Global Creatine Kinase Reagent Market By Product Type (Reagents, Instruments, and Kits), By Test (Enzymatic Tests, Point of Care Tests, ELISA-based Tests, Colorimetric Assay Based Tests, and Others), By Application (Research, and Diagnosis), By End-user (Hospitals & Clinics, Diagnostic Laboratories, Academic Research Institutes, and Other), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162152

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

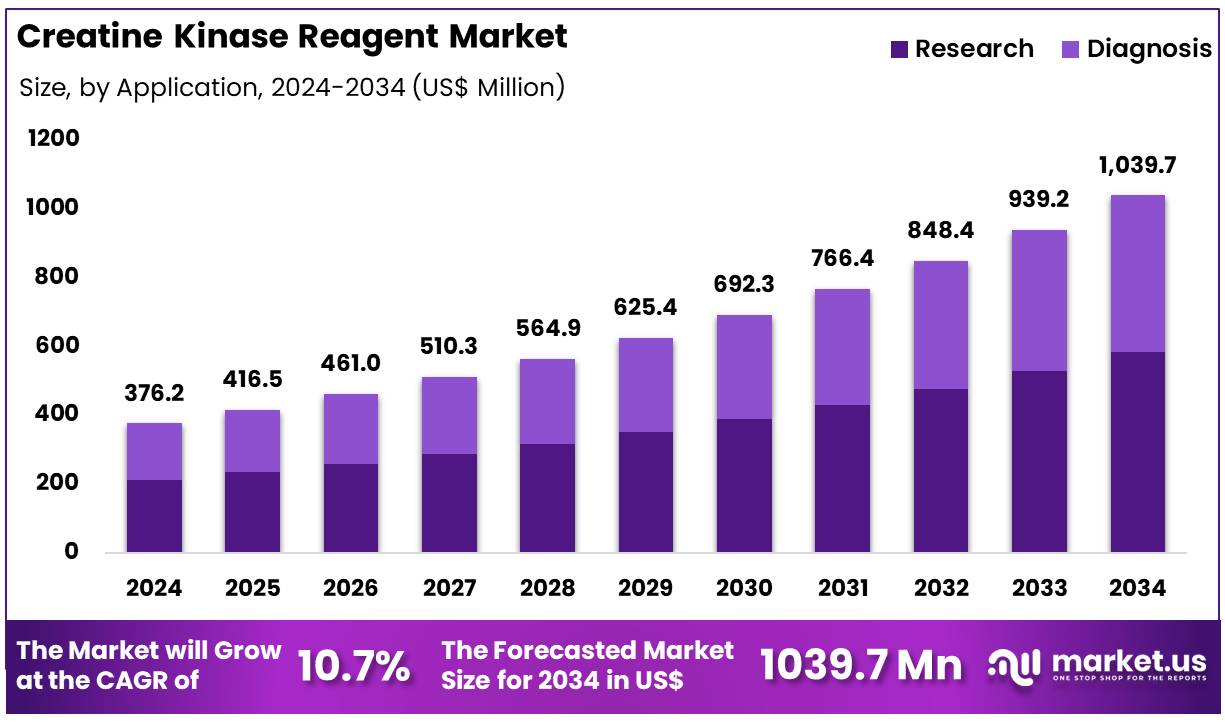

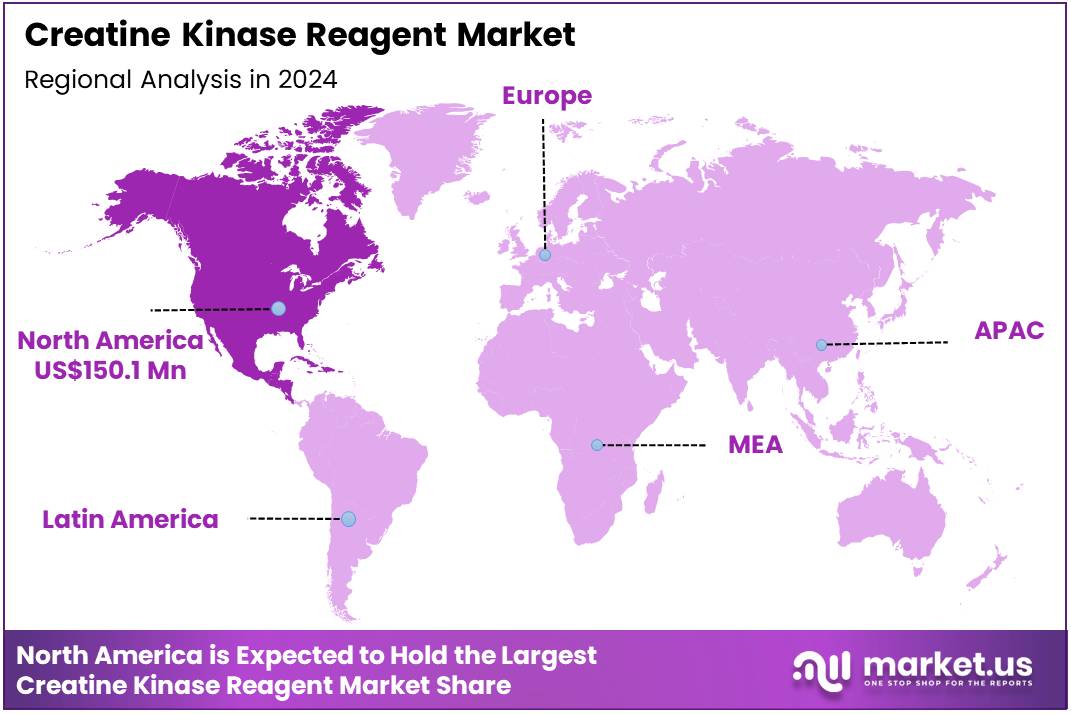

Global Creatine Kinase Reagent Market size is expected to be worth around US$ 1039.7 Million by 2034 from US$ 376.2 Million in 2024, growing at a CAGR of 10.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.9% share with a revenue of US$ 150.1 Million.

Rising incidence of cardiovascular disorders propels the creatine kinase reagent market as clinicians demand rapid, precise biomarkers for effective diagnosis. Cardiologists increasingly utilize creatine kinase reagents to detect myocardial infarction, measuring CK-MB levels to confirm heart muscle damage in emergency departments. This driver intensifies with the need for neuromuscular diagnostics, where reagents quantify total CK to identify muscular dystrophy in young patients.

Laboratories apply these reagents in rhabdomyolysis screening, guiding fluid therapy for trauma patients to prevent kidney injury. According to the Heart and Stroke Foundation of Canada, 750,000 individuals live with heart failure, with 100,000 new diagnoses annually, highlighting the urgent need for reliable testing solutions. In January 2022, Thermo Fisher Scientific’s US$1.85 billion acquisition of PeproTech enhanced its cardiac diagnostic reagent offerings, boosting clinical adoption.

Growing advancements in automated diagnostic platforms create significant opportunities in the creatine kinase reagent market. Innovators develop high-sensitivity reagent kits for oncology, monitoring CK levels to evaluate muscle toxicity from chemotherapy regimens. Research centers explore these reagents in sports medicine, analyzing post-exercise CK spikes to tailor athlete recovery plans.

Opportunities also emerge in critical care, where reagents track muscle breakdown in sepsis patients to inform treatment adjustments. The FDA reports over 200 diagnostic assay approvals in 2023, underscoring the potential for creatine kinase reagents to support diverse clinical applications. In September 2022, PerkinElmer’s Oxford Immunotec gained FDA approval for the T-Cell Select™ reagent kit, streamlining automated workflows and indirectly driving demand for precise diagnostic reagents.

Recent trends in the creatine kinase reagent market focus on automation and point-of-care integration to enhance diagnostic efficiency. Manufacturers embed reagents in compact analyzers for dialysis units, enabling rapid CK testing to monitor renal complications in real-time. Trends also include standardized reagents for veterinary diagnostics, assessing muscle damage in equine injury evaluations.

Hospitals adopt these solutions for perioperative monitoring, measuring CK to detect surgical stress in orthopedic procedures. In January 2022, Thermo Fisher Scientific’s acquisition of PeproTech further supported reagent development for cardiac diagnostics, strengthening market growth. These advancements reflect a strategic shift toward seamless, high-precision creatine kinase testing ecosystems across clinical and veterinary settings.

Key Takeaways

- In 2024, the market generated a revenue of US$ 376.2 Million, with a CAGR of 10.7%, and is expected to reach US$ 1039.7 Million by the year 2034.

- The product type segment is divided into reagents, instruments, and kits, with reagents taking the lead in 2023 with a market share of 51.8%.

- Considering test, the market is divided into enzymatic tests, point of care tests, ELISA-based tests, colorimetric assay based tests, and others. Among these, enzymatic tests held a significant share of 48.5%.

- Furthermore, concerning the application segment, the market is segregated into research and diagnosis. The research sector stands out as the dominant player, holding the largest revenue share of 56.2% in the market.

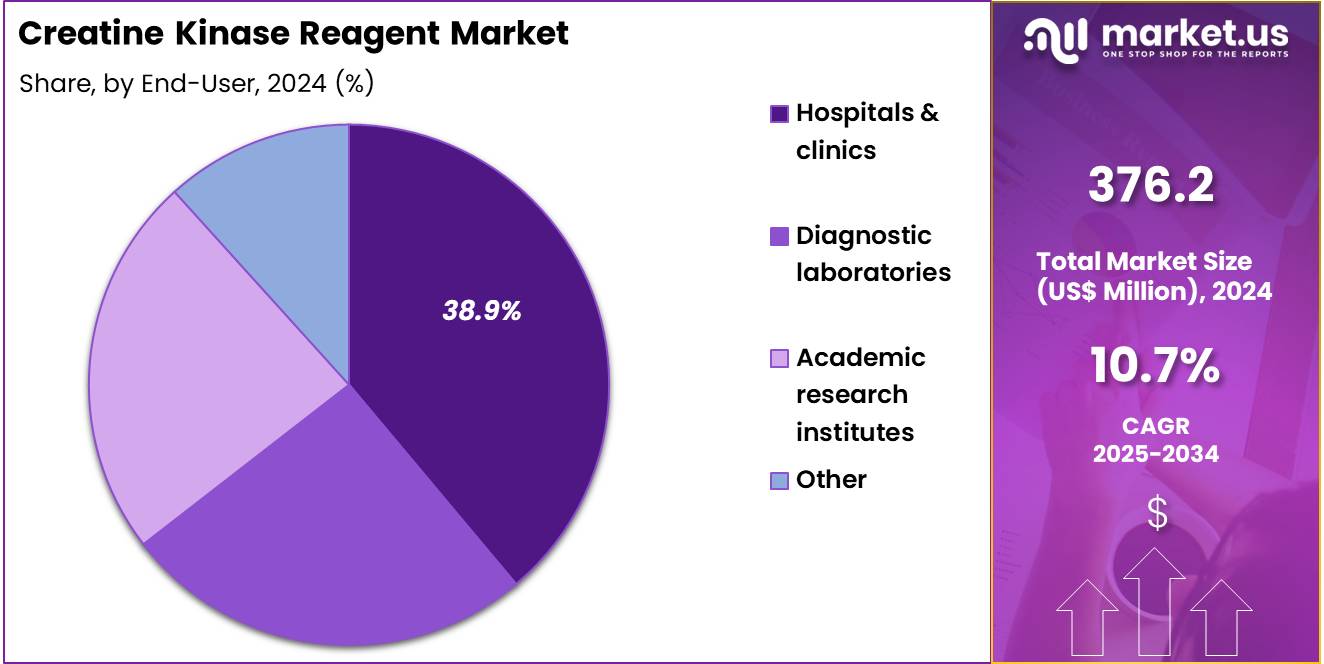

- The end-user segment is segregated into hospitals & clinics, diagnostic laboratories, academic research institutes, and other, with the hospitals & clinics segment leading the market, holding a revenue share of 38.9%.

- North America led the market by securing a market share of 39.9% in 2023.

Product Type Analysis

Reagents hold 51.8% of the Creatine Kinase Reagent market and are expected to maintain strong growth due to their essential role in both research and diagnostic testing. Reagents provide the necessary chemical components for accurate detection and measurement of creatine kinase levels, which is crucial for evaluating muscle damage, cardiac events, and metabolic disorders. The rising prevalence of cardiovascular diseases, muscle disorders, and metabolic syndromes is projected to drive the demand for high-quality reagents. Pharmaceutical and diagnostic companies increasingly rely on reliable reagents for preclinical studies and routine laboratory testing.

Additionally, advancements in reagent formulations to enhance sensitivity, stability, and reproducibility are likely to support market expansion. The adoption of automated laboratory systems is also expected to increase the consumption of reagents due to higher throughput testing. Growing investments in clinical research and molecular diagnostics further reinforce the demand for reagents.

As laboratories seek consistent and standardized testing solutions, reagents remain a core component of the market. The continuous introduction of improved formulations and the global expansion of testing facilities are projected to sustain growth in this segment.

Test Analysis

Enzymatic tests dominate the test segment with 48.5% share and are projected to continue growing due to their accuracy, reliability, and broad applicability in both research and clinical diagnostics. These tests measure creatine kinase activity in biological samples, allowing for precise evaluation of muscle and cardiac health. The growing prevalence of cardiac disorders and sports-related injuries is expected to drive demand for enzymatic tests. Enzymatic assays provide rapid results with high sensitivity, making them suitable for routine hospital testing and high-throughput research laboratories.

Advancements in assay technology, including miniaturization and automation, are likely to increase their adoption. The increasing emphasis on early disease detection and monitoring of treatment efficacy supports sustained demand. Hospitals and research institutes prefer enzymatic tests due to their reproducibility, compatibility with automated analyzers, and regulatory acceptance.

Rising awareness of metabolic and muscular conditions is expected to increase testing volumes. Integration with point-of-care platforms for rapid diagnostics is projected to enhance the market growth. Continuous innovation and expansion in clinical and research applications are likely to maintain the leading position of enzymatic tests.

Application Analysis

The research application segment holds 56.2% of the market and is expected to maintain dominance due to the increasing need for creatine kinase testing in biomedical studies, drug development, and disease modeling. Research institutions, pharmaceutical companies, and biotechnology firms rely on creatine kinase assays to study muscle physiology, metabolic pathways, and cardiac biomarkers. Rising investment in life sciences research and clinical trials is likely to drive the demand for reagents, enzymatic tests, and related instruments.

Research applications are expanding due to the development of new therapies for cardiovascular and muscular disorders, which require precise biochemical measurements. The segment benefits from technological advancements, including automated high-throughput testing systems and multiplex assays, which improve efficiency and data reliability. Increased collaboration between academic and commercial research organizations is anticipated to further boost testing activities.

Additionally, government and private funding for healthcare and biomedical research is expected to support market growth. As research applications extend into personalized medicine and translational studies, demand for creatine kinase testing solutions is likely to rise. Growing focus on biomarker discovery and validation strengthens this segment. Overall, research-driven demand continues to fuel the market.

End-User Analysis

Hospitals and clinics account for 38.9% of the end-user segment and are expected to remain a leading consumer of creatine kinase reagents and tests due to their central role in patient diagnostics and monitoring. Hospitals use creatine kinase testing to assess cardiac events, muscular injuries, and metabolic disorders in acute and chronic care settings. Rising prevalence of cardiovascular diseases, sports injuries, and metabolic conditions drives demand for accurate, rapid, and reliable testing in hospital laboratories.

Hospitals increasingly adopt automated enzymatic assays and kits for high-throughput and efficient diagnostics. Integration with hospital information systems ensures real-time reporting and patient management, further boosting adoption. Continuous training and awareness programs for healthcare professionals increase utilization of creatine kinase testing. Hospitals also serve as primary sites for research and clinical trials, indirectly driving demand for reagents and instruments.

Regulatory requirements and quality control standards ensure consistent use of validated testing solutions. The growing number of hospital facilities, particularly in emerging economies, is expected to expand market reach. Additionally, hospitals’ focus on preventive care and early diagnosis strengthens the long-term adoption of creatine kinase testing solutions.

Key Market Segments

By Product Type

- Reagents

- Instruments

- Kits

By Test

- Enzymatic Tests

- Point of Care Tests

- ELISA-based Tests

- Colorimetric Assay Based Tests

- Others

By Application

- Research

- Diagnosis

By End-user

- Hospitals & Clinics

- Diagnostic Laboratories

- Academic Research Institutes

- Other

Drivers

Rising incidence of cardiovascular diseases is driving the market

The rising incidence of cardiovascular diseases significantly drives the Creatine Kinase Reagent market by heightening the need for reliable biomarkers to diagnose and monitor heart-related conditions promptly. Clinicians rely on creatine kinase reagents to detect enzyme elevations indicative of myocardial damage, allowing for swift intervention in acute coronary syndromes. This driver gains momentum from the global burden of heart disease, where reagents facilitate serial testing to track treatment efficacy in patients with unstable angina.

Laboratories incorporate these reagents into routine cardiac panels, enabling comprehensive assessments alongside troponin levels for improved diagnostic accuracy. Healthcare providers utilize creatine kinase testing to differentiate between cardiac and skeletal muscle injuries, aiding in precise patient management. The demand escalates in emergency departments, where rapid reagent-based assays support triage for suspected heart attacks. Pharmaceutical companies employ these reagents in clinical trials to evaluate cardiotoxicity of new drugs, ensuring safety profiles.

Public health initiatives promote creatine kinase screening in high-risk populations, such as those with hypertension, to prevent complications. An estimated 19.8 million people died from cardiovascular diseases in 2022, representing approximately 32% of all global deaths. This statistic underscores the critical role of creatine kinase reagents in addressing the escalating cardiovascular health crisis. Governments invest in diagnostic infrastructure to support widespread reagent use, fostering market expansion.

Restraints

Stringent regulatory frameworks are restraining the market

Stringent regulatory frameworks restrain the Creatine Kinase Reagent market by imposing rigorous approval processes that delay product launches and increase development costs for manufacturers. Regulatory bodies require extensive validation studies to ensure reagent accuracy and reproducibility, complicating the introduction of innovative formulations. This restraint manifests in prolonged review times for new reagents, hindering timely responses to evolving clinical needs.

Companies must navigate complex compliance requirements for labeling and quality control, diverting resources from research to administrative tasks. Laboratories face challenges in adopting unapproved reagents, limiting market penetration in specialized applications. The emphasis on post-market surveillance adds ongoing obligations, straining smaller firms’ operational capacities. Global harmonization efforts remain incomplete, creating barriers for international trade of reagents.

Regulators mandate risk assessments for reagent stability, further extending timelines for market entry. In 2024, the FDA finalized a rule to phase in oversight of laboratory-developed tests as medical devices, affecting thousands of diagnostic assays including those involving creatine kinase reagents. This regulatory shift increases compliance burdens for labs, potentially slowing adoption rates. Manufacturers invest heavily in regulatory expertise to mitigate these constraints, yet the overall market growth experiences moderation.

Opportunities

Growing demand for point-of-care testing is creating growth opportunities

Growing demand for point-of-care testing creates growth opportunities in the Creatine Kinase Reagent market by enabling decentralized diagnostics that enhance accessibility and speed in clinical settings. Innovators design portable reagent kits compatible with handheld analyzers, allowing immediate CK assessment in ambulatory care for rapid decision-making. This opportunity expands in remote healthcare environments, where reagents support mobile testing for muscle injury in sports medicine.

Hospitals integrate point-of-care reagents into emergency protocols, facilitating quick evaluations of cardiac events without lab delays. Pharmaceutical developers explore these reagents for on-site monitoring in clinical trials, streamlining data collection for drug safety studies. The shift toward home-based testing opens avenues for user-friendly reagent formats, empowering patients with chronic conditions to self-monitor CK levels.

Telemedicine platforms incorporate reagent results for virtual consultations, improving follow-up care efficiency. Regulatory approvals accelerate for point-of-care devices, fostering market entry for new reagent variants. Companies capitalize on this trend by partnering with device manufacturers to develop integrated solutions.

Impact of Macroeconomic / Geopolitical Factors

Global economic expansions actively fuel investments in healthcare diagnostics, elevating demand for advanced testing solutions within the Creatine Kinase Reagent sector. However, inflationary pressures intensify raw material expenses, compelling manufacturers to streamline operations and absorb higher production costs. Geopolitical conflicts, such as ongoing US-Russia and Middle East tensions, interrupt global supply chains and delay reagent deliveries from key exporting regions.

The US Department of Commerce’s Section 232 investigation, launched on September 2, 2025, actively examines imports of medical consumables, potentially leading to new tariffs that hike prices for diagnostic products sourced abroad. These tariffs exacerbate trade barriers, prompting companies to face short-term margin erosion and reevaluate international partnerships.

Conversely, such measures encourage firms to bolster domestic sourcing and invest in local innovation hubs. Strengthened US manufacturing capabilities enhance supply security and foster technological advancements in enzyme-based assays. Forward-thinking leaders leverage these dynamics to drive long-term competitiveness and market expansion.

Latest Trends

Integration of AI in diagnostic testing is a recent trend in the market

Integration of AI in diagnostic testing represents a recent trend in the Creatine Kinase Reagent market, revolutionizing data interpretation and enhancing clinical efficiency. AI algorithms analyze CK reagent results alongside patient demographics, predicting cardiovascular risks with greater accuracy. This trend advances in laboratory automation, where AI optimizes reagent usage to minimize waste and improve throughput. Clinicians benefit from AI-driven insights that correlate CK elevations with imaging data for comprehensive heart assessments.

Research institutions employ AI to model CK patterns in neuromuscular disorders, accelerating biomarker discovery. The incorporation of AI reduces human error in reagent-based assays, ensuring consistent diagnostic quality. Telehealth services utilize AI to remotely review CK test outcomes, facilitating timely interventions. Regulatory bodies evaluate AI-integrated reagents for safety, paving the way for widespread adoption.

In 2024, advancements in microfluidic SERS platforms enabled AI-assisted detection of cardiac biomarkers, including creatine kinase, using just 3 μL of blood within 2 minutes. This innovation exemplifies the trend’s impact on rapid, sensitive testing. Manufacturers invest in AI partnerships to develop smart reagent systems, positioning the market for sustained growth.

Regional Analysis

North America is leading the Creatine Kinase Reagent Market

In 2024, North America secured a 39.9% share of the global creatine kinase reagent market, bolstered by heightened clinical adoption for cardiac biomarker assessment amid persistent high rates of myocardial infarction and muscular disorders in an aging population. Diagnostic labs expanded utilization of high-sensitivity reagents to improve assay precision, enabling earlier detection of tissue damage in emergency settings and supporting adjusted therapeutic protocols for patients with comorbidities.

Regulatory emphasis on quality control standards enhanced reagent formulation stability, reducing variability in results for point-of-care applications in ambulatory care centers. Academic collaborations with reagent suppliers refined enzyme-linked compositions, optimizing compatibility with automated analyzers for high-throughput processing in hospital networks.

Demographic trends, including increased obesity rates, amplified testing demands for rhabdomyolysis monitoring in sports medicine. These factors illustrated the region’s focus on diagnostic efficiency for cardiovascular outcomes. The Centers for Disease Control and Prevention reported approximately 805,000 heart attacks annually in the United States, with 605,000 being first-time events, underscoring the ongoing need for CK testing from 2022 onward.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Health ministries in Asia Pacific anticipate the creatine kinase reagent sector to surge during the forecast period, as escalating cardiovascular burdens in urbanizing nations necessitate expanded biomarker screening infrastructures. Authorities in India and China allocate funds to subsidize reagent kits for public hospitals, equipping them to handle large-scale assays for acute coronary syndromes in high-density populations.

Diagnostic firms partner with regional research institutes to customize formulations for local enzyme variants, projecting improved accuracy in detecting myopathy in tropical climates. Innovation hubs in South Korea and Japan pioneer freeze-dried reagents, positioning remote clinics to conduct reliable tests without cold-chain dependencies. Governments estimate incorporating the reagent into national health surveys, addressing gaps in muscular dystrophy diagnostics for pediatric cohorts.

Local innovators integrate pH-stabilized components, synchronizing with mobile labs to monitor rhabdomyolysis in labor-intensive sectors. These initiatives build a foundation for equitable renal and cardiac risk evaluation. The World Health Organization documented 19.8 million cardiovascular disease deaths globally in 2022, with a significant proportion in Asia Pacific, highlighting the imperative for enhanced testing capabilities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Influential providers in the cardiac enzyme assay domain propel advancement by pioneering multiplex kits that combine CK-MB with troponin markers, expediting myocardial infarction diagnostics in emergency settings. They broker distribution pacts with regional lab chains to infiltrate underserved African and South Asian territories, capitalizing on burgeoning chronic disease burdens. Enterprises earmark funds for automated calibration enhancements, minimizing technician variability and bolstering throughput in high-volume facilities.

Decision-makers orchestrate bolt-on purchases of reagent formulation specialists, assimilating proprietary stabilizers to extend shelf life and cut logistics expenses. They advocate for inclusion in national health protocols through lobbying efforts, securing tenders in government-backed screening initiatives. Besides, they curate digital companion apps for result interpretation, monetizing via premium access tiers to nurture clinician fidelity and incremental margins.

Danaher Corporation, incorporated in 1969 and headquartered in Washington, D.C., orchestrates a diversified conglomerate with Beckman Coulter as its diagnostics powerhouse, specializing in clinical chemistry analyzers and assay reagents. The entity equips thousands of laboratories globally with its AU series systems that automate CK testing alongside comprehensive panels for metabolic disorders.

Danaher propels forward through disciplined capital deployment in core technologies, fostering organic growth in life sciences and environmental segments. CEO Rainer M. Blair helms operations across 30 countries, instilling a culture of continuous improvement via the Danaher Business System. The corporation synergizes acquisitions like Cepheid to amplify molecular capabilities, enriching its immunoassay offerings. Danaher cements its elite stature by harmonizing operational rigor with visionary portfolio curation to dominate evolving diagnostic landscapes.

Top Key Players

- Wako Chemicals

- Tosoh Corporation

- Thermo Fisher Scientific

- Siemens Healthineers

- Roche Diagnostics

- PerkinElmer

- Ortho Clinical Diagnostics

- Mindray

- Beckman Coulter

- Abcam

Recent Developments

- In February 2023, Hangzhou Singclean Medical Products Co., Ltd introduced three in vitro diagnostic reagents, including a Creatine Kinase Isoenzyme MB (CK-MB) test kit. The launch strengthens lab capabilities in cardiac diagnostics and expands the market for creatine kinase reagents by providing reliable tools for early detection of myocardial injury.

- In 2023, BD obtained FDA clearance for its BD Vacutainer Troponin I Ultra test for point-of-care use, becoming the first FDA-approved rapid troponin test for acute myocardial infarction. This approval increases reliance on cardiac biomarkers like CK-MB, driving the demand for creatine kinase reagents in urgent care and hospital settings.

- In 2023, Bio-Rad launched its high-sensitivity Bio-Plex 2300 Troponin I Assay, enabling earlier detection of cardiac damage. By offering improved diagnostic accuracy, this assay encourages broader use of creatine kinase reagents in clinical laboratories, reinforcing the market for advanced cardiac testing solutions.

Report Scope

Report Features Description Market Value (2024) US$ 376.2 Million Forecast Revenue (2034) US$ 1039.7 Million CAGR (2025-2034) 10.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents, Instruments, and Kits), By Test (Enzymatic Tests, Point of Care Tests, ELISA-based Tests, Colorimetric Assay Based Tests, and Others), By Application (Research, and Diagnosis), By End-user (Hospitals & Clinics, Diagnostic Laboratories, Academic Research Institutes, and Other) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Wako Chemicals, Tosoh Corporation, Thermo Fisher Scientific, Siemens Healthineers, Roche Diagnostics, PerkinElmer, Ortho Clinical Diagnostics, Mindray, Beckman Coulter, Abcam. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Creatine Kinase Reagent MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Creatine Kinase Reagent MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Wako Chemicals

- Tosoh Corporation

- Thermo Fisher Scientific

- Siemens Healthineers

- Roche Diagnostics

- PerkinElmer

- Ortho Clinical Diagnostics

- Mindray

- Beckman Coulter

- Abcam