Global Coronavirus Immunoassay Market By Product Type (Immunoassay Kits & Reagents (Secondary Antibodies, Primary Antibodies, Kits, Immunoassay Substrates, and Immunoassay Buffers), Consumables, Analysers & Instrument, and Software), By Purpose (Clinical Use, and Research Use), By Application (Clinical Diagnostics, Drug Discovery, and Screening of Diseases & Disorders), By Assay (ELISA, LFA, FIA, CLIA, and Others), By Specimen (Nasopharynx, Blood, Saliva, and Cell Culture Samples), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162753

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

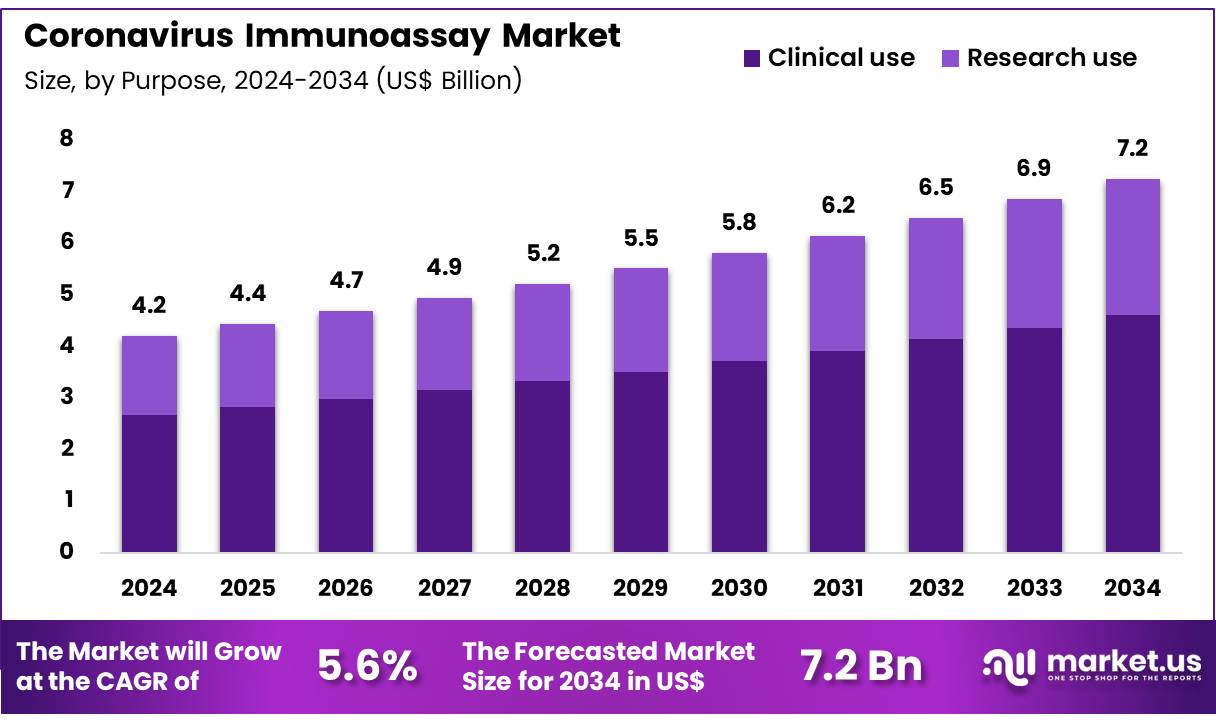

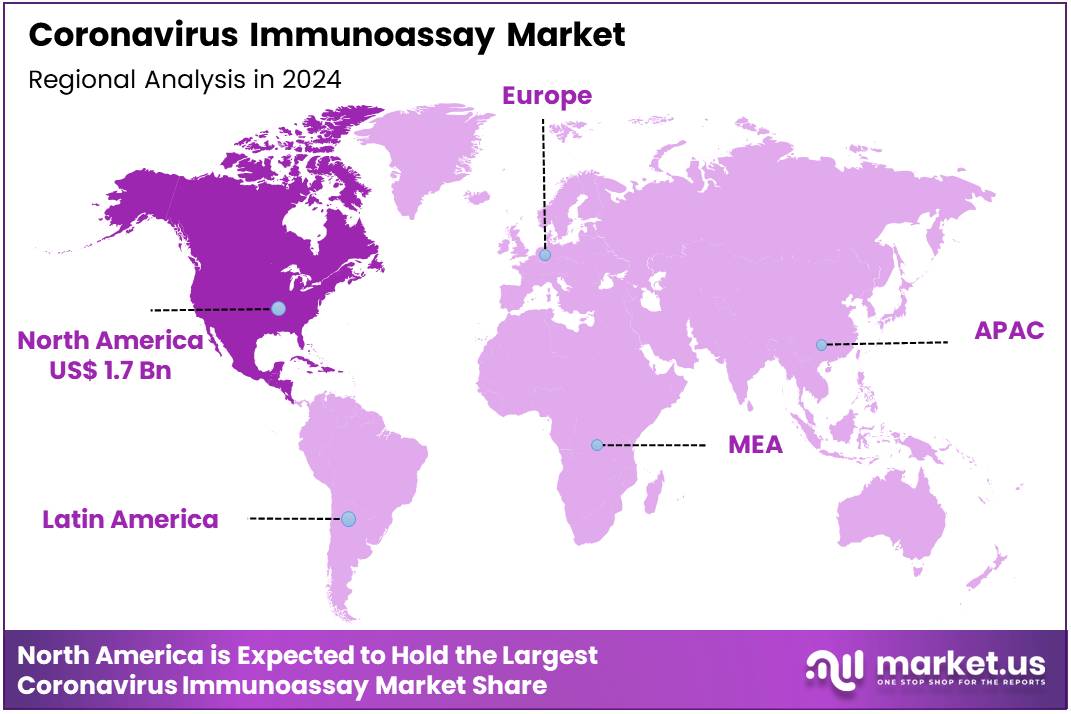

Global Coronavirus Immunoassay Market size is expected to be worth around US$ 7.2 Billion by 2034 from US$ 4.2 Billion in 2024, growing at a CAGR of 5.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.9% share with a revenue of US$ 1.7 Billion.

Increasing demand for seroprevalence surveillance drives the Coronavirus Immunoassay Market, as health organizations seek robust tools to track population-level immunity against SARS-CoV-2. Laboratories deploy these assays in epidemiological studies to quantify antibody prevalence, informing public health policies on vaccination coverage and outbreak risks.

Clinicians utilize immunoassay kits for vaccine efficacy assessments, measuring IgG levels to evaluate immune responses in vaccinated cohorts. Point-of-care applications enable rapid field testing during community surveys, accelerating data collection for real-time decision-making.

In March 2023, F. Hoffmann-La Roche Ltd. partnered with Eli Lilly and Company to develop the Elecsys Amyloid Plasma Panel (EAPP), advancing Roche’s immunoassay capabilities and reinforcing infrastructure for large-scale SARS-CoV-2 antibody testing. This collaboration enhances diagnostic scalability, presenting opportunities for integrated platforms that support ongoing pandemic monitoring.

Growing focus on post-infection immune profiling fuels the Coronavirus Immunoassay Market, with advancements enabling precise detection of neutralizing antibodies for personalized care. Researchers apply these tests in longitudinal studies to monitor waning immunity, guiding booster recommendations and therapeutic interventions.

Hospitals integrate immunoassays into recovery protocols, assessing antibody dynamics to predict reinfection susceptibility in high-risk patients. These tools facilitate biomarker research, linking serologic profiles to clinical outcomes like long COVID symptoms.

In April 2024, Bio-Rad Laboratories introduced a blood-based immunoassay kit for detecting antibodies against SARS-CoV-2, enabling accurate identification of immune responses and supporting broader surveillance in clinical settings. Such innovations drive adoption by streamlining workflows and improving reliability in immune status evaluations.

Rising integration of genomic tools with immunoassays propels the Coronavirus Immunoassay Market, as hybrid approaches enhance variant-specific detection capabilities. Public health labs employ these assays for post-treatment monitoring, verifying viral clearance through antibody persistence analysis. Vaccine developers leverage them in clinical trials to correlate seroconversion rates with protection against emerging strains.

Trends toward multiplex formats allow simultaneous screening for multiple coronavirus antigens, optimizing resource use in research environments. In June 2024, BioMérieux unveiled its EPISEQ® SARS-CoV-2 genomic software, assisting labs in detecting viral variants and increasing reliance on advanced immunoassay testing for data-driven management. This development creates opportunities for comprehensive diagnostic ecosystems, bolstering market growth through enhanced precision and adaptability.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.2 Billion, with a CAGR of 5.6%, and is expected to reach US$ 7.2 Billion by the year 2034.

- The product type segment is divided into immunoassay kits & reagents, consumables, analysers & instrument, and software, with immunoassay kits & reagents taking the lead in 2023 with a market share of 51.2%.

- Considering purpose, the market is divided into clinical use and research use. Among these, clinical use held a significant share of 63.7%.

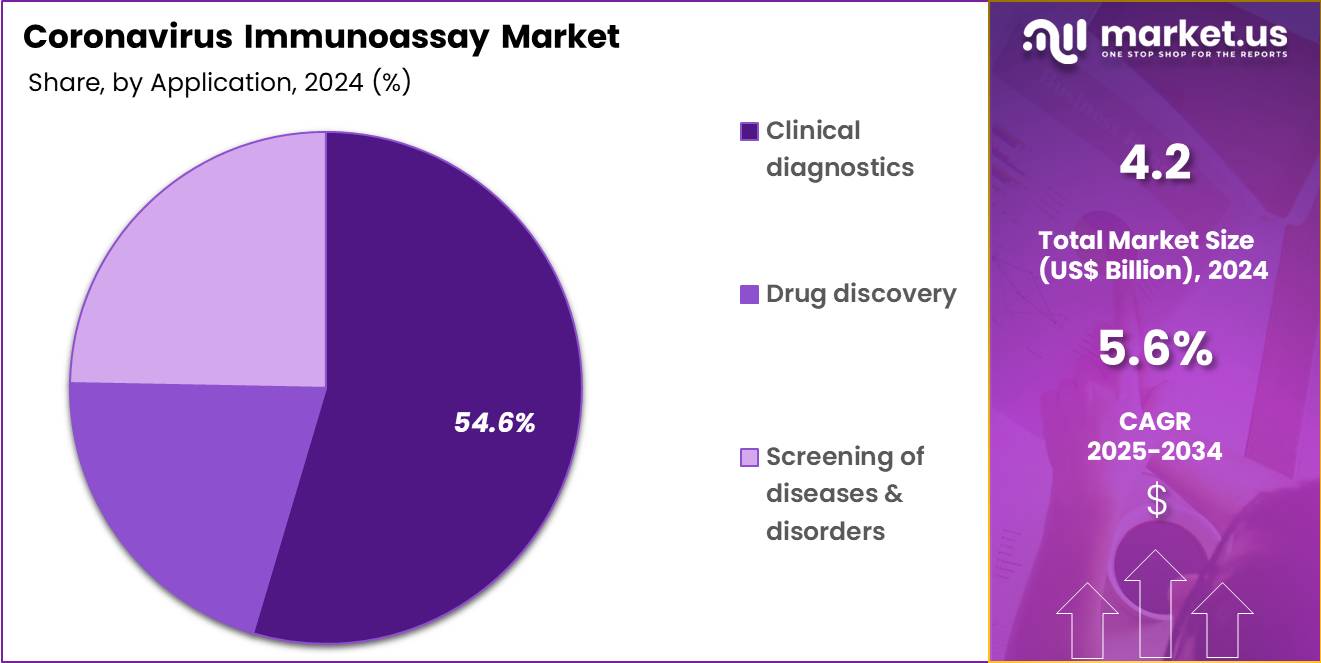

- Furthermore, concerning the application segment, the market is segregated into clinical diagnostics, drug discovery, and screening of diseases & disorders. The clinical diagnostics sector stands out as the dominant player, holding the largest revenue share of 54.6% in the market.

- The assay segment is segregated into ELISA, LFA, FIA, CLIA, and others, with the ELISA segment leading the market, holding a revenue share of 42.9%.

- Considering specimen, the market is divided into nasopharynx, blood, saliva, and cell culture samples. Among these, nasopharynx held a significant share of 46.5%.

- North America led the market by securing a market share of 39.9% in 2023.

Product Type Analysis

Immunoassay kits and reagents account for 51.2% of the market and are expected to maintain strong growth due to their essential role in detecting coronavirus infections accurately and efficiently. These kits include antibodies, detection substrates, and other reagents that enable rapid, reliable results across clinical diagnostics, research, and screening applications.

The rising global focus on early detection and ongoing monitoring of COVID-19 cases is likely to drive continued demand. Advances in assay sensitivity and specificity are enhancing reliability, making these kits suitable for high-throughput laboratories and point-of-care testing. The combination of cost-effectiveness, scalability, and ease of integration into laboratory workflows further strengthens their market position.

Healthcare providers increasingly prefer standardized kits and reagents to ensure reproducibility and regulatory compliance. Additionally, the growth of vaccination programs and monitoring for emerging variants supports ongoing use in research and clinical studies. Manufacturers are innovating to provide multiplex kits capable of detecting multiple viral strains simultaneously, further expanding adoption.

Hospitals, diagnostic centers, and research laboratories are projected to continue driving the demand for immunoassay kits and reagents. Increasing investments in global healthcare infrastructure are also anticipated to enhance accessibility and market penetration.

Purpose Analysis

Clinical use dominates with 63.7% of the purpose segment and is expected to grow as healthcare providers increasingly rely on immunoassays for routine coronavirus diagnostics and patient management. Clinical testing enables rapid identification of infections, supports treatment decisions, and informs quarantine measures. Hospitals and diagnostic laboratories are adopting automated immunoassay platforms to improve throughput and accuracy while reducing manual labor.

The rising prevalence of COVID-19 and the emergence of new variants drive the adoption of clinical use immunoassays for patient monitoring, outbreak control, and hospital screening programs. Regulatory approvals and guidelines from health authorities enhance clinician confidence and accelerate adoption. The integration of immunoassays with hospital information systems and electronic health records improves data management and clinical decision-making.

Point-of-care clinical applications further expand accessibility, particularly in high-risk or underserved populations. Continuous updates to assay protocols to accommodate emerging strains ensure sustained relevance in clinical settings. Training programs for healthcare professionals and widespread public health campaigns further encourage use. The combination of accuracy, reliability, and real-world utility positions clinical use as the primary driver of the coronavirus immunoassay market.

Application Analysis

Clinical diagnostics represent 54.6% of the application segment and are projected to grow due to increasing demand for accurate, rapid, and high-throughput coronavirus testing. Immunoassays are widely applied in diagnostic laboratories and hospital settings to detect infections and guide treatment protocols. The adoption of automated diagnostic systems reduces turnaround time and enhances consistency, allowing providers to handle larger volumes of patient samples efficiently.

Rising public awareness of early detection and the need for ongoing surveillance of COVID-19 variants fuels demand in clinical diagnostics. Laboratories prefer immunoassays for their sensitivity, reproducibility, and ability to integrate with other diagnostic tools. The ongoing requirement for population-level testing and monitoring, especially in outbreak-prone regions, strengthens the clinical diagnostics segment.

The availability of validated kits, robust reagents, and advanced analyzers contributes to trust and adoption among healthcare providers. Regulatory support for emergency use and clinical validation further enhances utilization. Increasing partnerships between hospitals, diagnostic labs, and research institutes expand access and capability for routine testing.

The combination of technological improvements, operational efficiency, and public health imperatives positions clinical diagnostics as a leading application area in the coronavirus immunoassay market.

Assay Analysis

ELISA holds 42.9% of the assay segment and is expected to continue leading due to its high sensitivity, specificity, and adaptability in detecting coronavirus antibodies or antigens. ELISA-based immunoassays provide quantitative results and support both research and clinical applications, including vaccine efficacy studies and patient immune response monitoring. The technology enables high-throughput testing in hospitals and diagnostic laboratories, which is crucial for large-scale screening programs.

Technological advancements, such as automated plate readers and enhanced substrates, improve efficiency, reduce variability, and allow for faster reporting. ELISA assays are widely recognized by regulatory agencies for reliability, encouraging adoption in clinical settings.

Multiplex ELISA kits capable of detecting multiple targets simultaneously further expand utility. The method’s scalability and adaptability for use in both routine diagnostics and research applications support ongoing growth. Hospitals and laboratories prefer ELISA for its reproducibility, accuracy, and compatibility with existing workflows.

Integration with digital data management systems enhances usability. Overall, ELISA maintains dominance due to its versatility, reliability, and alignment with clinical and research requirements.

Specimen Analysis

Nasopharynx specimens account for 46.5% of the specimen segment and are projected to remain the primary choice for coronavirus immunoassays due to the high viral load typically present in this region. Sampling from the nasopharynx provides reliable detection, making it ideal for accurate diagnosis, monitoring, and surveillance. Hospitals and diagnostic laboratories routinely use nasopharyngeal swabs for PCR, ELISA, and other immunoassay-based tests, ensuring consistency and comparability across studies.

Advances in collection methods, swab design, and transport media improve sample integrity and patient comfort, enhancing adoption. The high sensitivity of nasopharyngeal specimens supports early detection, critical for infection control and clinical decision-making. Clinical protocols and public health guidelines continue to recommend nasopharyngeal sampling for coronavirus testing, reinforcing its market dominance.

Automated extraction and processing systems facilitate large-scale testing and reduce handling errors. Nasopharyngeal sampling is also compatible with point-of-care and high-throughput platforms, expanding accessibility. The combination of accuracy, reliability, and regulatory endorsement ensures nasopharynx specimens remain the preferred option for coronavirus immunoassay applications.

Key Market Segments

By Product Type

- Immunoassay Kits & Reagents

- Secondary antibodies

- Primary Antibodies

- Kits

- Immunoassay Substrates

- Immunoassay Buffers

- Consumables

- Analysers & Instrument

- Software

By Purpose

- Clinical Use

- Research Use

By Application

- Clinical Diagnostics

- Drug Discovery

- Screening of diseases & disorders

By Assay

- ELISA

- LFA

- FIA

- CLIA

- Others

By Specimen

- Nasopharynx

- Blood

- Saliva

- Cell Culture Samples

Drivers

Ongoing Circulation of SARS-CoV-2 Variants is Driving the Market

The continuous emergence and dominance of SARS-CoV-2 variants have sustained the necessity for immunoassay-based diagnostics in the Coronavirus immunoassay market, enabling rapid antigen detection and serological monitoring to track infection dynamics.

These assays, including lateral flow and chemiluminescent formats, provide essential tools for community surveillance, distinguishing active infections from past exposures amid evolving viral threats. This driver is evident in the persistent need for point-of-care solutions that facilitate timely public health responses, such as isolation and contact tracing, in both clinical and non-clinical settings.

Healthcare authorities emphasize the role of immunoassays in complementing molecular tests, particularly during surges when laboratory capacities are strained. The adaptability of these platforms to variant-specific antigens further bolsters their utility, supporting vaccine efficacy evaluations and outbreak containment. Global surveillance systems underscore the variant-driven testing imperative, as immune evasion properties necessitate frequent reassessments of population-level immunity.

The World Health Organization reported over 28.1 million COVID-19 hospitalizations across 172 countries from January 2020 to November 2024, with weekly averages declining from 140,000 in 2022 to lower figures in subsequent years due to targeted diagnostics. This hospitalization burden highlights the sustained clinical reliance on immunoassays for efficient triage and resource allocation. Manufacturers are refining antibody conjugates to enhance sensitivity against subvariants, ensuring relevance in endemic phases.

Economically, variant surveillance through immunoassays mitigates escalation costs by averting widespread outbreaks. Collaborative networks with regulatory bodies accelerate assay validations, promoting equitable distribution in vulnerable regions. This viral evolution not only maintains diagnostic volumes but also reinforces the market’s alignment with adaptive pandemic management.

Restraints

Declining Demand for COVID-19 Testing is Restraining the Market

The marked reduction in COVID-19 testing volumes has imposed significant constraints on the Coronavirus immunoassay market, as public health priorities shift toward endemic management and reduced surveillance mandates. Immunoassays, once central to mass screening, now face diminished utilization due to widespread immunity and fatigue with routine testing protocols. This restraint manifests in supply chain adjustments, where excess inventory and scaled-back production lead to financial pressures on developers.

Healthcare budgets, previously augmented for pandemic responses, are reallocating funds, curtailing reimbursements for non-essential assays. The transition to sporadic testing in high-risk groups exacerbates revenue volatility, particularly for point-of-care formats reliant on volume sales. Regulatory frameworks, while supportive during emergencies, impose stricter post-emergency validations, prolonging market reorientation.

Roche Diagnostics experienced a 25% year-over-year revenue decline to CHF 10.43 billion in the first nine months of 2023, driven primarily by a drop in COVID-19 test sales from CHF 13.85 billion in the same period of 2022. Such contractions underscore the challenge of pivoting to baseline operations amid waning caseloads.

Providers encounter hesitancy in adopting updated immunoassays without clear endemic guidelines, fragmenting adoption patterns. Efforts to repurpose platforms for other respiratory pathogens offer partial mitigation, yet integration lags due to specificity recalibrations. These demand dynamics not only compress margins but also necessitate strategic consolidations in the sector.

Opportunities

Adaptation of Immunoassays for Other Respiratory Pathogens is Creating Growth Opportunities

The repurposing of Coronavirus immunoassay platforms for multiplex detection of additional respiratory viruses has unveiled considerable expansion potential in the market, capitalizing on established infrastructure for broader syndromic testing. These assays can now simultaneously profile influenza, RSV, and SARS-CoV-2 antigens, streamlining diagnostics in seasonal outbreaks and reducing turnaround dependencies on single-pathogen tools.

Opportunities arise in integrated care models, where combined panels enhance stewardship and minimize overtreatment in emergency departments. Developers are exploring hybrid formats that leverage existing antibodies, accelerating validations for co-circulating threats. Government initiatives promoting respiratory sentinel networks further incentivize adoption, subsidizing transitions to versatile systems. This versatility addresses surveillance gaps in post-pandemic eras, supporting data-driven policy formulations.

The Centers for Disease Control and Prevention noted that during the 2023-2024 respiratory season, concurrent peaks of COVID-19, influenza, and RSV contributed to elevated hospitalization burdens, underscoring the need for comprehensive immunoassays. Such patterns validate the economic case for multiplex investments, potentially offsetting single-use declines.

Partnerships with telehealth providers enable remote deployment, broadening access in ambulatory settings. As climate influences pathogen seasonality, adaptable assays promise resilience in variable epidemiological landscapes. These cross-applications not only rejuvenate portfolios but also embed the market within holistic infectious disease frameworks.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and limited access to capital are pressuring developers in the SARS-CoV-2 antibody testing market, leading them to delay improvements in multiplex detection panels while maintaining stockpiles of essential test strips. U.S.-China export restrictions and South China Sea shipping delays are disrupting supplies of latex particles, extending assay optimization timelines and increasing certification costs for international distribution.

To manage these challenges, some developers are partnering with particle manufacturers in Texas, implementing quality protocols that accelerate regulatory approvals and attract pandemic-preparedness funding. Ongoing variant monitoring is driving WHO support for point-of-care serology tools, encouraging adoption in community screening programs.

U.S. tariffs on imported pharmaceuticals and medical devices are raising costs for Asian-sourced antibodies and substrates, squeezing margins and occasionally delaying global test kit harmonization. In response, developers are using federal resilience grants to build conjugation facilities in Florida, enhancing nanoparticle-based sensitivity and developing expertise in shelf-stable formulations.

Latest Trends

FDA Clearance for Updated SARS-CoV-2 Antigen Assays is a Recent Trend

The regulatory progression toward variant-adapted antigen detection has characterized a prominent development in the Coronavirus immunoassay sector during 2024, emphasizing enhanced performance against dominant lineages like JN.1. These updates incorporate refined monoclonal antibodies to maintain sensitivity amid antigenic drifts, ensuring reliable qualitative results in diverse sample matrices.

The trend reflects a commitment to sustaining immunoassay relevance in low-prevalence contexts, with streamlined protocols for home and professional use. Integration with digital readers facilitates quantitative insights, aiding in severity predictions and outbreak mapping. This evolution aligns with global health directives for sustained vigilance, incorporating user feedback to refine usability.

Clearance processes prioritize real-world validations, accelerating market entry for compliant platforms. The Food and Drug Administration authorized updates to several SARS-CoV-2 antigen assays in 2024, including enhancements for Omicron subvariants that improved detection thresholds in clinical evaluations. Such endorsements bolster confidence in immunoassay efficacy, influencing procurement decisions.

Subsequent implementations demonstrate concordance with molecular gold standards, minimizing discordance in surveillance cohorts. The trajectory envisions AI-augmented interpretations, forecasting deeper analytics for epidemiological forecasting. This refinement not only preserves diagnostic accuracy but also fortifies preparedness for future viral incursions.

Regional Analysis

North America is leading the Coronavirus Immunoassay Market

In 2024, North America held a 39.9% share of the global coronavirus immunoassay market, driven by continuous surveillance for variant detection and the integration of rapid antigen assays into wastewater monitoring programs during seasonal respiratory surges. Public health laboratories expanded the use of enzyme-linked immunosorbent assays to track antibody responses in longitudinal studies, improving estimates of infection-induced immunity in unvaccinated populations and filling gaps in seroprevalence data for policy decisions.

The FDA’s oversight of emergency use authorizations for multiplex immunoassays enabled rapid adaptations for emerging sublineages, supporting point-of-care testing in emergency departments to accelerate triage during hospitalization peaks. Collaboration between state health departments and diagnostic manufacturers optimized supply logistics for high-affinity reagents, mitigating global shortages and improving throughput in community testing sites.

Vulnerable populations, including residents of correctional facilities and nursing homes, increased testing demand, aligning with federal mandates for weekly antigen screening in high-risk settings. These measures highlighted the region’s commitment to immunoassay-based epidemiological monitoring. The CDC estimated 17.0 million symptomatic COVID-19 illnesses in the U.S. during the week ending October 5, 2024, reflecting sustained reliance on diagnostic testing.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

In the Asia Pacific, health authorities expect the coronavirus immunoassay sector to grow as regional preparedness programs focus on antigen-based surveillance to manage endemic transmission in high-traffic trade zones. South Korea and Australia are investing in decentralized immunoassay hubs at border facilities, using fluorescence-linked kits to detect asymptomatic travelers with low viral loads.

National diagnostic consortia are validating chemiluminescent assays to track seroconversion and hybrid immunity in vaccinated urban populations. Indonesia and the Philippines are pioneering portable lateral flow devices, enabling coastal clinics to monitor post-flood outbreaks without laboratory infrastructure.

Governments are integrating immunoassay data with genomic platforms to ease interpretation in regions where dengue co-circulates, using dashboards to forecast outbreaks. Local developers are enhancing nanoparticle-based test strips and linking them to continental alert systems to predict influenza-COVID overlap risks.

These improvements strengthen a resilient diagnostic network across the region. India’s Ministry of Health and Family Welfare administered 220.67 crore COVID-19 vaccine doses by December 2023, supporting the expansion of testing infrastructure into 2024.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key organizations in the SARS-CoV-2 serology testing sector drive expansion by developing high-sensitivity lateral flow assays that detect neutralizing antibodies, enabling rapid immunity assessments for population health studies. They form strategic partnerships with diagnostic distributors to streamline kit deployment in community testing hubs, expanding access in high-demand regions.

Enterprises invest in scalable automation for reagent production, reducing costs and meeting surge demands in outbreak scenarios. Leaders acquire specialized biotech firms to integrate cross-reactive antigen panels, enhancing test specificity for variant strains.

They target growth in South Asia and Latin America, aligning with regional health campaigns to secure public-sector contracts. Additionally, they offer cloud-based reporting tools with subscription models, fostering long-term client engagement and consistent revenue growth.

Abbott Laboratories, founded in 1888 and headquartered in Chicago, Illinois, pioneers diagnostic solutions, including serology tests for infectious diseases, to support global healthcare systems. Its ARCHITECT platform delivers automated antibody assays, enabling high-throughput screening for SARS-CoV-2 with reliable performance.

Abbott commits significant resources to R&D, focusing on assay adaptability for emerging variants and point-of-care applications. CEO Robert B. Ford leads operations across 160 countries, emphasizing innovation and regulatory compliance. The company collaborates with public health bodies to deploy testing solutions in underserved areas. Abbott strengthens its market position through cutting-edge diagnostics and strategic global outreach.

Top Key Players

- Sysmex Corporation

- Siemens Healthineers

- Quidel Corporation

- Ortho Clinical Diagnostics

- Hoffmann-La Roche AG

- Danaher Corporation (Beckman Coulter)

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Becton, Dickinson, and Company

- Abbott

Recent Developments

- In January 2025, Anbio Biotechnology launched its Dry CLIA Solution ADL-1000, offering rapid, cost-effective diagnostic testing for clinical settings. Its efficiency and reliability meet growing demand for high-throughput COVID-19 antibody screening, driving adoption of immunoassay solutions across healthcare facilities.

- In April 2024, Mindray released new solutions for mid-volume laboratories, including two stand-alone analyzers and two integrated systems. These compact, high-efficiency instruments streamline chemiluminescence immunoassay testing for COVID-19, enabling laboratories to expand testing capacity and fueling growth in the Coronavirus Immunoassay Market.

Report Scope

Report Features Description Market Value (2024) US$ 4.2 Billion Forecast Revenue (2034) US$ 7.2 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Immunoassay Kits & Reagents (Secondary Antibodies, Primary Antibodies, Kits, Immunoassay Substrates, and Immunoassay Buffers), Consumables, Analysers & Instrument, and Software), By Purpose (Clinical Use, and Research Use), By Application (Clinical Diagnostics, Drug Discovery, and Screening of Diseases & Disorders), By Assay (ELISA, LFA, FIA, CLIA, and Others), By Specimen (Nasopharynx, Blood, Saliva, and Cell Culture Samples) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sysmex Corporation, Siemens Healthineers, Quidel Corporation, Ortho Clinical Diagnostics, F. Hoffmann-La Roche AG, Danaher Corporation (Beckman Coulter), Bio-Rad Laboratories, Inc., bioMérieux SA, Becton, Dickinson, and Company, Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Coronavirus Immunoassay MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Coronavirus Immunoassay MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sysmex Corporation

- Siemens Healthineers

- Quidel Corporation

- Ortho Clinical Diagnostics

- Hoffmann-La Roche AG

- Danaher Corporation (Beckman Coulter)

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Becton, Dickinson, and Company

- Abbott