Global Craft Spirits Market By Type (Whiskey, Vodka, Gin, Rum, Brandy and Others) By Distribution Channel (On-Trade and Off-Trade), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2023

- Report ID: 66158

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

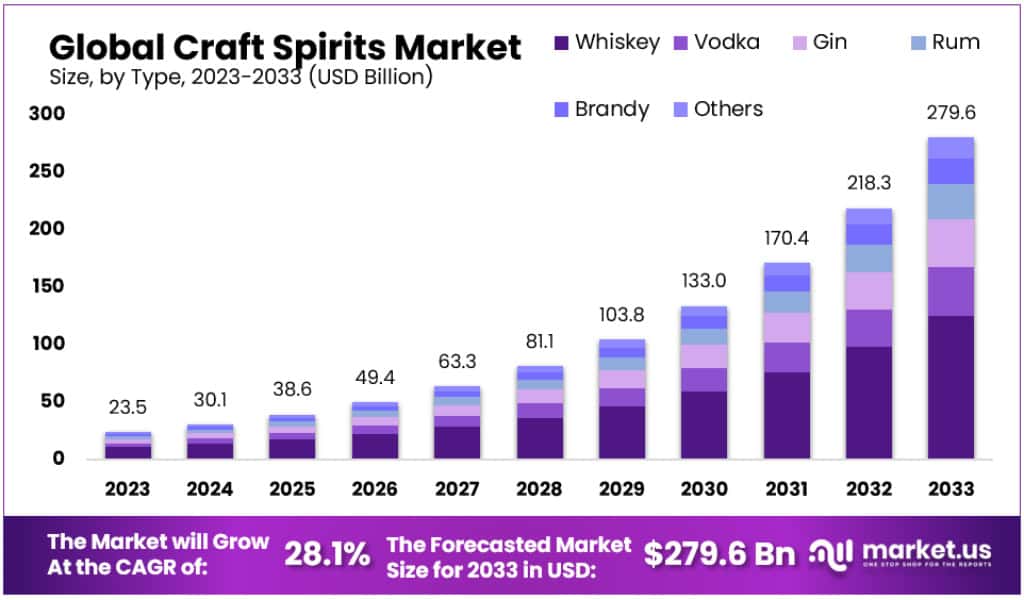

The Global Craft Spirits Market size is expected to be worth around USD 279.6 Billion by 2033, from USD 23.5 Billion in 2023, growing at a CAGR of 28.1% during the forecast period from 2023 to 2033.

Craft spirits are handcrafted, typically produced by small distilleries that often use locally sourced ingredients and materials. The definition of a craft spirit can vary depending on the source, but some general characteristics include:

- Small distilleries: Craft spirits are often produced by distilleries that value transparency in distilling and have a focus on quality over quantity.

- Limited production: Craft spirits are typically produced in smaller batches, with some distilleries limiting their production to fewer than 750,000 gallons annually.

- Innovation: Craft spirits often showcase innovation and experimentation, with unique flavors and ingredients.

- Artistry: Craft spirits are made with a certain level of artistry and mastery, reflecting the care and attention given to the distilling process.

The market’s growth is primarily due to rising demand and the increase in craft distilleries. Also, rising disposable incomes are a major factor. Market growth will be driven by a millennial population with high purchasing power.

Type Analysis

Whiskey Segment

In 2023, Whiskey held a dominant market position, capturing more than a significant 44.6% share. This dominance can be attributed to whiskey’s extraordinary and unique flavor profile. Product innovations have not only enhanced taste but also introduced potential medicinal benefits.

For instance, the integration of various herbs and spices in whiskey production not only diversifies flavor but also offers potential health benefits. High levels of polyphenols in whiskey, an antioxidant, have been linked to reducing LDL (bad cholesterol) and increasing HDL (good cholesterol). With approximately 51% of U.S. adults grappling with high cholesterol, whiskey’s health-related aspects have become increasingly relevant. Additionally, the growing appreciation for whiskey’s distinct taste contributes to its market dominance.

Vodka Segment

Vodka, projected to grow at a CAGR of ~22% during 2023-2033, is expected to be the fastest-growing segment. The surge in vodka’s popularity is largely driven by the millennial demographic, which shows a strong preference for canned cocktails and diverse flavors like orange, apple, lemon, and both light and hard variants. This versatility allows for vodka to be used in a myriad of ways, catering to a wide array of consumer preferences and occasions, thus fueling its demand.

Gin Segment

The gin market segment is anticipated to experience rapid growth, with a forecasted CAGR of ~30% from 2023 to 2033. This growth is spurred by brands incorporating regional botanicals, aged expressions, new flavors, and innovative production techniques. The average retail price of artisan gin, typically above USD 30, reflects its premium positioning in the market. This trend demonstrates consumers’ willingness to pay more for unique, high-quality gin offerings.

Rum, Brandy, and Other Spirits

Other segments, including rum, brandy, and various craft spirits, also contribute significantly to the market. These segments benefit from a similar trend of innovation and premiumization, where consumers are increasingly drawn to unique flavors and high-quality, artisanal production methods. These segments, while smaller in market share compared to whiskey and vodka, play a crucial role in the overall diversity and growth of the craft spirits market.

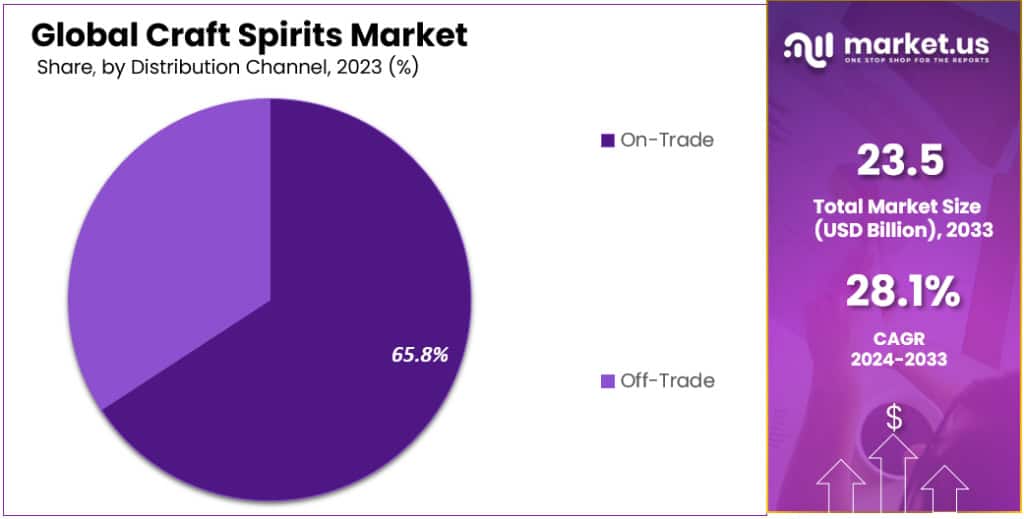

Distribution Channel Analysis

On-Trade Channel

In 2023, the On-Trade channel maintained a dominant position in the Craft Spirits Market, capturing a significant 65.8% share. This predominance can be attributed to the resurgence of restaurants, bars, and pubs, along with various ancillary establishments, whose sales have seen a substantial uptick following widespread vaccination and the reopening of economies. Consumers show a strong preference for enjoying craft spirits in social settings, where the ambiance and opportunity to connect with others enhance the drinking experience. This trend underlines the importance of on-premise consumption in the craft spirits market.

Off-Trade Channel

Conversely, the Off-Trade channel is expected to witness the fastest growth, with a projected CAGR of ~33.5% from 2023 to 2033. This segment includes hypermarkets, supermarkets, convenience stores, micro-markets, and wine and spirit shops. The appeal of these establishments lies in their offering of substantial discounts and exclusive incentives, making them an attractive option for consumers.

In the context of craft spirits, these retail settings allow consumers to explore a wide range of products at competitive prices. For instance, the cost difference observed in SLO Canned Cocktails – $17.99 for a pack of four RTDs in off-trade channels versus up to $65 for the same quantity in on-trade settings – underscores the financial advantage of choosing off-trade channels.

Кеу Маrkеt Ѕеgmеntѕ

By Type

- Whiskey

- Vodka

- Gin

- Rum

- Brandy

- Others

By Distribution Channel

- On-Trade

- Off-Trade

Drivers

- Growth in Craft Distilleries: A significant driver is the increasing number of craft distilleries. According to the US Craft Spirits Association, despite challenges like COVID-19, the craft spirits sector continues to grow, with the number of craft distilleries increasing by 1.1% between August 2020 and August 2021. This expansion has led to craft spirits sales exceeding $5 billion in 2020, indicating a strong market presence.

- AI and ML Integration: The integration of Artificial Intelligence and Machine Learning in craft spirit production is transforming the market. This technological adoption has seen the craft spirits volume grow from 2.2% in 2015 to 4.7% in 2020, and their value increase from 3% in 2015 to 7.1% in 2020.

Restraints

- Market Concentration and High Costs: The craft spirits market faces challenges due to high concentration and relative costs. In 2020, exports from the US saw a decrease of 32.9%, and employment in this sector dropped by 50% from 2019. Large producers overshadow small craft distillers, with 1.6% of ‘large’ craft producers representing 57% of the value, while the majority (90.1%) of small distilleries only contribute 10.3% annually.

Opportunities

- Innovative Flavors: The growing preference for innovative flavors in craft spirits, including natural spices and botanicals, presents a significant opportunity for market growth. Pubs, bars, and restaurants offering unique craft spirit flavors are increasingly popular, enhancing the market for craft spirits like whiskey, which has seen widespread growth in bars.

- Millennial Consumption: The increased disposable income among young consumers, particularly millennials, is expected to boost whiskey consumption. Their evolving taste preferences, favoring craft spirits, especially in social and corporate gatherings, present a substantial opportunity for market expansion.

Challenges

- COVID-19 Impact: The pandemic has had a profound impact on craft distillers, especially affecting on-site tasting room sales. The Distilled Spirits Council of the United States’ 2020 report indicated that over half of craft distillers experienced a major impact on their tasting room sales, with about 40% reporting a 25% or more decrease in on-site sales.

Trends

- Rising Popularity of Cocktails: The increasing popularity of cocktails has significantly influenced the craft spirits market. Bars, taverns, and restaurants, as primary distribution outlets, have prioritized the cocktail experience, contributing to a rise in on-trade sales globally. The on-trade segment is expected to hold the largest market share, with 58.7% in 2021.

- Social and Corporate Gatherings: The trend of consuming liquor, particularly craft spirits, in social and corporate gatherings is accelerating market growth. This trend reflects changing consumer behaviors and preferences, where the experience of drinking is as important as the drink itself.

Regional Analysis

North America: Dominant Market Presence

North America dominates the Craft Spirits Market with a commanding 58.7% share, valued at USD 13.8 billion in 2023. This leading position is primarily due to the growing demand for craft spirits and an increase in craft distilleries across the region. The United States plays a pivotal role, generating an impressive USD 200 million in economic activity within the spirits market, as reported by the Distilled Spirit Council in February 2022.

The US market, in particular, is witnessing significant growth fueled by the increasing popularity of the ‘cocktail culture’, with major manufacturers innovating in super-premium tequila and vodka. The craft spirits market in North America accounted for 62% of the global craft spirits volume, supported by favorable regulatory policies. With nearly 2,000 distilleries, the region’s craft spirits market, especially in the US, is thriving, growing at an expected CAGR of ~9.5% during the forecast period.

Asia Pacific: Fastest Growing Region

The Asia Pacific region is projected to experience the fastest growth in the Craft Spirits Market, with an estimated CAGR of ~34.5% from 2023 to 2033. This surge is driven by the increasing purchasing power and the rise of the millennial generation in emerging countries like China, India, Malaysia, Thailand, and Indonesia. These emerging markets offer vast potential for growth due to their underdeveloped marketplaces.

The increasing urbanization and the trend of millennials spending more on leisure activities are expected to positively influence the craft spirit market in this region. Specifically, Asia-Pacific is expected to generate USD ~15,800 million during the forecast period, with traditional spirits like Chinese baijiu gaining prominence. The online retail platforms in China, such as Ele.me, JD, Taobao/Tmall, and Meituan, are notable for their sales of craft spirits, with brands like Moutai, Martell, Absolut, Chivas, and Bacardi leading the market.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

International and domestic players can participate in this market. To improve their portfolio, the key market players are focused on strategies such as innovation and product launches in retail.

Diageo, the world’s largest alcohol company, today revealed plans for two new US$ 245 million distilleries in support of Crown Royal Canadian Whisky’s growth goals and momentum. It will utilize resource efficiency technology, and run on 100% renewable electricity to ensure that the new distillery produces no waste and is carbon neutral.

Diageo plc, a global beverage company, launched its latest manufacturing plant in 2022. The facility features two high-speed can lines and the capability to produce more than 25 million cases of malt, spirits, Ready-to-Drink (RTD), and cocktails.

Маrkеt Кеу Рlауеrѕ

- Heaven Hill Distilleries, Inc.

- Diageo plc

- Pernod Ricard

- Constellation Brands, Inc.

- Suntory Holdings Limited

- Bacardi Limited

- Campari Group

- Sazerac Company, Inc.

- Highwood Distillers

- Copper Fox Distillery

- Balcones Distilling

- Dark Corner Distillery

- Black Dirt Distillery

- F.E.W. Spirits

- Tito’s Handmade Vodka

- Chase Distillery Ltd.

- Beam Suntory Inc.

- William Grant & Sons

- House Spirits Distillery

- Remy Cointreau

- Rogue Ales

- Other Key Players

Recent Developments

Acquisitions

- October 2023: Pernod Ricard acquires a majority stake in ultra-premium tequila brand Código 1530, aiming to strengthen its portfolio in the high-end tequila market.

- September 2023: Constellation Brands acquires Austin-based craft spirits company High West Spirits for $160 million, expanding its presence in the growing whiskey market.

- August 2023: Diageo acquires Chase Distillery, a leading producer of craft vodka and gin, for an undisclosed sum. This move marks Diageo’s first major foray into the premium gin space.

New Trends

- Rise of “hyper-local” spirits: Consumers are increasingly seeking out spirits made with locally sourced ingredients, reflecting a desire for authenticity and connection to their communities.

- Experimentation with unique botanicals and flavors: Craft distilleries are pushing boundaries with innovative ingredients like elderflower, yuzu, and even seaweed, creating unexpected and exciting flavor profiles.

- The growing popularity of ready-to-drink (RTD) cocktails: Convenience and portability are driving the demand for pre-mixed cocktails made with craft spirits, offering premium options outside of traditional bars and restaurants.

Company-Related News

- July 2023: Bruichladdich, a renowned Scottish distillery, announces plans to build a new $120 million distillery on Islay, marking a significant investment in its future and production capacity.

- June 2023: St-Georges Spirits, a Canadian pioneer in craft spirits, celebrates its 50th anniversary, showcasing the longevity and resilience of the craft spirits industry.

- May 2023: The American Craft Spirits Association launches the “Craft Spirit Serve” initiative, aimed at educating consumers about responsible drinking and enjoying craft spirits in moderation.

Report Scope

Report Features Description Market Value (2023) USD 23.5 Billion Forecast Revenue (2033) USD 279.6 Billion CAGR (2023-2032) 28.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Whiskey, Vodka, Gin, Rum, Brandy and Others) By Distribution Channel (On-Trade and Off-Trade) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Heaven Hill Distilleries, Inc., Diageo plc, Pernod Ricard, Constellation Brands, Inc., Suntory Holdings Limited, Bacardi Limited, Campari Group, Sazerac Company, Inc., Highwood Distillers, Copper Fox Distillery, Balcones Distilling, Dark Corner Distillery, Black Dirt Distillery, F.E.W. Spirits, Tito’s Handmade Vodka, Chase Distillery Ltd., Beam Suntory Inc., William Grant & Sons, House Spirits Distillery, Remy Cointreau, Rogue Ales and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the size of the Craft Spirits Market in 2023?A: The Craft Spirits Market size is estimated to be USD 23.5 Billion in 2023.

Q: What is the projected CAGR at which the Craft Spirits Market is expected to grow at?A: The Craft Spirits Market is expected to grow at a CAGR of 28.1% (2023-2033).

Q: List the segments encompassed in this report on the Craft Spirits market?A: Market.US has segmented the Craft Spirits Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Whiskey, Vodka, Gin, Rum, Brandy, Liqueur, and Other Products. By Distribution Channel, the market has been further divided into On-trade and Off-trade.

-

-

- Heaven Hill Distilleries, Inc.

- Diageo plc

- Pernod Ricard

- Constellation Brands, Inc.

- Suntory Holdings Limited

- Bacardi Limited

- Campari Group

- Sazerac Company, Inc.

- Highwood Distillers

- Copper Fox Distillery

- Balcones Distilling

- Dark Corner Distillery

- Black Dirt Distillery

- F.E.W. Spirits

- Tito's Handmade Vodka

- Chase Distillery Ltd.

- Beam Suntory Inc.

- William Grant & Sons

- House Spirits Distillery

- Remy Cointreau

- Rogue Ales

- Other Key Players