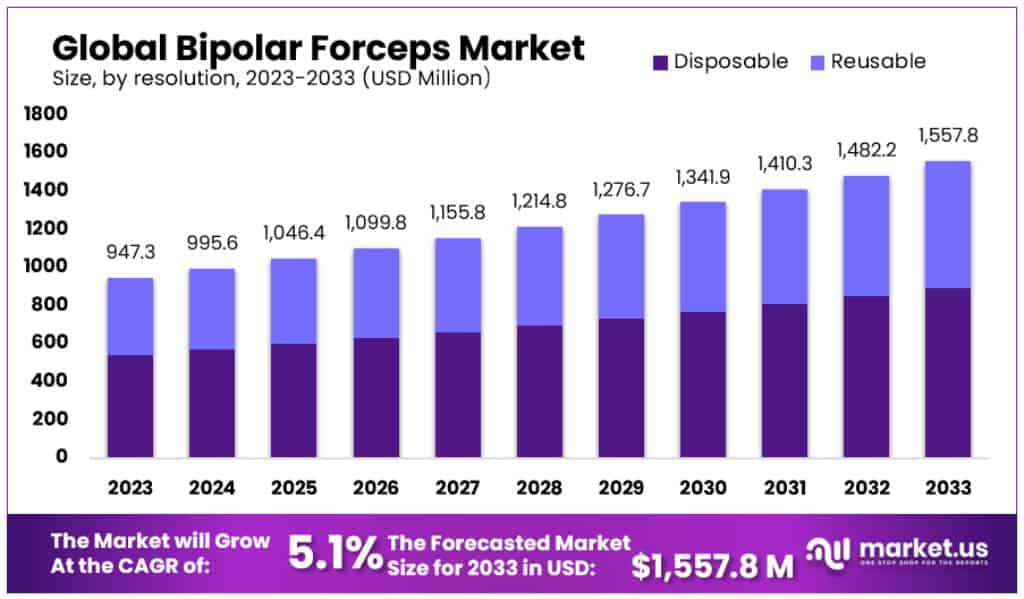

The Global Bipolar Forceps Market size is expected to be worth around USD 1557.8 Million by 2033, from USD 947.3 Million in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

Bipolar forceps are surgical instruments used for grasping, coagulating, and dissecting tissue during electrosurgery procedures. They are designed to provide superior control, safety, and surgical efficacy at minimum output power settings.

The growing number of chronic diseases and increasing preference for minimally invasive procedures are major factors that drive the bipolar forceps market.

Key Takeaways

- The Global Bipolar Forceps Market is expected to reach a value of USD 1557.8 Million by 2033.

- In 2023, the market was valued at USD 947.3 Million.

- The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.1% from 2024 to 2033.

- Disposable Bipolar Forceps holds a dominant market share of over 57.3%.

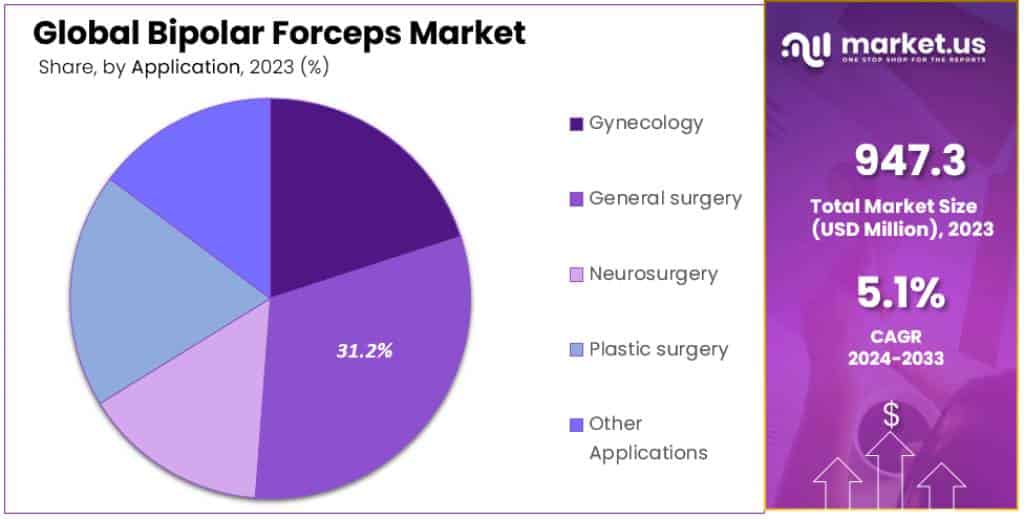

- The General Surgery segment accounts for more than 31.2% of the market.

- Hospitals lead the market with a share of more than 39.9%.

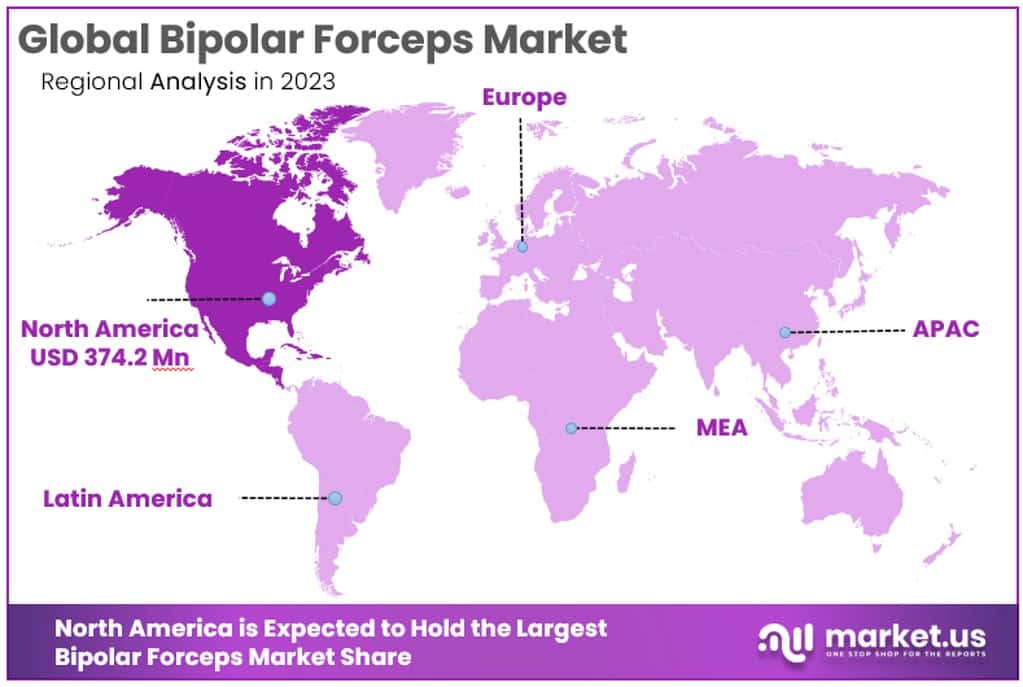

- North America leads the market with a 39.5% share, valued at USD 374.2 Million in 2023.

Type Analysis

In 2023, the Bipolar Forceps market exhibited a distinctive segmentation, primarily categorized into Disposable and Reusable types.

Disposable Bipolar Forceps

Disposable bipolar forceps held a dominant market position, capturing more than a 57.3% share. This segment’s prominence is attributed to several key factors. Firstly, the increased emphasis on hygiene and sterility in medical procedures has significantly boosted the demand for disposable forceps. These single-use instruments reduce the risk of cross-contamination and infection, aligning with stringent safety protocols in healthcare settings.

Additionally, the convenience and cost-effectiveness of disposable bipolar forceps, especially in high-volume settings like emergency rooms and outpatient surgical centers, have contributed to their market dominance. Rapid advancements in material technology have also enabled the production of high-quality disposable forceps, further bolstering their adoption.

Reusable Bipolar Forceps

On the other hand, the reusable segment, while smaller, maintains a steady presence in the market. Reusable bipolar forceps are traditionally favored for their durability and long-term cost efficiency. Made typically from high-grade materials, these forceps can withstand repeated sterilization processes, making them a sustainable choice for medical practices that prioritize long-term investments over immediate cost savings.

However, the need for meticulous cleaning and sterilization protocols slightly hampers the segment’s growth. The ongoing advancements in sterilization technology and the rising emphasis on sustainable medical practices are expected to support the steady growth of this segment.

Application Analysis

In 2023, the Bipolar Forceps market showcased notable segmentation by application, with sectors including Gynecology, General Surgery, Neurosurgery, Plastic Surgery, and Other Applications.

General Surgery

The General Surgery segment held a dominant position in the Bipolar Forceps market, capturing more than a 31.2% share. This segment’s prominence is largely driven by the increasing surgical volume attributed to the rising geriatric population, which is prone to various diseases due to lower immunity levels.

According to United Nations data, regions like Europe and Northern America are witnessing substantial increases in their older populations. The number of people aged 60 years or over in Northern America, for instance, grew from 40 million in 1980 to 78 million in 2017 and is projected to rise further to 104 million by 2030 and 123 million by 2050. This expanding patient base is expected to significantly boost the demand for bipolar forceps in general surgery over the forecast period.

Gynecology

The Gynecology segment is anticipated to exhibit the highest growth rate in the Bipolar Forceps market. This surge is primarily due to the increasing preference for minimally invasive surgeries in gynecological procedures, which result in less postoperative pain and shorter hospital stays.

For instance, the Centers for Disease Control and Prevention reported an estimated 1,208,176 cesarean deliveries in the U.S. in 2018. The advantages of bipolar forceps in such procedures, including precision and reduced bleeding, are key factors driving the segment’s growth.

Neurosurgery, Plastic Surgery, and Other Applications

While the Neurosurgery and Plastic Surgery segments represent smaller shares of the market, they contribute significantly to the overall demand for bipolar forceps. In neurosurgery, the precision and safety offered by bipolar forceps are crucial for delicate brain and spinal surgeries. In plastic surgery, these tools are valued for their ability to minimize tissue damage and scarring. The ‘Other Applications’ category encompasses a range of miscellaneous medical procedures where bipolar forceps are utilized, supporting the market’s diversified nature.

End-Use Analysis

In 2023, the Bipolar Forceps market was distinctly segmented by end-use into Hospitals, Specialty Clinics, and Ambulatory Surgical Centers, each playing a vital role in the market dynamics.

Hospitals

The Hospital segment held a dominant position in the market, capturing more than a 39.9% share. This dominance can be attributed to several key factors. Hospitals are increasingly adopting advanced medical devices and focusing on positive medical outcomes, driven by growing patient awareness. The shift towards minimally invasive procedures in hospitals is a significant contributor to this trend. These procedures reduce post-operative complications often associated with open surgeries, thereby improving patient outcomes and reducing costs.

A study by Johns Hopkins investigators in 2015 revealed that hospitals could save up to USD 300 million annually by preventing post-surgical complications through the adoption of minimally invasive procedures. This economic benefit, combined with improved patient care, solidifies the hospital segment’s leading position in the market.

Ambulatory Surgical Centers

The Ambulatory Surgical Center segment is anticipated to demonstrate the fastest growth rate during the forecast period. This growth is attributed to factors like lower surgical costs and the convenience these centers offer, especially to elderly and disabled populations. The increase in surgical interventions carried out in these settings is significant. According to Medpac estimates in 2019, the number of ASCs increased by 2.4 percent in 2017. The trend towards outpatient surgeries in ASCs, driven by efficiency and cost-effectiveness, is a major factor propelling this segment’s rapid growth.

Specialty Clinics

While the data specifically highlighting the Specialty Clinics segment’s market share in 2023 is not provided, it is important to note that these clinics play a crucial role in the Bipolar Forceps market. Specialty clinics often focus on specific types of surgeries or treatments and may offer more personalized care and specialized procedures, including those requiring bipolar forceps.

As healthcare continues to evolve towards specialized and patient-centric models, specialty clinics are likely to see a steady increase in their role within the market.

Key Market Segments

Type

- Disposable

- Reusable

Application

- Gynecology

- General surgery

- Neurosurgery

- Plastic surgery

- Other Applications

End-use

- Hospitals

- Specialty clinics

- Ambulatory surgical centers

Drivers

- Increasing Chronic Disease Prevalence: Chronic diseases are a major driver, with the CDC 2020 report indicating that 90% of the U.S.’s annual $3.8 trillion healthcare expenditure is linked to chronic and mental health conditions.

- Growth in Minimally Invasive Procedures: The market is buoyed by a global increase in minimally invasive surgeries. These procedures are less traumatic and offer quicker recovery times, enhancing their appeal.

- Advancements in Bipolar Forceps: Investments in R&D for innovative bipolar forceps are catalyzing market growth. Companies are focusing on developing advanced products to meet diverse surgical needs.

Restraints

- Lack of Awareness: In developing countries, limited awareness about advanced surgical devices impedes market growth.

- High Cost of Devices: The elevated cost of advanced bipolar forceps presents a barrier, particularly in less affluent regions.

Opportunities

- Disposable Bipolar Forceps Demand: The disposable segment, including products like Stryker Corporation’s Spetzler-Malis and Integra LifeSciences’s Codman Specialty Surgical range, is expected to see substantial growth. These forceps offer benefits like reduced infection risk and no need for sterilization.

- Regulatory Approvals and Product Launches: Regular introductions of new products and regulatory green lights, such as Erbe Elektromedizin GmbH’s launch of 12 new single-use forceps in 2022, present significant opportunities for market expansion.

Trends

- Growth in the Disposable Segment: Disposable forceps are trending upwards, driven by advantages like no requirement for autoclaving and compatibility with standard electrosurgery units. For instance, Integra LifeSciences reported over 1 million (1,025,232) in annual revenue in 2021 from its ‘CODMAN VersaTru’ range.

- Technological Advancements: Ongoing technological innovations, such as Kirwan Surgical Products LLC’s development of COHEN bipolar forceps in partnership with NREF, are enhancing surgical comfort and efficacy.

- Increased Electrosurgical Unit Adoption: Modern Healthcare reports a rise in electrosurgical unit adoption in hospitals, from 55% in 2014 to 60% in 2015, indicating a trend towards more advanced surgical systems.

Regional Analysis

In 2023, North America continues to lead the bipolar forceps market, holding a commanding 39.5% share, translating to USD 374.2 million. This dominance is largely due to a well-established healthcare infrastructure, the presence of key market players, and higher disposable incomes in the region. Chronic diseases, particularly cardiovascular and neurological disorders, are on the rise in North America.

The American Heart Association noted that over 92.1 million Americans were living with cardiovascular disease as of 2017, a factor that has significantly contributed to an increase in surgical procedures, thereby boosting the demand for bipolar forceps.

The market’s robust performance in North America is also underpinned by the adoption of minimally invasive procedures and the high prevalence of chronic diseases. The Centers for Disease Control and Prevention (CDC) reported in 2022 that six out of ten Americans suffer from at least one chronic disease such as heart disease, cancer, or diabetes. These diseases are not only the leading causes of death and disability in America but also drive healthcare costs, which reached approximately USD 4.1 trillion annually.

Additionally, the region is home to major players in the bipolar forceps market, including Johnson and Johnson, Medtronic, CONMED Corporation, Becton, Dickinson, and Company, further cementing its market leadership.

Furthermore, significant research and development in the field of bipolar forceps have been reported in North America. A 2022 study titled ‘Comparison of operative outcomes between monopolar and bipolar coagulation in hepatectomy’ highlighted the advantages of using bipolar forceps, such as reduced risks of intra-abdominal infections and ascites compared to monopolar forceps. This research supports the growing preference for bipolar forceps in surgical procedures, indicating a continued upward trajectory for the market in this region.

Meanwhile, the Asia Pacific region is poised for rapid growth in the bipolar forceps market. Factors fueling this growth include the increasing elderly population in countries like Japan, China, and India. Japan, in particular, has a significant geriatric population, with about 26.7% of its population being over 65 years old, as reported in the 2015 National Census. This demographic shift is leading to a higher prevalence of chronic diseases in the region, subsequently driving the demand for surgical interventions that utilize bipolar forceps.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The Bipolar Forceps market is characterized by high competition, with a mix of major and emerging players shaping the landscape. The market is somewhat fragmented, featuring a diverse array of companies varying in size and market influence. This fragmentation is due to the presence of numerous large, medium, and small-scale vendors, each contributing to the market dynamics.

The leading companies in the Bipolar Forceps market are actively engaging in product launches, strategic acquisitions, and innovative developments. These actions are crucial for these players to maintain their market share and stay ahead in the highly competitive environment. The focus on research and development is particularly evident, as companies strive to introduce new and improved products that cater to the evolving needs of the healthcare sector.

Маrkеt Kеу Рlауеrѕ

- ConMed

- Medtronic Plc

- KLS Martin

- B. Braun Melsungen AG

- Stryker

- Becton, Dickinson and Company

- Johnson & Johnson

- Integra LifeSciences

- Stingray Surgical Products, LLC

- Surgical Holdings

- Other Key Players

Recent Developments

- November 2023: Medtronic launches the InTouch Bipolar Forceps, a new generation of bipolar forceps with integrated sensors that provide real-time feedback on tissue temperature and impedance.

- November 2023: Olympus announces a partnership with Erbe Elektromedizin GmbH to develop and market a new line of bipolar forceps for minimally invasive surgery.

- October 2023: Johnson & Johnson receives FDA approval for its LigaSure Vessel Sealing System, a bipolar forceps technology designed for advanced hemostasis in laparoscopic surgery.

- October 2023: A study published in the Journal of Surgical Research finds that bipolar forceps are more effective than monopolar forceps in achieving hemostasis and reducing tissue damage in laparoscopic surgery.

- September 2023: Becton Dickinson (BD) launches the Valleylab ForceTriad Energy Platform, a versatile platform that combines monopolar and bipolar energy in one device, offering surgeons greater flexibility and control during surgery.

- September 2023: Ethicon, a subsidiary of Johnson & Johnson, announces the expansion of its Harmonic Ace portfolio with the launch of the Harmonic Ace+ 7 Shears, a bipolar forceps designed for precise tissue dissection and hemostasis in a variety of surgical procedures.

Report Scope

Report Features Description Market Value (2023) USD 947.3 Million Forecast Revenue (2033) USD 1557.8 Million CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Disposable and Reusable) By Application (Gynecology, General surgery, Neurosurgery, Plastic surgery and Other Applications) By End-use (Hospitals, Specialty clinics and Ambulatory surgical centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ConMed, Medtronic Plc, KLS Martin, B. Braun Melsungen AG, Stryker, Becton, Dickinson and Company, Johnson & Johnson, Integra LifeSciences, Stingray Surgical Products, LLC, Surgical Holdings, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the Bipolar Forceps size in 2023?A: The Bipolar Forceps size is USD 947.3 Million in 2023.

Q: What is the CAGR for the Bipolar Forceps?A: The Bipolar Forceps is expected to grow at a CAGR of 5.1% during 2023-2033.

Q: What are the segments covered in the Bipolar Forceps report?A: Market.US has segmented the Global Bipolar Forceps Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type (Disposable and Reusable) By Application (Gynecology, General surgery, Neurosurgery, Plastic surgery and Other Applications) By End-use (Hospitals, Specialty clinics and Ambulatory surgical centers).

Q: Who are the key players in the Bipolar Forceps?A: ConMed, Medtronic Plc, KLS Martin, B. Braun Melsungen AG, Stryker, Becton, Dickinson and Company, Johnson & Johnson, Integra LifeSciences, Stingray Surgical Products, LLC, Surgical Holdings, Other Key Players

-

-

- ConMed

- Medtronic Plc

- KLS Martin

- B. Braun Melsungen AG

- Stryker

- Becton, Dickinson and Company

- Johnson & Johnson

- Integra LifeSciences

- Stingray Surgical Products, LLC

- Surgical Holdings

- Other Key Players