Global Dehydrated Pet Food Market By Pet Type (Dog, Cat, Birds), By Nature (Natural, Conventional), By Distribution Channel (Online Stores, Supermarkets and Hypermarkets, Specialty Pet Stores, Others), By Ingredient Type (Meat, Fruits, Grains, Vegetables, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132546

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

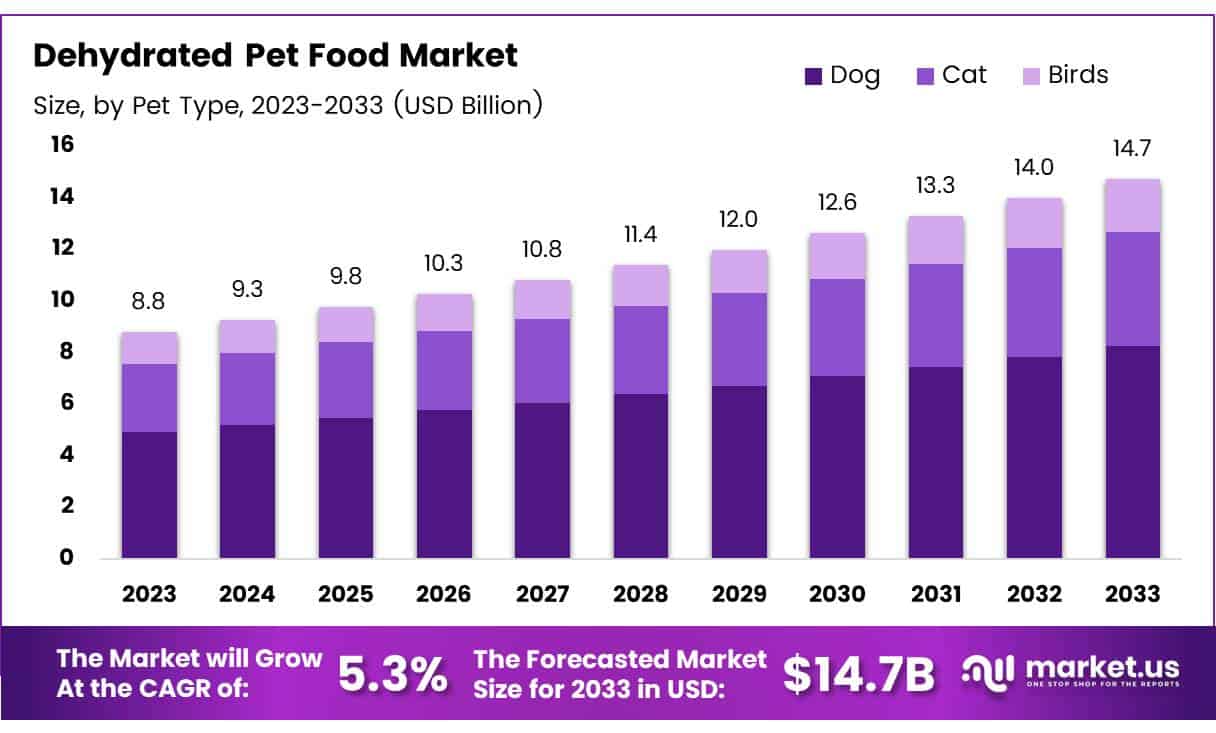

The Global Dehydrated pet food Market size is expected to be worth around USD 14.7 Billion by 2033, from USD 8.8 Billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

Dehydrated pet food refers to products that have been dried to remove moisture, preserving the food while retaining essential nutrients and flavor. This process ensures a longer shelf life without relying heavily on artificial preservatives.

Dehydrated pet foods often require rehydration before feeding, allowing for a convenient yet nutritious option for pet owners who prioritize natural and minimally processed diets for their pets. The dehydrated pet food market encompasses the commercial production, distribution, and sale of these dried pet food products.

This market segment includes a variety of products tailored for different pet species, age groups, and dietary needs, positioning itself at the intersection of convenience and nutritional richness in the pet food industry. The dehydrated pet food market is poised for growth, driven by several key factors.

Firstly, there is a rising trend of pet humanization, where pet owners treat their pets as family members and are therefore more attentive to their dietary needs. This has led to increased demand for pet food that mirrors human food trends, such as non-GMO, organic, and free from artificial additives.

Secondly, the convenience of storage and long shelf life of dehydrated pet food makes it appealing for busy pet owners who seek both convenience and quality.

Government investments and regulations in this sector also play a crucial role in shaping the market. With stricter regulations ensuring higher food safety standards, manufacturers are compelled to enhance their production processes and ingredient sourcing, thereby improving the overall quality of the products offered.

This regulatory environment, while demanding, actually serves as a growth opportunity for established players who can leverage their compliance as a competitive advantage in the marketplace.

According to a report by the pet food industry, 45% of pet owners have shown a preference for dehydrated pet foods, underscoring its significant acceptance in markets such as the U.S. This data highlights the substantial market penetration and acceptance of dehydrated foods within the pet food segment.

Furthermore, data from global pet industry indicates that 24% of dog owners and 22% of cat owners in the U.S. have purchased freeze-dried products over the past 12 months, reinforcing the growing consumer interest and potential growth avenue in the niche but expanding freeze-dried pet food segment.

Research conducted by research gate sheds light on product innovation within this sector, noting that pet foods incorporating 30 to 50% poultry by-products powder as a replacement for chicken meat powder have been evaluated positively for various quality characteristics. This suggests an increasing exploration of alternative ingredients to enhance nutritional profiles and meet consumer demand for sustainable and high-quality pet food options.

Key Takeaways

- The global Dehydrated Pet Food Market is projected to grow from USD 8.8 billion in 2023 to USD 14.7 billion by 2033, with a CAGR of 5.3%.

- Dogs are the leading consumer segment in the Dehydrated Pet Food Market due to rising global pet ownership rates.

- The Natural category dominates the market, driven by consumer preference for organic and natural pet food ingredients.

- Online Stores are the predominant distribution channel for dehydrated pet foods, favored for their convenience and broad selection.

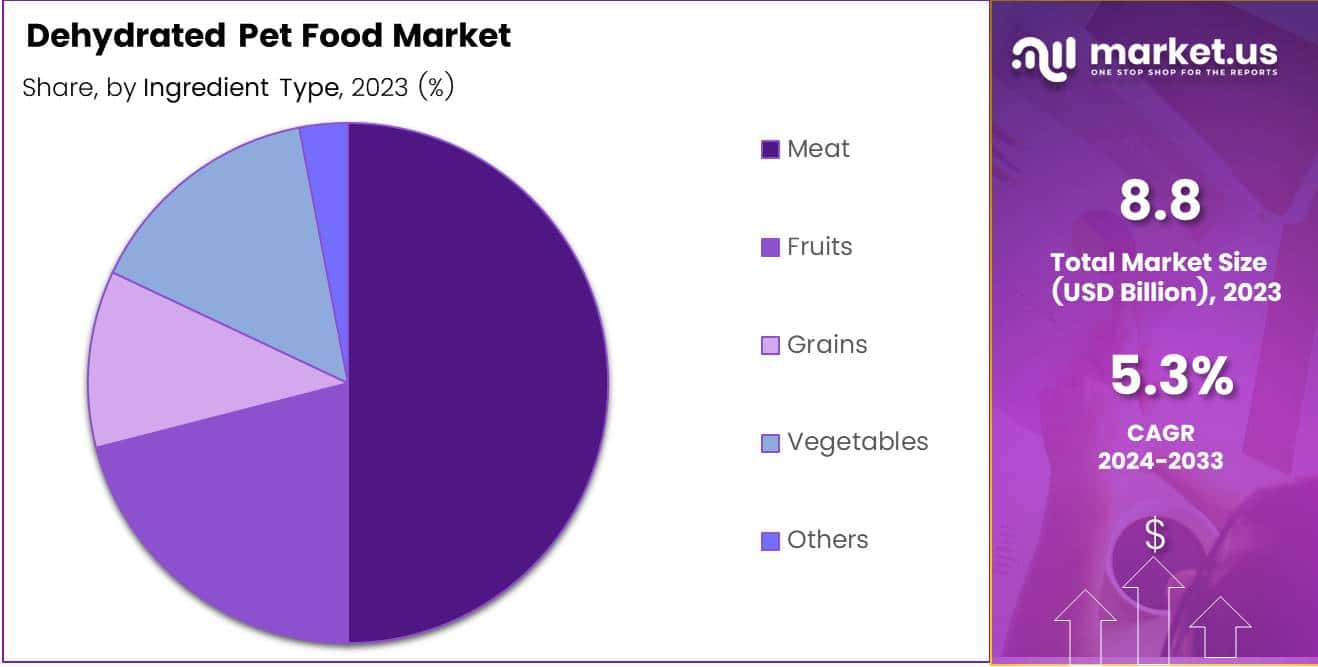

- Meat is the key ingredient type, popular for mimicking the natural diets of carnivorous pets.

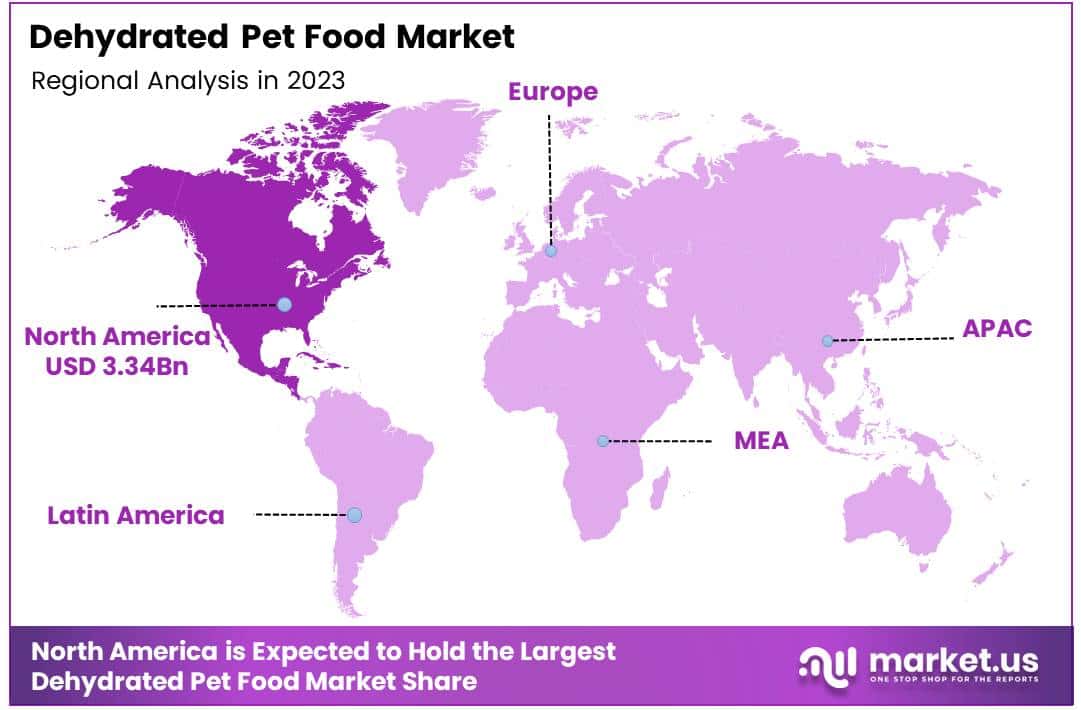

- North America holds the largest market share at 38%, equating to USD 3.34 billion, driven by high pet ownership and increasing awareness of dehydrated pet food benefits.

Pet Type Analysis

Dominance of Dog Segments in the Dehydrated Pet Food Market

In 2023, dogs held a dominant market position in the By Pet Type Analysis segment of the Dehydrated Pet Food Market. This trend is underscored by increasing pet ownership rates globally, particularly for dogs, which have positioned them as prime consumers of dehydrated pet foods.

The market’s growth can be attributed to the convenience and long shelf life of dehydrated products, appealing significantly to dog owners seeking nutritious, easy-to-store feeding options.

Cats, as the second-largest segment, exhibit a robust compound annual growth rate, driven by the rising awareness among cat owners about the benefits of high-quality, moisture-rich diets that dehydrated foods can offer. The unique dietary requirements of cats, including higher protein levels, have influenced product formulations in this segment, leading to a diversified product portfolio.

Birds represent a smaller, yet rapidly growing segment in the dehydrated pet food market. The expansion is facilitated by the increasing popularity of birds as pets and the demand for specialized, high-quality food that supports their distinct nutritional needs. Manufacturers are increasingly focusing on this niche segment, introducing a range of tailored options that cater to various bird species.

Nature Analysis

Natural Choices Lead in Dehydrated Pet Food Trends

In 2023, Natural held a dominant market position in the By Nature Analysis segment of the Dehydrated Pet Food Market. This ascendancy can be attributed to increasing consumer preference for organic and naturally sourced ingredients in pet nutrition.

The Natural segment’s robust performance is driven by a heightened awareness among pet owners regarding the health benefits associated with natural and minimally processed pet foods.

Conversely, the Conventional segment, characterized by products that include artificial additives or are more heavily processed, accounted for the remaining market share. This segment’s slower growth rate can be linked to growing consumer skepticism towards artificial ingredients and a shifting preference towards cleaner labels and health-oriented pet food options.

Despite this, the Conventional segment maintains a stable demand in markets less influenced by natural product trends, primarily due to its cost-effectiveness and longer shelf life.

The segmentation by nature within the dehydrated pet food industry highlights a distinct consumer shift towards natural products, influencing market strategies and product development across the sector.

Distribution Channel Analysis

Online Stores Lead 2023 Dehydrated Pet Food Sales with Enhanced Shopping Convenience

In 2023, Online Stores held a dominant market position in the By Distribution Channel Analysis segment of the Dehydrated Pet Food Market. This distribution channel’s prominence is primarily driven by the increasing consumer preference for shopping convenience, wider product selection, and competitive pricing offered by online platforms.

The availability of comprehensive product information and user reviews further enhances consumer trust and decision-making, leading to a higher sales volume through these channels.

Supermarkets/Hypermarkets also play a crucial role, serving as accessible points for consumers preferring physical verification of product quality before purchase. Their extensive reach and the advantage of immediate product availability continue to secure their substantial market share.

Specialty Pet Stores are preferred by consumers looking for expert advice and high-quality, specialized products that may not be available in broader retail settings. These stores often offer premium products tailored to specific dietary needs and preferences, thereby attracting a niche market segment.

Other distribution channels, including small retail shops and direct sales, although smaller in market share, cater to localized needs and offer personalized customer service, which remains significant for certain consumer segments.

Ingredient Type Analysis

Meat Dominates Dehydrated Pet Food Market with Leading Share

In 2023, Meat held a dominant market position in the By Ingredient Type Analysis segment of the Dehydrated Pet Food Market. This category has been pivotal due to pet owners’ increasing preference for high-protein diets that closely mimic the natural carnivorous diet of pets.

Meat-based dehydrated pet foods are highly sought after for their ability to provide sustained energy and essential nutrients, which are crucial for the overall health and well-being of pets.

Following Meat, the segment includes Fruits and Vegetables, which are valued for their vitamins and natural fibers, contributing to balanced pet nutrition and aiding in digestive health. Grains are also integral, often included in dehydrated forms to offer energy through carbohydrates while being easy on pet digestive systems.

The Others category encompasses a variety of ingredients like fish and specialty meats, which cater to specific dietary needs and preferences, highlighting the market’s versatility. The diversity within the segment underscores a dynamic market landscape where consumer preferences drive innovation and product offerings, ensuring a wide array of options for pet nutrition.

Overall, the robust demand for meat in the Dehydrated Pet Food Market underscores its critical role in shaping industry trends and consumer buying patterns, reflecting a continued preference for nutrient-rich, natural pet food options.

Key Market Segments

By Pet Type

- Dog

- Cat

- Birds

By Nature

- Natural

- Conventional

By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Pet Stores

- Others

By Ingredient Type

- Meat

- Fruits

- Grains

- Vegetables

- Others

Drivers

Pet Ownership Growth Fuels Market Demand

The dehydrated pet food market is experiencing significant growth, primarily driven by an increase in global pet ownership. As more individuals welcome pets into their homes, the demand for quality pet food, including dehydrated varieties, continues to rise.

This surge is further supported by the humanization of pets, where owners treat their animals as integral family members, thus seeking premium food options that reflect their dietary values and care commitments.

Additionally, there is a growing consumer inclination towards natural and organic products. Pet owners are increasingly aware of the health implications of their pet’s diet and are choosing dehydrated pet food for its minimal processing and preservation of nutrients.

This trend towards wholesome, less-processed food options is reshaping the market, as consumers prioritize the health and well-being of their pets alongside convenience and longevity offered by dehydrated foods.

Restraints

High Costs Limit Dehydrated Pet Food Adoption

Dehydrated pet food, while recognized for its nutritional advantages, often comes with a higher price tag compared to traditional pet foods. This substantial cost difference makes it a less attractive option for budget-conscious pet owners.

In emerging markets, the situation is exacerbated by a general lack of awareness about the unique benefits of dehydrated pet food products.

Many consumers in these regions continue to opt for conventional pet foods due to their familiarity and lower cost. This not only limits the market penetration of dehydrated pet food but also slows the overall growth potential of this sector.

Effective marketing strategies that educate consumers on the long-term health benefits and cost-effectiveness of these products could be key to overcoming these barriers and expanding market reach.

Growth Factors

Growth Opportunities in Dehydrated Pet Food Market

The dehydrated pet food market stands poised for growth by tapping into emerging markets where more people are getting pets. These regions present a fertile ground for introducing high-quality, nutritious pet food options that cater to the increasing awareness of pet health needs.

Beyond geographical expansion, innovating product lines with new flavors, specialized dietary formulas, and personalized nutrition options could significantly resonate with diverse consumer preferences. This approach not only differentiates brands in a competitive market but also enhances appeal to health-conscious pet owners seeking tailored solutions.

Additionally, forging partnerships and collaborations with veterinarians and pet care experts can boost product trustworthiness and deepen market penetration. Establishing these professional endorsements will underpin marketing strategies and foster consumer confidence in product benefits, driving both market reach and loyalty.

Emerging Trends

Pet Owners Prefer Grain-Free Options

As market analysts, we observe that the dehydrated pet food market is significantly influenced by three key trends. Firstly, there is a growing preference among pet owners for grain-free and limited ingredient diets, which is reshaping product offerings to meet these specific dietary demands. This trend reflects a broader shift towards more specialized pet nutrition that caters to health concerns and dietary sensitivities.

Additionally, there is an increasing focus on digestive health, with pet foods incorporating natural fibers and probiotics to enhance gastrointestinal well-being. This aspect is crucial as more consumers recognize the link between diet and health for their pets. Lastly, ethical and responsible sourcing of ingredients is gaining traction.

Consumers are increasingly conscious of the origins of the pet food they purchase, preferring products that ensure animal welfare and sustainable practices. These trends collectively drive innovation and variety in the dehydrated pet food market, aligning with the growing demand for high-quality, health-oriented pet food solutions.

Regional Analysis

North America Dominant Market Share of 38%, Valued at USD 3.34 Billion

The Dehydrated Pet Food Market demonstrates significant regional variation in both market penetration and growth dynamics.

As of recent assessments, North America emerges as the dominant region, accounting for approximately 38% of the global market, translating to a value of USD 3.34 billion. This dominance is primarily driven by a high prevalence of pet ownership, coupled with a growing awareness among pet owners regarding the benefits of nutrient-rich, dehydrated pet food.

Regional Mentions:

Europe exhibits robust market growth, driven by stringent pet food quality regulations and a strong preference for premium pet care products. The European market is characterized by its high demand for organic and non-GMO dehydrated pet food, reflecting the region’s overarching trends towards sustainability and health-consciousness.

Asia Pacific is identified as a rapidly expanding market for dehydrated pet food, fueled by increasing pet adoption rates and rising disposable incomes. This region’s market expansion is further supported by urbanization and the lifestyle shifts towards pet humanization, where pets are increasingly treated as family members.

The markets in the Middle East & Africa and Latin America, while smaller in comparison, show potential for growth. In these regions, the market is gradually evolving with the increasing availability of international brands and a growing middle class that is adopting pet ownership as a lifestyle choice. These factors are expected to catalyze the demand for dehydrated pet food products in the foreseeable future.

Overall, while North America continues to hold the largest market share, regions like Asia Pacific are poised for rapid growth, indicating a shift in major market dynamics towards emerging economies. This trend is likely to intensify competition among key players and drive innovation within the dehydrated pet food industry globally.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Dehydrated Pet Food Market for 2023, several key players are shaping industry trends and dynamics through strategic innovations and market expansion strategies.

Mars Inc., a longstanding giant in the pet food industry, continues to dominate with its diversified product portfolio and extensive distribution channels. The company’s commitment to sustainability and the use of high-quality ingredients appeal to health-conscious pet owners, reinforcing its market leadership.

Blue Buffalo stands out for its natural and organic product offerings, which cater to the increasing consumer demand for healthier pet food options. Its marketing strategies, focusing on transparency and the promotion of pet health, have effectively captured a significant share of the premium segment.

Heristo, known for its specialized pet food solutions, is gaining traction through its focus on tailor-made diets catering to specific nutritional needs of pets. This approach not only differentiates Heristo from competitors but also aligns with the growing trend of personalized pet nutrition.

Gambol and Ramical are notable for their robust growth in the Asian markets, where pet ownership rates are rising. These companies have leveraged local manufacturing advantages to optimize production costs and enhance market penetration.

Diamond Pet Foods remains a strong contender with its competitively priced products and strong distribution networks. The company’s focus on high-quality, affordable pet nutrition continues to make it a popular choice among pet owners across various demographics.

Emerging players like Mogiana Alimentos and Big Time are also noteworthy, each carving out niches through unique product offerings or regional focus, thus diversifying the competitive landscape of the global dehydrated pet food market.

Top Key Players in the Market

- Mars Inc

- Paide Pet Food

- Big Time

- Blue

- Mogiana Alimentos

- Diamond pet foods

- Heristo

- Gambol

- Ramical

- Affinity Petcare

Recent Developments

- In February 2024, Freeze-Dried Pet Food Co-Man Petsource completed a significant $75 million expansion, aimed at enhancing their production capacity and meeting the rising demand for freeze-dried pet food products.

- In September 2024, Nestlé announced an investment exceeding £150 million (approximately US$167 million) to upgrade its Nestlé Purina PetCare factory in Wisbech, Cambridgeshire. This investment will modernize facilities that produce popular UK pet food brands such as Felix, Gourmet, and Winalot.

- In October 2024, Pure Pet Food secured a $19 million investment to bolster its market position and expand its range of high-quality, natural pet food products.

- In September 2023, the Allana Group, a prominent Indian exporter of branded processed foods and agricultural commodities, unveiled a US$2.4 million investment to establish what is poised to be Asia’s largest pet food facility, significantly boosting its production capabilities in India.

Report Scope

Report Features Description Market Value (2023) USD 8.8 Billion Forecast Revenue (2033) USD 14.7 Billion CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Pet Type (Dog, Cat, Birds), By Nature (Natural, Conventional), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Specialty Pet Stores, Others), By Ingredient Type (Meat, Fruits, Grains, Vegetables, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Paide Pet Food, Big Time, Blue , Mars Inc, Mogiana Alimentos, Diamond pet foods, Heristo, Gambol, Ramical, Affinity Petcare Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mars Inc

- Paide Pet Food

- Big Time

- Blue

- Mogiana Alimentos

- Diamond pet foods

- Heristo

- Gambol

- Ramical

- Affinity Petcare