Global Desalination Technologies Market By Technology Type(Multi Stage Flash Distillation (MSF), Multi-Effect Distillation (MED), Reverse Osmosis (RO), Electrodialysis (ED), Nanofiltration, Others), By Source(Sea Water, Brackish Water, River Water, Others), By Capacity(Small-Scale, Medium-Scale, Large-Scale), By End-User(Municipal, Industrial, Power Generation, Others) , By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: Oct 2024

- Report ID: 129964

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

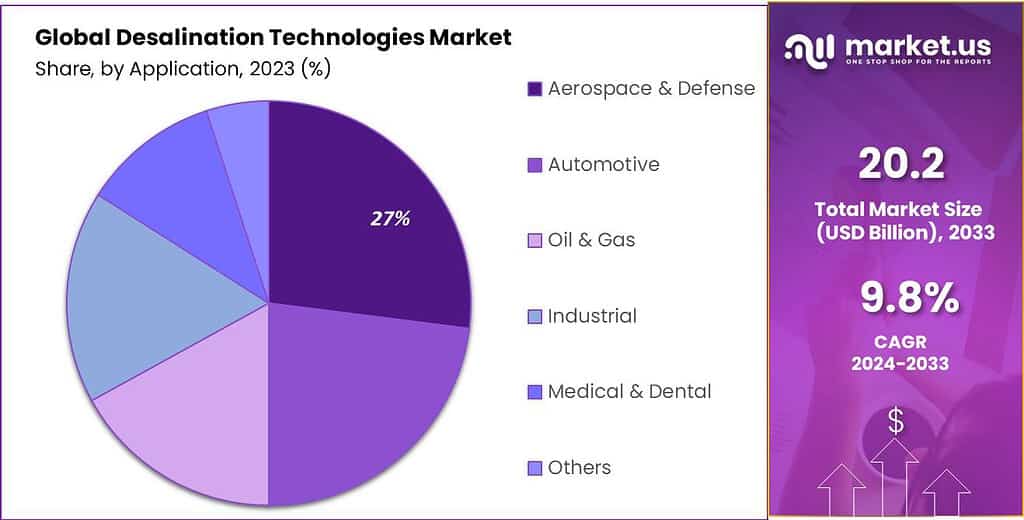

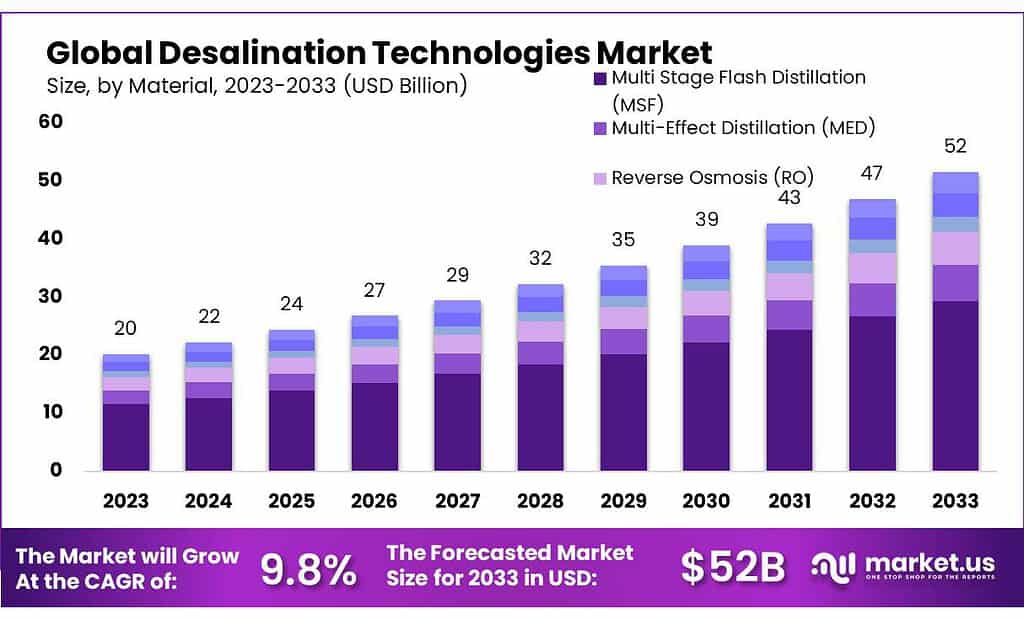

The global Desalination Technologies Market size is expected to be worth around USD 52 billion by 2033, from USD 20 billion in 2023, growing at a CAGR of 9.8% during the forecast period from 2023 to 2033.

The Desalination Technologies Market is a critical industry focused on developing methods to convert seawater or brackish water into fresh water that’s suitable for human consumption, industrial processes, and irrigation. This sector is experiencing rapid growth due to the escalating global water scarcity, which compels the need for sustainable and efficient water sources, particularly in regions with limited fresh water but ample seawater, such as the Middle East, North Africa, and certain areas in Asia and Australia.

Key technologies employed in this market include reverse osmosis, multi-stage flash distillation, and multi-effect distillation. Each technology differs in terms of energy requirements, operational costs, and suitability for various operational scales, making them essential to meeting the diverse needs of different regions and applications.

Governments worldwide are significantly influencing the growth and adoption of these technologies through supportive policies and investments. For example, the U.S. encourages development through public-private partnership laws, while Middle Eastern and North African countries are heavily investing in desalination projects to address their chronic water shortages. These initiatives are crucial as they help enhance the capacity and efficiency of desalination systems, ensuring water security for their populations and industries.

The market is also propelled by the demand from municipal and industrial sectors, especially in areas facing severe water scarcity. Municipal applications often lead in adopting these technologies due to the dire need for potable water, while industrial sectors require high-quality process water.

Moreover, the market is driven by continuous innovation and strategic activities such as partnerships and acquisitions, which are aimed at developing more cost-effective and efficient desalination technologies. A significant trend in this area is the integration of renewable energy sources with desalination processes to reduce the environmental impact traditionally associated with these methods.

Key Takeaways

- Desalination Technologies Market size is expected to be worth around USD 52 billion by 2033, from USD 20 billion in 2023, growing at a CAGR of 9.8%.

- Reverse Osmosis (RO) held a dominant market position in the desalination technologies sector, capturing more than a 57.5% share.

- Sea Water held a dominant market position in the desalination technologies market, capturing more than a 62.3% share.

- Large-Scale desalination projects held a dominant market position, capturing more than a 51.3% share.

- Municipal sector held a dominant market position in the desalination technologies market, capturing more than a 54.4% share.

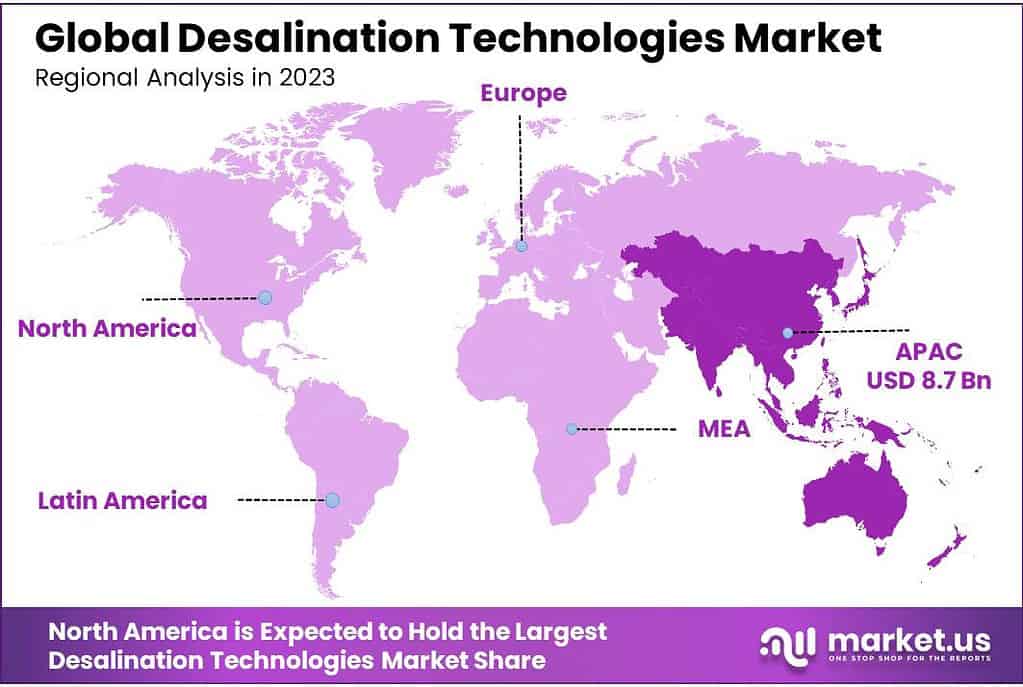

- Asia Pacific region dominates the market, holding a 43% share and valued at USD 8.7 billion.

By Technology Type

In 2023, Reverse Osmosis (RO) held a dominant market position in the desalination technologies sector, capturing more than a 57.5% share. This method is preferred for its efficiency and effectiveness in removing salts and other impurities from seawater or brackish water, making it suitable for both drinking and industrial use. RO systems are widely favored due to their relatively lower energy consumption compared to thermal desalination processes and their ability to be scaled up to accommodate large municipal and industrial projects.

Following RO, Multi-Stage Flash Distillation (MSF) and Multi-Effect Distillation (MED) are significant technologies within the market. MSF, known for its extensive use in the Middle East due to its capability to handle large capacities, utilizes heat to evaporate water, which is then condensed to form fresh water. MED, similarly, uses multiple stages of heating and evaporation to achieve higher efficiency and is considered beneficial where thermal energy is readily available and economical.

Electrodialysis (ED) and Nanofiltration are other notable technologies in the desalination market. ED uses electric potential to separate charged particles from water, making it suitable for regions with specific requirements for salt and ion removal. Nanofiltration, akin to RO but with slightly larger pores, is effective for removing divalent and larger ions, which makes it ideal for water softening purposes or specific industrial applications where complete desalination is not necessary.

By Source

In 2023, Sea Water held a dominant market position in the desalination technologies market, capturing more than a 62.3% share. This prevalence is largely due to the vast availability of seawater as a resource, which makes it the most accessed source for desalination, especially in regions with limited freshwater sources. Seawater desalination is pivotal in coastal areas and islands where freshwater is scarce but sea access is abundant.

Following seawater, Brackish Water is another significant source in the desalination market. This type of water typically has less salinity than seawater but more than fresh river water, making it a challenging yet valuable source for regions where it is abundant. Desalination technologies help convert brackish water into potable water, particularly useful in inland areas distant from oceans.

River Water, though less commonly used for desalination, still plays a crucial role in areas where river water is abundant but contaminated or too saline for direct use. The technology aimed at treating river water focuses on removing pollutants or reducing salinity to make the water safe for consumption and other uses.

By Capacity

In 2023, Large-Scale desalination projects held a dominant market position, capturing more than a 51.3% share. This segment includes major desalination facilities that serve metropolitan areas and industrial operations, providing substantial volumes of fresh water to meet the high demands of densely populated regions and large industrial complexes. These large-scale operations are often favored due to their economies of scale, which can lead to more cost-effective water production.

Following large-scale projects, Medium-Scale desalination facilities also play a critical role in the market. These facilities typically cater to smaller cities, communities, or specific industrial sectors that require a reliable water supply but do not have the massive demand that necessitates large-scale operations. Medium-scale plants offer a balance between efficiency and flexibility, often being easier to manage and quicker to adapt to changing water needs than larger plants.

Small-Scale desalination systems, capturing the smallest share of the market, are crucial for remote locations, small islands, or individual industrial operations where connection to larger networks is not feasible or cost-effective. These systems are increasingly popular for their ability to provide tailored solutions for specific, localized water challenges, often using innovative and energy-efficient technologies suitable for smaller operations.

By End-User

Desalination Technologies MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Desalination Technologies MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Acciona

- Ampac USA

- Aquatech

- Biwater Holdings Limited

- BWT Holding GmbH

- Danfoss A/S

- Doosan Enerbility Co. Ltd.

- DuPont de Nemours Inc.

- Evoqua Water Technologies LLC

- General Electric

- Genesis Water Technologies

- Hitachi Ltd.

- IDE Technologies

- Kepple Offshore & Marine Ltd.

- Komax Systems Inc.

- Lenntech

- SUEZ SA

- Veolia Water Technologies

- Webuild SpA