Global Dental Prosthetics Market By Type (Dental Implant (Endosteal Implant, Subperiosteal Implant), Dental Prosthetics (Dental Bridges, Crowns, Dentures), By Material ( Ceramic, Titanium, Zirconium), By End User (Dental Clinics, Hospitals, Academic), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Nov 2023

- Report ID: 95721

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

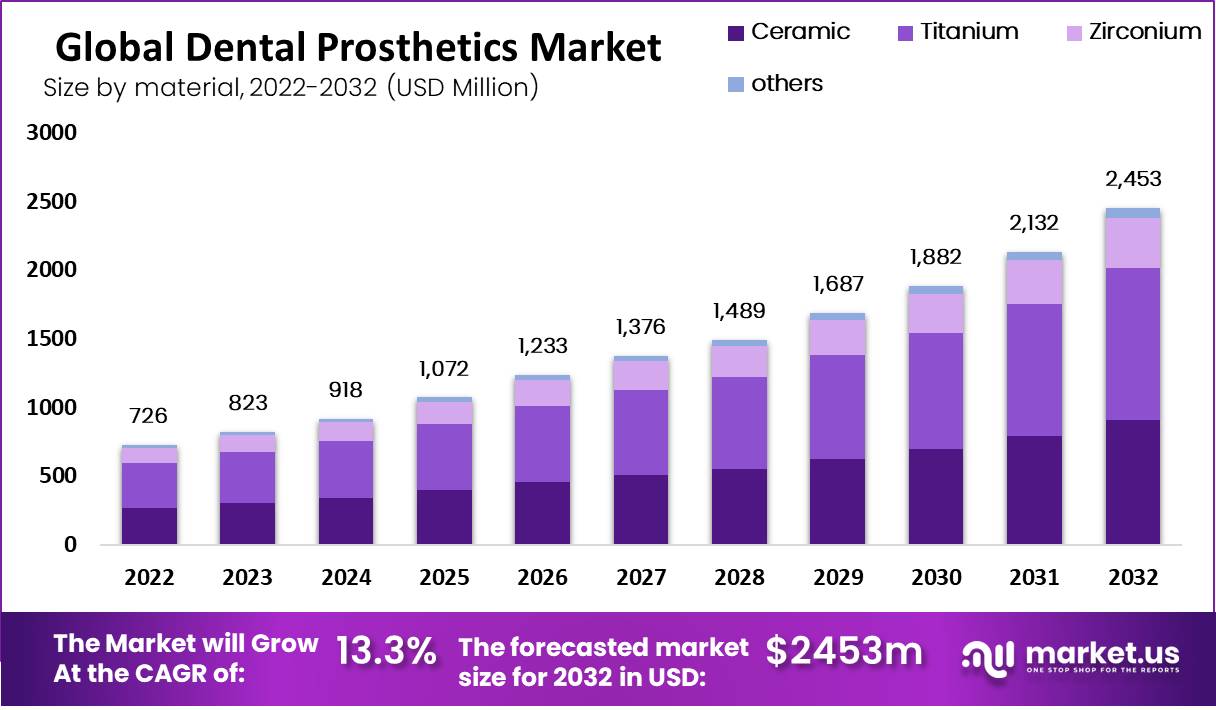

The Global Dental Prosthetics Market size is expected to be worth around USD 2453 Million by 2032 from USD 726 Million in 2022, growing at a CAGR of 13.3% during the forecast period from 2022 to 2032.

The upcoming expectations of dental disorders like edentulism are expected to increase the market revenue. Moreover, factors such as high disposable income levels and the upcoming rising awareness of oral health are also expected to bolster the market growth in the coming year.

In addition, the COVID-19 condition will severely affect dentistry which directly decreases the quality of care, clinical work, and professional training. Dental implants are considered to be a major advancement in dentistry as they have transformed the way in which missing teeth are replaced. They have a high success rate, and this success depends on the ability of the implant material to bond with the surrounding tissue.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- The global dental prosthetic market is predicted to be worth $2,453 million by 2032.

- It is expected to grow at a CAGR of 13.3% from 2023 to 2032.

- In 2022, the dental prosthetic market was valued at $726 million.

- Dental prosthetics are custom-made devices used to replace missing or damaged teeth. They can help with speech, aesthetics, and chewing.

- The market is driven by factors such as dental disorders, an aging population, and demand for cosmetic dentistry.

- Titanium is a commonly used material for dental prosthetics.

- Dental prosthetics are mainly used in laboratories and clinics.

- Europe is expected to grow significantly in 2022 due to healthcare spending and a large population.

- The Asia Pacific market is growing due to increasing dental care and a growing elderly population.

- Factors hindering market growth include the high cost of dental prosthetics and a lack of skilled professionals.

- Growing awareness about oral health is also contributing to market growth.

- Increasing disposable income is making dental prosthetics more affordable.

By Type Analysis

The crowns segment held the largest share of the market and it is also anticipated to remain dominant, and it is also likely to register the fastest growth during the forecast period.

The market is segmented into two main categories, which are dental implants (Endosteal Implant, Subperiosteal Implant, and Transosteal Implant) and dental prosthetics (Dental Bridges, Crowns, Dentures, Veneers, Inlays, And Onlays).

Dental implants are medical devices used to replace missing teeth. They consist of a titanium-based cylinder and additional prosthetics, such as a crown or cap. The implant site must be prepared using a precise technique to ensure that it bonds with the bone.

Implant placement kits contain specific drills that are used in a specific order to remove the bone as carefully as possible. Implant insertion is carried out using standard aseptic surgical techniques.

The intraoral examination for the implant focuses on the structural integrity of existing teeth and prosthetics restorative, the depths of the vestibular and palatal areas, the occlusion, jaw relationships, the periodontal status, inter-arch space, oral hygiene, parafunctional habits, maximum opening. Dental prosthetics are medical devices or intraoral prostheses used to correct dental defects, such as restoring missing teeth, improving appearance, and restoring the ability to chew and speak.

They are also known as prosthodontics and include various types of devices such as crowns, bridges, dentures, abutments, veneers, and inlays and Onlays. Dental prosthetics can be fixed in place or removable, for example, full or partial dentures.

By Material Analysis

The titanium segment held the largest share of the market.

Based on the material analysis, Dental implants include a titanium-based cylinder and additional prosthetics such as crowns or caps. Dental implants are made of titanium, which is a great material. Titanium is biologically inert and does not cause foreign body reactions. To ensure that an implant has intimate contact with bone, it must be prepared using a precise technique.

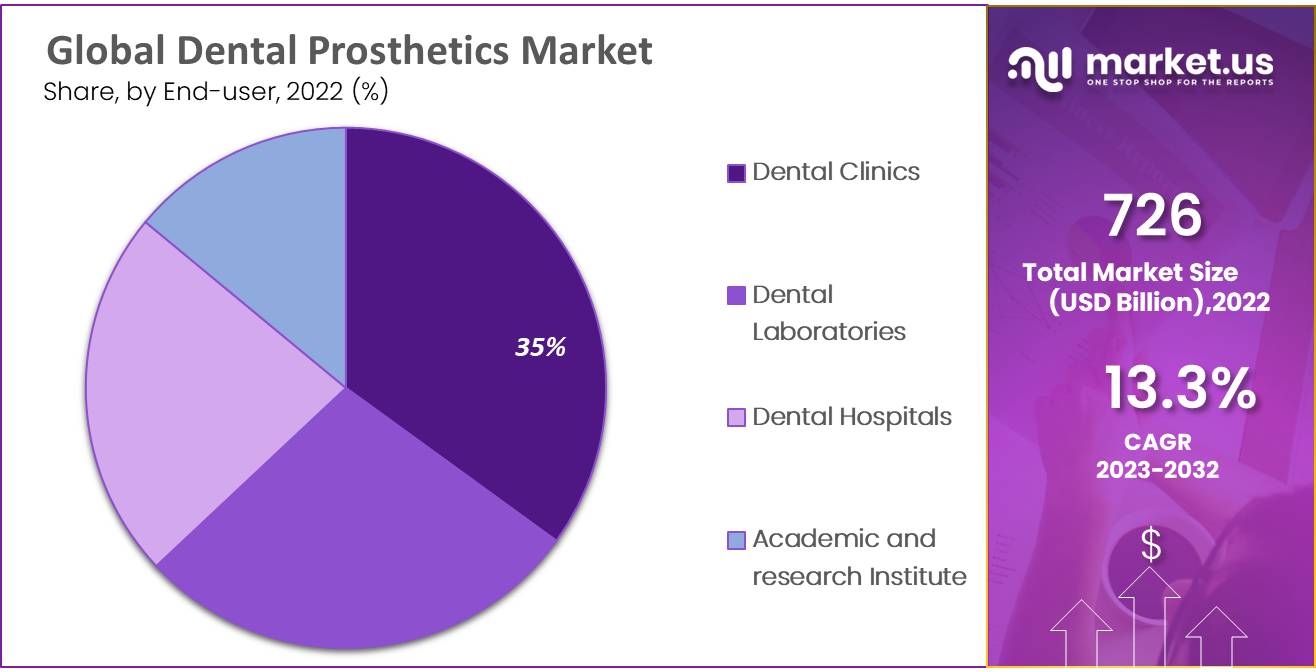

By End-User Analysis

The upgrade of procedures of implants, like the emergence of digital scanners like CAD and CAM equipment, is expected to improve the segment in the future years.

Based on end-users, the market is segmented into healthcare clinics, dental hospitals, dental laboratories, and others. The procedure of fitting the implants is completed in laboratories and clinics, making them dominated and segmented.

The claiming procedure is now done more easily and fast than in past years in clinics and hospitals. Using an implant in people can help in courage good information from one patient to another. Such factors are expected to boost the market growth for the target product.

Key Market Segments

Based on Type

Dental Implant

- Root form Implant (Endosteal Implant)

- Plate form Implant

- Subperiosteal Implant

- Transosteal Implant

Dental Prosthetics

- Bridges

- Crowns

- Dentures

- Veneers

- Inlays and Onlays

Based on the Material

- Ceramic

- Titanium

- Zirconium

- Others

Based on End-User

- Dental clinics

- Dental Laboratories

- Dental Hospitals

- Academic and Research Institutes

Drivers

A Growing Prevalence of Dental Diseases boosts the Dental Prosthetics Market.

Periodontal diseases and tooth decay are some of the most common conditions and require immediate attention from the global populace. According to the World Health Organization, approximately half of the world’s population (3.58 Billion) is affected by oral disease.

The increasing prevalence of dental diseases and dental caries is driving up demand for dental prosthetics all over the world. Increasing demand for cosmetic dentistry propels the market. Cosmetic dentistry is becoming more popular in developed and emerging countries.

Increasing demand for cosmetic dentistry

Cosmetic dentistry is gaining popularity due to changes in lifestyles and increased attention to aesthetics. The lucrative opportunities available for cosmetic and dental restoration have been created by the increased availability and willingness to pay for these procedures.

These solutions, which include whitening, polishing, and replacing teeth, will increase the market revenue for dental prostheses. The popularity of dental prosthetics for restoration has increased over the years. This market is driven mainly by referrals from people who have had positive experiences with the procedure.

A 2015 American Academy of Cosmetic Dentistry (AACD) investigation found that 86% of respondents opted for cosmetic dentistry to improve their self-esteem and appearance. According to 84% of respondents, the majority of cosmetic treatments performed in an esthetic dentist’s office are crowns, bridges, and implants.

Restraints

In the dental implant market, there is a cost associated with detailed analysis fundamentals rising exponentially.

In well-developed regions of, dental crowns and bridges are used the cosmetic products by most insurance companies, so it will affect the less or no reimbursement for dental procedures and implants.

As a result, patients have to bear a major part of the money which has to pay from their pocket, so the limited claiming process will affect the growth of the market. Developed and developing country is still struggling to get the basic need of oral hygiene and services; however, this unawareness of information and services are restraining the market growth.

The cost of dental treatment may rise in the future due to various factors, such as the need for more resources, such as personal protective equipment, modifications to dental practices, and longer waiting times caused by the need to separate patients in waiting rooms. This may lead to a decrease in the number of patients that can be seen daily.

Opportunity

The cosmetology segment is gaining high acceptance and innovation in the upcoming years.

As a high amount of people are ongoing cosmetic surgery to get a better appearance and enhance their beauty features and teeth appearance, people move towards dental aesthetics solutions and boost the amount of cosmetic market and product values.

Trends

Increasing demand for aesthetic and personalized implants.

Due to increasing incidences of oral/dental disorders, product demand will increase. The World Health Organization predicts that around 3.5 billion people will be suffering from oral disease by 2020. The market is expected to expand due to the increasing number of oral disorders.

In recent years, product demand has increased exponentially. The advantages of dental implants over other tooth-replacement options, such as their durability, effectiveness, and safety, are expected to boost the global market for dental implants.

Factors like the increasing importance of aesthetic restorations of tooth implants and the rapid adoption of advanced technologies will also boost the market.

High demand for digital dentistry

These trends include an increase in dental tourism, advanced product development, and a growing use for mini dental implants. The rising cost of medical management is a major problem in developed countries. These countries have been able to attract dental treatment at a lower price, and the public is relocating to these emerging countries.

The globalization trend has allowed for the rapid import of new equipment and products to developing countries. This has led to a rise in dental tourism within developing countries. For the customization of teeth, modern technologies such as 3D printing or CAD/CAM are widely used and adopted. Additionally, the materials used in this treatment are stronger and more durable than traditional methods. Cosmetic dentistry is increasingly using dental prosthetics.

A growing trend is seen in mini dental implant-supported prosthetics. They are minimally invasive and offer many benefits, including a lower cost, no need for bone grafting, and a shorter placement time. As mini implants are more commonly used in dental procedures than traditional implants, there has been a significant increase in research and development on mini implant-supported prosthetics.

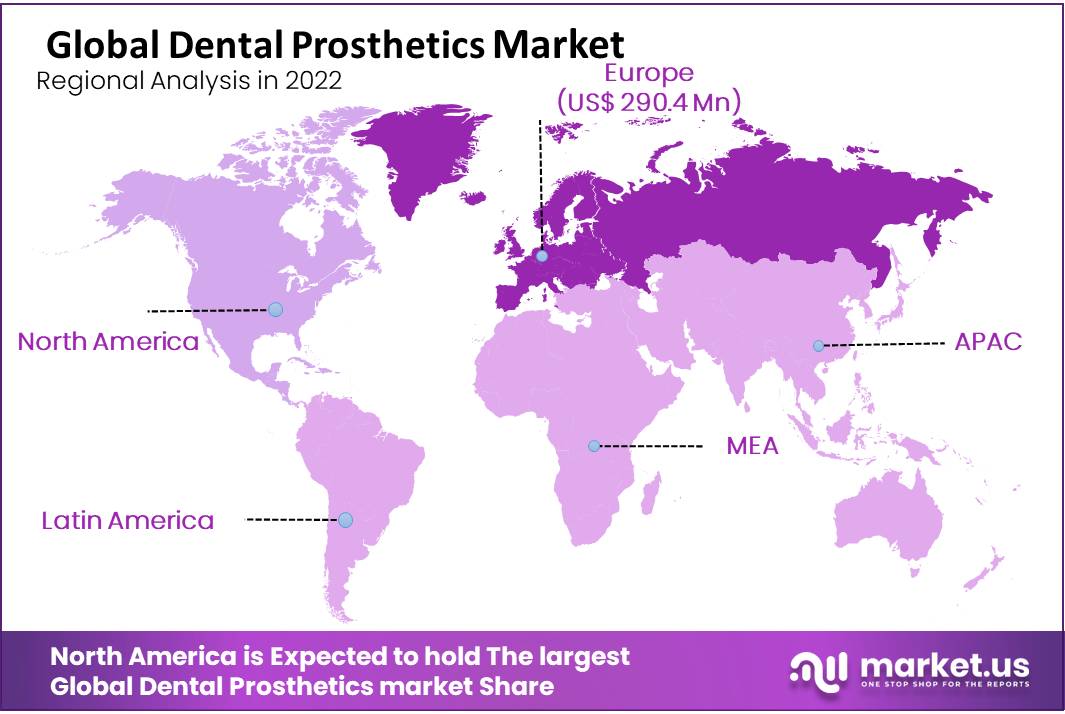

Regional Analysis

Europe is expected to see significant growth due to a surge in healthcare spending, a large population base, and an increase in disposable incomes.

the European market is projected to hold the largest market share globally. This is due to higher rates of diagnosis and treatment for dental diseases.

The dominant market share for the region’s dental prosthesis market is due to its higher dental spending, higher utilization of dental services, and increasing demand for premium products.

North America occupied the second-largest market position. This can be explained by the higher per capita dental spending and the availability of high-quality dental services in the area.

The growing number of edentulous people and increasing awareness can also explain the region’s growth. Asia-Pacific’s market is expected to grow at a faster rate than the rest of the world and will register a higher CAGR over the forecast period.

The Asia Pacific dental prosthetics market is expected to grow due to the increasing prevalence of dental care, the growing geriatric population, and the increased launch of key players.

Due to growing awareness of dental issues and the rise in medical tourism in Brazil, the Latin American market is expected to grow significantly during the forecast period.

The Middle East & Africa are still in a very early stage. The market is expected to grow due to the development of healthcare infrastructure and the rising prevalence of dental diseases.

The market is forecast to expand significantly over the forecast period due to a surge in dental tourism. Because of the high cost of treatment in developed countries, patients choose to travel to dental tourism countries such as India, Thailand, Turkey, Dubai, and Poland.

The availability of quality and affordable treatment in a few countries like India, Thailand, and Malaysia, as well as Mexico, has boosted medical tourism’s growth. Europe was the world’s largest in vitro diagnostics market in 2020 and will continue to be the dominant region during the forecast period.

Its well-developed healthcare system, high demand for dental cosmetic surgery, increased healthcare spending, and adoption of advanced technology are some of the reasons why this market is so dominant.

Key Regions

- North America

- The US

- Canada

- Mexico

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The market of implants is no debatably growing prospects. Most of the lead players in this market are focusing on innovations and new product launches by increasing their research and quality criteria.

However, the key company is gaining the key strategies and basically focusing on combinations and acquisitions to their shares and consumer criteria. The leading layers of the market are 3M, 3 Shape company, Biocon LLC, and others.

Market Key Players

- Institut Straumann AG

- Danaher

- Dentsply Sirona

- Henry Schein Inc.

- Zimmer Biomet

- Osstem Implant

- CeraRoot SL.

- Reckitt Benckiser Group PLC

- RPM International Inc.

- Diversey Holdings Ltd.

- Other Key Players

Recent Development

- In June 2021, DENTSPLY Sirona company had all the required assets of propel orthodontics recently, and DAC universals infections control successfully sold more than 50,000 devices and gained a new millstone. The company product portfolio confirms a cost-effective and fully auto processing and optical lubricants only in 15 or approximately 20 minutes.

- The major announcement is in June 2021, when the company has entered into a partnership with growing manufacturers such as 3 shape and 3D scanners. It also obligates with CAD/CAM software solutions. This strategic alliance and acquisition will help the company to grow and create new opportunities and gain a position in the market to improve digital density and oral health.

- 3D printers manufactured or Formlabs announced two new inventions in Dec 2020, which improved the material used in their dental portfolio: advanced materials are permeant crowns and bridges, which are used to improve the ease and effective compliance of the patient. These labs are provided high material quality and very affordable price solutions.

Report Scope

Report Features Description Market Value (2022) USD 726 Million Forecast Revenue (2032) USD 2453 Million CAGR (2023-2032) 13.3% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on the Type- Dental Implant (Root form Implant (Endosteal Implant), Plate form Implant, Subperiosteal Implant, Transosteal Implant), Dental Prosthetics (Bridges, Crowns, Dentures, Veneers, Inlays, and Onlays; Based on the material- Ceramic, Titanium, Zirconium, Others;Based on End-User- Dental clinics, Dental Laboratories, Dental Hospitals, Academic and Research Institutes. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Institut Straumann AG (Switzerland), Danaher (U.S.), Dentsply Sirona (U.S.), Henry Schein Inc. (U.S.), Zimmer Biomet (U.S.), Osstem Implant (South Korea), CeraRoot SL. (Spain), Reckitt Benckiser Group PLC, RPM International Inc., Diversey Holdings Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Who are the Top 3 Players in the Global Dental Implants and Prosthetics Market?The top 3 players in the global dental implants and prosthetics market are Institut Straumann AG, Danaher, Dentsply Sirona,

What is the Growth Outlook for the Global Dental Prosthetics Market?The global dental prosthetics market is anticipated to register a CAGR of 13.30% during the forecast period.

What is the projected market size & growth rate of the Dental Prosthetics Market?Dental Prosthetics Market was valued at USD 208 Billion in 2023 and is projected to reach USD 726.20 Billion by 2032, growing at a CAGR of 13.3% from 2023 to 2032.

What segments are covered in the Dental Prosthetics Market Report?The Global Dental Prosthetics Market is segmented based on Product Type, Material, End-User.

-

-

- Institut Straumann AG

- Danaher

- Dentsply Sirona

- Henry Schein Inc.

- Zimmer Biomet

- Osstem Implant

- CeraRoot SL.

- Reckitt Benckiser Group PLC

- RPM International Inc.

- Diversey Holdings Ltd.

- Other Key Players