Global Data Acquisition Market By Component (Hardware,others), By Speed, By Application (Testing, Monitoring), By Industry Vertical (Automotive & Transportation,Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166154

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

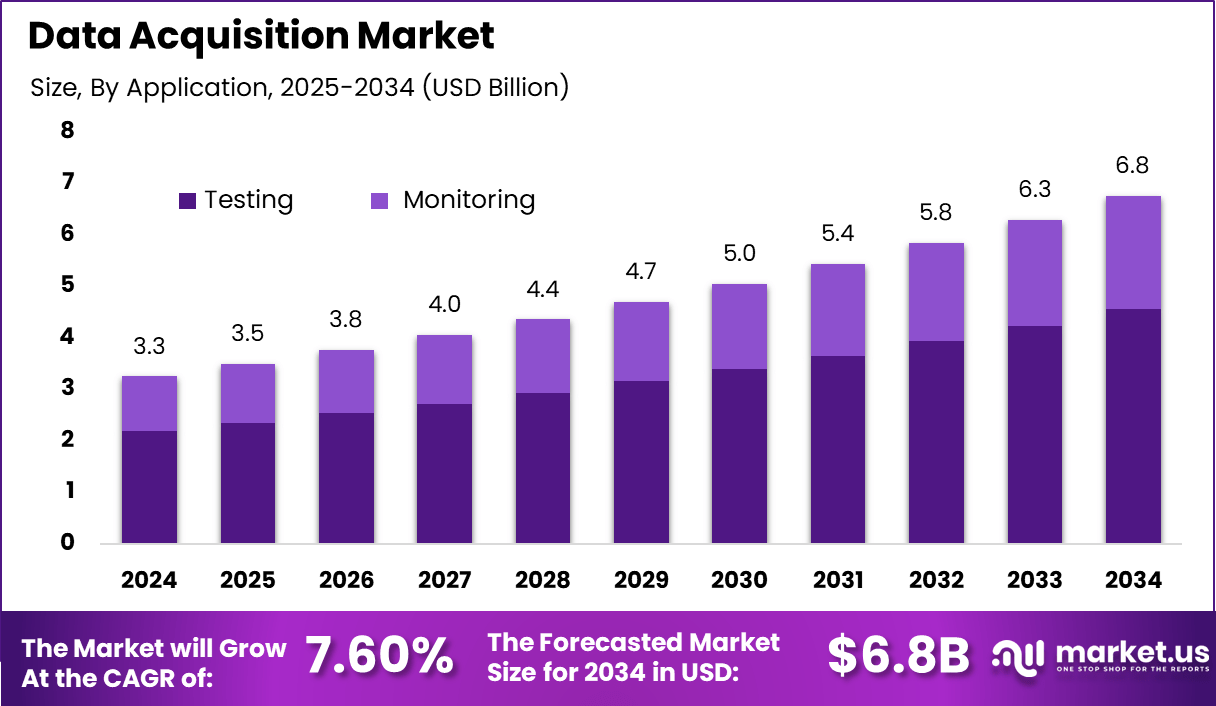

The Global Data Acquisition Market generated USD 3.3 billion in 2024 and is predicted to register growth from USD 3.5 billion in 2025 to about USD 6.8 billion by 2034, recording a CAGR of 7.6% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 40.4% share, holding USD 0.03 Billion revenue.

The data acquisition market has grown steadily as organisations rely on accurate measurement, monitoring and analysis of physical parameters across industrial, scientific and commercial environments. The market forms an essential foundation for modern automation, testing and validation processes. Growth reflects the rising use of sensor networks, digital instrumentation and connected systems that require continuous collection of real world data.

The growth of the market can be attributed to increased automation across manufacturing, energy, transportation and research sectors. The need for precise data to support performance optimisation, safety compliance and predictive maintenance strengthens adoption. Expansion of IoT ecosystems and edge analytics further increases demand for reliable acquisition hardware and software. The shift toward digital twins and real time monitoring also supports market growth.

Increasing Adoption Technologies include Industrial Internet of Things (IIoT), cloud computing, and edge processing. IIoT enables seamless data collection from connected devices, while cloud platforms facilitate storage and analytics, enhancing scalability and accessibility. Edge computing brings processing closer to the data source, improving speed and reducing latency.

Key Reasons for Adopting DAQ Systems are enhanced operational efficiency, improved decision-making, and regulatory compliance. Businesses can identify inefficiencies, optimize resource use, and maintain quality control with accurate, continuous monitoring. In sectors like healthcare, precise data acquisition enables better diagnosis and treatment monitoring.

Top Market Takeaways

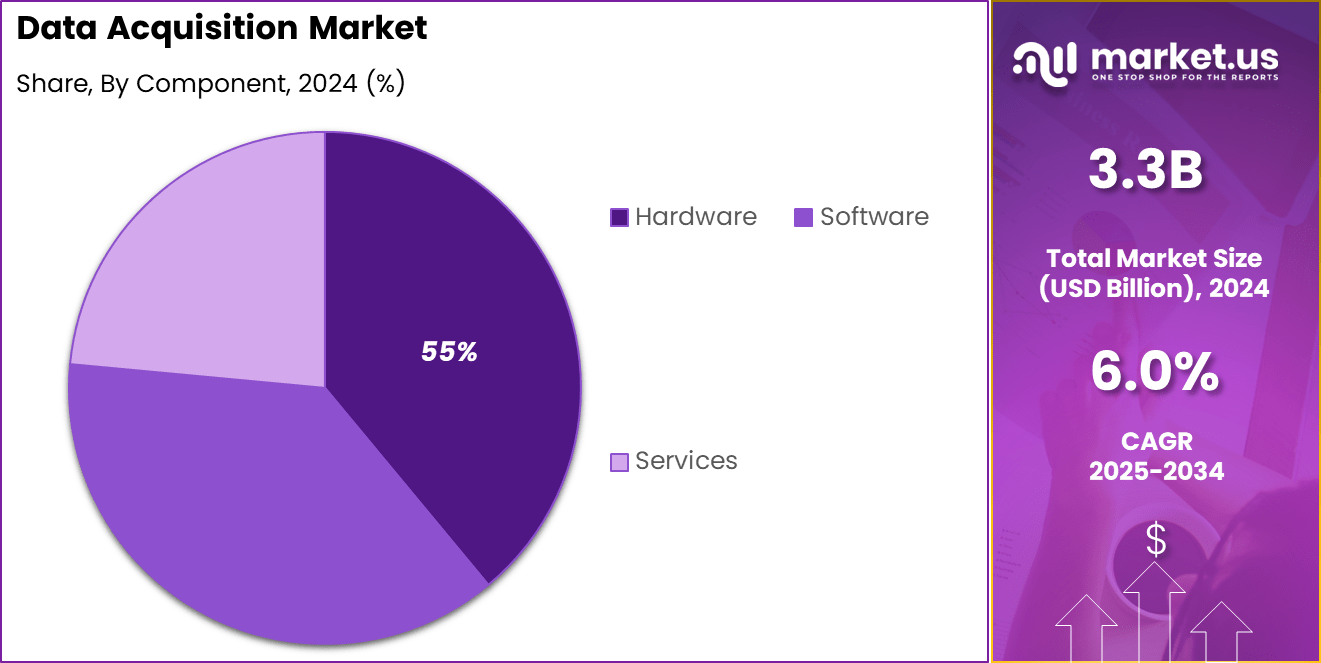

- By component, hardware dominates with 54.7% share, driven by the demand for reliable and accurate sensors, analog-to-digital converters, and signal conditioning devices essential for data capture and conversion in various applications.

- By speed, the high-speed segment (20 MS/S to 100 MS/S) accounts for 38.4% share, favored in applications requiring rapid data collection and processing such as automotive testing, aerospace, and healthcare.

- By application, testing is the largest segment at 67.3%, reflecting continued need for performance validation, quality assurance, and regulatory compliance in product development and manufacturing.

- By industry vertical, automotive and transportation lead with 35.5% share, driven by extensive use in vehicle performance testing, advanced driver-assistance systems (ADAS) validation, and autonomous vehicle development.

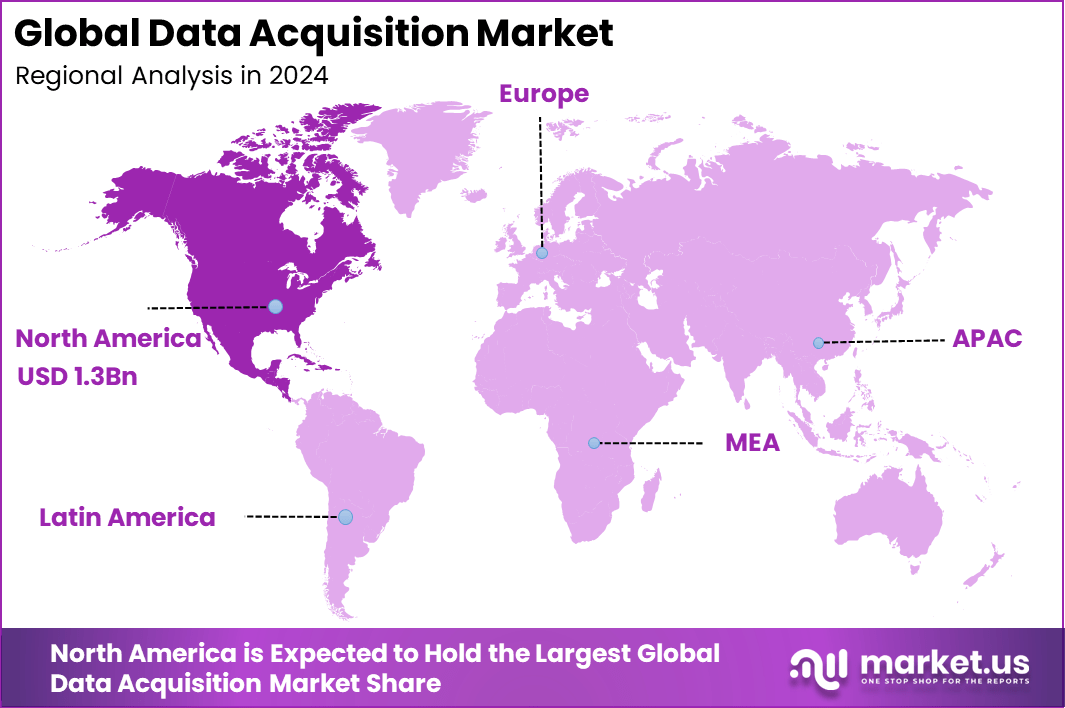

- Regionally, North America holds about 40.4% market share, benefitting from strong industrial infrastructure, extensive R&D investments, and high adoption of advanced manufacturing technologies.

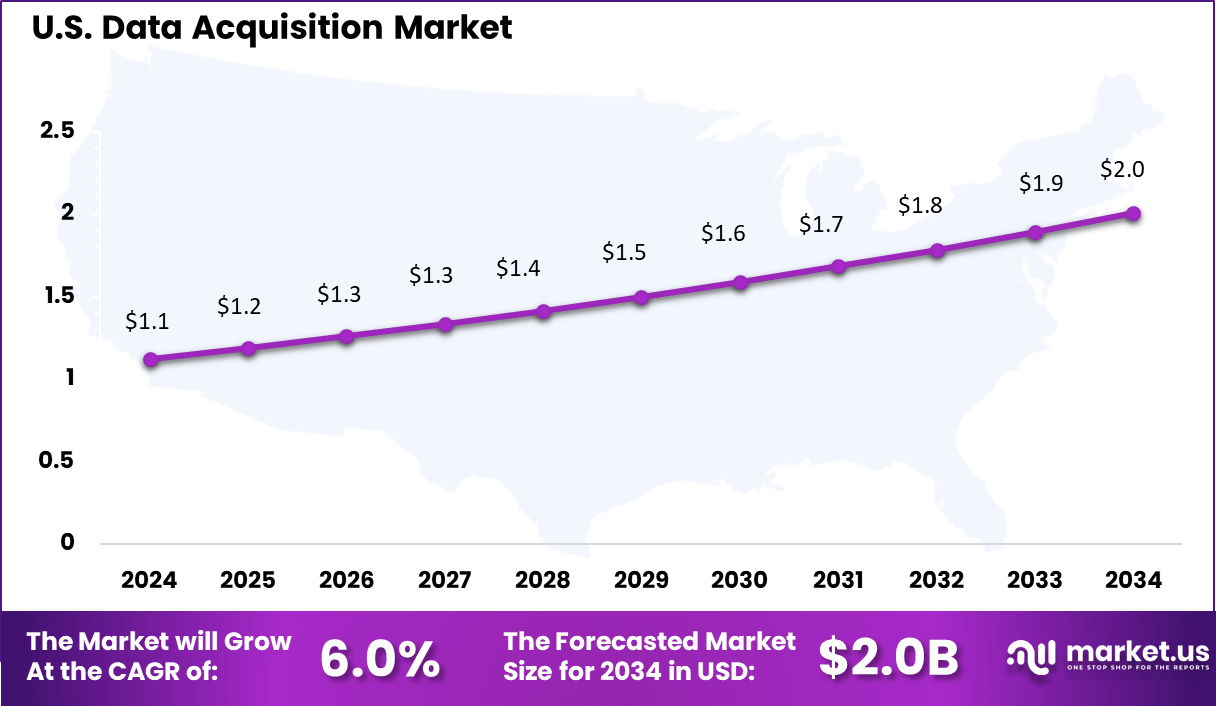

- The U.S. market size is estimated at approximately USD 1.12 billion in 2025.

- The market is growing at a CAGR of 6.0%, driven by rising demand for real-time data monitoring, digital transformation initiatives in automotive and transportation sectors, and growing industrial automation.

- Key players include National Instruments, Keysight Technologies, Tektronix, and Siemens, focusing on innovative hardware platforms that integrate with IoT, AI, and cloud analytics for enhanced data acquisition capabilities.

Adoption Rates

- Industrial automation: About 60% of companies had implemented some level of automation by 2024, creating strong momentum for wider adoption of data acquisition systems. This rate is expected to continue rising as more operations shift to automated workflows.

- IoT integration: The number of connected IoT devices is projected to reach 21.1 billion in 2025 and grow to 39 billion by 2030. In manufacturing, about 62% of companies have already adopted IoT technologies, which depend heavily on continuous data acquisition.

- AI and cloud adoption: Around 48% of businesses use AI to manage and analyze real-time data streams, reflecting the growing shift toward cloud-based and intelligent data acquisition solutions.

By Component

In 2024, The hardware segment holds a significant 55% share in the data acquisition market. This reflects the strong reliance on physical components such as sensors, data collectors, amplifiers, and interface modules that are essential for capturing and processing data across various industries.

Hardware’s pivotal role includes ensuring accuracy, durability, and speed in data collection, which are critical for real-time decision-making and automation systems. As technologies evolve, hardware solutions are becoming more compact, energy-efficient, and capable of handling higher data volumes, which fuels increased adoption across manufacturing, aerospace, and scientific research sectors.

By Speed

In 2024, High-speed data acquisition devices, with sampling rates between 20 million samples per second (MS/S) and 100 MS/S, account for 38.4% of the market. These systems are essential in applications requiring fast data processing such as radar, medical imaging, and high-frequency trading. Their ability to capture high-resolution data at rapid speeds enables precise analysis, which is increasingly demanded in demanding industrial and scientific applications.

Continued innovations in high-speed electronics and signal processing are expanding the capabilities of these systems, driving broader usage in cutting-edge research and automation.

By Application

In 2024, Testing applications dominate with a 67.3% share, highlighting their vital role in validating product quality, compliance, and system performance. Data acquisition systems are extensively used in R&D labs, manufacturing lines, and field testing environments to analyze electrical, mechanical, and environmental parameters.

Precision testing ensures products meet safety and quality standards while supporting predictive maintenance and failure analysis. The demand for reliable testing tools is driven by rising regulatory requirements and the need for detailed data insights, which are critical for innovation and quality assurance processes.

By Industry Vertical

In 2024, The automotive and transportation vertical holds a 35.5% share, emphasizing the importance of data acquisition in vehicle testing, autonomous driving, and transportation infrastructure. These systems collect crucial data related to vehicle dynamics, engine performance, and safety features.

They also play a role in the development of electric vehicles and driver assistance technologies, supporting innovation and safety improvements. As the automotive sector shifts toward smart, connected, and electric vehicles, data acquisition systems are increasingly vital for testing and real-time monitoring, pushing the industry toward higher levels of automation and safety.

Emerging Trends

Key Trend Description AI and ML Integration Use of artificial intelligence and machine learning for automated data analysis and predictive insights. Edge Computing for DAQ Processing data closer to the source to reduce latency and bandwidth requirements. Cloud-based and Wireless Monitoring Increased adoption of cloud platforms and wireless remote monitoring for real-time scalability. Low-Code/No-Code Platforms Simplifying data acquisition software development for a broader user base. Enhanced Cybersecurity Features Proactive development of security features to protect data and systems from cyber threats. Growth Factors

Key Factor Description Rising adoption of automation Growing need for real-time data monitoring and analysis across industries boosts demand for DAQ solutions. Increasing industrial and IoT usage Expansion of IoT devices and industrial automation creates higher demand for accurate data acquisition. Technological advancements Improvements in sensor technology and system integration enhance DAQ capabilities. Stringent regulatory requirements Regulatory compliance drives the adoption of advanced monitoring and data acquisition systems. Growing focus on smart manufacturing Industry 4.0 and Industry 5.0 trends encourage investment in high-speed, automated data acquisition. Key Market Segments

By Component

- Hardware

- Software

- Services

By Speed

- Ultra-High (>100 MS/S)

- High-speed (20 MS/S – 100 MS/S)

- Medium (1 MS/S – 20 MS/S)

- Middle (100 KS/S – 1 MS/S)

- Low (<100 KS)

By Application

- Testing

- Monitoring

- By Industry Vertical

- Automotive & Transportation

- Healthcare

- Food & Beverage

- Aerospace & Defense

- Power & Energy

- Manufacturing

- Others

Regional Analysis

North America retained its leading position in the data acquisition market, commanding a substantial 40.4% share driven by a well-established technological infrastructure and a diverse industrial base. The region’s growth is underpinned by increasing adoption of advanced data monitoring solutions across aerospace, automotive, telecommunications, manufacturing, and healthcare sectors.

Investments in real-time data analytics, IoT integration, and industrial automation further enhance the capabilities and demand for data acquisition systems. Supportive regulations alongside continuous R&D efforts by major market players amplify North America’s dominance, making it a critical hub for innovation and application of data acquisition technologies to improve operational efficiency and productivity.

The U.S. market is a significant contributor, valued at around USD 1.12 billion as of 2024 and growing steadily at a CAGR of 6.0%. The U.S. benefits from a strong ecosystem of leading manufacturers and service providers such as National Instruments, Keysight Technologies, and Schneider Electric, which focus on delivering high-performance, reliable, and scalable data acquisition solutions.

Adoption spans multiple industries with increasing emphasis on real-time monitoring, quality control, and data-driven decision-making. Factors like growing digital transformation initiatives, smart manufacturing processes, and government-backed infrastructure upgrades propel market growth. The U.S. remains pivotal in driving technological advancement and commercial adoption of data acquisition systems within North America and globally.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Adoption of Emerging Technologies

The data acquisition market is driven strongly by the rising adoption of emerging technologies such as the Internet of Things (IoT), artificial intelligence (AI), and Industry 4.0 implementations. These technologies require precise, real-time data to enable better decision-making, automation, and operational efficiency across various industries including manufacturing, healthcare, and energy.

Moreover, the growing complexity of industrial operations and stringent regulatory environments push the need for advanced data monitoring and compliance tracking solutions. This accelerates demand for sophisticated data acquisition systems capable of handling big data and ensuring traceability in operations, thereby expanding the market significantly.

Restraint

High Costs and Computational Requirements

The high costs associated with advanced data acquisition systems pose a major restraint for the market. These systems often require expensive hardware with robust processing power and advanced sensors, making initial investments significant, especially for small and medium enterprises.

Additionally, managing real-time data analysis demands substantial computational resources and skilled personnel.These factors increase the total cost of ownership and create barriers to adoption in budget-sensitive industries. The need for ongoing maintenance, specialized IT infrastructure, and continuous software upgrades further exacerbates these cost challenges, slowing down market penetration.

Opportunity

Automation and Cloud-Based Solutions

Automation and cloud-based data acquisition solutions present a notable opportunity for market growth. Automated data acquisition enhances accuracy, reduces human error and speeds up data processing, making operations more reliable and efficient. Cloud integration enables real-time data access and scalability, supporting remote monitoring and multi-site management, which is particularly attractive to large enterprises.

The increasing deployment of smart factories and digital twins in manufacturing, along with rising demand for predictive maintenance in sectors such as energy and transportation, create expansive use cases. These trends foster innovation and open doors for new entrants offering flexible, software-driven data acquisition platforms.

Challenge

Regulatory Compliance and Integration Complexity

Regulatory compliance and integration complexity are key challenges affecting the data acquisition market. Data acquisition systems must adhere to strict industry standards for data accuracy, security, and reporting, requiring costly certifications and frequent audits. Companies need to ensure that their systems are compliant with ever-evolving regulations, which can delay deployment and increase costs.

Additionally, integrating new data acquisition systems with legacy infrastructure poses technical difficulties. Diverse hardware, software, and protocols require seamless interoperability, demanding customized solutions and expertise. This integration challenge alongside a shortage of skilled professionals capable of managing sophisticated DAQ systems hampers smooth adoption and scaling.

Competitive Analysis

The data acquisition market is highly competitive, featuring established leaders such as Keysight Technologies, Agilent Technologies, Yokogawa Electric, Advantech, Phoenix Contact, Emerson Electric, Teledyne Technologies, Honeywell, Spectris, Campbell Scientific, General Electric, Brüel & Kjær, Fluke, Siemens Digital Industries Software, National Instruments, and AstroNova.

These firms compete by offering comprehensive hardware and software solutions that enable accurate, real-time data collection and analysis across a wide range of industrial, scientific, and commercial applications. Their strengths lie in delivering high precision, integration with emerging technologies such as IoT and AI, and robust global support and service networks.

The competitive landscape is shaped by ongoing innovation aimed at improving sensor accuracy, data processing speeds, and connectivity options, often integrating cloud computing and edge analytics to meet Industry 4.0 standards. Companies strive to differentiate through customized solutions to specific industries like manufacturing, aerospace, healthcare, and energy management.

Geographic expansion, strategic alliances, and acquisitions play a crucial role in enhancing product portfolios and market presence. As digital transformation accelerates, demand for advanced, efficient, and scalable data acquisition systems continues to drive competitiveness and growth in this sector.

Top Key Players in the Market

- Keysight Technologies

- Agilent Technologies

- Yokogawa Electric Corporation

- Advantech Co., Ltd.

- Phoenix Contact GmbH & Co. KG

- Emerson Electric Co.

- Teledyne Technologies Incorp

- Honeywell International Inc.

- orated

- Spectris PLC

- Campbel Scientific

- General Electric

- Brilel & Kjaer

- Fluke Corporation

- Siemens Digital Industries Software

- National Instruments Corporation

- AstroNova, Inc.

- Other Major Players

Recent Developments

- August, 2025, Keysight reported strong Q3 revenue and profit exceeding analyst expectations. The company raised its fiscal year 2025 sales growth outlook to 7%, driven by robust demand in communications, automotive, and semiconductors, and growth in AI-related wireline business.

- June, 2025, Agilent announced new product introductions at HPLC 2025, including Hybrid Multisampler and LC Single Quadrupole Mass Spectrometers, enhancing lab workflow efficiency and analytical performance in biopharma and industrial labs.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Bn Forecast Revenue (2034) USD 6.8 Bn CAGR(2025-2034) 7.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Speed (Ultra-High (>100 MS/S), High-speed (20 MS/S – 100 MS/S), Medium (1 MS/S – 20 MS/S), Middle (100 KS/S – 1 MS/S), Low (<100 KS/S)), By Application (Testing, Monitoring), By Industry Vertical (Automotive & Transportation, Healthcare, Food & Beverage, Aerospace & Defense, Power & Energy, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competetive Landschape Keysight Technologies, Agilent Technologies, Yokogawa Electric Corporation, Advantech Co., Ltd., Phoenix Contact GmbH & Co. KG, Emerson Electric Co., Teledyne Technologies Incorporated, Honeywell International Inc., Spectris PLC, Campbell Scientific, General Electric, Brüel & Kjær, Fluke Corporation, Siemens Digital Industries Software, National Instruments Corporation, AstroNova, Inc., and other major players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Keysight Technologies

- Agilent Technologies

- Yokogawa Electric Corporation

- Advantech Co., Ltd.

- Phoenix Contact GmbH & Co. KG

- Emerson Electric Co.

- Teledyne Technologies Incorp

- Honeywell International Inc.

- orated

- Spectris PLC

- Campbel Scientific

- General Electric

- Brilel & Kjaer

- Fluke Corporation

- Siemens Digital Industries Software

- National Instruments Corporation

- AstroNova, Inc.

- Other Major Players