Global Cosmetics Shea Butter Market By Nature(Organic, Conventional), By Grade(Grade A, Grade B, Grade C), By End-use(Lotions and Creams, Lip Balms and Lipsticks, Sun Care Products, Soaps and Toiletries, Cleansers, Shampoos and Conditioners, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135306

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

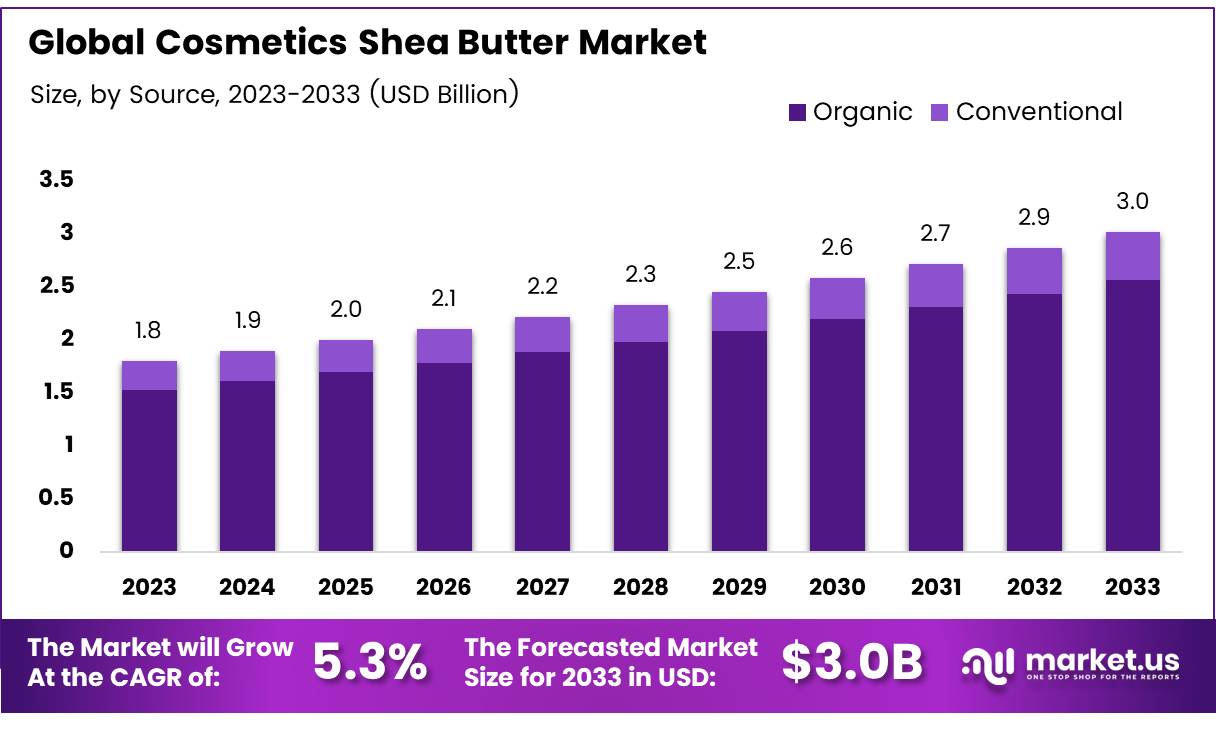

The Global Cosmetics Shea Butter Market size is expected to be worth around USD 3.0 Billion by 2033, from USD 1.8 Billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

Cosmetic shea butter, derived from the nuts of the shea tree (Vitellaria paradoxa), has gained widespread popularity in the beauty and skincare industry due to its rich composition of fatty acids, vitamins, and antioxidants. Shea butter is known for its moisturizing, anti-inflammatory, and healing properties, making it an essential ingredient in skincare formulations such as lotions, balms, soaps, and hair care products.

It is commonly used to hydrate and soothe the skin, particularly for individuals with dry or sensitive skin. With growing consumer awareness regarding natural and organic products, the demand for cosmetic-grade shea butter has increased significantly over the past decade.

The cosmetics shea butter market encompasses the production, distribution, and use of shea butter as a key ingredient in personal care and beauty products. The market has seen substantial growth due to a rising global demand for organic and natural skincare solutions. As consumers increasingly seek out products free from synthetic chemicals, shea butter has emerged as a preferred choice due to its natural origin and versatile benefits.

Key players in the market include both large multinational companies and small niche brands, particularly those in the organic beauty segment. The market is driven by the expanding awareness of shea butter’s skincare benefits, along with a surge in demand for cruelty-free and sustainably sourced cosmetic products.

The cosmetics shea butter market has witnessed robust growth, with key factors including increasing consumer demand for organic skincare products and the rise of ethical consumerism. As consumer preferences shift toward cleaner beauty solutions, companies are increasingly formulating products that incorporate shea butter, recognizing its potential in moisturizing and rejuvenating skin.

There is significant opportunity in the expansion of shea butter’s application within the haircare industry as well, with products targeting dry, brittle hair and scalp conditions gaining traction. Furthermore, an increasing number of brands are incorporating sustainable and ethically sourced shea butter, aligning with consumer expectations for transparency and corporate responsibility.

Government investment in the shea butter industry is also on the rise, particularly in West African countries where the majority of shea butter is sourced. In these regions, governments have been incentivizing local farmers and cooperatives to improve production efficiency, sustainability, and quality. This has led to the development of infrastructure, better access to international markets, and increased export volumes.

However, the industry also faces regulatory challenges, especially related to certification and standardization of organic and fair-trade products. Governments and industry bodies are working to establish regulations that ensure quality control, fair trade practices, and sustainability in production processes, while minimizing the environmental impact of shea butter extraction.

Africa remains the dominant source of shea nuts, with the continent producing approximately 60% of the world’s supply, particularly in countries like Burkina Faso, Mali, Ghana, Nigeria, and Côte d’Ivoire. Together, these countries contribute over 70% of global shea nut production.

In addition, the shea butter industry provides livelihoods for more than 16 million people across West Africa, reinforcing the economic importance of shea butter as both a commodity and a driver of local employment. Ghana, as the world’s largest exporter, accounts for over 60% of global shea butter exports, highlighting its crucial role in the global supply chain. This large-scale production and export capacity ensure that the market remains robust, with ample supply to meet rising global demand.

Key Takeaways

- Global Cosmetics Shea Butter Market expected to reach USD 3.0 Billion by 2033, growing at a CAGR of 5.3% from 2024 to 2033.

- Organic segment dominated the market in 2023, driven by consumer preference for natural, sustainable products.

- Grade A (Unrefined) shea butter accounted for largest market share in 2023 due to demand for natural skincare ingredients.

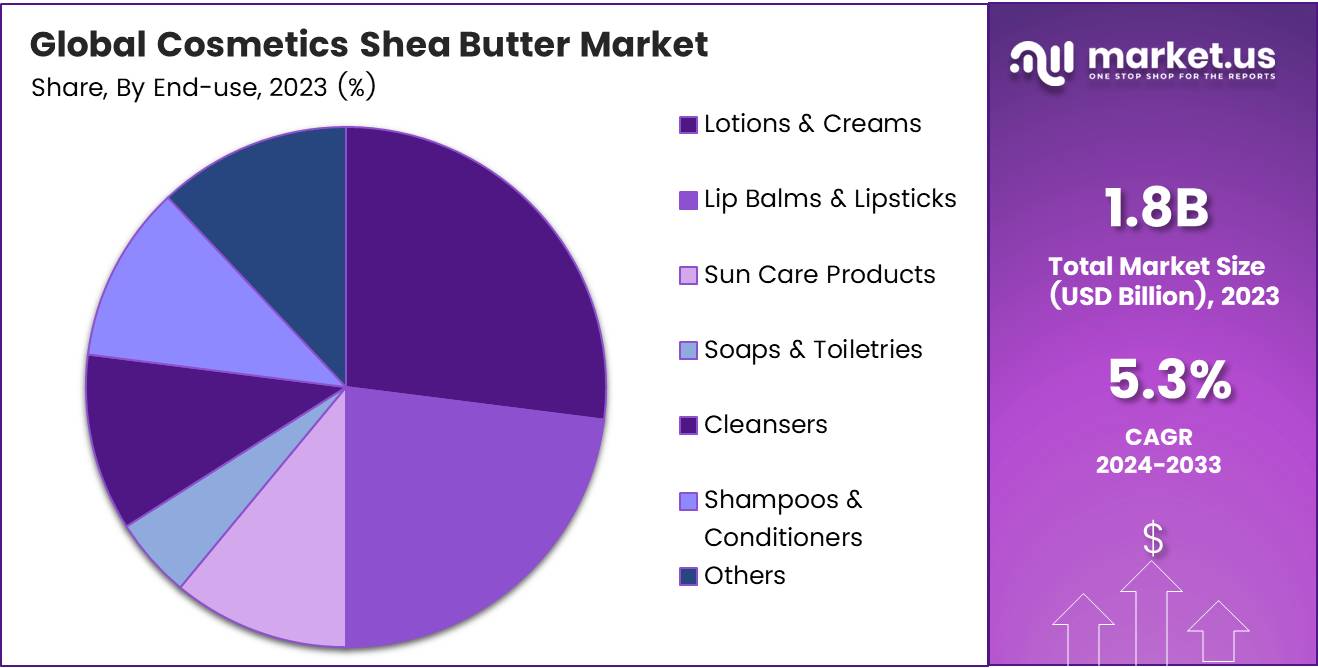

- Lotions & Creams led the market in 2023, fueled by rising consumer demand for moisturization and natural skincare.

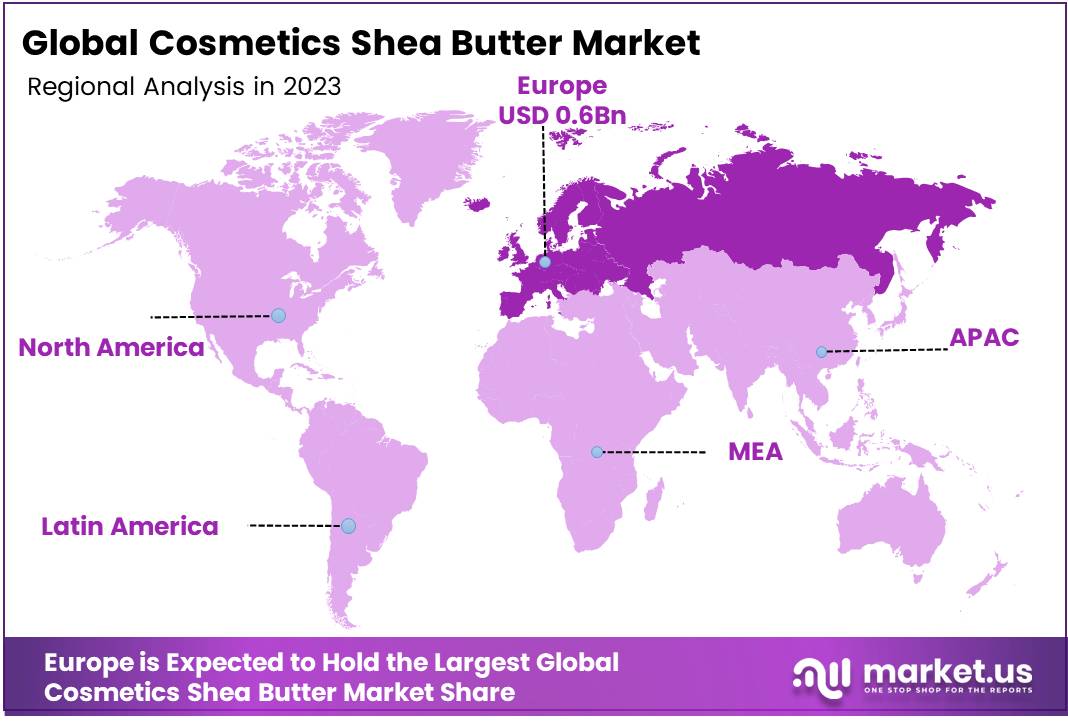

- Europe holds the largest market share at 31%, valued at approximately USD 0.6 Billion, driven by demand for organic products.

Nature Analysis

Organic Segment Dominated the Cosmetics Shea Butter Market in 2023

In 2023, the Organic segment held a dominant market position in the By Nature Analysis segment of the Cosmetics Shea Butter Market. This dominance can be attributed to the growing consumer preference for natural and sustainable products, driven by increased awareness of the harmful effects of chemicals in personal care products. Organic shea butter is perceived as a cleaner, more eco-friendly option, which has made it highly appealing to environmentally-conscious consumers.

The organic segment has benefited from its strong alignment with the clean beauty movement, which continues to gain momentum globally. Consumers are willing to pay a premium for organic skincare products, considering them safer and more beneficial for long-term use. Moreover, organic shea butter is often sourced from fair-trade, sustainable practices, further enhancing its appeal.

On the other hand, the Conventional segment, while still significant, faces pressure due to the rising demand for organic alternatives. Conventional shea butter, which is often produced using traditional methods without strict organic certifications, is perceived as less attractive in comparison to the organic offering. Despite this, it remains a more affordable option, contributing to its steady presence in the market.

Grade Analysis

Grade A (Unrefined) Dominates the Cosmetics Shea Butter Market in 2023

In 2023, Grade A (Unrefined) held a dominant market position in the By Grade Analysis segment of the Cosmetics Shea Butter Market. This high demand can be attributed to the growing consumer preference for natural, organic ingredients in skincare products.

Grade A Shea butter, being minimally processed, retains its essential fatty acids, vitamins, and antioxidants, making it ideal for moisturizing and nourishing the skin. The rise in clean beauty trends and the increasing awareness of the benefits of unrefined products have fueled its popularity in cosmetics formulations, especially for anti-aging, moisturizing, and healing products.

Grade B (Refined) Shea Butter, while still a significant player, holds a smaller share of the market due to its more processed nature, which reduces some of the beneficial properties of the raw material. This grade caters to a more budget-conscious segment of the market where cost-effectiveness and stability of the product are prioritized over raw benefits.

Grade C (Highly Refined) Shea Butter is typically used in products requiring long shelf life or when precise consistency is needed. While its market share remains limited, it has steady demand in mass-produced cosmetics and commercial formulations.

End-use Analysis

Lotions & Creams Lead the Cosmetics Shea Butter Market in 2023

In 2023, Lotions & Creams held a dominant market position in the By End-use Analysis segment of the Cosmetics Shea Butter Market. This growth is primarily driven by the increasing consumer preference for moisturization and skin hydration, with shea butter being a key ingredient known for its deep nourishment and soothing properties. The demand for natural and organic skincare products continues to rise, positioning lotions and creams as the top choice among beauty enthusiasts.

Following closely, Lip Balms & Lipsticks accounted for a significant share of the market, driven by the growing consumer awareness of the benefits of shea butter for lip care, including its ability to hydrate and prevent dryness. Sun Care Products, including lotions with SPF and after-sun creams, also saw considerable growth due to the increasing focus on sun protection and skin health.

Other product segments like Soaps & Toiletries, Cleansers, and Shampoos & Conditioners experienced moderate demand, with shea butter’s appeal extending across various personal care products due to its versatility. The overall trend reflects a preference for multifunctional products that offer natural skincare benefits, supporting continued market expansion across these categories.

Key Market Segments

By Nature

- Organic

- Conventional

By Grade

- Grade A (Unrefined)

- Grade B (Refined)

- Grade C (Highly Refined)

By End-use

- Lotions & Creams

- Lip Balms & Lipsticks

- Sun Care Products

- Soaps & Toiletries

- Cleansers

- Shampoos & Conditioners

- Others

Drivers

Growing Demand for Natural Ingredients Drives Shea Butter in Cosmetics

The cosmetics market is seeing a significant shift toward natural and organic ingredients, with rising consumer demand being a major driver for the popularity of shea butter.

Increasing concerns about the harmful effects of synthetic chemicals have led consumers to seek more natural, safe alternatives for their skincare routines. Shea butter, known for its moisturizing, anti-aging, and healing properties, has become a go-to ingredient for those looking for effective and gentle solutions for dry skin, wrinkles, and scars.

As more consumers turn to products with shea butter, especially in skincare, its presence in the market continues to grow. Additionally, as disposable incomes rise, especially in developing regions, consumers are willing to invest in premium cosmetic products that feature shea butter. This surge in purchasing power has further supported the growth of high-quality, natural cosmetic ingredients.

The overall demand for shea butter-infused beauty products is expected to keep increasing as more people become aware of its benefits and seek cleaner, healthier alternatives for their personal care.

Restraints

High Costs and Supply Chain Challenges Affect Cosmetics Shea Butter Market Growth

The cosmetics shea butter market faces several challenges that may limit its growth. First, the high price of pure shea butter can make products more expensive, especially in price-sensitive segments of the market. As high-quality shea butter is not cheap to produce, manufacturers often pass these costs on to consumers, which could reduce demand for shea butter-based cosmetics in certain regions.

Additionally, the supply chain for shea butter is heavily dependent on specific regions in Africa, where it is predominantly sourced. Factors like political instability, changing climate conditions, or even logistical challenges can disrupt this supply chain, affecting both availability and cost.

These supply chain issues can lead to production delays or shortages, further driving up prices or limiting the types of products available. The combination of high costs and potential supply disruptions makes it harder for companies to meet growing consumer demand for natural and sustainable beauty products, especially in a competitive market.

Growth Factors

Expanding Shea Butter Cosmetics Market with Values and Consumer Demand for Natural Products

The shea butter cosmetics market has significant growth potential, particularly due to expanding opportunities in emerging markets, like Asia-Pacific and Latin America. As disposable incomes rise and awareness of skincare benefits increases, consumers in these regions are seeking high-quality, natural ingredients, and shea butter fits perfectly into this demand.

Furthermore, the growing preference for vegan and cruelty-free cosmetics is providing brands with a chance to highlight shea butter as a key ingredient, which is naturally derived and aligns with these ethical values.

Another promising opportunity lies in the men’s grooming segment. With the rise in popularity of men’s skincare routines, incorporating shea butter into products like lotions, beard oils, and shaving creams offers an emerging niche market.

Additionally, collaborations with ethical and fair-trade initiatives are becoming increasingly important to consumers, who are keen on supporting brands that prioritize sustainability and responsible sourcing.

Partnering with organizations that promote fair trade in shea butter can not only help improve sourcing practices but also enhance brand reputation, fostering consumer loyalty and trust. As a result, brands that focus on these trends stand to gain a competitive edge in the market while addressing evolving consumer preferences for ethical and effective skincare solutions.

Emerging Trends

Trending Factors Driving Growth in the Shea Butter Cosmetics Market

The growing clean beauty movement is significantly boosting the demand for shea butter in cosmetics. As consumers become more conscious of the harmful chemicals in traditional beauty products, there’s a noticeable shift toward natural and toxin-free alternatives, with shea butter being a popular choice due to its rich moisturizing and healing properties.

Another key factor is the rising trend of personalized skincare, where consumers seek products that cater specifically to their skin concerns. Shea butter’s versatility makes it ideal for customized formulations, driving its popularity in this space.

Social media influencers also play a crucial role in spreading awareness, with many endorsing shea butter-based beauty products, further fueling consumer interest. These influencers often highlight the skin benefits and organic nature of shea butter, making it a sought-after ingredient among followers.

Lastly, there’s an increasing demand for sustainable and eco-friendly cosmetics. Consumers are opting for products with ethically sourced ingredients and sustainable packaging, and shea butter, often harvested through fair trade practices, fits well into this eco-conscious trend.

As these trends continue to evolve, the shea butter market is likely to see sustained growth, driven by the increasing consumer preference for natural, sustainable, and personalized skincare solutions.

Regional Analysis

Europe dominates the cosmetics shea butter market, accounting for 31% of the total market share

Europe dominates the market, accounting for 31% of the total market share, valued at approximately USD 0.6 billion. This can be attributed to the increasing demand for natural and organic skincare products in the region.

Consumers in European countries are increasingly seeking sustainable and ethically sourced ingredients, a trend that shea butter fits perfectly. The presence of a well-established cosmetic industry in countries such as France, Germany, and the UK further drives market growth.

Regional Mentions:

North America holds a significant portion of the market as well, driven by the growing preference for organic and cruelty-free cosmetics among consumers. The U.S. represents the largest market in the region, with rising awareness regarding the benefits of shea butter for moisturizing and anti-aging properties. This market is expected to grow at a steady pace, benefiting from the increasing use of shea butter in personal care formulations.

Asia Pacific is a rapidly emerging market for shea butter, primarily due to the rising disposable income, changing beauty standards, and growing demand for natural ingredients. Countries like China, India, and Japan are witnessing an uptick in the use of shea butter for skincare, haircare, and cosmetic products. Additionally, the growing e-commerce sector in the region has enhanced the accessibility of shea butter-based products.

Middle East & Africa sees moderate demand, with a significant portion driven by the increasing popularity of organic beauty solutions in countries like South Africa and the UAE. However, the market is still developing in comparison to more established regions.

Latin America is experiencing gradual growth, particularly in Brazil, where there is a growing consumer base for natural and sustainable beauty products.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, key players in the Global Cosmetics Shea Butter Market, such as Cargill, Incorporated, Clariant AG, AAK AB, and Olvea Group, among others, continue to shape the competitive landscape with their strategic initiatives, product innovations, and sustainable practices. These companies are increasingly focusing on expanding their market reach through collaborations, acquisitions, and eco-friendly sourcing, which has helped drive growth in the shea butter sector.

Cargill and AAK AB, for example, are leveraging their extensive supply chains and strong relationships with local African communities to ensure a consistent supply of high-quality shea butter. This has proven to be a significant competitive advantage, particularly as the demand for natural and organic ingredients grows among cosmetic brands.

Clariant AG and BASF SE are focusing on the development of sustainable and innovative formulations, capitalizing on the growing consumer demand for eco-conscious products. These companies have also made considerable strides in incorporating shea butter into advanced cosmetic formulations, such as anti-aging and moisturizing skincare products.

The Savannah Fruits Company and Ghana Nuts Company Ltd stand out for their direct involvement in the ethical sourcing of shea butter, emphasizing community empowerment and fair trade practices. This focus aligns with the broader trend in the industry toward sustainable and transparent sourcing, which appeals to environmentally-conscious consumers.

With increasing demand for natural, organic, and ethically sourced ingredients, companies that innovate in both product development and sustainability will likely continue to lead the market in the coming years.

Top Key Players in the Market

- Cargill, Incorporated

- Clariant AG

- AAK AB

- Olvea Group

- Croda International Plc

- Ghana Nuts Company Ltd

- Agrobotanicals, LLC

- Archer Daniels Midland Company

- Bunge Limited

- BASF SE

- Sophim S.A.

- AOS Products Private Limited

- The Savannah Fruits Company

- Ojoba Collective

- The HallStar Company

Recent Developments

- In October 2024, skincare startup ClayCo Cosmetics successfully raised ₹16 crore in Series A funding from Unilever Ventures to accelerate product development and expand its market reach in the Indian beauty industry.

- In June 2024, RENÉE Cosmetics raised ₹100 crore in Series B funding, which will be used to scale operations, enhance digital marketing, and expand its portfolio of innovative beauty products in the competitive Indian skincare market.

- In December 2024, Sugar Cosmetics secured US$4.5 million in a funding round aimed at bolstering its e-commerce presence, expanding its product offerings, and strengthening its brand in the fast-growing Indian beauty market.

Report Scope

Report Features Description Market Value (2023) USD 1.8 Billion Forecast Revenue (2033) USD 3.0 Billion CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature(Organic, Conventional), By Grade(Grade A, Grade B, Grade C), By End-use(Lotions and Creams, Lip Balms and Lipsticks, Sun Care Products, Soaps and Toiletries, Cleansers, Shampoos and Conditioners, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cargill, Incorporated, Clariant AG, AAK AB, Olvea Group, Croda International Plc, Ghana Nuts Company Ltd, Agrobotanicals, LLC, Archer Daniels Midland Company, Bunge Limited, BASF SE, Sophim S.A., AOS Products Private Limited, The Savannah Fruits Company, Ojoba Collective, The HallStar Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cosmetics Shea Butter MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Cosmetics Shea Butter MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Cargill, Incorporated

- Clariant AG

- AAK AB

- Olvea Group

- Croda International Plc

- Ghana Nuts Company Ltd

- Agrobotanicals, LLC

- Archer Daniels Midland Company

- Bunge Limited

- BASF SE

- Sophim S.A.

- AOS Products Private Limited

- The Savannah Fruits Company

- Ojoba Collective

- The HallStar Company