Global Deep Observability Market Size, Share, Statistics Analysis Report By Component (Software, Services), By Deployment(On-Premise, Cloud-Based, Hybrid), By End-User Industry (IT & Telecom, Healthcare, BFSI, Manufacturing, Government, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan. 2025

- Report ID: 137256

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. Deep Observability Market Size

- Component Analysis

- Deployment Analysis

- End-User Industry Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

The Global Deep Observability Market size is expected to be worth around USD 15,108 Million By 2034, from USD 630 Million in 2024, growing at a CAGR of 37.4% during the forecast period from 2025 to 2034. In 2024, North America dominated the Deep Observability Market, accounting for over 40% of the global share, with a revenue of USD 252 Mn. The US market specifically reached USD 186.4 Mn, exhibiting a robust CAGR of 37.7%.

Deep Observability refers to a sophisticated level of system monitoring that extends beyond traditional observability. It incorporates a variety of data sources, such as logs, metrics, traces, and events, collected from applications, infrastructure, and security systems. This approach is designed to provide a comprehensive view of IT environments, enabling real-time insights into system performance and behavior.

The goal of deep observability is to enhance the ability of organizations to identify, diagnose, and address issues proactively, ensuring optimal system functionality and reliability. The deep observability market is driven by the growing complexity of IT environments, including the expansion of hybrid and multicloud infrastructures. As organizations deploy more distributed systems, the need for enhanced visibility into these systems becomes critical.

Deep observability solutions are increasingly vital for managing the performance and security of these environments. They help in detecting anomalies, understanding system dependencies, and optimizing resource allocation, which are essential for maintaining system integrity and operational efficiency in today’s dynamic IT landscapes.

Additionally, the rising prevalence of cybersecurity threats and the need for stringent compliance measures make deep observability indispensable for identifying potential vulnerabilities and preventing security breaches. Furthermore, the shift towards digital transformation initiatives across industries demands more robust IT monitoring to support critical applications and services effectively.

Market demand for deep observability is surging as businesses recognize the value of proactive system management. Companies are seeking solutions that can provide end-to-end visibility across all layers of their IT infrastructure. This demand is underscored by the necessity for systems that can rapidly diagnose and rectify issues before they impact business operations, thereby enhancing overall productivity and reducing downtime.

According to ChannelLife, Gigamon dominates 63% of the rapidly expanding deep observability market, reflecting a 61% growth in 2023. This highlights the growing demand for detailed network monitoring to enhance real-time threat detection and power AI-driven insights. With over 4,000 global organizations trusting Gigamon, the company has positioned itself as a leader in helping businesses secure and manage their hybrid cloud environments effectively.

Insights from Gigamon’s research reveal critical gaps in cloud security strategies. While 83% of organizations recognize the importance of full visibility into data in motion, 73% prioritize East-West traffic over traditional North-South monitoring for better protection against threats. Additionally, 87% agree that monitoring encrypted traffic is essential to ensure cloud security, yet many teams fall short in achieving this visibility.

Alarmingly, 60% of organizations admit they lack proper insight into lateral (East-West) traffic, which is crucial for detecting internal threats. Even more concerning, 1 in 3 organizations failed to identify a recent breach with their current tools, and 62% confessed that encrypted traffic often bypasses their security inspections.

Technological advancements in deep observability include the integration of artificial intelligence and machine learning techniques. These technologies enable more precise anomaly detection and predictive analytics, allowing organizations to anticipate potential issues and act preemptively. Additionally, improvements in data processing capabilities allow for the real-time analysis of vast amounts of telemetry data, which is crucial for dynamic and complex IT environments.

Implementing deep observability brings numerous business benefits. It enhances operational efficiency by enabling quicker root cause analysis and issue resolution, which minimizes downtime and improves service reliability. It also supports better decision-making through data-driven insights and optimizes resource allocation by identifying underutilized assets.

Key Takeaways

- The Global Deep Observability Market is projected to reach a valuation of USD 15,108 million by 2034, growing from USD 630 million in 2024. This reflects an impressive CAGR of 37.4% over the forecast period from 2025 to 2034.

- In 2024, North America took the lead, commanding over 40% of the global market share and generating USD 252 million in revenue.

- The US market contributed significantly to this dominance, reaching USD 186.4 million in 2024 with a robust CAGR of 37.7% anticipated through 2034.

- The software segment of the deep observability market was a standout in 2024, holding a commanding 70% share of the overall market.

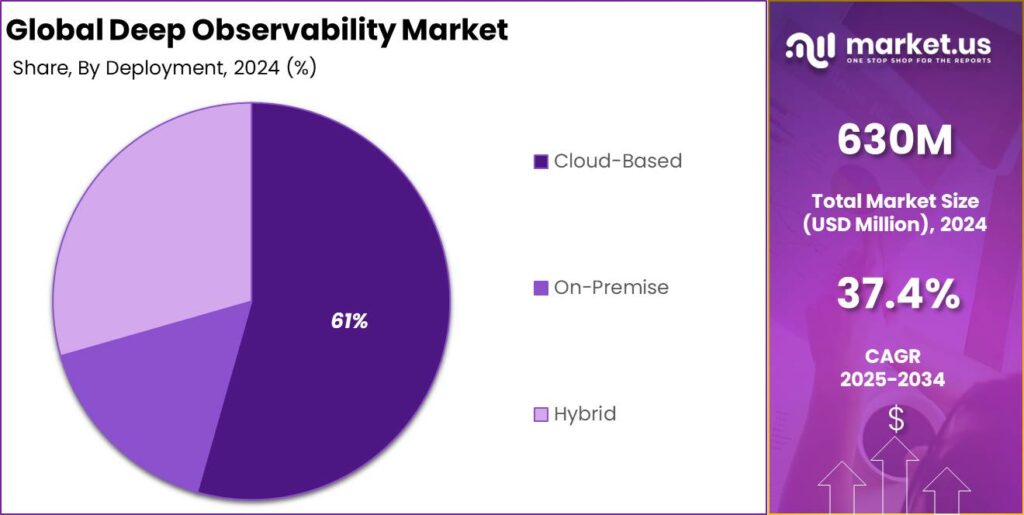

- Additionally, the cloud-based solutions category emerged as a strong growth area, capturing more than 61% of the market share in 2024.

- The IT & Telecom sector also solidified its position as a key player, representing 27% of the market during the same year.

U.S. Deep Observability Market Size

The US market for deep observability was substantial in 2024, valued at USD 186.4 million with a remarkable compound annual growth rate (CAGR) of 37.7%. Several factors contribute to the US’s dominant position in this rapidly growing market.

The US has historically been at the forefront of adopting and developing advanced technologies, including AI and machine learning, which are integral to the advancement of deep observability solutions. These technologies enhance the capabilities of observability platforms, enabling more effective data processing and anomaly detection across complex IT environments.

Significant investments in research and development within the deep observability sector are another key driver. These investments fuel innovation in the field, leading to the development of more sophisticated solutions that cater to the diverse needs of various industries, from healthcare to finance and beyond.

In 2024, North America held a dominant market position in the deep observability sector, capturing more than a 40% share with revenues amounting to USD 252 million. This region’s leadership can be attributed to several key factors.

Primarily, the substantial investment in cloud-based technologies and advanced analytics across industries such as healthcare, finance, and retail drives the demand for deep observability solutions. These tools are crucial for managing complex data infrastructures and ensuring efficient operational processes.

Moreover, the presence of leading market players in North America, who are continuously innovating and expanding their product offerings, significantly contributes to the region’s commanding hold on the market. Companies are investing in research and development to integrate artificial intelligence and machine learning with observability platforms, enhancing their capability to predict system anomalies and manage data more effectively.

The regulatory landscape in North America also plays a critical role. Stricter data protection laws and compliance requirements force companies to maintain high levels of data transparency and traceability, propelling the adoption of advanced observability tools. Additionally, the growing emphasis on digital transformation strategies by North American businesses necessitates robust monitoring and management frameworks, further bolstering the market growth.

Component Analysis

In 2024, the software segment of the deep observability market held a commanding lead, capturing more than 70% of the market share. This dominance can be attributed to several critical factors that highlight the segment’s integral role in modern IT environments.

Firstly, the escalating complexity and continuous evolution of digital ecosystems drive the need for robust software solutions in deep observability. Organizations across various sectors are increasingly reliant on complex IT infrastructures, including cloud-based architectures, microservices, and containerization. These elements require advanced monitoring tools that go beyond traditional methods to provide comprehensive system insights.

Moreover, the adoption of DevOps and agile methodologies further bolsters the demand for observability software. These practices emphasize continuous monitoring and improvement, requiring tools that can seamlessly integrate and function in dynamic development and operational environments. The ability of observability software to support these methodologies enhances its utility and adoption rate among businesses striving for agile and efficient operations.

Furthermore, the increasing focus on enhancing user experience and customer satisfaction is another driving force behind the software segment’s dominance. In the competitive digital marketplace, organizations leverage observability software to optimize application performance, ensuring a seamless end-user experience. This not only helps in maintaining high customer satisfaction but also supports business growth by improving service reliability and performance metrics.

The trend towards digital transformation, marked by the integration of advanced technologies such as AI and machine learning, has made deep observability software even more critical. These technologies are often embedded within observability solutions, enabling more intelligent and automated system monitoring and analytics. This capability allows organizations to proactively manage their IT environments, predict potential issues, and mitigate risks before they impact business operations.

Overall, the software segment’s prominence in the deep observability market is a reflection of its crucial role in enabling businesses to manage increasingly complex and dynamic IT environments effectively. As digital transformation continues to drive the need for advanced monitoring and analytics, the importance of observability software is expected to grow, maintaining its significant market share

Deployment Analysis

In 2024, the cloud-based segment of the deep observability market held a significant lead, capturing more than 61% of the market share. This dominant position can be attributed to several influential factors that have increasingly made cloud-based solutions essential in the observability landscape.

The primary driver for the dominance of cloud-based solutions is the escalating complexity of IT infrastructures, particularly with the widespread adoption of cloud-native architectures, microservices, and the implementation of multi-cloud strategies. These sophisticated environments require robust and scalable observability tools that can provide comprehensive insights across various platforms and services simultaneously.

Cloud-based observability tools address these needs effectively by enabling seamless monitoring and management of distributed systems. Furthermore, the integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) within cloud-based observability tools has significantly enhanced their capability to offer proactive monitoring, intelligent anomaly detection, and predictive analytics.

Additionally, the economic aspect plays a crucial role in the widespread adoption of cloud-based observability solutions. These tools often come with flexible pricing models and reduced overhead costs associated with on-premises infrastructure, making them an attractive option for businesses looking to optimize their IT spend while gaining enhanced operational insights.

End-User Industry Analysis

In 2024, the IT & Telecom segment of the deep observability market held a dominant market position, capturing more than a 27% share. This leadership is primarily attributed to the inherent complexities and rapid technological advancements within the sector.

IT and Telecom industries manage vast networks and diverse data streams that necessitate robust monitoring solutions to ensure continuous system performance and availability. Observability tools are critical in these sectors for providing real-time insights into network performance and service availability, which are essential for maintaining system reliability and customer satisfaction.

The significant growth in this segment is further driven by the increasing shift towards cloud computing and digital transformation initiatives. IT & Telecom companies are prioritizing scalable and agile solutions that can adapt quickly to their evolving infrastructures. This adaptability is crucial in supporting the high demand for reliable and uninterrupted services.

Additionally, the focus on enhancing customer experience through advanced services such as personalized communication and predictive analytics has become a pivotal growth factor. These services rely heavily on the data insights provided by observability tools, which help in optimizing service delivery and troubleshooting issues proactively. This capability not only improves customer satisfaction but also supports the operational efficiency of the companies in this sector.

Overall, the dominant position of the IT & Telecom segment in the deep observability market is underpinned by its critical role in modern digital infrastructures, where real-time data monitoring and advanced analytics are indispensable for operational success and competitive advantage.

Key Market Segments

By Component

- Software

- Services

By Deployment

- On-Premise

- Cloud-Based

- Hybrid

By End-User Industry

- IT & Telecom

- Healthcare

- BFSI

- Manufacturing

- Government

- Others

Driver

Increasing IT Complexity and Cloud Adoption

The profound growth of the deep observability market is significantly driven by the increasing complexity of IT environments. As organizations continue to expand their digital landscapes, they face the challenges of managing intricate cloud-based architectures, microservices, and containerization. This complexity necessitates advanced observability tools that offer comprehensive system insights, facilitating quicker issue detection and resolution.

Moreover, the widespread adoption of cloud computing further amplifies the demand for these tools, as businesses seek to monitor and analyze their multi-cloud infrastructures effectively. These observability tools, integrated with AI and machine learning, enable proactive monitoring and anomaly detection, which are crucial for maintaining system health and enhancing performance.

Restraint

High Costs and Skills Shortage

Despite its benefits, one major restraint in the deep observability market is the high cost associated with implementing and maintaining advanced observability platforms. These costs can be prohibitive for small to medium-sized enterprises, limiting their ability to adopt such technologies.

Additionally, there is often a skills gap in the workforce regarding the expertise required to effectively manage and maximize the utility of these complex systems. Organizations frequently face challenges in finding and retaining personnel with the necessary technical skills to handle sophisticated observability tools, which can hinder the adoption and efficient use of these technologies.

Opportunity

AI Integration and Digital Transformation Initiatives

There is a significant opportunity in the integration of artificial intelligence with observability platforms. AI enhances the capabilities of these platforms, enabling more sophisticated data analysis, predictive maintenance, and automated problem resolution.

This integration is particularly beneficial in handling the vast amount of data generated by modern IT operations and can lead to more dynamic and responsive IT management practices. As more organizations embark on digital transformation initiatives, the demand for AI-enhanced observability tools is expected to rise, presenting a substantial growth opportunity for the market.

Challenge

Managing Complexity in Diverse IT Environments

A primary challenge in the deep observability market is managing the complexity inherent in diverse and dynamic IT environments. As organizations use a variety of technologies and platforms, from on-premises to multiple clouds, ensuring comprehensive visibility and control becomes increasingly difficult.

The integration of various tools and systems into a cohesive monitoring strategy requires significant effort and expertise. Additionally, the need to adapt to continuous technological advancements without disrupting existing operations presents a continual challenge for IT teams striving to maintain an effective observability strategy.

Growth Factors

The growth of the deep observability market is primarily fueled by the increasing complexity of IT environments and the need for enhanced monitoring capabilities that can provide comprehensive insights into these complex systems.

As organizations continue to expand their digital operations, integrating various cloud-based architectures and deploying multi-cloud strategies, the demand for sophisticated observability tools that offer deeper visibility into these infrastructures significantly rises. These tools are crucial for managing the performance and security of IT systems, ensuring they operate efficiently and effectively.

Additionally, the rapid adoption of technologies such as AI and machine learning within observability solutions enhances their capability to predict issues before they occur, thereby minimizing disruptions and maintaining system integrity.

Emerging Trends

A key trend shaping the deep observability market is the integration of AI technologies, which significantly enhances the functionality of observability platforms by enabling more proactive and predictive monitoring capabilities. This integration helps in automating the detection and resolution of IT issues, facilitating faster and more efficient operational workflows.

Furthermore, the shift towards cloud-native observability reflects the growing adoption of cloud-native technologies like Kubernetes, which require specialized monitoring solutions that can adapt to dynamic and scalable environments.

Another emerging trend is the focus on delivering enhanced user experiences by utilizing observability data to improve application performance and end-user interactions. This approach not only boosts customer satisfaction but also aligns IT operations more closely with business outcomes.

Business Benefits

Implementing deep observability within an organization offers multiple business benefits. It significantly enhances operational efficiency by providing real-time insights into IT systems, which helps in quick identification and resolution of potential issues before they affect the broader operations.

This capability reduces downtime and improves service reliability, which are critical for maintaining business continuity. Moreover, deep observability supports better decision-making processes by offering detailed analytics on system performance, enabling organizations to optimize their operations and resource allocation effectively.

Additionally, from a security perspective, deep observability tools can identify and mitigate potential threats promptly, thereby strengthening the overall security posture of the organization and ensuring compliance with various regulatory requirements.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Gigamon has solidified its position as the undisputed leader in the deep observability market, commanding an impressive 61% market share in 2024. The company’s success stems from its comprehensive deep observability pipeline and a large customer base of over 4,000 organizations worldwide.

Gigamon hasn’t been resting on its laurels, though. In June 2024, they launched the innovative Power of 3 Cloud Integration Initiative, partnering with industry giants like Dynatrace and Trace3 to deliver enhanced deep observability solutions to joint customers.

Keysight Technologies has been making bold moves to strengthen its position in the deep observability market. In a significant development, the company announced plans to acquire Synopsys’ Optical Solutions Group in September 2024. This strategic acquisition aims to bolster Keysight’s software-centric solutions strategy, expanding its capabilities in the rapidly growing field of photonics design automation.

NetScout has been making waves in the deep observability market by leveraging artificial intelligence and machine learning to bolster its offerings. In 2024, the company introduced enhancements to its nGenius Enterprise Performance Management solution, incorporating AI-powered analytics to provide deeper insights into network performance.

Top Key Players in the Market

- Datadog

- New Relic

- Elastic

- Gigamon

- Netscout

- Keysight

- Arista

- Cribl

- Kentik

- Honeycomb.io

- Others

Recent Developments

- In August 2025, Arista Networks made a significant push into cloud observability with the acquisition of a cloud-native monitoring startup. This move expands Arista’s capabilities beyond network hardware and into the software realm.

- In July 2024, New Relic doubled down on AI, launching New Relic AI for enhanced observability. This tool uses natural language processing to help users navigate complex telemetry data and generate insights, making observability more accessible to non-technical teams.

- In November 2024, Elastic doubled down on its open-source roots, releasing a fully open-source observability stack16. This move aims to challenge the proprietary solutions dominating the market and appeal to cost-conscious users.

- In December 2024, Gigamon maintained its position as the market leader in deep observability, capturing a whopping 61% market share. The company’s comprehensive pipeline and large customer base have kept it ahead of the pack.

Report Scope

Report Features Description Market Value (2024) USD 630 Mn Forecast Revenue (2034) USD 15,108 Mn CAGR (2025-2034) 37.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By Deployment(On-Premise, Cloud-Based, Hybrid), By End-User Industry (IT & Telecom, Healthcare, BFSI, Manufacturing, Government, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Datadog, New Relic, Elastic, Gigamon, Netscout, Keysight, Arista, Cribl, Kentik, Honeycomb.io and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Datadog

- New Relic

- Elastic

- Gigamon

- Netscout

- Keysight

- Arista

- Cribl

- Kentik

- Honeycomb.io

- Others