Global Data Observability Market Size, Share, Upcoming Investments Report By Component (Solution, Services), By Deployment Mode (Public Cloud, Private Cloud), By End-Use Industry (BFSI, IT & Telecom, Energy & Utility, Manufacturing, Healthcare & Life Science, Retail & Consumer Goods, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 128676

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Segment Analysis

- Deployment Mode Analysis

- End-Use Industry Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Latest Trends

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Top Key Players in the Market

- Recent Developments

- Report Scope

Report Overview

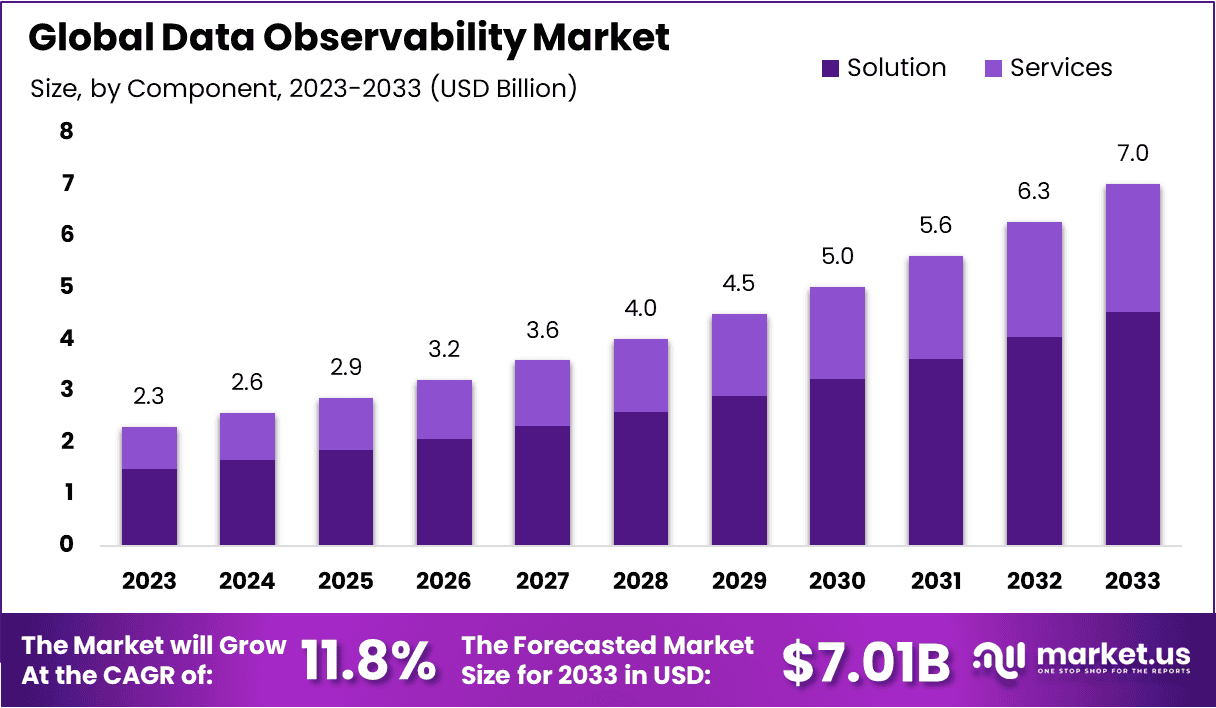

The Global Data Observability Market size is expected to be worth around USD 7.01 billion by 2033, from USD 2.3 billion in 2023, growing at a CAGR of 11.8% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 42% share, holding USD 0.9 Billion revenue.

Data observability is an advanced approach to data management that enables teams to understand the health and reliability of their data systems comprehensively. It extends beyond traditional monitoring by offering end-to-end coverage of the data pipeline, including metrics, metadata, lineage, and logs. This method provides deep insights into data systems, allowing for proactive identification of anomalies and ensuring the integrity of data throughout its lifecycle.

The Data Observability Market is experiencing significant growth due to the increasing importance of big data management and analytics across various industries. Companies are leveraging data observability to gain deeper insights into their data processes, which supports decision-making and strategic planning. This market encompasses a range of solutions including tools for data quality monitoring, incident resolution, and real-time analytics, aimed at enhancing the visibility and control over data ecosystems.

The primary driving factors of the Data Observability Market include the escalating volume of data generated by businesses, the rising demand for data-driven decision-making, and the increasing complexities in data operations across cloud and on-premise environments. As businesses continue to undergo digital transformation, the need for robust data management and analytics solutions becomes crucial to ensure operational continuity and performance.

Market demand for data observability solutions is propelled by the need to address the challenges associated with managing large and complex data landscapes. With the exponential growth of data sources and integration points, businesses require more sophisticated monitoring tools to detect and rectify data anomalies swiftly. This demand is particularly strong in sectors like finance, healthcare, and e-commerce, where data integrity directly impacts business outcomes.

Technological advancements in artificial intelligence (AI) and machine learning (ML) are revolutionizing the Data Observability Market. AI and ML are being integrated into observability tools to provide predictive insights, automate problem detection, and offer prescriptive actions to prevent potential data issues before they affect the business. These technologies improve the accuracy and timeliness of data monitoring, thereby enhancing overall system reliability and efficiency.

The expansion of cloud computing and machine learning technologies presents vast opportunities for the Data Observability Market. These technologies enhance the capabilities of observability platforms by enabling more scalable, flexible, and intelligent monitoring solutions. Moreover, the increasing adoption of IoT devices and the expansion of 5G networks are expected to create new streams of data, further driving the need for advanced data observability solutions.

One of the key drivers of this market is the increasing adoption of cloud-based data environments. By 2025, 65% of enterprises are expected to deploy data observability tools to monitor and optimize cloud data infrastructure, as organizations rely more on hybrid and multi-cloud strategies. These tools help ensure that data pipelines function efficiently, reduce downtime, and improve data accuracy, which is critical for cloud-based operations.

As companies prioritize data-driven decision-making, the demand for end-to-end data visibility has become crucial. By 2026, it is projected that 50% of large enterprises will have fully adopted data observability platforms to monitor the health of their data across the entire lifecycle, from ingestion to consumption. This includes detecting anomalies, tracking lineage, and ensuring compliance with data governance regulations. These platforms are increasingly integrated with AI and machine learning to automate insights and reduce manual intervention.

The rise of artificial intelligence and machine learning in the business landscape further fuels the need for data observability. In 2024, AI-driven observability platforms are expected to represent 35% of new deployments as businesses leverage AI to proactively detect and resolve data quality issues, ensuring high-quality data inputs for advanced analytics and machine learning models. These platforms play a critical role in maintaining data trustworthiness, which is essential for accurate algorithmic predictions and insights.

However, challenges such as data fragmentation and a lack of standardization persist. Despite these hurdles, the growing complexity of data pipelines and the increasing use of real-time analytics present vast opportunities for vendors. In 2024, investments in R&D for data observability solutions are expected to exceed $500 million, as companies seek to improve data transparency, reduce downtime, and enhance data reliability. With the continuous rise in data volumes and velocity, the demand for observability solutions is set to accelerate, making it a crucial component of modern data strategies.

Key Takeaways

- The Global Data Observability Market size is expected to be worth around USD 7.01 billion by 2033, from USD 2.3 billion in 2023, growing at a CAGR of 8% during the forecast period from 2024 to 2033.

- In 2023, the Solution segment held a dominant market position, capturing more than a 64.6% share of the data observability market.

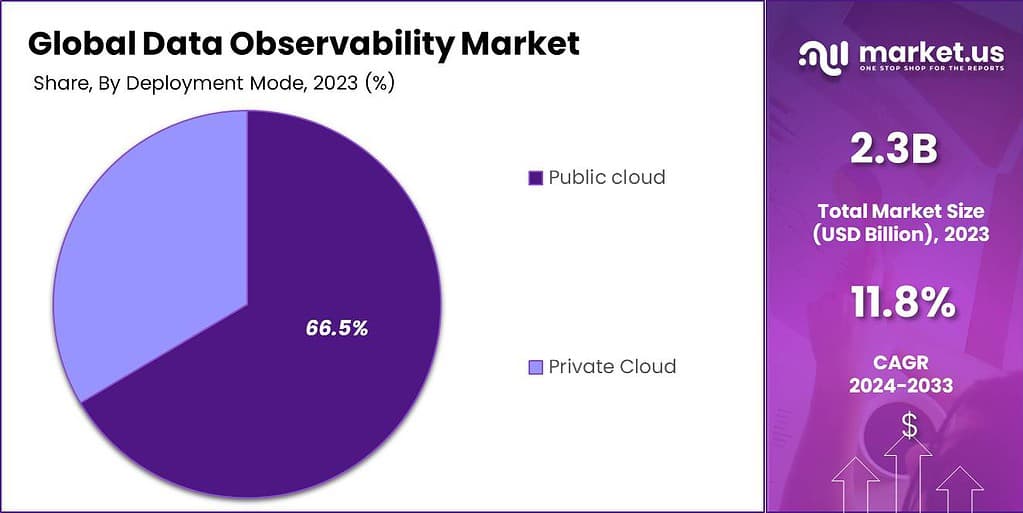

- In 2023, the Public Cloud Segment held a dominant market position, capturing more than a 66.5% share of the data observability market.

- In 2023, the BFSI segment held a dominant market position, capturing more than a 21.2% share of the data observability market.

- In 2023, the North America region held a dominant market position in the data observability market, capturing more than a 42% share.

Component Segment Analysis

In 2023, the solution segment held a dominant market position, capturing more than a 64.6% share of the data observability market. The dominance of the solution segment in the data observability market is primarily driven by the increasing complexity and scale of modern data environments.

As organizations generate and rely on vast amounts of data across multiple platforms, the need for comprehensive tools that provide end-to-end visibility and control over data pipelines has surged. These solutions offer integrated features such as data monitoring, anomaly detection, and root cause analysis, enabling businesses to ensure data quality and reliability in real time.

Moreover, with the rise of cloud adoption and hybrid data architecture, organizations seek robust solutions that can seamlessly integrate across diverse environments. The focus on regulatory compliance and data governance also drives demand for advanced solutions capable of maintaining data integrity and transparency. This combination of factors positions the solutions segment as a critical component of enterprise data strategies, leading to its dominance in the market.

Deployment Mode Analysis

In 2023, the Public Cloud segment held a dominant market position within the Data Observability Market, capturing more than a 66.5% share. This strong performance is primarily due to the scalable, flexible, and cost-effective features of public cloud services, which resonate well with enterprises aiming to streamline their data management processes without significant upfront investment.

Public cloud platforms offer robust data analytics and real-time monitoring tools that enhance data visibility and operational efficiency across diverse industry verticals. The preference for public cloud solutions is also driven by their inherent capacity to handle vast volumes of data generated by modern applications and IoT devices.

These platforms facilitate easier integration with existing IT infrastructure, which is a pivotal factor for organizations looking to adopt data observability without disrupting their ongoing operations. Moreover, the public cloud’s pay-as-you-go model allows companies to manage costs effectively, adjusting resources as business needs evolve.

The surge in remote work trends has further amplified the demand for public cloud observability solutions, as businesses seek to ensure the reliability and security of their distributed networks. Additionally, public cloud providers continuously enhance their offerings with advanced machine learning and artificial intelligence capabilities to provide deeper insights and predictive analytics, making them even more appealing to companies aiming to future-proof their operations.

As more organizations embark on digital transformation journeys, the dominance of the public cloud segment is expected to strengthen, underpinned by its ability to offer scalable and cutting-edge data observability solutions.

End-Use Industry Analysis

In 2023, the BFSI segment held a dominant market position, capturing more than a 21.2% share of the data observability market. The BFSI segment dominates the data observability market due to its high reliance on data accuracy, security, and compliance. In the BFSI sector, data is integral for risk management, fraud detection, customer insights, and regulatory reporting.

Consequently, organizations in this segment require advanced observability tools to ensure the integrity, consistency, and availability of their data. The sector’s stringent regulatory requirements, such as GDRP and Basel III, demand rigorous monitoring and auditing capabilities, which data observability solutions provide.

Additionally, the BFSI industry’s focus on real-time transaction processing and analytics necessitates robust tools to detect and resolve data issues swiftly, preventing disruption and maintaining customer trust.

Key Market Segments

By Component

- Solution

- Services

By Deployment Mode

- Public Cloud

- Private Cloud

By End-Use Industry

- BFSI

- IT & Telecom

- Energy & Utility

- Manufacturing

- Healthcare & Life Science

- Retail & Consumer Goods

- Others

Driving Factors

Growing complexity of data

The growing complexity of data is a significant driver for the global data observability market due to the increased volume, variety, and velocity of data generated by modern enterprises. As organizations adopt diverse data sources and technologies, including cloud platforms, IoT devices, and big data analytics, managing and ensuring the quality of this data becomes increasingly challenging.

Data observability tools address these challenges by providing comprehensive visibility into data pipelines, enabling real-time analysis. They help organizations track data flow across complex systems, identify and resolve issues promptly, and maintain data integrity and consistency.

The need for such tools grows as data environments become more intricate, making observability solutions essential for effective data management and decision-making. This rising demand for sophisticated monitoring and control capabilities fuels the expansion of the data observability market.

Restraining Factors

Data privacy concern

Data privacy concerns can act as a restraint for the global data observability market due to the complexities involved in ensuring that observability tools themselves adhere to stringent privacy regulations.

As organizations deploy data observability solutions, they must ensure these tools do not inadvertently expose sensitive information or violate data protection laws. This challenge is particularly acute when observability tools access or analyze personal data, requiring stringent security measures to protect against potential breaches.

Additionally, integrating observability tools into existing systems can complicate compliance with privacy regulations, requiring organizations to implement extra layers of security and data masking. The need for extensive vetting and validation of observability tools to ensure they meet privacy standards can slow down adoption and increase costs.

Growth Opportunities

The integration of AI and Machine Learning

The integration of AI and machine learning represents a significant opportunity for the global data observability market by enhancing the capabilities of data monitoring and analysis. AI and Machine Learning algorithms can automate the detection of anomalies, predict potential issues, and provide deeper insights into data trends and patterns.

This advanced functionality enables proactive management of data pipelines, reducing the need for manual intervention and improving the accuracy of issue identification. These technologies can also optimize data observability by learning from historical data to improve detection algorithms and adapt to evolving data environments.

The ability to apply AI-driven analytics can lead to more efficient data management, faster resolution of data issues, and enhanced overall data quality. As organizations increasingly seek to leverage advanced technologies for better data insights, the integration of AI and machine learning into observability solutions presents a substantial growth opportunity for the market.

Challenging Factors

Increased cost

Increased cost poses a significant challenge for the global data observability market. High prices for advanced data observability solutions can be prohibitive, especially for smaller organizations or those with limited budgets. These solutions often require substantial investment in both software licenses and the necessary infrastructure to support them, including cloud services and integration services.

Additionally, the total cost of ownership can include ongoing maintenance, updates, and skilled personnel to manage and interpret the data further driving up expenses. This financial burden can deter organizations from adopting or fully utilizing observability tools, limiting market growth.

The high costs associated with implementing comprehensive observability solutions may also lead to budget constraints or prioritization of other investments, impacting the market’s expansion and adoption rates. Addressing these cost barriers is essential for broadening the accessibility and appeal of data observability tools.

Growth Factors

- Increasing data volumes and its complexities: the rapid expansion of data sources and the complexity of the data environment drive the need for comprehensive monitoring and management solutions.

- Cloud adoption: the shift to cloud and hybrid environments necessitates advanced observability solutions that can provide visibility across diverse and distributed data platforms.

- Data-driven decision-making: the growing emphasis on data-driven strategies in businesses boosts the demand for tools that ensure data accuracy, reliability, and quality.

- Emerging technologies: integration with AI and machine learning enhances the observability tools capabilities. Offering advanced anomaly detection and predictive analytics.

Latest Trends

- Real-time monitoring: growing emphasis on real-time data monitoring and altering to quickly identify and address issues as they arise.

- Unified observability platforms: the emergence of platforms that provide end-to-end visibility across data pipelines, integrating monitoring, logging, and analytics in a single solution.

- Enhanced user experience: improved interface and user experience, making observability tools more intuitive and accessible for users across different levels of technical expertise.

- Automation and orchestration: growth in automated workflows and orchestration capabilities to streamline data management processes and reduce manual intervention.

Regional Analysis

North America region is leading the market

In 2023, North America held a dominant market position in the data observability market, capturing more than a 42% share with a revenue of USD 0.9 Billion. The dominance of North America in the global data observability market is primarily driven by the region’s advanced technological infrastructure and early adoption of cutting-edge technologies like big data, cloud computing, and artificial intelligence.

The presence of numerous large enterprises and tech giants in the U.S. and Canada, which heavily invest in data management and analytics, further fuels the demand for sophisticated data observability solutions.

Additionally, North America’s stringent regulatory environment, particularly with data privacy laws such as CCPA and industry-specific regulations, drives organizations to implement robust data observability tools to ensure compliance. The region also benefits from a strong ecosystem of innovative start-ups and established companies in the data observability space, fostering continuous innovation and growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Different key players in the market focus on innovation and competition. Each of these key players has its strengths and challenges that tend to shape their position in the market and influence the overall landscape of the industry.

One of the prominent players in the market is Datadog which is known for its comprehensive monitoring and observability platform. It offers full-stack visibility, including metrics, traces, and logs.

Another crucial player is Dynatrace, which focuses on providing advanced observability with AI-driven insights and automated monitoring for applications, infrastructures, and user experience.

Top Key Players in the Market

- Microsoft

- Monte Carlo

- Acceldata

- AppDynamics

- Datadog

- Dynatrace LLC

- Hound Technology, Inc.

- IBM Corporation

- New Relic, Inc.

- Splunk Inc.

- Other Key Players

Recent Developments

- In July 2024, Cloudera announced the launch of two new offerings for Cloudera Observability Premium designed to simplify and automate platform administration. These platforms feature to provide a single source of observability across all cloud-based and on-premises data centers, even for the most secure enterprises.

- In May 2024, Riverbed launched an open, AI-powered data observability platform aimed at resolving the issues that exist in complex IT environments including public cloud and remote work environments, as well as zero Trust and SD-WAN architectures.

Report Scope

Report Features Description Market Value (2023) USD 2.3 billion Forecast Revenue (2033) USD 7.01 billion CAGR (2024-2033) 11.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Deployment Mode (Public Cloud, Private Cloud), By End-Use Industry (BFSI, IT & Telecom, Energy & Utility, Manufacturing, Healthcare & Life Science, Retail & Consumer Goods, Others) Region Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft, Monte Carlo, Acceldata, AppDynamics, Datadog, Dynatrace LLC, Hound Technology, Inc., IBM Corporation, New Relic, Inc., Splunk Inc., and Other Key Players. Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Data Observability?Data observability refers to the ability to monitor, track, and analyze the health and quality of data across its entire lifecycle, ensuring data reliability, accuracy, and compliance.

What are the key factors driving the growth of the Data Observability Market?The growth is driven by the rising complexity of data architectures, the adoption of cloud-based environments, and the increasing need to prevent costly data quality issues that affect business operations and decision-making.

What are the current trends and advancements in the Data Observability Market?

-

-

- Microsoft

- Monte Carlo

- Acceldata

- AppDynamics

- Datadog

- Dynatrace LLC

- Hound Technology, Inc.

- IBM Corporation

- New Relic, Inc.

- Splunk Inc.

- Other Key Players